Soybean Breakout – Time to Steal Profits!🚨 "SOYBEAN HEIST ALERT: Bullish Loot Ahead! 🎯💰 (Thief Trading Strategy)"

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to plunder the 🌱🍃SOYBEAN CFD market! Here’s your master plan for a smooth heist."

🔎 TRADE SETUP (Thief Edition)

Entry 📈: "Buy the dip or chase the breakout—bullish momentum is ripe for stealing!"

Pro Tip: Use buy limits near 15-30min pullbacks (swing lows/highs) for optimal theft.

Stop Loss 🛑: "Hide your loot!" Set SL at nearest 4H swing low (1030.00). Adjust based on your risk appetite.

Target 🎯: 1085.0 — or escape early if bears ambush!

⚡ SCALPERS’ NOTE:

"Only long scalps allowed! Rich? Raid now. Poor? Join swing thieves & trail your SL!"

🔥 WHY SOYBEAN? (Bullish Catalysts)

Technicals + fundamentals align for a bullish heist.

Check: COT reports, seasonals, macro trends, and intermarket signals (links below 👇).

⚠️ WARNING: NEWS = VOLATILITY

Avoid new trades during major news.

Trailing SLs = your escape rope! Lock profits before the cops (bears) arrive.

💎 BOOST THIS HEIST!

"Smash 👍 LIKE, hit 🔔 FOLLOW, and share the loot! Your support fuels our next raid."

🎯 Final Tip: "Profit is yours—take it and vanish! 🏴☠️"

📢 Stay tuned for the next heist! "Market thieves never sleep…" 😉

SOYBNUSD trade ideas

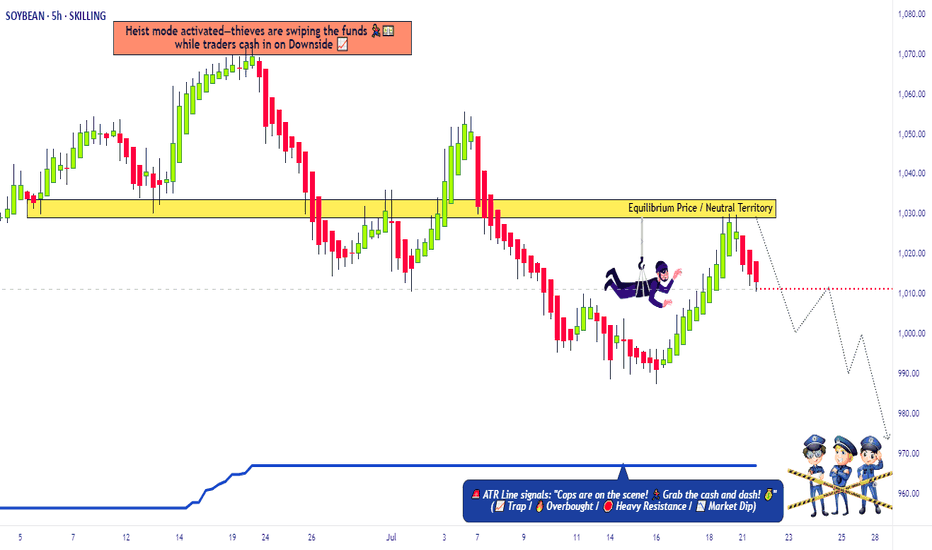

SoyBeans Price Reversal – Time to Swipe Bearish Profits🔓 Operation SoyBeans: Vault Breach Underway! 💼🌾

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Calling All Market Bandits, Scalping Buccaneers & Swinging Looters 🕵️♂️💰💣

We've marked our next robbery target—the "SoyBeans" Commodities CFD Market.

This isn’t just a trade, it’s an orchestrated heist built off Thief Trading intelligence: a mix of technical traps, fundamental cues, and criminal market psychology. 🧠💸

🔎 🎯 Entry Point - Where the Safe Cracks Open:

The vault is wide open—grab bearish loot at any price!

But for maximum stealth, layer in buy limit orders on the pullback using the 15m or 30m timeframe near swing highs/lows.

(We thieves call this: DCA under the radar.) 🕳️📉

🛡️ 🚨Stop Loss - Our Escape Hatch:

Set SL at the nearest 4H candle wick swing high (1040.00).

Customize it based on your loot size (lot size), order count, & risk appetite.

A smart thief knows when to vanish! 🏃♂️💨

🏁 💰Target - The Vault Cash-Out Point:

Main Heist Target: 970.00

Or exit early if the cops (volatility) show up! 🚔🎯

💡 Scalper’s Note - Quick Grab & Dash:

If you’ve got a heavy bag 💼💸, scalp short aggressively.

If not, roll with the swing crew—use trailing SLs to lock the loot and flee clean. 💨📦

📉 Thief Insight – Why We're Robbing This Vault:

"SoyBeans" showing bearish breakdowns due to:

📰 COT Positioning

📦 Inventory & Storage Data

🕰️ Seasonal Weakness

💭 Sentiment Drift

🔗 Intermarket Signals

Get the full scoop—go dig deeper into your own thief intelligence sources. 📚🕵️♂️

⚠️ Stay Alert – Market Mayhem Incoming!

News drops = surveillance upgrades. Avoid new trades during major releases.

Protect running loot with tight trailing SLs—guard your stolen goods! 🛑🗞️📉

❤️🔥 Show Some Love to the Robbery Crew!

💥Smash that BOOST button💥 to fuel the Thief Army.

Together, we rob smarter. 💰🚀

🔔 Stay Tuned, Looters:

Another heist is being planned. Don't miss the next setup.

Money is out there… we just have to take it the thief way. 🧠💎

📜 Disclaimer:

This plan is for chart criminals in training 📉🕵️♂️ – not personalized financial advice.

Always assess your own risks before raiding any market vault.

Stealing from bears: soybean long setup!🚨 THE GREAT SOYBEAN HEIST: Bullish Raid Plan (Swing/Day Trade) 🏴☠️💸

🌟 ATTENTION, MARKET BANDITS & MONEY SNATCHERS! 🌟

(Hola! Oi! Bonjour! Salaam! Guten Tag!)

🔥 Using the ruthless Thief Trading Strategy (TA + FA), we’re executing a bullish raid on the SOYBEAN Commodities CFD Market! Time to steal profits from the bears before they wake up! 🥷💨

🎯 MASTER HEIST PLAN (BULLISH RAID)

📈 Entry Point (Buy Limit/Market):

"The vault is unlocked—grab the bullish loot at any price!"

🔹 *For precision heists, set buy limits near pullbacks (15M/30M).*

🔹 ALERT: Set price alerts to catch the perfect steal!

🛑 Stop Loss (Escape Route):

📌 Thief SL at nearest swing low (3H timeframe) – 1030.0

📌 Adjust SL based on your risk tolerance & position size.

🎯 Profit Target (Escape Before Bears Strike Back):

💥 1095.0 (or exit early if the trap snaps shut!)

🧲 Scalper’s Bonus:

Only scalp LONG!

Big wallets? Go all-in! Small wallets? Swing-trade the robbery!

Use trailing SL to lock profits and escape clean!

🌱 MARKET TREND: BULLISH (BEAR TRAP SET!)

Overbought? Maybe. But the real trap is where bearish robbers get slaughtered.

High risk = High reward—only for cold-blooded traders!

📡 FUNDAMENTAL INTEL (DON’T SKIP THIS!)

🔗 Full reports (COT, Macro, Seasonals, Sentiment, Intermarket Analysis) in our biio!

🚨 TRADING ALERT: NEWS = DANGER ZONE!

❌ Avoid new trades during news!

🔐 Use trailing stops to lock profits & escape alive!

💥 BOOST THIS HEIST! (HELP US ROB THE MARKET!)

🔥 Hit LIKE & FOLLOW to strengthen our robbery squad!

💰 More heists = More profits. Stay tuned for the next raid!

🐱👤 See you in the shadows, bandits! 🤑🚀

"SOYBEANS" Commodities CFD Market Bearish Heist (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🥔🍀🍃SOYBEAN🍃🥔🍀 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 1D timeframe (980.0) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1100.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🍀🍃SOYBEAN🍃🍀 Commodities CFD Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Symmetrical Triangle Breakout Incoming?### **Soybean (USD) – Symmetrical Triangle Breakout Incoming?**

Soybean prices are consolidating within a **symmetrical triangle** on the **30-minute timeframe**, indicating an imminent breakout.

### **Key Observations:**

✅ **Symmetrical Triangle Formation** – Price is tightening, forming higher lows and lower highs, preparing for a potential breakout.

✅ **XABCD Harmonic Pattern** – Suggests a bullish scenario if price respects the pattern completion zone.

✅ **Technical Indicators:**

- **RSI** approaching overbought territory, signaling strength but also potential for short-term pullback.

- **MACD** is turning bullish with a possible crossover confirmation.

### **Trade & Consumption Factors:**

🌍 **Supply Chain & Trade Flows:**

- U.S. soybean exports remain strong, but **Brazil's harvest is adding competition**, potentially capping price gains.

- Global demand from **China, the world’s largest soybean importer**, will be crucial in determining the next move.

🍽️ **Consumption & Demand:**

- Soybeans are a key ingredient in **animal feed and vegetable oils**, with demand closely tied to livestock production.

- Any changes in **biodiesel policies** or **weather conditions affecting planting** could impact pricing.

### **Trading Plan:**

📈 **Bullish Scenario:** Breakout above the upper trendline could push prices toward **1,020.80**.

📉 **Bearish Scenario:** A breakdown below the lower trendline may lead to further declines toward **960**.

📊 **Risk Management:** Stop-loss set below the lower trendline for protection.

🚨 **Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also, share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free, and allow the idea to reach as many people as possible.**

Soybean Market Dynamics: Supply Shifts and Price StabilityGlobal soybean ending stocks are up 1.1 million tons to 122.5 million, while US stocks are down 5 million bushels to 375 million. Despite these fluctuations, soybean prices remain stable at $9.95 per bushel.

Global Soybean Supply: A Tale of Two Regions

The WASDE report highlights not so simple picture for global soybean supply in 2024/25. Beginning stocks are raised by 2.7 million tons, primarily due to a revised 2023/24 crop estimate for Brazil, now up 1.5 million tons to 154.5 million tons. This adjustment reflects stronger-than-expected production in Brazil, a key player in the global soybean market. However, global soybean production for 2024/25 is lowered by 0.2 million tons to 676.62 million tons, driven by a decline in Bolivia (down 0.3 million tons), partially offset by increases in South Africa (up 0.1 million tons), the UAE (up 0.05 million tons), and the European Union (up 0.05 million tons).

Despite the slight production drop, global ending stocks are up 1.1 million tons to 122.5 million, with Brazil and the EU leading the increase. Brazil’s stocks are bolstered by its revised 2023/24 output, while the EU benefits from higher production and imports. Global soybean exports are also raised by 0.2 million tons to 182.1 million tons, with Canada and Nigeria increasing shipments (up 0.1 million tons each), though Ukraine sees a decline (down 0.05 million tons). These supply shifts indicate a relatively balanced global market, but regional disparities offer opportunities for investors to explore.

US Soybean Market: Tightening Stocks and Stable Prices

In the US, the soybean outlook shows a tightening of domestic supplies. Ending stocks are lowered by 5 million bushels to 375 million, driven by higher imports (up slightly to 140.49 million tons) and increased crush (up 10 million bushels to 2.42 billion). The rise in crush reflects stronger domestic use of soybean meal (up due to ample global supplies) and increased soybean oil exports (up based on export commitments). Soybean oil use for biofuels is lowered due to tariffs impacting imports of alternative feedstocks like used cooking oil, though stronger use is expected later in the marketing year.

Despite these supply adjustments, the US season-average soybean price remains unchanged at $9.95 per bushel. Soybean meal prices are lowered by $10 to $300 per short ton, reflecting ample global supplies, while soybean oil prices are raised by 2 cents to 45 cents per pound, driven by export demand. This price stability amidst tightening stocks suggests a market in equilibrium, offering predictability for investors while hinting at potential upside if demand surges.

Demand Drivers: Soybean Meal and Oil in Focus

The WASDE report also shows to us growing global demand for soybean derivatives, particularly soybean meal and oil. Global soybean crush is raised by 2.0 million tons to 354.8 million tons, with increases in Brazil (up 0.5 million tons), Argentina (up 0.4 million tons), Ukraine (up 0.3 million tons), and the US (up 0.2 million tons). This rise goes straight from ample soybean meal supplies, lower prices, and a reduced supply of alternative oilseed meals, leading to increased global consumption of soybean meal.

However, global vegetable oil production is down 0.9 million tons to 228.1 million tons, as gains in soybean oil production (up 0.6 million tons) are offset by a 1.3 million ton decline in palm oil production to 78.2 million tons, primarily due to lower output in Indonesia (down 0.5 million tons), Malaysia (down 0.4 million tons), and Thailand (down 0.2 million tons). This reduction in palm oil supply could give a hand to demand for soybean oil, particularly in markets like India, where soybean oil imports are projected to rise to 4.6 million tons (up 0.2 million tons). The US, with soybean oil exports up to 1.17 million tons, is well-positioned to benefit from this trend.

Investment Opportunities in the Soybean Market

The soybean market’s dynamics present a wealth of long-term investment opportunities for those looking to capitalize on evolving supply and demand trends. With US soybean prices holding steady at $9.95 per bushel, investors have a predictable entry point to explore soybean futures or agricultural ETFs, such as the Teucrium Soybean Fund ( AMEX:SOYB ), which tracks soybean futures and could see gains if tightening US stocks-down to 375 million bushels-drive price appreciation later in the year, especially given SOYB’s assets under management reaching $50 million in 2024 amid growing investor interest. Beyond futures, agribusiness companies involved in soybean processing and export offer another avenue for growth, with firms like Archer-Daniels-Midland ( NYSE:ADM ) reporting a 5% increase in soybean crush volumes in 2024, aligning with the WASDE’s forecast of 2.42 billion bushels, potentially positioning ADM’s stock for upside as global soybean meal consumption rises. The vegetable oil market also holds promise, as rising US soybean oil exports of 1.17 million tons and a decline in global palm oil production to 78.2 million tons create opportunities for companies like Bunge Global ( NYSE:BG ), which processes soybean oil for food and biofuel and saw a 10% revenue increase in its biofuel segment in 2024 due to similar demand trends. Additionally, Brazil’s higher soybean stocks, bolstered by a 2023/24 crop of 154.5 million tons, make its agribusiness sector attractive, with companies like SLC Agrícola-boasting ( BMFBOVESPA:SLCE3 ) 450,000 hectares of soybean cultivation and a 15% production increase in 2024-offering direct exposure, while Brazilian ETFs like the iShares MSCI Brazil ETF ( AMEX:EWZ ) provide a diversified way to tap into this market’s potential.

Risks to Consider

While the soybean market offers opportunities, risks remain. The US-China trade conflicts, with tariffs impacting agricultural exports, could dampen demand if economic growth slows in key markets like China, which holds 83.16 million tons of soybean stocks. Inflationary pressures in emerging markets, such as Brazil, could increase production costs, affecting profitability. Additionally, the decline in palm oil production might be temporary, potentially easing pressure on soybean oil demand if output recovers in Indonesia or Malaysia.

Global ending stocks of 122.5 million tons and stable US prices at $9.95 per bushel offer predictability, while tightening US stocks (down to 375 million bushels) and rising soybean meal demand (crush up to 354.8 million tons) hint at potential upside. Opportunities in soybean futures, agribusiness companies like ADM, and soybean oil sectors provide diverse avenues for investment. Despite risks from trade tensions and production costs, the soybean market’s fundamentals-bolstered by Brazil’s supply strength and global demand for derivatives-make it a compelling area for long-term investors, seeking exposure to agriculture in a volatile global economy today.

Long trade SoybeansWe have seasonal tendencies for Soybeans to be bullish

We have a divergence between soybeans and Wheat were Soybeans are the leader in strenght.

We have a bullish Weekly OB to go long from with stopploss at halfpoint of that OB.

This is a swing trade that I will hold until target or June were seasonality weares of.

"SOYBEAN" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🥔🍀🍃SOYBEAN🍃🥔🍀 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (1015) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1060 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🥔🍀🍃"SOYBEAN"🍃🥔🍀Commodities CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"SoyBeans" Commodities CFD Market Robbery Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SoyBeans" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (975.0) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (1015.0) Swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 935.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🥔🍀🍃"SoyBeans" Commodities CFD Market Heist Plan is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Soybean Market Trends: Impact of Exports and Production ForecastProduction Forecasts and Supply Adjustments

The USDA's latest projections indicate a downward revision in global soybean production, primarily due to adverse weather conditions in South America. Brazil, the world’s largest soybean producer, has faced inconsistent rainfall patterns, leading to a production estimate of 153 million metric tons (MMT), a 1.5 MMT decrease from previous forecasts. Similarly, Argentina's output is now expected to reach 49.5 MMT, reflecting a reduction of 0.5 MMT due to ongoing drought concerns.

Meanwhile, U.S. soybean production remains steady at 112.5 MMT, with domestic ending stocks revised up to 8.5 MMT as lower export demand contributes to higher carryover supplies. This increase in stock levels could exert downward pressure on U.S. soybean prices in the coming months.

Export Dynamics and Demand Shifts

The global soybean trade landscape is also shifting. While China remains the dominant buyer, its import demand has softened slightly, leading to a 1 MMT reduction in projected purchases, now standing at 97 MMT for the 2024/25 season. This decline is attributed to higher domestic inventories and efforts to diversify feed sources.

Conversely, the U.S. has adjusted its export projections downward by 2 MMT, now estimated at 47.5 MMT, as Brazil continues to dominate the market with competitive pricing. The depreciation of the Brazilian real against the U.S. dollar has made Brazilian soybeans more attractive to global buyers, reinforcing Brazil’s position as the leading exporter. Additionally, with about 74% of Brazil’s soybean crop already harvested, up from 69% last year, the country is well-positioned to capture further market share.

Further complicating U.S. export prospects, President Trump’s plan to impose sweeping reciprocal tariffs on key trade partners, including Canada and Mexico, starting April 2nd, raises concerns over reduced demand for U.S. grains and oilseeds. U.S.-China trade tensions have also intensified, with China retaliating by raising duties on U.S. agricultural products and shifting more purchases to Brazil. This policy shift could exacerbate pressure on American soybean exporters.

Price Outlook and Market Implications

Soybean futures CBOT:ZS1! on the Chicago Board of Trade (CBOT) are fluctuating around $10 per bushel, reflecting concerns over shifting global demand, higher U.S. stockpiles, and trade policy uncertainties. If production estimates in South America continue to decline, prices could find some short-term support. However, the risk of weakened U.S. exports due to tariffs and strong Brazilian competition may limit any significant upside potential.

Looking ahead, market participants will closely monitor the USDA's upcoming Grain Stocks and Prospective Planting Reports, set for release on March 31st, which will provide insight into U.S. farmers’ planting intentions for 2025. These updates, along with geopolitical developments and weather conditions in South America, will play a crucial role in shaping soybean market trends in the coming months.

"SOYBEAN" Commodities Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SOYBEAN" Commodities Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1045.00) then make your move - Bullish profits await!"

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (1020.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 1083.00 (or) Escape Before the Target

Final Target - 1130.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🌾"SOYBEAN" Commodities Market is currently experiencing a bullish trend,., driven by several key factors.

Market Overview

Current Price: 1036.00

30-Day High: 1080.00

30-Day Low: 980.00

30-Day Average: 1000.00

Previous Close Price: 1020.00

Change: 16.00

Percent Change: 1.57%

🍀Fundamental Analysis

Supply and Demand: Global soybean demand is expected to increase, driven by growing demand for soybean oil and meal.

Weather Trends: Weather conditions in major soybean-producing countries are expected to be favorable, potentially leading to increased production.

Inventory Levels: Global soybean inventory levels are expected to decrease, driven by growing demand and limited supply.

Trade Trends: Global soybean trade is expected to increase, driven by growing demand for soybean products.

🍀Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for soybeans, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for soybeans as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for soybeans.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

🍀COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 60%

Open Interest: 150,000 contracts

Commercial Traders (Companies):

Net Short Positions: 30%

Open Interest: 80,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 20,000 contracts

COT Ratio: 2.0 (indicating a bullish trend)

🍀Sentimental Outlook

Institutional Sentiment: 65% bullish, 35% bearish

Retail Sentiment: 60% bullish, 40% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +50.

🍀Next Move Prediction

Bullish Move: Potential upside to 1120.00-1150.00.

Target: 1150.00 (primary target), 1200.00 (secondary target)

Next Swing Target: 1250.00 (potential swing high)

Stop Loss: 980.00 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 114.00 vs potential loss of 57.00)

🍀Overall Outlook

The overall outlook for SOYBEAN is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global soybean demand, favorable weather trends, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected weather events.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Soybean Market Outlook (2.21.25)The global soybean market is navigating a period of shifting supply and demand dynamics, driven by increased U.S. stock levels and production adjustments in key South American countries. Let’s take a look at notable revisions in production estimates, trade flows, and pricing trends that will shape the market in the coming months.

U.S. Soybean Stocks and Production Adjustments

The USDA has increased its forecast for U.S. soybean ending stocks to 315 million bushels, up 10 million bushels from the previous estimate. This revision is largely due to lower domestic crush projections, reflecting reduced demand from the U.S. processing sector. Total production remains at 4.16 billion bushels, with no changes to yield estimates at 50.6 bushels per acre.

South American Crop Revisions and Global Supply Impact

In South America, weather conditions have led to downward adjustments in soybean production forecasts. Argentina's soybean output is now projected at 50 million metric tons (MMT), reflecting a 1.5 MMT reduction from last month due to persistent dryness affecting key growing regions. In contrast, Brazil's soybean production remains at 157 MMT, as strong early-season yields have offset localized drought concerns. These supply adjustments influence global export flows, with Brazil expected to maintain its dominant position in the market despite Argentina's production decline.

Trade and Demand Dynamics

Global soybean trade projections remain largely stable, with U.S. exports holding at 1.76 billion bushels. Brazil is set to continue leading global soybean exports, supported by a favorable exchange rate and competitive pricing. Meanwhile, Chinese soybean imports are forecasted at 102 MMT, consistent with previous estimates, as demand for animal feed and soybean meal remains strong.

Price Outlook and Market Implications

Soybean futures on the Chicago Board of Trade (CBOT) are trading near $11.90 per bushel, reflecting market concerns over South American weather conditions and export competition. The average farm price for U.S. soybeans is projected at $12.55 per bushel, unchanged from previous estimates.

Investment Considerations

With rising U.S. stock levels and weather-driven supply concerns in South America, the soybean market presents opportunities for traders and investors. Key areas to watch include:

• Futures and Options Strategies: Volatility in global production may create trading opportunities in soybean futures CBOT:ZS1! .

• Agricultural Input Stocks: Companies involved in fertilizers and crop protection may benefit from shifting planting conditions.

• Export Competitiveness: U.S. soybean exports face continued pressure from Brazil’s pricing advantages, making trade policy and currency movements critical factors.

SOYBEANS to 1.035 bullish trend for Frist Quarter 2025The fundamental factors affecting soybean prices in 2024 have shown mixed developments, with weather conditions and global demand playing crucial roles. For 2025, the direction of prices will depend on China's economic recovery, weather conditions, and agricultural policies in the U.S. under the new Trump administration.

On the technical side, there is an accumulation of positions and manipulation in sell stops at the monthly level. I would like the price to reach the equilibrium of the range in the first quarter of the year; depending on the evolution of the fundamentals, we could even see a value of 1,100. If this idea is invalidated, I would expect prices of at least 927.7.

Monthly chart for context:

SOYBEAN CFD Commodity Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOYBEAN CFD Commodity market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 1050.00.

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Target 🎯: 1130.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

The SOYBEAN CFD is expected to move in a bullish direction.

REASONS FOR BULLISH TREND:

Weather Conditions: The weather conditions in the US and Brazil, the two largest soybean-producing countries, are expected to be favorable for soybean production. This will lead to a potential increase in supply, which will put upward pressure on prices.

Demand from China: China, the largest importer of soybeans, is expected to increase its imports of soybeans due to a shortage of domestic supply. This will lead to an increase in demand for soybeans, which will drive up prices.

US-China Trade Deal: The US and China have signed a trade deal, which includes an agreement to increase Chinese purchases of US agricultural products, including soybeans. This will lead to an increase in demand for soybeans, which will drive up prices.

Low Inventory Levels: The inventory levels of soybeans in the US are currently low, which will lead to an increase in prices as demand increases. When inventory levels are low, suppliers are less likely to offer discounts, and buyers are more likely to pay a premium to secure supplies.

Strong Export Demand: The export demand for soybeans is expected to remain strong, driven by demand from countries such as China, Mexico, and Japan. This will lead to an increase in demand for soybeans, which will drive up prices.

Production Costs: The production costs for soybeans are expected to increase due to higher costs for inputs such as seeds, fertilizers, and pesticides. This will lead to an increase in the cost of production, which will be passed on to consumers in the form of higher prices.

Government Policies: The US government has implemented policies to support soybean farmers, such as subsidies and tariffs. These policies will help to increase the profitability of soybean farming, which will lead to an increase in production and higher prices.

Market Sentiment: The market sentiment for soybeans is currently bullish, with many traders and investors expecting prices to rise. This will lead to an increase in demand for soybeans, which will drive up prices.

Technical Analysis: The technical analysis for soybeans is currently bullish, with the price trading above its 50-day and 200-day moving averages. This indicates that the trend is upward, and prices are likely to continue to rise.

Seasonal Trends: The seasonal trends for soybeans are currently bullish, with prices typically rising during the summer months due to strong demand from countries such as China and Mexico.

These fundamental points suggest that the SOYBEAN CFD is likely to move in a bullish direction, with prices expected to rise due to strong demand, low inventory levels, and favorable weather conditions.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Adding trades to a Gartley 222 on Soya ( Trade of the week)First entry was a classic butterfly entry and that was a no brainer, but the second one is that trade where you look stupid when your stop is hit!

D point was a normal entry after the doji candle, price rallied and an opportunity to scalp the lower time frames paid dividends. The second entry was a retest of the fib level 0.618 and the twizzers played to my bias and put my second entry with a tight stop. When i am wrong l exit the trade immediately. l was a bit overweight on Soya because it was one of my high probability trades this week.

Dont worry too much about your hit rate just make your winners count

This is my trade of the week. Always trade what you see and practise good risk management

Nested AB=CD in parallel Chanel Nested ABCD harmonics provided 2 bullish signals at C with a symmetrical profit objective of the AB leg.

Sell opportunity at the last D point for a 31,8% retracement profit target of the whole bullish swing.

It's a thing of beauty when you get the picture perfect harmonics❤️

Always Trade what you see and practice good risk management.🍻

Soybean: Bear Flag Signals Potential Downward BreakSoybean prices are currently consolidating within a bear flag pattern, characterized by minor breakouts of key levels.

I anticipate that once the lower boundary of the flag is broken, the market will continue its descent, confirming the bearish scenario.

Should monitor for a strong breakout below the flag’s support to validate short positions.

SOYBEAN CFD Market Money Heist Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist SOYBEAN CFD Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low Point.

Stop Loss 🛑 : Recent Swing Low using 2h timeframe.

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂