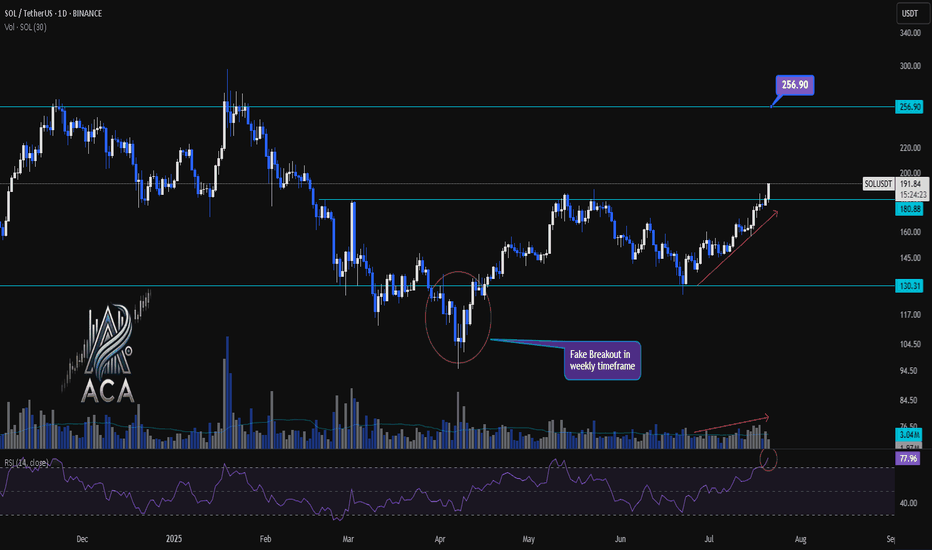

SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals....SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals Fresh Momentum

🔍 Let’s drill into the SOL/USDT daily chart, focusing on the recent breakout above the accumulation range, key support and resistance levels, RSI momentum, and volume confirmation for a robust bullish scenario.

⏳ Daily Overview

SOLUSDT has decisively broken out above a prolonged accumulation box, marking a significant shift in market structure. A daily close beyond this range now serves as a strong indicator for renewed bullish momentum. RSI is currently above 77, signaling that buyers are commanding momentum. Notably, volume has surged in tandem with price, confirming trader participation behind this breakout move.

📈 Technical Convergence and Trend Structure

- Accumulation Zone Break: After consolidating within a clear box for weeks, SOLUSDT closed above the upper boundary (around $180.88–$191.05), signaling a possible trend reversal or continuation.

- Daily Close Signal: A daily close outside the accumulation box offers high conviction for bullish continuation. This close acts as a potential entry signal for trend-followers.

- RSI Momentum: The RSI sits above 77—deep in the overbought territory. A close here not only confirms buyer strength but often precedes sustained uptrends when accompanied by price breakouts.

- Volume Surge: Volume has increased with the breakout, providing confirmation the move isn’t a false start, but likely fueled by real demand.

- Weekly Fake Breakout: There was a notable false breakout in the weekly timeframe, quickly reclaimed by bulls. This flip suggests buyers fended off downside attempts and now drive higher prices.

🔺 Bullish Setup & Targets

- First Target: $256.90 — marking the next major resistance on the chart and a logical upside objective for traders.

- Key Trigger: A confirmed daily (or weekly) close above the accumulation range with strong volume is essential for validating the upward trajectory.

📊 Key Highlights

- The breakdown of the accumulation box—now turned support—marks a pivotal structural change.

- RSI and price are making new local highs, solidifying the case for continued bullish momentum.

- Volume is climbing in sync with the move, offering real confirmation versus a potential fakeout.

- Recent fake breakout on the weekly chart, immediately negated, emphasizes that buyers are regaining—and likely maintaining—control.

🚨 Conclusion

SOLUSDT appears set for higher prices following the confirmed breakout above the accumulation range. Signs of trend health include an overbought RSI, volume confirmation, and the swift invalidation of a recent weekly fake breakout. As long as daily closes stay above the breakout level, the path remains clear for a rally toward $256.90. A strong daily close and continued volume will be your best signals for bullish continuation.

SOLUSDT.3S trade ideas

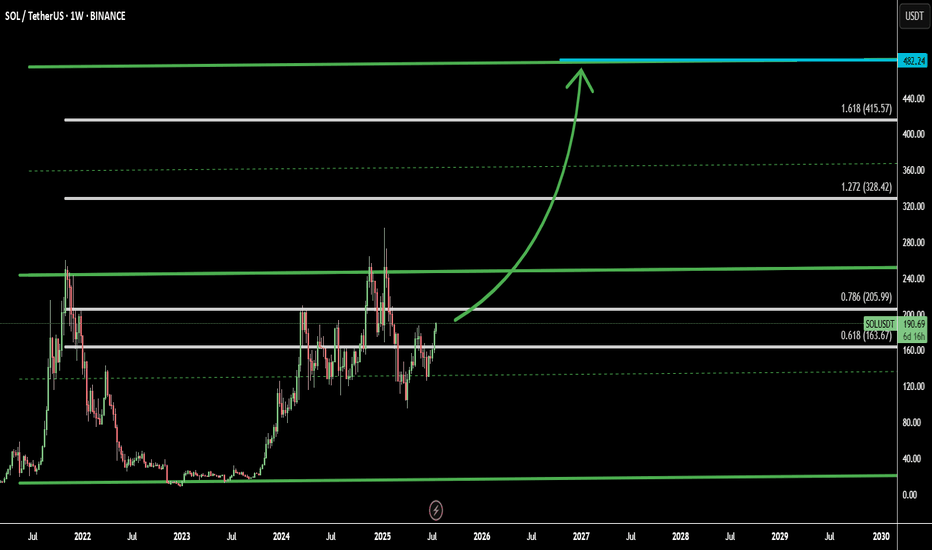

SOL Aiming to Double: Channel & Fibonacci Targets Signal $380Solana (SOLUSD) is currently trading around $190, and technical analysis suggests it may be on the path to doubling in price toward $380. This projection is supported by both a bullish ascending channel and Fibonacci extension levels, providing confluence for an extended rally.

Using this combined strategy, I’ve identified 4 key targets:

Target 1: 0.786 Fib – 205.99 - mid-range target within the upper half of the channel

Target 2: 1.272 Fib – 328.42 - aligns with historical breakout levels

Target 3: 1.618 Fib – 415.57 - Last Fibonacci Targets

Target 4: projected top of the current channel near 482.24

Beyond the technicals, Solana’s ecosystem continues to outperform many other Layer 1 chains, offering faster transaction speeds, lower fees, and robust DeFi and NFT activity. This fundamental strength supports the technical bullish thesis.

As always, breakout confirmation and volume are key. Manage risk accordingly.

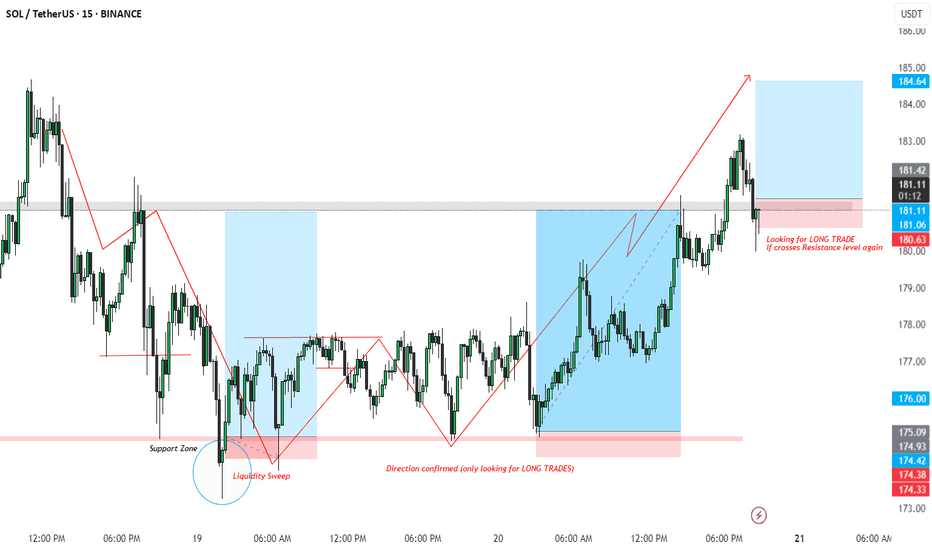

SOL/USDT LONG Setup – Liquidity Sweep + Break of Structure

Timeframe: 15m

Market Bias: Bullish (Long only)

Setup Type: Liquidity Sweep + BOS + Retest

📌 Breakdown:

Liquidity Sweep Identified:

Price dipped below the previous support zone, triggering stop hunts and grabbing liquidity.

Marked as a clear sweep of lows, signaling possible reversal.

Shift in Structure:

Following the sweep, price printed a Higher High and Higher Low, confirming change in structure.

At this point, we shift bias to Long Only trades.

Retest & Entry Zone:

After bullish momentum, price has pulled back to a key resistance-turned-support zone (highlighted in pink).

Looking for long entry on confirmation if price reclaims the resistance again (~181 zone).

📈 Trade Plan:

Entry: On reclaim and candle close above 181.00

SL: Below the recent structure low (~180.00 or dynamic based on confirmation)

TP: Previous high at 184.60 zone (approx 1:3 RR)

🧠 Trading Psychology:

Patience is key — wait for structure confirmation and avoid pre-emptive entries. The liquidity sweep setup gives us a solid probability edge when combined with market structure shift.

#SOLUSDT #CryptoTrading #SmartMoneyConcepts #LiquiditySweep #TradingSetup #BOS #MarketStructure #ReversalPattern #CryptoAnalysis #LongTradeOpportunity #PriceActionTrading #15MinSetup

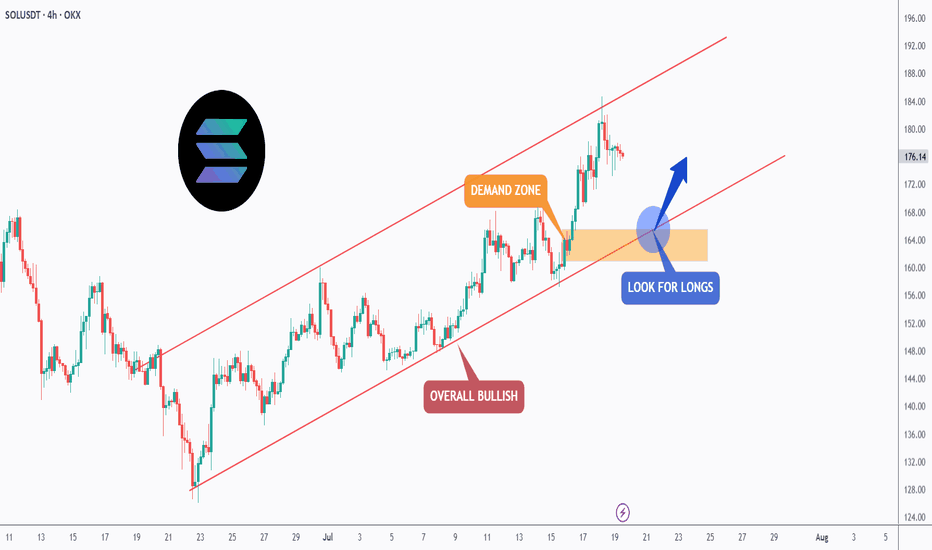

SOL - Trend-Following Longs in the making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

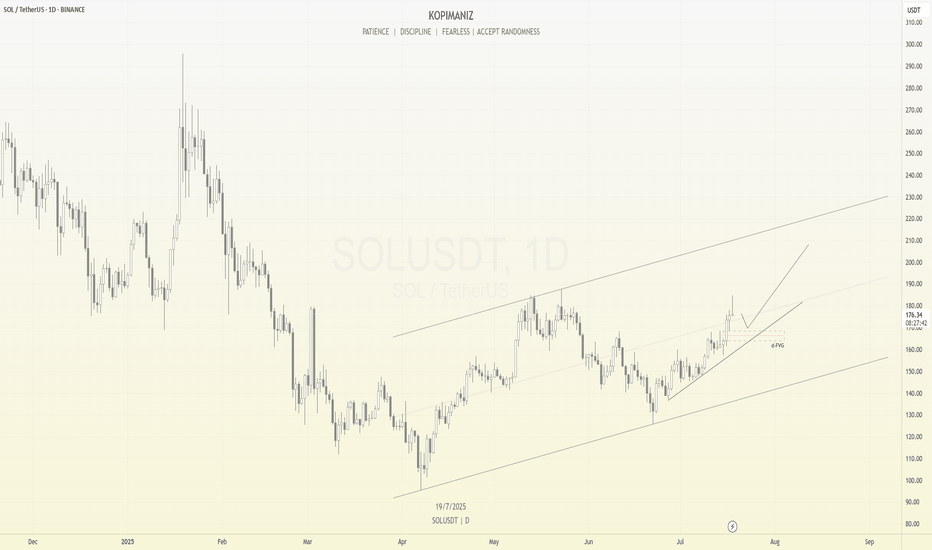

📈SOL has been overall bullish trading within the rising channel in red.

Moreover, the orange zone is a strong demand.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SOL retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

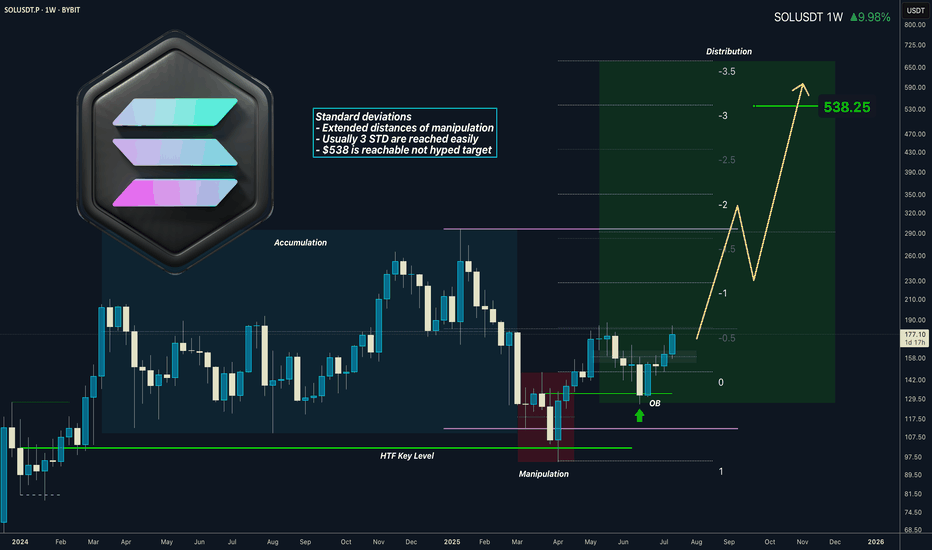

SOLANA I 3M CLS I 3STD Deviations Extension = $538 TargetHey what up traders welcome to the COT data and Liquidity report. It's always good to go with those who move the market here is what I see in their cards. I share my COT - order flow views every weekend.

🎯 Non Commercials added significant longs and closed shorts at the same time. So for that reason I see the highs as a liquidity for their longs profits taking.

📍Please be aware that institutions report data to the SEC on Tuesdays and data are reported on Fridays - so again we as retail traders have disadvantage, but there is possibility to read between the lines. Remember in the report is what they want you to see, that's why mostly price reverse on Wednesday after the report so their cards are hidden as long as possible. However if the trend is running you can read it and use for your advantage.

💊 Tip

if the level has confluence with the high volume on COT it can be strong support / Resistance.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

Solana Eyes 15% Rally, Targeting $210 After Key Support BounceHello✌

Let’s analyze Solana’s upcoming price potential 📈.

BINANCE:SOLUSDT is approaching a key daily support near the 0.38 Fibonacci level, setting up for a potential 15% rally with a target around $210. Breaking above the important psychological resistance at $200 could confirm a bullish trend continuation. 📈 If this level holds, SOL looks well-positioned for further upside in the coming weeks. 🚀

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale 🐋

Inverted head and shoulder suspected ..keep an eye on necklineHi dear friends and followers, I suspect this inverted head and shoulders pattern with a neckline around 160 usd. If it breaks in, it can go down toward the inferior support level around 130 usd and the 0.618 Fibo. If it breaks out it can go up until the next resistance and psychological level of 200 usd. As you can see, this 200usd resistance level does match with a large ascending channel.

You all need to DYOR and keep an eye on RSI and volume to confirm the movement and take a trade.

Wishing you the best and success on your decision.

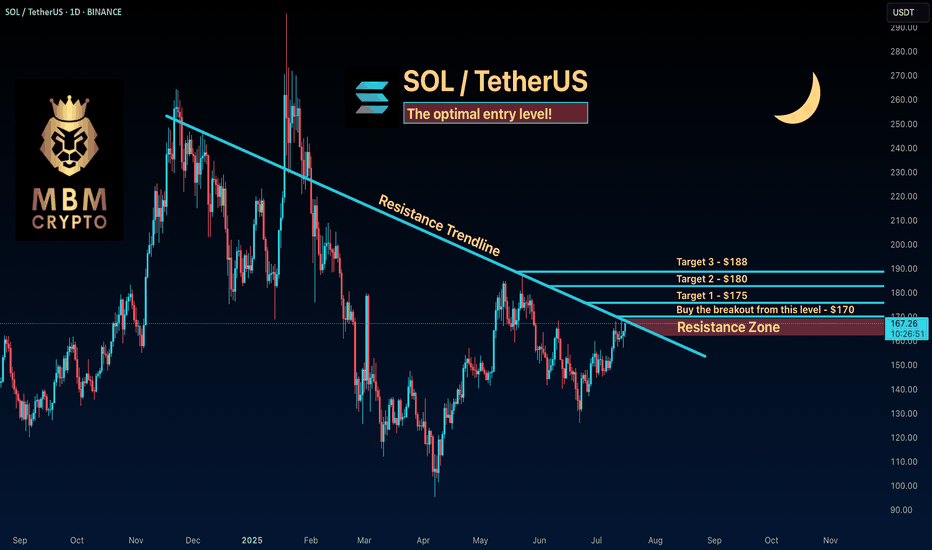

SOL: The optimal entry level! Keep an Eye on SOL

Now is the time to watch SOL. If the price breaks to the upside, we could see a significant move that might take it above $190!

Trading Setup

If you’re considering trading SOL, here’s a quick setup that may help you.

The idea is: Buy when the price breaks above $170 and take profits at the levels shown in the chart.

Targets:

1. $175

2. $180

3. $188

-------------------------------------------

About our trades:

Our success rate is notably high, with 10 out of 11 posted trade setups achieving at least their first target upon a breakout price breach (The most on TW!). Our TradingView page serves as a testament to this claim, and we invite you to verify it!

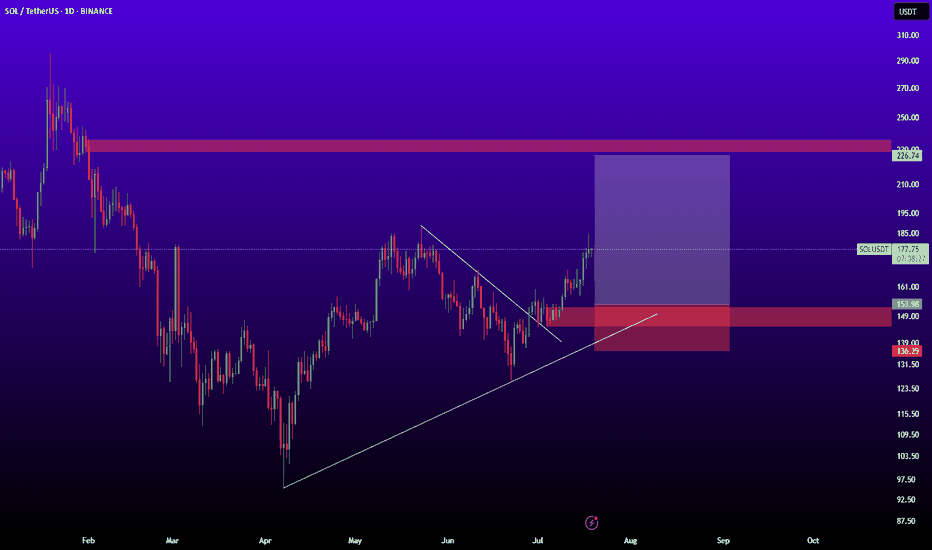

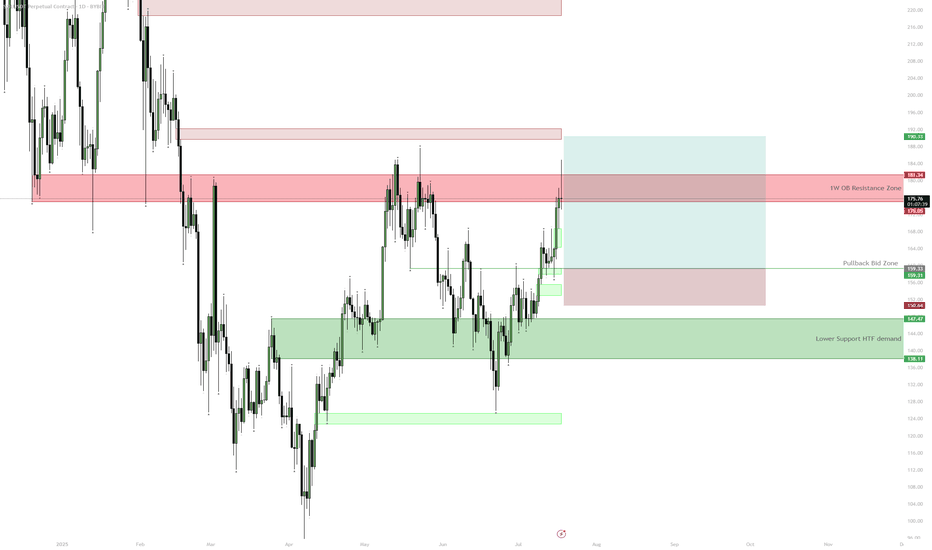

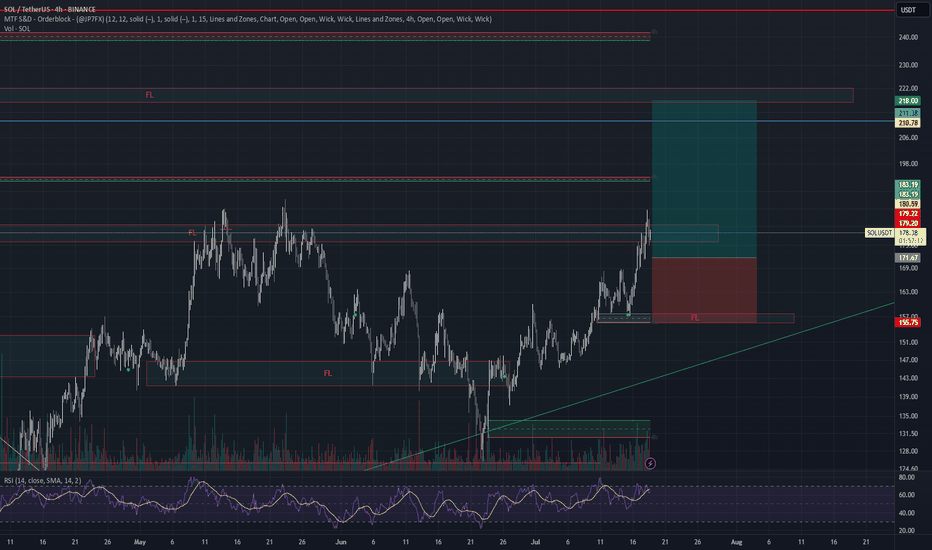

SOL — $180 HTF Resistance | Consolidation ExpectedSOL is approaching a key HTF resistance zone at $175–$181 with 1D RSI close to overbought. Unless price cleanly breaks above this area, a pullback to $160 or even the $138–$147 demand zone is likely before further upside. The setup provides a better risk/reward for longs on pullbacks after consolidation rather than chasing at resistance.

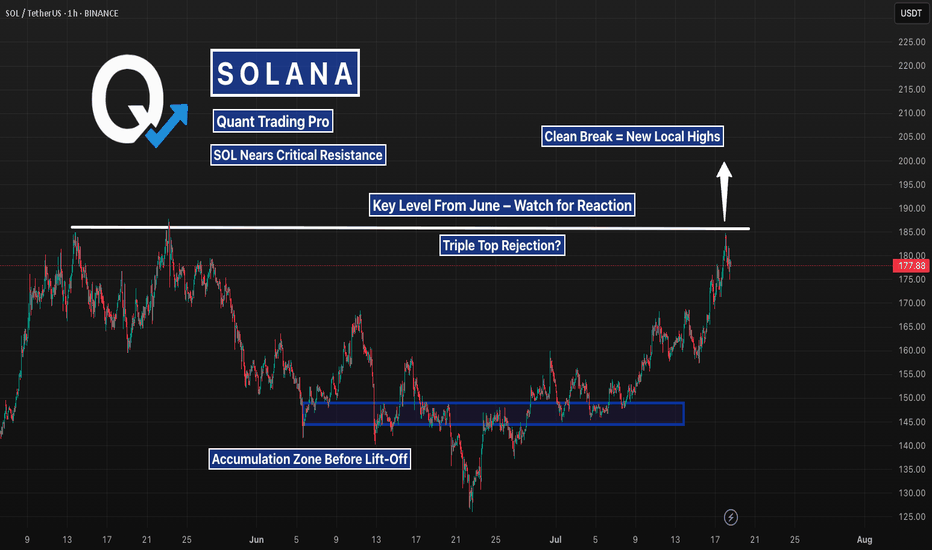

Solana Testing the June Breakdown Level — Decision TimeAfter weeks of slow grind, SOL is now pressing into a level that triggered a major selloff in June. A clean breakout here could flip momentum hard — but if buyers stall again, a short-term double top could catch late longs off guard. Watching $185 closely.

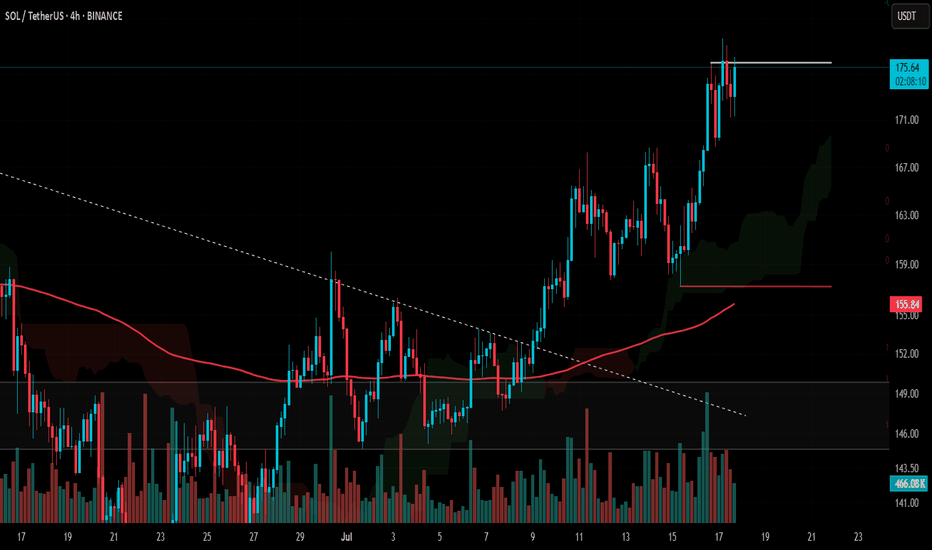

SOL/USDT Technical Outlook – Breakout Holding, Eyes on 175+Solana has successfully broken above the key resistance zone at $155–157 and is currently testing it as new support. If the level holds, this breakout could extend toward the next major target around $175–178.

📌 Key Insights:

Clean breakout followed by a potential SR flip

Watch for confirmation of support before continuation

Target aligns with previous swing high

Invalidated on breakdown below reclaimed level

🟢 Bias remains bullish as long as price holds above the breakout zone. A confirmed retest could provide a high-probability long setup.

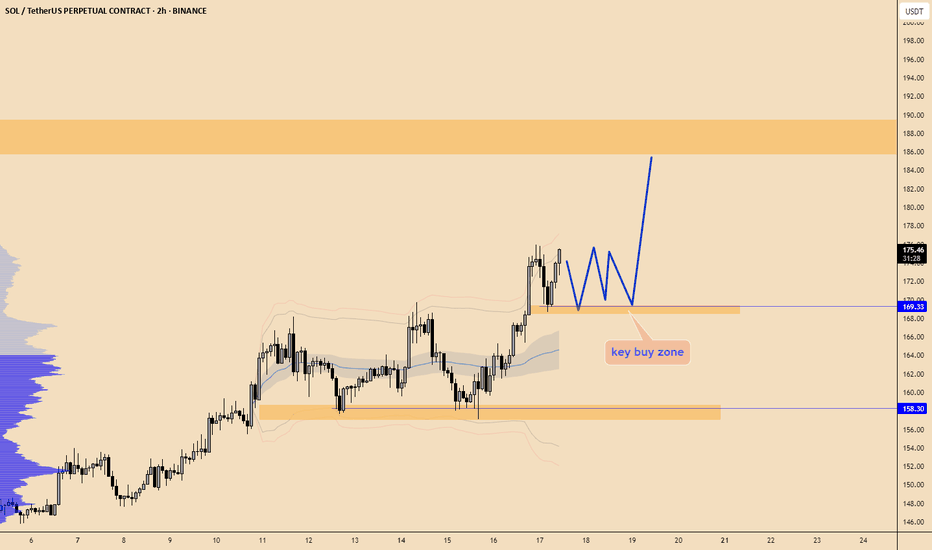

SOLUSDT – Healthy Pullback Before ContinuationSolana has shown strong bullish momentum recently, breaking out of a consolidation range and trending upward within a clear ascending channel.

However, in the short term, I expect a minor correction as price is likely to revisit the Fair Value Gap (FVG) zone marked around the $160–$165 area. This would be a healthy retracement within the trend and could provide a solid base for continuation toward higher targets.

If price respects the FVG and the lower trendline, SOL could resume its bullish move, potentially aiming for the $200 level and higher within the channel.

Key levels to watch:

FVG support zone: $160–$165

Resistance target: $200 – $220

Waiting for a pullback to enter on strength. Trend remains intact as long as the channel holds.

Solana starting to look bullish again | Target $180 - $260In my previous idea, I anticipated a liquidity hunt below the $140 level, and price action played out exactly as expected. SOL wicked below this key support zone, triggering stop-losses and inducing panic selling — classic behavior before a major reversal. Following this sweep, price quickly reclaimed the range, breaking out of the downward channel, and is now retesting a bullish break of a textbook cup-and-handle pattern, signaling a potential trend continuation to the upside.

📊 Technical Setup

Cup and Handle formation is evident, with the "handle" forming as a downward-sloping channel now being challenged.

Price reclaimed the $140 demand zone post-sweep and is now retesting.

Target zones: $180 → $220 → $260 based on historical resistance levels and measured move projections.

📉 Invalidation Level

A daily close below $120 (marked as the Invalidation Zone) would invalidate this setup and suggest bulls have lost control.

🌐 Macro Perspective

Fed Rate Cut anticipation and cooling inflation data are helping risk-on assets like crypto regain momentum.

SOL staking ETF launching this week, while SOL spot ETF approval imminent.

Solana's growing DeFi ecosystem, along with high TPS performance and low fees, continues to attract developer and user activity. SOL remains a top candidate for sector outperformance in a bullish H2 crypto cycle.

📌 Conclusion

With market structure turning favorable and strong macro tailwinds, SOL may be gearing up for a major breakout rally. Watch the $160 level closely — a decisive break and hold above could confirm the next leg higher.

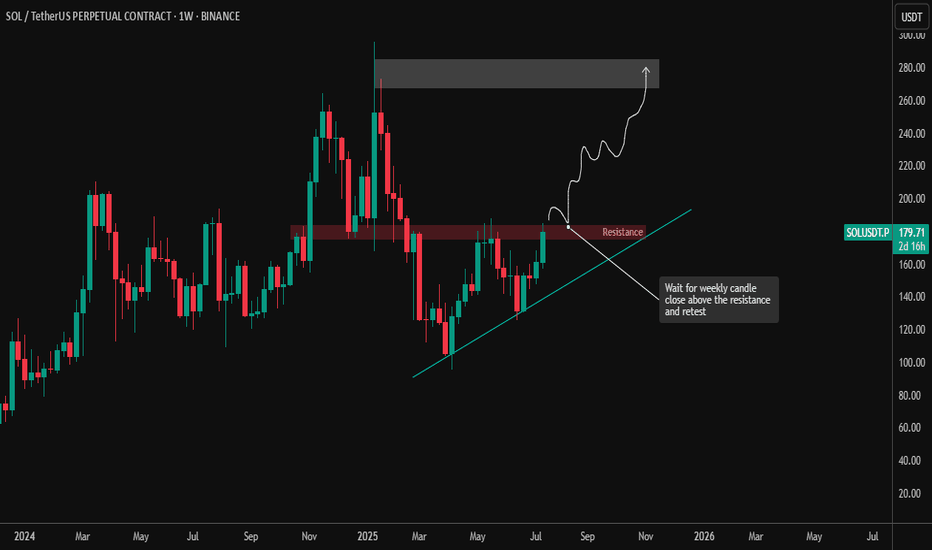

SOL/USDT – Weekly Chart Analysis (July 18, 2025)Solana is at a critical breakout point as price pushes against a long-standing horizontal resistance zone between $175–$180. This zone has been tested multiple times since late 2024, making it a significant level to watch.

🔹 Current Price: ~$179.66

🔹 Resistance Zone: $175–$180

🔹 Next Major Supply Zone: $260–$290

🔹 Trendline Support: Still intact and respected since the Q2 lows

📌 Key Setup:

SOL is attempting a breakout above the horizontal resistance.

Price structure shows a series of higher lows, indicating growing bullish momentum.

A weekly candle close above $180 followed by a successful retest would confirm the breakout and could open up upside toward the $260–$290 zone.

📈 Trade Plan:

Breakout Entry: After a confirmed weekly close + bullish retest of $175–$180

Invalidation: Break below trendline and failure to hold above $160

Target: $260–$290 zone, where previous supply stepped in

🧠 Patience is key: Wait for confirmation and don’t chase breakout candles. This level has historically acted as a trap — confirmation is critical for safer entries.

#Solana #SOLUSDT #CryptoTrading #TechnicalAnalysis #Altcoins #Binance

DeGRAM | SOLUSD seeks to confirm the breakout📊 Technical Analysis

● Bulls pushed back inside the broad rising channel and pierced the five-week gray trend-cap; the breakout has been retested at the 147-150 pivot (green strip), now acting as support.

● Price is carving a tight bull-flag on diminishing volume; its 1.618 swing and the channel median intersect with the May swing high near 173, while the upper rail aligns with 187-190.

💡 Fundamental Analysis

● VanEck’s late-June 19b-4 filing for a US spot Solana ETF trimmed perceived regulatory risk, and Firedancer’s public test-net timeline lifted developer sentiment, both fuelling fresh inflows.

✨ Summary

Long 147-150; flag break above 155 targets 173 → 187. Invalidate on a 16 h close below 140.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

#SOL Update #5 – July 18, 2025#SOL Update #5 – July 18, 2025

Solana has returned to the region where its last impulsive move was formed. It appears to be attempting another bounce, but when we look at the SOL/BTC pair, it is currently facing a strong resistance zone.

There isn't much room between this resistance and the 200 MA band, which makes this a critical decision zone. At the moment, I do not recommend entering either a Long or Short position — it’s best to wait and observe.

If Solana breaks out to the upside, the next target will likely be $179.

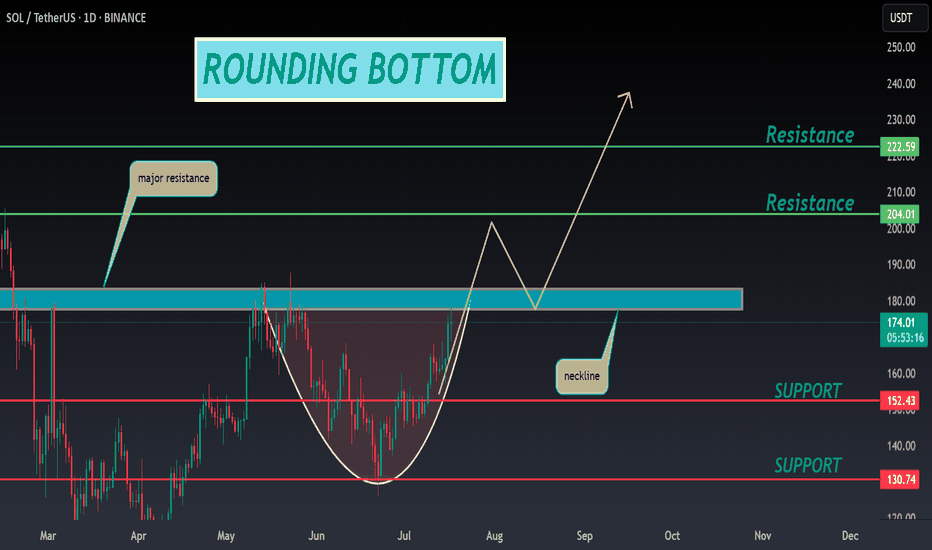

SOL ANALYSIS🔮 #SOL Analysis 💰💰

📊 #SOL is making perfect and huge rounding bottom pattern in daily time frame, indicating a potential bullish move. If #SOL retests little bit and breakout the pattern with high volume then we will get a bullish move📈

🔖 Current Price: $173.75

⏳ Target Price: $204.00

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#SOL #Cryptocurrency #Pump #DYOR

SOL - Excellent Trade Opportunity- Trade is giving us a trade with huge potential with huge risk reward ratio.

- Currently price is heading towards teh support around 160 range and this is strong support zone.

- I'm expecting price to bounce back from this zone and head towards the next target of 200 range

Entry Price: 163

StopLoss: 148

TP1: 172

TP2: 182

TP3: 200

Stay tuned for more updates.

Cheers

GreenCrypto