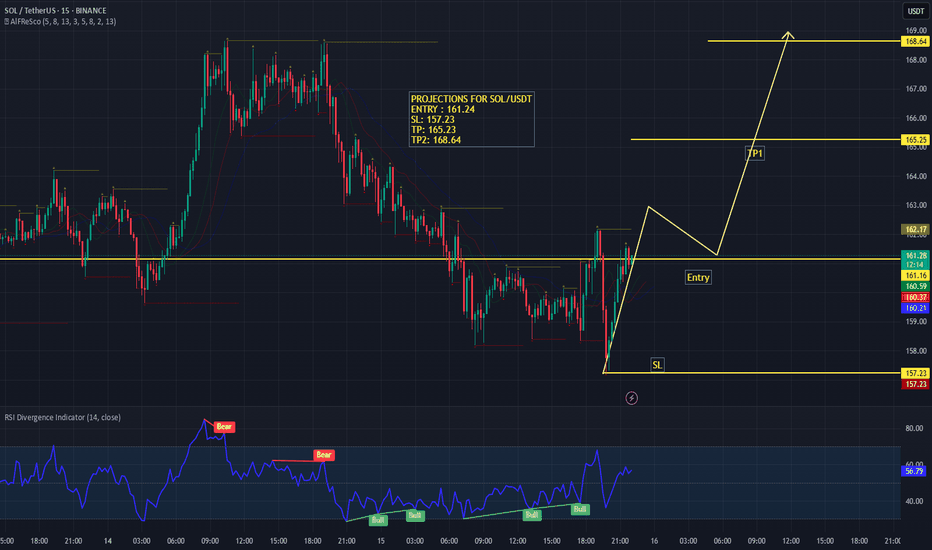

SOL/USDT – 15M Technical AnalysisSolana (SOL) is showing signs of a potential bullish reversal on the 15-minute timeframe after a sharp downtrend. Price has reclaimed key support levels and is preparing for a possible breakout.

📈 Projections & Trade Plan:

Entry: 161.24 (above immediate resistance)

Stop Loss (SL): 157.23 (below recent swing low)

Take Profit (TP):

TP1: 165.23 (near previous resistance cluster)

TP2: 168.64 (targeting the upper resistance zone)

Technical Insights:

The price has broken the descending structure and is showing bullish momentum with a clean impulse leg upwards.

A minor pullback to the entry zone would provide an optimal long opportunity before continuation towards TP levels.

Momentum Indicators:

RSI is trending upwards at 55.56, indicating strengthening buying pressure. Multiple bullish divergences can be observed, which align with the reversal thesis.

⚡ Bias: Bullish

If price holds above 161.24 and confirms breakout strength, we can expect a move toward 165.23 and potentially extend to 168.64. However, failure to hold above 161.00 may invalidate the setup.

SOLUSDT.3S trade ideas

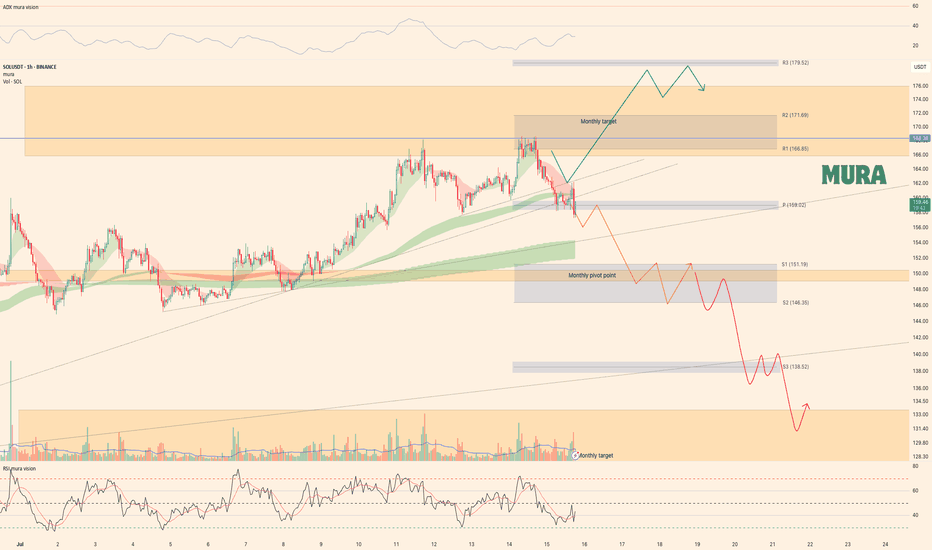

Solana - key levels for this weekSolana is currently testing the weekly pivot point and trying to break higher, but we've already seen one rejection. If it manages to hold above this level, we could see a push toward $169. However, if we get a fake breakout or fail to sustain above the weekly pivot, the nearest support target sits at $151. In that case, price would follow through with our orange scenario. More details are in yesterday's video analysis

Levels marked—now let the market decide

Solana UpdateHello friends🙌

After the price growth we had, the price hit the resistance level of $160 twice and failed to break it, which caused a double top pattern to form, which if confirmed, there is a possibility of falling to the specified areas.😉

The specified areas are good prices for buying in steps, of course, with capital and risk management.✔

🔥Join us for more signals🔥

*Trade safely with us*

Solana:Daily free signalhello friends👋

As you can see, after the drop that we had, insider buyers showed and were able to support the price well.

But it was not enough, and as you can see, a noisy pattern has formed, which can indicate a further decrease in the price.

Now we can take advantage of this opportunity and make step-by-step purchases with risk and capital management in the support areas that we have obtained for you and move to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

Will Solana Explode? This Important Zone Could Trigger a MoveYello, Paradisers! Is #Solana about to break free into a new bullish wave? After months of struggling under key resistance, the bulls are finally making a serious push… but only one zone stands between SOL and a potential explosion.

💎After peaking in January, Solana has remained suppressed under a descending trendline. But now, that trendline is being challenged aggressively, and the price structure is starting to form a reversal pattern that demands attention.

💎Right now, the most important level on the chart is the descending channel resistance at $167. Bulls are actively testing this zone, and if they manage to flip it into support, it could trigger a significant shift in momentum. But just above, at $180, sits an even more critical barrier, the neckline of the current reversal pattern. This entire region between $167 and $180 is the true battleground.

💎#SOLUSDT's confirmed breakout above $180 would be a major technical signal. It would likely send Solana toward the $210 to $225 zone, which marks a significant resistance area. This isn’t just psychological; it also aligns with the 61.8% Fibonacci retracement, a level where institutional players often begin offloading positions

💎As for the downside, support remains solid between $155 and $160. This region is protected by both horizontal demand and dynamic support from key moving averages, offering bulls a stable base to defend. Adding to the bullish case is a potential golden cross formation between the EMA-50 and EMA-200, a signal that, if confirmed, could inject even more confidence into Solana’s price action.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

#SOL Update #4 – July 15, 2025#SOL Update #4 – July 15, 2025

Solana’s latest impulsive move failed to close significantly higher than the previous one. In fact, they closed at nearly the same level, which raises the risk of a potential double top pattern.

Looking at the current 4-hour chart, Solana seems to be nearing the end of this move. If the $157 support level breaks, it would likely indicate a transition from a bullish to a bearish structure on the 4H timeframe. The first target in such a breakdown would be around $154. If the $154 support fails to hold, the second target would be near $149.

Volume currently appears quite low, and the presence of long upper wicks adds further risk. Given the current conditions, Solana looks quite risky, and I do not recommend any trading positions—either buy or sell—at this time.

SOL | Relative UnderperformanceSOL is showing relative underperformance compared to the broader crypto market, but the technical picture suggests a potential reversal opportunity.

Current Setup:

Price recently bounced from the crucial support zone (green box) around $118-140

A clear ascending trendline has formed, indicating building momentum

Key Levels:

Support Zone: $118-140 (green box) - holding well

Resistance Zone: $190-200 (purple box) - next major hurdle

Breakout Target: $340+ based on the projected path

Technical Outlook:

The ascending trendline breakout combined with the support zone hold suggests SOL may be ready to catch up with market leaders. The relative underperformance could present a catch-up opportunity once it clears the resistance zone.

Risk Consideration:

A break below the green support zone would invalidate this bullish scenario and could lead to further weakness.

TradeCityPro | SOL Holds PRZ as Bulls Eye Range Breakout👋 Welcome to TradeCity Pro!

In this analysis, I want to review the SOL coin for you. This is one of the popular Layer1 projects, nicknamed the “Ethereum killer,” with a market cap of $85 billion, currently ranked 6 on CoinMarketCap.

📅 Weekly timeframe

In the weekly timeframe, after the bankruptcy news related to FTX, this coin had a very sharp bearish move and even dropped to as low as 9.84, but it managed to recover afterward.

⭐ From the key top at 27.62, a very strong bullish move started, reaching up to 255.96 and retesting its previous ATH.

📊 Currently, a range box has formed between the 128.66 and 255.96 levels, where the bottom of this box is a very strong PRZ, created from the overlap of a major support zone and the area between the 0.236 and 0.382 Fibonacci levels.

🔍 Also, the price is being supported by the SMA99, which has supported the price twice so far and has prevented the box from breaking to the downside.

⚡️ If you have already bought SOL, you can set your stop-loss if the price closes below this area. A confirmed breakdown could lead to deep corrections toward lower Fibonacci levels.

🛒 For buying this coin, the first trigger is the break of 178.22, which is a bit riskier but offers a good price entry. On the other hand, if the price revisits 128.66 and gives confirmation, we can enter from there.

📈 However, the main trigger for spot entry is the breakout of the 255.96 top. Breaking this level can unlock some very ambitious targets. If that happens, I’ll definitely update the analysis and provide those targets.

📅 Daily timeframe

In this timeframe, we can see the price action in more detail. A small range box has formed between 144.11 and 164.74, and the price is currently stuck below the top of the box and reacting to it.

✨ If 164.74 breaks, we can enter a long position. The next major resistance is 183.54. A breakout above that will serve as the main confirmation for a long position targeting 255.96, which can also be used as a spot trigger.

💥 The RSI oscillator is now above the 50 zone, and if it enters the Overbuy area, it will serve as strong momentum confirmation for this position.

✅ If the price gets rejected from the top, we can also open short positions on lower timeframes. A break below 144.11 will be the main short trigger.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

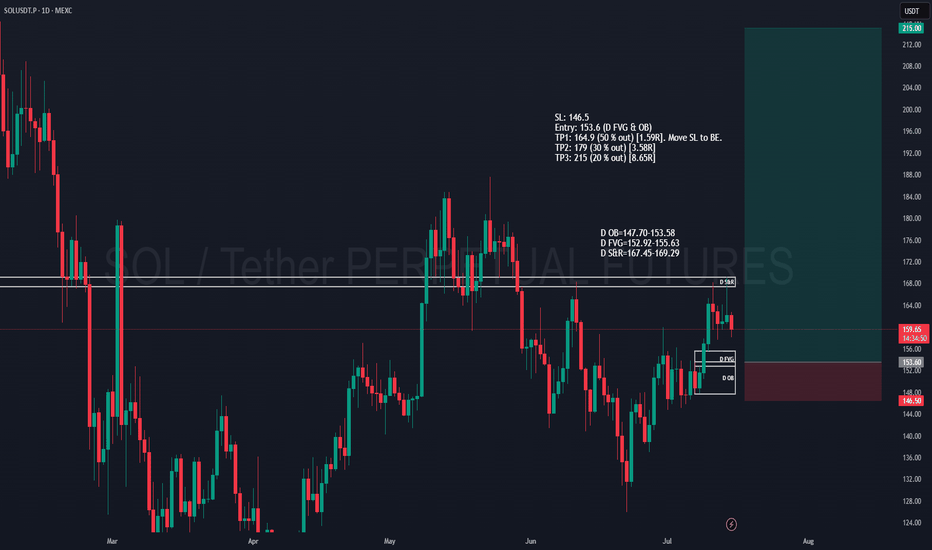

SOL Swing long - MTF ConfluencePositioning for a swing long entry on SOL based on alignment across Weekly, Daily, and 4H.

Weekly structure is bullish with clean HL-HH sequence. Stochastic RSI still rising = potential momentum continuation.

Daily structure remains bullish with HL-HH and is valid unless price closes below 146.5. Volume profile shows POC around 152.2.

On the 4H there´s a clear volume cluster around my entry, confirming heavy accumulation and interest. EMA 100 & 200 on 4H sits right beneath = dynamic support.

Trade Setup (SOL limit long order)

Entry: 153.6 (within OB & FVG)

SL: 146.5 (below OB & invalidation level)

Targets:

TP1: 164.90 → +1.59R (50% out, move SL to BE)

TP2: 179.00 → +3.58R (30% out)

TP3: 215.00 → +8.65R (20% runner)

DISCLAIMER: I am not providing trading signals or financial advice. The information shared here is solely for my own documentation and to demonstrate my trading journey. By openly sharing my process, I aim to put pressure on myself to stay focused and continually improve as a trader. If you choose to act on any of this information, you do so at your own risk, and I will not be held responsible for any outcomes. Please conduct your own research and make informed decisions.

Bearish RSI Divergence on SOLUSDT (4H) – Patience Over FOMO!

🚨 Observing a clear Bearish RSI Divergence on the 4H chart for $BYBIT:SOLUSDT.

While the price made a higher high, the RSI showed a lower high, indicating weakening bullish momentum.

🟣 RSI is now trending down and currently around 46.

💡 I'm waiting for RSI to approach the 30 level (oversold zone) before considering a long entry.

🎯 No rush to buy — I prefer to wait for confirmation and a better risk-reward zone.

📅 Timeframe: 4H

📍 Plan: Waiting for RSI near 30

✅ Staying disciplined and avoiding emotional entries.

🧠 Let the setup come to you. Don’t chase the market.

Solana Coiling Beneath Resistance — A Breakout Could Get ViolentSolana is pressing against the upper bounds of its multi-month range, with price tightening just beneath key resistance near $180. This level has historically triggered strong sell-offs, but the rising structure from June suggests bullish pressure is building.

Momentum is elevated, but not overheated — a clean breakout above the range high could trigger a rapid move toward $200+. If rejected, eyes shift back to the $140–$120 demand zone. This is a high-stakes zone — breakout traders should be ready.

Weekly trading plan for SolanaLast week, BINANCE:SOLUSDT price followed our bullish scenario after breaking out from the ABCDE triangle. We’ve now hit all projected targets, with current trading around $165. However, the 4-hour RSI is showing divergence, suggesting potential near-term correction or consolidation. Full analysis in the video idea

Trade safe and stay adaptive

#SOL/USDT Loves THIS Pattern | BULLISH#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 143.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 142, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the moving average of 100.

Entry price: 149.

First target: 153.

Second target: 156.

Third target: 159.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Will Solana reach $1400?After analyzing Solana’s complete data, it appears that a large diametric pattern is forming in the long term.

Currently, it seems we are in wave c of C.

If the key level of $187 is broken and price consolidates above it, we can be much more confident that we are indeed in wave c of C, confirming this scenario.

However, if the price fails to break and hold above $186 on higher timeframes like the 3D or weekly, and gets rejected downward, this scenario will be invalidated.

If confirmed, the targets for wave c of C are marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

sol sell midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SOL/USDT Scalp Setup: Shorting the Break of StructureThis trading setup outlines a short-term, or scalp, short position on the SOL/USDT pair on the 30-minute timeframe. The logic is fundamentally based on a confirmed market structure shift from bullish to bearish.

Technical Analysis of the Setup Components:

Ascending Trendline Break: The first warning signal is the decisive break of the primary ascending trendline (green line). This indicates a weakening of buyer strength and a loss of bullish momentum.

Change of Character (CHoCH): Following the trendline break, the price failed to create a new higher high. Instead, it formed a lower low than the previous one, signaling a "Change of Character" in the market structure from bullish to bearish. This is a key signal to start looking for short opportunities.

Break of Structure (BoS) Confirmation: By breaking a significant prior support level, the price created a bearish "Break of Structure" (BoS). This move confirms the new downtrend and suggests that sellers are now in control of the market.

Strategic Entry Point: The entry is set at $161.12. This area represents a broken support zone that is now expected to act as resistance (a classic Support-Resistance Flip). Entering on a pullback to this broken structure is a high-probability strategy for joining the new trend.

Risk and Reward Management:

Stop Loss (SL): The stop loss is placed at $162.07, just above the most recent lower high. This is a logical placement, as a price move above this level would invalidate the current bearish scenario.

Take Profit (TP): The take profit is targeted at $156.90, near the next major support or demand zone, making it a reasonable objective for the bearish leg.

Risk/Reward (R/R) Ratio: The setup offers an excellent risk/reward ratio of 4.44 to 1. This means the potential profit is more than four times the potential loss, which is highly favorable from a risk management perspective.

Can SOL break out strong and rally 12% to $185?Hello✌

let’s dive into a full analysis of the upcoming price potential for Solana📈.

BINANCE:SOLUSDT is forming a clear inverse head and shoulders pattern near a strong daily support zone, signaling a potential trend reversal. This setup suggests at least a 12% upside, targeting $185, marking a promising start for SOL’s next bullish move. 📊🔥

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

The 1.414 Fib – Smart Money’s Darkpool Fib📐💸 The 1.414 Fib – Smart Money’s Darkpool Fib 🔍🧠

Let’s talk about the 1.414 Fibonacci extension — also known as √2 — a subtle but deadly precise level that smart money uses to trap retail.

We saw this play out perfectly on Solana.

That ~$295 zone (close to 300$ but 'no cigar') ?

That was the 1.414 Fib , and it nailed the top before a brutal reversal — a textbook darkpool distribution move.

But Solana wasn’t alone.

🔁 This Isn't Just About SOL

The 1.414 (√2) level has repeated across the crypto market , quietly acting as a marker for institutional exit zones:

📉 It showed up on multiple altcoins in December 2024, just before the entire altcoin rejection

🟠 It’s even been visible recently on Bitcoin itself — yes, even the king of crypto respects this level

So no — this isn’t random. This level has a story to tell.

🤖 Why 1.414 Matters

Most retail traders fixate on the golden ratio: 1.618.

But the 1.414 (√2) is just as important — and arguably more manipulative.

It allows institutions to:

- Front-run major Fibs

- Exit quietly

- Trap late bulls

It’s less obvious, less crowded, and often more effective.

That’s why I call it the "Darkpool Fib."

💔 Why I’m Divorcing Altcoins — But Not Yet

Solana’s chart — and its story — are symbolic of a deeper shift in me as a trader.

I’ve made the decision: at the end of this cycle , I’ll be divorcing altcoins.

Not out of hate — but out of clarity. I won’t “believe” in them anymore. I’ll just trade them.

But let’s be clear:

That moment isn’t now.

Right now, I’m still bullish. I still see opportunity. I’m here to ride the structure — while it’s still giving, or at least going to give something back.

📍Take Solana...

🔹 It was built on Rust, a language praised for speed and performance — perfect for high-throughput, data-heavy blockchain architecture

🔹 It could have been the chain that led us into the future

🔹 Instead, it’s become a memecoin playground , with repeated outages and centralized concerns

I don’t hate it. I just don’t believe in it the way I used to.

Narratives die. Structure doesn’t.

So yes — I’m trading SOL. I respect its levels. But I’ve let go of the idea that it will “change the game.”

I’ll trade the rally. I won’t marry the story.

📊 The Technical Setup

[📍 Support Zone: $153.48 $140.44

Below that, deeper support at $130.17 and $112.12

📍 Current Price: ~$158

📍 Upside Targets:

Minor: $196.80

Mid-channel: $221.53

Structural resistance: $234.97

Upper red trendline: $271.07

Final Extension: ~$325–$362

Potential: 271$, 362$, 490$(close but no cigar of the 500$ mark), 593$ technically is the ultimate resistance.

If Solana reclaims its momentum, this setup gives plenty of upside. But let’s be surgical. We are traders first.

⚠️ Final Thought

We’re in the phase of the cycle where hope is expensive.

Structure is free — if you choose to follow it.

Buy over support

Exit near resistance

Trade the level — not the label

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈