SPX500 trade ideas

20% in 60 daysSince the 90's we have seen many times where the broader market (SPX) has seen a pretty significant pull back, more than 10% and then a rally. Almost every time the market rose more than 20% in 60 days or less has been a good place to take profits. Clearly everything is super bullish right now, and I am not saying this will be the top, I am simply saying, we could experience a correction driven by profit taking. In an uptrend, you want to be a buyer on pull backs, so a pull back could give us another longer term opportunity

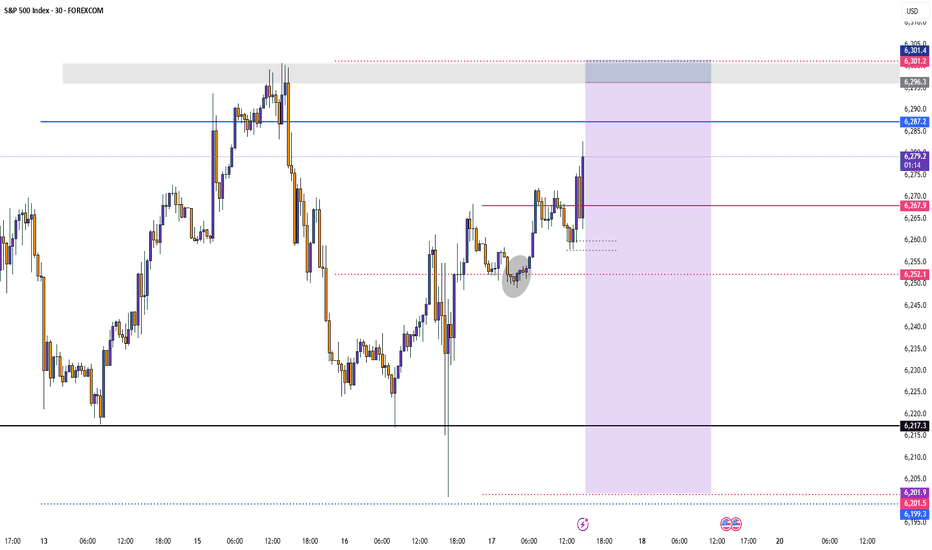

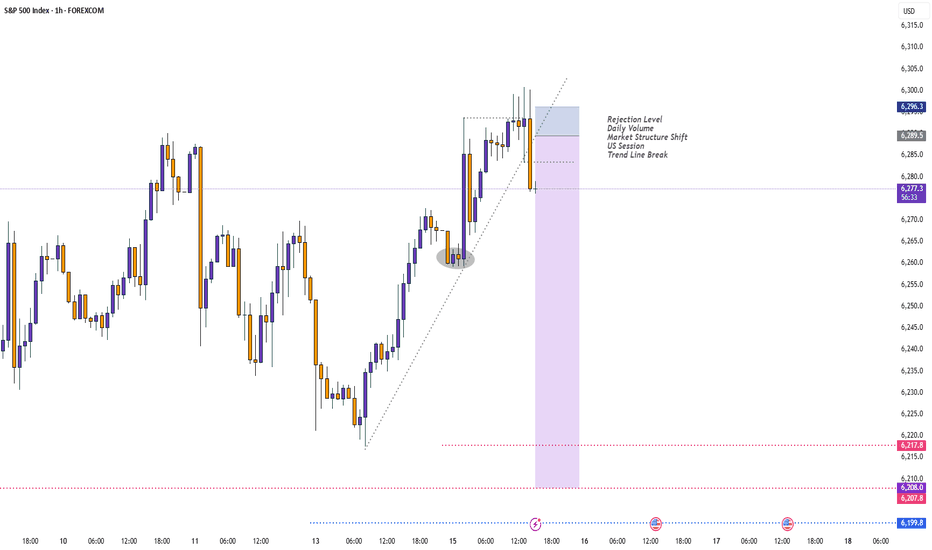

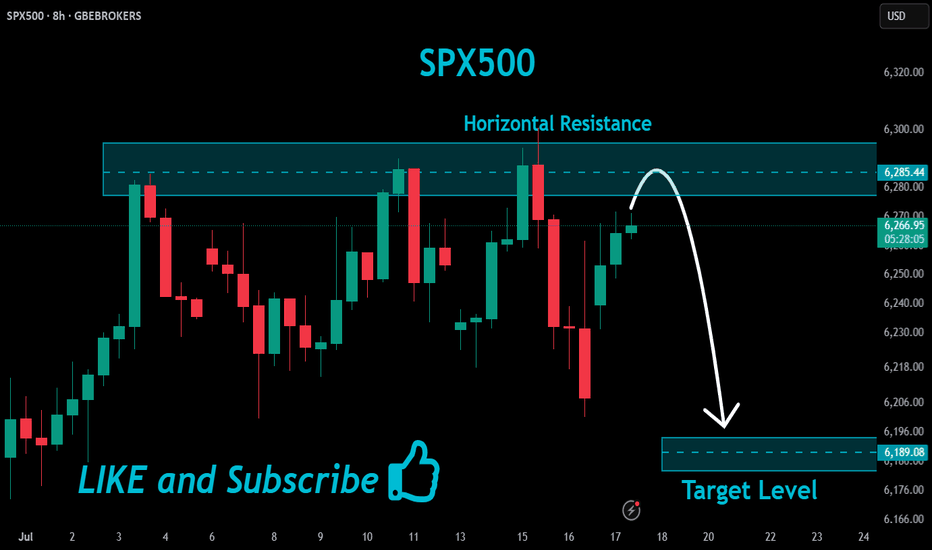

S&P 500 (CASH500) Short - Head and shoulders H1Potential short on S&P 500.

Risk/reward = 3.4

Entry = 6264.9

Stop loss = 6280.3

TP level 1 = 6221.7 (50%)

TP level 2 = 6200.5 (50%)

Need current candle to close back in range at 10.00 for all variables to be met.

Volume exception applied since current candle is the open of European markets.

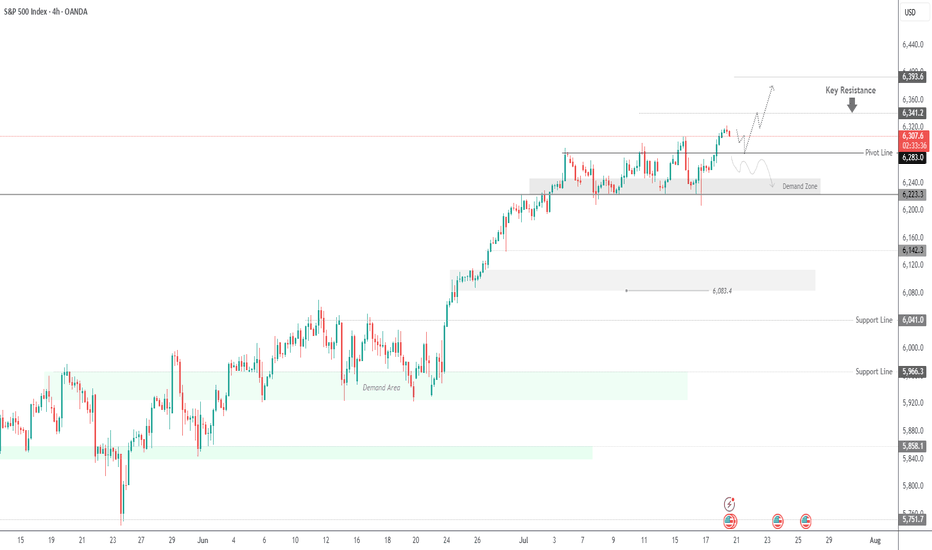

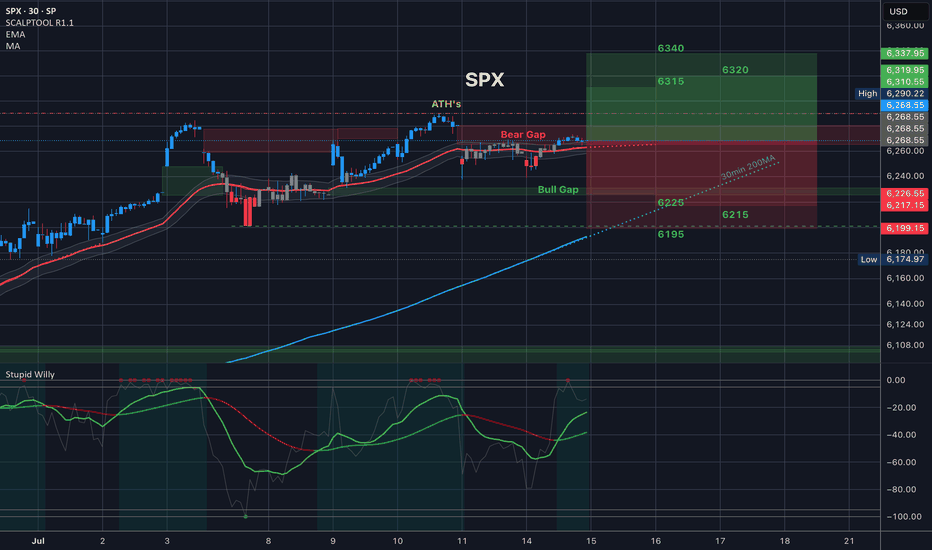

SPX500 Eyes Further Upside After Breaking to New HighSPX500 | Technical Overview

The price continued its bullish momentum after stabilizing above the 6283 support level, as anticipated. It has since posted a new all-time high (ATH) and is currently aiming for the next key resistance at 6341. A confirmed breakout above this level may open the path toward 6393.

On the downside, a break and sustained close below 6283 would shift the structure bearish in the short term, potentially targeting 6223.

Pivot line: 6283

Resistance: 6341 – 6393

Support: 6247 – 6223

previous idea:

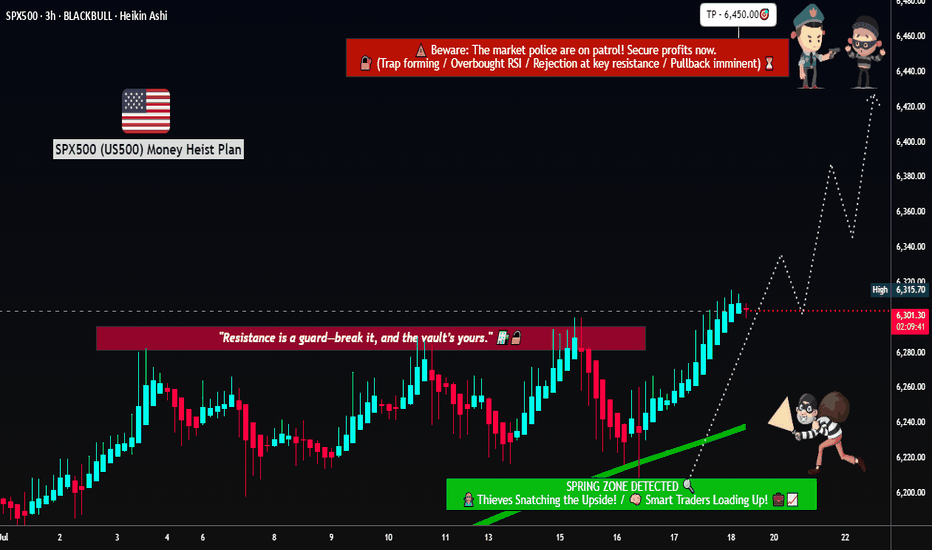

US500 Bulls Assemble | Breakout Heist Strategy📈🚨 MASTER HEIST PLAN: “SPX500 ROBBERY – THIEF TRADING STYLE 🔥💸” 🚨📈

(The Ultimate Long Strategy Blueprint for Smart Day/Swing Traders)

🌍 Greetings to All Market Bandits, Bullish Burglars, and Chart Snipers!

Hola! Bonjour! Ola! Hallo! Marhaba! 🙌

🦹♂️This is your friendly chart thief checking in with the latest SPX500/US500 masterplan!

This isn’t just a trade—it’s a heist 🎯. We’re not here to participate, we’re here to dominate! Welcome to the Thief Trading Style, where we map, trap, and snatch those pips with ruthless precision. 🧠🔍💰

🚀 THIEF TRADE SETUP - SPX500/US500

A mix of technical sniper entries + fundamental black ops analysis = 💸 Maximum Extraction. 💸

🎯 ENTRY PLAN: THE BREAKOUT HEIST

📍Buy Entry Zone: Wait for the clean breakout + candle close above 6270.00.

"The vault opens once we clear that wall. Let the bullish getaway begin!" 💥🚪📈

🛠️Thief Tips for Entry:

Use Buy Stop Orders above resistance levels.

OR layer in Buy Limit Orders near recent pullbacks (15/30m swing zones) using DCA Style (Dollar Cost Average layering like a pro).

Want stealth mode? Set that alert (alarm), and strike when the breakout sings. 🔔🎯

🛑 STOP LOSS – PROTECT THE LOOT

🧨Set your SL smart—beneath the nearest swing low using the 2H timeframe for stronger structure.

💬 “Look, don’t gamble. A thief knows when to run. Set that stop where I showed ya, or risk losin’ the bag.” 💼💣

❗Your SL should reflect your risk per trade, lot size, and number of entries. It’s your getaway plan—don’t mess it up.

💥 TARGETS – WHERE WE CASH OUT

🏴☠️Primary Take Profit (TP1): 6310.00

🏴☠️Secondary Take Profit (TP2): 6370.00

💹 Scalp Traders: Stick to the Long Side Only. Ride the momentum, but use trailing SL to lock it in.

🔍 THIEF FUNDAMENTAL INTEL: WHY THIS IS OUR MOMENT

Current SPX500 bullishness driven by:

✅ Positive macro & geopolitical tailwinds

✅ Institutional positioning (COT reports)

✅ Intermarket analysis showing strong correlations

✅ Momentum building with sentiment and volume

📌 Stay sharp—check all your fundamental reports, news catalysts, and sentiment tools before executing your move. Smart thieves plan every detail. 🎓📊

⚠️ NEWS RELEASE REMINDER

📢 News = Chaos. Don’t get caught in the spray:

🔒Avoid entering trades just before big announcements.

🚀 Use Trailing SL to secure profit if you're already in.

Stay agile. Stay smart. Stay rich. 💼🚁

❤️ SUPPORT THE HEIST – HIT THAT BOOST BUTTON!

👊 Liked the plan? Hit the Boost to join the elite robbery crew.

Every boost fuels the mission. Every like sharpens the strategy. Let's build a team of smart, profitable traders. 🚀💸🔥

🧠 Remember: This is general analysis – not financial advice. Manage your risk like a true thief. Stay updated. Adapt fast. Don't get caught. 🕵️♂️

🎉See you in the next Heist Plan! Keep your tools sharp, your charts cleaner, and your profit bags fatter. 🤑🔥

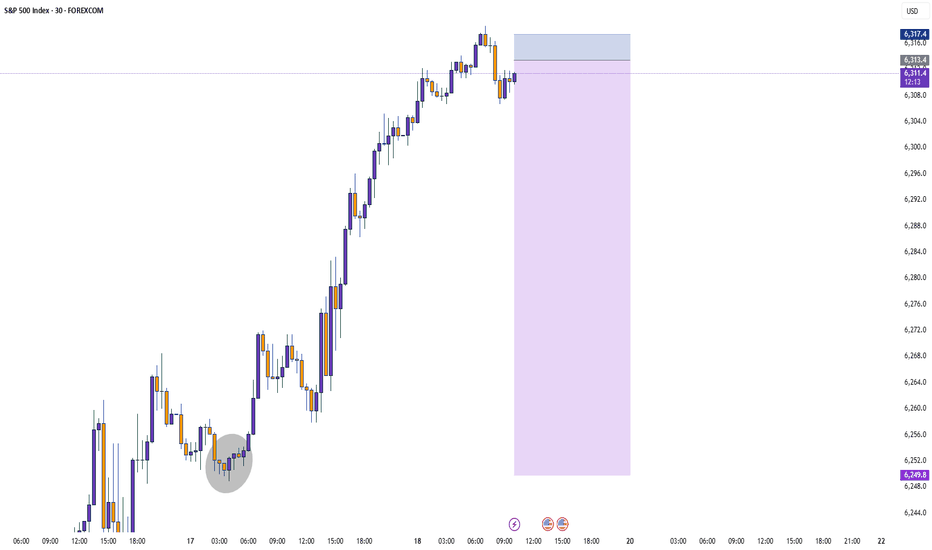

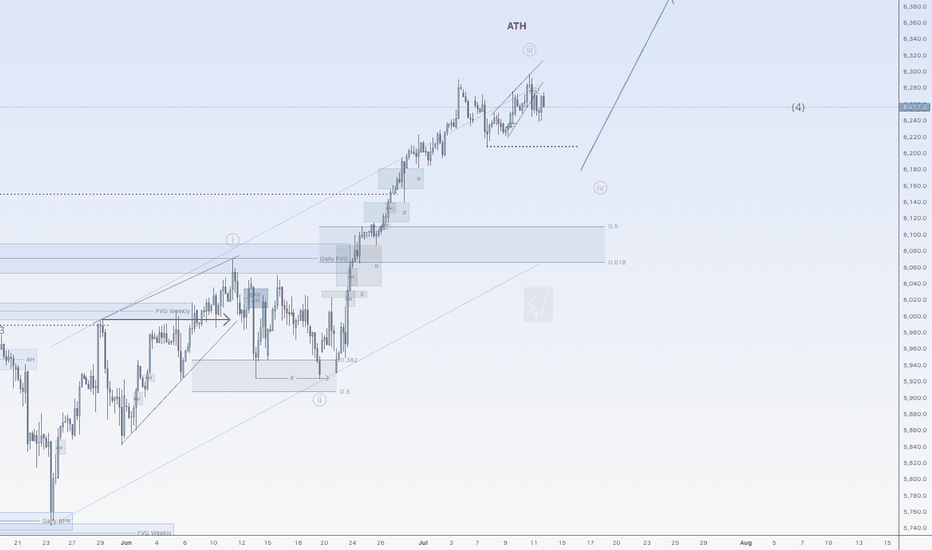

More upside after correction for SPX500USDHi traders,

Last week SPX500USD went a little more up (diagonal) just as I've said in my outlook.

Next week we could see the start of a bigger correction down (grey wave 4) and a break of the dotted trendline. Or the diagonal is a leading diagonal wave 1 and grey wave 3 extends more.

Let's see what the market does and react.

Trade idea: Wait to see if price breaks the dotted trend line (for shorts) or not (for longs).

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Rob the Rally SPX500: Enter Before Resistance Catches You🦹♂️💰**“SPX500 Street Heist” – Thief-Style Robbery Plan for Bulls!**📈💸

(Powered by Thief Trader's Market Robbing Tactics – Scalp | Swing | Day Trade Edition)

🌍Hello, Global Money Hunters!

📣 Salaam, Bonjour, Ola, Hola, Hallo, Marhaba & Welcome to the heist floor! 🎩💼

Thief Trader is back again with a loaded plan to rob the market clean — this time targeting the mighty SPX500 / US500 🎯. Based on a fusion of technical setups, macro sentiment, and the Thief Trading System, we’ve set our sights on the next breakout vault of Wall Street.

🎯 The Gameplan – Heist the Resistance Vault

The index is entering a high-risk resistance barricade — overbought, consolidated, and heavily guarded by bearish robbers (sellers). This is the zone where the market police lurk and trend reversals often get triggered. However, smart thieves always plan with precision.

Here’s the mission briefing:

🔓Entry Zone (Break-in Point)

💥 “The vault is open — grab the bullish loot!”

Enter Long anywhere close to market price or on pullbacks near recent swing lows/highs.

Preferred timeframes: 15-min to 30-min for sniper-level accuracy.

Deploy DCA-style limit orders (layered entries for maximum control).

🛑Stop Loss (Escape Hatch)

Base SL on recent swing low candle wicks on the 4H timeframe.

Suggested: ~6250.00 — but adapt based on your risk appetite, lot size, and position stacking.

📈Target / Loot Location

🎯 Primary Take-Profit: 6450.00

Or… pull out early if you spot resistance fighters guarding the vault.

Use trailing SL to secure gains and manage getaway.

⚡Scalper’s Notice

Only Long-side allowed!

Got big capital? Jump in now.

Running low? Tag along with swing traders and follow the robbery protocol.

Always protect your bag with dynamic trailing stops.

🧠Fundamental Fuel Behind the Plan

Bullish sentiment across major indices

Macro trends, COT positioning, sentiment outlook, and intermarket analysis all greenlit

Geopolitical and Fed tone supportive — tap into real data before entering

👉 Always analyze: News, Fundamentals, Sentiment, COT reports, and macro conditions.

🚨NEWS ZONE ALERT – No Loud Moves!

Avoid entry during major economic news drops

Use trailing SLs to guard profits

Don’t let your open trades get caught in the chaos of news releases!

💥Let’s Boost the Thief Army!

Smash the BOOST button 💖 to power up the robbery crew.

Support the strategy, share the love, and stay ahead of the game using Thief Trading Style. Every trade is a step closer to freedom from financial traps. 🚀💰🎉

📌Disclaimer: This is a general market analysis for educational purposes and should not be considered personal financial advice. Please evaluate your own risk management strategy before placing trades.

📌Markets shift fast — stay flexible, stay alert, and always rob smart.

🔥Stay locked in for the next heist plan — Thief Trader signing off for now…

💸💼📈 Trade smart. Rob harder. 🤑🦹♂️📊

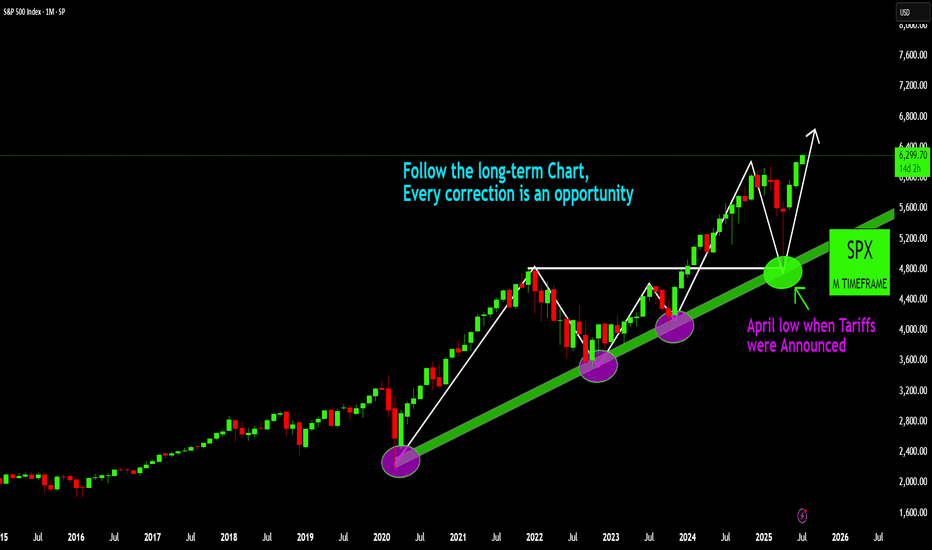

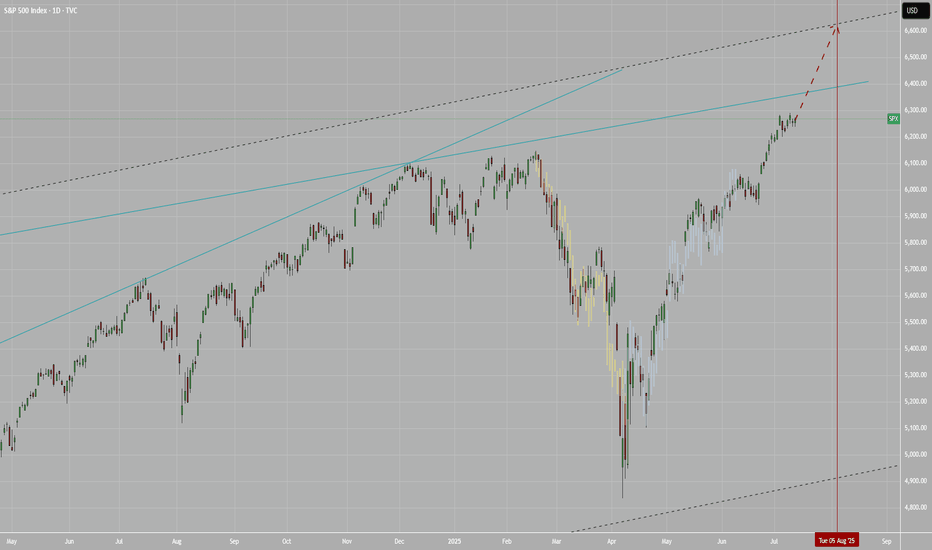

SPX: Long-Term Strength and Opportunity

SPX: Long-Term Strength and Opportunity

The S&P 500 (SPX) on this monthly timeframe clearly illustrates a powerful long-term uptrend, where each significant pullback has consistently presented a valuable buying opportunity. Most recently, the market effectively retested and bounced off the established long-term trendline, even amidst geopolitical concerns such as the April low experienced when tariffs were announced, underscoring the underlying bullish resilience. This sustained trajectory suggests continued upward momentum, reaffirming the 'buy the dip' strategy within this robust market environment.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

US 500 – A New Record Peak or Reversal in the Week AheadSo far in July, the US 500 has recorded multiple all-time highs on its way to an eventual peak of 6294 on Thursday (July 10th), from which it finally succumbed to some profit taking into the weekend, leading to a small Friday sell off to close at 6255 (-0.4%).

Along the way traders have ignored mixed US economic data, and more importantly they have, for the most part, shrugged off President Trump’s increasingly aggressive approach to tariffs, choosing instead to focus on economic resilience, renewed AI optimism and an improving outlook for the Q2 corporate earnings season that kicks fully into gear in the coming days.

In terms of tariffs, the fact that there is now a new August 1st deadline to concentrate on may be taking away some of the immediate urgency for the announcement of trade deals, although these issues still remain important and on-going, highlighted by President Trump's weekend social media announcement of 30% tariffs on the EU and Mexico, if a better deal cant be reached in the next 3 weeks.

With regard to corporate earnings, the major US banks like JP Morgan (Tuesday before the open) and Bank of America (Wednesday before the open) report this week. Both company’s share prices have seen strong gains since the April lows, so traders will be eagerly awaiting their actual numbers. They will also be keen to hear the thoughts of the bank CEOs on future earnings, bad debt provisions and the potential impact of Trump’s tariffs on the US economy moving forward. Only last week, Jamie Dimon, CEO of JP Morgan, warned market complacency towards potential tariff risks.

In terms of scheduled economic data. Tuesday’s US CPI (1330 BST) and Wednesday’s PPI release (1330 BST) stand out. Traders are sensitive to US inflation updates and have been watching over the last several months for signs that tariffs are pushing up prices. So far this hasn’t been the case but these new releases may tell a different story.

All of these issues could impact risk sentiment and the direction of the US 500 index in the next 5 trading days. Certainly, the early open has been impacted by President Trump's weekend tariff announcement, with the US 500 currently down 0.46% at 6227 (0800 BST).

The technical outlook could also be an important factor in determining price moves.

Technical Update: Assessing the Move to A New Record High

Last week appears to have seen a slowing in the speed of the recent price strength, but a new all-time high was still posted at 6294 on Thursday. It could be argued that this activity maintains what is still a more constructive pattern of higher price highs and higher price lows that have materialised since the April 7th downside extreme of 4799.

However, there is no guarantee this price activity will continue to see new all-time highs posted, so we need to be aware of potential support and resistance levels that may influence price activity.

Possible Support Levels:

If last week’s possible slowing in upside price momentum develops into a new phase of price weakness, a support level that traders might now be watching could be 6148.

This 6148 level is equal to both the 38.2% Fibonacci retracement of June 23rd to July 10th strength and the current level of the rising Bollinger mid-average. Closes below 6148 might suggest a more extended phase of weakness back to 6058, the lower 61.8% Fibonacci retracement, possibly further if this in turn gives way.

Possible Resistance Levels:

Having been capped by the 6294 all-time high last week, sellers may continue to be found at this level, so this might prove to be the first potential resistance if fresh attempts at price strength over the coming week develop.

Closing defence of 6294 may need to be watched if challenged, as successful breaks above this level might suggest an extension of the uptrend pattern currently evident in price activity. Such closing breaks higher may well suggest price strength towards 6418, the 200% Fibonacci extension level of the recent price decline.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

3 month rally just not sustainable SPXThe economy is not doing horribly, but many are citing lagging indicators and there's signs of that this level is just not sustainable. Current levels abouve 9, 50, 200 SMAs! Seriously, what's great that isn't artificially propped up. Highest bankruptcies, highest level of housing unaffordability, dollar losing over 10% of value YTY, unemployment #s but that's bc people are giving up and it's a lagging indicator, hardship withdrawals up, defaults across the board up at over 10 year levels, banks with historic unrealized losses on their books (how much did Wells Fargo drop the other day!), yields going up up up. The Champage effect will end and many will get wiped out, unfortunately. Not being a dooms day person, but this economy is overheated and it's mostly driven by tech, which is over represented in the S&P. VIX is pretty low right now, would be an interesting play when it starts spiking (and it will!) when the deck starts falling apart.

Best of luck and always do your own due diligence.

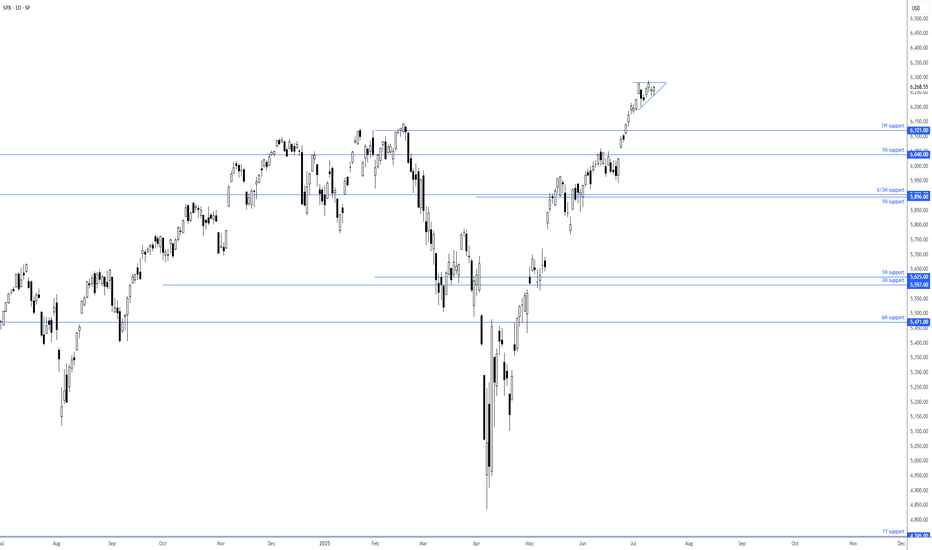

S&P 500 consolidating at all-time highsOf late, we have seen price action on the S&P 500 consolidate around all-time highs of 6,290 and is on track to form a small ascending triangle. The nearest support to note resides at the 1W level of 6,121, closely shadowed by a 1M support from 6,040.

Based on the current technical picture, this clearly remains a buyers’ market.

- FP Markets Research Team

US500 trending higher as the US earnings season gains momentum. Fundamental

US500 is pushing higher as the US 2nd quarter earnings season gains momentum under President Trump's second administration amidst tariffs. Big tech earnings will have a significant impact on the index price action.

Technical

Bullish momentum is gaining as the uptrend remains strong. The RSI is approaching the overbought region however a break above the 6,333 key resistance level sees the index trading at all time highs with resistance levels at 6,475 and 6,670. A move below 6,230 sees a possible move towards supports at 6,150, 6,080 and subsequently 6,000.

by Terence Hove, Senior Financial Markets Strategist at Exness

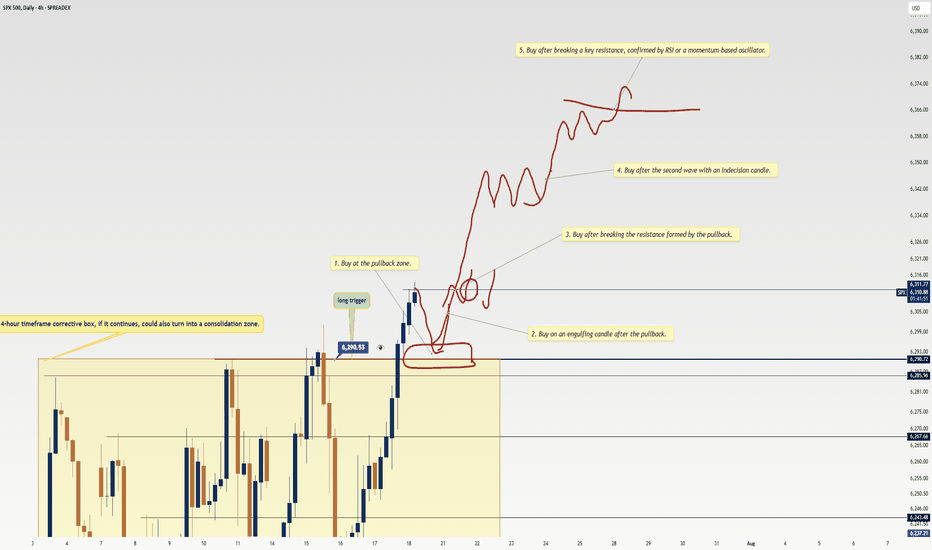

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

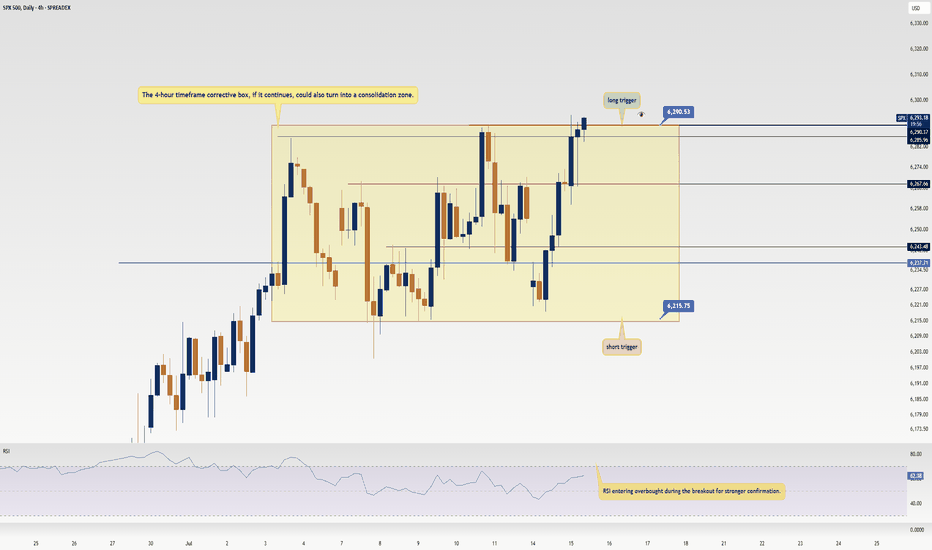

SPX500 Update: Monster Trigger Ready to Launch!Welcome back, traders, it’s Skeptic from Skeptic Lab! 😎 With news of the unemployment rate rising, stock and crypto markets have been surging hard, and right now, we’ve got a killer trigger on SPX500 you don’t want to miss. Its breakout could spark the next major bullish leg. Let’s dive into the Daily and 4-hour timeframes to unpack this setup. here’s the play:

✔️ Daily Timeframe:

After a strong rally, SPX500 hit an all-time high (ATH) at 5,249.14 before entering a deep correction. Here’s what many traders miss: support/resistance levels aren’t static—they shift over time. The resistance that was at 6,146.89 has now climbed to 6,290. Breaking 6,290 signals the start of a major bullish trend after 146 days of correction. This is our primary long trigger.

📊 4-Hour Timeframe (Futures Triggers):

Long Trigger: After a solid uptrend with strong momentum, we entered a time-based correction within a box pattern. Breaking the box ceiling at 6,290 is the long trigger, aligning with the Daily breakout.

Short Trigger: Breaking the box floor would trigger a short, but this goes against the trend, so stop-loss risk is higher, and your win rate could take a hit—stay cautious.

📉 Key Insight: The 6,290 breakout is the big move to watch, fueled by market momentum from the unemployment news. Shorts are riskier due to the bullish trend, so prioritize longs with volume confirmation.

🔔 Confirmation: For longs, confirm the 6,290 break with RSI entering overbought.Risk management is critical—cap risk at 1%–2% per trade to survive the market’s swings.

🔼 I’ll update if the structure shifts! Thanks for vibing with this analysis! <3

💬 Let’s Talk!

Which SPX500 trigger are you locked on? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! ✌️

The S&P 500 Is Hitting New Highs, But Its Charts Look MixedThe S&P 500 SP:SPX has made a series of new all-time closing and intra-day highs in recent days as Wall Street staged a remarkable comeback from the April lows that followed President Donald Trump's announcement of "Liberation Day" tariffs. Does fundamental and technical analysis say the key index could go higher from here ... or pull back?

Let's check it out:

The S&P 500's Fundamental Analysis

The SPX fell more than 21% intraday in less than seven weeks between its Feb. 19 peak and its April 7 low as Trump rolled out his plan for big tariffs on foreign imports.

Many investors feared that high import duties -- coupled with foreign retaliatory tariffs on American exports -- would boost U.S. inflation and unemployment at the same time, creating "stagflation."

But about a week after Trump rolled out the "Liberation Day" tariffs on April 2, the president paused much of the plan for 90 days to allow for trade talks with other countries.

Risk-on assets quickly started to come back as Wall Street began to think deals with trading partners might blossom. So far, only the United Kingdom, China and Vietnam have played ball, but that's been good enough for many investors.

Meanwhile, consumer-level U.S. inflation has largely been beaten back (at least for now), and Trump has had other economic victories as well.

For example, his "Big, Beautiful Bill" of tax cuts and spending changes recently passed into law, offering what many see as multiple pro-growth provisions.

True, the Congressional Budget Office warned that the Big, Beautiful Bill could add some $3.3 trillion to the U.S. government's already huge deficits over the next decade. However, the agency's projections didn't include $2.8 trillion of expected revenues over the next 10 years from Trump's tariffs.

The CBO also chose to model almost no economic growth over the next decade, which probably isn't very realistic.

Of course, it's still unclear whether Wall Street has already priced in all of the "Big, Beautiful Bill" potential positives, or whether the measure's tax cuts and deregulation will have their desired economic effects.

Similarly, we don't know whether there are any more bilateral trade deals around the corner, or whether the Federal Reserve will soon cut interest rates -- which could boost stocks by making bond and money-market yields less attractive.

The S&P 500's Technical Analysis

Now let's look at the SPX's chart going back some four months and running through midday Tuesday:

Readers will see that the S&P 500 has been in a clear uptrend for the past three months, as denoted by the orange- and purple-shaded areas above.

The index has colored neatly within the lines, finding support at the lower trendline in mid-June. Additionally, support came at the S&P 500's 21-day Exponential Moving average, or "EMA, marked with a green line above.

More recently, the S&P 500 also enjoyed the benefits of what we call a "golden cross." That's when the index's 50-day Simple Moving Average (or "SMA," marked with a blue line) crosses above a rising 200-day SMA (marked with a red line). That's historically a bullish technical signal for the index.

The S&P 500 also experienced "Day One" bullish reversals on May 27 and June 23. Those "Day Ones" were then confirmed on June 3 and June 26, respectively.

A "Day One" reversal occurs when an index reversed direction up or down on increased trading volume, followed by a "Confirmation Day" that moves the market in the same direction as the reversal on increased volume as well. That combination typically signifies changes in an index's short-term trend.

Now, astute readers might notice that the S&P 500's June 23 "Day One" reversal occurred on decreased day-over-day trading volume.

However, that's misleading because the market day just prior to June 23 was a "triple-witching" day, which technical analysts therefore discard.

Readers should also understand that there must be at least a one-day pause between a "Day One" reversal and a "Confirmation Day." Otherwise, technical analysts will consider both days to represent one move, and we wouldn't have a volume-based technical confirmation.

Next, let's look at the SPX's chart going back to January and running through midday Tuesday:

This chart shows that the S&P 500 is in danger of putting in what's called a "Double Top" pattern of bearish reversal, denoted with the red boxes above marked "Top 1" and "Top 2." With all that's going on politically and geopolitically, that's a concern.

On top of that, Q2 earnings season begins next week, and analysts' consensus is for rather paltry 5% year-over-year earnings growth for the S&P 500 component companies as a whole.

In addition, the S&P 500 has a conflicting Relative Strength Index ("RSI") and Moving Average Convergence Divergence indicator (or "MACD").

The index's RSI, marked with gray lines at the above chart's top, is practically at technically overbought levels.

But at the same time, the daily MACD (marked with black and gold lines and blue bars at the chart's bottom) is showing signs of weakness.

The histogram of S&P 500's 9-day EMA (the blue bars) is now below the zero-bound, which is historically a short-term bearish technical signal.

On top of that, the 12-day EMA (the black line) is threatening to cross under the 26-day EMA (the gold line). This hasn't happened yet, but would be a short-term bearish signal if it did.

Add it all up and the S&P 500 is showing a mixed technical picture right now despite trading at or close to all-time record highs.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in S&P 500-related ETFs or mutual funds at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

Major LowI'm buying puts expiring on October 31st, All Hallow's Eve.

I'll give price room to keep melting up to 666 at the farthest, that is my stop level. If we breach that price, then just know that tech is unstoppable and Artificial Intelligence is the Mark of the Beast.

If the market doesn't drop here, then the sky is the limit.