SOLUSDT trade ideas

Solana vs Ethereum – A Meme War or Market Shift?🔥⚔️ Solana vs Ethereum – A Meme War or Market Shift? 🧠📉

It’s getting spicy out here in the crypto arena... and the memes are hitting just as hard as the market caps! 💥

Over the weekend, Solana briefly flipped Ethereum in total staking value — triggering a fiery debate on whether that’s bullish or bearish for SOL. Some celebrated the milestone 🥂, while others, especially from the ETH camp, argued it reveals a deeper problem: Solana’s staking isn't really staking (as slashing isn’t automatic, and network restarts are still a thing). 🛑🔧

📸 Bonus Meme: Apparently Ethereum’s new logo is now Internet Explorer 😂 — can’t say the UX didn’t earn it.

🧠 The FXProfessor’s Technical Take: Let’s cut through the noise.

📉 SOLETH (Solana vs Ethereum Ratio)

Rejected at grand resistance: 0.088

Projected drop: -28% to 0.063

Structure: Bearish inside an ascending channel (highlighted in orange)

📊 ETHUSD

Support: $1,530

Rebound potential: $1,650 and beyond

Long-term structure still forming — this could be a spring.

📈 SOLUSD

Key support: $114

If that breaks higher, next test is $179, then $215

But failure at this level opens room for downside re-test near $80

💬 So where do we stand? On chart structure alone, Solana might still outperform ETH short-term — but technically, SOLETH suggests a correction is due.

🧑🏫 Yes, I’m emotionally attached to Ethereum — I have build on it, invested in it, got smashed on it for months..pain, at least for now. But I trade what I see (or at least i try damn it!)

Let the memes roll, but let the charts speak. Drop your thoughts — SOL or ETH? 👇

One Love,

The FXPROFESSOR 💙

SOL - PERFECT Levels still played out.18th April i published a SOL TA/Signal and updated it through days.

Those given Levels played out again and again and have some nice profits.

Days ago : "We are ready to short below POC or long above hVn or loc Daily :)"

Look how those 3 Levels played out nicely. Even with nice retests.

loc-D and 2x hVn. 🎯 👌

5-6 Trades though days ...

Look at all previous SOL TA and more important at that TA about Alts days ago to understand the levels and lines.

Alts TA:

previous SOL Signal:

Follow for more ideas/Signals.💲

Check out my previous TA/Signals which played out nicely. :)

Just donate some of your profit to Animal rights or other charity :)✌️

SOL SCALP.SOL brokestructure on the 1h timeframe with a valid orderblock as seen on the chart. Bias is generally bullish. This is a more riskier setup as I've analysed that SOLANA is going lower because of the HTF OB. Because they always outperform the LTF :). For riskier setups always use .5% risk or less.

I always appreciate a follow :) keeps me going.

SOL/USDT – 3D Long Signal Active📅 April 29, 2025

The system triggered a long entry at the last 3D bar close.

Currently, the price remains around the same levels.

✅ System conditions for a long are fully met:

MLR > SMA > BB Center > PSAR

Price is trading above the 200 MA on the 3D timeframe.

⚠️ Caution:

On the 1D timeframe, price is still below the 200 MA, which suggests some lingering weakness. Proceed carefully.

📍 Strategy Plan:

Consider entering long at today’s daily close or at the next 3D bar close.

Suggested stop-loss: below the latest PSAR dot for system integrity.

🔔 Keep an eye on updates and thank you for reading! 📈📊

sol buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SOL Daily – Bullish Break of Structure with Trendline ReversalSolana is currently trading around $146, having broken out of the descending trendline and confirmed a bullish break of structure (BoS) to the upside. This signals a shift in market direction, now favoring long setups.

The price is above the Ichimoku cloud, with Span A at $140.00 and Span B at $126.13, confirming the bullish trend is supported not just by price action but also by momentum structure. The cloud is angled upward, reinforcing that bullish continuation remains the most likely scenario.

The optimal entry zone lies between $126.36 and $112.45, a key support area that previously acted as resistance and has since been validated by multiple reactions. A retracement into this zone would offer a high probability long setup, particularly if combined with a short-term TSI reset or bullish candlestick signal.

The Trend Strength Index (TSI) supports this scenario:

TSI(20): 0.89 — strong bullish momentum

TSI(10): 0.19 — early in the cycle, with potential for expansion

The main bullish target is $256.00, which aligns with the next macro resistance zone and offers a risk-to-reward ratio 1:4.

Trade Setup Summary:

Entry Zone: $126.36 – $112.45

Target: $256.00

Stop Loss: Below $95

Solana remains one of the top-performing Layer 1 blockchains in terms of throughput, user activity, and developer interest. Its low fees and high speed have supported growing ecosystems in DeFi, NFTs, and consumer apps. Despite past setbacks, recent improvements in network stability and increased institutional attention have reignited bullish sentiment. With the market shifting into broader altcoin rotation, Solana is well-positioned to benefit from renewed investor flows.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

SOLOn CRYPTOCAP:SOL you can see the support zone I mark out. Take them as POI and watch PA closely when it reaches them. When I see a proper confirmation on either of the support levels you see on the chart I will announce it asap and notify you guys about my entry.

Remember to always use a stop loss and proper take profit to eliminate emotions and secure the profits.

Goodluck!

I always appreciate a follow, it keeps me going :) thanks!!!

SOLUSDT SHORT IDEAUnder current market conditions, the area near 148.3 has been identified as a critical resistance zone, where the AI model detects a high-probability trade setup.

From a technical perspective, a clear directional bias based on recent price action patterns. Suppose the market demonstrates increased volume and price stability above key moving averages in the 148.3 area. In that case, traders are advised to monitor for trend-continuation entry opportunities in alignment with the prevailing momentum.

Profit targets are defined at 145.0 and 140.2, corresponding to logical technical support zones. These levels are designed for staged profit-taking across different trade management styles. Stop-loss should be strictly enforced at the designated level; once breached, the strategy is considered invalidated in order to limit potential downside.

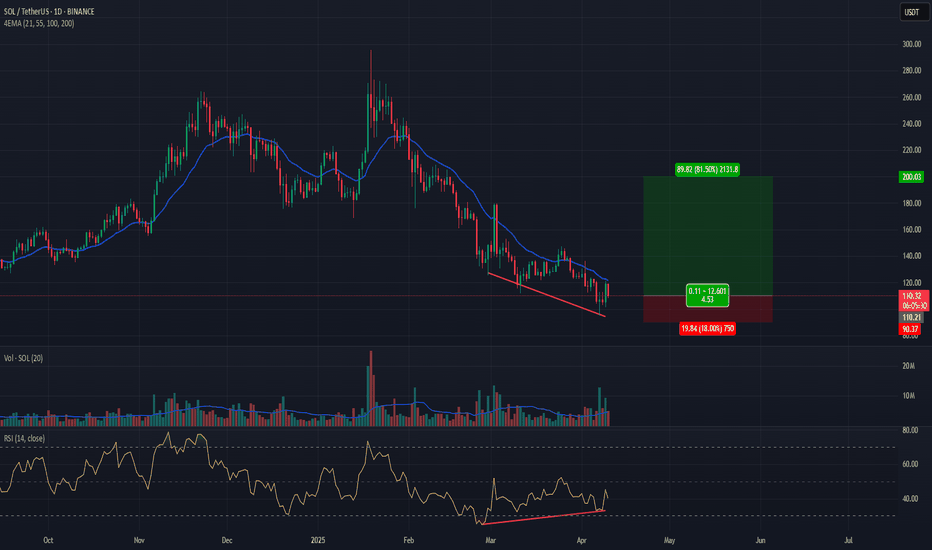

SOL Trade Setup – Structure Shift & Higher Low FormationSolana (SOL) has shown significant strength after deviating below range lows and tagging $95, quickly recovering and reclaiming key support, indicating a bullish structural shift. We’re now watching for a retrace into the $120 zone, which could confirm a higher low and set up a strong medium-term long entry.

🔹 Entry Zone:

Around $120

🎯 Take Profit Targets:

🥇 $162

🥈 $187

🥉 $213

🛑 Stop Loss:

Daily close below $110

Lingrid | SOLUSDT Consolidation After KEY Resistance BreakThe price perfectly fulfilled my previous idea . BINANCE:SOLUSDT market has effectively bounced off the support level and continues moving higher. The price has established a significant swap zone around the 135.00 level, where it has repeatedly found resistance or support in previous tests.

Recently, the market broke and closed above the 140.00 resistance zone, and following this breakout, the market has entered a consolidation phase, suggesting it may continue moving sideways in the near term. However, if the price pulls back toward the established swap zone, we can anticipate continuation of the current bullish trend. This consolidation pattern following a resistance break often signals strengthening market conviction before the next meaningful advance. My goal is resistance zone around 165.00

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Solana Classic Signals (5 Total) & Bullish ConfirmationIt is the first time that Solana moves back above EMA55 after producing a major low since late 2024. Naturally, when this event happened back in late 2024 what followed was a bullish impulse. This is always the case as this is a confirmed classic bullish signal.

Solana is trading daily above EMA55 and this confirms mid-term growth potential.

The low happened 7-April and produced the highest buy volume in more than a year, since March 2024.

The difference is that March 2024 was a peak while April 2025 was a bottom. The volume signal is another classic.

The RSI is really strong with a reading reaching ~60.

The MACD is on the bullish zone now, it has been trading in this zone since 19-April.

There is a broken downtrend line (black) and this is another classic.

We have a total of five classic signals and we used these one hundred trillion times in the past few years to predict how the market would behave next. The list goes as follows:

» Moving averages

» Volume indicator

» Oscillators (MACD & RSI)

» Chart patterns

» Trendlines

Another one that we use very often is candlestick reading. Even if it is not mentioned in the analysis, it is always there. The bottom is confirmed with a reversal candlestick pattern.

» These are some of the classic signals, all bullish. Bullish means up. Solana is going up.

Thank you for reading.

Namaste.

SOL/USDT 1H: Distribution Phase – Short Setup Below $150SOL/USDT 1H: Distribution Phase – Short Setup Below $150

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $148.45, showing neutral-bearish structure after rejection at previous candle high (PCH).

Hidden bearish divergence visible on RSI, signaling potential downside continuation.

Market Makers actively distributing within premium zone ($152 – $154).

Trade Setup (Short Bias):

Entry: $148.40 – $148.60 range.

Targets:

T1: $146.20

T2: $144.80

Stop Loss: $150.20 (above PCH and resistance zone).

Risk Score:

7/10 – Strong rejection at $150.00 – $150.50 resistance supports setup, but minor bounce risk due to oversold RSI.

Key Observations:

Resistance cluster confirmed at $150.00 – $150.50.

Volume profile supports bearish continuation, with recent breakdowns in market structure.

Smart Money likely positioned short after multiple liquidity sweeps at highs.

Distribution signals align with hidden bearish divergence on RSI.

Recommendation:

Short positions favored within entry zone with stop above $150.20.

Consider scaling profits at $146.20 and $144.80 to maximize reward.

Monitor price action around $146.20 for potential absorption or stronger breakdown.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!