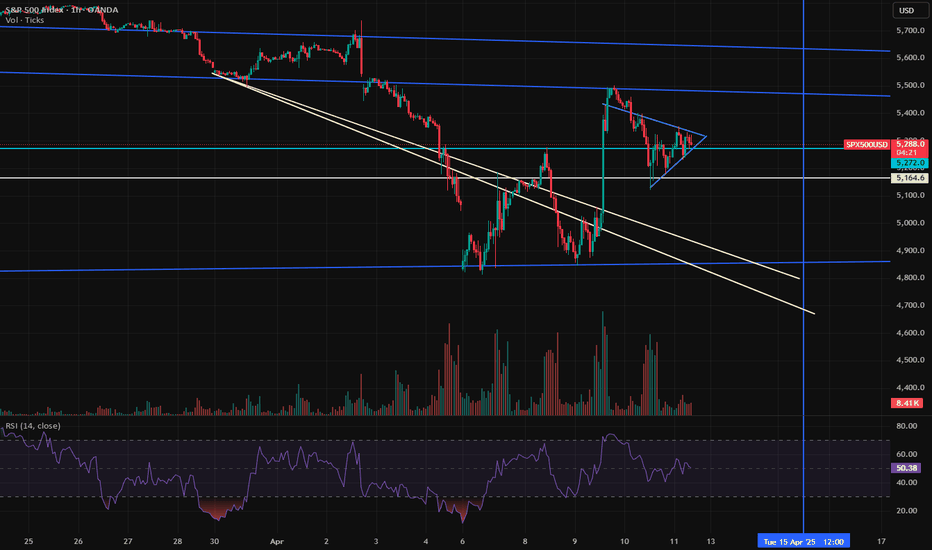

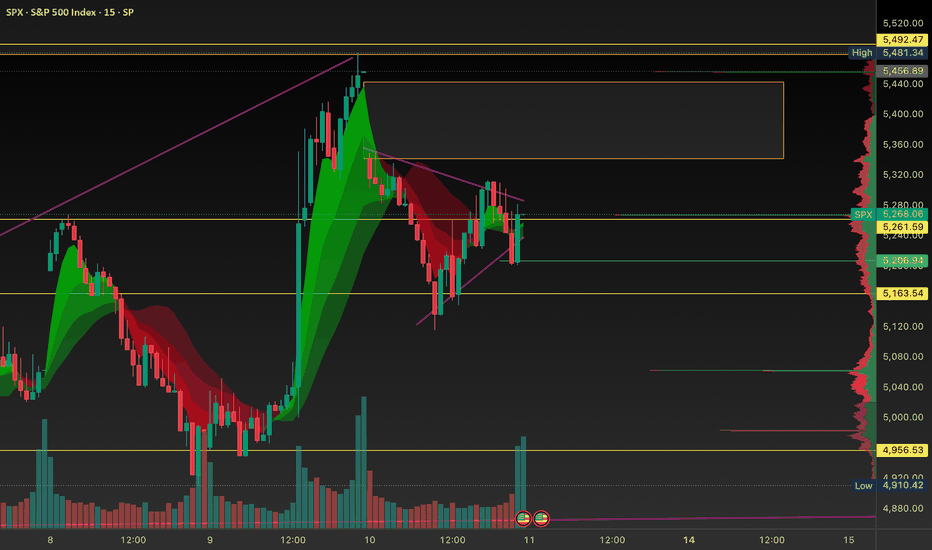

SPX 500 >>> Trade Idea FOR CALL FRAME 75

If price reaches $5,300 after a clear rejection from the current level, consider a long position with a stop loss at $5,250 (below the identified order block). Take Profit at $5,500 (previous high level). This setup aims to capture a mean reversion move following the liquidity sweep.

SPCUSD trade ideas

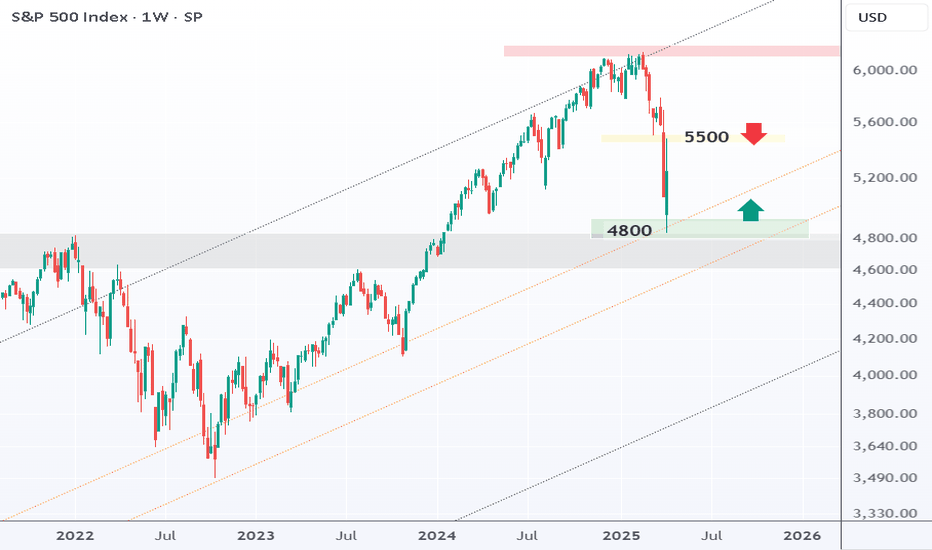

Long Term TrendlineA long term trend line on the SPX

Great place to buy if you are speculative of the current price movement

Price from this line will most likely move up

If not up from this trend line, very bearish.

Great time within a bear market to buy oversold stock regardless. Just have to HODL.

If bearish HODL .

S&P 500 Daily Chart Analysis For Week of April 11, 2025Technical Analysis and Outlook:

During the current trading session, the Index has recorded lower opening prices, thereby completing our key Outer Index Dip levels at 5026 and 4893, as previously highlighted in last week's Daily Chart analysis. This development establishes a foundation for a continuous upward trend, targeting the Outer Index Rally at 5550, with an interim resistance identified at 5455. Should this upward momentum persist, further extension may reach the subsequent resistance levels of 5672 and 5778, respectively. However, it is essential to note that a downward momentum may occur at the very significant completion target level of the Outer Index Rally at 5550, with the primary objective being a Mean Sup 5140 and retest of the completed Outer Index Dip at 4890.

Yes i predicted the stock market crashnot many people can say they predicted the stock market crash, no one believed me but you can see in my previous ideas i saw it over 6 months in advance, though i wished it crashed a whole lot more, i do believe it has bottomed out and is a great long term buying opportunity.

S&P500 Still a Short: Be mindful of Alternate CountI discuss how the additional wave up could have a larger implication on the entire outlook of S&P500 and could cause a re-labelling of the entire wave structure. What we want to see in order to keep our primary count, is a breakdown below the low of where I plotted wave 1 of C. That is, below 5119.8.

But no matter the primary count or the alternate count, it is still a short opportunity. But there is an implication on the Take Profit target.

TP 3300 Long term projectionsS&P we have seen the blow off TOP this early beginning of bearish trend , sell will continue almost 15 months set your target 🎯 3300 get this trend profit taking

as mentioned below

TP1. 5100

TP2. 46500

TP3. 3900

TP4. 3300

Long term projections those who invest sell side for longer term

Trump Tariffs - Trade War - High Volatility - Key LevelsEasy trading for 2025, right? Haha

We are seeing some of the wildest swings ever in the markets

Extreme intraday swings and volatility is getting everybody's attention

This video discusses all key levels and current seasonality

Hoping for the best and preparing for the worst

"SPX500/US500" Index Market Money Heist Plan (Day / Scalping)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SPX500/US500" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Blue MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (5100) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"SPX500/US500" Index Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets & Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

We are not in a bear marketIt´s amazing how social media is trying to provoke fear. We are not in a bear market. Even if there has been a more than a 20% drop. This is only an idea of a person: Donald Trump. Everything has been orquested by him and his team.

The real bear market will trigger when the 50MMA is broken down or the 200WMA. Until then, be ready for a blow off top to 7000 in the next 12 months.

Trading with Liquidity Sentiment IndicatorsJust a short introduction to trading with our indicators. I can't emphasise enough that you need to have at least 6 securities/tickers to click through to find the liquidity that fits the price action. At different times of day, different tickers are used by market makers to lay off deltas for hedging, this makes up the largest volumes in the markets, as well as the securities/tickers that you and others are trading. All these securities prices are moved around by the index they are a component of and the VIX which is made up of 30 day(dte) put IV. I will post more regularly this week reading live trading using the indicators.

Some say bitcoin is an un-correlated asset. What about XRP ???This chart clearly shows how XRP is uncorrelated to the price of the S&P !!

Some experts in crypto say that Bitcoin is an un-correlated asset. However, if bitcoin is, XRP is even more so.

The chart moreover shows how the price of XRP broke out of an 7 YEAR BEAR FLAG !!!

It broke down decisevely in november 2024.

At the present moment it is making a halt, drawing a bear flag (n° 2) as it did after it broke down of a very similar bear flag in March of 2017 (n° 1).

How do you think this will resolve ?

Any more questions ?

This is a very bearish chart - for the SPX !!!

$S&P500 macro analysis , market approaching correction °•° $SPXHi 👋🏻 check out my previous analysis ⏰ on SP:SPX macro bullish analysis ⏰

As provided it went up up 🚀 completed my target's 🎯 💯💪🏻 ✅ ✔️

Click on it 👆🏻 just check out each and every time updates ☝🏻 ☺️

•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

NOW I was completely 🐻 BEARISH on the market with in upcoming months SP:SPX

📌 Expecting liquidation pump $6500 - $6700

Invalid 🛑 when complete month close above $6700

¹support - $5500 ( 🎯 ¹ )

²support - $5130 ( 🎯 ² )

🎯 3 ... Will be updated based on market conditions by that time ☺️

📍 A wise 🦉 man said - always having patience " is " always gaining only /-

NASDAQ:TSLA ( i accumulate slowly until it cross above $400 )

rest of stocks i will follow index ☝🏻 i will invest based on market conditions ..... ✔️

VIX Hits 27-Year Extreme. Is the Market About to CRASH or SOAR?The Volatility Index (VIX displayed by the blue trend-line) has entered a level that has visited only another 5 times in the last 27 years (since August 1998)! That is what we've called the 'VIX Max Panic Resistance Zone'. As the name suggests that indicates ultimate panic for the stock markets, which was fueled by massive sell-offs, leading to extreme volatility and uncertainty.

So the obvious question arises: 'Is this Good or Bad for the market??'

The answer is pretty clear if you look at the chart objectively and with a clear perspective. In 4 out of those 5 times, the S&P500 (SPX) bottomed exactly on the month of the VIX Max Panic signal. It was only during the 2008 U.S. Housing Crisis that VIX hit the Max Panic Zone in October 2008 but bottomed 5 months late in March 2009.

As a result, this is historically a very strong opportunity for a multi-year buy position. If anything, today's VIX situation looks more similar to September 2011 or even the bottom of the previous U.S. - China Trade war in March 2020.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Just Let Me Cash Out Before the Weekend | SPX Analysis 11 April Let’s be honest…

This week has been ridiculous.

The market pumped harder than a spin class on espresso because of a rumour.

Then dumped.

Then teased a breakout.

Then decided against it mid-sentence.

It’s been a full-blown rollercoaster of overreactions, headline bait, and “wait, what did Trump say now?” moments.

But amidst the noise, the plan is still holding up.

5400?

Still resistance.

Still our pivot level.

Still doing its job.

---

👁️ Trader’s Eye View – Charting the Nonsense

Let’s recap what I’m seeing:

📉 Earlier this week, the 5400 bull trigger got pierced by an emotional market surge.

But there was no confirmation, no sustained breakout – and we’ve reversed since then.

Now?

We’re seeing the start of a rising channel – but every turn seems to align with a tweet, a walk-back, or a reaction to misread data.

It’s like price is drawing patterns using the tip of a headline.

That’s not conviction.

That’s chaos dressed as structure.

🧭 What I’m Doing Now

📌 Still bearish below 5400

📌 Watching for a move to 5000 or the rising channel low

📌 Will use Tag ‘n Turn, Pulse Bars, and GEX flips for entries

The ideal scenario?

Let my bear swing cash out before the close, pour something brown into a glass, and avoid blood pressure spikes over the weekend.

That’s the play.

---

🎯 Expert Insight – When the Chart's Not Lying, But the Headlines Are

Mistake:

Assuming a spike equals a breakout. Trading on headline strength instead of chart strength.

Fix:

Let the level prove itself.

5400 is my line in the sand – not because I said so, but because price keeps reacting to it.

That’s structure. That’s what we trade.

---

Fun Fact

In 2020, the average headline-related spike in SPX lasted under 37 minutes before mean-reverting.

This week?

We saw multiple trillion-dollar reactions last less than half an hour.

It’s not a breakout if it’s a sugar rush.

SPX500 on the Brink: Unveiling the Critical 4800 Gann Pivot ThatThe chart is drawn inside a Gann Square from the 2020 low (March COVID bottom) to a projected 2030 high, mapping both time (X-axis) and price (Y-axis) in 1:1 ratio (Square of Time & Price).

The blue ascending diagonal (45° line) represents the ideal balance of time and price (1 point per unit of time). A break of this line is often seen as a major trend reversal signal.

Colored zones:

Green zone (top-right triangle): bullish expansion territory.

Yellow zone (center): consolidation/transition.

Red zone (bottom-right): bearish decline/major correction zone.

🟢 Bullish Continuation - Bounce from current level or 4800 support - Next Target 5,800–6,200 - maximum by 4 2025–Q2 2026. (Bounce from 0.5 level means trend is intact and accelerating into green zone)

🟡 Sideways/Neutral - Holds between 4800–5400 - TP could be 6,400 ±200 pts range Until ~March 2026 (0.618 time). This Indicates market is digesting gains; triangle pattern may form!!

🔴 Bearish Breakdown - Break and close below 4,800 - TP could be 4,100 (Fib 0.382) then 3,200 (Gann 0.25) Through 2026.Fall into red zone begins if 0.5 support fails — major cyclical top in place

Warning: what can save us from a collapse: must read.⚠️This analysis isn’t purely chart-based, but in this macro environment, understanding the bigger picture is essential for predicting market movements. Hopefully, TradingView will allow this idea so that everyone can read it.

What Can Save Us?

Before looking for a solution, we must first acknowledge the problem—and then determine if and when a resolution is coming.

1. Trump’s Tariffs & Policies: A Market Shock

Trump’s economic strategy marks a radical departure from the policies of the past 30 years. However, previous administrations weakened U.S. global influence, shifting power in favor of China.

Since Trump's motto is "Make America Great Again", serious changes are inevitable. Until investors fully grasp these policies, uncertainty will persist.

Let’s break down the key areas of impact and Trump’s expected responses:

2.Monetary Policy & The Federal Reserve

The Federal Reserve (FED) and Jerome Powell are not aligned with the White House.

Powell is sticking to his monetary policy approach, but Trump needs 0% interest rates to implement his vision.

Markets hate uncertainty, and this is fueling volatility.

🔴 Trump's Response:

Expect a bombshell move—Trump will fire Jerome Powell and replace him with a Fed chairman who supports rate cuts to 0%. This will cause short-term chaos but ultimately fuel a massive market rally as:

✔️ The housing market recovers

✔️ Liquidity surges

✔️ Stocks skyrocket

3.U.S. Dependence on China & Russia for Raw Materials

The U.S. imports essential resources from China and Russia, making it vulnerable.

The BRICS alliance is strengthening, further threatening U.S. dominance.

🔴 Trump's Response:

Trump has openly expressed interest in acquiring Greenland, citing its rich natural resources. He will take it by military force if necessary, positioning the U.S. as a raw material powerhouse on par with Russia.

4.Lost Allies: Canada, Mexico & South America

Canada is aligning with Europe

Mexico & South America are leaning towards BRICS

🔴 Trump's Response:

To counter this:

Canada will be pressured into rejoining a U.S.-led trade bloc—or face potential annexation.

South American economies will be crippled by tariffs, forcing them to reintegrate under U.S. influence.

5.Geopolitical Conflicts: Middle East & Ukraine

Iran is aligned with Russia & China

Ukraine relies on Europe (France, UK, EU), rather than the U.S.

The U.S. is not benefiting from these wars

🔴 Trump's Response:

If Zelensky continues to align with Europe, Trump may order a full-scale U.S. bombing of Ukraine, flatten Kyiv, eliminate Zelensky live on TikTok, and then split Ukraine with Russia.

This move would:

✔️ Strengthen U.S.-Russia relations

✔️ Secure a deal on Greenland

✔️ Humble Europe

6.Conclusion: A Global Power Shift

Expect a period of chaos and fear. However, what investors must understand is that Trump is 100% serious about these moves—and he will execute them regardless of global opinion.

If Trump’s strategy works:

✅ The U.S. will regain dominance

✅ Markets will rally hard

✅ Confidence in the U.S. economy will be restored

If Trump fails:

🚨 A prolonged economic downturn (15-20 years of stagflation)

🚨 U.S. & Europe suffer major losses

🚨 Best move? Relocate to Asia or the Middle East before the crash.

So, even if Trump’s policies seem insane, the best-case scenario is that he succeeds.

💡 DYOR (Do Your Own Research)

#Bitcoin #Crypto #Trump #MAGA #Geopolitics #StockMarket #SPX500 #Trading #Investing #Economy #FederalReserve #RateCuts

SPX: Roller Coaster Fest. Looking for a possible short?Not FA*

A lot of set ups looking like flags. Missed the move up but caught puts today for good profit. Or decent profit. I have yet to conquer on how NOT to sell too early? Anyone have any tips?

Set up I’m seeing right now (SPY/SPX): Looks to be flagging.

Green Ray for a short entry

Overall sentiment still feels very bearish. Trump seemed to postpone the tariffs to prevent this market from tanking into near *recession* touches but some say it was a manipulative swing?

So thinking we sell off Friday - as China tariff deal still yet to solidify. A lot of uncertainty overall.

Also on the 1M, the set up looks like a bear flag.

Let me know what you guys think and any insight is welcome! Still new to TA and really wanting to get better at understanding charts/levels. Goal is to be consistent in trading and profitable, very profitable.

GLHF