SOLUSDT.3S trade ideas

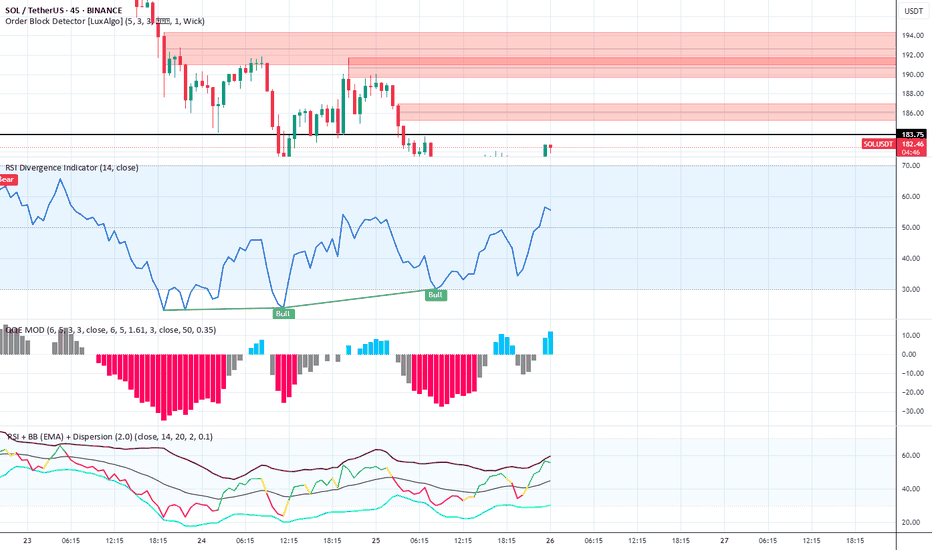

Vijay D - Smart Order Block + RSI Divergence Reversal SuiteIndicators Used in the Setup

Order Block Detector

Settings: (5, 3, 3), 1 Wick

Function: Highlights institutional order blocks to identify high-probability supply/demand zones.

Chart Insight: Multiple bearish order blocks marked in red between $186–$194, confirming strong overhead resistance. Price is reacting at the lower boundary (~$183.75), showing signs of rejection.

RSI Divergence Indicator (14)

Settings: 14-period RSI

Function: Detects bullish and bearish divergences between price and RSI.

Chart Insight: Bullish Divergence identified — price made a lower low while RSI made a higher low, signaling a potential trend reversal or bullish bounce.

QQE MOD

Settings: (6, 5, 3), Smoothing: 6.5, RSI Length: 14

Function: A momentum oscillator derived from RSI with smoothing and histogram representation.

Chart Insight:

Histogram flipped from red (bearish) to blue (bullish).

Bullish transition suggests increasing momentum in favor of bulls.

TSI – BB (EMA) + Dispersion

Function: Combines True Strength Index with Bollinger Band (EMA-based) and dispersion overlays.

Chart Insight:

TSI is rising toward midline with narrowing dispersion bands.

Indicates a potential volatility contraction before an expansion — likely upside if TSI crosses above signal.

H&S Expected for Sol And Pyth until HHsPyth is following SOL and I expect a bit of a pullback for a better impusle to reach Higher Highs.

Technicals (RSI, Bollinger band) are showing overbought conditions and we can expect the usual End of months pullback. The pullback could reach the 168 - 170 Area before coming back to the current levels and after a potential light pullback to grab liquity and to create a new contraction before a new push toward 210 - 212 is expected.

This idea is only for educational content, please Do your own research before investing.

Solana maintains its upward structure ┆ HolderStatBINANCE:SOLUSDT is bouncing from the $170–172 zone, building higher lows just below resistance at $180. The structure is shaping into a rounded bottom with signs of accumulation. If SOL clears $180 with volume, targets lie at $188 and beyond. Trend remains bullish as long as price stays above the local demand zone.

SOL - Support Broke, Is This Just a Retest Before The Pump?Solana just lost a key structural level on the 4H chart — the former range high (~163–166), which had acted as resistance throughout June and flipped to support in mid-July. Price is now sitting just below this zone, forming a weak retest without any real bullish momentum.

This setup often leads to trap scenarios: either a fast reclaim (bullish deviation) or a clean continuation to the next demand. So far, the price is holding below the EMAs and failing to reclaim lost ground — not a bullish look.

📌 Confluence for Further Downside:

Break and close below prior support

EMA 50/100 acting as dynamic resistance

No bullish divergence present (if RSI confirms)

Weak volume on current bounce attempt

If sellers stay in control, eyes are on the next demand zone around 144–146, which supported the last major breakout. Conversely, a clean reclaim above 166 and back inside the range would flip bias neutral-to-bullish.

Bias: Bearish unless 166 is reclaimed

Invalidation: Break above 177–180 (EMA cluster)

Next Key Support: 144–146

Potential Setup: Short on failed retest / Long on demand reaction

Do you see this as a breakdown or a trap? Let me know 👇

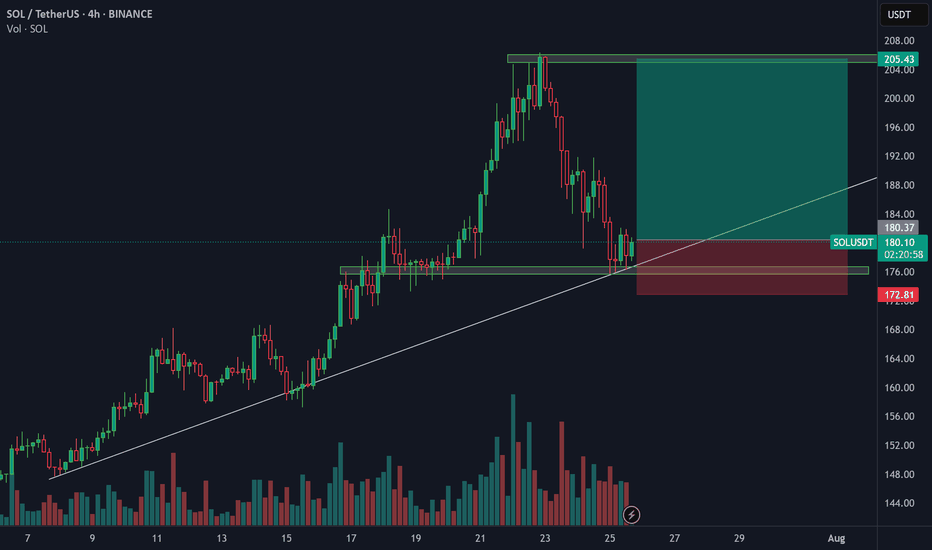

SOLUSD 4H — Holding the Line Before Altseason?Solana’s 4H chart presents a textbook continuation setup — a steady ascending trendline combined with well-defined resistance zones stacked overhead. This kind of compression within an uptrend often precedes explosive expansion, especially when aligned with broader altcoin market sentiment.

📊 Structural Breakdown:

Trendline Support:

Sol has maintained a rising trendline since early June, consistently bouncing off higher lows. This provides a dynamic support zone currently sitting around ~$175–180.

Horizontal Support:

The horizontal box at ~$175 represents prior structure highs turned into support — tested multiple times and aligning with the trendline. A breakdown here would be structurally significant.

Resistance Layers to Monitor:

$215 – Minor S/R flip and local liquidity cluster

$245 – Consolidation ceiling from Q1, where sellers previously took control

$270 – Clean weekly-level rejection from January

$300–310 – Final major resistance from the post-FTX crash range; breakout here signals full bullish expansion

Market Context:

The broader altcoin market is coiling, with majors like ETH and SOL holding structure while BTC ranges. If Bitcoin remains sideways or breaks slightly higher, capital rotation could drive a full “altseason” wave — with SOL as one of the first movers.

🔍 Key Conditions to Watch:

✅ Bullish Scenario:

Price holds ~$175 and breaks above $215 with strong volume

Clean retest of breakout zones confirms continuation

Targeting $245 → $270 → $300 in stages

❌ Bearish Invalidation:

Break and close below $175 trendline support

Would shift bias toward a wider range or even short-term downtrend

⚙️ Indicators to Watch:

4H RSI holding above midline (50) supports bullish continuation

MACD crossover + volume expansion = trigger confirmation

This chart is a reminder that you don’t need to chase green candles — spotting compression structures and planning for breakout zones is where the edge lies. Whether you’re positioning spot or looking for a leveraged entry, this structure rewards patience and timing.

HARMONIC PATTERN on Daily for SOL ?I wonder if this pattern is the one which is highlighted by our friend and chart analyst @The_Alchemist_Trader_

Let's see if it need to test one last time the support of this channel or if it will break out for the long waited rally.

Level to keep an eye :

0.5 Fib support need to hold and clean breakout of the 0.382 Fib

Indicators : RSI, volume and volatility (liquidations)

SOL/USDT 1H Chart – Technical Analysis BreakdownTrend Reversal Structure: Price broke out of a descending trendline after sweeping prior lows (liquidity grab), indicating a possible bullish reversal setup.

Point of Control (POC): Price is currently retesting the POC area (high-volume node), aligning with the trendline and prior support — a potential bounce zone.

RSI Divergence: Bullish RSI divergence marked near the sweep confirms the loss of bearish momentum, strengthening the case for upward continuation.

$SOL Loses Key Support | Eyes on $140 & $95 Zones📉 CRYPTOCAP:SOL Loses Key Support | Eyes on $140 & $95 Zones

🕵️♂️ On the daily timeframe, #Solana has officially lost its key support near $140, which previously acted as a strong bounce zone. A failure to reclaim this level could open the gates for a deeper drop toward the $95–$100 support range.

📊 Indicators signal downside:

RSI is trending downward

MACD shows a bearish crossover

Stochastic RSI confirms continued selling pressure

⚠️ Macro pressure adds fuel to the fire: August 1st tariff tensions, with expected news from Trump on charging Paris, are weighing down global risk assets. Historically, August tends to be a bearish month for crypto markets.

🎯 Key Levels to Watch:

Immediate Resistance: $140

Major Support: $95–$100

🧠 Trade wisely and manage risk accordingly.

SOLANA could have a major retracement Solana completed a major ABC correction into a supply zone on the higher time frame (HTF), taking out the previous quarter’s highs.

On the daily chart, the RSI is overbought and signals the potential for a significant retracement.

Price action on the 4-hour chart shows a series of lower highs, indicating a bearish trend. If Solana fails to break above the previous high and trigger a market structure shift, the downtrend is likely to continue, leading to a deeper retracement on the higher time frames.

#SOL Update #6 – Aug 01, 2025#SOL Update #6 – Aug 01, 2025

Unfortunately, Solana failed to hold the last low where its most recent impulsive move had started, and it closed below that level. This close also occurred below the MA200 band. In other words, Solana broke a very strong support on the 4-hour chart and moved downward, reaching the previous K-Level zone. It’s hard to say anything positive for Solana at this stage. If the current K-Level fails to hold, Solana may look for support around the $158 level. A long position on Solana is definitely not recommended. I also do not suggest a short position. However, unless there’s a strong reversal, it’s safe to say that Solana has entered a bearish phase on the 4-hour chart.

#SOL Update #7 – Aug 02, 2025#SOL Update #7 – Aug 02, 2025

Solana has broken below the low of its last impulsive move, forming a new, deeper bottom. The first area where it may find support is the $158 level. If this fails, the next support level lies at $147. At the moment, Solana is clearly in a downtrend on the 4-hour chart. For Solana to resume its upward movement and confirm a trend reversal, it needs to break above the $206 level with a strong, high-volume candle. Currently, Solana might be considered a cheap opportunity only for those looking to hold spot positions long-term. Otherwise, I don't see it as a suitable option for trading.