SPOTCRUDE trade ideas

Oil will soon be $200Technical and Fundamental Analysis of Crude Oil (WTI)

Technical Analysis:

1. Key Support and Resistance Levels:

The $80 level acts as a strong resistance, where the price has reversed in the past.

Major support levels are at $66 and $68.

2. Overall Trend:

The price has bounced from $66 and is currently trading around $70.94.

If the price breaks above the $72 resistance, it could move towards $74-$76.

A break below $68 may push the price down to $66 and potentially $64.

3. Price Action:

A recent strong bullish move indicates buying interest in this zone.

The price is attempting to stabilize above $70.

Fundamental Analysis:

1. Key Influencing Factors:

OPEC+ Decisions: Any production cuts could support oil prices.

U.S. Economic Data: Inflation, interest rates, and Federal Reserve policies impact oil demand.

Geopolitical Tensions: Conflicts in the Middle East or Russia can drive prices higher.

U.S. Crude Oil Inventory: Declining inventories signal higher demand, boosting prices.

2. Overall Outlook:

If global demand continues to rise and OPEC+ cuts production, oil could reach $74-$76.

Weak economic data and slowing global growth may push prices down to $66.

Conclusion: The price is at a critical level. A breakout above $72 confirms a bullish trend, while dropping below $68 could indicate weakness.

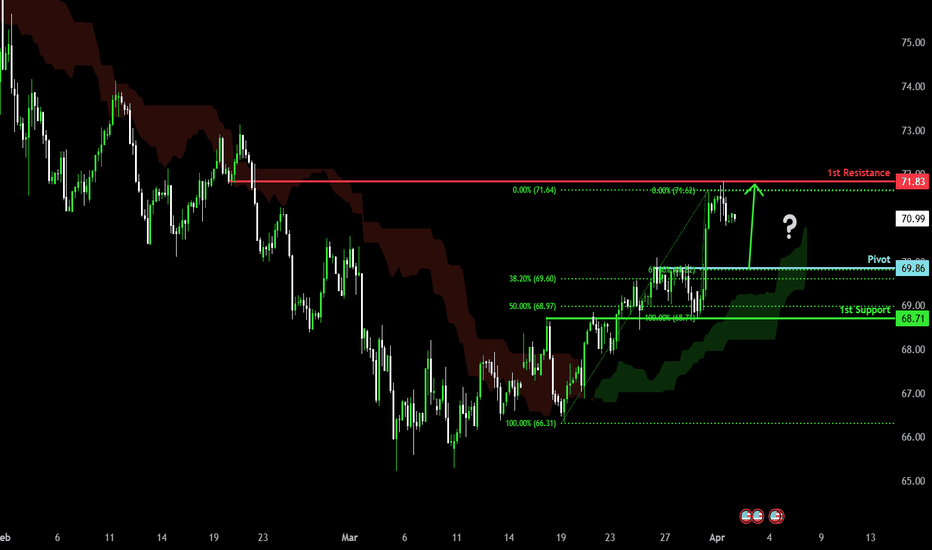

Bullish momentum to extend?WTI Oil (XTI/USD) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 69.86

1st Support: 68.71

1st Resistance: 71.83

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CRUDE OIL LONG SIGNAL|

✅CRUDE OIL is trading in a

Strong uptrend and was making

A local bearish correction but

A horizontal support level was

Hit at 71.00$ so we can go

Long on with the TP of 71.72$

And the SL of 70.59$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Crude Oil: WTI Recovers Slightly Above the $70 ZoneSince touching the key support level at $67 , WTI crude oil has posted a notable recovery of more than 7% in recent weeks, and is now hovering slightly above the $70 per barrel mark. For now, the bullish bias remains intact as comments from the White House suggest potential tariffs ranging from 25% to 50% on countries that choose to trade Russian oil. According to President Trump, Russia has failed to implement a ceasefire in the short term and this could lead to additional tarrifs. Although this new tariff strategy has no official date, if enacted, it could significantly disrupt global oil supply, reinforcing short-term bullish expectations for crude.

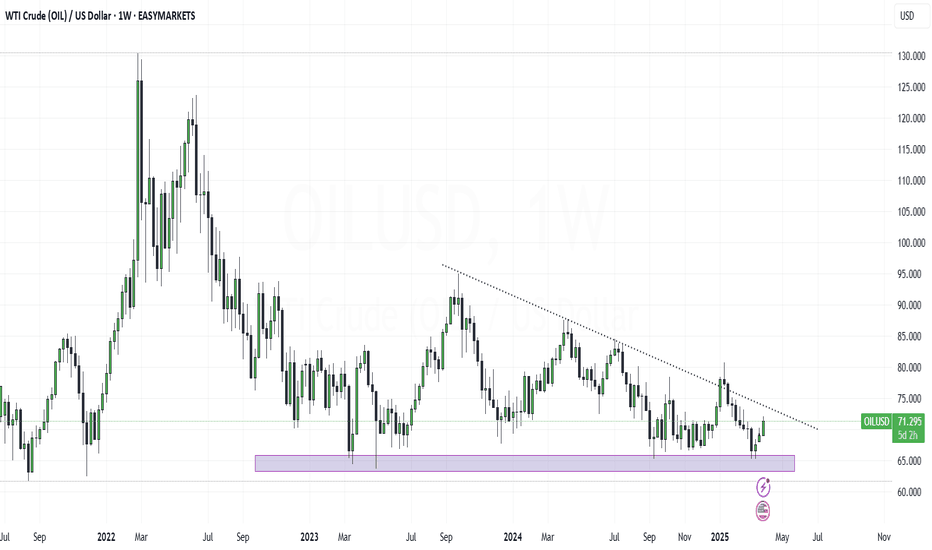

Wide Sideways Range:

For several months now, oil has been moving within a stable sideways range between $81 (resistance) and $67 (support) per barrel. So far, there hasn't been any significant breakout from this channel, making it the dominant structure on the chart in the short term.

MACD:

The MACD histogram continues to oscillate just above the zero line, but recent sessions have shown slight bearish momentum, possibly signaling a pause in the upward movement as the dominance of the moving averages appears to be neutralizing.

TRIX:

A similar situation is developing in the TRIX indicator, with the line hovering just below the neutral 0 level. This suggests that the strength of the 18-period moving average has entered a zone of balance, lacking a clear directional force.

The behavior of both indicators implies that momentum is gradually weakening as the price approaches resistance levels.

Key Levels:

$73: A key resistance level located near the midpoint of the sideways range, also aligning with the 200-period moving average. A breakout above this level could trigger a solid short-term bullish trend.

$81: A distant resistance level marking the top of the current range. Price action reaching this level could be decisive in confirming a long-term bullish breakout.

$67: A significant support level , marking the lower boundary of the range. A return to this level could revive previously dormant bearish pressure and potentially resume a longer-term downtrend that began several weeks ago.

By Julian Pineda, CFA – Market Analyst

USOIL Daily Analysis: Bullish Reversal from Key Support USOIL (WTI Crude Oil) daily chart showing price action analysis.

Key Observations:

Support Zone:

A strong demand zone is marked around $65-$66, which has acted as a reversal area in the past.

The price has recently bounced off this zone, indicating potential buyer interest.

Current Price Action:

Price is currently trading at $68.25.

A bullish move started from the support region, with a higher low formation suggesting potential upside momentum.

Potential Scenario:

The chart suggests a pullback before continuation to the upside.

If the support holds, $70-$72 could be the next target.

If price fails to hold above $66, further downside towards $64 may be possible.

Outlook:

Bullish Bias 📈 as long as the price remains above the demand zone.

Watch for a higher low confirmation before entering a long trade.

Breakout above $70 could signal a stronger rally.

USOIL-Sell in the 71.6-72 rangeUSOIL has also experienced a strong uptrend recently, driven by news events. However, as we all know, "what goes up must come down"—even in a one-sided market, technical corrections are inevitable. Right now, we are seeing a perfect opportunity for a pullback-based short trade after the sharp rally.

Trading Recommendation:

📉 Sell in the 71.6-72 range

USOIL:The bullish momentum demonstrates strong performanceRecently, the United States has stepped up its sanctions against Iran. It also made threatening remarks indicating that if the peace talks between Russia and Ukraine fail to reach an agreement, it will further intensify sanctions against Russia. Such actions have heightened the market's concerns about the future supply side.

Meanwhile, the short-term and phased decline in the United States' domestic oil production, combined with its temporary abstention from taking additional measures to suppress oil prices, has led to a certain increase in the supporting strength of the oil market recently. Yesterday, the upward trend of oil prices continued.

Take a long position at $71.05 for the oil price. Set a stop-loss of 30 basis points and a take-profit at $72.70.

Trading Strategy:

buy@70.8-71.05

TP:72.20-72.50

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Oil and Gas Markets: Price Pressures and Future OutlookPYTH:WTI3! ICEEUR:BRN1! NYMEX:RB1! FXOPEN:XNGUSD

Market Overview: Supply, Demand, and Geopolitical Factors

The oil and gas markets continue to experience significant volatility, driven by a combination of seasonal trends, production adjustments, and geopolitical developments. U.S. natural gas storage has decreased due to seasonal withdrawals, though inventories remain above the five-year average. Meanwhile, crude oil prices have struggled to find momentum, weighed down by concerns over demand growth and economic uncertainty.

Global oil production has remained relatively stable, but market participants are closely monitoring potential disruptions. OPEC+ has maintained its commitment to output restrictions, aiming to support prices amid fluctuating demand. However, recent indications from major producers suggest potential shifts in supply strategies, particularly in response to changes in global consumption patterns.

Price Trends and Market Pressures

Oil prices have faced downward pressure, with West Texas Intermediate (WTI) recently trading below $70 per barrel. Concerns over slowing demand, particularly in key economies like China and the Eurozone, have contributed to this decline. Additionally, rising interest rates in the United States have dampened economic activity, potentially reducing fuel consumption in the long term.

Natural gas prices have also been volatile, reflecting shifts in supply and demand dynamics. While storage levels remain elevated compared to historical averages, colder-than-expected weather in certain regions has led to temporary price spikes. However, recent price movements indicate a broader downward trend, as fundamental supply-demand balances exert pressure on valuations. The price of the F26, which reached $5.9 two weeks ago, has since declined to $5.3, with further movement toward approximately $4.8 anticipated based on current market conditions. These dynamics reflect the ongoing adjustments in global gas markets amid changing consumption patterns and seasonal fluctuations.

Corporate Performance

The impact of these price movements has been felt unevenly across the oil and gas sector. Major integrated energy companies have managed to maintain profitability due to diversified revenue streams, while smaller, more vulnerable producers have faced greater challenges. Refining margins have fluctuated, with some refiners benefiting from lower crude prices while others struggle with narrowing spreads.

Companies with strong exposure to liquefied natural gas (LNG) exports have seen continued demand, particularly in Europe and Asia, where energy security remains a priority. However, firms heavily reliant on upstream oil production have encountered profit pressures as crude prices remain subdued. The resilience of oilfield service providers has also been tested, with cost-cutting measures and efficiency improvements becoming necessary for a sustainable existence.

Risks and Future Outlook

The outlook for oil and gas markets remains uncertain, with multiple risk factors at play. Potential production policy changes by OPEC+, geopolitical tensions in key producing regions, and ongoing economic uncertainties all contribute to an unpredictable pricing environment. Additionally, regulatory shifts and climate policies could further impact the long-term trajectory of fossil fuel demand.

While short-term volatility may deter some, long-term structural changes in energy consumption and supply dynamics will shape future investment strategies. As global economies navigate inflationary pressures and evolving energy policies, oil and gas markets will continue to adjust, presenting both risks and rewards for market participants.

USOIL - Bracketing A Breakout Opportunity As traders we want to be predictive in our analysis and reactive in our execution. And there is no easier way to follow through with this concept then on a bracketed breakout trading opportunity.

Oil has recently been on a short-term bullish run which has ended with price entering a period of consolidation. Consolidation leads to expansion so I do expect a future breakout to occur.

The question however is in which direction. If I knew the answer I would bet everything I have including the house and the kids on it but unfortunately I don't. (and my wife would kill me).

What I do know, is that there's a good chance that the market will give us a clue of what direction it wants to continue in and that's what I'm waiting for with this trading opportunity.

If you have any questions or comments please leave them below & be sure to show some love by hitting that LIKE button before you go.

Akil

WTI OIL Approaching a potential rejection level.Our last short-term analysis (March 18, see chart below) on WTI Oil (USOIL) hit the $70.00 Target and is currently extending the uptrend:

We believe however that this uptrend may be coming to a temporary end as not only does it approach the 1D MA200 (orange trend-line) that has been intact since February 03, but also the 73.40 Symmetrical Resistance that kick started the -7.70% September 24 2024 rejection.

As you can this this is also where the 1D RSI 67.00 Resistance is, which has also caused 2 rejections.

Based on that, we will wait for a short on the 1D MA200 to target $68.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oil - Expecting The Price To Bounce Higher FurtherH1 - Price has created series of higher highs, higher lows structure

Strong bullish momentum

Higher highs based on the moving averages of the MACD indicator

Expecting retraces and further continuation higher until the two strong support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XTIUSD (WTI Crude Oil) – Market Analysis (23rd March 2025)XTIUSD (WTI Crude Oil)

Timeframe: 4H

1. Mak Method

Price recently broke above the descending trendline, indicating a potential bullish shift.

Key 369 Level: Price is hovering around $68.61, aligning with my levels.

If price maintains above $67.50, we could see continued bullish movement.

2. Fibonacci, Gann Levels & Elliott Wave

Fibonacci Retracement:

61.8% level at $72.50, making it a critical upside target.

Gann Levels:

Major support at $66.00, which aligns with institutional buying zones.

Elliott Wave Count:

Potential Wave 3 underway, with a break above $70 confirming bullish momentum.

3. Key Technical Levels (Support & Resistance)

Support Levels:

$67.50 - $66.00 → Strong demand zone, potential bullish retest.

$61.50 - $60.00 → Major institutional support (if breakdown occurs).

Resistance Levels:

$69.50 - $70.00 → Short-term resistance, possible liquidity grab.

$72.50 - $75.00 → Next bullish target, aligning with Fibonacci & order blocks.

4. Probable Scenarios with Probability %

Scenario Probability

Bullish Breakout: Retest of $67.50, then continuation to $70-$72.50. 65%

Fake Breakout & Rejection: Price rejects $69.50 and retraces to $66.00. 25%

Bearish Breakdown: Failure to hold $66.00, leading to a drop to $61.50-$60.00. 10%

5. Conclusion & Trading Strategy

Bias: Bullish above $67.50, bearish below $66.00.

Entry Areas:

Long Entry → Retest of $67.50 with confirmation.

Short Entry → Breakdown below $66.00, targeting $61.50.

Stop Loss:

Long trades → Below $65.80.

Short trades → Above $70.50.

Final Thoughts:

Watch for false breakouts at $69.50 before confirming bullish moves.

If price consolidates above $68.50 - $69.00, we could see a rally toward $72.50 - $75.00.

Volume Confirmation: Institutional buying at $67.50 could trigger a strong bullish move.

USOIL Is Bullish! Long!

Please, check our technical outlook for USOIL.

Time Frame: 8h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 71.913.

Considering the today's price action, probabilities will be high to see a movement to 73.911.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Oil – Shorts Getting Squeezed But How Far Can it Run?After trading between $65-70 for much of March as fears of a slowdown in the global economy would lead to reduced demand, Oil prices popped 3% yesterday to close at 71.50 and have initially nudged higher again today.

The catalyst for the recent move that led to this spike, unsurprisingly, were comments from President Trump. Yes, he seems to be moving all markets right now!

His weekend comments which suggested he was getting fed up with Putin dragging his feet on a Ukraine ceasefire, adding the US may work to restrict Russian crude shipments and consider secondary tariffs on buyers of Russian Oil, were enough for traders to reduce weak short positions, as this could impact Oil supplies, if it were to become a reality.

Add to that, yesterday’s positive news from China, the world’s biggest Oil importer, that showed manufacturing activity in the country expanded at a faster pace for the year to March, and you can see why prices have bounced in the short term.

However, can this move continue?

It could all depend on how aggressive President Trump and his team are tomorrow when they unveil the next wave of reciprocal tariffs on trading partners, in what President Trump has labelled ‘Liberation Day’.

Current expectations are for these new tariffs to impact all countries, but the size of the penalties is unclear, as are the size of retaliatory measures from China, Canada, EU and the rest of the world for that measure.

The worst ‘Liberation Day’ outcome could see Oil traders focus on a global recession and a potential drop in Oil demand, which could see prices fall from current levels, while anything else could see Oil prices continue to fluctuate depending on what it means for global trade and for the economies of specific Oil importing nations like China.

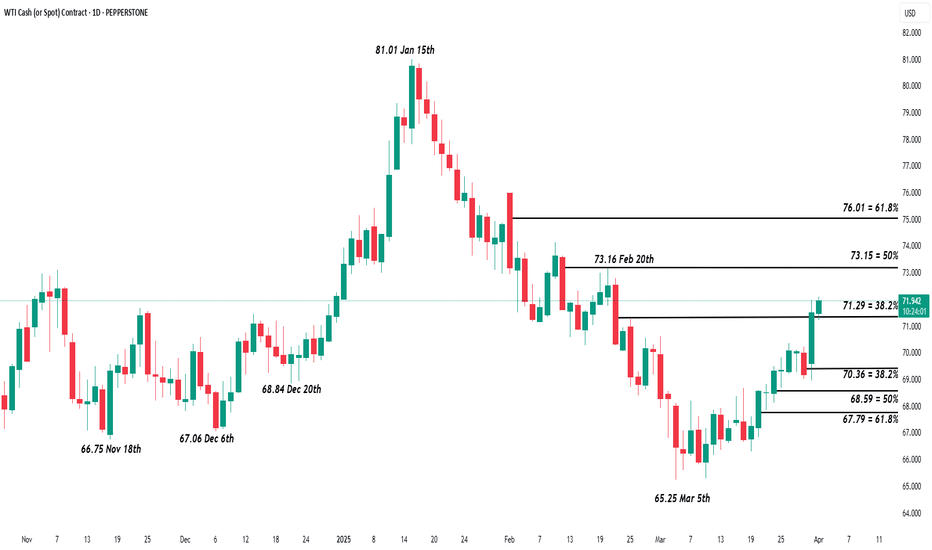

Technical Picture:

It was an extended phase of weakness in Oil prices from the January 15th, 2025, high at 81.01 into the March 5th, 2025, low at 65.25, a decline of 19.45%, which took prices to levels last seen in May 2023.

Subsequently, while a price recovery has materialised, it is only until recently that a more sustained period of strength looks to be developing, and only yesterday the 38.2% Fibonacci retracement of January/March weakness, which stood at 71.29, was challenged.

In fact, with signs emerging that traders with short positions are reverting to the sidelines and ‘covering positions’ ahead whatever tomorrow’s tariff announcements bring, this 71.29 resistance level gave way on a closing basis.

A close above a Fibonacci retracement resistance is not a guarantee of a more prolonged phase of recovery in price, especially when we have such significant news about to hit traders’ screens, but it does suggest scope to higher levels in price are still possible.

Next Resistance:

A break above a 38.2% retracement resistance level can open potential for a more extended phase of price strength and traders may now be focusing on 73.15/16 as the next resistance within current strength. This represents the February 20th 2025 high in price, from which fresh selling was recently seen to post new price lows and the higher 50% Fibonacci retracement level.

Next Support:

Of course, it is equally possible any reaction to the up-and-coming tariff announcement could be negative for Oil, in which case it is important to consider what are the levels that if broken to the downside within any extended phase of weakness, might again suggest increasing downside pressure in the price of Oil.

The 38.2% Fibonacci retracement of latest March strength stands at 70.36, with possibilities that if any fresh weakness sees this level give way on a closing basis, might indicate it is the oil bears are gaining a foothold once more, to expose a deeper price decline and retracement of March strength.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Brent Crude Oil Price Rises Above $71Brent Crude Oil Price Rises Above $71

Brent crude oil is trading above $71 per barrel today, marking its highest level since late February. As shown on the XBR/USD chart, the price surged by approximately 2.6% on the last day of March.

Why Has Oil Risen?

Bullish sentiment in the market is driven by the US President’s stance on Russia and Iran. According to Trading Economics:

➝ Trump has vowed to impose tariffs of 25–50% on buyers of Russian oil if he believes Moscow is obstructing his efforts to end the war in Ukraine. This could put pressure on key importers such as India and China.

➝ He has also threatened Iran with further tariffs and airstrikes until the country agrees to abandon its nuclear weapons programme.

The rise in Brent crude prices appears to reflect traders’ concerns over potential disruptions to global oil supply chains.

Technical Analysis of XBR/USD

In early March, oil formed a bullish Double Bottom pattern (see the lows on 5 and 11 March), followed by an upward trend within a rising channel (marked in blue).

Notably, the XBR/USD chart shows that the price:

➝ Has moved into the upper half of the channel.

➝ Broke through key resistance at around $70.25, a level that previously acted as support multiple times (as indicated by the arrows).

As a result, the median of the channel, reinforced by the $70.25 level, may now serve as support, keeping Brent crude within the blue channel. However, market direction will likely depend on the news cycle, particularly sharp statements from the White House.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

WTI Oil H4 | Falling to pullback supportWTI oil (USOIL) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 71.06 which is a pullback support.

Stop loss is at 69.80 which is a level that lies underneath a pullback support and the 23.6% Fibonacci retracement.

Take profit is at 72.94 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USOil Key Resistance Hit: Is WTI Crude Due for a Correction?WTI crude oil appears overextended after a strong bullish rally, trading into a key resistance level amid heightened geopolitical tensions and market volatility. The current price action suggests a potential retracement, with equilibrium around the 50% Fibonacci level being a likely target for correction 📉. Given the reactionary nature of the market, traders should remain cautious as political developments could drive further instability ⚠️. While the technical setup supports a pullback, external factors may disrupt this scenario, so risk management is essential. 📊

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making trading decisions.