SPOTBRENT trade ideas

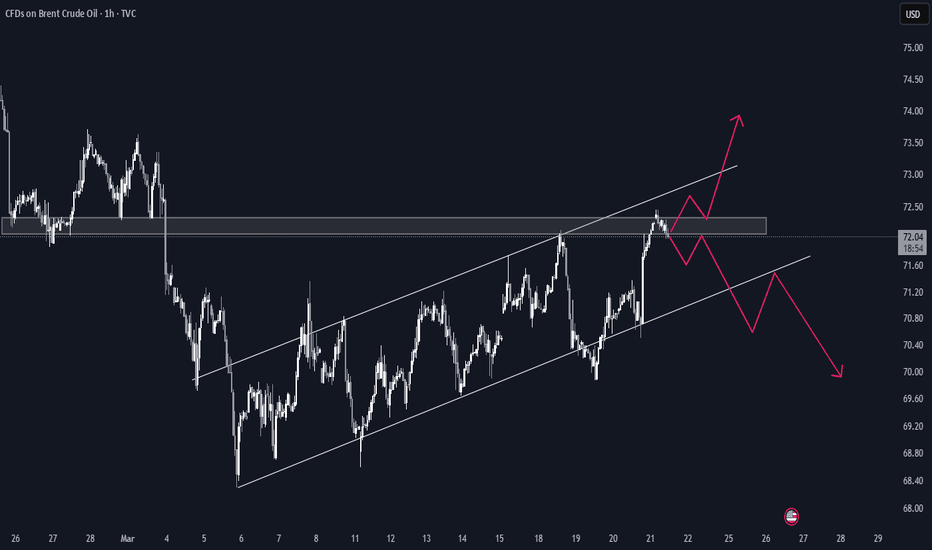

Potential short in OilOil is declining from the 50-day moving average, and on higher timeframes, the price remains in a downtrend.

A short trade could be considered, with the first target at 70.50 and the next at 68.00 .

Stop-loss at 73.50 .

For several reasons, I’m not a fan of short positions and prefer to trade short setups intraday without holding them overnight. Because of this, the trade is suboptimal for me. However, if shorts fit well into your trading system, this could be a good opportunity to capture the move.

Is there more room for OIL to the upside??? BUY BRENT (OIL)All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

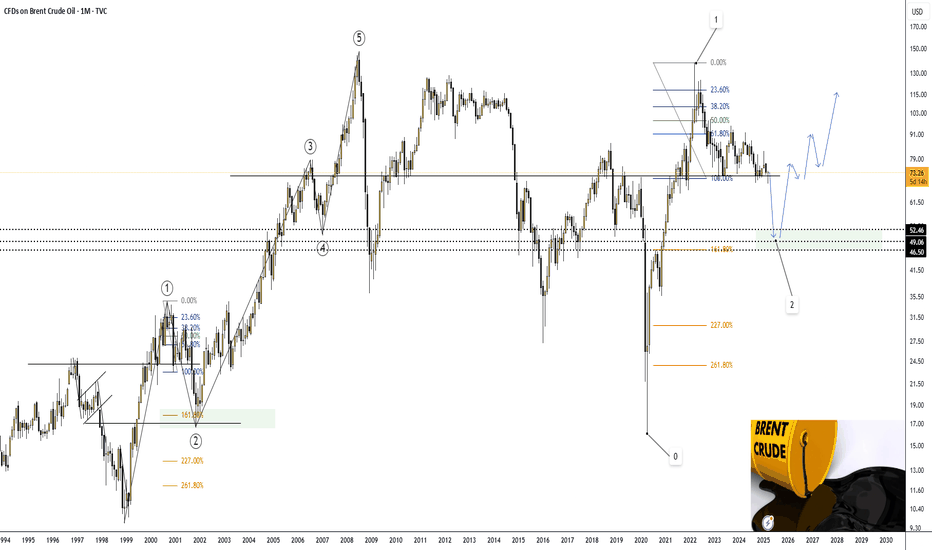

A major correction in Brent crude oil (UKOIL).A major correction in Brent crude oil (UKOIL).

- This idea is invalidated if the price exceeds $73.755.

On the monthly chart, it shows that we are forming a 50% Fibonacci correction from wave 1, from where we will further expect growth toward the $115 area, and possibly even a new all-time high due to a military conflict in the Middle East.

I’ve marked potential downside targets on the chart at $46.50, $49.06, and $52.46, from where we will look for entry points for long positions lasting 2 years or more.

Brent Crude INTRADAY oversold bounce back The Brent Crude Oil price action remains bearish, in line with the prevailing downtrend. The recent move suggests an oversold bounce, but overall sentiment remains weak unless a significant breakout occurs.

Key Levels to Watch:

Resistance Levels: 74.25 (critical level), 74.90, 75.90

Support Levels: 71.70, 70.70, 69.13

Bearish Scenario:

A rejection from the 74.25 resistance level could confirm the bearish outlook, leading to further downside movement toward 71.70, with extended losses targeting 70.70 and 69.13 in the longer timeframe.

Bullish Scenario:

A breakout above 74.25 with a daily close above this level would challenge the bearish sentiment, opening the door for further gains toward 74.90, followed by 75.90.

Conclusion:

The market sentiment remains bearish, with the 74.25 level acting as a key resistance zone. A rejection from this level could reinforce the downside trend, while a confirmed breakout would shift the outlook to bullish, favoring further upside. Traders should closely monitor price action at this critical level for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Institutional Supply: OIL shortsHey,

Many good things happening in the markets, been a while that I updated though.

Everything I watch and trade is of course posted in my community.

But let's get back to it.

UKOIL is in supply and ready to roll, but USOIL supply is slightly higher, so price might want to wait a little bit before both are ready.

I love it when they move in sync and both are at value.

Studying correlation and different pov's is always good.

Regards,

Max

Brent crude oil Wave Analysis – 24 March 2025

- Brent crude oil broke resistance zone

- Likely to rise to the resistance level 73.60

Brent crude oil recently broke the resistance zone between the resistance level 71.30 (top of wave A), resistance trendline of the daily down channel in January and the 38.2% Fibonacci correction of the downward impulse from February.

The breakout of this resistance zone accelerated the C-wave of the active intermediate ABC correction (2) from the start of March.

Brent crude oil can be expected to rise to the next resistance level 73.60 (top of the previous minor correction 4 from the end of February).

XBR/USD Analysis: Price Near Resistance ZoneXBR/USD Analysis: Price Near Resistance Zone

As seen on the XBR/USD chart, Brent crude oil prices are hovering near last week’s highs this morning as market participants assess various influencing factors, including:

→ New U.S. sanctions on Iran, which are limiting its export capacity and tightening global supply, particularly to China.

→ Ongoing negotiations between the U.S., Ukraine, and Russia in Saudi Arabia, which could potentially lead to increased Russian oil exports.

→ OPEC+ plans to raise oil production starting in April.

Technical Analysis of XBR/USD

From a technical perspective, Brent crude oil is trading near a key resistance zone, which consists of:

→ A bearish Fair Value Gap (highlighted in purple).

→ The upper boundary of the descending channel.

→ The upper boundary of a narrowing triangle (shown in black), which can be interpreted as a Rising Wedge pattern.

The Rising Wedge may represent a corrective rebound within a broader bearish trend. If buyers fail to break through this resistance zone, Brent crude prices could resume their downtrend within the red channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Brent Crude INTRADAY ahead of US inventories reportThe Brent Crude price action remains bearish, driven by the prevailing downtrend. Recent price movements indicate persistent selling pressure, with rallies being met with resistance.

Key Levels:

Resistance: The critical resistance level to watch is 7240, the current intraday swing high. An oversold rally toward this level followed by a bearish rejection would reinforce the downtrend.

Support: On the downside, the next key support levels are located at 6975, 6875, and 6780, marking potential targets over a longer timeframe.

Bullish Scenario: A confirmed breakout above the 7240 resistance level, accompanied by a daily close above this point, would invalidate the bearish outlook. Such a move could signal renewed buying interest, paving the way for a rally toward the 7300 resistance level, followed by 7450.

Conclusion: The sentiment remains bearish as long as the 7240 resistance holds. Traders should be cautious of oversold rallies, as they could present selling opportunities near resistance. A decisive breakout above 7240 would indicate a potential shift in sentiment, favoring further gains.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Will Oil Prices Ignite Amid a Middle East War?The global oil market is critical, with geopolitical tensions in the Middle East potentially leading to significant price fluctuations. Recent military actions by the U.S. against Yemen's Houthi group have contributed to rising oil prices, as Brent crude futures reached $71.21 per barrel and U.S. West Texas Intermediate crude futures hit $67.80 per barrel. Positive economic indicators from China, including increased retail sales, have supported oil prices despite global economic slowdown concerns.

The Middle East remains a focal point for oil price volatility due to its strategic importance in global oil supply. Iran, a major oil producer, could face disruptions if tensions escalate, potentially driving prices higher. However, global spare capacity and demand resilience might cap long-term increases. Historical events like the 2019 Saudi oil facility attacks demonstrate the market's sensitivity to regional instability, with prices spiking by $10 following the incident.

Analysts predict that if the conflict escalates to close the Strait of Hormuz, oil prices could exceed $100 per barrel. Nevertheless, historical data suggests that prices may stabilize within a few months if disruptions prove temporary. The delicate balance between supply shocks and market adjustments underscores the need to closely monitor geopolitical developments and their economic ripple effects.

As global economic uncertainties overshadow geopolitical risks, maintaining market confidence will depend on sustained positive economic data from countries like China. The potential for peace negotiations in Ukraine and changes in U.S. sanctions could also impact oil prices, making this a pivotal moment for global energy markets.

The Crossroads of Decision of BRENT

Alex had been sitting in front of his computer for several days, the glow of the screen illuminating his anxious face. He was a novice trader, and the world of forex felt both exhilarating and overwhelming. Today, his focus was on Brent crude oil, a commodity that had captured his attention and his curiosity.

As he stared at the chart, he noticed that resistance was firmly set at 70.60. The price had flirted with that level multiple times but had failed to break through. To make matters more complicated, the chart also displayed a bearish wedge pattern, a formation that suggested potential downside movement. Alex felt his stomach tighten as he tried to decipher the conflicting signals.

"What to do next?" he thought, biting his nails nervously. He had read countless articles and watched numerous tutorials, but the information seemed to swirl in his mind without offering any clarity. Each time he thought he had a grasp on the market, new doubts crept in.

He glanced back at the chart, heart racing. Should he take a position now, betting that the price would drop, or wait for confirmation? He felt the weight of uncertainty pressing down on him. Trading was supposed to be about making informed decisions, but all he felt was confusion.

In a moment of frustration, Alex pushed back from his desk and took a deep breath. He remembered the advice he had read: "Stay calm and stick to your strategy." He had promised himself that he would not rush into trades based on fear or anxiety. Instead, he needed to focus on what the data was telling him.

Returning to the screen, he pulled up a few indicators—momentum oscillators and moving averages. He wanted to see if they aligned with the bearish wedge pattern and the resistance level at 70.60. As he analyzed the data, a clearer picture began to form. The indicators suggested a weakening momentum, reinforcing his sense that a pullback might be imminent.

Feeling a bit more confident, Alex decided that patience would be his ally. He would watch for the price to approach the resistance level again, looking for signs of weakness before making any move. He would set alerts to notify him if Brent approached 70.60, keeping his emotions in check while waiting for the right moment.

With a newfound sense of determination, Alex refocused on his screen. Trading was a journey, and he was learning that sometimes the best action was no action at all. The market would always be there, and he was committed to becoming a smarter, more strategic trader, one decision at a time.

Brent crude oil Wave Analysis – 12 March 2025

- Brent crude oil reversed from the pivotal support level 68.55

- Likely to rise to resistance level 71.30

Brent crude oil recently reversed from the support area between the pivotal support level 68.55 (former multi-month low from September) and the lower daily Bollinger Band.

The upward reversal from this support area stopped the earlier downward impulse waves 3 and (3).

Given the strength of the support level 68.55 and the oversold daily Stochastic, Brent crude oil can be expected to rise to the next resistance level 71.30.

Brent Crude Bearish ahead of US weekly inventoriesThe Brent Crude Oil price action sentiment remains bearish, aligned with the prevailing long-term downtrend. Recent price movements suggest a potential oversold rally approaching a critical resistance zone.

Key Levels and Price Action

The primary trading level to watch is 71.73, representing the current intraday swing high and falling resistance trendline. An oversold rally toward this level, followed by a bearish rejection, could indicate continued downside momentum. In this scenario, the next support targets are at 69.72, 68.80, and 68.25 over the longer timeframe.

Conversely, a confirmed breakout above the 71.73 resistance level, accompanied by a daily close above it, would invalidate the bearish outlook. This breakout could trigger further rallies, targeting the next resistance levels at 72.68 and 73.65.

Conclusion

The sentiment remains bearish as long as the 71.73 resistance level holds, with potential downside targets at 69.72, 68.80, and 68.25. A confirmed breakout above 71.73 would shift the outlook to bullish, opening the way for potential rallies toward 72.68 and 73.65. Traders should closely monitor the price action and daily closing levels to gauge potential sentiment shifts and trading opportunities.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

It's a LAUGH but Brent looks like it's heading to $56This looks like a JOKE.

But when you look at the DAILY chart - text book says the price is going to hit $56.13!

As long as the price remains below the DOwntrend, it will seem feasible and there may be a few fundamental reasons for such downside.

Oversupply 📈: Too much oil flooding the market is keeping prices low.

Economic Slowdown 📉: Sluggish global growth is cutting demand.

Green Shift 🌱: More focus on renewables means less reliance on oil.

US Production 🚀: A boost in US shale adds extra supply.

Speculation 🔮: Traders betting on drops are fueling the downward trend.

Technicals

M Formation has formed and the price broke below the neckline.

We have seen the price stay below 20MA and 200MA - BEARISH

Target $56.13

WHat do you think?

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Brent Crude Struggles at $69 as Global Demand Risks MountBrent crude hovered around $69 per barrel on Tuesday as concerns grew that U.S. tariffs could slow economic growth and weaken oil demand. Tariffs imposed by President Trump on major suppliers like Canada and Mexico, along with China’s retaliatory measures, heightened fears of a global slowdown.

China’s deepening deflationary pressures further weighed on crude prices despite stimulus efforts. On the supply side, Russia’s Deputy PM Alexander Novak confirmed OPEC+ plans to boost production in April but noted the decision could be reassessed if market conditions shift.

Technically, the first support is at $68.1, with subsequent levels at $65 and $63.6. On the upside, the initial resistance is at $70.2, followed by $73.3 and $75.80.

Crude Tests Key Support: How to Trade ItAfter a steady decline in recent weeks, Brent crude is currently testing a key level of support. Let's take a look at what's caused this year’s sell-off and the two scenarios that may play out at support this week following OPEC's upcoming report on Wednesday.

OPEC’s Output Shift Sparks Sell-Off

Brent crude’s sharp decline has been driven by a combination of factors, with OPEC+ announcing plans to bring back production in April, a larger-than-expected build in U.S. crude inventories, and renewed concerns over demand.

OPEC+ members Saudi Arabia, Russia, and the UAE are set to unwind a portion of their voluntary production cuts next month, adding to market fears of a supply glut. Although OPEC’s official statement suggested these additions could be paused or reversed based on market conditions, traders have responded with skepticism. The announcement triggered a fresh wave of selling, with Brent crude now down over 6% this year.

Adding to the pressure, U.S. crude stocks surged by 3.6 million barrels —well above analyst expectations—further dampening sentiment. Meanwhile, concerns over the impact of Trump’s latest round of tariffs have weighed on the demand outlook, with markets fearing a broader economic slowdown could hit energy consumption.

The result? Energy stocks have tumbled alongside crude. The Energy Select Sector SPDR Fund has slumped over the past week, with Big Oil names like Exxon Mobil, Chevron, and Occidental Petroleum all posting losses. With sentiment already fragile, OPEC’s upcoming Monthly Oil Report will be key in determining whether the market sees a reason to stabilise—or continues its downward slide.

Brent Crude: A Key Test at Support

Brent crude’s seven-week downtrend has taken prices back to a major support level at the September spike lows. Last week saw an initial bounce from this area, but the rally struggled to break through the steep descending trendline that has defined the market’s decline over the past month.

Analysing a market across multiple timeframes can provide a clearer picture of trend strength and potential reversals. On the daily chart, Brent is testing a well-established support zone. However, the hourly chart reveals two possible scenarios that traders should watch closely:

1. A Double Bottom Reversal: If last week’s swing lows hold, Brent could form a double bottom on the hourly chart. This would indicate that buyers are stepping in, potentially leading to a counter-trend rally. If price clears the descending trendline, this could confirm a short-term bullish reversal.

2. A Breakdown Below Support: If Brent decisively breaks support on elevated volume, it would signal that bearish momentum is accelerating. In this case, traders may look to short pullbacks, using previous support as resistance and targeting lower levels.

With Brent sitting at a major inflection point and OPEC’s report due midweek, volatility could pick up in the coming days. Whether this key support holds or gives way will determine the next leg of crude’s trend.

Brent Oil Daily Candle Chart

Past performance is not a reliable indicator of future results

Brent Oil Hourly Candle Chart

Past performance is not a reliable indicator of future results

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.