SPX500 trade ideas

S&P 500 hits fresh records: Levels to watchBreaking its February peak, the S&P 500 has joined the Nasdaq 100 in hitting a new record high this week. The latest gains came on the back of a sharp de-escalation in the Middle East and mounting pressure on the Fed to cut rates.

They question is whether it will kick on from here or we go back lower given that trade uncertainty is still unresolved. Indeed, there’s the upcoming 9 July deadline, when the current reciprocal tariff truce is due to expire. Unless it’s extended—or replaced by something more concrete—we could be in for another wave of trade tensions.

It is also worth remembering the ever-looming US fiscal showdown. Trump’s much-touted spending bill—nicknamed the “One Big Beautiful Bill”—is targeting a Senate vote by the 4th of July. If passed, it could reignite concerns about ballooning deficits and inflationary pressure.

Anyway, from a purely technical analysis point of view, the path of least resistance continues to remain to the upside. Thus, we will concentrate on dip buying strategy than looking for a potential top - until markets make lower lows and lower highs again.

With that in mind, some of the key support levels to watch include the following:

6069 - the mid-June high, which may now turn into support on a potential re-test from above

6000 - this marks the launch pad of the latest rally and marks the 21-day exponential average

5908 - this week's low, now the line in the sand. It wouldn’t make sense for the market to go below this level if the trend is still bullish.

Meanwhile, on the upside:

6169 is the first target, marking the 161.8% Fib extension of the most recent downswing

6200 is the next logical upside target given that this is the next round handle above February’s peak of 6148

By Fawad Razaqzada, market analyst with FOREX.com

July 9th EU-US tariff deal, what will happen to S&P500?Timeline & Context

-The U.S. initially implemented a 10% baseline tariff on most imports (April 5), with potential spike to 50% for EU goods on July 9 unless a deal is struck.

-On June 26, Macron warned that if U.S. keeps a 10% tariff, the EU will impose equivalent retaliatory levies.

-EU offer of “zero-for-zero” (Macron, von der Leyen) remains on the table, though Washington reportedly resists.

How Markets May React

If a 10%–10% deal is struck (U.S. keeps 10%, EU matches):

-Markets will likely breathe a sigh of relief—clearing headline risk.

-Expect a moderate rally, perhaps +1–3% in the S\&P 500, as tariff uncertainty diminishes.

-Economists note past discussion: when the EU delay hit May, S\&P futures jumped ~2%.

If they agree to Macron’s “zero-for-zero” proposal:

-That would be a bullish surprise—tariffs completely lifted.

-Market response could range +3–5%, though EU has indicated U.S. pushback on full zerozero .

-Analysts warn clarity isn’t always calm: the S\&P is already priced above fundamentals—choppy reactions still possible .

If the pause lapses with no EU agreement:

-U.S. could enforce 50% tariffs; EU likely retaliates.

-Risks: recession fears in EU, U.S. inflation spike so stocks will likely fall.

-Bank strategists forecast flat S\&P (5,900), but warn of volatility range 5,600–6,000 based on trade policy surprises.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

SPX : A reminderJust a follow-up reminder of what was shared on 18 May.

Price is moving as anticipated - soon to enter the blow-off zone.

Be careful. Be bold.

Over on the EURUSD - what can we expect? Actually, I can see that the price is also moving along - a bit challenging to know when to move in, until .........

Good luck.

Hellena | SPX500 (4H): LONG resistance area of 6176 (Wave 1).Colleagues, the previous forecast remains essentially unchanged, and the target is still 6176, but I think the forecast can be updated because the price has been flat for quite some time.

I still expect the upward movement to continue in the large wave “1” and in the medium-order wave “5”.

A small correction to the support area of 5873 is possible.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

SPX500 Macro Fibonacci Projection – Eyeing 7190+ 🗓️ Posted by Wavervanir International LLC | June 26, 2025

The S&P 500 continues to respect key Fibonacci zones on the macro scale. After a strong recovery from the recent correction near the 0.5–0.618 retracement region (4800–5100), price is now hovering near critical confluence at the 1.0 level (~6150).

We’re tracking a bullish extension path toward 1.382 and 1.618 Fibonacci levels, which gives us a primary upside target zone between 7,190 and 7,795 — aligning with the projected long-term wave expansion. This structure favors a continued institutional accumulation phase, supported by macroeconomic resilience and liquidity conditions.

🔶 Key Levels to Watch:

Major Support: 4838.28 (0.5 Fib Retest)

Immediate Resistance: 6170–6200

Target Range: 7190.71 → 7795.41

🧠 Bias remains bullish unless price breaks back below 5830 with volume.

This is not financial advice. Shared for educational and strategic insights.

Let me know your thoughts, traders!

—

#SPX500 #Fibonacci #WaverVanir #MacroTrends #StockMarket2025 #QuantitativeAnalysis

S&P 500 , UPDATE CHART Uptrend

I closed all my open positions when the price was near the All-Time High (ATH) and observed a bearish candle at the end of June 11th. Now, the chart is attempting to break the resistance (S/R) level again. However, I've noticed a divergence between the main chart and the Awesome Oscillator (AO), which leads me to believe we will either see a correction below this level or a pullback after a potential breakout. I am waiting for one of these scenarios to materialize before re-entering with new buying positions.

S&P 500 - Fibonacci Resistance Intermediate wave (5) up from the 04/07/25 bottom could be nearing completion.

Minor wave 5 of (5) is close to a Fibonacci relationship with Minor wave 1.

Using leeway around the 6,208 target gives a broad zone of 6,175 to 6,220. The SPX could reach this zone on 06/27/25.

52 W hi Capitalize on the around-the-clock liquidity of S&P 500 futures , and take advantage of one of the most efficient and cost-effective ways to gain market exposure to a broad-based, capitalization-weighted index that tracks 500 of the largest companies of the US economy

they'll losing they pants. we're selling gang

!!!!!!!!! Lol

Is Now a Good Time to Invest in the S&P 500? Is Now a Good Time to Invest in the S&P 500?

The chart shows the S&P 500 in a long-term upward trend, with clear channels indicating zones from "extremely cheap" (bottom green line) to "extremely expensive" (top red line). Currently, the index is trading near the upper part of the channel, in the "expensive" to "extremely expensive" area.

What Does This Mean for Investors?

The current price level suggests the S&P 500 is expensive compared to its historical trend, increasing the risk of a short-term correction.

Historically, buying near the top of such channels has offered less margin of safety and a higher probability of pullbacks in the following months.

Investment idea

It is a good time to start investing gradually (using a dollar-cost averaging strategy, investing a fixed amount each month) rather than making a lump-sum, “all-in” investment with your savings.

This approach allows you to benefit from long-term market growth while reducing the risk of entering at a market peak.

The risks currently outweigh the potential short-term gains, and we could see better prices in the coming months.

In summary:

Now is not the time to go all-in on the S&P 500. Gradually investing each month is a sensible approach, given the elevated risk of a correction and the possibility of better entry points ahead.

Bearish Wolfewave set upPrice has gone above the 1-3 line.

Short signal is when price enters back below the 1-3 line.

Target will be the 1-4 line.

Alternative targets are the magic lines.

An earlier entry is when the hourly SAR moves above price.

Earlier clues could be seen on the shorter timeframes.

Patterns can fail.

Do your own due diligence.

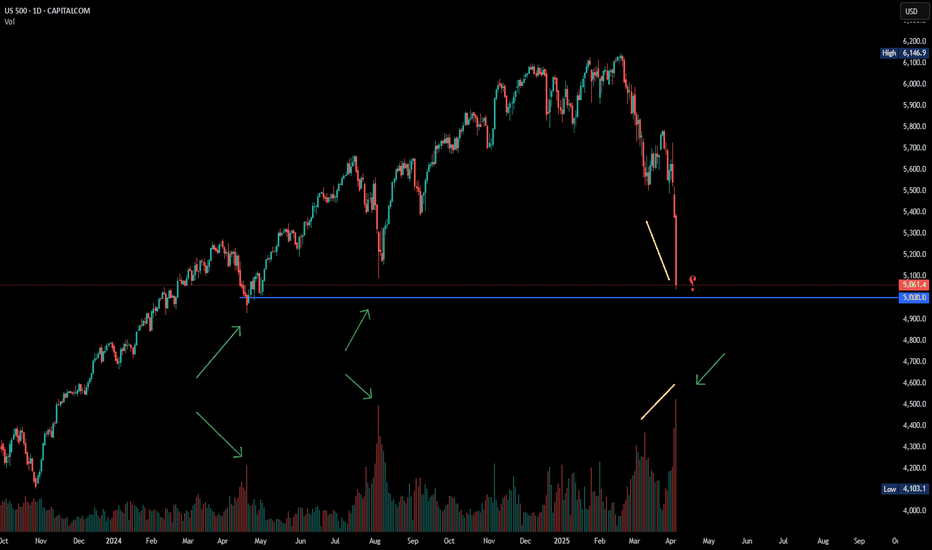

Market crash looming - Fractal Echo of 2007 - 2025 S&P 500 In what other case could the "market" be here if it wasn't centrally rigged?

Geopolitics aside. The 2025 vs. 2007 numerological equivalence ("9" year) shows the power of 9 taking over: the end of a rigged bull market.

Chart overlays the S&P 500 price action from 2023–2025 (white line) with that of the 2006–2008 pre-GFC period (red line), highlighting an uncanny fractal similarity in structure, tempo, and momentum. The visual suggests that 2025 (numerologically marked as a “9” year, like 2007) may be echoing the same setup seen before the 2008 financial crisis: just massively worse.

S&P500 Bullish breakout support at 6040 The US dollar hit a three-year low and Treasury yields declined after reports suggested Donald Trump may replace Fed Chair Jerome Powell earlier than expected. Investors interpreted this as a sign that rate cuts could come sooner, adding uncertainty to the outlook for the dollar and US bonds—already under pressure from tariff concerns and a growing fiscal deficit.

Oil Sector:

Shell ruled out a takeover bid for BP, putting to rest speculation of a potential mega-merger between the two energy giants. Despite BP's weak stock performance and activist pressure, Shell appears unwilling to pursue a deal.

Corporate Highlights:

Nvidia shares hit a record high, once again becoming the world’s most valuable company.

Xiaomi launched its first electric SUV, the YU7, aiming to challenge Tesla’s Model Y.

Shell denied reports of merger talks with BP, reaffirming its current strategy focus.

Key Support and Resistance Levels

Resistance Level 1: 6145

Resistance Level 2: 6178

Resistance Level 3: 6210

Support Level 1: 6040

Support Level 2: 6010

Support Level 3: 5978

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SPX500 Holds Above 6,098 | Bullish Bias Toward ATH at 6,143OANDA:SPX500USD OVERVIEW

S&P 500 Futures Subdued After Near-Record Close | Market Eyes Powell’s Comments

U.S. stock futures were muted on Wednesday after the S&P 500 closed near an all-time high, following signals from Israel and Iran that their air conflict has ended.

Investors now await further comments from Fed Chair Jerome Powell for clues on the monetary policy outlook.

TECHNICAL OUTLOOK – SPX500

The price remains in a bullish trend as long as it trades above 6,098, with upside potential toward the ATH at 6,143.

However, a 1H or 4H candle close below 6,098 would likely trigger a bearish correction toward 6,056 and 6,041.

Pivot Level: 6,098

Resistance Levels: 6,143 → 6,175 → 6,210

Support Levels: 6,066 → 6,041