SPX500

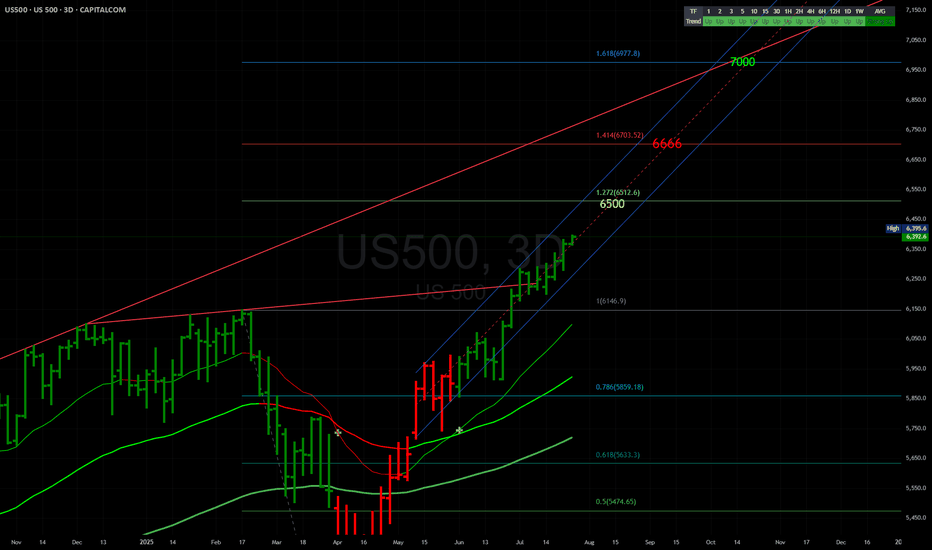

Based on the provided 4-hour chart of the S&P 500 Index (SPX500), here is a brief summary and outlook.

The SPX500 has been in a clear uptrend, as indicated by the trend channel and a series of higher highs and higher lows. The price is currently facing resistance near the 6,450 level, where a recent high was made before a pullback. The chart also highlights several key support zones, with the most immediate one being around the 6,290 level.

The chart illustrates a potential scenario where the price consolidates or pulls back from the current resistance. The orange arrow depicts a possible movement where the price could retrace towards the immediate support level around 6,290 before finding buyers. From this support, the expectation is for the uptrend to resume, with the price aiming to break through the resistance at 6,450. A successful breakout would open the path towards the upper boundary of the trend channel, with a target set around 6,600.

The key expectation is a continuation of the overall bullish trend after a potential short-term dip. Traders should look for the price to hold above the support at 6,290 for a long entry opportunity. A break below this support would be a bearish signal, but as long as the price stays within the trend channel, the overall bias remains bullish. The final target for this move is projected to be around the 6,600 level, which aligns with the trend channel's upper boundary.

SPIUSD trade ideas

S&P500 awaits US CPI data capped by 6437US equities were little changed Monday. Nvidia (-0.35%) and AMD (-0.28%) slipped after agreeing to pay 15% of Chinese AI chip sales revenue to the US government in exchange for export licenses — a deal Trump confirmed, adding he may allow a scaled-down Blackwell chip to be sold in China. The Philadelphia Semiconductor Index fell -0.13%, cushioned by Intel (+3.51%) after its CEO met with Trump. The Mag-7 (-0.09%) saw slight outperformance, led by Tesla (+2.85%).

Trump extended the US–China tariff truce by 90 days to November 10, keeping additional tariffs at 30%. China matched the extension.

The Fed chair search now includes vice chairs Bowman and Jefferson, plus Dallas Fed President Logan. Trump appointed EJ Antoni (Heritage Foundation) to lead the Bureau of Labor Statistics.

Markets await today’s US CPI, which could influence Fed rate-cut bets, while gold traders look for clarity after Trump said gold imports won’t be tariffed.

Key Support and Resistance Levels

Resistance Level 1: 6437

Resistance Level 2: 6480

Resistance Level 3: 6520

Support Level 1: 6340

Support Level 2: 6295

Support Level 3: 6256

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

S&P 500 Ascending Triangle Breakout SetupThe S&P 500 index is consolidating within an ascending triangle pattern, with strong support along the rising trendline. Price action suggests bullish momentum building towards a potential breakout above the resistance zone, targeting higher levels if confirmed

1. Previous Trend:

Strong bullish rally before the current consolidation phase, indicating momentum is on the buyers’ side.

2. Pattern Formation:

Horizontal resistance around 6,418–6,420 (marked by the grey line).

Rising support trendline connecting higher lows, showing buying pressure is increasing.

3. Volume (Not Shown Here):

If volume is decreasing inside the triangle and expected to spike on breakout, it supports a bullish case.

4. Breakout Expectation:

A confirmed close above 6,420 with strong volume could trigger a rally towards the next target zone of 6,470–6,500.

The arrow drawn on your chart aligns with this possible breakout scenario.

5. Invalidation Zone:

If price breaks below the rising trendline (~6,360), the bullish pattern would be invalidated, potentially pushing price back to 6,300–6,280.

USD cpi yr/yr forecast of 2.8 looks too high for tomorrowBased upon the price of oil, the recent trend of CPI readings, and the 10 yr avg of 2.68 USD cpi reading may come in as a market miss tomorrow. The expected 2.8 looks to high relative to the trend of readings and the price of oil. It might be fair to expect a range of 2.4 to 2.7.

Activation of the rounded pattern? Or a trend reversal?In the previous analysis, we mentioned that the price was at a decision point — and it made its decision, managing to move up slightly before returning to the bottom of the channel.

Now, at the end of the channel, a pattern has formed. We need to see whether it gets activated or turns out to be a fake.

If the pattern fails (turns out fake), the bullish trend could continue more strongly.

S&P 500 extends drop - can dip buyers come to rescue again?After a decent rally earlier in the day, the major indices and futures started to ease off around mid-morning London trade, before easing further lower in the last couple of hours.

At the time of writing, the S&P was testing its session lows. Here it was probing support and a short-term bullish trend line in the 6319-6331 range. This area needs to hold to keep the bulls happy and in charge. Break this and we could see a bigger correction in the days ahead.

Resistance now comes in at 6372 followed by 6,400.

By Fawad Razaqzada, markets analyst with FOREX>com

SPX: awaits inflation data Regardless of concerns regarding the future effects of implemented trade tariffs by the U.S. Administration, the positive sentiment continued to hold on the U.S. equity markets during the previous week. The S&P 500 closed the week at the level of 6.389, surging by 2,4% for the week. The index is slowly nearing its all time highest level, achieved on 31st July, at the level of 6.426.

Friday's rally was for one more time led by tech companies. Shares of Apple gained around 13% for the week, after the company announced its significant investments of $600B within the next four years in the U.S. Analysts are calling this deal as “appease” to the U.S. President, who on several occasions expressed his wish that IPhones are made in the U.S.A. As per comments made by Tim Cook, CEO of Apple, “the final assembly that you focus on, that will be elsewhere for a while”, meaning that the production of IPhones is still not going to be done in the U.S.A. Nevertheless, markets reacted positively to Cook's meeting with the U.S. President, especially taking into account a heavy burden of tariffs, which the U.S. President announced to be 100% on chip imports.

Considering current market sensitivity on inflation data, the week ahead might bring some major testing for the U.S. equity markets, as July inflation data are scheduled for a release. Analysts are noting that any surprises in the inflation figures might imply a correction in the value of US companies, especially after a significant surge during the last four months.

S&PS&P 500 waiting for overbought of 240 min. If it pass 6427 net resistance is about 6615. at this resistance there is a chance to drop 1 oversold of timeframe 240 min. however, it is on a long up trend, which the mid period target is 6952 (2-4 months). however, during this period it may go direcly to 6952 or down for 1 oversold of timeframe day or 240 min is OK. Note that the very importance supporting line,which should not be lower is at 4841. if it not fall below this point. S&P still on the uptrend.

SPX500 Technical Setup – Eyes on 6365 and 6399 TargetsSPX500 – Overview

The price has stabilized above the key pivot level at 6341, maintaining a bullish bias. As long as the price holds above this level, the upward momentum is expected to continue toward 6365 and potentially 6389 or 6399.

However, a 1H close below 6323 would signal a possible trend reversal, opening the door for a deeper correction toward 6283.

🔹 Pivot: 6341

🔹 Resistance: 6365, 6399, 6427

🔹 Support: 6323, 6283

Rob the Rally SPX500: Enter Before Resistance Catches You🦹♂️💎 “SPX500 Vault Breach – Layered Robbery in Progress!” 💼📈

(Thief Trader's Multi-Limit Entry Bullish Blueprint – No Mercy, Just Money)

📍Asset: SPX500 / US500

🎯Plan: Bullish Heist

🧠Style: Layered Limit Orders | Thief Strategy Entry | Zero Mercy Execution

📈Target: 6600.00

🛑Stop Loss: 6200.00

💣Entry: Any level — thieves adapt, not wait!

🌍 Welcome to the Global Robbery Room, Traders!

It’s your boy Thief Trader, back in the vault with another plan to crack the SPX500 like a safe on Wall Street. This one’s for the bold bulls who like to rob with precision, not permission. 🎯💰

💼 The Setup – High Stakes, High Floors

SPX500 is lining up for a classic breakout breach. This isn’t just technical — it’s tactical warfare. Market noise? Ignore it. We operate on strategy and steel nerves. 🧠🔫

🔥 Entry Protocol – Layer Up or Miss Out

🧱 Multiple limit orders across price zones — like planting C4 charges on every door.

🎯 Enter wherever price dips — don’t wait for permission from retail traders.

🎯 No fixed entry — this is Thief Layering: get in where you fit in.

🚪 Escape Plan – Stop Loss Strategy

📍 SL: 6200.00

Why? That’s where the guards start showing up. If price drops below, we vanish.

💡 Be flexible — smart robbers don’t get caught, they regroup.

💎 Target Loot – The Golden Zone

📍 Primary TP: 6600.00

Once we breach the 6500+ resistance, it's a moonwalk. Lock gains or trail with confidence.

📢 Warning for Scalpers & Swing Thieves Alike:

Only play Long-side. Don’t try to rob both ends — that’s suicide.

Big wallet? Scale heavy. Small bag? Layer light but tight.

Always use trailing stops — never trust the market with your escape bag. 🎒💸

📊 Thief Intel – Why We’re Bullish

✅ Index rotation favors large-cap strength

✅ Macro sentiment + institutional bias points UP

✅ No bearish COT signals in sight

✅ Fed tone & economic backdrop: neutral to supportive

This isn’t hopium. It’s strategy.

🚨 NEWS FLASH – Stay Stealthy!

Do NOT enter during economic bombs 💣 (NFP, CPI, Fed minutes, etc.)

Market noise kills precision. We only move in silence and with SLs trailing tight.

💬 Smash that BOOST 💖 if you’re riding with the Thief Army.

Share this plan, spread the word, and let’s rob the markets the smart way.

📢 Tag your crew, stack your layers, and let’s hit 6600 like pros.

📌Disclaimer: Not financial advice — this is a market operation plan for educational use. Trade at your own risk. Smart thieves plan exits before entries. 💼📉📈

🦹♂️ Thief Trader out.

💸 Rob smart. Rob clean. Rob global.

SPX500 Dips Ahead of NFP as Tariff Risks RiseSPX: S&P 500 Dips to Close July — Still Positive for the Month Amid Tariff Tensions & Fed Uncertainty

The S&P 500 retreated in the final session of July, weighed down by renewed tariff concerns and lingering uncertainty around the Fed’s next move. Despite the late pullback, the index remains positive for the month overall.

Looking ahead, non-farm payrolls (NFP) and U.S. jobs data are expected to have a strong impact on market direction. In addition, August 1st marks a key date for potential tariff developments, which could trigger further volatility.

Technical Outlook – SPX500

The index has dropped approximately 2.5% since yesterday and maintains a bearish bias as long as it trades below 6283. If the price continues to slide, the next downside target is 6246, with further support at 6223.

However, if the price manages to close above 6289 on the 1H timeframe, it could trigger a bullish recovery toward 6320 and 6341.

Pivot Line: 6283

Support Levels: 6246 • 6223

Resistance Levels: 6320 • 6341

The worst drops often come later!Don’t be fooled by the first crash… The worst drops often come later in a bear market.

Let’s break down the brutal truth about the 2008 GFC and what it teaches us today. 🧵

1.

In the 2007–2009 bear market, the S&P 500 had 7 failed rallies before finally bottoming.

Every bounce looked like the bottom — and every one was a trap.

👇

2.

The early drops were steep:

🔻 Down 11%

🔻 Down 17%

But the most violent crashes came after those…

Near the END — not the beginning — of the bear market.

3.

Later stage declines:

❌ Down 28%

❌ Down 36%

❌ Down 29%

That’s when capitulation kicked in.

Investors gave up. Fear took over.

4.

Capitulation volume isn’t a guaranteed bottom.

It feels like it’s over.

But if fundamentals haven’t turned and the trend isn’t broken, the bear can still bite — hard.

5.

Final crashes are like cliffs:

Markets are exhausted.

Hope is crushed.

And that’s finally when the real bottom shows up.

6.

The lesson?

Bear markets are full of traps.

Relief rallies can fool even seasoned pros.

Stay patient. Wait for trend confirmation. Don’t chase fake bottoms.

7.

📉 The biggest crashes usually happen at the end of the bear market.

That’s the final flush — and it sets the stage for true opportunity.

Learn from the past. Don’t get trapped. Stay sharp.

S&P Market Update – Signs of a Short-Term Correction?Although the S&P remains in an uptrend, recent price action suggests that momentum may be fading.

📉 Key Observations:

A Key Day Reversal occurred at 6409 – a potential warning signal.

We're seeing RSI divergence: price made a new high, but RSI didn’t follow suit.

The market is grinding higher, but without conviction.

📊 What to Watch:

The 15-day EMA, currently at 6317, is acting as near-term support. A close below this level could trigger a short-term correction.

Initial downside targets: 6147–6100, the previous highs from late 2024 and early 2025.

✅ To negate this bearish bias, the market would need to break above 6409 and continue higher with stronger momentum.

Stay alert — the technicals are flashing red flags. Always manage risk accordingly.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

SP500 H4 analysis Breakdown TrendlineChart Components Observed:

Ichimoku Cloud: For trend and support/resistance visualization.

Uptrend line (manually drawn): Connecting higher lows since early May 2025.

Support break: Price has recently broken below the trendline and below the Ichimoku cloud.

Current Price: 6,237.15 (▼ -1.64%)

---

📉 Analysis Summary:

The trendline and Ichimoku cloud were acting as major dynamic support.

A bearish breakdown has occurred — price closed below the trendline and the cloud.

This suggests a potential trend reversal or correction underway.

---

🎯 Trade Setup Suggestion (Short Entry)

🟢 Entry Target (Short Position):

Sell Entry: Around 6,237 – 6,245 (current zone or slight pullback)

If price retests the underside of the broken trendline/cloud, that's a better entry confirmation.

📉 Take Profit Levels:

1. TP1: 6,130 (recent consolidation zone)

2. TP2: 6,000 (psychological + historical support)

3. TP3: 5,880 (next major support based on previous consolidation in early June)

🛡 Stop Loss:

SL: 6,300 – 6,310 (above the cloud and broken trendline for safe buffer)

---

📊 Risk Management:

Position size should be based on your account size, using 1–2% risk per trade.

Watch the S&P futures and macro news (e.g., U.S. data, Fed news) to avoid whipsaw.

The $CURE For Your Healthcare PortfolioHey team,

Everyone knows how the health sector is beat up.

The Trump administration hasn't shown any mercy to the health and pharma sectors. They’ve been hammering Big Pharma with a mix of fiery rhetoric and aggressive policy moves. Trump has brought back his “most favored nation” drug pricing plan, tying Medicare reimbursements to what other countries pay, slashing profits for drugmakers who’ve been charging Americans a fortune.

As a result, some of the top health stocks such as NYSE:PFE , NYSE:LLY , NYSE:JNJ , and NYSE:UNH , among many others, have been suffering.

We need, however, to understand that healthcare is sometimes cyclical, and there are some clues that tell us what's likely to happen next:

For most years, AMEX:XLV (health index ETF) is highly correlated with the $SP:SPX. Historically, when this correlation breaks, it's either because healthcare is lagging behind the S&P 500, or because the S&P 500 is crashing, and healthcare is holding well because healthcare is recession-resistant. Typically, these moments of uncorrelation are followed by a very well-performing healthcare sector.

AMEX:XLV / SP:SPX is now at a 25-year low! Healthcare stocks have never been so low in 25 years compared to the benchmark.

While the S&P P/E ratio is at 28, healthcare is at 14. This shows a potentially underdeveloped sector.

The spread between healthcare and the rest of the stock market is very large and unnatural. Considering this, it's more likely that it will regress to its mean and recover. You can see this in the Dual Z-Score indicator in the chart.

Additionally, the US midterms are coming, which can bring policy changes that might favor healthcare again.

Now, you might be wondering: Why invest in AMEX:CURE and not in AMEX:XLV ?

I plan to allocate around 2% of my portfolio to CURE, the 3x leveraged ETF, because it's an easier way to achieve the proper Kelly allocation to this sector, a sector that I believe will recover over the next couple of years. The leverage provided by this ETF will help compound returns.

Is this strategy risky?

Well, CURE is 3x more volatile than XLV, but this is the way I see it: healthcare is already too beat up to continue declining sharply from here. Additionally, healthcare is recession-resistant, meaning that it should not be too affected if the US economy suffers, enters a recession, or if unemployment numbers increase.

I think CURE gives me a potentially good risk/reward ratio, considering that if healthcare catches up with the S&P 500, CURE could return approximately (and very roughly) 100%.

Quick note: I'm just sharing my journey - not financial advice! 😊

SPX 1W – Long-Term Breakout Holding, Can the Rally Sustain?The S&P 500 just printed a weekly breakout above historical highs, tapping into uncharted territory above 6,300 — but now the question is whether the trend can sustain or if a deeper retest is on the horizon.

🔹 Macro Structure

Multiple clean support levels exist below, each marking prior macro pivots — from the 2020 breakout to the 2022 base.

The most immediate zone of interest is 6,100–6,200, which could act as a bullish retest zone if this breakout is valid.

Deeper downside remains structurally healthy unless 4,250 or below is breached.

🔹 Trend Health

Price remains well above the EMA 50 and 100, showing no signs of structural weakness.

Pullbacks into the EMAs historically triggered trend continuation — and bulls will likely treat those zones as reload points.

🔹 Big Picture

As long as SPX holds above 5,400, the macro bull trend remains intact.

A drop to retest lower zones wouldn’t necessarily break the uptrend — but it would shake sentiment and invite reaccumulation.

Is this the beginning of a new macro leg — or the last shake before a deeper correction?

Let’s chart it out 👇