SUI 4H ANALYSISHI friends,

Today we are going to analyze SUI/UST in 4H time frame

As we see that we have a key support level at $2.08 and also we had a strong 4 hours resistance trend line which is broken with good volume.

Also as marked on the chart we have a key resistance area at $3.6 which is a key level for retaining its bullish momentum.

SUIUSDT trade ideas

SUI the bullish scenariosSUI / USDT

Price broke out downtrend after 4months in bear market , Its also bouncing from a support cluster (1st key support in my chart )

What next ?

The bullish scenarios which iam looking forward here are : either we've already started a new uptrend, or we're seeing a drop to the second major area in my chart , followed by a rally

By all means the 2nd support must be hold in HTF for this coin to remain bullish

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.20.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 2.26

First target: 2.32

Second target: 2.40

Third target: 2.47

SUI I Weekly CLS, KL - Order Block, Model 1Hey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

David Perk ⚔

SUI Rebounds from Key Demand Zone – Bullish Continuation Ahead?SUI has recently bounced from a key supply and demand zone between the 0.618 ($2.36) and 0.786 ($1.52) Fibonacci retracement levels, showing strong buyer interest in this range. This zone also coincides with a previous resistance line that has now flipped into support, adding further confluence to this area as a significant level for trend continuation.

After pulling back from its recent high around $5.44, SUI respected the 0.618 Fib level and has begun to recover, currently trading around $2.71. If momentum continues, the next resistance levels lie at the 0.5 ($2.95) and 0.382 ($3.54) Fib levels, followed by a potential move back toward the $4.26 zone.

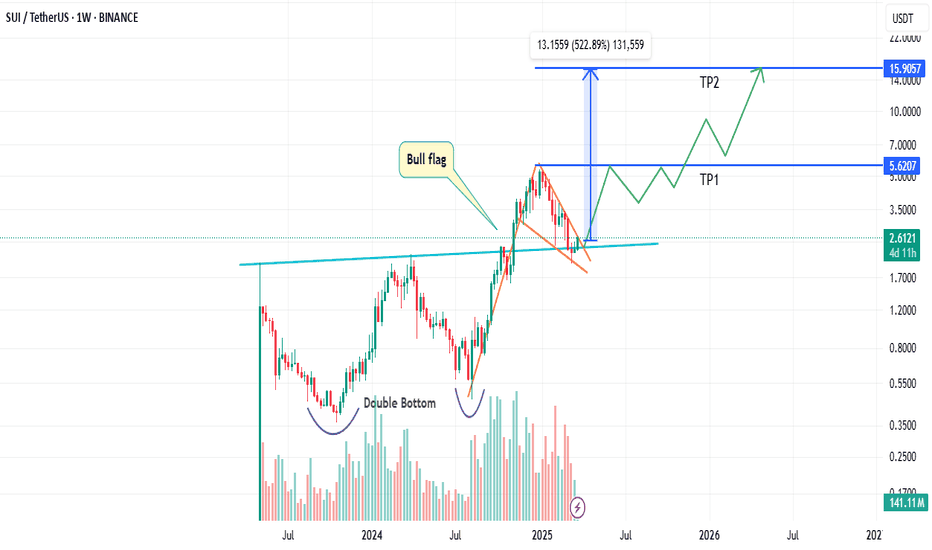

From $5 to $16 ? The SUI Setup You Need to See !Hello Traders 🐺

These days, everyone is talking about SUI—a U.S.-based cryptocurrency that’s showing serious potential to become one of the top gainers in the upcoming Altcoin Season. Let me break it down for you 👇

📈 Chart Analysis

On the chart, we can clearly see a Double Bottom formation, which led to a breakout and a rally to a new ATH at $5.62. After reaching that level, SUI pulled back to retest the previous resistance—which has now flipped into support. ✅

📉 What Now?

Currently, SUI is trading inside a falling wedge pattern, which in my opinion has great potential to act as a bull flag. Depending on how we interpret the pattern, price targets can vary—but don’t worry, I’ve simplified it for you:

🎯 Price Targets

1️⃣ First Target → Top of the falling wedge at $5.62 (ATH)

2️⃣ Second Target → Around $16 🚀

Make sure to take partial profits along the way and manage your risk properly.

Thanks for reading my idea—I hope you found it helpful! 🙌 Don’t forget to like and follow for more updates and support. And always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

SUI Possible New ATH, AgainLooking at the Oscillator's curves I circled, that means the current CRYPTOCAP:SUI Price Action is oversold.

we are very close to Alt seasons, indicated by CRYPTOCAP:ETH rally. So, there's a big chance that smart moneys will start to accumulate the big caps of alt coins.

Well, SUI is one of the best alt coins out there.

My personal target

TP 1 $5

TP 2 $10

Friendly reminder, I don't set stop losses as I'm not doing derivatives market

Alt seasons is coming very soon, do not lose your money by speculating low to no market caps coins! it's always a great choice to bet on bluechips and large caps

SUI/USDTHello friends

You can see that after the price fell in the specified support area, the price was supported by buyers and caused the resistance to break, and now, when the price returns to the specified ranges, you can buy in steps and move with it to the specified targets, of course, with capital and risk management...

*Trade safely with us*

SUI: Scaling Blockchain with High PerformanceDescription:

This trading idea focuses on SUI, a next-generation Layer 1 blockchain designed for high scalability, low latency, and enhanced security. Developed by former Meta engineers, SUI leverages the Move programming language to optimize smart contracts and improve transaction efficiency. Its innovative architecture enables parallel execution, reducing network congestion and enhancing speed, making it a strong competitor in the blockchain space. As demand for scalable and cost-effective blockchain solutions grows, SUI is positioned to attract developers, enterprises, and DeFi projects seeking a more efficient infrastructure.

Despite its strong fundamentals, the cryptocurrency market remains highly volatile, influenced by regulatory developments, macroeconomic factors, and overall market sentiment. Therefore, investing in SUI carries inherent risks, and traders should implement proper risk management strategies.

Disclaimer:

This trading idea is for educational purposes only and should not be considered financial advice. Cryptocurrencies like SUI are highly speculative and subject to rapid price fluctuations, which can result in the complete loss of capital. Always conduct thorough research, assess your financial situation, and consult with a financial advisor before making investment decisions. Past performance is not indicative of future results.

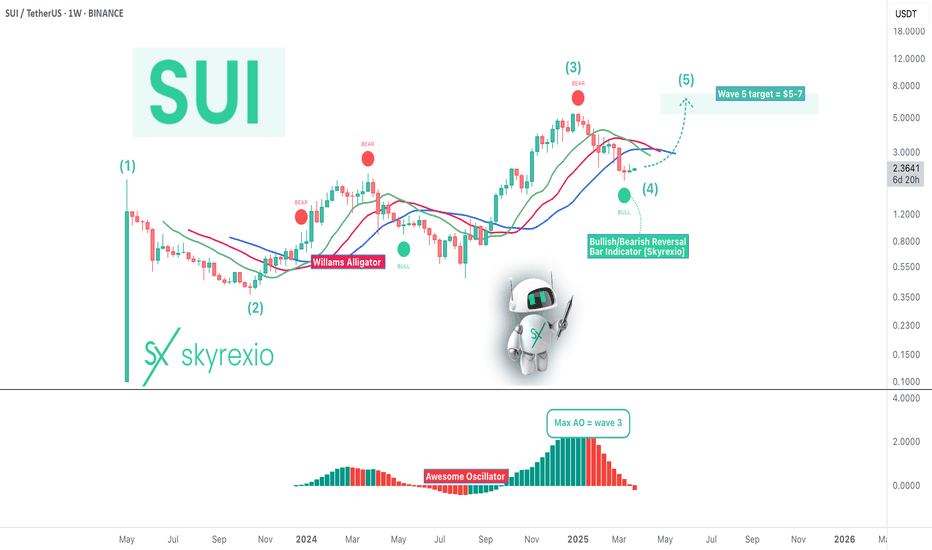

SUI - Last Growth Ahead Before Bear MarketHello, Skyrexians!

It's time to update BINANCE:SUIUSDT idea. Last time we pointed out that wave 3 has been finished and correction incoming. Now we are seeing this correction. Today we got the indicating that correction is over and we can see the great growth soon.

Let's look at the weekly chart. Here we can see the Elliott waves structure. Wave 3 has been finished at the recent top. Awesome oscillator gives us the hint that bull run will continue, but now that much because we have only wave 5 ahead which has a target $5-7 in the next 3-6 months. The strong confirmation that correction is over is the green dot on the Bullish/Bearish Reversal Bar Indicator below the alligator's lines.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

SUI/USDT Short🧠 Overview

Market: SUI/USDT

Timeframe: 4H

Bias: Bearish

Structure Type: Internal Market Structure Shift (iMS), Internal Break of Structure (iBOS)

Trade Type: Trend Continuation after Failed Bullish Breakout

Tool Set: Structure Zones, iBOS Labels, Trendlines, Wave Momentum Indicator, EMAs

🧱 Context Building: Market Structure Analysis

The 4H chart on SUI/USDT provides a textbook case of a swing market structure breakdown following a false breakout attempt.

✅ What We Observed:

Bullish internal market structure (iMS) led to multiple internal breaks of structure (iBOS), confirming higher lows and building bullish momentum.

Price consolidated between the ascending support line and horizontal resistance around $2.35.

Despite two clean iBOS, the price failed to break the swing high—a signal of internal bullish weakness.

🔻 Confirmation: Bearish Shift in Structure

Key Confirmation Events:

Break of Ascending Trendline

Price decisively broke below the ascending diagonal trendline, invalidating bullish continuation.

Internal Lower High Forms

A new lower high formed after failing to clear $2.35, which confirmed the start of a bearish internal trend.

Momentum Oscillator Flips Bearish

Using a wave-style oscillator, we observe:

Red dots appearing on top of momentum waves.

Decreasing money flow index (flowing toward zero or negative).

Bearish divergence relative to previous highs.

EMA Rejection

Price is trading below a fast EMA (likely 9 or 21 EMA), and the moving average has begun to curl downward, further confirming a momentum shift.

🎯 Trade Execution

🛑 Entry Trigger

Entry: On confirmed break and close below trendline and support at $2.30.

Confirmation: Momentum oscillator showing bearish crossover and price retesting structure as resistance.

🧷 Stop Loss Placement

Stop Loss: Placed just above the lower high around $2.35–$2.37.

This invalidates the trade if price reclaims bullish territory.

📉 Target Zones

TP1: $2.00 psychological round number.

TP2: $1.94 – previous structural support / weekly level.

TP3 (optional): Trail further if breakdown accelerates with strong volume.

🪙 Risk-Reward Profile

Entry Stop Loss TP1 TP2 R:R Estimate

$2.28 $2.36 $2.00 $1.94 ~2.5 - 3.0x

The trade offers an excellent R:R ratio when executed after trendline break and bearish momentum alignment.

🔄 Trade Management

After Entry: Monitor price reaction at $2.24 zone. If price bounces hard and reclaims the broken trendline, consider partial exit or move SL to breakeven.

If TP1 is hit: Move stop to breakeven, secure profits, and let the rest run to TP2.

Exit Full Trade: If bullish structure begins forming with an iBOS above $2.35.

🔎 Lessons & Takeaways

Structure Breaks Matter More Than Candle Patterns: The loss of structure support carried more weight than bullish candle wicks or oversold indicators.

Internal Structure Gives Early Signal: The iBOS and lower highs signaled the reversal before the BOS occurred.

Confluence is King: Combining market structure, trendlines, and momentum indicators gives confidence in bias.

🧭 Final Thoughts

This SUI/USDT trade is a high-probability example of trading against weak highs from internal structure after a failed breakout. By reading market structure correctly and executing with discipline, this setup aligns well with smart money principles and can be consistently repeatable across assets and timeframes.

SUI Weekly Chart Analysis CRYPTOCAP:SUI Weekly Analysis

#SUI is showing a potential trend reversal after a deep retracement from its previous highs. Currently, the price is holding above a major support zone, which previously acted as resistance — now flipping into support 🧠

We can spot a falling wedge breakout pattern forming, which is typically bullish 📊

If momentum continues to build, here are the target levels to watch:

🎯 Target 1: $3.5

🎯 Target 2: $4.5

🎯 Target 2: $6

@Whalesdesk

SUIUSDT: Breakout + Retest = Lift-Off Soon!BINANCE:SUIUSDT has shown impressive strength, bouncing back with solid volume after hitting a major weekly support level. This bullish reaction suggests a potential move toward higher highs, making it an attractive opportunity for long-term investors. Entering a position in the spot market and holding for the long term could yield significant gains.

On the 4-hour chart, SUI is forming an ascending triangle pattern. After breaking out, it has successfully retraced and is now gearing up for a strong swing move. Traders can consider entering at this level and look to book profits as the price climbs higher. As always, managing risk with a proper stop loss is crucial.

BINANCE:SUIUSDT Currently trading at $2.4

Buy level : Above $2.4

Stop loss : Below $2.15

Target : $3.5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

SUI/USDT 4H ANALYSISHello friends today we are going to analyze SUI/UST in 4H time frame as one of our viewers on YouTube asked for it. I forgot to to include it in that video but here on trading View we are going to analyze it.

As we see that we have a key support level at $2.08 and also we have a strong 4 hours resistance trend line that for it to retain its bullish momentum it needs to close or make a higher high in 4H over the resistant trend line.

Also as marked on the chart we have a key resistance area at $3.6 which is a key level for retaining its bullish momentum.

SUI - A New TAOI rises but CVD is decreasing!

1h and 2h OBV looks a little bit different! not that clear where are we going.

Depends on USDT.D and BTC.D

Daily and VAH is broken.

Marked yellow level could be a nice short.

Eyes on it ...

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

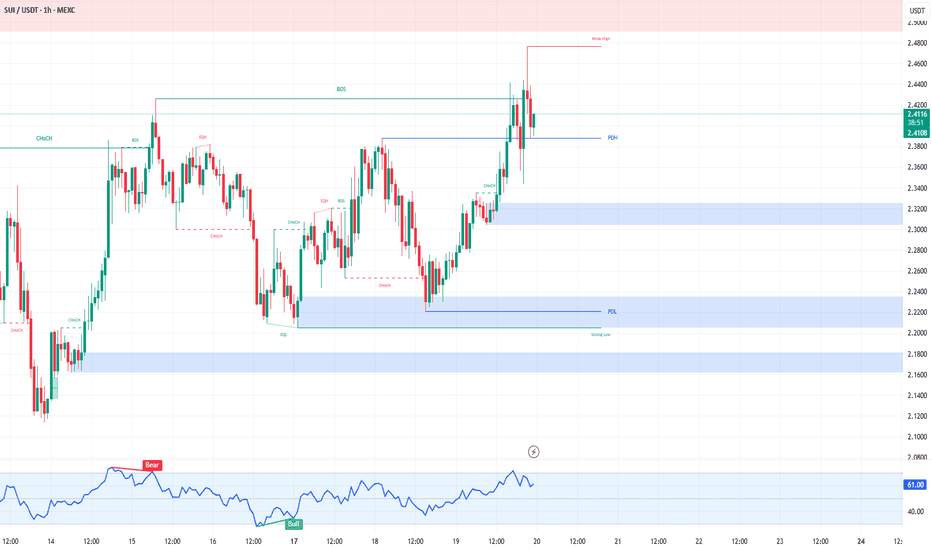

SUI/USDT 1H: Bullish Breakout Confirmed – Can $2.65 Be ReachedSUI/USDT 1H: Bullish Breakout Confirmed – Can $2.65 Be Reached?

Current Market Conditions (Confidence: 8/10):

Price at $2.40, showing a strong breakout from the accumulation zone.

RSI at 60.41, indicating bullish momentum with room to run higher.

Clean break above $2.35 resistance with strong volume confirms bullish intent.

Hidden bullish divergence forming on RSI, reinforcing continuation potential.

LONG Trade Setup:

Entry: $2.38 - $2.42 zone.

Targets:

T1: $2.50 (first resistance).

T2: $2.65 (major liquidity zone).

Stop Loss: $2.30 (below recent support).

Risk Score:

7/10 – Favorable risk-to-reward, but watch for temporary resistance at $2.50.

Market Maker Activity:

Accumulation is evident with minimal selling pressure above $2.35.

The clean break of resistance suggests a continuation of the uptrend.

Strong support is established at $2.30, with clear order blocks reinforcing demand.

Bull flag pattern forming, signaling an imminent move higher.

Recommendation:

Long positions remain favorable in the $2.38 - $2.42 range.

Monitor price action at $2.50, as this level may provide temporary resistance.

If volume continues to increase, expect a move toward $2.65.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!