Phemex Analysis #100: Pro Tips for Trading Sui (SUI)Sui ( PHEMEX:SUIUSDT.P ) has swiftly emerged as one of the most promising Layer 1 blockchains, well-known for its focus on scalability, high throughput, and developer-friendly infrastructure. Recently, Sui has attracted significant attention thanks to its growing DeFi ecosystem, strategic partnerships, and community enthusiasm.

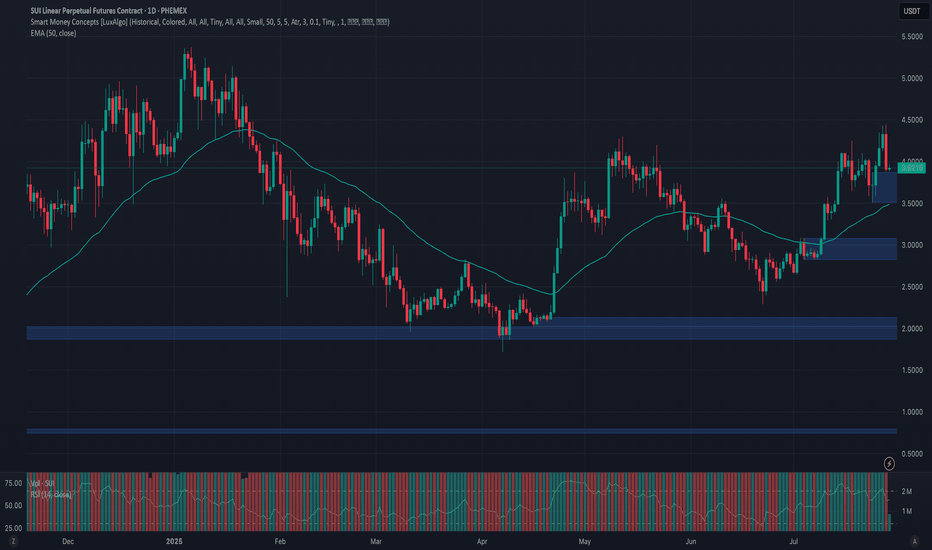

Over the past 2 weeks, SUI showed robust bullish activity, rising more than 30% to break key resistance around $4.3, and it’s now trading at around $3.9. The current price action indicates a potential continuation of bullish momentum, yet traders remain cautious about possible retracements and volatility.

Let’s carefully examine a few likely scenarios for SUI and determine how traders can capitalize strategically.

Possible Scenarios

1. Short-term Retracement (Healthy Pullback)

Following the recent rapid price rise, SUI might experience a short-term correction toward previous resistance-turned-support near $3.6. A low-volume retracement to this level could represent a healthy pause before the next bullish leg.

Pro Tips:

Buying the Dip: Closely watch support around $3.6; a successful retest on lower volume could present an ideal buying opportunity.

Volume Monitoring: Pay close attention to volume levels during the pullback—a low-volume dip indicates healthy profit-taking rather than bearish reversal.

2. Bullish Breakout (Pushing Higher!)

If SUI maintains bullish momentum and successfully holds above recent support around $3.8, it may continue to target higher resistance levels. Strong buying volume accompanying further gains could send SUI towards key resistance zones around $5.0 and potentially breaking previous all-time-high $5.37.

Pro Tips:

Entry Signals: Consider buying positions on a high-volume breakout confirmation above $4.45, signaling bullish continuation.

Profit Targets: Plan partial profit-taking around $5.0 and $5.37 resistance zones to lock in gains.

3. Bearish Scenario (Deeper Correction)

If broader market sentiment turns negative or if buying volume significantly weakens, SUI could break below $3.6, signaling bearish pressure. In this scenario, deeper corrections towards support levels at $2.8 or potentially $2.3 may occur.

Pro Tips:

Short Opportunities: Experienced traders could consider shorting or reducing exposure if SUI decisively breaks below the key $3.6 support level on increased selling volume.

Accumulation Strategy: Long-term investors can strategically accumulate positions near stronger support zones around $2.8 and $2.3 after confirming price stabilization.

Conclusion

Sui (SUI) currently offers compelling trading opportunities driven by recent bullish activity and increasing ecosystem growth. Traders should stay alert for critical breakout levels ($4.45) and monitor essential support areas ($3.6) closely. By applying disciplined trading approaches, setting clear profit targets, and managing risk prudently, traders can navigate SUI’s volatility with greater confidence and potentially maximize gains.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

SUIUSDT trade ideas

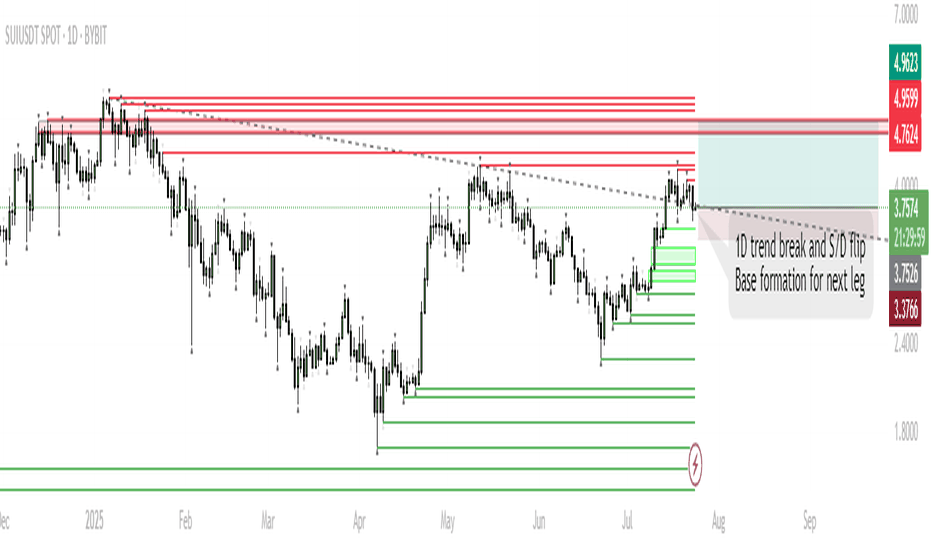

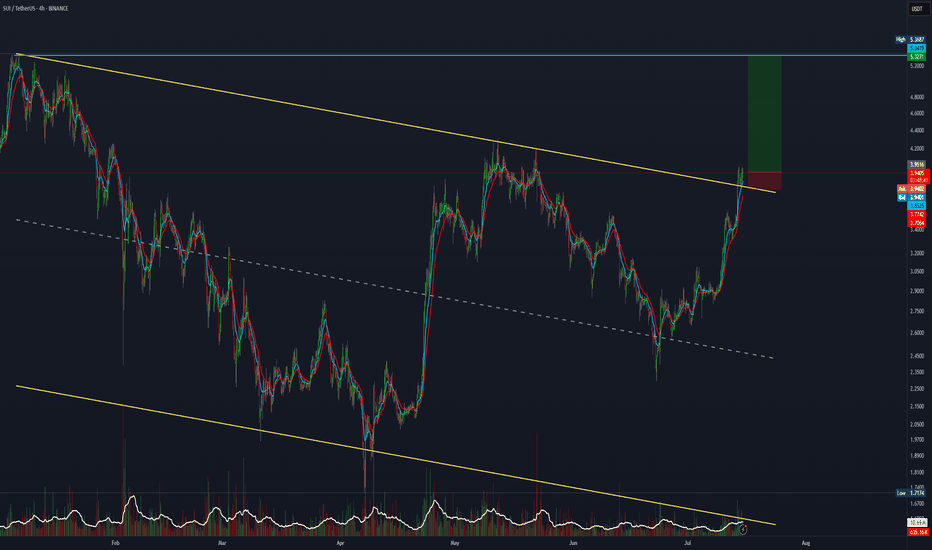

SUI – Base Formation for Next Leg HigherTrend Shift:

SUI has broken the 1D downtrend and is now consolidating above a key supply/demand zone, suggesting accumulation.

Short-Term Range:

Expect ranging/chop as price tests acceptance above broken resistance. This phase could last up to a week.

Trigger for Next Move:

Sustained closes above $4.0 will signal buyers are in control, opening the way for a move higher.

Targets:

If the base holds and SUI establishes above resistance, the next push is toward $5.10–$5.40 (previous highs/ATH zone).

Invalidation:

A sustained move below $3.37 would invalidate the bullish base thesis and open the door for deeper retrace.

SUI has flipped its 1D trend and is now consolidating above a key S/D level. Historically, such consolidations above reclaimed resistance often precede strong trend continuation. While a short-term range is likely as the market digests recent gains, the structure favors an eventual push toward previous highs and potentially new ATHs in August. Patience during this ranging phase is key; the setup remains bullish unless price falls back below $3.37.

SUI Hits Key Liquidity Zone After – Correction Ahead?SUI has been climbing steadily inside a well-structured ascending channel for the past few weeks. The recent breakout above the $4.30 resistance zone – which was a key liquidity level – seems to have swept stop-losses and trapped late buyers.

🔎 Here's what we're watching:

- Price broke out of the ascending channel briefly and rejected from the upper parallel.

- The breakout above $4.30 was likely a liquidity grab (buy-side liquidity taken).

- Price is now pulling back, showing signs of distribution below resistance.

📉 Expecting a correction toward the lower channel line as price seeks rebalancing.

🧠 Strategy Notes:

- No reason to long here unless price reclaims $4.35 with volume.

- Ideal buy zone is near the midline or lower channel.

- A break below the channel could signal deeper correction toward $3.60 or lower.

📊 Always respect risk – don’t chase after price in these zones.

📡 Analysis by CryptoPilot – navigating the market with precision.

#CryptoPilot #SUI #SmartMoney #LiquidityGrab #CryptoTrading #TrendChannel #Altcoins

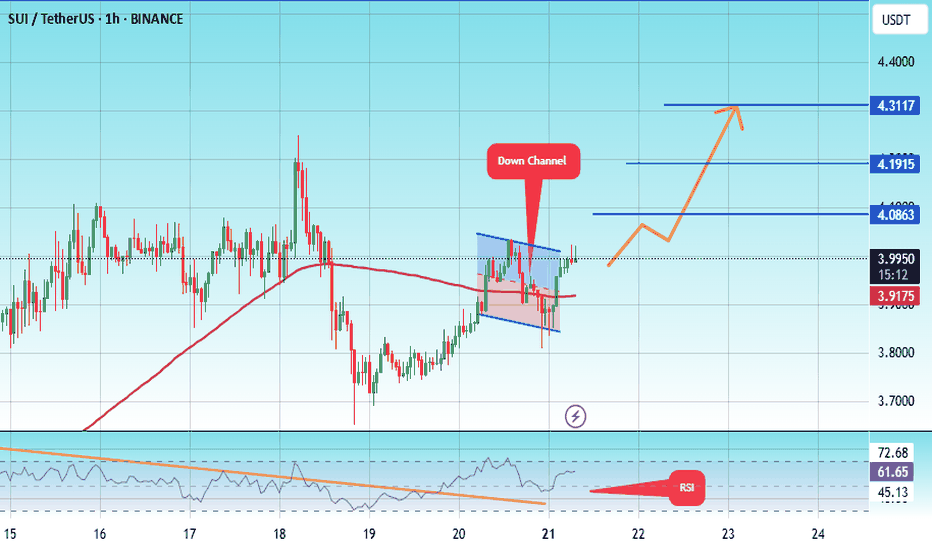

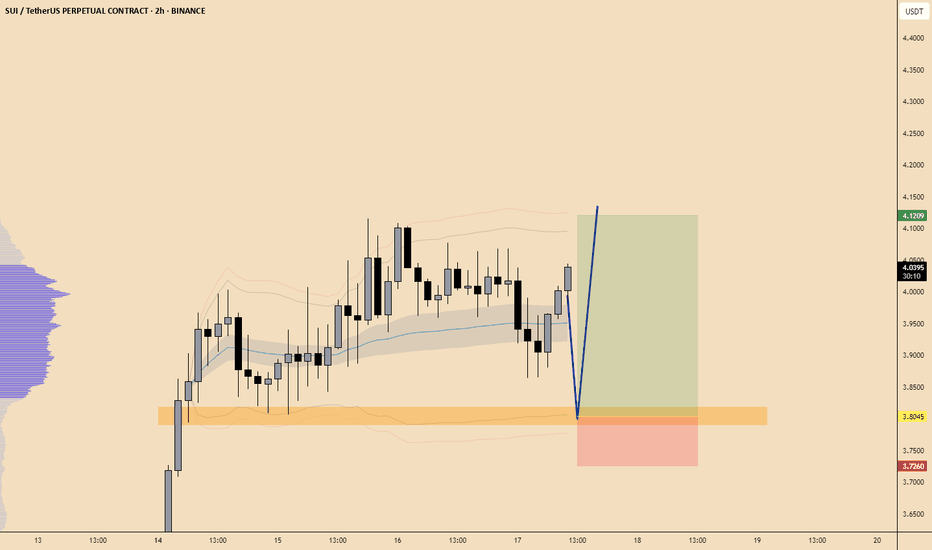

#SUI/USDT potentail to 4.30 $#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 3.85.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3.80, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 3.99.

First target: 4.08.

Second target: 4.19.

Third target: 4.30.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

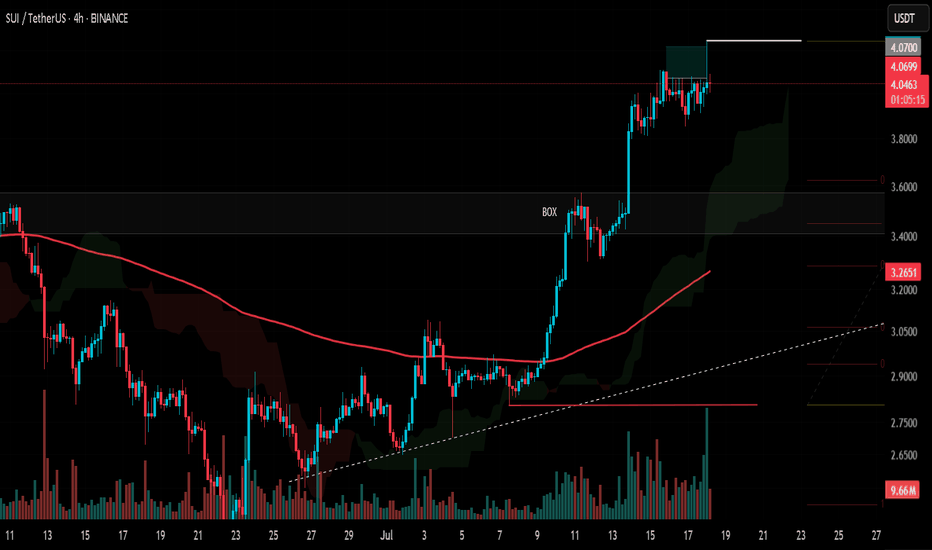

SUI to $5.31? Chart Says It’s 22% Away!SUI is shaping up beautifully on the daily chart. After spending weeks in a consolidation zone, the price has finally broken out with strong momentum and reclaimed bullish territory. The CM_EMA TrendBars are showing green, which confirms a positive directional shift. This indicates the bulls are now back in control.

The most recent breakout has pushed SUI above a key structure level near $3.93, turning previous resistance into new support. What’s impressive is that price didn’t just break this level — it retested it and bounced sharply, suggesting strong buyer interest. This kind of price action is typically seen before continuation moves.

Currently, the setup shows a clean bullish structure. Price is holding firmly above the moving average and is supported by recent higher highs and higher lows. If this momentum continues, SUI could be on its way toward the next major resistance zones, clearly marked on your chart as Profit Target 1 ($5.014) and Profit Target 2 ($5.312).

Volume seems steady, not explosive, but enough to support a sustainable climb — which is ideal for swing setups. This gives the chart a healthy look, especially in the context of the wider altcoin recovery theme.

Now, let's talk about risk. The Stop-Loss is logically placed at $3.602, just below the most recent breakout level and the prior base structure. If the price breaks below this zone, it would likely invalidate the current bullish setup.

🎯 Trading Idea Based on Chart Setup:

• Entry: $4.213 (current zone)

• Stop-Loss: $3.602

• TP1: $5.014 — near-term resistance

• TP2: $5.312 — full extension target

• Risk-to-Reward: ~2.36 on TP2 💹

This is a favorable setup for swing traders with clear levels and a clean chart structure. The EMAs are aligned bullishly, and the breakout has followed a strong trend resumption. If the market conditions continue supporting altcoins, SUI has the potential to outperform in the coming weeks.

In summary, SUI is in a confirmed uptrend, riding strong momentum after a clean breakout. As long as price holds above $3.93 and especially above the stop at $3.60, the path of least resistance remains upward.

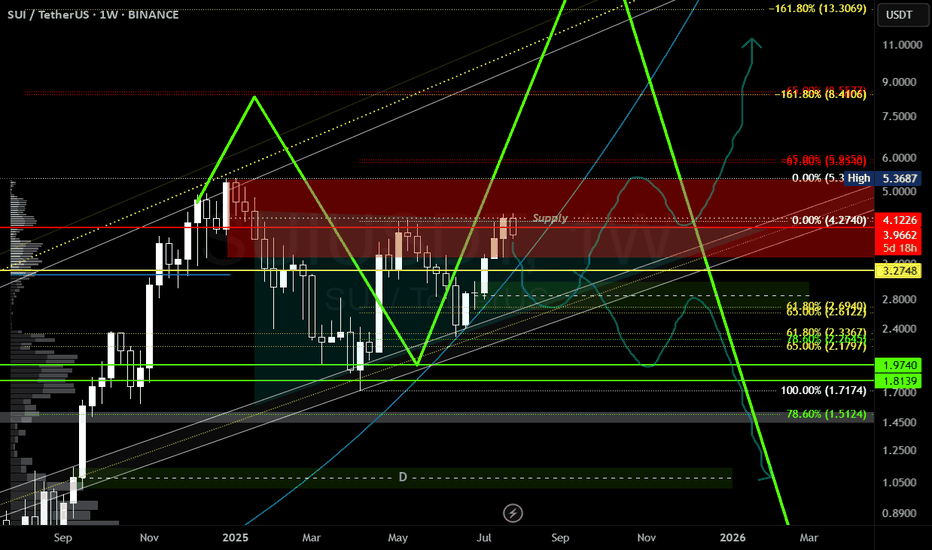

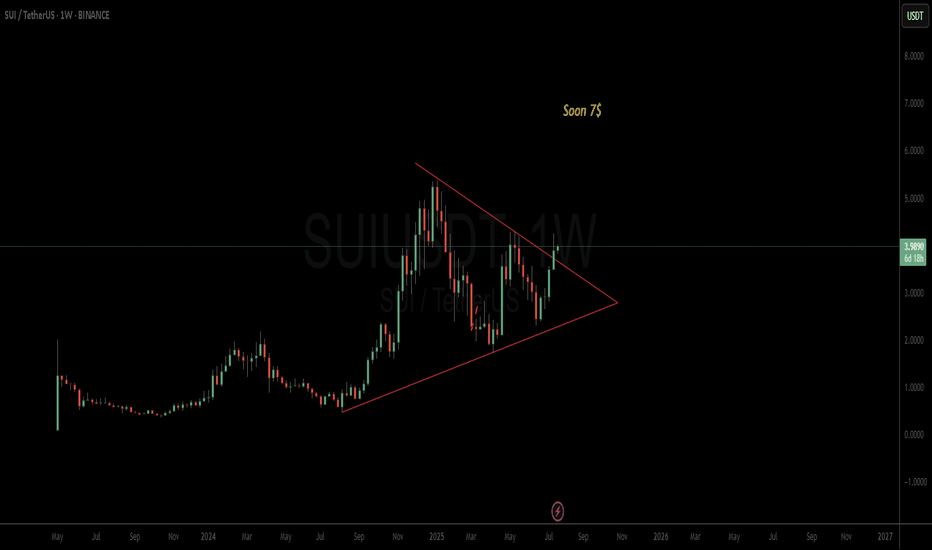

#SUI HTF Update Major update on #SUI after 6 months or so...

We have been tracking this idea since 2024, i am still biased with entire market & not looking at 2026 for ONE MORE run up, we just have few months left now & with august coming up i believe we will see one final dip before blasting everything in September. Majors topping around September & other alts like sui probably in October.

I have already updated about my positions before do check if you haven't yet.

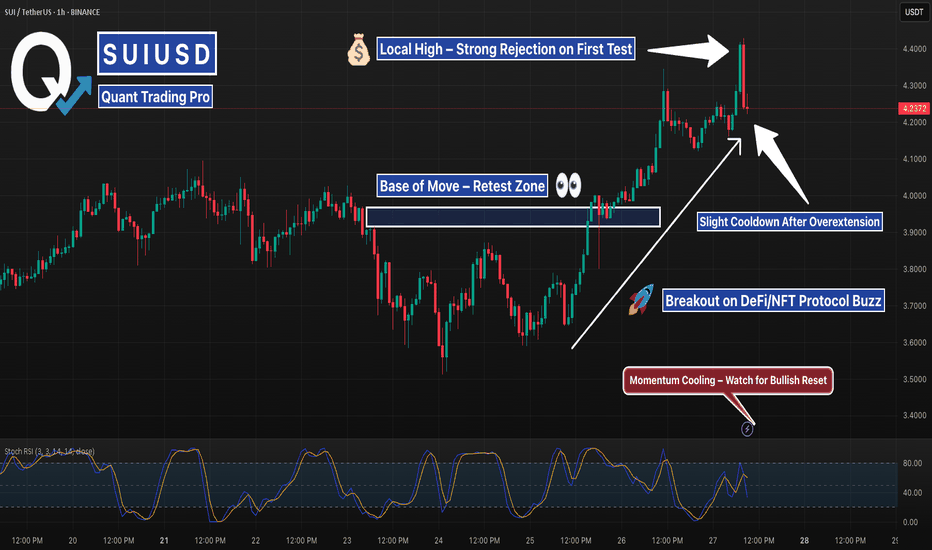

SUI Breaks Out on Hype Surge — Momentum Cooling After Sharp PumpSUIUSDT 1H chart showing a clean breakout following renewed hype around SUI’s DeFi/NFT expansion. Over the past 48 hours, SUI gained ~15% as social buzz and bullish sentiment picked up — driven by strong ecosystem growth and analysts labeling it “ready for a second wave.”

Price broke above recent consolidation around the $3.95–$4.10 zone and surged to new local highs near $4.40. However, the first test of that high was immediately rejected, with the current candle showing signs of a minor cooldown. Stochastic RSI confirms this — hinting at potential for a short retracement or consolidation before continuation.

Key levels to watch:

$4.10–$4.00 zone (potential retest support)

$4.40 high as breakout resistance

Stoch RSI reset for a second leg

If buyers step in quickly on a retest, this breakout could extend into new territory. If not, we may see a revisit to the $4 zone before any further upside.

#SUI Update #1 – July 18, 2025#SUI Update #1 – July 18, 2025

While many major altcoins showed strong upward momentum yesterday, Sui failed to generate a significant volume-driven breakout. One of the primary reasons was the presence of heavy whale sell orders in the $4.20–$4.25 zone. As shown on the chart, price left a wick at the top and pulled back slightly.

Technically, Sui has not yet completed a proper correction following its recent impulsive move. If a correction does occur, the first support level lies around $3.61 — approximately a 10% drop from current levels. This would be a healthy pullback, not a cause for panic.

If you use a stop-loss, honor it. If not, make sure you have sufficient capital to average down in case of a deeper retracement.

If another impulsive leg is to come, $4.25 will again be a critical resistance area, still stacked with whale orders.

SUI/USDT - Testing the Top of ValueSUI is back in focus as price pushes into a critical zone of resistance that has capped previous rallies. With key moving averages reclaimed and volume shifting in favour of bulls, the question now is simple - can it break free, or is this another trap before rotation lower?

Let’s break down the current structure and what comes next!

SUI is trading at a critical inflection point after staging a strong recovery off the March and April lows . The broader context shows a market transitioning from a bearish phase into a more constructive accumulation structure. The recent price action has been guided largely by reclaiming key areas of previous acceptance and value.

However, sellers are still active at the upper bounds of this range. The next few sessions will determine whether SUI transitions into full breakout mode or requires further consolidation below resistance.

⦿ Volume Profile

The Value Area Low (VAL) is anchored around $1.62 . This area marked the exhaustion point for sellers, triggering the current recovery leg.

The Point of Control (POC), which represents the highest traded volume zone, sits at approximately $2.27 . This zone acted as a magnet for price through May and June and is now firmly reclaimed, reinforcing its importance as a structural support.

The Value Area High (VAH) comes in at $3.82 . Price has recently reclaimed this level, which suggests buyers have shifted control of the auction. Acceptance above the VAH often implies that the previous range is no longer valid and a new range expansion could be underway.

⦿ Key Technical Insights

Several technical levels align with this recovery. The 200-day MA and the anchored VWAP from the all-time high converge between $3.00 and $3.50. This area has been successfully reclaimed and held, adding further conviction to the bullish case.

Above current prices, $4.12 represents the Yearly Open and a clear horizontal supply level. The market has shown hesitation here, as expected. The price action suggests sellers are attempting to defend this zone, but the overall structure remains bullish as long as higher lows are maintained.

Support levels to monitor include $3.82, the Value Area High, and $3.50, where both the VWAP and the 200-day Moving Average provide dynamic support. Below that, the POC at $2.27 remains a crucial level of last defense for bulls.

⦿ Market Structure

Structurally, the market has transitioned from a downtrend into a rounded bottom formation, which typically precedes more sustained uptrends. The higher low structure since the March lows confirms this shift. The recent push above both the POC and VAH further validates the strength of this reversal.

Volume has supported this breakout. We saw clear expansion through the $3.00 handle, suggesting conviction among buyers. The visible consolidation just below $4.12 reflects natural supply pressure but not yet evidence of distribution.

⦿ Scenarios to Consider

1. Bullish Scenario:

If buyers manage to establish acceptance above $4.12, particularly with daily closes through this level, the path higher opens cleanly. The low-volume node between $4.12 and approximately $5.00 suggests limited resistance in this zone. Price could expand swiftly toward $5.36 to $6.00 as a first target.

2. Healthy Pullback Scenario:

Should price reject the $4.12 zone, a pullback toward $3.82 or even $3.50 would be healthy and expected. As long as the structure of higher lows remains intact and price holds above the reclaimed POC at $2.27, this pullback would likely serve as a base for the next leg higher.

3. Bearish Breakdown Scenario:

A sustained loss of $3.00 would be the first real warning sign for bulls. Breaking below the POC at $2.27 would suggest a failed breakout and could see the price cycle back toward the lower end of the volume profile, targeting $2.26 or even the Value Area Low at $1.62. However, given current strength, this scenario looks less likely unless broader market sentiment shifts.

I’m primarily focused on bullish scenarios or potential pullbacks, as the current market looks stronger compared to a few months ago. I believe we’re likely to see some decent long opportunities moving forward.

Let me know your thoughts in the comments! 👇

⚠️ Disclaimer

As always, this post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

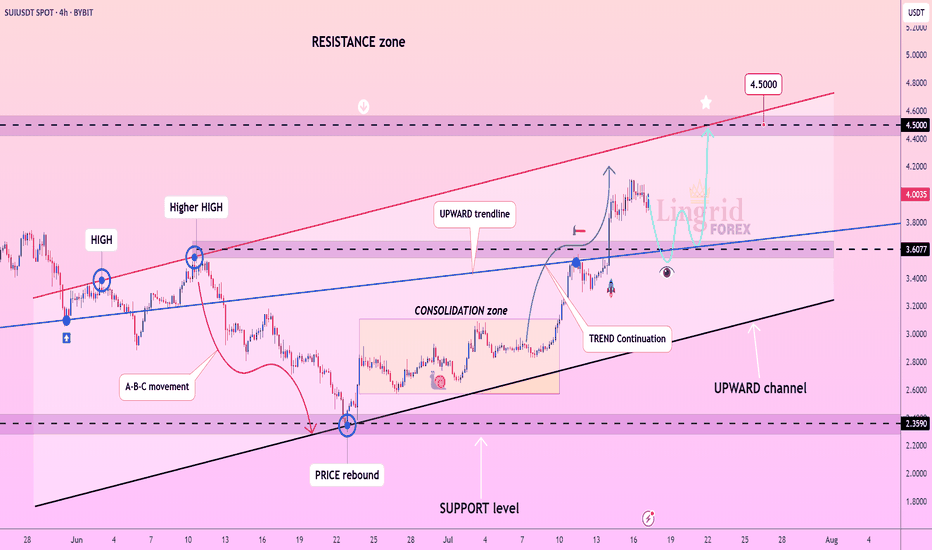

Lingrid | SUIUSDT Pullback and New Higher High PotentialBINANCE:SUIUSDT has rebounded strongly from the support level at $3.60, continuing its bullish sequence of higher highs and higher lows. The price broke out of the consolidation zone and climbed above the blue upward trendline, confirming a continuation of the bullish trend. A retest of the breakout area is likely before a push toward the major resistance zone at $4.50. The structure remains bullish as long as the channel support holds.

📉 Key Levels

Buy trigger: Bounce from $3.60 zone

Buy zone: $3.55–$3.70 (retest range)

Target: $4.50 (red resistance line)

Invalidation: Close below $3.45 trendline support

💡 Risks

Breakdown of the black channel line

Volume divergence or failure to hold the $3.60 support

Broader market weakness across altcoins

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

SUI - Upside continuation - with a great R/R of 26SUI has had upside buying pressure since its inception around Jun 23. I have been looking for a chance to get in and this symmetrical triangle shows it is likely to give upside continuation with a great R/R of 26.

Entry - 3.5818

SL - 3.3094

Interval 1 - 3.79

Interval 2 - 6.45

Target - 10.755

SUIUSDTSUI has broken out above a long-term descending trendline and reclaimed the key Monthly(2) resistance at $3.71, now acting as support. After a successful retest of this level, I’m entering a long position targeting a move toward $5.00, aligning with prior highs and the next major resistance zone. The breakout is supported by strong bullish momentum, VWAP trend shift, and confluence from Fair Value Gap absorption. My stop is placed below $3.60 to protect against a failed retest, with a favorable risk-reward setup in play.

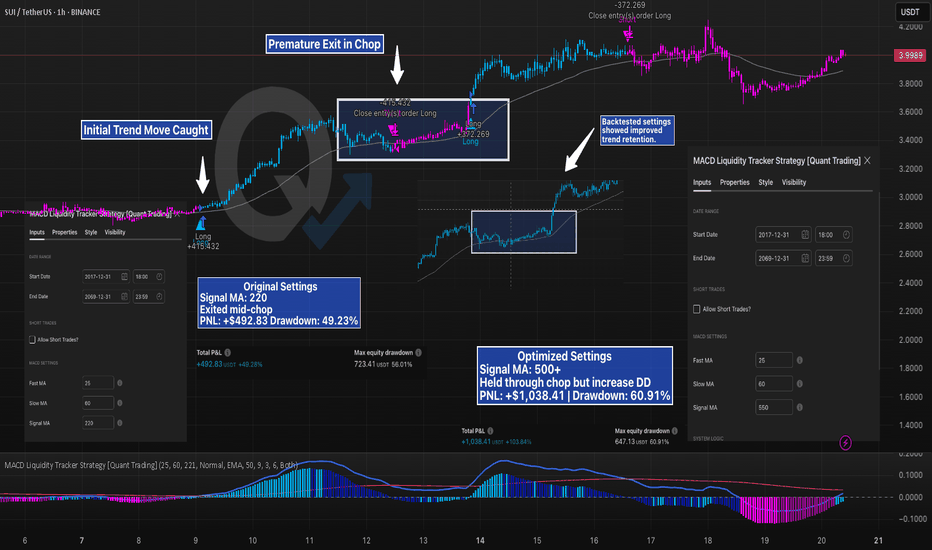

Mid-Chop Exit vs Trend Hold — How One Setting Changed EverythingSUI’s trend looked solid — but the strategy didn’t hold.

Using the MACD Liquidity Tracker Strategy with default settings (Signal MA = 220), the system caught the initial move well, but then exited during consolidation. It missed the continuation and had to re-enter late — resulting in more trades and reduced edge.

After running a few backtests, we increased the Signal MA to 550 to reduce early exits. The result:

Strategy held through the mid-trend chop

PNL more than doubled

Drawdown increased slightly, but the trade stayed intact

This is a perfect case study on how signal sensitivity affects trend behavior. Faster MAs respond quicker but tend to exit on noise. Slower MAs smooth it out — at the cost of larger swings.

Both versions are valid — but backtesting revealed which better fit this market structure.

No settings are one-size-fits-all — the key is understanding how each tweak behaves.

—

#SUIUSD #CryptoTrading #Backtesting #MACDStrategy #StrategyTweaks #LiquidityTracker #TradingEdge #QuantTradingPro #TradingView #TechnicalAnalysis

fthjgyfghjSUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

SUI - Breakout of the yearSUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

SUI: Calm Before the Wave 3 Surge?CRYPTOCAP:SUI is shaping up to be one of those charts that makes you lean in a little closer.

Right now, it appears to be sitting inside a potential wave 3, but something feels off. It hasn’t exploded yet. And when you’re looking for wave 3 behavior, that’s what you want: speed, commitment, follow-through. A clean surge, ideally in a straight line, that clears doubts and leaves the doubters behind.

We’re not seeing that yet. Right now the move is decipherable at many nested degrees making this move feel cautious.

And that opens the door to some possibilities:

It is a wave 3, just one that hasn’t lit the match yet.

We’re still nesting, multiple wave 1s and 2s stacking before the actual move hits.

Or it's a wave C of a Zig Zag.

As for levels, $4.20 stands out. Whether this turns into a rocket or a reset likely hinges on how price reacts there.

Stay nimble. If this is a true wave 3, it’ll leave no time for hesitation.

Be early, but not reckless.

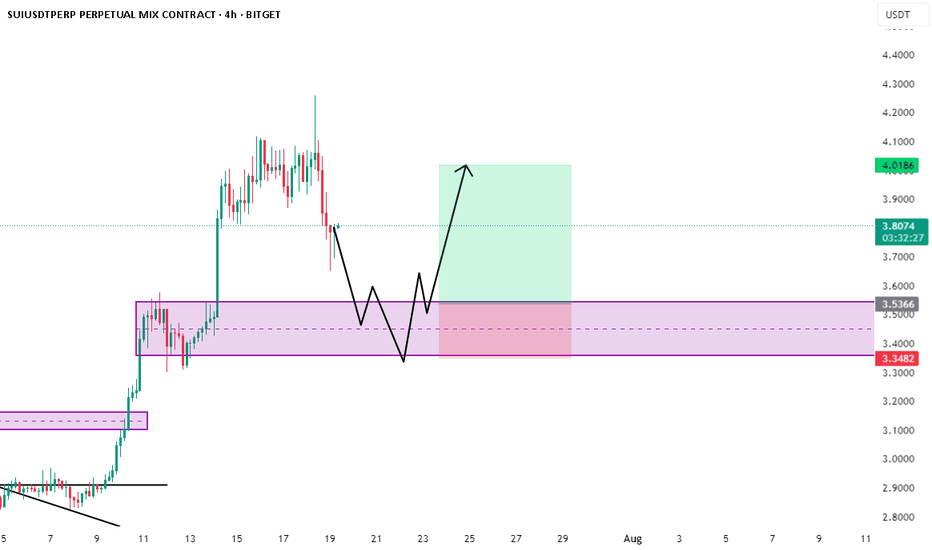

SUI/USDT Perpetual (BITGET)📊 Chart Overview

Pair: SUI/USDT Perpetual (BITGET)

Timeframe: 4H

Current Price: $3.8063

Key Zones:

Demand Zone: $3.35 – $3.54 (highlighted purple box)

Resistance/TP Zone: ~$4.01

🧠 Technical Breakdown

✅ Structure & Pattern

Price has broken down from recent highs after a sharp impulse.

Now heading into a clear demand zone, with a potential double bottom or liquidity sweep pattern forming inside that zone.

The black arrows suggest a W-shaped recovery, meaning price may:

Dip into the purple demand zone

Bounce slightly

Retest the bottom again (possibly sweep liquidity)

Strong bullish reversal toward $4+

🔍 Reasoning

Demand Zone: Previously respected as a consolidation + breakout base.

Liquidity Grab Possibility: Dips below recent minor support could trap shorts.

Volume Drop + Wicky Action: Shows potential exhaustion in selling pressure.

Reversal Plan: Smart money may reload here before next bullish impulse.

⚠️ Invalidation

Clean break and 4H candle close below $3.34 = setup invalid.

Could lead to further downside into the next lower support area (~$3.00).

"Not Financial Advice"