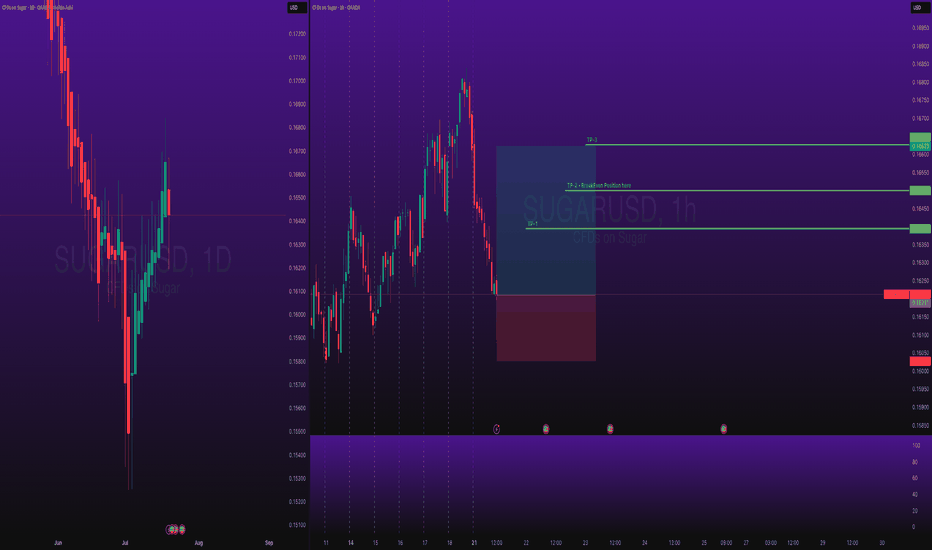

Sugar Long Trade Risking 1% to make 2.25%OANDA:SUGARUSD Long Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Sugar is keeping bullish volume, its still summer and final months of summer vacations ending soon, sugar will take dip down and hit back up once

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Don't be greedy and risk most only on one trade - follow proper risk management.

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

SUGARUSD trade ideas

Quick take o sugar futuresThe technical picture is starting to look quite interesting. Let's see if seasonality will kick in as well. Let's dig in.

MARKETSCOM:SUGAR

ICEUS:SB1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Sugar futures are falling. But is it just seasonality?Looking at the futures of MARKETSCOM:SUGAR , we can see that the price continues to slide and we are currently at historic lows. This can be explained by seasonality and by the fact that Brazil is currently introducing a lot of sugar into the market. Let's dig in...

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Are sugar futures ready to extend further up?Looking at the technical picture of sugar futures, we can see that we have approached a key area of resistance. In order to get comfortable with further upside, a break of that territory is required. However, if we see the price struggling to move above all the EMAs on our daily chart, maybe the upside might off the table, at least for now.

MARKETSCOM:SUGAR

ICEUS:SB1!

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

USD/CAD Long and SUGAR/USD ShortUSD/CAD Long

Minimum entry requirements:

• Tap into area of value.

• 1H impulse up above area of value.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

SUGAR/USD Short

Minimum entry requirements:

• 1H impulse down.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CAD Short, NZD/CHF Short, GBP/CHF Short and SUGAR/USD ShortNZD/CAD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If 2 touch 5 min continuation, reduced risk entry on the break of it.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CHF Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

GBP/CHF Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CAD Short, NZD/CHF Short and SUGAR/USD ShortNZD/CAD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If 2 touch 5 min continuation, reduced risk entry on the break of it.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CHF Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 5 min continuation, reduced risk entry on the break of it.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SOYBN/USD Short and SUGAR/USD ShortSOYBN/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

AUD/JPY Long and SUGAR/USD LongAUD/JPY Long

• If price pushes down to and ideally just below our area of value, then regardless of how it does so I'll be waiting for a subsequent impulse back up on the one hour chart followed by a tight two touch fifteen minute flag and then I'll filter the latter on the five minute chart and be looking to get long with either a risk entry within it if the flag is structured, or a reduced risk entry on the break of it if it's unstructured or I don't manage to secure a risk entry.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SUGAR/USD Long

• If price corrects and a subsequent two touch tight fifteen minute flag forms, then I'll filter the latter on the five minute chart and be looking to get long with either a risk entry within it if the flag is structured, or a reduced risk entry on the break of it if it's unstructured or I don't manage to secure a risk entry.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SUGAR - LONG - 0.32$ in 2024Brief explanations of my trading idea:

1️⃣ Sugar is in an upward long-term trend, working only in long is a priority - since March 2020, the price of sugar has already increased by a little more than 100%, by 2024 it will already be about 270%, that is, compared to March 2020 - until 2024 of the year sugar will rise in price almost x3.5 😱

2️⃣ In the first quarter of 2022, a correction to 16 cents per pound of sugar is likely, after which the uptrend is expected to continue. After the correction, the sugar will make x2, as I said many times before.

🎯 My target for 2024 is 0.32-0.33$ per pound of sugar , after which the price will drop to current levels by 2027.

EUR/CAD Long and SUGAR/USD ShortEUR/CAD Long

• If price pushes down to and ideally just below our area of value, then regardless of how it does so I'll be waiting for a convincing impulse back up followed by a tight flag and then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SUGAR/USD Short

• If price pushes up to and ideally just above the upper trend line of our most recent piece of structure, then regardless of how it does so I'll be waiting for a convincing impulse back down followed by a tight flag and then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SUGARUSD Confirmed the Bullish BAMM Trigger Line as SupportThis has been a Years Long trade and Sugar is nearly there at the 88.6% target, but I do think since we spent some time testing the B point as support that it has potential for pushing all the way to the 1.13 Extension to complete a Full ABCD, so I will be opening up another bullish position on the CANE ETF from here and targeting higher levels.

SUGAR/USD ShortPositive Confluence Factors... (14)

1. LTF and HTF direction in alignment? ✅

2. At edge of HTF structure (in green zone)? ✅

3. HTF candlestick confirmation? ✅

4. Trade setup visible on multiple time frames? ✅

5. Break out of structure and a break back in present? ✅

6. Near miss present (below price if looking to get short, or above price if looking to get long)?

7. Reliable looking sequence of flags present (if looking for further continuation)?

8. Correction/s I'm looking to get long or short within and/or on the break of proportionate to preceding impulse? ✅

9. M style pattern present? ✅

10. Structural approach to area of value? ✅

11. Fairly flat structure present? ✅

12. Expanding pattern present?

13. Equal spacing present? ✅

14. Clearly identifiable middle section present? ✅

15. Head and shoulders pattern present? ✅

16. Decent R:R available? ✅

17. No hook point sat just beyond stop loss? ✅

18. Protection available for your stop loss?

Negative Confluence Factors... (1)

1. Counter to HTF trend?

2. Not at edge of HTF structure (in red zone)?

3. Trade setup only visible on one time frame?

4. Price only wicked to area of value on multiple time frames?

5. Near miss present (above price if looking to get short, or below price if looking to get long)?

6. Unreliable looking sequence of flags present (if looking for further continuation)?

7. Correction/s I'm looking to get long or short within and/or on the break of disproportionate to preceding impulse? ❌

8. Squeeze present (structure not parallel or expanding)?

9. Fairly steep structure present?

10. Very unequal spacing present?

11. No clearly identifiable middle section present?

12. Excessively voluminous middle section present?

13. Multiple possible entry types?

14. Limited R:R available?

15. Hook point sat just beyond stop loss?

16. Entry around swap hours?

17. Entry directly before major news announcement?

SUGAR/USD Short• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SUGAR/USD Short• If price pushes up above our rayline, then regardless of how it does so I'll be waiting for a convincing impulse back down followed by a tight flag and then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.