SPX Tariff Relief dips to buy: 5282 ideal, 5100 a Must-Hold zoneStonks got sold in panic then bought in fomo.

We of the Fib Faith indulge in logical serenity.

We plan and execute calmly and deliberately.

5428-5454 bounce would indicate Strong Bull.

5271-5282 Bounce would be ideal structural dip.

5109-5136 is the Must-Hold or it was a bull trap.

==========================================

SPCUSD trade ideas

S&P 500 off earlier highsThe major US indices have come noticeably off their earlier highs, following the positive start on the back of the weekend news of temporary tariff relief on technology sector.

The fact the indices could break out to test waters above last week's highs, suggests traders have not been convinced that they have had the all-clear just yet. Perhaps volatility will ease a little this week, but with earnings from tech giants to come in the next couple of weeks, on top of all the trade war saga, anything is possible. Traders must remain nimble.

It is all about the 5380 level now on the S&P 500. This is where it found resistance on Friday and now this level could turn into support. But if we break decisively below it again, then this could trigger a big of selling towards the next support at 5272.

However, the near-term trend has turned bullish following the big recovery last week. So, dip-buyers will be lurking. Let's see where we go from here.

In any case, more bullish price action is needed to completely nullify the bearish control. Specifically, the key resistance zone between 5490 to 5550 must give way before the bulls can be confident that we have see a major low last week.

By Fawad Razaqzada, market analyst with FOREX.com

SPX: Eye of The StormIn a hurricane the EYE of the storm is region of "calm" and even blue skies

To the unaware, the break in the clouds and the blues skies may bring a sense of relief that "the worst is over"

But the informed know that the OTHER SIDE of the storm is coming and the worst has yet to happen

IMO the aforementioned scenario accurately describes what we are about to see in markets

The Administration is slowly backing off the more severe of the tariffs

Over the weekend they removed tariffs on major electronics and associated components coming from China which should bring a sense of relief to markets

We will most likely see continued softening on the worst of the tariffs as the administration grapples with the true reality of things: MARKETS ARE IN TROUBLE

This softening will give the appearance that things will be OK and we may even see markets rally to new ALL TIME HIGHS

But a rally to new ATHs will be akin to the "eye of the storm" as just like with a Hurricane..the other side of the storm is coming

US500 (S&P 500) Sell Limit Trade IdeaBearish Daily Signals Align with Key Resistance Levels

📅 Published: 14/04/2025 14:22 | ⏳ Expires: 15/04/2025 12:00

Market Outlook

The US500 is showing signs of fatigue at higher levels. A Doji-style candle formed near the highs suggests indecision and potential reversal. Current levels are near the 50% Fibonacci pullback at 5485, an area that previously attracted selling pressure.

The 20-day EMA at 5466 and the pivotal level at 5501 reinforce this as a strong resistance zone. With no major economic events in the next 24 hours, technicals are likely to dominate near-term price action.

Trade Details

Entry (Sell Limit): 5459

Stop Loss: 5611 (-152 pts)

Take Profit: 5016 (+443 pts)

Risk/Reward Ratio: 2.91:1

Key Levels

Resistance:

R1: 5446

R2: 5501 (Pivotal Level)

R3: 5600

Support:

S1 : 5381

S2: 5280

S3: 5135

Technical & Sentiment Highlights

✅ Bearish Daily Signals – Doji candle and declining momentum suggest exhaustion at highs.

✅ EMA & Fibonacci Confluence – 5466 EMA + 5485 Fib zone aligning with resistance.

✅ High Reward Potential – Offers a strong 2.9:1 risk/reward ratio.

⚠️ No Major News Catalysts – Technicals expected to guide near-term direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SPX Fractal Expansion: New Highs Ahead Despite FearAs of April 14, 2025, the CBOE:SPX is exhibiting a clear fractal expansion, suggesting the beginning of a new bullish leg. The recent correction, which caused widespread panic, appears to have completed a fractal cycle reset, with price respecting historical support near 4704 and forming a new fractal edge around 5300.

Despite the fear-driven selloff, momentum indicators like RSI and MACD show signs of bottoming, and volume surged on rebound days, confirming strong institutional buying. The price is now testing temporary resistance at 5878, with a path open to reclaim all-time highs (6100+).

Global & Technical Tailwinds

Technical momentum is recovering across timeframes, with positive divergence on stochastic oscillators.

Breadth is improving: More stocks are participating in the rally, reflecting internal strength.

Sentiment has flipped: The VIX has cooled from panic levels (above 45), and investor fear is easing.

Macro support: Inflation is declining, and central banks are signaling potential rate cuts by late 2025.

Earnings outlook remains solid, and analysts forecast SPX to end 2025 around 6500–7100.

🔍Conclusion

The SPX is carving out a fractal mirror of past bullish reversals, reinforced by strong macro and technical context. Barring unexpected shocks, the index is likely to break above resistance and push toward new highs, even as residual fear lingers. The setup favors buying dips within this emerging structure.

S&P500 INTRADAY oversold bounce backMarkets Overview – Monday US Open

Trump Tariffs: Trump says tariffs on phones, computers, and other consumer tech are still on the table, calling the weekend exemption just a "procedural step."

Tech Rally: Despite that, tech stocks are up Apple and Nvidia leading on hopes the delay gives room for a better long-term trade deal.

Futures & Gold: US equity futures are pointing higher. Gold hit a new record as investors seek safe-haven assets.

FX Moves: The dollar is down for a fifth straight day, with the euro is surging, it is thefastest rally vs USD in 15 yearsas, traders eye a move toward $1.20.

Earnings Outlook:

Q1 earnings season kicks into gear this week.

Citigroup and Morgan Stanley lowered their S&P 500 earnings forecasts, citing tariff concerns and broader economic headwinds.

Key Support and Resistance Levels

Resistance Level 1: 5509

Resistance Level 2: 5660

Resistance Level 3: 5787

Support Level 1: 5110

Support Level 2: 4947

Support Level 3: 4816

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

The Art of Doing Nothing: Why Tape Watchers Beat Impulse TradersLess is more. In this Idea we dig into the trading philosophy where less action means more traction. It’s the dispute between the chart readers and the button clickers.

Some swear by this: the smartest trading strategy sometimes involves sitting on your hands and embracing the sweet, underrated beauty of doing absolutely nothing. The Italians figured this out ages ago—they call it Dolce Far Niente , the sweetness of doing nothing.

But can a trader really get away with just kicking back and waiting while sipping espresso (or the mezcal martini type if you got your Patagonia vest)? Actually, yes—and it often pays better than impulsive clicks.

Let’s talk about why chart-watching and tape-reading often outsmart trigger-happy trading.

🤷♂️ Doing Nothing Is Harder Than It Looks

First off, let’s acknowledge something painfully true: not trading is tough. Seriously tough. Trading never sleeps, notifications flash at you like slot machines. Headlines constantly scream about massive opportunities you're missing — Tesla's NASDAQ:TSLA latest rally or gold’s OANDA:XAUUSD record-breaking surge powered by tariff jitters.

The pressure to click, buy, sell, or do something—anything!—can be overwhelming. It’s why there’s something called a heatmap — because it’s hot, hot, hot!

But here’s the secret: successful traders know that impulse trading isn't a strategy; it's just financial caffeine. Instead, chart watchers—the cool-headed crowd who sit back, patiently observing price movements, market structure, and volume flow—tend to win the marathon, while impulse traders burn out in the sprint.

🌸 The Dolce Far Niente Method

Ever watched an old Italian movie? There's usually a scene featuring someone lounging effortlessly, soaking in life’s beauty without lifting a finger—this is Dolce Far Niente.

In trading terms, it’s the act of patiently waiting, savoring the calm between trades, watching your charts like an old-school tape reader that would make Jesse Livermore proud. (“A prudent speculator never argues with the tape. Markets are never wrong, opinions often are.”)

A good setup is worth the wait. Instead of diving into trades, relax, observe, and let opportunities come to you. Because the reality is, not every candlestick needs your immediate response. Markets don’t reward hyperactivity; they reward patience and calculated action.

🤩 Tape Reading vs. Trading: The Difference Between Winning and Clicking

The lost art of tape reading, as hedge fund guru Paul Tudor Jones calls it, is about carefully tracking price action, volume, and market sentiment. It’s far less exciting than rapid-fire day trading but potentially more rewarding.

“When it comes to trading macro,” Tudor Jones says, “you cannot rely solely on fundamentals; you have to be a tape reader, which is something of a lost art form.

Learning when to sit quietly (doing nothing) and when to strike decisively is the hallmark of trading mastery.

✋ Real Traders Don’t Chase—They Anticipate

Waiting isn’t passive. It’s actually active restraint—a calculated choice to do nothing until the odds tip decidedly in your favor. Let’s be clear: chart watchers aren’t asleep at the wheel; they're carefully steering clear of trouble until clear setups emerge.

The result? Better entry points, clearer risk-reward ratios, and fewer sleepless nights worrying about impulsive mistakes.

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!,’ ignore them.” Bonus points if you know who said that!

So, next time your finger hovers over that "buy" or "sell" button, ask yourself if you’re trading strategically or just for the dopamine hit. Remember the Italian saying, take a breath, embrace the tranquility, and let patience become your trading superpower.

Let us know in the comments: Are you team “click less, wait more,” or do you find yourself riding the impulse wave fairly frequently?

Tariff Exemptions Stir the Bounce | SPX Analysis 14 April 2025It’s Monday… and the markets are once again dancing like a puppet on a tweet-fuelled string.

One minute, tariff fears.

The next, selective exemptions for “favourites.”

Now the weekend’s over and futures are bouncing higher like none of it happened.

SPX looks set to test – or break – the 5400 bull trigger, and if you’ve been following the last few newsletters, you’ll know that’s a big one.

We’ve mapped it.

We’ve rejected it.

Now we’re staring it down… again.

---

The 5400 Line Returns

Let’s back up.

5400 has been my bull/bear trigger for weeks.

When we’re below it, I’m hunting bear swings.

Above? I start reassessing bullish setups, GEX bulls-eye trades, and pullback long entries.

This week, the GEX flip is also sitting around 5400.

That’s no coincidence.

It’s now more than just a price level –

It’s the emotional fault line between headline-driven panic and headline-driven hope.

So… do we flip bullish?

Not so fast.

Strategy: Structure First, Narrative Second

Just because futures are up doesn’t mean momentum is back.

We’ve seen far too many fakeouts, tweet-spikes, and algorithm blinks to trust the first move on a Monday.

That’s why my plan is simple this week:

✔️ 5400 is still the decision line

✔️ No aggressive trades until price confirms

✔️ Will adapt only if structure shifts – not just sentiment

This week isn’t about swinging for the fences.

It’s about precision. Patience. And setup clarity.

Behind the Charts: Tinkering, Rebuilding, Refining

While the markets work out their next identity crisis, I’m taking the time to:

Optimise my new charting layout

Tweak + update my indicator codebases

Re-align my tools for speed and efficiency

Because if the market wants to act like a circus,

I’ll tighten the tent and sharpen the knives.

---

Expert Insight – Don’t Rush the Flip

Common mistake:

Flipping long just because futures are green.

Fix:

Use anchored levels like 5400 as your decision points – and only flip bias when structure confirms.

GEX flips, pulse bars, and price action matter.

Tweets do not.

---

Fun Fact

Did you know?

In 2023–2024, over 60% of intraday SPX rallies over 1.5% failed to hold past 2 days when triggered by political headlines.

Translation?

Headline rallies are easy to sell into – unless they’re confirmed by price.

US500 Bullish Momentum Boosted by Tariff ExemptionsUS500 Bullish Momentum Boosted by Tariff Exemptions

The US500 index may continue its upward trend after President Trump announced exemptions for smartphones, computers, and other tech products from new tariffs.

This decision eased market concerns, especially for companies like Apple, which rely heavily on manufacturing in China.

Trump had previously imposed steep tariffs on Chinese imports, but the exemptions now include semiconductors, solar cells, TV displays, and data storage devices. These changes could support further bullish movement in the market.

You may watch the analysis for further details!

Thank you!

SPX sharp moves begin arround monthly option expiryWatch out for the this weeks options expiry on Thursday (Friday being holiday)

During volatile time option expiry does produce sharp moves. They are not that significant during normal markets. Also key levels approaching. Monday after Easter, I am expecting the new move to happen. Breakdown or breakout.

I am sure the big boys are aware from the social media that everyone is expecting a reversal and they will set up a trap. They will make us thing we are wrong create a FOMO to the upside and then sell

A volume drop could indicate a big move

S&P 500 on the Verge of a Death Cross!The S&P 500 (SPX) could soon have a cross of the 50 – day Simple Moving Average (SMA) below the 200 – day SMA. This is called a Death Cross and is usually the prelude to more decline.

In this case after the crossing the SPX could drop to 4,500 in a few trading days.

$SPX: Rising WedgeSPX looking a bit tight, possibly a rising wedge?

Tariff news has been such a wash up. Tariffs on/Tariffs off. A lot of moving pieces and indecision. If the news is false regarding electronics not included, then markets can possibly take a downturn.

Green ray is my entry, I’m looking for a short. But tbh, any one word “positive” said can move things up and fill the gap above.

I’m going to bias short. Let’s see what the week brings.

SP:SPX AMEX:SPY NASDAQ:TSLA NASDAQ:NVDA

S&P500 INDEX (#US500): Intraday Bullish ConfirmationAfter a breakout of a key horizontal resistance,

📈US50P retested this level and then formed an ascending triangle pattern on a 4-hour time frame.

A bullish breach of the triangle's neckline is a key confirmation of buyer strength and suggests potential for a price increase to at least 5,500.

Market Outlook of S&P 500 This is a S&P 500 Weekly Chart and it’s on a perfect uptrend since the covid bottom, and on a shorter time frame, it has also broken the time frame. It has also touch the 2022 support which is around 4800.

I expect it to retest the recent bottom and maybe even a lower low, I think it can make a fib extension and retest 4250-4300.

SPX: the absurdity of tariffsTariffs-narrative continues to shape the sentiment of investors on the US equity markets. The high volatility continues to be the predominant way of price movements, ranging from deep pessimism to higher optimism. The reality is that no one is sure what to trade and in which direction. Markets are extremely unhappy in times of high uncertainty, like the tariff-time currently is. Another week with extreme moves is behind the market. The S&P 500 reached the lowest weekly level at 4.840, but soon realized that this might be too low for current conditions of the US economy. Then the news hit the market that US tariffs will be delayed for the majority of countries for up to 90 days, and the market suddenly entered into an optimistic mood, reaching the highest weekly level at 5.480. This occurred at Wednesday's trading session, where S&P 500 gained around 10% within one day. For the S&P 500 this could be treated as highly extreme movement, but it shows how much nervousness is within investors at this moment.

One of few reactions on the extreme volatility of US equity markets came from Susan Collins, head of the Boston Fed, who noted that “markets are continuing to function well” and that the Fed would be prepared to address chaotic conditions on the market, if needed. However, there is no indication that the Fed will react at this moment, and whether current developments will have any effect on their decision on rate cuts during the course of this year. The next FOMC meeting is scheduled for May 6-7th.

At this moment, the long term investors should not be worried, as this absurdity will come to pass one day, and US equities will continue to follow the growth of the US economy. Short term investors and traders will find this period of time as highly challenging. This sentiment will, unfortunately, continue for some time in the future, until the final tariffs-deal is set or dismissed.

SPX Elliott Wave Count AnalysisJust dropping a multi-timeframe breakdown of my current EW thesis for SPX, starting from the macro and drilling down to now.

Big Picture (3M View):

We’re still grinding through Grand Super Cycle Wave 3 (GSCW3) that I have starting in the 1932 low till now.

Scoped in look at Super Cycle W4(SCW4)

Super Cycle Wave 4 (SCW4) wrapped up around the ‘08-‘09 housing crash lows. Since then, we’ve been in SCW5, and based on current structure, I believe we’re still early or mid-stage, not near the end.

Zoom-In: SCW5 to Present (Cycle Degree Breakdown):

From the 2009 lows, price action carved out a textbook impulsive structure into what I’m labeling as Cycle Wave 1 (CW1), which likely topped out ~Dec 2024.

The correction that followed has the characteristics of an Expanded Flat:

A-B-C structure where Wave C just completed around April 7th.

This structure, in my view, forms Wave W of a potential WXY complex for CW2.

Now we’re either in:

The early stages of Wave X, targeting the 0.618 retracement zone of W (marked on the chart),

Or, X has already completed in a shorter move.

Alt (Low-Probability) Scenario:

There’s a slim case that the ABC (now W) correction was all of CW2 — given how it wicked into a deep, low-probability Fib zone (gray box).

If we get a clear impulsive move above that 0.618 area, I’ll pay closer attention to this alt — but for now, I’m leaning toward more downside after this X-wave finishes (if it hasn't already).

EW interpretations evolve, but this is my current working roadmap

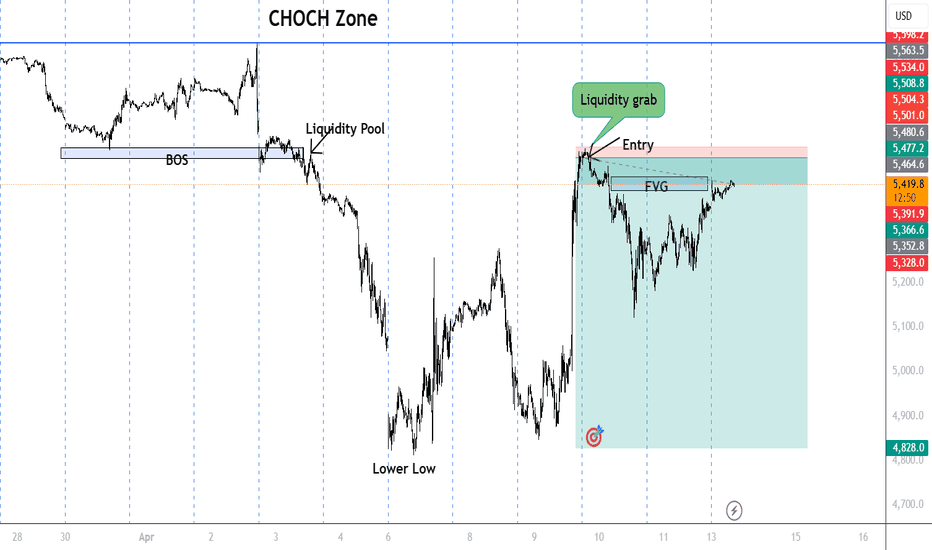

One more wave down for SPX500USDHi traders,

SPX500USD went straight into the target last week. From there it rejected and made a bigger correction (orange) wave X (updated wavecount).

Next week we could see the last impulse wave down to finish the bigger (red) WXY correction.

Let's see what the market does and react.

Trade idea: Wait for a change in orderflow to bearish and a small correction up on a lower timeframe to trade shorts.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Is SP500 / US M2 Money Supply telling us a story?Historically this ratio has inflected from key levels. Last week the upper boundary of what 8 would call a normal range has acted as support. If history rhymes to dot com bubble, this AI bubble can bounce from these levels and see an increase until Q4 2026, then a sharp fall will follow. To the lower boundary of that normal range.