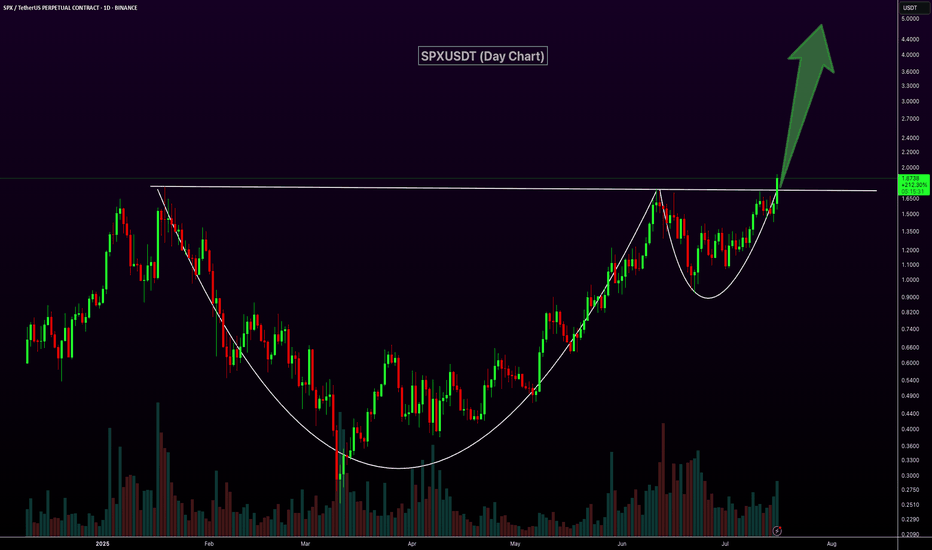

SPXUSDT 1D#SPX has broken above the Cup and Handle pattern, and based on the RSI, there's a high probability it may retest the neckline once again, which now serves as a support zone.

📌 In case of a bounce from this level, the potential upside targets are:

🎯 $2.3693

🎯 $2.7724

🎯 $2.9829

🎯 $3.2852

🎯 $3.8514

⚠️ As always, use a tight stop-loss and apply proper risk management.

SPXUSDT trade ideas

SPX6900 Bulls Eyeing 33% Surge Toward Explosive $2.60 TargetHello✌

Let’s analyze SPX6900’s upcoming price potential 📈.

MEXC:SPXUSDT has maintained strong bullish momentum in recent weeks, supported by a stream of positive fundamentals 📈. The price is currently holding within an ascending channel and resting near daily support. If this level holds, a 33% upside toward the $2.60 target could follow 🚀

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

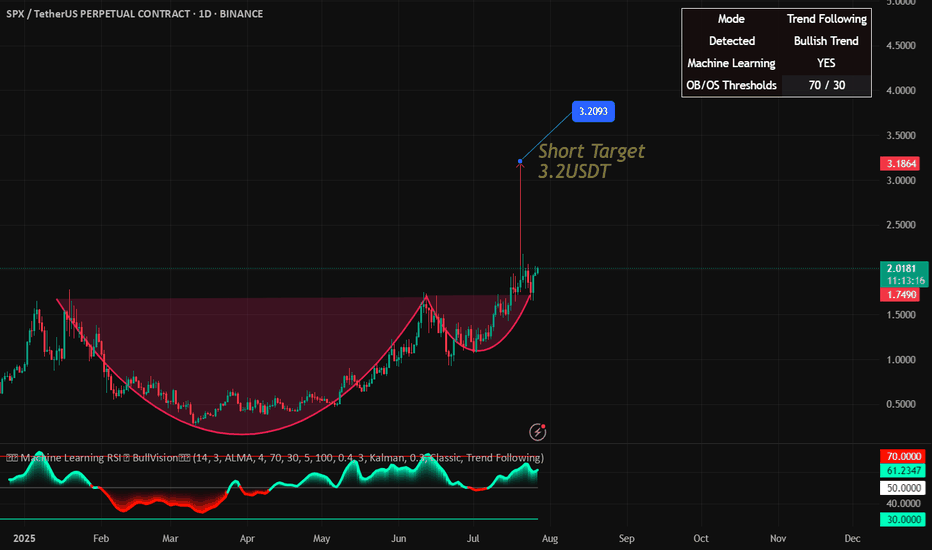

Short Target Idea for SPX/TetherUS Perpetual ContractThis analysis focuses on the SPX/TetherUS Perpetual Contract on Binance, identifying a potential short target based on current market trends. The chart indicates a bullish trend with a machine learning RSI suggesting a possible reversal point.

Description

Asset: SPX/TetherUS Perpetual Contract (1D, Binance)

Short Target: 3.2 USDT

Trend: Bullish (Detected by Trend Following Mode)

Machine Learning: Enabled (RSI Thresholds: 70/30)

Analysis: The chart shows a recent uptrend with the Machine Learning RSI peaking around 61.2102, indicating overbought conditions. A short target is set at 3.2 USDT, aligning with the support level observed in the recent price action. Consider monitoring for a reversal confirmation before entering a short position.

Created: Jul 27, 2025 18:14 UTC+5:30 by shyamshm7

SPX6900 Bidding 4H S/R + FVG Zone — Looking for New Highs✅ 4H S/R + FVG provides strong support and bid opportunity

✅ 200EMA adds further confluence to the setup

✅ Invalidation = 1h closes/consolidates below $1.14

Active Setup:

Long Entry: In $1.08–$1.14 zone (confirmation: reclaim or bullish trigger in area)

Target: $1.72 (new highs/ATH)

Manual Invalidation: Cut if 1h candles close and consolidate below $1.14

🔔 Triggers & Confirmations:

Only bid on strong reaction or reversal in FVG/S/R zone

Exit if 1h PA settles below $1.14 (red pattern bars area)

🚨 Risk Warning:

Aggressive longs — keep risk tight, cut quickly if invalidated

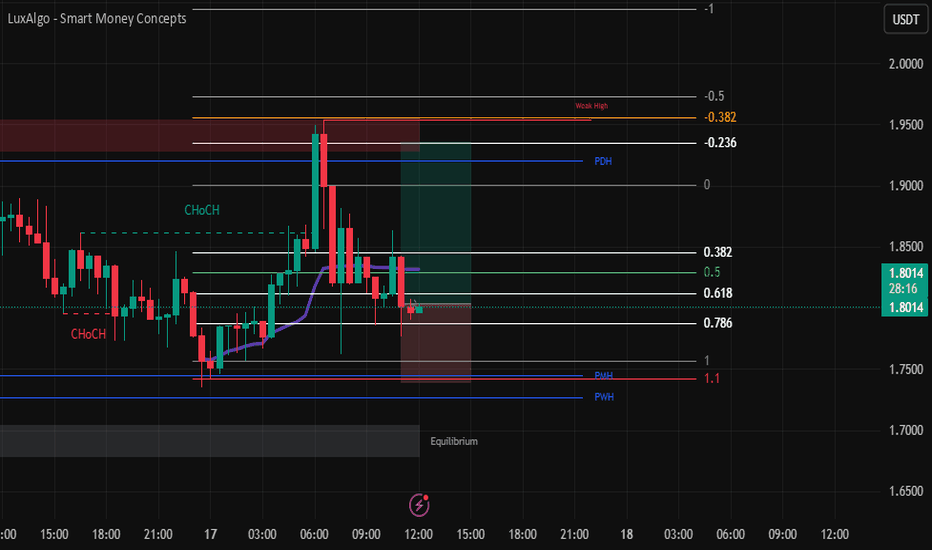

SPX LONG📘 Daily Trade Journal – Thursday, July 17

1. Trade Overview

- Asset:-SPX - Direction:** Long

- Entry Time:** After 10:00 p.m. (Vietnam Time)

- Timeframes Used:** 1H, 30m

- Bias Origin:** Bullish market structure continuation with recent change of character

---

2. Trade Idea (Before Entry)

I came to the charts shortly after 10:00 p.m. PopCat had just wicked into the 0.618 Fibonacci level. I considered it a chase, so I passed on it—didn’t get the retracement I wanted.

ETH and Solana were not retracing into the OTE zones either.

Pengu appeared more bearish—potentially forming a daily lower high, indicating slowing upside momentum. I ruled that one out too.

I ended up selecting **SPX**, trading it for the first time. Despite that, I stayed focused on structure and levels:

1H timeframe had a bullish **external break of structure.

30m timeframe showed a temporary bearish retracement, but then a bullish change of character followed.

This change of character swept the previous day’s high, which was a concern since that level was also my target, and it had already been touched—possibly by London.

Despite this, I decided to take the trade based on:

* Anchored Fibonacci from today's early session low to the current high

* Overall structure still being bullish

* Expecting a possible sweep of today’s **intraday high** and maybe even another test above **yesterday’s high**

---

### 3. **Entry Details**

* **Entry Price:** \

* **Risk Taken:** \

* **Stop Loss Placement:** Below the retracement swing low / point of invalidation

* **Confluences Used:**

* ✅ Fibonacci retracement

* ✅ Change of Character

* ❌ No AVWAP, trendlines, or order blocks used

---

### 4. **Exit Details**

*(To be completed when the trade closes)*

* **Exit Time:** \

* **Exit Price:** \

* **Reason for Exit:** \

---

### 5. **Outcome**

*(To be completed when the trade closes)*

* **P\&L:** \

* **Partial or Full Exit:** \

* **Session of Exit:** \

---

### 6. **Self-Assessment**

* ✅ **What went right?**

* Didn’t force a trade on assets that didn’t return to key levels.

* Stayed open to switching assets when familiar names didn’t provide ideal setups.

* Executed a setup based on structure, not emotional attachment.

* ❌ **What could be improved?**

* SPX target had already been swept—may need to reevaluate entering **after** key liquidity has already been taken.

* More clarity needed when trading unfamiliar assets for the first time (like SPX).

* 📋 **Did I follow my trading plan?**

* Yes. I stayed within my timeframe, followed structure, used Fibonacci, respected the process.

* 📈 **Would I take this trade again, exactly the same way?**

* Yes, with caution. Would want stronger confirmation if the target liquidity has already been touched. Otherwise, setup fits criteria.

* 🔎 **How would I rate this trade out of 10?**

* \

---

🧠 Notes for Improvement

Today, I didn’t fixate on one asset, which may be a strength.

Need to define a clearer protocol for **target levels that have already been swept**—whether to stand aside or expect continuation.

Emotionally balanced today. No FOMO trades. If this one plays out, great. If not, it’s still within plan.

---

💤 Closing Note

This is Day 3 of live journaling and publishing. One clean setup executed. No overtrading. I’ll let the market decide the outcome and stick to my commitment: one session, one plan, one trade idea. Back tomorrow—same window.

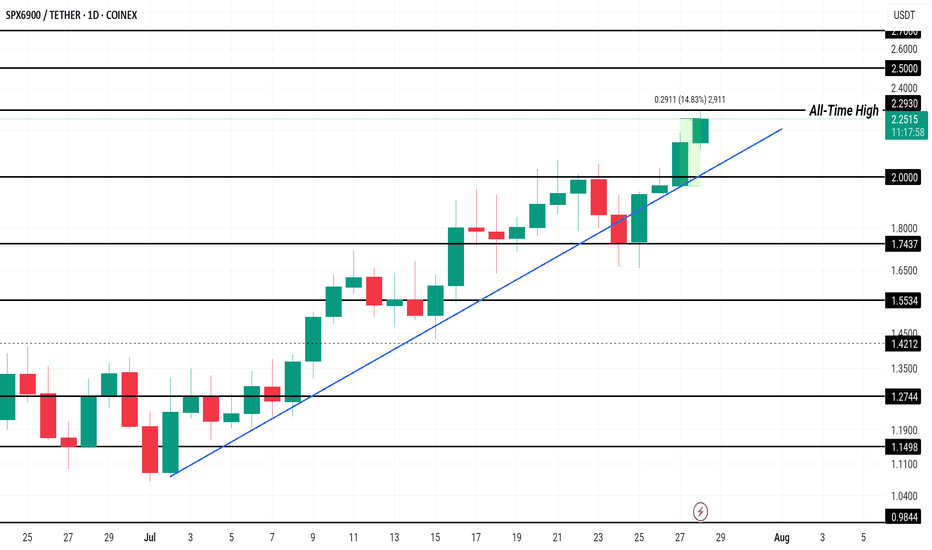

SPX Price Hits New All-Time High, $2.50 Up NextCOINEX:SPXUSDT has been experiencing a consistent uptrend since the beginning of the month, leading to the formation of multiple all-time highs, including one today at $2.27 . This price action reflects strong investor interest, pushing the altcoin to new levels and generating a positive market sentiment.

Currently trading at $2.23, COINEX:SPXUSDT has gained 14% in the past 24 hours . The Ichimoku Cloud, acting as support, signals bullish momentum. This suggests that SPX could rise further, with the potential to reach $2.50 or higher if market conditions remain favorable and investor confidence persists.

However, if selling pressure intensifies, COINEX:SPXUSDT could experience a reversal . A dip below the $2.00 support could push the altcoin toward $1.74 or lower, invalidating the bullish outlook.

SPX / USDT : Broke out and now successful retestSPX/USDT has broken out from a consolidation zone, with the price approaching key resistance at $1.90. A sustained move above this level could push the price towards the $2.10-$2.40 range, offering a 6.3% upside.

Bullish Scenario: Price stays above support, targeting $2.10-$2.40.

Bearish Scenario: Breakdown below support invalidates the setup, signaling potential downside.

Risk Management: Monitor price action closely and adjust positions if support fails.

SPXUSDT Forms Classic Cup and HandleSPXUSDT daily chart is showcasing a strong Cup and Handle breakout with high volume, a classic bullish continuation pattern. After a well-formed, rounded base, price has cleanly broken above the neckline resistance around the $1.80 level, supported by strong momentum and a sharp bullish candle. This breakout signals the potential for a significant upside move, with the next leg likely to push toward much higher price levels.

SP:SPX MEXC:SPXUSDT

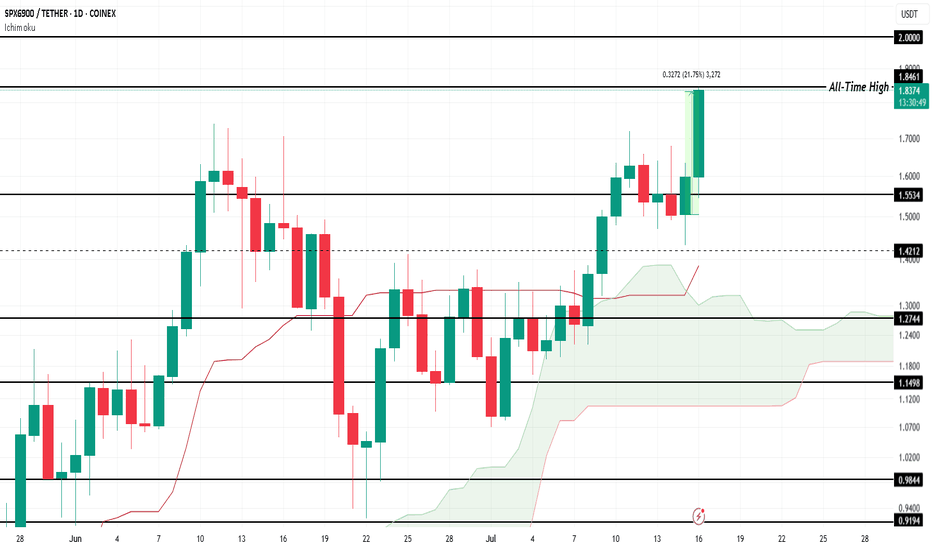

SPX Forms New All-Time High, Price Nears $2.00COINEX:SPXUSDT price has surged by 21.75% over the last 24 hours , reaching a new all-time high (ATH) of $1.84 . At the time of writing, SPX is trading at $1.83, showing promising signs of further upward movement. The altcoin's strong performance reflects growing investor interest and market optimism.

The Ichimoku Cloud, which lies beneath the candlesticks, signals that bullish momentum is currently prevailing for $COINEX:SPXUSDT. This technical indicator suggests that the altcoin could continue its ascent, potentially breaching the $2.00 level in the near future . If the trend persists, SPX could set new price milestones.

However, if COINEX:SPXUSDT experiences significant selling pressure from investors, the altcoin could face a correction. A drop below $1.55 would indicate a shift in momentum and potentially erase some of the recent gains. A failure to maintain key support levels could lead to further downside risks.

SPX/USDT – Retest Opportunity Within TriangleAs shared in the previous post, SPX was approaching a crucial breakout zone. Price has now retraced and is hovering around the lower trendline, presenting an ideal retest entry opportunity.

Entry (on retest): 1.37 – 1.39

Stop Loss: Below 1.33

Targets:

T1: 1.70

T2: 2.05

T3: 2.54

T4: 3.56

Support Levels: 1.3737 / 1.33

Resistance Levels: 1.70 / 2.05

Price structure remains intact, and consolidation above this range can fuel a strong move. Entering this retest zone keeps risk low with an excellent risk-to-reward ratio

DYOR | Not financial advice

SPXUSDT Approaching Breakout Zone – 20% Potential Move?SPXUSDT is gearing up for a potential breakout after consolidating in an ascending triangle. Price is once again testing the key horizontal resistance at $1.38, which has held for several days.

Structure:

Ascending triangle on the 4H timeframe – typically bullish

Multiple rejections at the $1.38 level indicate a strong breakout if flipped

RSI is around 63, signaling growing momentum

Trade Setup (If Breakout Confirms):

Entry: Candle closes above $1.38 resistance

Stop Loss: Below $1.3422 support zone

Targets:

$1.4753

$1.5679

$1.7019

Potential upside of ~20% if momentum holds.

Support & Resistance:

Immediate Support: $1.3422 & $1.2962

Major Resistance: $1.38 → $1.4753 → $1.5679 → $1.7019

A breakout from this structure can trigger a strong bullish move. Watch for confirmation and volume.

DYOR. Not financial advice.

SPX/USDT – Breakout WatchSPX is currently testing a major horizontal resistance zone around 1.34–1.36, after a consistent series of higher lows forming an ascending triangle.

Trade Setup:

Entry (after breakout and retest): 1.34–1.36

Targets:

First target: 1.475

Second target: 1.567

Final target: 1.701

Stop Loss: Below 1.29

Structure: Ascending triangle showing compression and bullish pressure

RSI: Trending up, signaling possible continuation

This setup requires patience — the ideal long entry is after a breakout with successful retest. Rushing in early can be risky.

Do your own research. Not financial advice.

SPX/USDT CUP&Handle On the daily time frame, SPX/USDT has formed a classic Cup and Handle pattern, one of the most reliable bullish continuation setups. The structure shows a smooth rounded base followed by a brief consolidation forming the handle.

Now, the price is attempting a breakout from the handle zone, signaling momentum for the next leg up. A daily candle close above the handle resistance will confirm the pattern breakout and likely trigger strong upside movement.