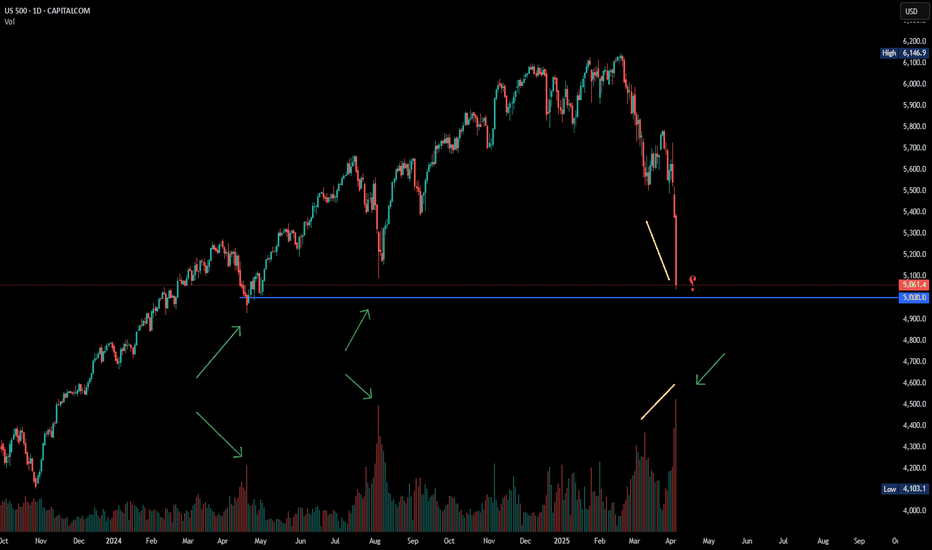

SPX500 Detailed Trading Game Plan🎯 Current Market Context:

Current Price: 6,000 (Approx.)

Trend: Bullish; forming higher highs and higher lows.

Key Technical Observations:

Strong support and trendline respecting bullish structure.

Fibonacci confluence points towards potential upside momentum continuation.

Volume Profile indicating key levels at 5,950–6,000.

🚦 Trading Scenarios & Probabilistic Setups:

🟢 Scenario A (High Probability Long Trade ~65%):

Entry Zone: Current Levels (6,000–5,950) or retest to 5,863 support.

Stop Loss: Below 5,709 (critical structural support).

Targets:

Primary: 6,262 (100% Fibonacci Extension)

Secondary: 6,460 (Key Horizontal Resistance)

Risk-to-Reward: Favorable (~1:3)

🟡 Scenario B (Medium Probability Short Trade ~45%):

Entry Zone: 6,460–6,500 (strong resistance confluence)

Stop Loss: Above 6,600 (clear invalidation)

Targets:

Primary: 6,100 (structural retest)

Secondary: 5,950–5,863 (previous support zone)

Risk-to-Reward: Good (~1:2)

🔴 Scenario C (Low Probability but High Reward Long Trade ~35%):

Entry Zone: Deep retracement at ~5,408–5,106

(Invalidated if price breaks below 5,107.)

Stop Loss: Below 5,107 (firm invalidation)

Targets:

Primary: 5,950 (key resistance)

Extended: 6,460–7,176 (long-term bullish target)

Risk-to-Reward: Excellent (~1:5+), but lower likelihood of triggering.

📊 Probability & Risk Management Summary:

Scenario Probability Risk Reward Potential

A (Long) 65% ✅ Moderate High

B (Short) 45% ⚠️ Moderate Moderate

C (Long Deep) 35% ❗ Lower Very High

⚙️ Recommended Approach:

Primary Strategy: Bullish Continuation (Scenario A) due to current market structure and volume profile confirmation.

Secondary Consideration: Watch closely for Short Setup (Scenario B) only upon clear resistance signals.

Contingency Setup: Deep retracement (Scenario C) provides excellent value entry if fundamentals trigger a major correction.

🛠 Trade Management Tips:

Position Size according to scenario probabilities. Allocate larger sizing to Scenario A, cautious sizing for Scenario B, and small, speculative sizing for Scenario C.

Trailing Stops: As price approaches targets, adjust stops to lock profits progressively.

🗓 Timeline & Key Levels for Reference:

Immediate actionable trades: Scenario A (Long) setup at current levels.

Monitor closely by Mid-August 2025 for Scenario B potential short setup.

Watch closely for deep retracement scenario by November 2025 if substantial correction occurs.

🚨 Important Note: Always adjust your trades dynamically based on evolving macroeconomic and geopolitical news. These probabilities are guidelines—not certainties.

⚠️ Disclaimer:

Trading involves substantial risk and is not suitable for every investor. The information provided is purely for educational and informational purposes and does not constitute financial advice, a recommendation, or solicitation to buy or sell any financial instrument. Always perform your own analysis, consider your financial situation and risk tolerance, and consult with a qualified financial advisor before executing trades. Past performance does not guarantee future results. You alone bear the full responsibility for any investment decision you make.

Stay disciplined, trade wisely, and good luck! 🍀📊

SPCUSD trade ideas

How High is High Enough - welcome to the Void & VanityUS500 | ATH Extension and Rebalancing Outlook

What is going on beyond the surface? – Here is how I will anticipate next move.

Today , price carved a new All-Time High (ATH) , extending beyond Monday’s peak and breaching the previously defined Sell Limit Bound at 6173 .

6173 level capped prior upside and served as the structural ceiling on the weekly timeframe – would demand balance.

While price has cleared 6173 , failure to retain acceptance above it raises the possibility of a rebalancing phase —necessary before any sustainable bullish expansion. This retracement, if triggered, would offer clarity on whether this breakout is a continuation or merely a premature exploration into thin liquidity.

📌 Key Observations:

• 6173 – Breached, but yet to prove retention. A weekly close and reaccumulation above here is required to maintain bullish momentum.

• 6577–6408 – Marked as a hidden liquidity pool and potential upside target zone. Price may hunt for this range, but only if it holds structurally above 6173.

• Below 6173 – Failure to anchor here may trigger a rebalance into prior value areas before any serious upside projection takes form.

Price must find equilibrium before the next leg. Any upside without that balance risks collapsing under its own weight.

S&P 500 , UPDATE CHART Uptrend

I closed all my open positions when the price was near the All-Time High (ATH) and observed a bearish candle at the end of June 11th. Now, the chart is attempting to break the resistance (S/R) level again. However, I've noticed a divergence between the main chart and the Awesome Oscillator (AO), which leads me to believe we will either see a correction below this level or a pullback after a potential breakout. I am waiting for one of these scenarios to materialize before re-entering with new buying positions.

S&P500 Bullish breakout support at 6040 The US dollar hit a three-year low and Treasury yields declined after reports suggested Donald Trump may replace Fed Chair Jerome Powell earlier than expected. Investors interpreted this as a sign that rate cuts could come sooner, adding uncertainty to the outlook for the dollar and US bonds—already under pressure from tariff concerns and a growing fiscal deficit.

Oil Sector:

Shell ruled out a takeover bid for BP, putting to rest speculation of a potential mega-merger between the two energy giants. Despite BP's weak stock performance and activist pressure, Shell appears unwilling to pursue a deal.

Corporate Highlights:

Nvidia shares hit a record high, once again becoming the world’s most valuable company.

Xiaomi launched its first electric SUV, the YU7, aiming to challenge Tesla’s Model Y.

Shell denied reports of merger talks with BP, reaffirming its current strategy focus.

Key Support and Resistance Levels

Resistance Level 1: 6145

Resistance Level 2: 6178

Resistance Level 3: 6210

Support Level 1: 6040

Support Level 2: 6010

Support Level 3: 5978

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

S&P500 key trading level at 6130Trade Tensions:

Trump has threatened higher tariffs on Japan, criticising its refusal to import U.S. rice.

The EU is open to a trade deal with the U.S. involving a 10% universal tariff on many exports, but seeks lower rates for key sectors like pharmaceuticals and semiconductors.

Markets:

U.S. equity futures are steady after the S&P 500 posted its best quarter since 2023.

Focus remains on trade developments and ongoing disputes in Washington over a major $3.3 trillion tax bill.

Canadian stocks are outperforming, led by gold miners, as investors seek safe-haven hedges amid tariff risks.

U.S. Tax Bill:

Republican leaders are struggling to secure votes.

A controversial AI regulation amendment was rejected.

Yale economists estimate the bill would cost the bottom 20% of earners $560/year, while the top 20% gain $6,055/year on average.

Corporate News:

Apple may use OpenAI or Anthropic’s AI to upgrade Siri, potentially sidelining its own AI models.

Key Support and Resistance Levels

Resistance Level 1: 6260

Resistance Level 2: 6310

Resistance Level 3: 6350

Support Level 1: 6130

Support Level 2: 6090

Support Level 3: 6055

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

July 9th EU-US tariff deal, what will happen to S&P500?Timeline & Context

-The U.S. initially implemented a 10% baseline tariff on most imports (April 5), with potential spike to 50% for EU goods on July 9 unless a deal is struck.

-On June 26, Macron warned that if U.S. keeps a 10% tariff, the EU will impose equivalent retaliatory levies.

-EU offer of “zero-for-zero” (Macron, von der Leyen) remains on the table, though Washington reportedly resists.

How Markets May React

If a 10%–10% deal is struck (U.S. keeps 10%, EU matches):

-Markets will likely breathe a sigh of relief—clearing headline risk.

-Expect a moderate rally, perhaps +1–3% in the S\&P 500, as tariff uncertainty diminishes.

-Economists note past discussion: when the EU delay hit May, S\&P futures jumped ~2%.

If they agree to Macron’s “zero-for-zero” proposal:

-That would be a bullish surprise—tariffs completely lifted.

-Market response could range +3–5%, though EU has indicated U.S. pushback on full zerozero .

-Analysts warn clarity isn’t always calm: the S\&P is already priced above fundamentals—choppy reactions still possible .

If the pause lapses with no EU agreement:

-U.S. could enforce 50% tariffs; EU likely retaliates.

-Risks: recession fears in EU, U.S. inflation spike so stocks will likely fall.

-Bank strategists forecast flat S\&P (5,900), but warn of volatility range 5,600–6,000 based on trade policy surprises.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

Top fundamentals that will shape the S&P 500 this summer 2025The summer of 2025 is characterized by a combination of macroeconomic and microeconomic factors that will shape the trajectory of the US equity market. While the S&P 500 is trading close to its all-time highs and at a valuation comparable to that at the end of 2021, the strength of the upward momentum will depend on the conjunction of several key variables. Understanding these fundamentals is crucial to grasping the potential and risks awaiting investors over the coming months.

1) The trade war and economic diplomacy, the main source of uncertainty

The trade issue remains the most unpredictable at the start of the summer. The July 9 deadline for the conclusion or failure of tariff negotiations is crystallizing tensions between the United States and its main partners. The prospect of a new wave of tariffs could have a direct impact on production costs, inflation and business confidence. Trade diplomacy is thus the variable most likely to provoke volatility jolts and challenge positive earnings growth expectations. If trade agreements are signed, then this will help to sustain the S&P 500's uptrend.

2) US fiscal policy: the “One Big, Beautiful Bill”

The Trump administration's major tax bill is another hotspot. This piece of legislation calls for an extension of the tax cuts initiated in 2017 and a dramatic increase in the public debt ceiling, to the tune of $5,000 billion. While these measures potentially support consumption and private investment, their medium-term impact on public finances is uncertain. The real issue for the equity market is to assess whether these decisions will lead to a surge in long-term US bond yields. A slippage in US Treasury yields would increase corporate financing costs and undermine currently high valuation multiples. Conversely, if yields remain contained, the equity market's upward momentum could continue.

3) Inflation and the Fed's monetary policy: a delicate balance

The trajectory of inflation, in particular that of the PCE index, will be a major determinant. US inflation is currently slightly below the Fed's target. Several components, notably the services sector, which accounts for almost two-thirds of the PCE basket, are proving relatively stable. Inflationary risks are more likely to come from commodities, particularly if trade tensions reignite. Oil, which accounts for around 11% of the PCE basket, is currently showing no major warning signs, benefiting from a geopolitical calm. Real estate and healthcare are also showing reassuring indicators. Against this backdrop, the Federal Reserve is adopting a cautious stance: while several major Western central banks are moving towards a neutral rate, the Fed is stalling and conditioning its monetary pivot on visibility regarding tariffs and corporate behavior.

The timing of rate cuts is one of the biggest sticking points. According to recent signals, the first rate cut could take place as early as September. However, influential members of the FOMC, appointed by the Trump administration, are arguing for earlier easing. The political pressure is strong: Trump is calling for immediate cuts, but Chairman Powell remains in control of the agenda, taking care to preserve a consensus within the committee.

4) The job market and the likelihood of a recession

The US employment situation is an advanced barometer of the economic cycle. Weekly jobless claims and the aggregate unemployment rate are closely monitored. Historically, a significant rise in unemployment signals that the economic slowdown is already underway. For the time being, the labor market is proving resilient, but the slightest deterioration could alter investors' central scenario and reinforce recessionary expectations. This risk is one of the potential dampeners to the prevailing optimism, unless it were to accelerate the timetable for resuming the cut in the federal funds rate.

5) Second-quarter results and earnings outlook

The second-quarter earnings season is of particular importance. US companies must demonstrate their ability to deliver earnings growth in line with forecasts, even as valuation multiples remain stretched. Maintaining high price levels on the S&P 500 assumes robust earnings growth and confident guidance from management. Failing this, the risk of a correction would be high, especially as the market has already incorporated many positive factors. The weakness of the US dollar and the price of oil, as well as the current momentum in AI, could hold out some pleasant surprises for second-quarter results.

6) Geopolitics and oil, potential sources of volatility

Finally, global geopolitics is a second-order variable, but one that could suddenly become a priority. A rapid deterioration in the international situation, particularly in the Middle East or the China Sea, could affect trade flows and oil prices, fuelling renewed inflation and financial volatility.

Conclusion :

The summer of 2025 promises to be a period of strategic transition for the US equity market. Between trade diplomacy, fiscal policy, inflation, the trajectory of interest rates and earnings momentum, investors will have to deal with an accumulation of uncertain factors. If these uncertainties gradually dissipate, the uptrend could continue. Conversely, the combination of a geopolitical shock, a rebound in inflation and a political stalemate over the federal budget would have the potential to weaken the current rally.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Wind of Change - VOO ETFPlease watch this interesting article and feel the cool nice breeze blowing along...........

Nice , isn't it ?

As I read this article, I can't help as if a REAL giant fan was blowing at me although I know it is not REAL, just an image in my mind, magnified by the LED image and the sound as well.

And for a moment, I allowed it to play with my mind and instantly, I felt cooler.........

It is the same for reporters/journalists worldwide who made a living covering news and writing sensational news headlines to capture your eyeballs. Although we are not in Israel/Iran war, we too feel the pain and tragedy suffered by the innocent people.

How about the numerous floods happening in China ? I can't help but feel a sense of gratitude for where I am born - Singapore , free from natural disasters.

It is the same as INVESTING/TRADING. If you look at your P&L statement on a daily/hourly basis, it somehow spurs you to take an impulsive action. This is especially if you have lost some money and you wanted to quickly recover your losses. On one hand , you wanted it to go along but afraid the pullback may be too strong and your profits turn to losses again.

I remembered the book I read about - it says yesterday result was history. Whatever had happened , leave it there. Today is a fresh start and if you want to trade, you must have a brave heart and start afresh , look at your available capital (not including what you had lost) and do what you are supposed to do in the moment.

Social media is a double edge sword and every day, there are doomsday porns including marketing gurus telling you that the stock market is overvalued, tariffs this , tariffs that and you should sell. Did you ?

And there are also Asia bulls or rather China bulls that claims US funds are shifting to China and the price is going to the moon. I have often said treat this as entertainment , as reference but do your own due diligence.

A safer and lower risk is to get exposed to the VOO ETF where it is more diversified and you need not worry about a single company performance dragging the rest down.

Position sizing is also important - just because you had made some money (could be luck), it does not mean you should increase your position size (increase in risk) due to your greed. Consistency is the game in trading not BIG IN BIG OUT.

SPX500 Holds Above 6,098 | Bullish Bias Toward ATH at 6,143OANDA:SPX500USD OVERVIEW

S&P 500 Futures Subdued After Near-Record Close | Market Eyes Powell’s Comments

U.S. stock futures were muted on Wednesday after the S&P 500 closed near an all-time high, following signals from Israel and Iran that their air conflict has ended.

Investors now await further comments from Fed Chair Jerome Powell for clues on the monetary policy outlook.

TECHNICAL OUTLOOK – SPX500

The price remains in a bullish trend as long as it trades above 6,098, with upside potential toward the ATH at 6,143.

However, a 1H or 4H candle close below 6,098 would likely trigger a bearish correction toward 6,056 and 6,041.

Pivot Level: 6,098

Resistance Levels: 6,143 → 6,175 → 6,210

Support Levels: 6,066 → 6,041

S&P500 Bullish breakout support at 5980A fragile ceasefire is in place between the U.S. and Iran, but both sides are still blaming each other for missile attacks. Tensions remain high, especially as Iran’s stockpile of near-weapons-grade uranium is missing. Markets were shaken—stocks gave back some gains and oil prices dipped after Israel threatened to respond.

In business news, Nvidia’s CEO Jensen Huang began selling shares as part of a plan worth up to $865 million. Starbucks denied it's selling its China business, and Northern Trust said it won’t merge with BNY Mellon.

Fed Chair Jerome Powell will speak to Congress today, likely defending the decision to keep interest rates steady until at least September, despite pressure from Trump for major cuts.

NATO leaders are meeting in the Netherlands, with talks focused on defense spending. Trump is expected to push allies to meet the 5% target.

Key Support and Resistance Levels

Resistance Level 1: 6115

Resistance Level 2: 6147

Resistance Level 3: 6180

Support Level 1: 5980

Support Level 2: 5950

Support Level 3: 5910

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish continuation?S&P500 (US500) is falling towards the pivot which has been identiifed as ab overlap support and could bounce to the 1st resistance.

Pivot: 5,796.40

1st Support: 5,555.95

1st Resistance: 6,091.55

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

52 W hi Capitalize on the around-the-clock liquidity of S&P 500 futures , and take advantage of one of the most efficient and cost-effective ways to gain market exposure to a broad-based, capitalization-weighted index that tracks 500 of the largest companies of the US economy

they'll losing they pants. we're selling gang

!!!!!!!!! Lol

S&P 500 Daily Chart Analysis For Week of June 27, 2025Technical Analysis and Outlook:

During the current trading week, the S&P 500 Index has predominantly demonstrated an upward trajectory, surpassing the Mean Resistance level of 6046, the Outer Index Rally target of 6073, and the critical Key Resistance threshold of 6150. Currently, the index is exhibiting a bullish trend, indicating potential movement towards the Outer Index Rally objective of 6235. However, it is essential to note that there is a substantial probability that prices may retract from their current levels to test the Mean Support at 6136 before experiencing a resurgence.

S&P 500 hits fresh records: Levels to watchBreaking its February peak, the S&P 500 has joined the Nasdaq 100 in hitting a new record high this week. The latest gains came on the back of a sharp de-escalation in the Middle East and mounting pressure on the Fed to cut rates.

They question is whether it will kick on from here or we go back lower given that trade uncertainty is still unresolved. Indeed, there’s the upcoming 9 July deadline, when the current reciprocal tariff truce is due to expire. Unless it’s extended—or replaced by something more concrete—we could be in for another wave of trade tensions.

It is also worth remembering the ever-looming US fiscal showdown. Trump’s much-touted spending bill—nicknamed the “One Big Beautiful Bill”—is targeting a Senate vote by the 4th of July. If passed, it could reignite concerns about ballooning deficits and inflationary pressure.

Anyway, from a purely technical analysis point of view, the path of least resistance continues to remain to the upside. Thus, we will concentrate on dip buying strategy than looking for a potential top - until markets make lower lows and lower highs again.

With that in mind, some of the key support levels to watch include the following:

6069 - the mid-June high, which may now turn into support on a potential re-test from above

6000 - this marks the launch pad of the latest rally and marks the 21-day exponential average

5908 - this week's low, now the line in the sand. It wouldn’t make sense for the market to go below this level if the trend is still bullish.

Meanwhile, on the upside:

6169 is the first target, marking the 161.8% Fib extension of the most recent downswing

6200 is the next logical upside target given that this is the next round handle above February’s peak of 6148

By Fawad Razaqzada, market analyst with FOREX.com

SPX500 Short There are multiple patterns on M15 and H1

All timeframes up to H4 are overbought

There are multiple double tops with divergence

This is at the all-time high, suggesting there will be a lot of resistance

Markets look like they are due for a drop after such a sharp move up\

Stop loss above 6130

S&P 500 (SPX) 1M next week?The S&P 500 is pulling back from a key resistance after completing a bearish AB=CD pattern on the monthly chart. Price action suggests a potential correction toward the 4662–4700 zone, aligning with the 0.618 Fibonacci retracement level, which may serve as a key area for bullish reaccumulation. Momentum indicators show bearish divergence, hinting at a cooling rally.

Fundamentally, the index remains supported by strong earnings in tech and AI sectors, but risks persist from elevated interest rates, sticky inflation, and potential Fed policy shifts. A pullback into the 4662–4700 zone may offer a medium-term setup for continuation toward 5198 and potentially 5338. A breakdown below 4662 would invalidate the bullish structure and shift focus to lower Fibonacci levels.

Stock Markets Rebound Following Trump’s Ceasefire AnnouncementStock Markets Rebound Following Trump’s Ceasefire Announcement

Last night, U.S. President Donald Trump made a social media post announcing a ceasefire agreement between Iran and Israel. According to his own words, the ceasefire is set to last “forever.” This announcement triggered a sharp bullish impulse (indicated by the blue arrow) on the S&P 500 index chart (US SPX 500 mini on FXOpen), pushing the price to a new high above the 6074 level.

Just yesterday, traders feared that the United States could be drawn into yet another costly war following bomber strikes on Iran’s nuclear facilities. However, today the stock markets are recovering, signalling growing optimism and a waning of fears over a major escalation of the conflict.

Technical Analysis of the S&P 500 Chart

When analysing the S&P 500 index chart (US SPX 500 mini on FXOpen) seven days ago, we identified an ascending channel. The angle of the trend remains relevant, while the width of the channel has expanded due to the downward movement caused by tensions in the Middle East.

Notably:

→ the price marked the lower boundary of the channel as well as the internal lines (shown by black dots) dividing the channel into quarters;

→ the latest bullish impulse suggests that the upward trend is resuming after breaking out of the correction phase (indicated by red lines).

It is possible that in the near future, the S&P 500 index (US SPX 500 mini on FXOpen) could reach the median line of the channel. There, the price may consolidate, reflecting a balance between buyers and sellers—particularly if the peace in the Middle East proves to be lasting.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.