Is This a Bear Market or a Golden Opportunity?The indices have plummeted sharply, and whether you believe this is due to Trump’s tariffs or would have happened anyway, regardless of the trigger, the reality remains the same.

Both the S&P 500 and Nasdaq 100 are officially in bear market territory— defined by a decline of more than 20% from their peaks . Meanwhile, the Dow Jones Industrial Average is down approximately 15%.

Given these facts, the big question is: Are we in a bear market, or is this a fantastic buying opportunity? 📉📈

Now, let's break down the key levels, potential scenarios, and how to approach the current market environment. 🚀

Dow Jones 30 (DJI): Navigating Key Support and Resistance Levels

On the weekly chart, DJI has been in an uptrend since the pandemic lows of 2020. The double top formation from 45k measured target has already been exceeded, and the index is now approaching a critical confluence support zone between 37k and 37,700.

📌 My Outlook:

• I believe this support will hold in the near future, presenting a buying opportunity.

• Resistances: 40k and 41,600 are important technical levels and potential targets for bulls.

💡 Alternative Scenario:

• If DJI starts rising without testing the long-term confluence support, I will focus on selling opportunities, particularly around the 41,500 zone, as we have 2 unfilled gaps from last week.

________________________________________

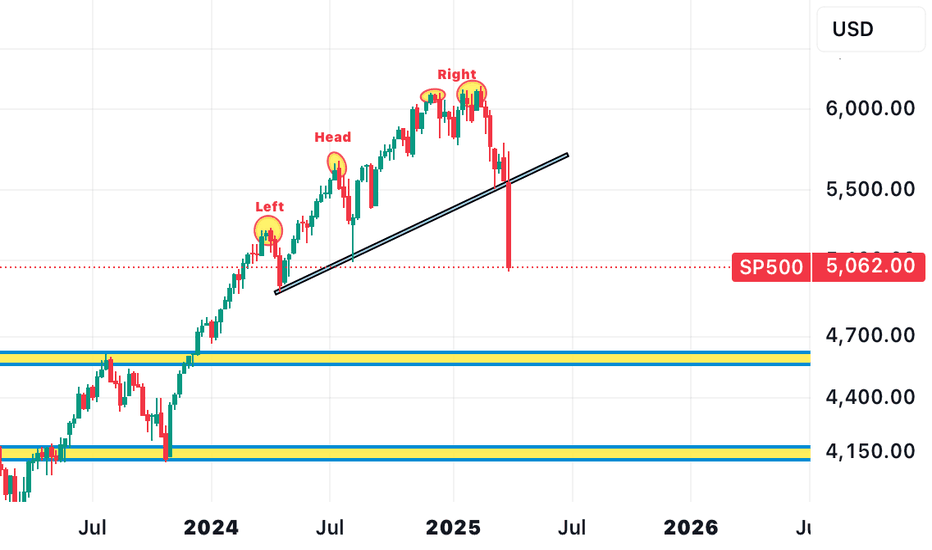

S&P 500 (SPX): Bear Market Territory, But Still Holding Uptrend (posted main chart)

According to classical theory, SPX is now officially in bear market territory. However, we are still above the ascending trend line established from the 2020 pandemic low, and approaching a confluence support zone around 4,820 - 4,900.

📌 My Outlook:

• I will be looking for buying opportunities if the index continues its decline towards the 4,820 - 4,900 zone next week.

• Target: Filling the first gap at 5,400.

💡 Alternative Scenario:

• If the week begins positively, and SPX doesn’t reach the 4,900 support zone, I will focus on shorting opportunities on gap filling, aiming for a return to 5,000.

________________________________________

Nasdaq 100 (Nas100): Hovering Above Key Support

Unlike DJI and SPX, Nas100 is still well above the ascending trend line from the 2020 pandemic low. However, it is nearing an important horizontal support defined by the 2021 ATH and the 2024 lows.

📌 My Outlook:

• Drops towards 17k or slightly lower could present good buying opportunities, anticipating a potential rise to fill the gaps.

💡 Alternative Scenario:

• If the price rises above 18.500k zone without dipping under 17k I will look for selling opportunities.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

SPXM trade ideas

Institutional Demand: SP500 longsHey,

Trump’s April 2025 tariffs triggered a global market crash, with the Dow plunging and the Nasdaq entering a bear market. China retaliated, raising recession fears. News warns of rising unemployment, inflation, and a major economic slowdown.

So what does this mean for us as traders and investors?

Volatility equals opportunity.

The S&P 500 is approaching a strong demand zone and trendline. I’m not a fan of trying to catch the exact bottom — just have a consistent plan to scale in, buy once at the zone or do it in chunks. But with prices this low, it’s a great time to consider adding more. Data shows, every major crash has rebounded sooner than expected for the past 100 years.

Great opportunities where fear makes people miss it.

Kind regards,

Max

S&P 500 Index: First Correction Since July 2023I was just looking at NVDA and the market has been bullish forever. A drop is approaching and I wondered, "Will this be a short lived correction or will it turn into a bear-market?"

Good question isn't it?

The last correction for the SPX happened between July and October 2023, after that, it has been 100% bullish with some retraces lasting a maximum of three weeks. So it is hard to think of a bear-market.

From January 2022 through October 2022 the SPX entered a strong correction, a bear-market, it lasted 280 days. There you have it.

How would that look like today? Let's see... Ten months would put us at August/September 2025, can you imagine?

These markets are super resilient, and with money printing going on over-drive soon, it is possible that we only experience a correction. A correction can last several weeks to a few months maximum.

Big correction or small correction, three weeks or ten months, the SPX is bearish and pointing lower in the coming days, weeks and months.

Namaste.

"SPX500/US500" Index CFD Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SPX500 / US500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: (5730) Thief SL placed at the nearest / swing high level Using the 8H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 5300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"SPX500 / US500" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

$SPX monthly chart and next downside targets Important levels to monitor for support on SP:SPX we are now at monthly trend-line support from bottom of 2022 to bottom of 2023. Next support will be top of January 2022 which is 4791 and trendline from Covid 2020 lows and 2022 lows. If it breaks next 4589-4500. We may first go up and test 20 month moving average around 5260.

Corrective waves and trade war at the same time.Even before the trade wars started, I think the uptrend was over.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

Opening (IRA): SPX May 16th 5000/5030/5785/5815 Iron Condor... for a 10.45 credit.

Comments: High IVR. After having taken small profit on the setup I put on before "Liberation Day," back in with a more symmetric setup in a higher IV environment.

Metrics:

Buying Power Effect: 19.55

Max Profit: 10.45

ROC at Max: 53.45%

50% Max: 5.23

ROC at 50% Max: 26.73%

Will generally look to take profit at 50% max, roll in untested side on side test, manage at 21 DTE.

SP500,A BIRTH OF A NEW TREND (FURTHER DECLINE EXCEPTED)Sp500 has given birth a to new trend after forming bullish pattern from our previous analysis to give us ATH of 6k. It has form another bearish reversal pattern on weekly timeframe. We might see further declines in coming weeks. Overall target $4700 a $43,00

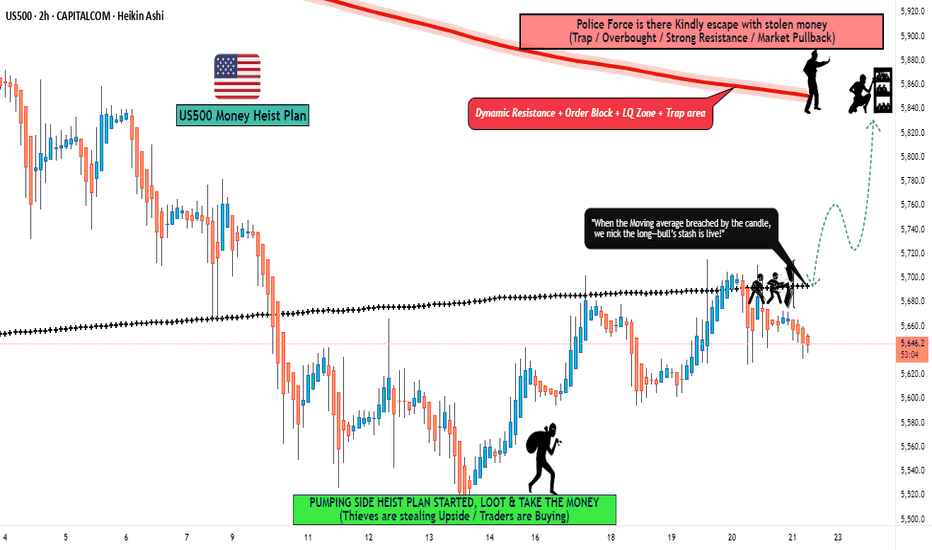

"US500/SPX500" Indices Market Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US500/SPX500" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5780) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 30m timeframe (5700) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5860 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US500/SPX500" Indices Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"US500 / SPX500" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US500 / SPX500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (5600) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5850 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US500 / SPX500" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

More down for SPX500USDHi traders,

Could an outlook be more accurate then this? Last week I said that SPX500USD could see more downside. I also annotated the liquidity on the chart where we could see a reaction.

And what did price? It took the liquidity, made a correction up (orange wave 2) and dropped.

Did I know the news before? No of course not. This is the power of Wave analysis.

If you've followed my outlook, you could have made much profit.

Now for next week we could see a small correction up and more downside for this pair.

Let's see what the market does and react.

Trade idea: Wait for a small correction up on a lower timeframe to trade shorts.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Geopolitics, Rates, and Risk: Why 1987 Is Back on the RadarThe current mix of geopolitical tensions, policy uncertainty, and fragile market sentiment brings to mind the setup ahead of October '87.

Without stabilizing signal, especially from the U.S. administration this weekend, the risk of a sharp correction is not negligible.

S&P 500 Daily Chart Analysis For Week of April 4, 2025Technical Analysis and Outlook:

During this week's trading session, the Index experienced lower openings, completing the Outer Index Dip at 5403, as highlighted in the previous week's Daily Chart analysis. This development lays a foundation for a potential decline targeting the Outer Index Dip at 5026, with the possibility of further extension to the subsequent target of the next Outer Index Dip, 4893. An upward momentum may materialize at either completed target level, with the primary objective being the Mean Resistance level of 5185.