SOLANA (SOL/USDT) – TP: 170 - 252 & 295SOLANA (SOL/USDT) is currently trading at $130.17 after rebounding from a well-defined sell-side liquidity zone between $98 and $131. The recent weekly candle shows a strong bullish recovery (+22.93%), suggesting that liquidity has been swept and buyers are stepping in. This level has historically served as a key accumulation zone, and the bounce aligns with oversold conditions on the StochRSI, which is now curling upward — indicating growing bullish momentum. If price sustains above the $125–131 level, the next immediate upside target lies between $170 and $188, where prior supply and consolidation occurred. A confirmed breakout above this range opens the path toward a higher resistance zone between $254 and $295 — a region that aligns with unfilled inefficiencies and previous price distribution.

The ideal swing trade approach would be to enter on a pullback within the $110–125 range, set a stop loss below $98, and scale out at the $170 and $254 levels. This setup offers a favorable risk-to-reward ratio of approximately 1:3.5.

Trade Strategy Suggestion (Swing or Positional):

Entry: Ladder between $115–$125 on retrace

SL: $105–110 (below wick low)

TP1: $170–188

TP2: $254–295

Scaling Out: 50% at TG1, rest at TG2 or trail stops above $200

With macro tailwinds like renewed interest in Solana’s DeFi and meme coin ecosystems, institutional flow returning, and technical confirmation across multiple timeframes, this could be a high-conviction mid-term play for swing traders and positional investors alike.

🔮 Narrative & Fundamentals:

ETH L2 congestion → SOL gets transactional inflows

SOL’s DeFi, NFT, and memecoin activity resurging (e.g., SEED_WANDERIN_JIMZIP900:WIF , SEED_DONKEYDAN_MARKET_CAP:BONK ecosystem)

Institutional flow picking up (Grayscale SOL trust rallying)

SOL remains one of the fastest L1s with growing developer traction

SOLUST trade ideas

SOL/USDT – Potential Final Leg Down Before Major RallyBINANCE:SOLUSDT 🚀📉🔁

We are likely approaching one of the final moves down before a significant push higher. But before that, I expect one last move up to the $142 area, forming what I believe is a Red ABC corrective structure.

🔴 Red Wave A-B-C

Red Wave A has likely already completed, confirmed by a clean White ABC move.

We are now inside Red Wave B.

✅ Ideal Long Entry Zone

The ideal entry would be near the 88.7% Fibonacci retracement, which aligns with Green Wave B around $119.4.

From that level, I expect a drop down toward $100, completing Red Wave B.

🔄 What Comes After?

From the $100 zone, two possible scenarios for Red Wave C (or Wave 1 of a new impulse):

A 1-2-3-4-5 impulsive wave structure to the upside

Or a corrective A-B-C structure

We’ll need to carefully watch the first move out of the $100 zone:

A 5-wave move would suggest a new bullish impulse has begun

A 3-wave move might just be a larger corrective rally

🎯 Upside Target: $142

Once we hit $142, I anticipate another corrective move downward.

This could take the form of:

A clean ABC

A complex correction (A-B + 1-2-3-4-5)

Or even a direct impulsive 5-wave drop

Again, the key is watching the first leg down from $142 – whether it's impulsive or corrective will define the entire next phase.

⚠️ Summary:

Current focus: Entry near $119.4 (88.7% Fib), targeting $142

Caution: Expect volatility – structure will only become clear wave by wave

Watch: Reactions at $100 and $142 for structure confirmation

Let me know what you think below!

Like & follow if you enjoy deep EW breakdowns!

Elliott Wave Analysis 🔹 Wave Structure:

The chart shows a clear corrective structure unfolded, currently developing as a complex correction (likely WXY or an ABC):

Wave A: Strong impulsive move to the downside

Wave B: Ongoing corrective rally (possibly a flat or zigzag)

Wave C (anticipated): Final downward leg yet to unfold

🟩 A green target box marks the potential end zone of the correction, aligning with a horizontal support level around 85.35.

📊 Indicators:

🔸 MACD:

Currently showing a bullish crossover (MACD line above the signal line) → supports the idea of a temporary B-wave rally.

Momentum is not very strong → another hint that the move might be corrective, not impulsive.

Watch for a bearish crossover as a possible trigger for the start of Wave C.

🔸 RSI:

RSI is recovering from lower levels, signaling short-term strength.

No overbought condition yet → allows more room for the B-wave to extend.

Key Watch: If RSI enters overbought territory while MACD turns down, it could mark the start of the C-wave drop.

🎯 Summary & Outlook:

We are likely in the final phase of Wave B.

Expectation: One last downward move in Wave C towards the green zone.

That area could offer a strong long opportunity, but only after clear confirmation (e.g., divergence, impulsive reversal, rising volume).

📌 Potential Strategy:

❌ No long entries yet – risk of another drop in Wave C.

🔔 Set alerts around 85–60 – monitor for reversal signs.

📈 Upon confirmation: potential entry for the next larger impulsive wave.

LONG SOL TP 125 CONFIRMED.long sol at 115 which is current price,Confirmations vwap,support of emas at lower tfs,has to retest at daily ema,vwap is postive,so faris RSI,Bullish engulfing candle hs been made another confirmation,there is 1 thing about me i dont make wild guesses,I give calls on Confirmations so there you go LONG at 115 tp at 125 Thanks,over n out

$SOL Weekly Bounce from Dynamic Support – Watch for BreakoutCRYPTOCAP:SOL is holding above a key rising trendline that has acted as strong support since 2021. After a successful retest near $95–$100, SOL bounced sharply and is now trading above $120.

This move also confirms a reclaim of a previous resistance-turned-support zone. As long as it holds, SOL could aim for $145 and above.

DYOR, NFA

#Solana: Speed, Scalability & Ecosystem Power**Description**:

This trading idea is based on **Solana (SOL)**, one of the fastest and most scalable layer-1 blockchains in the cryptocurrency space. Known for its low transaction fees and lightning-fast processing speeds, **Solana** supports a thriving ecosystem of decentralized applications (dApps), NFTs, DeFi platforms, and GameFi projects. Its high-performance architecture attracts developers and users seeking efficiency without compromising decentralization. Backed by strong institutional interest and community support, **SOL** continues to stand out as a key player in the race for blockchain adoption and innovation.

Despite its technological strengths, Solana, like all cryptocurrencies, is exposed to high market volatility, potential network outages, and evolving regulatory landscapes. Investors should be aware of these dynamics before entering the market.

**Disclaimer**:

This trading idea is intended for educational purposes only and does not constitute financial advice. Investing in cryptocurrencies like **Solana (SOL)** involves significant risk, including the potential for total loss of capital. Always conduct in-depth research, assess your risk tolerance, and consult a financial advisor before making any investment decisions. Past performance is not indicative of future results.

SOLUSDT NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

SOL preppin for a 300 revisit from this 100 bargain zone. SEED!SOL has been on rollercoaster ride the past few months -- going from 100 to almost 300 in a zoom when the market is at its peak.

Moreso, when memes started taking over the market and everyone, including the president himself is launching one on SOL blockchain, market started pickup up pace and eliciting euphoria among all, albeit momentarily. It has stirred up some hype and frenzy skyrocketing prices only to be met with so much saturation and gravity, then the BIG BLEED happens.

After a few weeks thing seem to have settled down -- a shift is gradually transpiring as we speak. SOL is now exhibiting some basing behavior at this current range at 100 levels. Net longs has started to pile up around this zone conveying a prep work of upside reversal soon.

Long term metrics suggests a tap at 61.8 FIB levels - a buyers convergence zone. This is where it all starts.

Ideal seeding is at the current discounted price range.

Spotted at 110

Mid target 300.

Long term 500.

TAYOR. Trade safely.

Solana Update: To Buy Or Not To Buy? Hold Or Sell?Here is an update on Solana.

The chart has the same numbers as before but the support line has been moved to match the 5-August 2024 low. The action is happening right above this level.

While Solana trades above its August 2024 low, the action is considered bullish. Below this level and we are certainly bearish. Being bearish in this way does not change the long-term outlook, bias and perspective, we are set to grow long-term based on a broader trend and bigger cycle. This is a closer look.

The low in April is a shy lower low compared to March. This is always important. Notice the steep decline. This is a bearish impulse, prices tend to move down fast and strong. When bearish momentum starts to die down, we see patterns like the one we have on the chart above. Some shaky action and then a lower or higher low. The market (SOLUSDT) is preparing to change course.

The correction is present since November 2024. For Solana, the higher high in January 2025 is part of a complex correction, an extended flat. 3-3-5 wave in Elliott terms.

This is irrelevant. The point is that once the correction is over prices tend to grow.

Consider this, between June and September 2024 we have more than three months of consolidation. The market garnered enough strength to produce a bullish wave. It took a while but it happened. Then there is a correction and this bullish wave was erased by more than 100%.

If buyers showed up at a price of $100, $120, $130 and even $150 in the past, they can definitely show up again. Now that the bullish move has been erased, we are back to square one, the starting point, the base; from this point forward Solana can grow again.

Solana looks weak right now on the very, very short-term. But do not let this deceive you, we are going up next. Focus on the long-term.

Accumulation can be done each time prices hit support.

What happens if I buy and prices move lower?

Wait patiently. If you have capital available, buy more.

And if it drops again? Keep waiting, continue buying.

You will be happy with the results once the market turns.

Thank you for reading.

Patience is absolutely key.

If you didn't sell at $290, $280 or $250, why would you sell when prices trade at $100? It makes no sense.

Buy when prices are low and hold.

Only sell when prices are moving higher.

Namaste.

SOL — Clean Liquidity Grab & FVG Flip. Mid-Term Setup in PlayClassic move on SOL — liquidity sweep, inverted the FVG, and pushed higher. Textbook stuff.

Not expecting an instant pump, this one looks more like a mid-term play… although, with SOL, you never know.

Stay sharp. And follow to catch the next ones early.

Entry: 109

TP: 123-148

SOL Long from 103As You can see on 6h tf we have 2 mentioned LOWS which are refering not only sol is on support but also vwap confirmation on MARKET CIPHER and bullish divergence VWAP 6H and 24m TF,SOL will cover fair value gap upwards first then heads down but mean while we have a good trade on our hands,TP and SL are Mentioned.Drop like Comment if You get profits Thanks

SOL LONG????🔍 Overall Market Structure

The price recently saw a sharp drop from the $120.69 high and is currently consolidating around the $108–110 area.

A bullish structure is forming, suggested by the potential for a reversal pattern from a support zone.

🧠 Key Technical Components

📉 Fibonacci Levels (retracement from $101.21 to $120.69):

0.236 – $115.78 (resistance)

0.382 – $112.84

0.5 – $110.53

0.618 – $108.25 ← Current support

0.786 – $105.20

Price is bouncing from the 0.618 zone, a strong reversal area.

🟣 RSI (Relative Strength Index):

RSI is near oversold (31.15) and showing bullish divergence:

Price made lower lows.

RSI made higher lows.

This divergence suggests momentum is weakening on the downside, signaling a potential bullish reversal.

🟪 Support & Resistance Zones:

Demand Zone (support) around $107–108 (marked with purple box).

Supply Zone (resistance) around $118–120.

Price could bounce from support, targeting higher fib levels and possibly retesting the supply zone.

✏️ Projected Price Action (Black Curve):

Anticipated short-term reversal from $108.

Price might climb through:

$110 (0.5 fib)

$112.84 (0.382 fib)

Potentially to $115.78 (0.236 fib) or even back to the $120.69 high.

Shown within a larger wedge structure, so upper trendline resistance around $120.

✅ Conclusion:

Bullish reversal likely from $107–108 support.

RSI divergence + Fibonacci confluence supports the reversal thesis.

Next targets: $110.50 → $112.84 → $115.78 with final resistance near $120.69.

Elliott Wave Update – Clean Count DevelopmentBINANCE:SOLUSDT

We are currently tracking a developing (B) wave as part of a larger corrective structure.

The move up from the local low unfolds as a classic 5-wave impulse (yellow), where wave 3 is completed, wave 4 is forming as an A-B-C flat correction, and wave 5 is still expected to follow, completing wave (C) of (A).

After that, we anticipate a drop into wave (B) of the corrective sequence before a potential final push into the green target zone to complete wave (C) of (B).

Once this entire correction is done, the expectation remains for a larger 5-wave decline to complete the macro structure.

Wave count stays valid as long as internal rules of Elliott Wave Theory are respected.

Elliott Wave Analysis – Focus on Wave StructureBINANCE:SOLUSDT

The current setup shows a completed green (A) wave, followed by a corrective (B) wave unfolding as an A-B-C structure.

Within wave (C) of (B), we can clearly identify a 5-wave impulse:

Wave 1 is complete

Wave 2 formed as a correction

Wave 3 extended strongly

Wave 4 is currently developing

Wave 5 is expected to complete wave (C) of (B)

Once this move finalizes, a larger downward (C) wave is anticipated to complete the overall corrective pattern.

This setup remains valid as long as the internal structure respects the rules of Elliott Wave Theory.

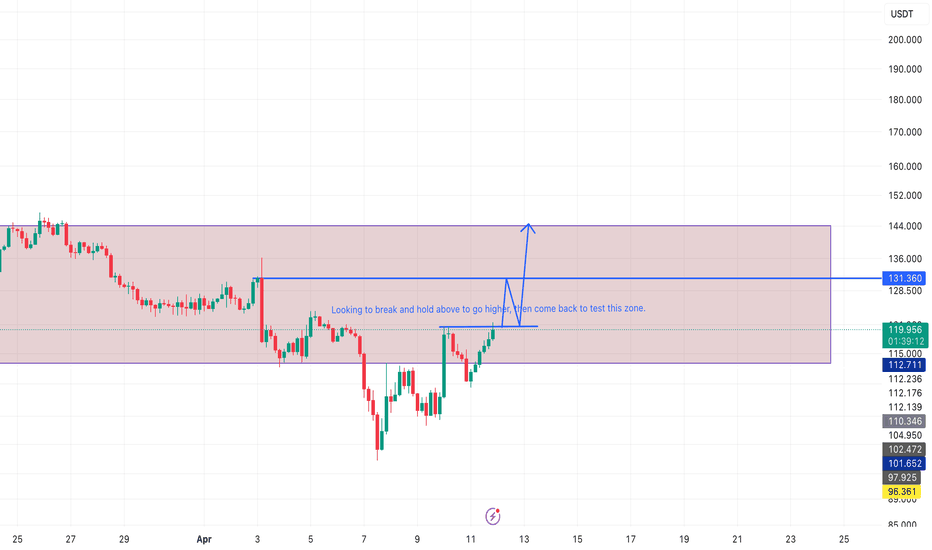

SOL/USDT Wedge Breakout (08.04.2025)The SOL/USDT pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 120.60

2nd Resistance – 130.63

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Lingrid | SOLUSDT testing MARCH low. Short OpportunityBINANCE:SOLUSDT market is making lower lows and lower closes, indicating a bearish trend. It is slowly approaching the key psychological level at 100.00 while currently testing the previous month's low. The price broke and closed below the upward trendline that had been holding for a couple of weeks. I think the price may continue to move lower toward the key support level, and there is a possibility it could push even lower. Furthermore, the price has been consolidating around the 120.00 level, demonstrating significant bearish sentiment in the market. I expect the price to move lower, possibly breaking below the March low. My goal is support zone around 102.00

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻