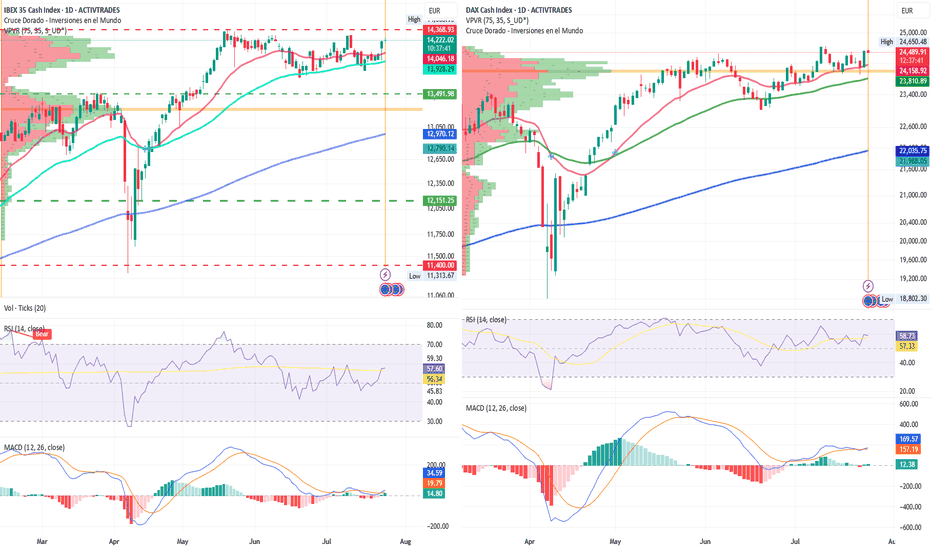

IBEX 35 Leads European Gains, DAX Enters Price Discovery ModeIBEX 35 lider of european bullish advances in the tariff agreements

By Ion Jauregui – Analyst at ActivTrades

European markets kick off the day with strong gains, driven by renewed optimism over trade negotiations between the United States and China. In this context, IBEX 35 futures surge by 1.52% to 14,273 points, positioning the index as one of the top performers in Europe. Meanwhile, Germany’s DAX 40 also rises 1.34% to 24,635 points.

News of potential tariff agreements, combined with growing expectations of a more accommodative stance from the European Central Bank (ECB), are pushing major European indices higher. The French CAC 40 climbs 1.56%, while the EuroStoxx 50 gains 1.33%, reflecting renewed risk appetite across the board.

Global Context: Asian Rebound and Moderate Commodities Euphoria

The upbeat tone isn’t limited to Europe. In Asia, major indices closed in the green, and the Australian dollar hit an eight-month high, reflecting investor optimism around global trade and corporate earnings. Oil prices are also rising, supported by a larger-than-expected drop in U.S. crude inventories and expectations of stronger global demand.

All Eyes on the ECB

Today’s highlight is the ECB meeting, where a decision on interest rates will be announced. While no major surprises are expected, investors will be watching closely for clues on the timing of future rate cuts—especially in light of recent inflation and activity data.

Additional key data scheduled for release today:

Unemployment and PPI in Spain

Composite PMIs for Germany, France, the Eurozone, and the U.S.

U.S. housing data and jobless claims

Corporate Outlook: IBEX Boosted by Strong Earnings

Several IBEX 35 companies are in the spotlight due to positive developments:

Banco Sabadell targets a 16% return on equity by 2027, supported by a €6.3 billion shareholder payout plan.

Indra nearly doubles profits, fueled by operational gains and revaluation of its stake in TESS.

ACS acquires Segade to strengthen its position in the data center sector.

Telefónica is in talks with AXA to join its fiber joint venture with Vodafone.

Santander makes a €1 billion bid for Mercedes’ leasing division.

Technical Analysis – IBEX 35: Key Zone at 14,300 Points

The IBEX 35 shows a clear structure of higher lows since the beginning of the month. Breaking above the 14,200-point level, an intermediate resistance, reinforces its short-term bullish outlook. The index is now approaching the 14,300–14,350 zone, which has acted as a ceiling since May.

This is a pivotal area; a failure to break through could form a triple top pattern, potentially triggering a correction toward support at 13,698 or even lower toward the control area near 13,491. A consolidation above 14,350, however, could set the stage for a new upward leg toward 14,500 points, provided the ECB maintains a dovish tone.

Momentum indicators support the move, although they are nearing overbought levels. RSI stands at 57.89%, while the MACD remains positive and climbing above the histogram.

Technical Analysis – DAX 40: Eyeing a Break Above 24,700

The DAX 40 is also benefiting from global bullish momentum. After consolidating above 24,300, a breakout above the 24,650 resistance could trigger a move toward the 24,700–24,800 zone, pushing the index beyond its all-time highs recorded in June.

A daily close above 24,800 would place the German index firmly in price discovery mode, with the next psychological target at 25,000 points. The RSI remains strong at 58.84%, with no immediate signs of exhaustion, while the MACD confirms the bullish signal from last week, expanding well above the histogram—though momentum appears moderate.

Conclusion

Progress in trade negotiations and expectations of a dovish ECB are setting the stage for a bullish session in European markets. The IBEX 35 leads the rally, supported by strong corporate results and technical strength, while the DAX 40 continues its upward trend, with potential for new all-time highs. Today’s ECB decision could be a turning point if it confirms the accommodative stance the market is anticipating.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

GDAXI trade ideas

Technical Weekly AnalysisGermany 40 remains in a bullish trend but has entered a pullback phase. It is trading at 24,239, slightly above its VWAP of 24,180. The RSI at 55 suggests a neutral momentum with potential for a continuation of the uptrend. Support is found at 23,631 and resistance at 24,604

U K 100 continues its bullish trend in an impulsive phase, trading at 8,984, above its VWAP of 8,886 but still below the key 9k level. This shows underlying strength. The RSI at 61 reflects continued buying interest. Support lies at 8,708 and resistance at 9,064.

Wall Street remains bullish but is experiencing a pullback just under the March highs, trading at 44,429 just above the VWAP of 44,400. The RSI at 58 suggests moderate bullish momentum. Support is at 43,894, and resistance is at 44,788.

Brent Crude is in a neutral trend, currently in a tight range which fits inside a bigger range - with price at 6,849 and VWAP at 6,847. The RSI at 49 indicates balanced sentiment. Key support lies at 6,637, with resistance at 7,054.

Gold is in a neutral range phase, trading at 3,364 and below the VWAP of 3,332. The RSI of 55 shows slight bullish bias. Support is at 3,283, with resistance at 3,391.

EUR/USD continues in a bullish trend but is correcting, with price at 1.1643 below its VWAP of 1.1704. The RSI at 50 implies neutral momentum. Support stands at 1.1571, and resistance is at 1.1837

GBP/USD remains in a bullish trend but is undergoing a correction. Price is at 1.3455, slightly below the VWAP of 1.3559. RSI at 42 shows weakening momentum. Support is at 1.3316 and resistance at 1.3802.

USD/JPY is in a neutral trend and ranging as it tests the upper limits of the range for a possible breakout. It trades at 147.78, above the VWAP of 146.25. The RSI at 59 suggests slightly bullish momentum. Support is at 142.57, and resistance is at 149.94.

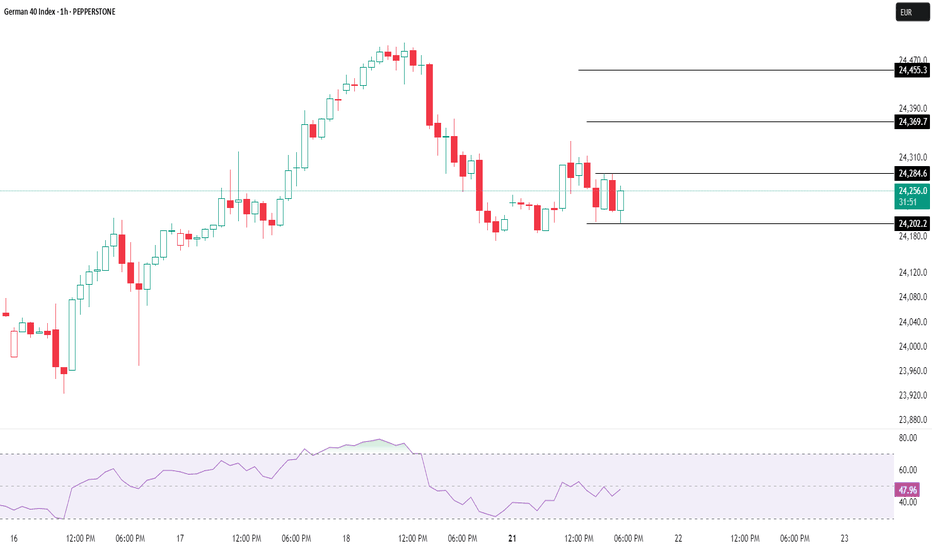

Germany 40 – Preparing For A Short Term Range BreakoutTariff worries, including new comments from President Trump stating that he is likely to impose fresh import charges on pharmaceuticals, have continued to dominate the thinking of Germany 40 traders this week. This has lead to some choppy price action for the index, which after opening on Monday at 24140, has bounced between a Tuesday high of 24293 and a Wednesday low of 23923, before settling back into the middle of that range.

Throw into the mix, the start of Q2 earnings season for European corporates and an upcoming ECB interest rate decision in a week's time and you can see how price action could become increasingly volatile moving forward into the end of July.

Earnings season has so far got off to a slow start in Europe and Germany 40 traders may have to wait until SAP, the company carrying the highest market capitalisation ($352 billion) and index weighting (14.5%), reports its results next Tuesday (after the close) for further insight into where prices may move next.

In terms of the ECB rate decision next Thursday (July 24th), market expectations may currently be indicating that another rate cut is unlikely, although it could be a close call. Traders seem to be focusing on recent commentary from policymakers which suggests the balance of power for the time being has shifted to the more hawkish committee members, who have stated that with inflation sitting on the central bank's target of 2% there is no need to cut rates further. Choosing instead to wait for more clarity on the outcome of trade negotiations with the US, which could decide whether a trade war between the world's first and third biggest economies may be something they need to navigate.

Technical Update: Assessing Current Pirce Action

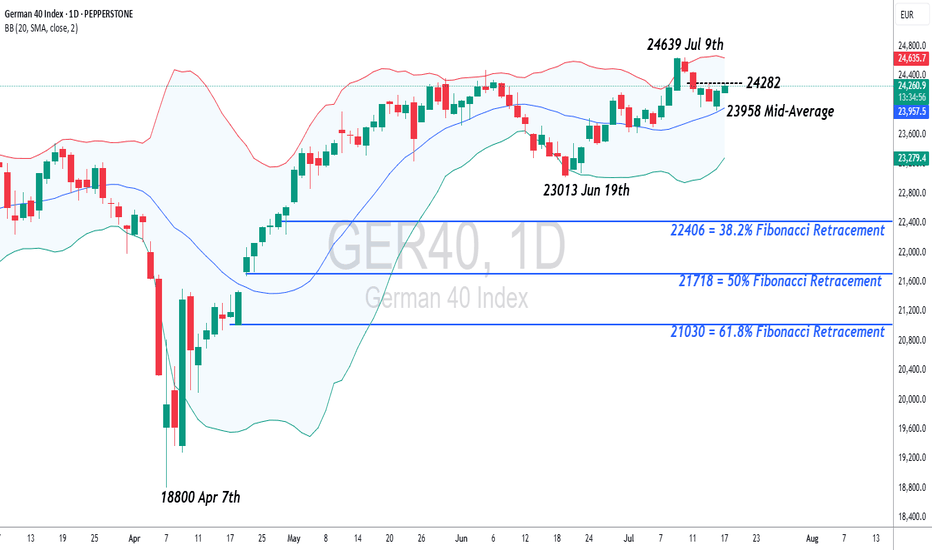

Having posted a new all-time high at 24639 on July 9th the Germany 40 index has entered a corrective period in price. However, while much will depend on future market sentiment and price trends, traders may well be asking, whether current price declines can develop into a more extended phase of weakness, or if the downside move could be limited as buyers return once again.

Time will tell, but in the meantime, technical analysis may help pinpoint potential support and resistance levels which can aid traders in establishing the next possible trends and directional risks.

Potential Support Levels:

Having recently posted a new all-time high at 24639, it might be argued this is still a positive price trend, especially as the Bollinger mid-average is currently rising. The mid-average stands at 23954, so may mark the first support focus for traders over coming sessions.

However, if closing breaks of this 23954 level materialise, it might lead towards a further phase of price weakness towards 23013, the June 19th session low, even 22406, which is the 38.2% Fibonacci retracement of April to July 2025 price strength.

Potential Resistance Levels:

If the 23954 mid-average successfully holds the current price setback, it could prompt further attempts to extend recent strength.

The first resistance might then stand at 24282, which is equal to half of the latest weakness, with successful closing breaks above this level possibly opening scope back to the 24639 all-time high and maybe further, if this in turn gives way.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Germany 40 – Preparing For A Short Term Range BreakoutTariff worries, including new comments from President Trump stating that he is likely to impose fresh import charges on pharmaceuticals, have continued to dominate the thinking of Germany 40 traders this week, leading to some choppy price action for the index, which after opening on Monday at 24084, has bounced between a Tuesday high of 24293 and a Wednesday low of 23925, before settling back into the middle of that range.

Throw into the mix, the start of Q2 earnings season for European corporates and an upcoming ECB interest rate decision in a week's time and you can see how price action could become increasingly volatile moving forward into the end of July.

Earnings season has so far got off to a slow start in Europe and Germany 40 traders may have to wait until SAP, the company carrying the highest market capitalisation ($352 billion) and index weighting (14.5%), reports its results next Tuesday (after the close) for further insight into where prices may move next.

In terms of the ECB rate decision next Thursday (July 24th), market expectations may currently be indicating that another rate cut is unlikely, although it could be a close call. Traders seem to be focusing on recent commentary from policymakers which suggests the balance of power for the time being has shifted to the more hawkish committee members, who have stated that with inflation sitting on the central bank's target of 2% there is no need to cut rates further. Choosing instead to wait for more clarity on the outcome of trade negotiations with the US, which could decide whether a trade war between the world's first and third biggest economies may be something they need to navigate.

Technical Update:

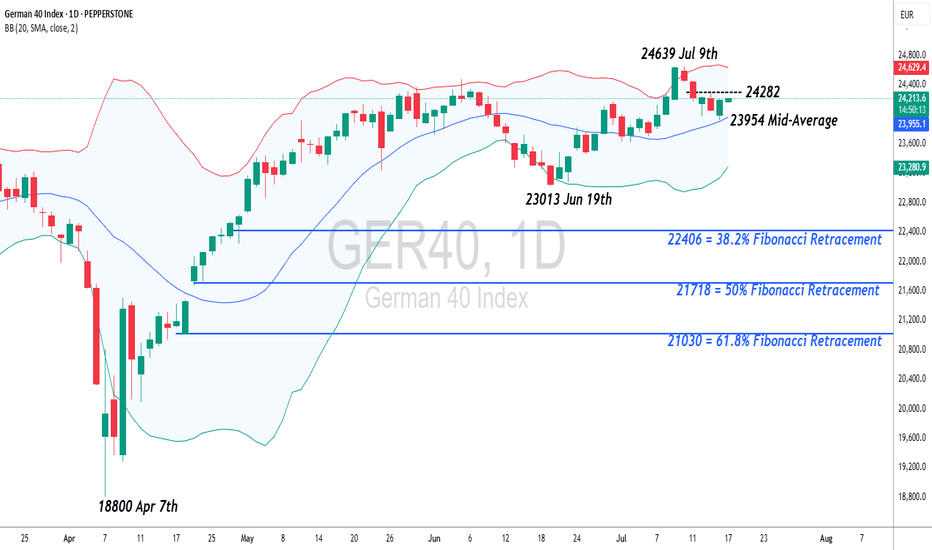

Having posted a new all-time high at 24639 on July 9th the German 40 index has entered a corrective period in price. However, while much will depend on future market sentiment and price trends, traders may well be asking, if current price declines can develop into a more extended phase of weakness, or if downside is just a limited move before buyers return to extend price strength.

Time will tell, but in the meantime, technical analysis may help pinpoint potential support and resistance levels, aiding in establishing next possible trends and directional risks.

Potential Support:

Having recently posted a new all-time high at 24639, it might be argued this is still a positive price trend, especially as the Bollinger mid-average is currently rising. This for Thursday stands at 23954, so may mark the first support focus for traders over coming sessions.

If closing breaks of this 23954 level materialise, it might lead towards a further phase of price weakness towards 23013, the June 19th session low, even 22406, the 38.2% Fibonacci retracement of April to July 2025 price strength.

Potential Resistance:

If the 23954 mid-average successfully holds the current price setback, it could possibly prompt further attempts to extend recent strength.

First resistance might then stand at 24282, equal to half latest weakness, with successful closing breaks possibly then opening scope back to the 24639 all-time high and maybe further, if this in turn gives way.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Germany 40 – Preparing For A Short Term Range BreakoutTariff worries, including new comments from President Trump stating that he is likely to impose fresh import charges on pharmaceuticals, have continued to dominate the thinking of Germany 40 traders this week, leading to some choppy price action for the index, which after opening on Monday at 24084, has bounced between a Tuesday high of 24293 and a Wednesday low of 23925, before settling back into the middle of that range.

Throw into the mix, the start of Q2 earnings season for European corporates and an upcoming ECB interest rate decision in a week's time and you can see how price action could become increasingly volatile moving forward into the end of July.

Earnings season has so far got off to a slow start in Europe and Germany 40 traders may have to wait until SAP, the company carrying the highest market capitalisation ($352 billion) and index weighting (14.5%), reports its results next Tuesday (after the close) for further insight into where prices may move next.

In terms of the ECB rate decision next Thursday (July 24th), market expectations may currently be indicating that another rate cut is unlikely, although it could be a close call. Traders seem to be focusing on recent commentary from policymakers which suggests the balance of power for the time being has shifted to the more hawkish committee members, who have stated that with inflation sitting on the central bank's target of 2% there is no need to cut rates further. Choosing instead to wait for more clarity on the outcome of trade negotiations with the US, which could decide whether a trade war between the world's first and third biggest economies may be something they need to navigate.

Technical Update:

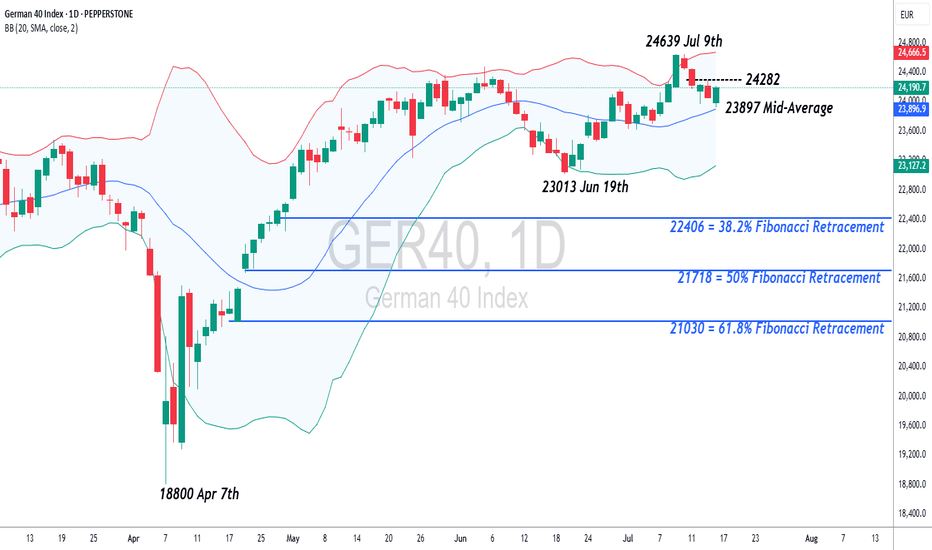

Having posted a new all-time high at 24639 on July 9th the German 40 index has entered a corrective period. However, while much will depend on future unknow market sentiment and price trends, traders may well be asking, if current price weakness can develop into a more extended phase of weakness, or if downside is just a limited move before buyers return to extend price strength.

Time will tell, but in the meantime, technical analysis may help pinpoint potential support and resistance levels, aiding us establish next potential trends and directional risks.

Potential Support:

Having recently posted a new all-time high at 24639, it might be argued this is still a possible positive trend, especially as the Bollinger mid-average is currently rising. This for Thursday stands at 23897, so may mark the first support focus for traders over coming sessions.

If closing breaks of this 23965 level materialise, it might lead towards a further phase of price weakness towards 23013, the June 19th session low, even 22406, the 38.2% Fibonacci retracement of April to July 2025 price strength.

Potential Resistance:

If the 23965 mid-average successfully holds the current price setback, it could possibly prompt further attempts to extend recent strength.

First resistance might then stand at 24282, equal to half latest weakness, with successful closing breaks possibly then opening scope back to the 24639 all-time high and maybe further, if this in turn gives way.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

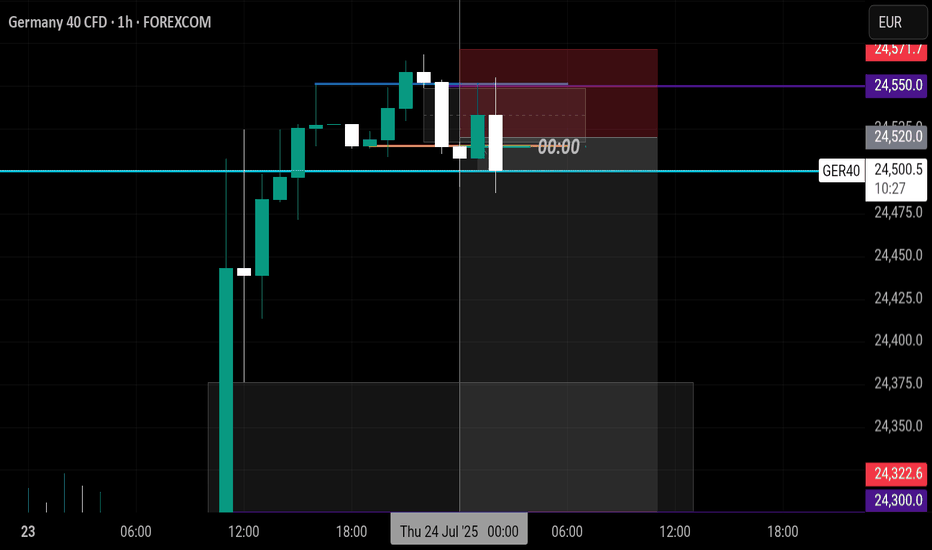

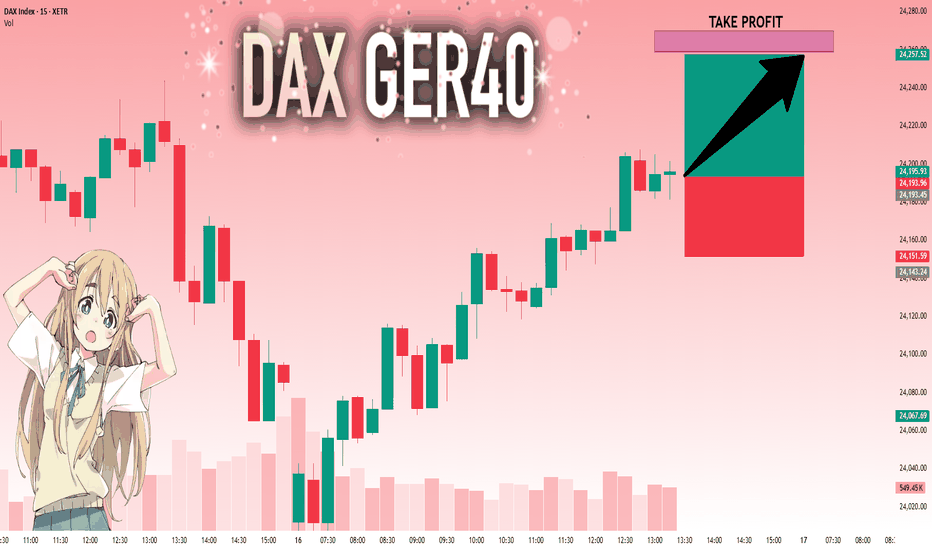

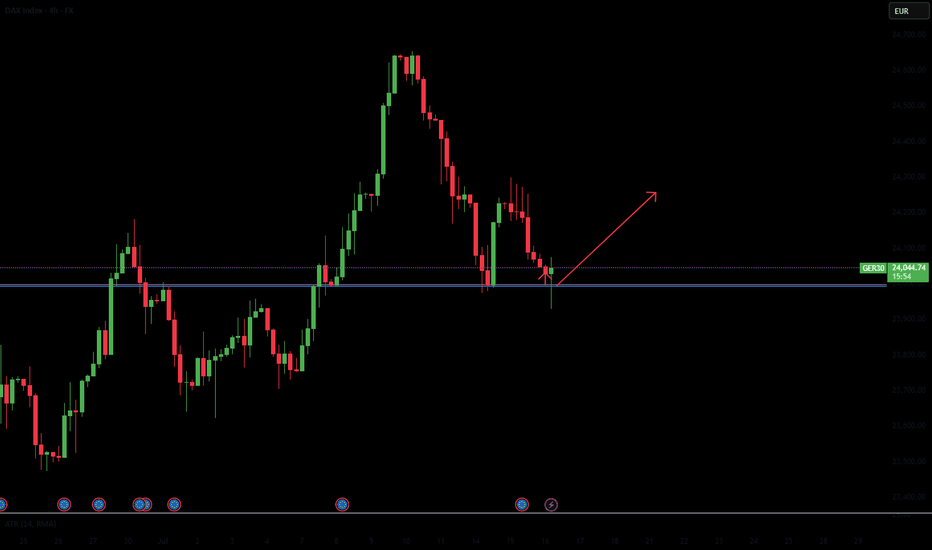

DAX: Will Go Up! Long!

My dear friends,

Today we will analyse DAX together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 24,193.45 will confirm the new direction upwards with the target being the next key level of 24,258.97 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

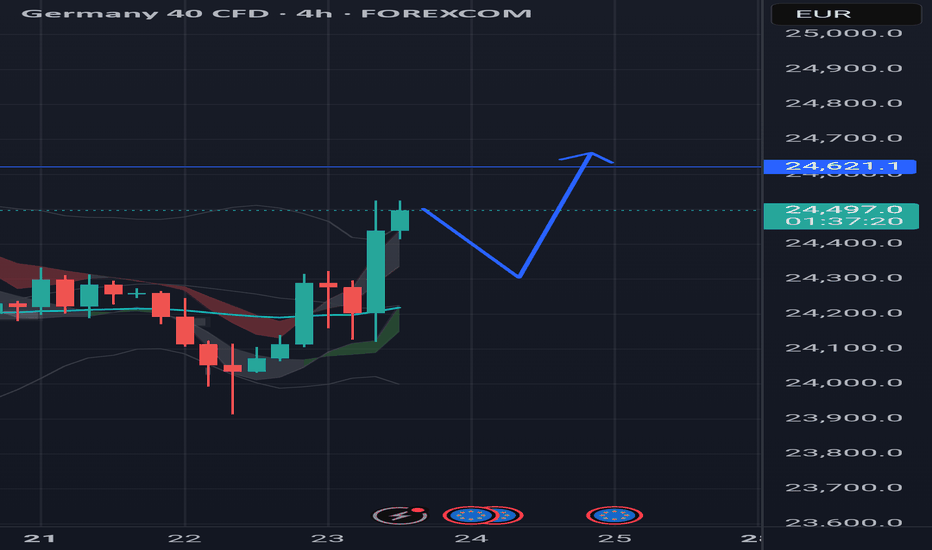

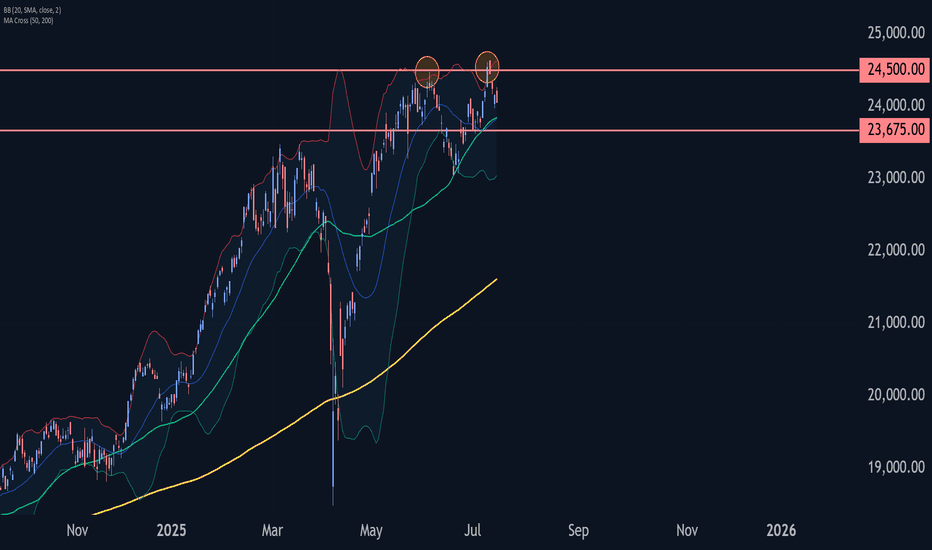

DAX Wave Analysis – 15 July 2025

- DAX reversed from the resistance area

- Likely to fall to support level 23675.00.

DAX index recently reversed down the resistance area between the pivotal resistance level 24500.00 (former top of wave 3 from June) and the upper daily Bollinger Band.

The downward reversal from this resistance zone stopped the earlier short-term ABC correction B.

Given the strength of the resistance level 24500.00, DAX index can be expected to fall further to the next support level 23675.00.

GER40 is BullishPrice was in a downtrend, however the bullish divergence with a double bottom reversal formation hints the return of bulls. If previous lower high is broken along with the descending trendline, then we can expect a bullish reversal as per Dow theory. Targets are mentioned on the chart.

Falling towards 50% Fibonacci support?DAX40 (DE40) is falling towards the pivot and could bounce to the pullback resistance.

Pivot: 24,122.25

1st Support: 23,935.80

1st Resistance: 24,622.91

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

KOG - DAXDAX:

Let’s have a quick look at DAX and apply the red boxes to the 4H Chart. We have our bullish above indication which if supported, should give us a move into the 23,400 region initially. That’s the level that will need to break to go higher with our ideal target level being above at the 24,6-700 region before a potential RIP.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

DAX pause at the ATH The DAX remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend.

Support Zone: 24335 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24335 would confirm ongoing upside momentum, with potential targets at:

24800 – initial resistance

24900 – psychological and structural level

25000 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 24335 would weaken the bullish outlook and suggest deeper downside risk toward:

24175 – minor support

24090 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX holds above 24335. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX (Ger40): Defying Global TensionsDespite all this tariff drama, the DAX hit another record high. What gives? Markets seem to be betting that Trump enjoys the threat of tariffs more than the implementation. Some traders are pricing in yet another extension beyond the August 1 deadline.

The DAX is riding momentum from both global AI enthusiasm, thanks to Nvidia’s $4 trillion market cap milestone, and the assumption that European exporters might dodge the worst of Trump’s trade penalties, at least for now. However, this rally is precarious. If a tariff letter hits Brussels, or copper tariffs ripple into industrial demand expectations, we could see a swift correction.

Technically, near term resistance is sitting around. 24,700. However as stated, should sentiment change. A correction back down, to the support level at 24,200, which also aligns with the 50 Fibonacci retracement level, could be on the cards. Or even all the way down to 23,800, aligning with the 88% Fibonacci level.

GER40 Breaks Resistance – Eyes Set on 25,000 The index has broken above the key resistance at 24,367 🔼, turning it into fresh support. This breakout confirms bullish momentum, with strong upward structure and follow-through candles.

Support Levels: 24,367 🔽, 23,718 🔽

Resistance Levels: 25,000 🔼

Bias:

🔼 Bullish: If price holds above 24,367, we may see a continued push toward 25,000.

🔽 Bearish: A drop below 24,367 could invalidate the breakout and shift momentum back to 23,718.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

DAX / GER TIME TO PRINT MONEY ON SHORTTeam, i have not been posting DAX/GER for almost 3-4 weeks

now it is time to attack the DAX.

I have set two different target ,

ensure you take 60% and bring stop loss to BE

I also want to give you the time frame for target to hit.. do not expect today, however we could see the target for tomorrow or early next week

Sometimes i wait for the right moment to trade. DAX is very sophisticated to trade with, but if you have the patience, you can make money on them.

DAX flirts with ATHs againAfter breaking out of the triangle formation a couple of days ago, the DAX is now flirting with the previous record hit in early June at 24490. With Trump's tariffs uncertainty at the forefront again, there is a possibility we could potentially see a double top or a false break reversal formation here, so do watch out for that. However, we will continue to focus on the long side until we see an actual, confirmed, reversal. With that in mind, dip-buying remains the preferred trading strategy.

Key support levels to watch:

24,278, marking yesterday's high

24,176, broken resistance from last week

23,927, the base of this week's breakout

The technical picture would turn bearish in the event we go back below the support trend of the triangle pattern.

In terms of upside targets,

24,750, marking the 127.2% Fib extension of the big drop from March

24,890, marking the 127.2% Fib extension of the most recent drop from June high

25,000, the next big psychological level

By Fawad Razaqzada, market analyst with FOREX.com

Is the Trend Intact? Key Signal Emerging on GER40 4H ChartHey Guys,

We could see a pullback on the GER40 index from the 24,060 level. If that happens, the 23,824 – 23,675 zone could present a potential buying opportunity. The primary trend still points upward, and bullish momentum remains intact.

Also worth noting—the rise in volume is quite striking, which supports my target level of 24,500.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

Elliott Wave Outlook: DAX Set to Rally Higher in Wave 5Since April 7, 2025, the DAX Index has been advancing in a clear impulsive cycle, originating from a low that has set the stage for a structured upward movement. The initial advance, wave 1, concluded at 20468.43. It was followed by a corrective pullback in wave 2, which found support at 19384.39. The subsequent rally in wave 3 was robust, peaking at 24479.42, as depicted on the 1-hour chart. Wave 4 unfolded as a zigzag Elliott Wave pattern, characterized by a decline in wave ((a)) to 23360.16. A recovery in wave ((b)) took place to 23711.73, and a final dip in wave ((c)) to 23047.13, completing the corrective wave 4.

The Index then resumed its upward trajectory in wave 5, structured as an impulse in a lesser degree. From the wave 4 low, wave (i) reached 23481.97. A minor pullback in wave (ii) followed which ended at 23080.29. The rally then continued with wave (iii) peaking at 23812.79, a slight correction in wave (iv) to 23466.73, and the final leg, wave (v), concluding at 241200.82, marking the completion of wave ((i)).

A corrective wave ((ii)) found support at 23620.42, and the Index has since turned higher in wave ((iii)). As long as the pivot low at 23407.13 holds, the DAX is expected to extend its gains, with pullbacks likely finding support in a 3, 7, or 11 swing structure. This analysis suggests continued bullish momentum in the near term, with key support levels providing opportunities for further upside.

DAX: Target Is Up! Long!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 24,193.11 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️