Look there is our bottom :)I loved my title :) haha if you're reading this: I intrigued you! And I made you read it. ☺️ thankyou!

Ok, This is what I think about why we might be near the bottom.

The 200 EMA on a weekly scale has been a very selective indicator to indicate this. Above, you can see how the chart touches the candle when the market is oversold (as indicated by RSI below). You can see that it repeats itself in sharp, spike-like, and short-term decline: marked by the yellow circles on the chart.

And finally, the volume indicates, with blue dot lines, the high and medium volume levels. There's no hay below. And we just entered HIGH :) This is going to get even more interesting... and sharp 😜 ✌🏼

SPXM trade ideas

So here’s what I’m doing: Not Panicking.This analysis is provided by Eden Bradfeld at BlackBull Research.

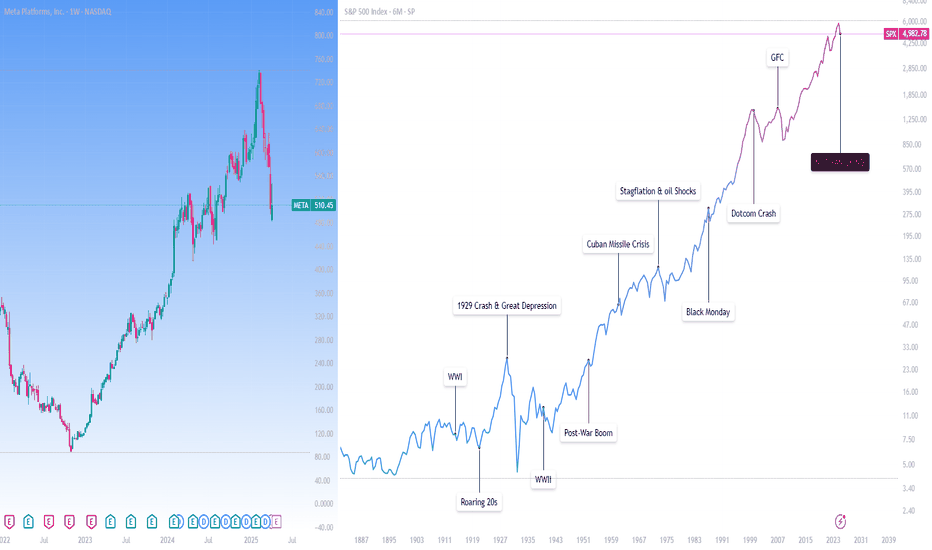

Listen, the US has survived the depression of WWI, the Great Depression, the depression of WWII, oil shocks, the dot com bubble, the GFC, the COVID-sell off. It’ll likely survive this.

In the scope of history, that $1 survived very well indeed. Panicking and running for the hills does not do so well. Winston Churchill was a great and flawed man but a terrible investor; he bought and sold shares prior to the 1929 crash in such speculative investments as mining companies, railways, and so on — most of them lost money (hence why Churchill continued to write at such a pace — to fund his Champagne-and-spec stock lifestyle). Hetty Green, on the other hand, (known as the “Queen of Wall Street”, managed to do very well her time — her quote?

I buy when things are low and no one wants them. I keep them until they go up, and people are crazy to get them.

Now, that’s something I can get behind.

Nobody wanted Meta a few years ago. I wrote an internal memo, close to its plummet in ‘22 (it got to $99 or so a share!). I wrote this:

ii) Yet what if we were to tell about about a company with this set of heuristics? Let’s call it “Company A”

Company A has a 31% return on equity and a 20% return on capital.

It has a net income margin of 37% and a FCF margin of 21%

Its income has a compounded annual growth rate over the last 5 years of 41%

If we add in numbers, now, let’s say the net income for 2020 was $29 billion, and $10 billion of that was used to repurchase stock from shareholders?

Let’s say the unlevered FCF is around $6 billion per quarter, and let’s say the debt to equity ratio is about 9x.

In other words, Company A is grows at a quick clip, and has done sustainably for the majority of its life. Its return on capital and return on equity would make any investor happy. Its FCF is an absolute machine.

Would you buy Company A?

Company A was Meta . You would’ve roughly made 4x or 5x’d your money if you’d bought around then. The point is, the fundamentals of a business matter, and right now there a quite a few exceptional businesses with good fundamentals trading at a good price. Alphabet (Google) trades at ~16x earnings. LVMH trades at ~18x earnings. And so on. Brown-Forman trades at ~15x earnings. These are all “inevitables” — Google will continue to be a dominant advertising platform, LVMH will continue to sell luxury, and Brown-Forman will continue to sell Jack Daniel’s and so on.

I talked to my ma in the weekend. She is not really a share person. Her portfolio is a bunch of “inevitables”. It’s done very well. She said “aren’t you worried about this stock market?”, and I said “You love supermarket shopping, Mum. If you see something at a 25% discount you buy it. You come home, and you’re delighted that you found some mince on special²”

She was like, “oh, that makes sense”.

The problem is you have a lot of people looking at charts and catching worry that the world will end. The world, I am delighted to say, has a magnificent disposition to carry on.

SPX500 – Nailed the Drop, Now Time to Fly?We’ve been calling for a decline—and the market delivered exactly as forecasted.

✅ 100% accuracy on the previous moves.

Now the structure is shifting, and signs are pointing to a strong rebound.

Wave count, momentum, and price action all align for the next bullish leg.

Time to flip the script. See you on the other side. 📈

[S&P500] 2008-Style Collapse in MotionI believe we are witnessing the early stages of a 2008-style crash, though this one will unfold more swiftly and catch many by surprise. The crash will likely test the COVID-era lows, and once the panic subsides, a recovery toward new highs will follow.

FUNDAMENTAL REASONS

After the COVID-crash recovery, the market became significantly overbought, and a pullback was inevitable—such is the nature of markets. Trump’s tariffs have provided a convenient excuse for profit-taking. While the tariffs didn’t directly cause the crash, they served as a much-needed catalyst. What might have been a typical bull market pullback, however, could escalate into full-blown panic.

Why? Index funds.

For the past decade, there has been near-religious advocacy for investing solely in low-cost index funds. This extraordinary delusion has overtaken investors’ collective consciousness—the belief that no one can beat the S&P 500, nor should they try. The most rational choice, then, becomes focusing on your career or business and parking your money in index funds. After all, if the game can’t be beaten, why bother playing? This logic resonates with rational index fund buyers—many of whom lack market experience and have never been tested in the trenches of a downturn. They assume they’re in it for the long haul, unbothered by pullbacks, confident they can hold through volatility. It’s a sound and logical stance.

But will they hold? It’s easy to stay committed when the market is rising. When losses mount, however, the limbic system overrides rational thought, thrusting you into survival mode. You begin calculating how many years of work you’ve “lost,” lamenting that you could have bought a house if you’d sold at the peak, or watching your children’s college fund evaporate. Sleepless nights follow, compounded by a barrage of negative news. Eventually, exhaustion sets in, and in a desperate bid to salvage what remains, you hit the sell button.

With so many unsophisticated investors—who have never endured a true market panic—holding portfolios dominated by index funds, a negative feedback loop emerges. The further the market falls, the more people question their strategy and sell. This cycle intensifies until the panic is overdone, weak hands are shaken out, and the market stabilizes. It’s a tale as old as markets themselves, though today’s index fund evangelists have yet to experience it firsthand.

TECHNICAL REASONS

On the monthly chart, a clear and potent triple RSI divergence stands out. This indicates the market is severely overbought and has been struggling to make new highs.

While technical analysis rarely delivers definitive signals and can often be ambiguous, a triple RSI divergence on a monthly chart is as strong as it gets. Monthly charts of high-market-cap indices are immune to manipulation and short-term noise—it would take an infinite amount of capital to artificially “draw” such a pattern.

The 2021-2022 pullback was an Elliott Wave impulsive wave down (a Leading Diagonal). In Elliott Wave Theory, impulsive waves mark either the final leg of a correction or the first wave of a new trend. A Leading Diagonal almost always signals the latter—meaning another impulsive wave in the same direction is likely to follow.

The 2022-2025 bull market, meanwhile, has proven to be an ABC corrective wave up within the broader trend. This suggests the bull run wasn’t a continuation of the prior uptrend but rather an extended correction that pushed to new highs.

Thus, the leading diagonal down foreshadows another impulsive wave lower, and the corrective wave up confirms this trajectory. Since March 2025, the market has entered free-fall mode—precisely what one would expect following an upward corrective wave.

This sets the stage for a high-probability Elliott Wave Expanding Flat pattern. What’s unfolding now is an impulsive wave down that should, at minimum, retest the 2022 low. If panic takes hold, however, the decline won’t find a floor until it hits a major support level—namely, the 200-month moving average (MA200 Monthly), which sits precisely at the COVID bottom. Should that occur, the magnitude of the drop would rival the 2008 crash.

June 2026 Sp500 will be at 7000 pipsThis is a corrective move. Trump wanted this to deal with the US debt. Everything is smoke a Trump crash. Nothing else.

In June 2026 Sp500 will top at 7000 pips in a massive EW 5.

Now we are in EW 4. It will take some time to settle the dust as you can see.

Be ready, because after Sp500 bottoms out around 4700-4900 pips we will see a MOASS in the next year.

After that, be ready, as well, to see a massive crash to 2500 pips that we will see at the end of 2028.

Could the price bounce from here?S&P500 is falling towards the support level which is an overlap support that lines up with the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 4,963.98

Why we like it:

There is an overlap support level that lines up with the 61.8% Fibonacci retracement.

Stop loss: 4,800.67

Why we like it:

There is a pullback support level.

Take profit: 5,158.53

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Stocks well off earlier highsWhile Trump's earlier post had lifted sentiment, things have now unraveled again as Trade uncertainty continues to weigh on sentiment. S&P almost flat on the session after failing to break yesterday's high. Let's see if dip buyers emerge later on. For now trading remains quite choppy as reciprocal tariffs are set to go into effect tomorrow, along with those additional tariffs on China.

With trading so choppy, best to trade from level to level and exit on first sign of trouble. Lots of volatility = lots of trading opportunity, but if you are not careful, the choppiness could seriously dent your trading capital.

By Fawad Razaqzada, market analyst with FOREX.com

US 500 Index – Retracement Holds DeclineAfter one of the most extreme trading days for the US 500 index that we have seen since the pandemic of March 2020, a slightly uneasy calm has descended across markets this morning as traders await the next tariff updates from President Trump and his team of advisors.

Right now it is still unclear whether President Trump would provide an opportunity for individual trading partners to reduce the penalty level or gain exemptions from the reciprocal tariffs that are due to go into force tomorrow.

Traders are also on the lookout for any news from China regarding tariffs or fresh stimulus measures to support the economy, and the announcement of retaliatory actions from the EU are still on the horizon.

What is clear, is that as this unfolds across the rest of today and tomorrow, being prepared for any volatility in the US 500 index that may appear again, with a trading plan, clear assessment of technical levels to deploy any potential stop loss and take profit orders, may well be a solid approach to consider.

Technical Update: US 500 Index - Retracement Holds Decline

During times of market turmoil, where sharp declines in the price of an asset are seen to reverse what was previously a strong phase of strength, traders will often focus on using Fibonacci retracement levels to identify potential support levels.

Clearly, global equities have recently entered a period of uncertainty and aggressive price declines. However interestingly, the US 500 index has found support this week at a Fibonacci retracement level, which at least for now, has succeeded in holding declines, and is even starting to see attempts at an upside recovery materialise.

Looking at the weekly chart of the US 500 index above, we can see the latest price capitulation tested 4791, which is equal to the 50% Fibonacci retracement of the October 2022 to February 2025 advance.

Traders may now be asking ‘Do the latest price declines to 4791, represent the extent of the current liquidation in assets, and can upside now emerge again?’

It is currently impossible to answer this question with any true conviction as there is still much to be heard from President Trump regarding tariffs, which will likely dictate future market sentiment and price trends.

However, monitoring important support and resistance levels over the upcoming trading sessions may help us gauge where the next potential directional moves may be seen in the US 500 index.

Possible Support Levels to Monitor:

Having tested the 4791 Fibonacci retracement level and seen a recovery develop from it this week, it may be suggested this remains an on-going downside support focus in price. As such, it may well be closing breaks of this level if seen, that could skew directional risks towards the potential of further declines.

Therefore, closes below 4791 might be an indication that the recent weakness may carry further to the downside, prompting traders to look for possibilities of a more extended decline in price. This may in turn lead to tests of 4474, which is the deeper 62% retracement, maybe even further if this gives way.

Possible Resistance Levels to Monitor:

Having seen the 4791 support hold and prompt the latest recovery moves, some traders may well be looking for the potential of a more sustained recovery in price, even though much will depend on the reaction to any future trade war escalation or easing of tariff concerns.

By calculating Fibonacci retracements on the latest US 500 index decline, we may be able to gauge possible target resistance levels if a recovery in price is to emerge.

The 38.2% Fibonacci retracement of the February 2025/April 2025 sharp sell-off stands at 5313. This may be an interesting level to watch, as if it were broken on a closing basis traders may start to look for fresh attempts to push towards higher levels once more. In this case, the 50% retracement resistance level which stands at 5474, and the 61.8% level at 5635, could be relevant.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

SPX500 Short at M5 supply zone due to tariffs uncertainty

Market overview and macro outlook

Rise in the equities market mainly due to the possibility of a 90 days postponement of the tariffs

1. What can kill this optimism: A single Trump administration comment otherwise.

2. We've risen by close to 8% from the lows.

3. Until the postponement is confirmed, i don't think there's much upside, thus, the risk is to the upside, and we should be looking for downside trades now

Upcoming news

1. FOMC meeting on Wed - probably to the downside as it should be comments on keeping rates high to combat the tariffs uncertainty

2. US CPI/Unemployment on Thu - TBD

- If high CPI - good for equities as it raises probability of interest rates cut

- If high unemployment - good for equities as it raises probability of interest rates cut

3. US Core PPI on Fri - TBD

- If high PPI - good for equities as it raises probability of interest rates cut

Thus, I have a bearish view of the market and look to take Short positions here.

Technical View

At a higher time frame, I want to see price hit 5500 for a short position then.

In the short term of today and tomorrow, I want to see prices hit 5267 for me to take a Short position - there's a Supply zone there from the M5 TF.

SL: 5300 (Above supply zone and a major psychological point)

TP: 5130 (Slightly above the lows of the previous trading zone before the breakout)

Execution

1. Limit order

- SL: 5300 (Above supply zone and a major psychological point)

- TP: 5130 (Slightly above the lows of the previous trading zone before the breakout)

- TF: Close limit order before CPI or PPI reports. If no entry by then

Results of ideas thus far:

Number of trades: 2

WR: 0%

Profit: -1.1R

Notes: This is currently for personal practice to write out trade ideas. Feedback is welcome, and please don't mind if none of this makes sense.

S&PThe SPX touched a long-standing overhead, and came down ever-so-slightly to retrace the most recent peak. This is all totally normal. There is nothing here to worry about. In fact, the more touches of this overhead, the more likely it is that we break above it. You can see this has happened many times before in the S&P, where it breaks above an overhead, only to land on top of it, and then launch for a new even steeper part of the curve. The macro parabola that the markets are in.

Is Trump Intentionally Crashing the Econ?I want to preface this by saying I'm a TA and this is just dinner table chat as far as I am concerned.

I've no interest what-so-ever in why a market moves. All the money is made based on how it moves- and the TA is working great for that.

Just sharing a theory that is floating about (It's not mine).

The idea is Trump is intentionally crashing the markets in an attempt to reduce the debt burden on the US.

This would work by this sequence of events;

1 - Markets crash. Making people who care about their money anxious and less eager to take risk in the stocks (etc) markets.

2 - This money moves to bonds. Pushing bond prices up. Rising bond prices push interest rates down. So crashing the econ can lead to lower interest rates.

3 - At a lower interest rate (say 2%) the US can refi its debt.

Inside of this theory, everything we're seeing is part of a calculated plan to, literally, force stocks lower.

S&P 500: Bottoming Out or Just a Bounce?Has the market bottomed?

The S&P 500 has bounced 10% from the critical 4800 level, signaling strong buyer interest and disrupting the bearish trend that’s been in place since February 2025. Selling pressure appears to have exhausted as the bearish pattern reached its target near 5000.

This bounce is a positive sign, suggesting downward momentum may be fading. However, for a stronger confirmation, we need to see the index hold above the 4800–5000 zone. If it fails to stabilize here, the 4500 level could act as the next buffer.

SP500: Is This the 2025 Correction? Or Just Another Bounce?Looking at the weekly chart of the S&P 500 with RSI and key support trendlines, it’s clear we’ve entered a historically important level.

🔍 Context:

2020 → COVID Crash, RSI bottomed 💥

2022 → Bear Market, RSI again flagged a major drop 📉

2023 → Healthy correction, price respected trendline support

2025? → RSI flashing oversold, price testing the long-term trendline again.

📊 RSI is approaching the same low levels as the previous two macro shocks — is this a signal of another reversal opportunity? Or could this time be different?

🚨 If we break below this trendline convincingly, it could open the door for a deeper bear leg. But if we hold, we might just see another bounce-back rally like in 2020 and 2022.

📈 Watch for confirmation:

A strong bounce with bullish RSI divergence = potential long

Breakdown + volume spike = more downside ahead

Let’s see if the trendline holds up — it has for 5 years… 👀

#SP500 #Correction #BearMarket #RSI #TechnicalAnalysis #MarketUpdate #2025Outlook #StockMarketIdeas