SonicCoin (SUSDT) Trading in a Descending ChannelHello Traders,

Today, we’re analyzing SUSDT (SonicCoin), which is currently trading within a descending channel—a bearish pattern where price tends to gravitate toward key boundary points. Recently, price action was rejected at channel resistance, an area that confluences with the value area high at 0.6185. This rejection has shifted the previous uptrend into a more bearish outlook, as price has now taken out prior lows, confirming the rejection as strong.

At present, SonicCoin is trading around the POSC (Point of Structural Control), hovering near the channel midpoint while liquidity continues to build. If buyers fail to reclaim the channel high resistance, this liquidity could fuel a cascade move lower, potentially sending price towards the $0.26 support region.

Points to Consider

• Descending Channel Structure – Price remains within a bearish pattern, respecting key resistance and support levels.

• Liquidity Build-Up at Midpoint – Current price action is consolidating around the channel midpoint, which could lead to a breakout or further downside.

• Potential Drop to $0.26 – If strength does not return, a liquidity-driven move toward key support could be next, offering a potential long setup from lower levels.

Market Outlook & Trade Considerations

SonicCoin is currently range-bound within a downtrending environment, making it a market that requires careful risk management. If price action remains weak below resistance, the probability of a breakdown into $0.26 increases. However, should buyers step in at that level, it could present an opportunity for a long play back into channel resistance.

For now, traders should monitor whether price can regain strength above channel resistance or whether the liquidity build-up leads to a deeper correction. Confirmation signals will be crucial before entering any trades.

Overall, SonicCoin remains in a bearish structure for the time being. Until price decisively breaks above resistance, the risk of further downside remains in play

SONICUST trade ideas

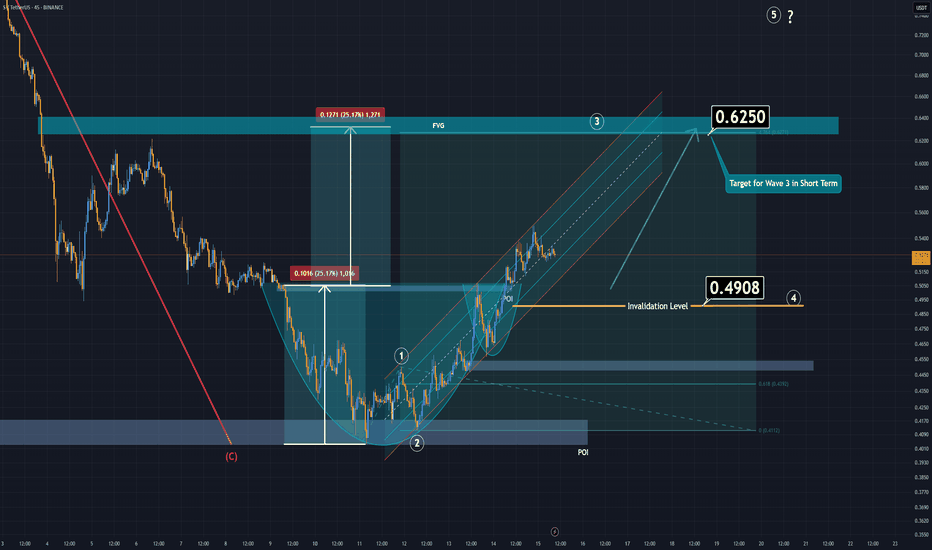

S (The Ex FTM) Has Formed a Bull Pattern and in Wave 3In short time frame the S, AKA "Ex FTM" has formed a Cup&Handle pattern. The breakout has already copleted. If it can stay above the invalidation level, S can reach the level 0.62 easily.

For a better perspective for long term, S also completed it's Bearish A-B-C waves and seems bullish again.

Good Luck.

S (Ex FTM) Next MoveAt the moment, S is going in a parallel channel through upwards. Either right from around here or from a lower demand zone, S will be going through 0,63 level.

It's a low risk trade and might be usefull.

Below the are 0.58 which is marked on the chart might be dangerous and would be a usefull stoploss.

If you can follow the chart in low time frame wait for a 4 hour candle close before stop the position if it reaches the invalidation level.

S Trade Setup - Waiting for Retrace to SupportS has had a strong rally over the last two weeks and is now at resistance. We’re waiting for a retrace to the next support level before entering a long spot trade.

🛠 Trade Details:

Entry: Around $0.55

Take Profit Targets:

$0.62 (First Target)

$0.74 - $0.80 (Mid Target)

$0.91 - $0.98 (Extended Target)

Stop Loss: Just below $0.48

We'll be watching for confirmation of support before executing the trade! 📈🔥

S/USDT: FALLING WEDGE BREAKOUT!! 🚀 Hey Traders! SONIC Breakout Alert – ATH Incoming? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 SONIC/USDT – Breakout & Retest in Play! 🚀

SONIC is breaking out of a falling wedge on the 4H timeframe and is currently retesting the breakout level. With momentum building, we’re expecting a move toward ATH soon.

💰 Trade Setup:

📍 Entry: CMP, add more up to $0.50

🎯 Targets: $0.56 / $0.62 / $0.69 / $0.78 / $0.85 / $0.96

🛑 Stop-Loss: $0.46

⚡ Leverage: Low (Max 5x)

🔎 Strategy:

Enter with low leverage now

Add more on dips and ride the wave higher

💬 What’s Your Take?

Are you bullish on SONIC’s breakout? Share your analysis, predictions, and strategies in the comments! Let’s lock in those gains and ride this pump together! 💰🚀🔥

S - Roadmap to $1S has been overall bullish trading within the rising channel marked in blue.

Currently, S is retesting the upper boundary of the channel and a key structure at $0.63.

For the bulls to stay in control and aim for the $1 round number, a break above $0.63 is needed.

In the meantime, if S retests the lower boundary of the blue channel and the $0.50 round number, we will be looking for trend-following long opportunities.

Its not looking good Im glad i got out of this coin, Pump and dump. Still got a tiny bag but its not looking good at all.

Dumped again from last support (now resistance) while btc is just steady.

Team is constantly posting about how big they growing and how much TVL they gaining but price is only decreasing and team is dumping on investers

SU/USDT REVIEWSU/USDT Market Review – Potential Breakout Opportunity

After the previous fake breakout around $0.99, it became evident that there wasn’t enough liquidity in the market to sustain a breakout of that magnitude. This aligns with the broader macroeconomic landscape, where U.S. money printers have yet to fully engage, limiting the influx of fresh capital into assets like crypto.

Now, we are witnessing the formation of a new breakout structure, presenting an attractive buying opportunity at a discounted price level. Historical price action suggests that similar setups have preceded significant upward movements. Given the current market conditions and the cyclical nature of liquidity flows, this could be an optimal entry point before the next leg up.

Traders should keep an eye on volume expansion and market sentiment to confirm the strength of this potential breakout. If liquidity injections increase, we could see a strong rally, potentially breaking previous resistance levels and entering a new price discovery phase.

Key Levels to Watch:

Support: Current price zone as a potential accumulation area

Resistance: Breakout level near previous highs (~$0.99 and beyond)

Liquidity influx: A key factor for sustained momentum

As always, risk management is essential—while the setup looks promising, market conditions can shift rapidly.

Bulls in Trouble! Sonic Rejected Again—Lower Lows Incoming?Yello, Paradisers! Is #Sonic about to take another dive? The latest price action suggests trouble for the bulls. After failing to reclaim key support, the downtrend is back in full force.

💎#SUSDT continues to reject from a historically strong resistance at $0.63 – $0.65, a level that has repeatedly proven difficult to break. This latest rejection is only accelerating the downside, putting lower targets into play.

💎The sellers are initially aiming for the $0.46 – $0.44 levels, a strong support zone where we could see some short-covering as traders take profits on their positions. This level has provided temporary relief in the past, making it a key area to watch.

💎However, if sellers maintain control and the bearish momentum continues, the price could dip even further into the $0.3850 – $0.3740 zone. This area has historically acted as a strong support base, attracting significant buying pressure that could fuel a potential reversal.

💎For bulls to regain control, they must reclaim the $0.63 – $0.65 zone, a strong resistance level. However, with descending resistance reinforcing this area, breaking out won’t be easy. Until then, the trend remains bearish, and lower levels are in play.

Stay patient, Paradisers! The market always rewards discipline. If we see confirmation, we take action. If not, we wait. Trade smart, not fast! 🎖

MyCryptoParadise

iFeel the success 🌴

Major Levels – Is Sonic Ready to Pump?After reaching the daily resistance level ($0.7818), price faced strong rejection. The anchored VWAP, acting as dynamic resistance just below the daily level, provided additional confluence for a low-risk short opportunity.

Additionally, a key high at $0.7891 further reinforced this resistance zone. Following the rejection, price sharply declined -13%, retracing back into the previous trading range.

Support Confluence

Price is now approaching a well-defined support zone:

Bullish Order Block: $0.6816

Key Level Near Order Block: $0.6803

Golden Pocket (Fib 0.618 - 0.65): 0.618 at $0.6793 & 0.65 at $0.6739

Monthly Open: $0.6732

Point of Control (POC): $0.6732 (aligning with Monthly Open)

Daily 21 EMA/SMA: 21 EMA at $0.6835 & 21 SMA at $0.6790

Fib Speed Fan 0.7 (from $0.615 to $0.7818): Providing additional support in this zone

Long Trade Setup

Entry Zone: $0.6816 – $0.6732

Stop Loss: Below the Monthly Open ($0.6732)

Take Profit Zone: $0.7111 – $0.7201

Risk-to-Reward (R:R): 3:1 R:R setup, offering a high-probability trade

Take Profit Targets & Resistance Zones

Previous Swing Low: $0.7111 (untested)

Value Area Low (VAL): $0.7152

Anchored VWAP (from $0.615 low): $0.7137

Fib Retracement 0.382 (from $0.7818 high to current low): $0.7201

SUSDT BULISHThe market has been in a bad situation following the Bybit stolen coins incident. However, I can see that SUSDT may turn bullish now.

Please pay close attention to the danger zone and stop loss.

Note: My ideas are not intended for any type of scalping or scalpers!

You can find the full list of my ideas here: www.tradingview.com

Here are some of my ideas:

$SUSDT | Limit Long #4H📌 Current Situation:

A deviation of the key level occurred, followed by a strong recovery and consolidation on the 1H timeframe.

The price rebounded from a critical zone, showing a local reversal.

🎯 Trading Plan:

🔹 Entry Zone: Limit orders in the range of 0.6828 - 0.6670 (1H OB cluster).

🔹 Stop-Loss: Placed below 0.6524, as marked on the chart.

🔹 Target: Potential upside towards 0.88 - 0.90 as part of a mid-term recovery.

📈 Justification:

✅ Technical Support: The price bounced off a strong demand zone.

✅ Market Structure: Possible formation of an Inverse Head and Shoulders pattern.

✅ Risk/Reward: Favorable R/R ratio, with strong support below current levels.

💡 Conclusion:

The trade setup is justified in terms of risk management and market structure. However, it's crucial to consider BTC's overall trend, as it impacts the entire altcoin market.