S&P500: Rebound or Correction before another fallFRED:SP500 moving below 200 Days EMA on Daily Chart and taking a support on same EMA on Weekly Chart. Due to current situation in the market, high volatility due to Tariffs and announcements, Traders should be cautious as current rebound might be a correction before another fall with support at 4587

SP500 trade ideas

S&P 500 Index vs PresidentIn this layout you can see how the S&P has been performed on each presidency.

Presidency terms,

Obama 1st term: after the financial recession, the index was trying to recover and we saw falls from 16 to 21%, market went up 83%.

Obama 2nd term: the index saw falls from 10 to 15%, Market went up 50%.

Trump 1st Term: the index saw falls 3 big times 11, 21 and 34% Market went up 68%.

Biden 1st Term: the index saw falls 27% and 10%, Market went up 55%.

Trump 2nd Term: we are in the 1st fall 21% not sure if it will continue going down.

The price wants to get closer to the 200MA every time

Fibonacci levels, we are on 0.5, we still have 2 more levels down so these 3 levels could be a good entry point 😊

S&P 500 still testing 5,000Some participants in stock markets had hoped for negotiations to make some progress in the first week of April and at least some countries to be exempted quickly from the latest round of tariffs. However, now it’s a full-scale trade war: China in particular, under 104% tariffs, is very unlikely to back down. The main uncertainty for markets now is less how major countries such as China will continue to react and more whether the American government has discipline of policy to stick to what was announced.

So far there hasn’t been a full-day close below 5,000, which suggests that this area is still a support and it’d be possible to see another attempt at a bounce soon. However, it’s important to consider the bigger picture: the current retracement has barely touched the highs from late 2021 and early 2022 plus the losses in the last two months haven’t so far been bigger than in early 2022, just faster.

A very obvious bullish interpretation of the chart would be inverted head and shoulders, suggesting a return to 6,000 around this time next month. Perhaps obviously, that’s very questionable given how quickly the trade situation can change. Traders also need to monitor the upcoming earnings season in the USA, particularly banks’ reports on Friday 11 April, and sentiment on the Fed’s upcoming meetings.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

Retests, Rallies, and Bear Swings LoadingYou know what’s better than nailing a trade?

Not having to flip, flop, hedge, unhedge, reverse, scalp, and do the full Hokey Cokey just to survive.

Today was one of those days – the kind where the plan just works.

Futures? Wild.

Down 143, up 188, then back to flat - all before most traders finished their first sip of coffee.

But while price whipsaws, I’m not chasing shadows.

I’ve got my line out.

My bear swing is on.

And I’m just waiting for the exit alert to ding.

---

Let’s break down what happened:

Yesterday’s tariff chaos acted like a Mr. Miyagi market prank.

“Tariff on.”

“Wait, just kidding.”

“Tariff off.”

The move up?

Landed exactly at Monday's news spike and the days 5250 gamma flip level – which we had marked and mapped.

Perfect resistance.

Retest. Rejection.

Bear pulse bars triggered.

And now the swing is on.

Trade location: Dialled in.

Directional bias: still bearish under 5400.

Execution: GEX levels + pulse bar structure.

Retests, Not Reversals

Tuesdays action also gave us something sneaky:

An intraday retest of the recent lows.

Now, if you’ve been around since the 2020 V-turn era, you’ve seen this before.

Panic sell.

Sharp bounce.

Retest the low to check for real conviction.

Then make the real move.

This retest could be the prelude to a bull thesis - but not yet.

Structure comes first. Bias second.

Until we break clean above 5400, I stay bear-biased.

---

Expert Insights: Don’t Trade Like You’re in a Dance-Off

The Mistake:

Overtrading volatility. Flipping bias every 15 minutes. Trading like it’s a talent show.

The Fix:

Pick your structure. Define your invalidation.

Enter once, scale in if needed, and let it play out.

No need to “turn around and shake it all about.”

Leave the Hokey Cokey for weddings.

---

Fun Fact

During the 2015–2020 bull run, the average false breakout-to-retest cycle happened within 3 sessions after a panic reversal.

Translation?

Markets often retest panic lows before deciding the next big move.

This isn’t new. It’s just noisy. And totally tradable.

...Another fun fact

Did you know?

The 104% tariff imposed by the U.S. on Chinese imports is among the highest in modern history, reminiscent of protectionist measures not seen since the early 20th century.

SPX WEEKLY SUPPORTIn this chart, you can see the weekly volume supports and the key support points for each bounce and buy. We have not yet completed the weekly selling to determine the distribution

Potential Targets:

August 2023 Volume Area – ~5,076

2020 COVID Lows / Support Zone – ~4,370

2016 Trump Tariffs Level – ~3,641

2008 Financial Crisis Support – ~2,308

SPX500 Short - Due to tariffs impactMarket overview and macro outlook

1. Tariffs, tariffs, tariffs

- The 104% tariffs response to China's response and possible 25% pharmaceutical tariffs are weighing down the markets

- Markets are expected to keep going down until some news of relief is announced

2. Upcoming news

- FOMC meeting on Wed - probably to the downside as it should be comments on keeping rates high to combat the tariffs uncertainty

- US CPI/Unemployment on Thu - TBD

-- If high CPI - good for equities as it raises probability of interest rates cut

-- If high unemployment - good for equities as it raises probability of interest rates cut

- US Core PPI on Fri - TBD

-- If high PPI - good for equities as it raises probability of interest rates cut

Thus, I have a bearish view of the market and look to take Short positions here.

Technical View

Continuing the downtrend from yesterday

Limit short position at 4910, which is right above a major psychological level. Going for a 1:1 trade.

- SL: 4976 (Above the highs of a pullback in the downtrend)

- TP: 4842 (Slightly above the lows of the previous trading zone)

Execution

1. Limit order

- SL: 4976 (Above the highs of a pullback in the downtrend)

- TP: 4842 (Slightly above the lows of the previous trading zone)

2. Key note:

- To watch out for news on tariffs action by Trump, EU and China. Focus on China, then EU then US as per the timezones for today.

3. TF:

- Will close by Friday if price does not retrace back to entry level by then.

Results of ideas thus far:

Number of trades: 3

WR: 33%

Profit: 1.9R

Notes: This is currently for personal practice to write out trade ideas. Feedback is welcome, and please don't mind if none of this makes sense.

S&P 500 clearly long term bullishFor all of those saying we are in a bear market, I could be wrong but at least long term, I don't agree. We are in a post corona "normal" correction to the 50 EMA / 50% FIB retracement / RSI low / Previous monthly resistance that will most like will turn to support. We have no new low's. All signs of a correction in an uptrend. Let's see how it pans out.

Look there is our bottom :)I loved my title :) haha if you're reading this: I intrigued you! And I made you read it. ☺️ thankyou!

Ok, This is what I think about why we might be near the bottom.

The 200 EMA on a weekly scale has been a very selective indicator to indicate this. Above, you can see how the chart touches the candle when the market is oversold (as indicated by RSI below). You can see that it repeats itself in sharp, spike-like, and short-term decline: marked by the yellow circles on the chart.

And finally, the volume indicates, with blue dot lines, the high and medium volume levels. There's no hay below. And we just entered HIGH :) This is going to get even more interesting... and sharp 😜 ✌🏼

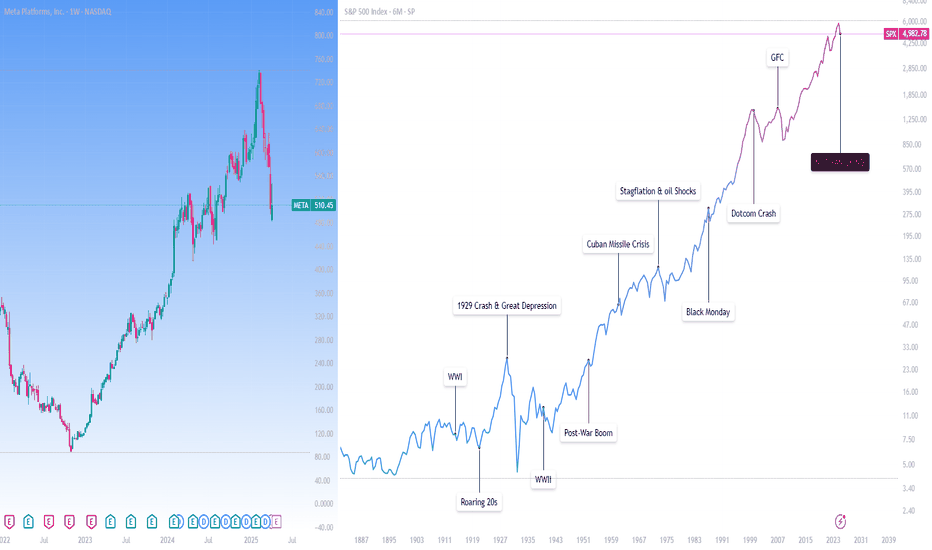

So here’s what I’m doing: Not Panicking.This analysis is provided by Eden Bradfeld at BlackBull Research.

Listen, the US has survived the depression of WWI, the Great Depression, the depression of WWII, oil shocks, the dot com bubble, the GFC, the COVID-sell off. It’ll likely survive this.

In the scope of history, that $1 survived very well indeed. Panicking and running for the hills does not do so well. Winston Churchill was a great and flawed man but a terrible investor; he bought and sold shares prior to the 1929 crash in such speculative investments as mining companies, railways, and so on — most of them lost money (hence why Churchill continued to write at such a pace — to fund his Champagne-and-spec stock lifestyle). Hetty Green, on the other hand, (known as the “Queen of Wall Street”, managed to do very well her time — her quote?

I buy when things are low and no one wants them. I keep them until they go up, and people are crazy to get them.

Now, that’s something I can get behind.

Nobody wanted Meta a few years ago. I wrote an internal memo, close to its plummet in ‘22 (it got to $99 or so a share!). I wrote this:

ii) Yet what if we were to tell about about a company with this set of heuristics? Let’s call it “Company A”

Company A has a 31% return on equity and a 20% return on capital.

It has a net income margin of 37% and a FCF margin of 21%

Its income has a compounded annual growth rate over the last 5 years of 41%

If we add in numbers, now, let’s say the net income for 2020 was $29 billion, and $10 billion of that was used to repurchase stock from shareholders?

Let’s say the unlevered FCF is around $6 billion per quarter, and let’s say the debt to equity ratio is about 9x.

In other words, Company A is grows at a quick clip, and has done sustainably for the majority of its life. Its return on capital and return on equity would make any investor happy. Its FCF is an absolute machine.

Would you buy Company A?

Company A was Meta . You would’ve roughly made 4x or 5x’d your money if you’d bought around then. The point is, the fundamentals of a business matter, and right now there a quite a few exceptional businesses with good fundamentals trading at a good price. Alphabet (Google) trades at ~16x earnings. LVMH trades at ~18x earnings. And so on. Brown-Forman trades at ~15x earnings. These are all “inevitables” — Google will continue to be a dominant advertising platform, LVMH will continue to sell luxury, and Brown-Forman will continue to sell Jack Daniel’s and so on.

I talked to my ma in the weekend. She is not really a share person. Her portfolio is a bunch of “inevitables”. It’s done very well. She said “aren’t you worried about this stock market?”, and I said “You love supermarket shopping, Mum. If you see something at a 25% discount you buy it. You come home, and you’re delighted that you found some mince on special²”

She was like, “oh, that makes sense”.

The problem is you have a lot of people looking at charts and catching worry that the world will end. The world, I am delighted to say, has a magnificent disposition to carry on.

SPX500 – Nailed the Drop, Now Time to Fly?We’ve been calling for a decline—and the market delivered exactly as forecasted.

✅ 100% accuracy on the previous moves.

Now the structure is shifting, and signs are pointing to a strong rebound.

Wave count, momentum, and price action all align for the next bullish leg.

Time to flip the script. See you on the other side. 📈

[S&P500] 2008-Style Collapse in MotionI believe we are witnessing the early stages of a 2008-style crash, though this one will unfold more swiftly and catch many by surprise. The crash will likely test the COVID-era lows, and once the panic subsides, a recovery toward new highs will follow.

FUNDAMENTAL REASONS

After the COVID-crash recovery, the market became significantly overbought, and a pullback was inevitable—such is the nature of markets. Trump’s tariffs have provided a convenient excuse for profit-taking. While the tariffs didn’t directly cause the crash, they served as a much-needed catalyst. What might have been a typical bull market pullback, however, could escalate into full-blown panic.

Why? Index funds.

For the past decade, there has been near-religious advocacy for investing solely in low-cost index funds. This extraordinary delusion has overtaken investors’ collective consciousness—the belief that no one can beat the S&P 500, nor should they try. The most rational choice, then, becomes focusing on your career or business and parking your money in index funds. After all, if the game can’t be beaten, why bother playing? This logic resonates with rational index fund buyers—many of whom lack market experience and have never been tested in the trenches of a downturn. They assume they’re in it for the long haul, unbothered by pullbacks, confident they can hold through volatility. It’s a sound and logical stance.

But will they hold? It’s easy to stay committed when the market is rising. When losses mount, however, the limbic system overrides rational thought, thrusting you into survival mode. You begin calculating how many years of work you’ve “lost,” lamenting that you could have bought a house if you’d sold at the peak, or watching your children’s college fund evaporate. Sleepless nights follow, compounded by a barrage of negative news. Eventually, exhaustion sets in, and in a desperate bid to salvage what remains, you hit the sell button.

With so many unsophisticated investors—who have never endured a true market panic—holding portfolios dominated by index funds, a negative feedback loop emerges. The further the market falls, the more people question their strategy and sell. This cycle intensifies until the panic is overdone, weak hands are shaken out, and the market stabilizes. It’s a tale as old as markets themselves, though today’s index fund evangelists have yet to experience it firsthand.

TECHNICAL REASONS

On the monthly chart, a clear and potent triple RSI divergence stands out. This indicates the market is severely overbought and has been struggling to make new highs.

While technical analysis rarely delivers definitive signals and can often be ambiguous, a triple RSI divergence on a monthly chart is as strong as it gets. Monthly charts of high-market-cap indices are immune to manipulation and short-term noise—it would take an infinite amount of capital to artificially “draw” such a pattern.

The 2021-2022 pullback was an Elliott Wave impulsive wave down (a Leading Diagonal). In Elliott Wave Theory, impulsive waves mark either the final leg of a correction or the first wave of a new trend. A Leading Diagonal almost always signals the latter—meaning another impulsive wave in the same direction is likely to follow.

The 2022-2025 bull market, meanwhile, has proven to be an ABC corrective wave up within the broader trend. This suggests the bull run wasn’t a continuation of the prior uptrend but rather an extended correction that pushed to new highs.

Thus, the leading diagonal down foreshadows another impulsive wave lower, and the corrective wave up confirms this trajectory. Since March 2025, the market has entered free-fall mode—precisely what one would expect following an upward corrective wave.

This sets the stage for a high-probability Elliott Wave Expanding Flat pattern. What’s unfolding now is an impulsive wave down that should, at minimum, retest the 2022 low. If panic takes hold, however, the decline won’t find a floor until it hits a major support level—namely, the 200-month moving average (MA200 Monthly), which sits precisely at the COVID bottom. Should that occur, the magnitude of the drop would rival the 2008 crash.

June 2026 Sp500 will be at 7000 pipsThis is a corrective move. Trump wanted this to deal with the US debt. Everything is smoke a Trump crash. Nothing else.

In June 2026 Sp500 will top at 7000 pips in a massive EW 5.

Now we are in EW 4. It will take some time to settle the dust as you can see.

Be ready, because after Sp500 bottoms out around 4700-4900 pips we will see a MOASS in the next year.

After that, be ready, as well, to see a massive crash to 2500 pips that we will see at the end of 2028.