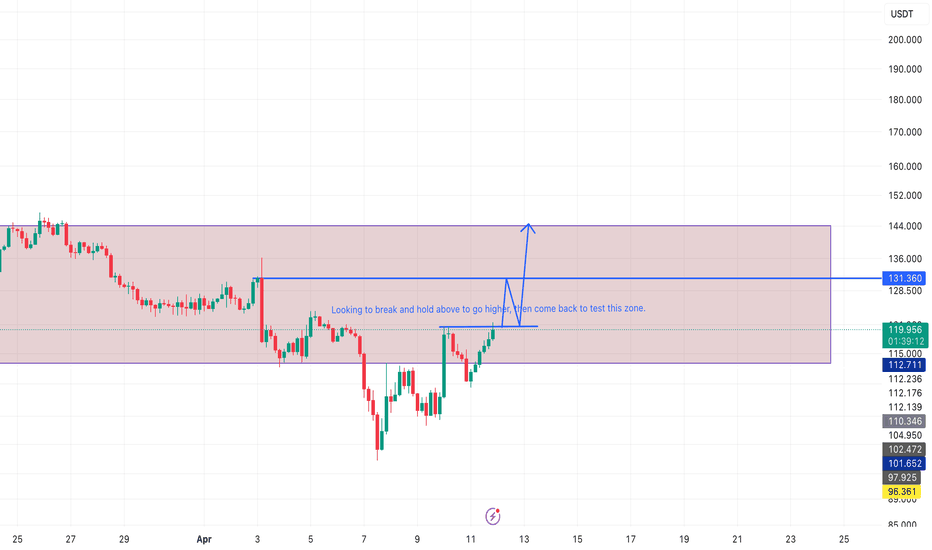

SOL preppin for a 300 revisit from this 100 bargain zone. SEED!SOL has been on rollercoaster ride the past few months -- going from 100 to almost 300 in a zoom when the market is at its peak.

Moreso, when memes started taking over the market and everyone, including the president himself is launching one on SOL blockchain, market started pickup up pace and eliciting euphoria among all, albeit momentarily. It has stirred up some hype and frenzy skyrocketing prices only to be met with so much saturation and gravity, then the BIG BLEED happens.

After a few weeks thing seem to have settled down -- a shift is gradually transpiring as we speak. SOL is now exhibiting some basing behavior at this current range at 100 levels. Net longs has started to pile up around this zone conveying a prep work of upside reversal soon.

Long term metrics suggests a tap at 61.8 FIB levels - a buyers convergence zone. This is where it all starts.

Ideal seeding is at the current discounted price range.

Spotted at 110

Mid target 300.

Long term 500.

TAYOR. Trade safely.

SOLUSDT trade ideas

Solana Update: To Buy Or Not To Buy? Hold Or Sell?Here is an update on Solana.

The chart has the same numbers as before but the support line has been moved to match the 5-August 2024 low. The action is happening right above this level.

While Solana trades above its August 2024 low, the action is considered bullish. Below this level and we are certainly bearish. Being bearish in this way does not change the long-term outlook, bias and perspective, we are set to grow long-term based on a broader trend and bigger cycle. This is a closer look.

The low in April is a shy lower low compared to March. This is always important. Notice the steep decline. This is a bearish impulse, prices tend to move down fast and strong. When bearish momentum starts to die down, we see patterns like the one we have on the chart above. Some shaky action and then a lower or higher low. The market (SOLUSDT) is preparing to change course.

The correction is present since November 2024. For Solana, the higher high in January 2025 is part of a complex correction, an extended flat. 3-3-5 wave in Elliott terms.

This is irrelevant. The point is that once the correction is over prices tend to grow.

Consider this, between June and September 2024 we have more than three months of consolidation. The market garnered enough strength to produce a bullish wave. It took a while but it happened. Then there is a correction and this bullish wave was erased by more than 100%.

If buyers showed up at a price of $100, $120, $130 and even $150 in the past, they can definitely show up again. Now that the bullish move has been erased, we are back to square one, the starting point, the base; from this point forward Solana can grow again.

Solana looks weak right now on the very, very short-term. But do not let this deceive you, we are going up next. Focus on the long-term.

Accumulation can be done each time prices hit support.

What happens if I buy and prices move lower?

Wait patiently. If you have capital available, buy more.

And if it drops again? Keep waiting, continue buying.

You will be happy with the results once the market turns.

Thank you for reading.

Patience is absolutely key.

If you didn't sell at $290, $280 or $250, why would you sell when prices trade at $100? It makes no sense.

Buy when prices are low and hold.

Only sell when prices are moving higher.

Namaste.

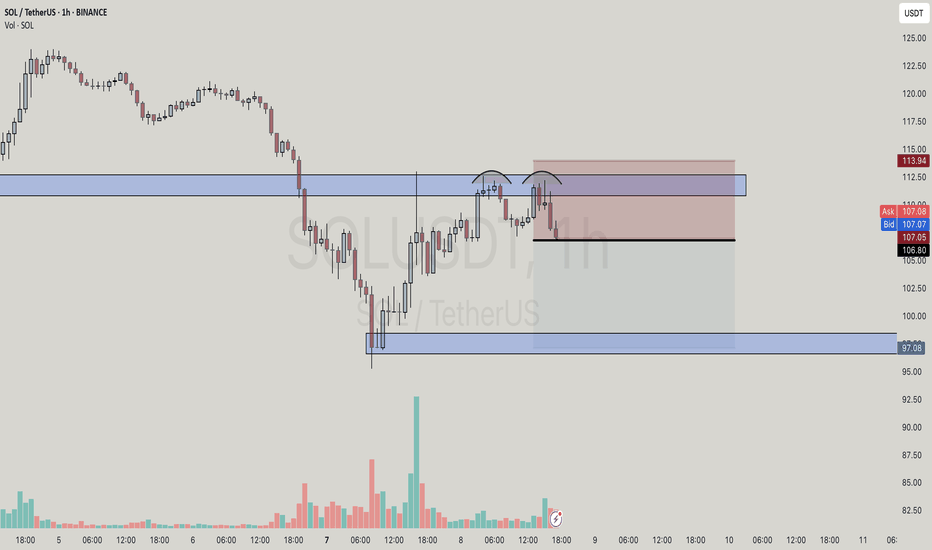

SOL — Clean Liquidity Grab & FVG Flip. Mid-Term Setup in PlayClassic move on SOL — liquidity sweep, inverted the FVG, and pushed higher. Textbook stuff.

Not expecting an instant pump, this one looks more like a mid-term play… although, with SOL, you never know.

Stay sharp. And follow to catch the next ones early.

Entry: 109

TP: 123-148

SOL Long from 103As You can see on 6h tf we have 2 mentioned LOWS which are refering not only sol is on support but also vwap confirmation on MARKET CIPHER and bullish divergence VWAP 6H and 24m TF,SOL will cover fair value gap upwards first then heads down but mean while we have a good trade on our hands,TP and SL are Mentioned.Drop like Comment if You get profits Thanks

SOL LONG????🔍 Overall Market Structure

The price recently saw a sharp drop from the $120.69 high and is currently consolidating around the $108–110 area.

A bullish structure is forming, suggested by the potential for a reversal pattern from a support zone.

🧠 Key Technical Components

📉 Fibonacci Levels (retracement from $101.21 to $120.69):

0.236 – $115.78 (resistance)

0.382 – $112.84

0.5 – $110.53

0.618 – $108.25 ← Current support

0.786 – $105.20

Price is bouncing from the 0.618 zone, a strong reversal area.

🟣 RSI (Relative Strength Index):

RSI is near oversold (31.15) and showing bullish divergence:

Price made lower lows.

RSI made higher lows.

This divergence suggests momentum is weakening on the downside, signaling a potential bullish reversal.

🟪 Support & Resistance Zones:

Demand Zone (support) around $107–108 (marked with purple box).

Supply Zone (resistance) around $118–120.

Price could bounce from support, targeting higher fib levels and possibly retesting the supply zone.

✏️ Projected Price Action (Black Curve):

Anticipated short-term reversal from $108.

Price might climb through:

$110 (0.5 fib)

$112.84 (0.382 fib)

Potentially to $115.78 (0.236 fib) or even back to the $120.69 high.

Shown within a larger wedge structure, so upper trendline resistance around $120.

✅ Conclusion:

Bullish reversal likely from $107–108 support.

RSI divergence + Fibonacci confluence supports the reversal thesis.

Next targets: $110.50 → $112.84 → $115.78 with final resistance near $120.69.

Elliott Wave Update – Clean Count DevelopmentBINANCE:SOLUSDT

We are currently tracking a developing (B) wave as part of a larger corrective structure.

The move up from the local low unfolds as a classic 5-wave impulse (yellow), where wave 3 is completed, wave 4 is forming as an A-B-C flat correction, and wave 5 is still expected to follow, completing wave (C) of (A).

After that, we anticipate a drop into wave (B) of the corrective sequence before a potential final push into the green target zone to complete wave (C) of (B).

Once this entire correction is done, the expectation remains for a larger 5-wave decline to complete the macro structure.

Wave count stays valid as long as internal rules of Elliott Wave Theory are respected.

Elliott Wave Analysis – Focus on Wave StructureBINANCE:SOLUSDT

The current setup shows a completed green (A) wave, followed by a corrective (B) wave unfolding as an A-B-C structure.

Within wave (C) of (B), we can clearly identify a 5-wave impulse:

Wave 1 is complete

Wave 2 formed as a correction

Wave 3 extended strongly

Wave 4 is currently developing

Wave 5 is expected to complete wave (C) of (B)

Once this move finalizes, a larger downward (C) wave is anticipated to complete the overall corrective pattern.

This setup remains valid as long as the internal structure respects the rules of Elliott Wave Theory.

SOL/USDT Wedge Breakout (08.04.2025)The SOL/USDT pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 120.60

2nd Resistance – 130.63

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Lingrid | SOLUSDT testing MARCH low. Short OpportunityBINANCE:SOLUSDT market is making lower lows and lower closes, indicating a bearish trend. It is slowly approaching the key psychological level at 100.00 while currently testing the previous month's low. The price broke and closed below the upward trendline that had been holding for a couple of weeks. I think the price may continue to move lower toward the key support level, and there is a possibility it could push even lower. Furthermore, the price has been consolidating around the 120.00 level, demonstrating significant bearish sentiment in the market. I expect the price to move lower, possibly breaking below the March low. My goal is support zone around 102.00

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Elliott-Wellen Analyse 1-2-3-4-5 incomingBINANCE:SOLUSDT

🧠 Elliott Wave Analysis

🔍 Market Structure & Wave Count:

After a strong bearish impulse, the market completed a complex corrective (A)-(B)-(C) structure.

The recent move up appears to be wave (2) of a larger downward impulse and seems to have finished.

We are currently in the early stages of wave 3 to the downside, aiming for a full 5-wave structure (1-2-3-4-5) within wave (C).

The final wave 5 is expected to complete in the demand zone (gray box) around 90–95 USDT.

📉 Short-Term Bearish Target:

Target zone for the completion of wave (C)-(B) lies around 97 USDT.

📈 Next Bullish Move (Rebound Target):

After completing wave (C), a new upward move in the form of wave (A) is expected.

This bullish corrective wave could reach up to 115 USDT, completing a larger A-B-C structure.

📊 Indicators:

MACD shows weakening bullish momentum – potential confirmation for wave 3 downside continuation.

RSI is near the oversold zone (~27) – supporting the idea of a wave 5 bottom and a bullish reversal afterward.

🧭 Conclusion:

➡️ Focus is on a final move down to complete wave (C) around 90–95 USDT.

➡️ After that, a possible long setup is expected for a corrective rally.

➡️ Great setup for swing or scalp trades using Elliott Waves + demand zone confluence.

Solana vs. Ethereum: Why Investors Are Turning to Solana in 2025In recent months, a growing shift in sentiment has been observed among crypto investors: many are increasingly eyeing Solana (SOL) as a strong alternative to Ethereum (ETH). The comparison chart above, plotting Solana’s price action alongside Ethereum's, reveals that despite ETH retracing back to October 2023 levels, SOL is still holding higher support zones—a sign of relative strength and growing market confidence.

But why exactly is Solana capturing investor attention more than Ethereum in 2025? Let’s dive into the technical, fundamental, and sentiment-driven reasons behind this evolving preference.

___________________

📊 Technical Outlook: Solana Holding Strong

Ethereum (red line) has dropped back to its October 2023 price levels (~$1500), reflecting a broader altcoin weakness.

Solana, on the other hand, is still trading above $100, even though the macro market has turned bearish.

SOL has tested and respected the long-term ascending trendline that began in early 2023, while holding above a key horizontal support near $68–$82.

This divergence in structure suggests stronger buy-side interest and support zones forming on Solana, while Ethereum appears to be losing momentum.

___________________

🧬 Fundamental Comparison: Solana vs. Ethereum

Solana’s technical design gives it a speed and cost edge that appeals to users and developers building consumer-facing applications like NFTs, GameFi, and micro-transactions. Ethereum remains the institutional and DeFi heavyweight, but it’s starting to feel the pressure of competition in usability and scalability.

___________________

💬 Investor Sentiment: What’s Driving the Shift?

User Experience

Solana offers near-instant confirmation and negligible fees, making it ideal for gaming, NFTs, and mainstream use cases. Ethereum's scaling solution rollouts are still clunky and fragmented (Layer 2s like Arbitrum, Optimism, etc.), creating friction.

Vibrant Ecosystem Growth

Solana’s ecosystem is experiencing a boom in dApps, especially with high-profile launches like Jupiter, Marinade, and Phantom wallet integration. The mobile-first approach (Saga phone initiative) and deeper ties with consumer apps are also pushing adoption.

Performance During Market Pullbacks

As seen in the chart, SOL is showing relative strength during market corrections, indicating long-term accumulation rather than panic selling.

Narrative Momentum

The "ETH killer" narrative has found new life with Solana's resurgence. While Ethereum focuses on L2 scaling and abstract complexity, Solana is betting on a simpler, high-performance monolithic chain.

SOL Trade Plan: Daily Support, Liquidity Grab & Trade Idea.Solana (SOL) is currently navigating a challenging market environment, with broader sell-offs across the crypto space weighing heavily on its price action. On the daily and 4-hour timeframes, SOL has traded into a significant support zone, marked by previous swing lows. This area has historically acted as a magnet for buyers, but the recent dip below these levels suggests a liquidity grab is underway. This move has likely triggered sell stops sitting below the lows, creating the potential for a reversal as smart money steps in. ⚡

Zooming into the 15-minute timeframe, SOL is consolidating within a tight range, reflecting a period of indecision. This range-bound behavior often precedes a breakout, and a bullish break above the range could signal the start of a recovery. A shift in market structure—marked by higher highs and higher lows—would provide further confirmation of bullish intent.

Key Insights:

Daily Timeframe: SOL has dipped below key support levels, sweeping liquidity.

4-Hour Timeframe: Price is overextended, trading into a critical demand zone.

15-Minute Timeframe: Consolidation within a range, awaiting a breakout for directional clarity.

Trading Plan:

Patience is Key: Wait for SOL to break out of the 15-minute range to the upside. 🚀

Market Structure Confirmation: Look for a clear shift to bullish market structure (higher highs and higher lows). 📊

Entry Strategy: Enter long positions after confirmation, with a stop-loss placed below the range low. 🛡️

Profit Targets: Focus on resistance levels on the 4-hour and daily timeframes for potential take-profit zones. 🎯

Levels to Watch:

Support Zone: Previous daily swing lows, now acting as a liquidity zone.

Resistance Zone: The upper boundary of the 15-minute range and key levels on the 4-hour chart.

This setup highlights the importance of waiting for confirmation before entering a trade. While the liquidity grab below support is a promising signal, a breakout and bullish structure are essential to avoid false moves. As always, this is not financial advice—traders should conduct their own analysis and manage risk appropriately. ⚠️