SPX: Long-Term Strength and Opportunity

SPX: Long-Term Strength and Opportunity

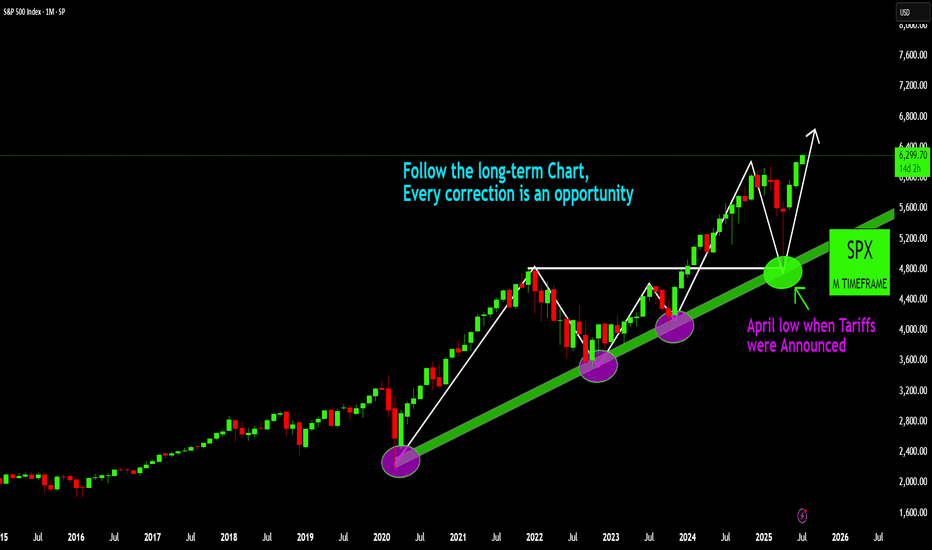

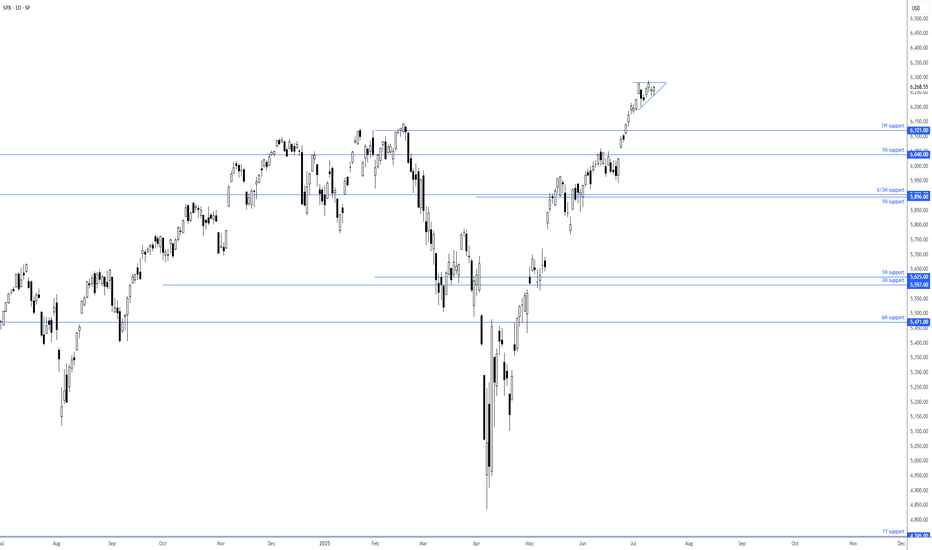

The S&P 500 (SPX) on this monthly timeframe clearly illustrates a powerful long-term uptrend, where each significant pullback has consistently presented a valuable buying opportunity. Most recently, the market effectively retested and bounced off the established long-term trendline, even amidst geopolitical concerns such as the April low experienced when tariffs were announced, underscoring the underlying bullish resilience. This sustained trajectory suggests continued upward momentum, reaffirming the 'buy the dip' strategy within this robust market environment.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

SP500FT trade ideas

S&P 500 Daily Chart Analysis For Week of July 18, 2025Technical Analysis and Outlook:

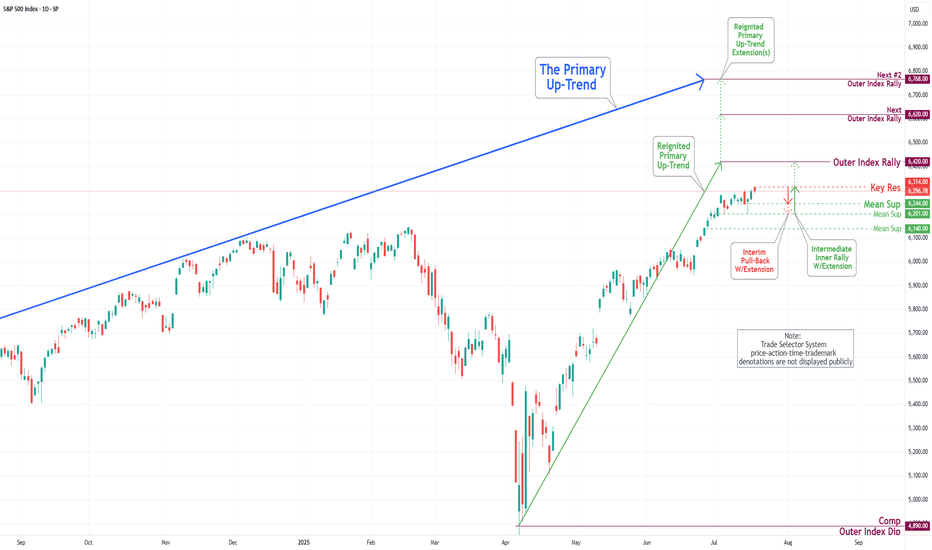

During the current trading week, the S&P 500 Index has demonstrated a predominantly upward trajectory. It has successfully retested the Mean Support level at 6200 and established a new Key Resistance level at 6314. Currently, the index displays a bullish sentiment, with the objective for the Outer Index Rally set at 6420.

Nevertheless, it is essential to recognize that the current price action may result in a decline, potentially leading to a retest of the Mean Support at 6244 and extending to the Mean Support at 6201. Following this potential downward movement, it is anticipated that the index will resume its upward trend, driving the price action towards the Key Resistance level at 6314 and ultimately achieving the Outer Index Rally target of 6420.

S&P 500 consolidating at all-time highsOf late, we have seen price action on the S&P 500 consolidate around all-time highs of 6,290 and is on track to form a small ascending triangle. The nearest support to note resides at the 1W level of 6,121, closely shadowed by a 1M support from 6,040.

Based on the current technical picture, this clearly remains a buyers’ market.

- FP Markets Research Team

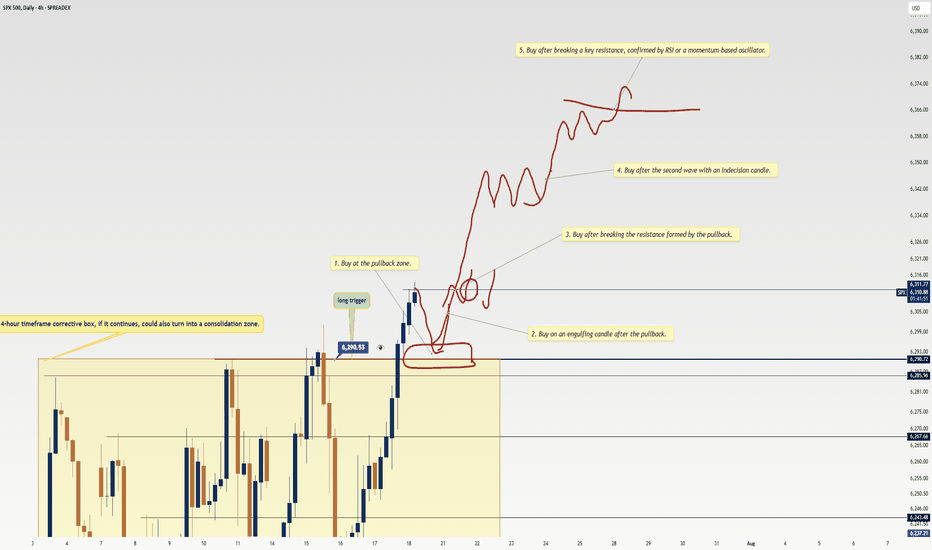

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

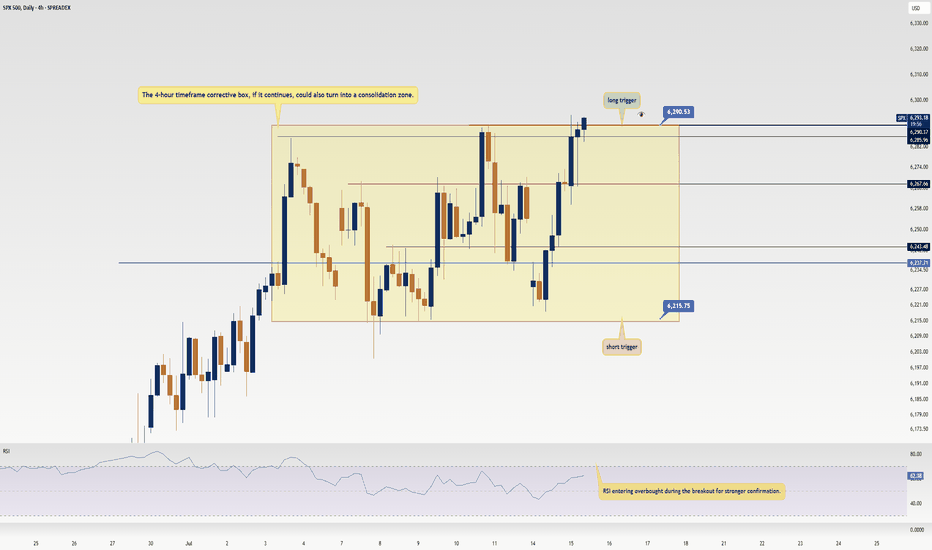

SPX500 Update: Monster Trigger Ready to Launch!Welcome back, traders, it’s Skeptic from Skeptic Lab! 😎 With news of the unemployment rate rising, stock and crypto markets have been surging hard, and right now, we’ve got a killer trigger on SPX500 you don’t want to miss. Its breakout could spark the next major bullish leg. Let’s dive into the Daily and 4-hour timeframes to unpack this setup. here’s the play:

✔️ Daily Timeframe:

After a strong rally, SPX500 hit an all-time high (ATH) at 5,249.14 before entering a deep correction. Here’s what many traders miss: support/resistance levels aren’t static—they shift over time. The resistance that was at 6,146.89 has now climbed to 6,290. Breaking 6,290 signals the start of a major bullish trend after 146 days of correction. This is our primary long trigger.

📊 4-Hour Timeframe (Futures Triggers):

Long Trigger: After a solid uptrend with strong momentum, we entered a time-based correction within a box pattern. Breaking the box ceiling at 6,290 is the long trigger, aligning with the Daily breakout.

Short Trigger: Breaking the box floor would trigger a short, but this goes against the trend, so stop-loss risk is higher, and your win rate could take a hit—stay cautious.

📉 Key Insight: The 6,290 breakout is the big move to watch, fueled by market momentum from the unemployment news. Shorts are riskier due to the bullish trend, so prioritize longs with volume confirmation.

🔔 Confirmation: For longs, confirm the 6,290 break with RSI entering overbought.Risk management is critical—cap risk at 1%–2% per trade to survive the market’s swings.

🔼 I’ll update if the structure shifts! Thanks for vibing with this analysis! <3

💬 Let’s Talk!

Which SPX500 trigger are you locked on? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! ✌️

06/30 Weekly Gamma Exposure Outlook🧠 SPX Weekly Outlook — Gamma Breakout + Short Week Setup

The bulls finally broke through after weeks of painful grinding — and they did so with force.

📈 Thursday & Friday brought a textbook gamma squeeze as SPX sliced through the long-standing 6100 call wall , triggering sharp upside acceleration.

We are now firmly in positive Net GEX territory.

🔺 Entire GEX structure has shifted higher.

🎯 New squeeze zone at 6225 , with major call resistance near 6200 .

🔍 What Just Happened?

📊 The 6060–6120 zone acted as a tough resistance range for weeks — until last week’s breakout.

💥 Put skew collapsed , suggesting downside hedges are being unwound.

📉 VIX and IV keep dropping , confirming a shift toward lower-volatility environment .

🧲 Strong Net GEX across expiries created sustained upward dealer pressure → we’re in long gamma mode .

✅ Bullish Bias — But Stay Tactical

We're in a bullish gamma regime , so dips are likely to be bought.

Key pullback zone to watch: 6125–6060 .

🛠️ Strategy Ideas:

• Wait for a 6060–6125 retest before re-entering longs

• Use shorter-DTE bull put spreads or 0DTE gamma scalps above 6130+

• Scale out or trim risk near 6200–6225

⚠️ Risks to Watch

We’re overextended short-term.

🚨 Losing 6130–6125 could spark a quick flush to 6050 .

Bearish signals to monitor:

• IV spike or renewed put buying

• Loss of 6100 = no-man’s land without confirmation

• Consider short-term debit put spreads if breakdown confirms

🗓️ Short Trading Week Note

🇺🇸 U.S. markets closed Friday, July 5 for Independence Day.

This compresses flows into 4 sessions. Expect:

📌 Early week dealer hedging

📌 Possible positioning unwind on Thursday

💡 Weekly Trade Idea — Structure in Place

💼 Setup:

• Put Butterfly below spot

• 3x Call Diagonal Spreads above spot (5pt wide)

• Slight net negative delta , 11 DTE

🎯 Why it works:

• Leverages IV backwardation

• Profits from time decay

• Favors a stable or modestly bullish week

• Takes advantage of horizontal skew (July 11 vs July 14)

💰 Profit Target: 10–20% return on ~$1,730 risk.

Take profits before time decay kills the center valley — don’t overstay. 🏃💨

📌 Final Thoughts:

The 6100 breakout was technically & gamma-structurally significant ,

but big moves often retest before continuing.

Let price breathe.

Stay aligned with gamma exposure profile. 🔄

IS THE STOCK MARKET HEADING INTO DOT COM BUBBLE 2.0?In this video we look at the 3 month chart of SP:SPX using the traders dynamic index & Fibonacci retracement levels to put together a bullish case for the overall stock market to go on a monster rally over the next 7 years

We also theorize about how over the next 2 years the SP:SPX can indeed hit 7200+ by Q3 2026 and have pullbacks to 5800-6100, but how that could just be the "consolidation move in price" of the overall stock market before we get what could end up being the largest stock market rally we have ever seen in the 21st century

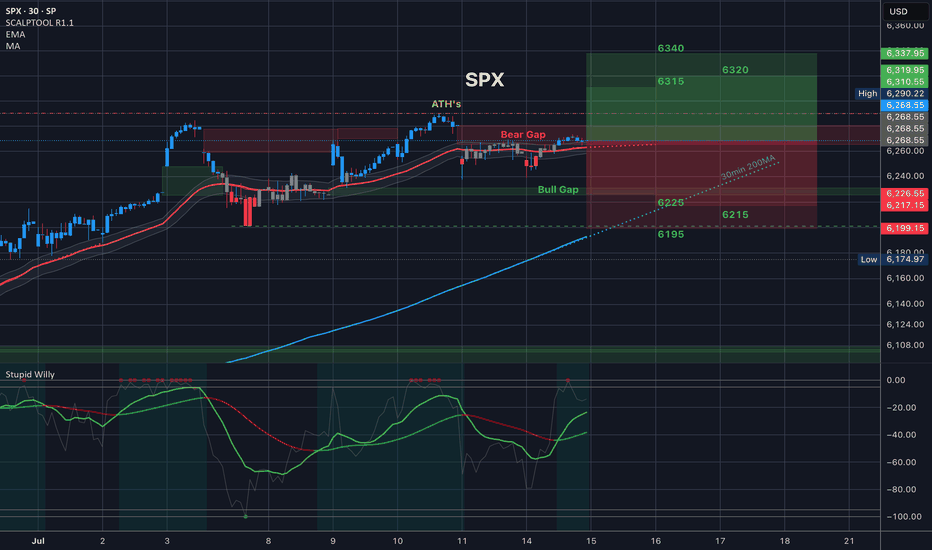

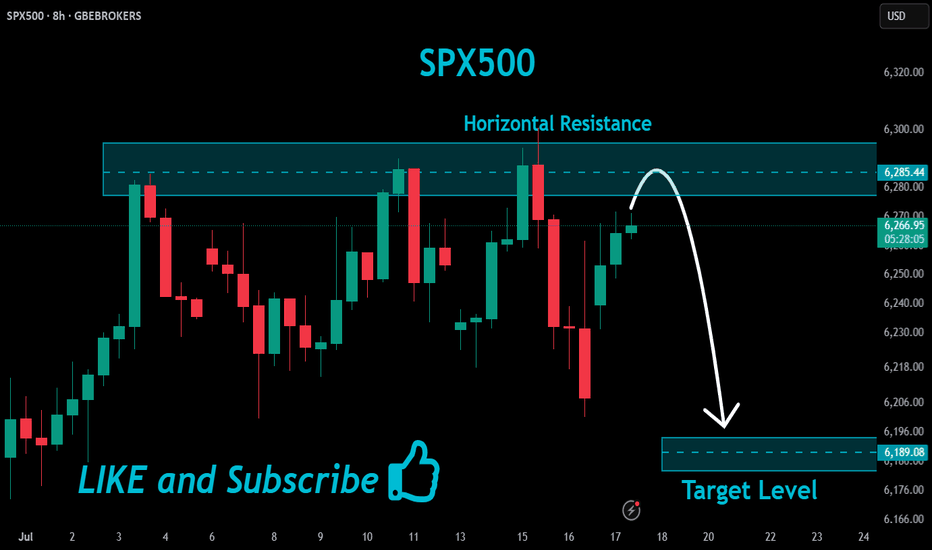

SPX500 Bearish Below 6246 – Eyes 6223 and 6195SPX500 Analysis

SPX500 stays under bearish pressure below 6246, targeting 6223 and possibly 6195 if the decline continues.

Recent tariff escalation by President Trump is adding weight to downside momentum across indices.

Pivot: 6246

Support: 6223, 6195, 6143

Resistance: 6268, 6291

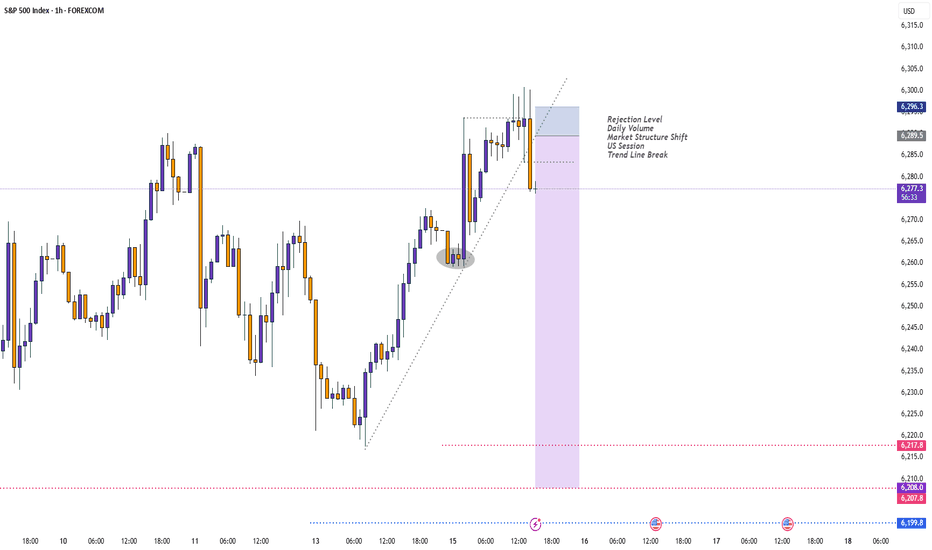

US 500 – A New Record Peak or Reversal in the Week AheadSo far in July, the US 500 has recorded multiple all-time highs on its way to an eventual peak of 6294 on Thursday (July 10th), from which it finally succumbed to some profit taking into the weekend, leading to a small Friday sell off to close at 6255 (-0.4%).

Along the way traders have ignored mixed US economic data, and more importantly they have, for the most part, shrugged off President Trump’s increasingly aggressive approach to tariffs, choosing instead to focus on economic resilience, renewed AI optimism and an improving outlook for the Q2 corporate earnings season that kicks fully into gear in the coming days.

In terms of tariffs, the fact that there is now a new August 1st deadline to concentrate on may be taking away some of the immediate urgency for the announcement of trade deals, although these issues still remain important and on-going, highlighted by President Trump's weekend social media announcement of 30% tariffs on the EU and Mexico, if a better deal cant be reached in the next 3 weeks.

With regard to corporate earnings, the major US banks like JP Morgan (Tuesday before the open) and Bank of America (Wednesday before the open) report this week. Both company’s share prices have seen strong gains since the April lows, so traders will be eagerly awaiting their actual numbers. They will also be keen to hear the thoughts of the bank CEOs on future earnings, bad debt provisions and the potential impact of Trump’s tariffs on the US economy moving forward. Only last week, Jamie Dimon, CEO of JP Morgan, warned market complacency towards potential tariff risks.

In terms of scheduled economic data. Tuesday’s US CPI (1330 BST) and Wednesday’s PPI release (1330 BST) stand out. Traders are sensitive to US inflation updates and have been watching over the last several months for signs that tariffs are pushing up prices. So far this hasn’t been the case but these new releases may tell a different story.

All of these issues could impact risk sentiment and the direction of the US 500 index in the next 5 trading days. Certainly, the early open has been impacted by President Trump's weekend tariff announcement, with the US 500 currently down 0.46% at 6227 (0800 BST).

The technical outlook could also be an important factor in determining price moves.

Technical Update: Assessing the Move to A New Record High

Last week appears to have seen a slowing in the speed of the recent price strength, but a new all-time high was still posted at 6294 on Thursday. It could be argued that this activity maintains what is still a more constructive pattern of higher price highs and higher price lows that have materialised since the April 7th downside extreme of 4799.

However, there is no guarantee this price activity will continue to see new all-time highs posted, so we need to be aware of potential support and resistance levels that may influence price activity.

Possible Support Levels:

If last week’s possible slowing in upside price momentum develops into a new phase of price weakness, a support level that traders might now be watching could be 6148.

This 6148 level is equal to both the 38.2% Fibonacci retracement of June 23rd to July 10th strength and the current level of the rising Bollinger mid-average. Closes below 6148 might suggest a more extended phase of weakness back to 6058, the lower 61.8% Fibonacci retracement, possibly further if this in turn gives way.

Possible Resistance Levels:

Having been capped by the 6294 all-time high last week, sellers may continue to be found at this level, so this might prove to be the first potential resistance if fresh attempts at price strength over the coming week develop.

Closing defence of 6294 may need to be watched if challenged, as successful breaks above this level might suggest an extension of the uptrend pattern currently evident in price activity. Such closing breaks higher may well suggest price strength towards 6418, the 200% Fibonacci extension level of the recent price decline.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Major LowI'm buying puts expiring on October 31st, All Hallow's Eve.

I'll give price room to keep melting up to 666 at the farthest, that is my stop level. If we breach that price, then just know that tech is unstoppable and Artificial Intelligence is the Mark of the Beast.

If the market doesn't drop here, then the sky is the limit.

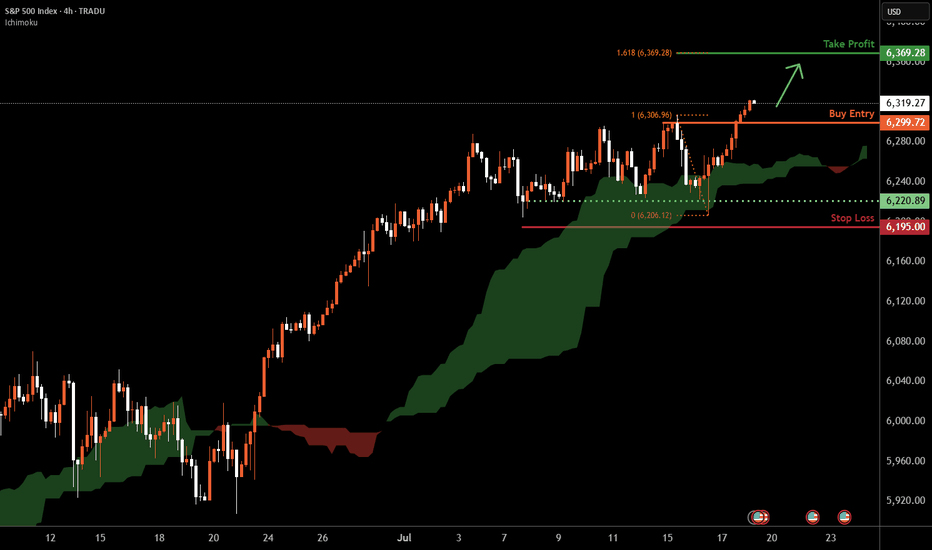

S&P 500 H4 | Making a run towards a new ATH?The S&P 500 (SPX500) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 6,299.72 which is a pullback support.

Stop loss is at 6,195.00 which is a level that lies underneath a multi-swing-low support.

Take profit is at 6,369.28 which is a resistance that aligns with the 161.8% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

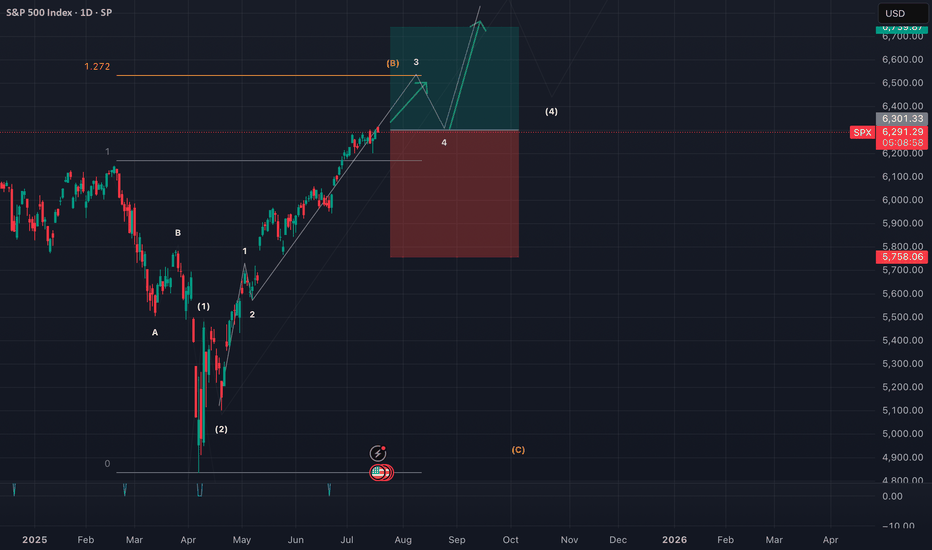

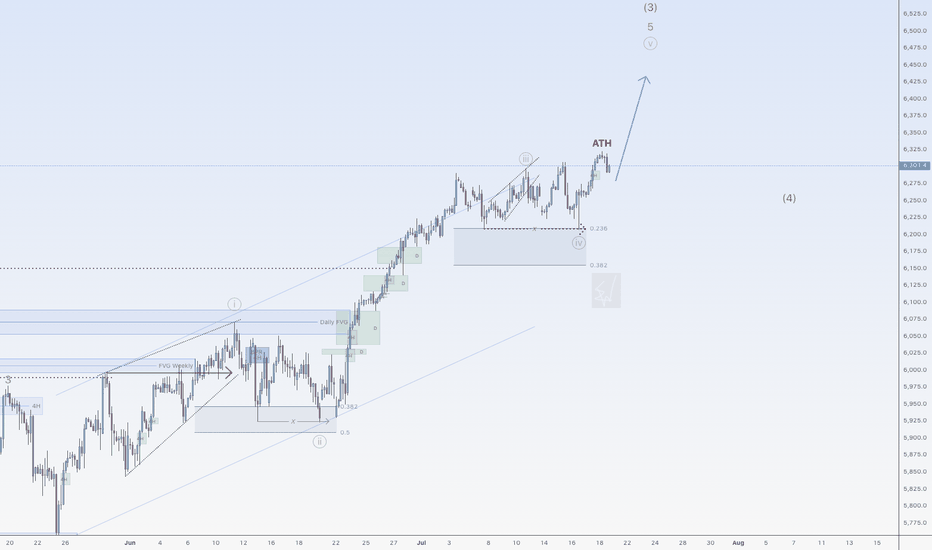

More upside for SPX500USDHi traders,

Last week SPX500USD made a small correction down (grey wave 4) and after it swept the dotted trendline it went up again. This could be the next impulse wave 5 (grey).

If this is true, then next week we could see more upside for this pair.

Let's see what the market does and react.

Trade idea: Wait for a small pullback and a change in orderflow to bullish on a lower timeframe to trade longs.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

US500 Bulls Assemble | Breakout Heist Strategy📈🚨 MASTER HEIST PLAN: “SPX500 ROBBERY – THIEF TRADING STYLE 🔥💸” 🚨📈

(The Ultimate Long Strategy Blueprint for Smart Day/Swing Traders)

🌍 Greetings to All Market Bandits, Bullish Burglars, and Chart Snipers!

Hola! Bonjour! Ola! Hallo! Marhaba! 🙌

🦹♂️This is your friendly chart thief checking in with the latest SPX500/US500 masterplan!

This isn’t just a trade—it’s a heist 🎯. We’re not here to participate, we’re here to dominate! Welcome to the Thief Trading Style, where we map, trap, and snatch those pips with ruthless precision. 🧠🔍💰

🚀 THIEF TRADE SETUP - SPX500/US500

A mix of technical sniper entries + fundamental black ops analysis = 💸 Maximum Extraction. 💸

🎯 ENTRY PLAN: THE BREAKOUT HEIST

📍Buy Entry Zone: Wait for the clean breakout + candle close above 6270.00.

"The vault opens once we clear that wall. Let the bullish getaway begin!" 💥🚪📈

🛠️Thief Tips for Entry:

Use Buy Stop Orders above resistance levels.

OR layer in Buy Limit Orders near recent pullbacks (15/30m swing zones) using DCA Style (Dollar Cost Average layering like a pro).

Want stealth mode? Set that alert (alarm), and strike when the breakout sings. 🔔🎯

🛑 STOP LOSS – PROTECT THE LOOT

🧨Set your SL smart—beneath the nearest swing low using the 2H timeframe for stronger structure.

💬 “Look, don’t gamble. A thief knows when to run. Set that stop where I showed ya, or risk losin’ the bag.” 💼💣

❗Your SL should reflect your risk per trade, lot size, and number of entries. It’s your getaway plan—don’t mess it up.

💥 TARGETS – WHERE WE CASH OUT

🏴☠️Primary Take Profit (TP1): 6310.00

🏴☠️Secondary Take Profit (TP2): 6370.00

💹 Scalp Traders: Stick to the Long Side Only. Ride the momentum, but use trailing SL to lock it in.

🔍 THIEF FUNDAMENTAL INTEL: WHY THIS IS OUR MOMENT

Current SPX500 bullishness driven by:

✅ Positive macro & geopolitical tailwinds

✅ Institutional positioning (COT reports)

✅ Intermarket analysis showing strong correlations

✅ Momentum building with sentiment and volume

📌 Stay sharp—check all your fundamental reports, news catalysts, and sentiment tools before executing your move. Smart thieves plan every detail. 🎓📊

⚠️ NEWS RELEASE REMINDER

📢 News = Chaos. Don’t get caught in the spray:

🔒Avoid entering trades just before big announcements.

🚀 Use Trailing SL to secure profit if you're already in.

Stay agile. Stay smart. Stay rich. 💼🚁

❤️ SUPPORT THE HEIST – HIT THAT BOOST BUTTON!

👊 Liked the plan? Hit the Boost to join the elite robbery crew.

Every boost fuels the mission. Every like sharpens the strategy. Let's build a team of smart, profitable traders. 🚀💸🔥

🧠 Remember: This is general analysis – not financial advice. Manage your risk like a true thief. Stay updated. Adapt fast. Don't get caught. 🕵️♂️

🎉See you in the next Heist Plan! Keep your tools sharp, your charts cleaner, and your profit bags fatter. 🤑🔥

SP500 Bullish Momentum Amid Trade DevelopmentsThe US stock index continues to trade higher as overall market sentiment remains bullish, driven by optimism despite Donald Trump's aggressive tariff stance and ongoing global trade negotiations.

Currently, the index is consolidating within a narrow range around 6260. A confirmed breakout from this zone is essential to determine the next directional move. then Upside Target will be :6,250 and 6,300

If you like this idea if you Have on Opinion about this analysis share in comments.

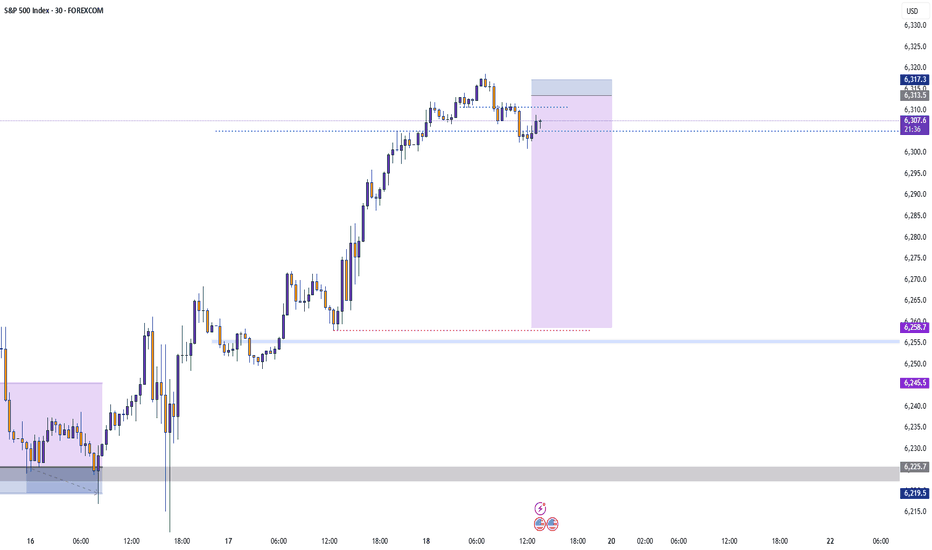

S&P500 (CASH500) (SPX500) SHORT - Head and shoulders 30minRisk/reward = 3.3

Entry price = 6314.8

Stop loss price = 6318.4

Take profit level 1 (50%) = 6301.3

Take profit level 2 (50%) = 6297.5

Waiting on validation from a few other variables.

For example, waiting for the current 30min candle to close in range.

Letssss goooooo