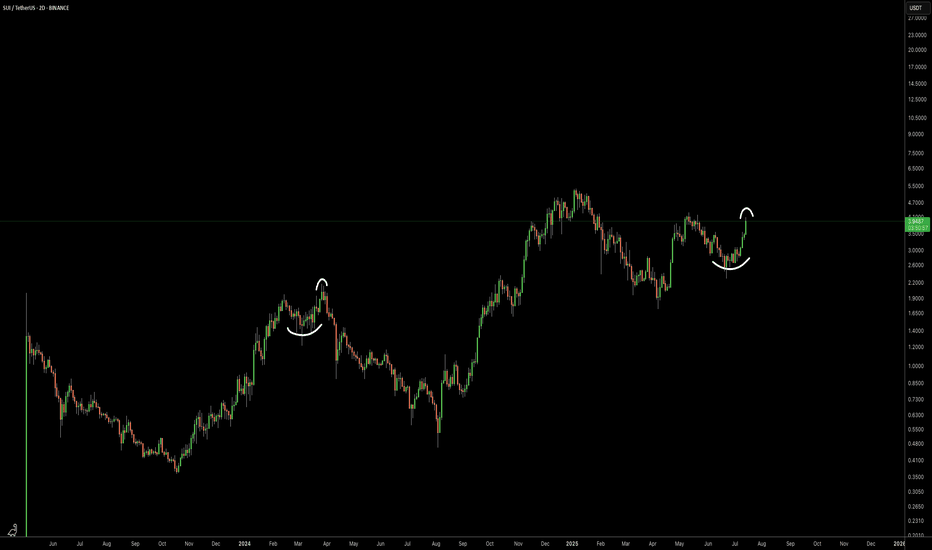

SUI Approaches Key Level Again…SUI has recovered sharply from range lows and is now staring down the same resistance that slapped it twice before. If momentum carries it through this time, there’s very little above. If not, this could be the last squeeze before a reset. Classic inflection point setup.

SUIUST trade ideas

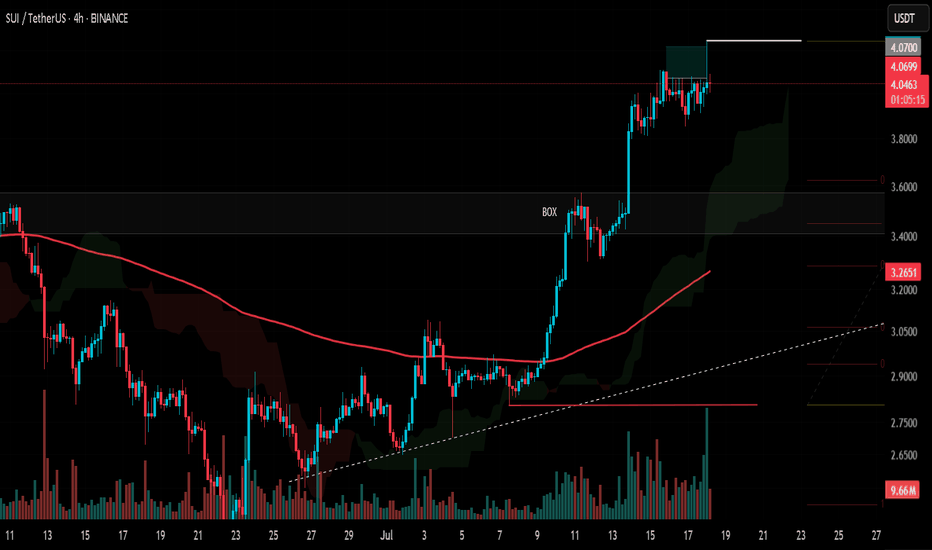

#SUI Update #1 – July 18, 2025#SUI Update #1 – July 18, 2025

While many major altcoins showed strong upward momentum yesterday, Sui failed to generate a significant volume-driven breakout. One of the primary reasons was the presence of heavy whale sell orders in the $4.20–$4.25 zone. As shown on the chart, price left a wick at the top and pulled back slightly.

Technically, Sui has not yet completed a proper correction following its recent impulsive move. If a correction does occur, the first support level lies around $3.61 — approximately a 10% drop from current levels. This would be a healthy pullback, not a cause for panic.

If you use a stop-loss, honor it. If not, make sure you have sufficient capital to average down in case of a deeper retracement.

If another impulsive leg is to come, $4.25 will again be a critical resistance area, still stacked with whale orders.

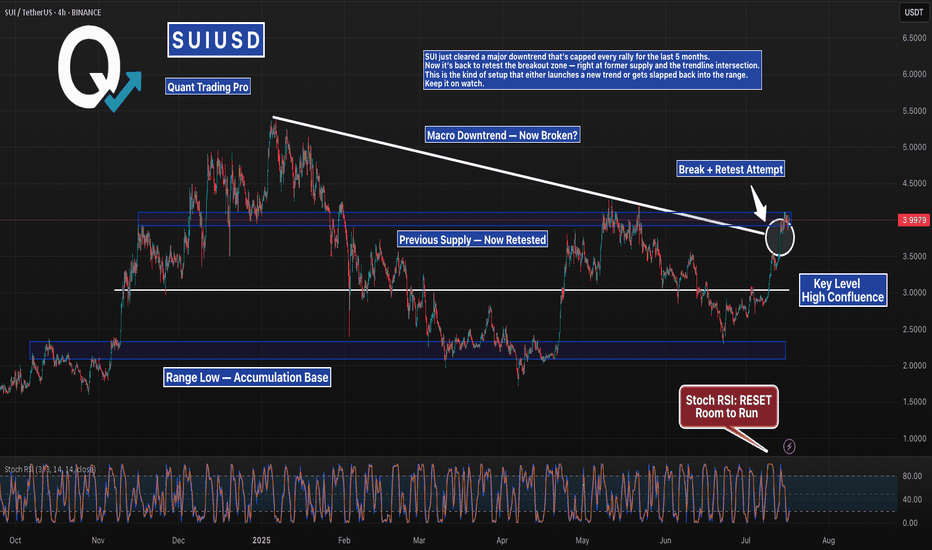

SUI Just Broke Its Downtrend — But Can It Hold?SUI just cleared a major downtrend that’s capped every rally for the last 5 months.

Now it’s back to retest the breakout zone — right at former supply and the trendline intersection.

This is the kind of setup that either launches a new trend or gets slapped back into the range.

Keep it on watch.

#SUI #SUIUSDT #CryptoBreakout #TrendlineTest #ChartAnalysis #BacktestEverything #TradingView #QuantTradingPro #CryptoTraders

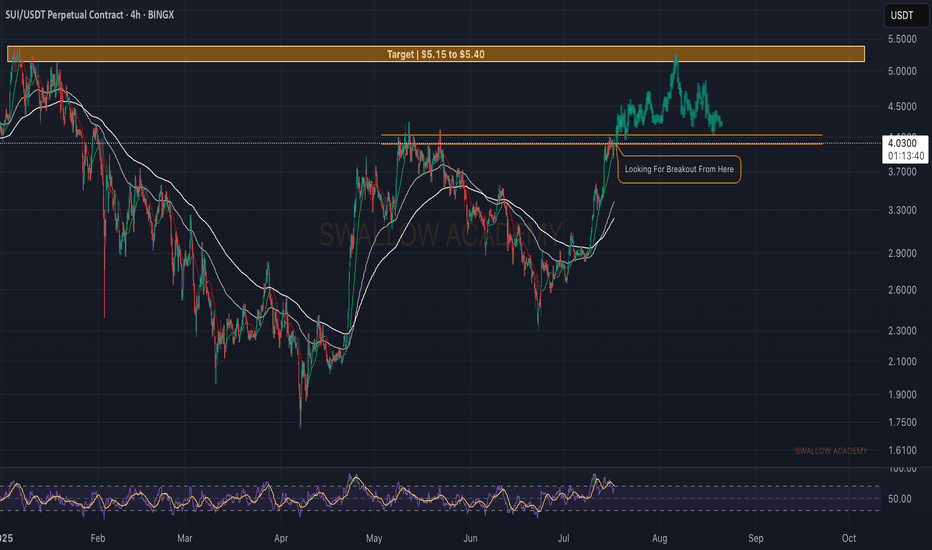

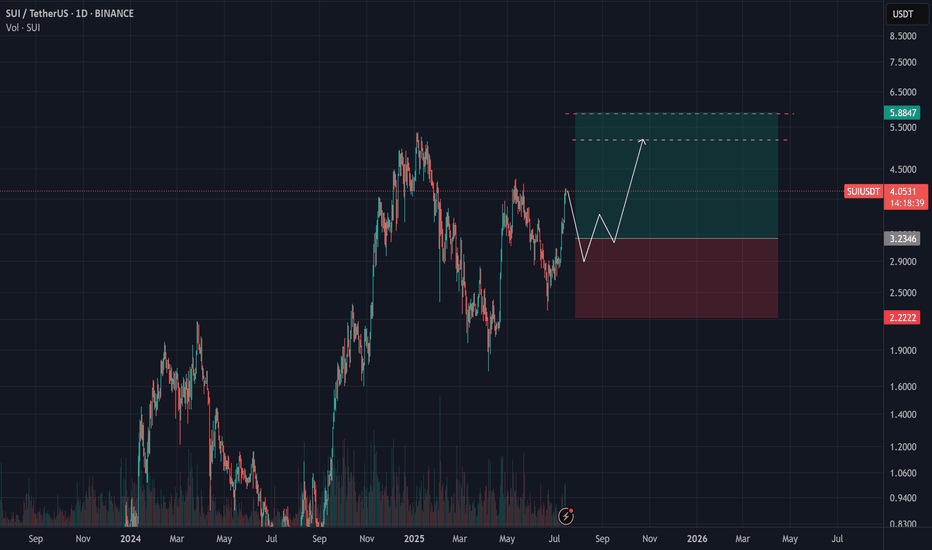

Sui (SUI): Looking For BOS (Break of Structure) Sui coin looks strong, where we are about to get a proper BOS (Break of Structure), which then would give us an ideal opportunity for a long position up until $5.40, where our target is sitting currently.

Once there we expect to see some sort of correction or sideways movement, before next wave of upward movement.

Swallow Academy

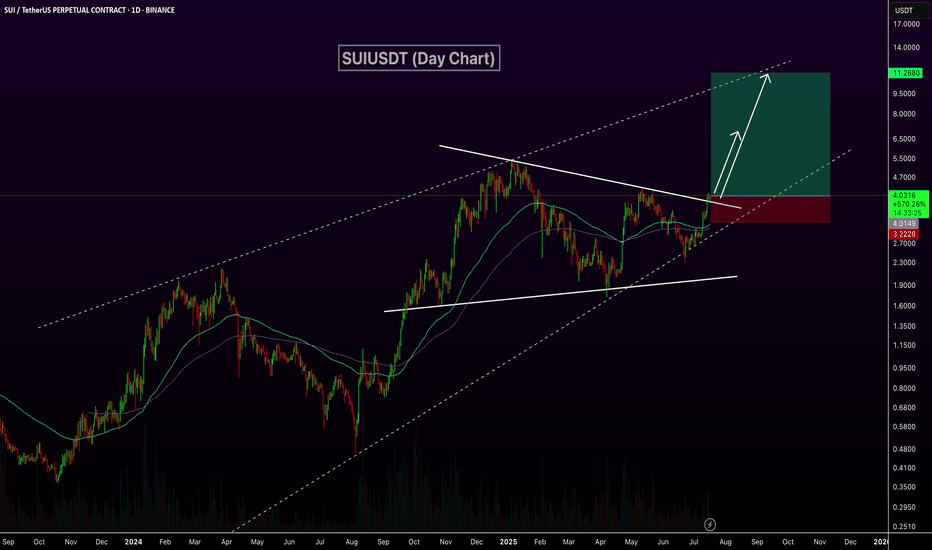

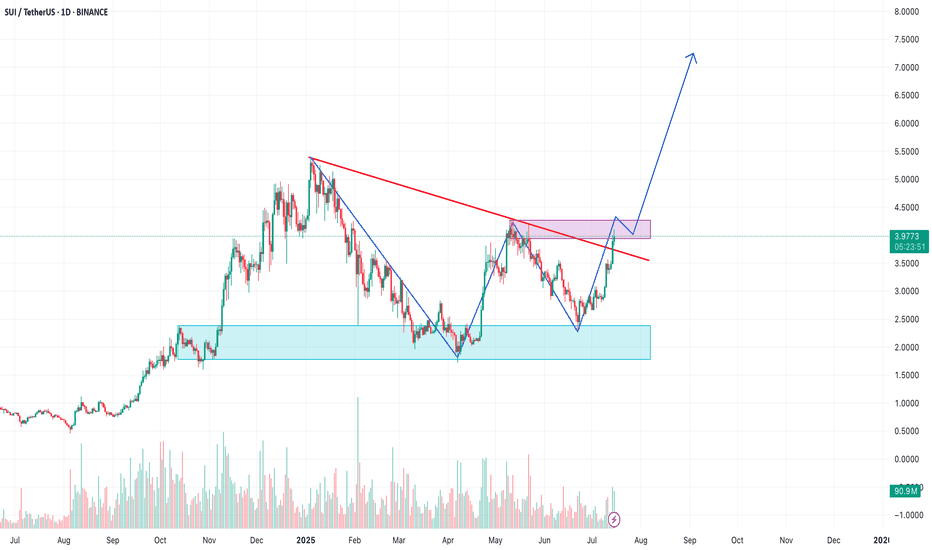

SUIUSDT Breaks Out of Triangle – Eyes on $10BINANCE:SUIUSDT daily chart has confirmed a breakout above a symmetric triangle resistance line within a larger ascending channel, signaling strong bullish momentum. Price has reclaimed the 100 and 200 EMAs, and the breakout is backed by rising volume. This setup opens the door for a potential rally toward the $10.00 level, with price currently holding above key structure support around $4.00. As long as this level holds, continuation toward the upper trendline remains likely. CRYPTOCAP:SUI

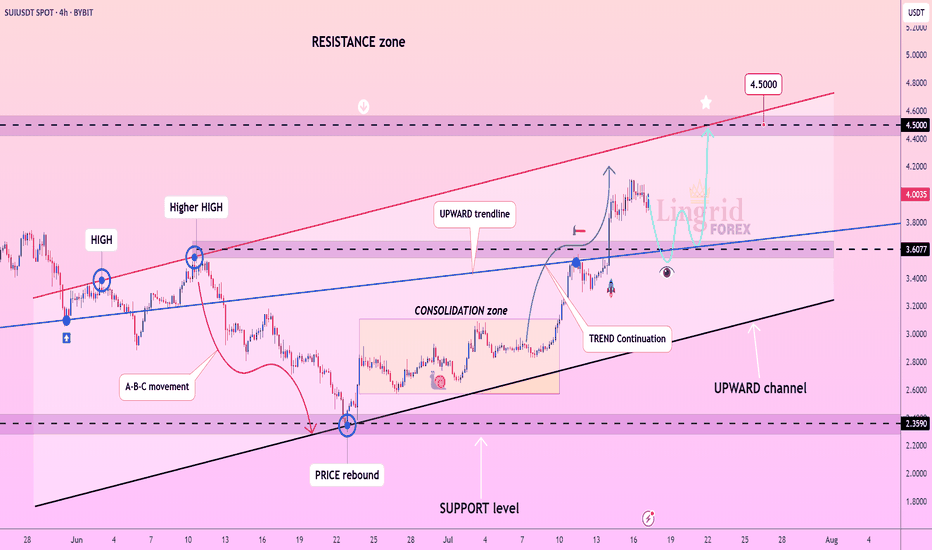

Lingrid | SUIUSDT Pullback and New Higher High PotentialBINANCE:SUIUSDT has rebounded strongly from the support level at $3.60, continuing its bullish sequence of higher highs and higher lows. The price broke out of the consolidation zone and climbed above the blue upward trendline, confirming a continuation of the bullish trend. A retest of the breakout area is likely before a push toward the major resistance zone at $4.50. The structure remains bullish as long as the channel support holds.

📉 Key Levels

Buy trigger: Bounce from $3.60 zone

Buy zone: $3.55–$3.70 (retest range)

Target: $4.50 (red resistance line)

Invalidation: Close below $3.45 trendline support

💡 Risks

Breakdown of the black channel line

Volume divergence or failure to hold the $3.60 support

Broader market weakness across altcoins

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

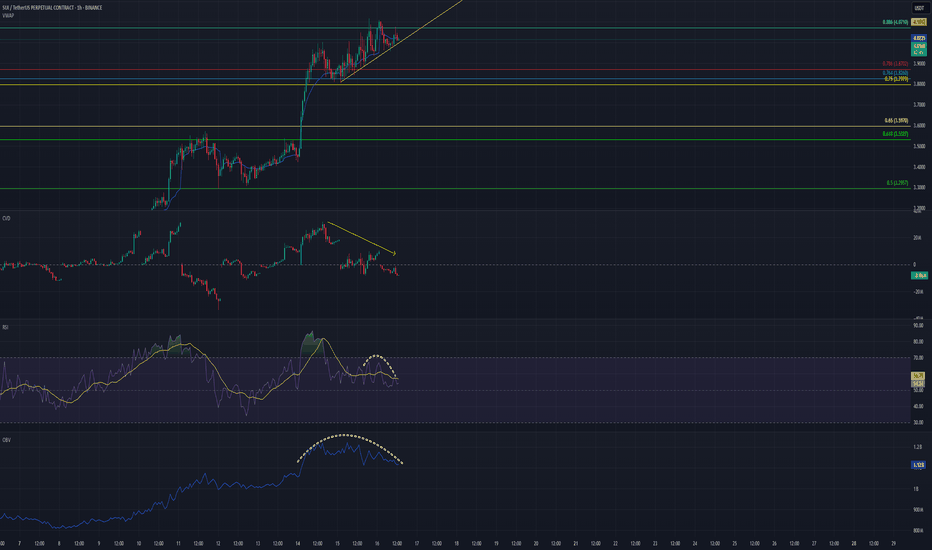

SUI‑USDT – Exhaustion or Extension?1. Why this zone matters

Price has reached the 0.886 Fib retrace of the May -> Jun swing.

Momentum is fading: 1‑hour RSI peaked lower (60 vs. 69 on the prior swing).

OBV and hourly volume both rolling over

2. Order‑flow snapshot (since 14 Jul 00:00 UTC)

Spot CVD → up Retail/FIAT buyers still lifting offers.

Perp CVD → down Aggressive shorts absorbing that demand.

Aggregated OI → up, now stalling Fresh longs trapped; beginning to unwind.

Interpretation: spot bids are being offset by short perps, and the build‑up in leverage is leaking—classic exhaustion.

3. Historical stats to know

The combo Spot CVD ↑ + Perp CVD ↓ + OI roll‑over + RSI bear‑div has produced a ≥ 1 % downside move within 30 minutes about 65 % of the time on tier‑1 alts (Jan 2023 – Apr 2025 sample).

4. Checklist before I short

M5 structure break (lower‑high plus close below the last M5 swing low).

Need a 1H candle CLOSE below the yellow ascending trendline!

Perp CVD flips ≤ 0 and OI prints two consecutive down‑ticks.

TPO sell tail with at least 3 single prints right at the high.

If all three fire → short is live. Otherwise, stand aside.

Bottom line

Momentum is fading; spot buying is being soaked up by stealth perp shorts, and leverage is already leaking out. Wait for the checklist—then look for a mean‑reversion move lower.

And remember: Reaction beats prediction.

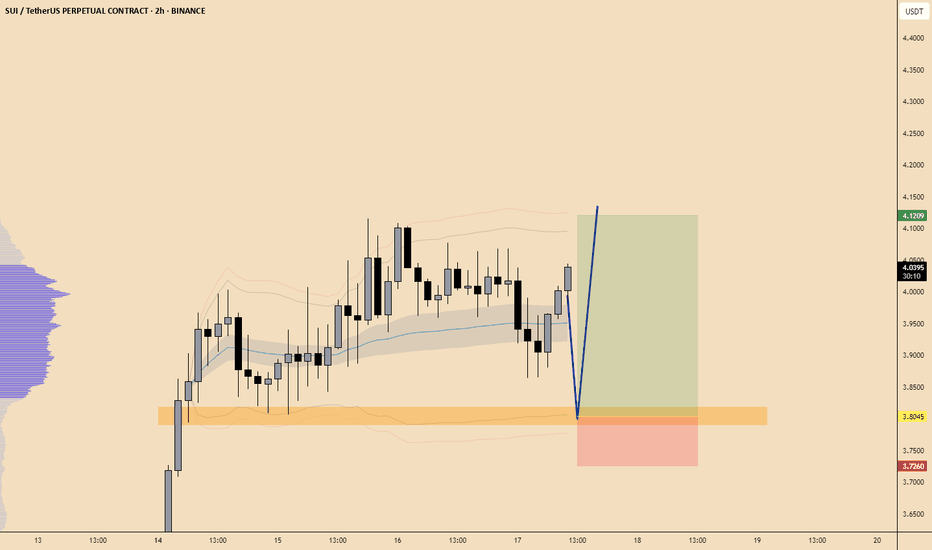

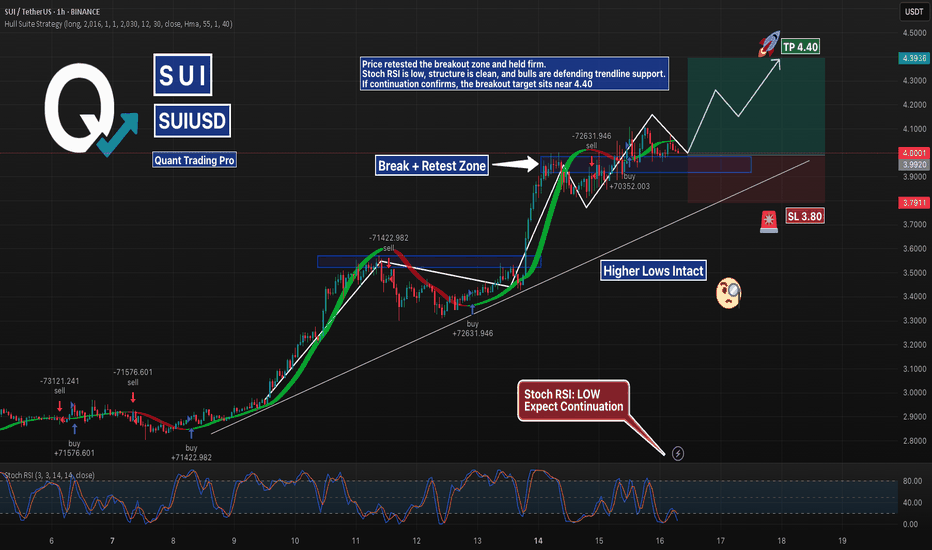

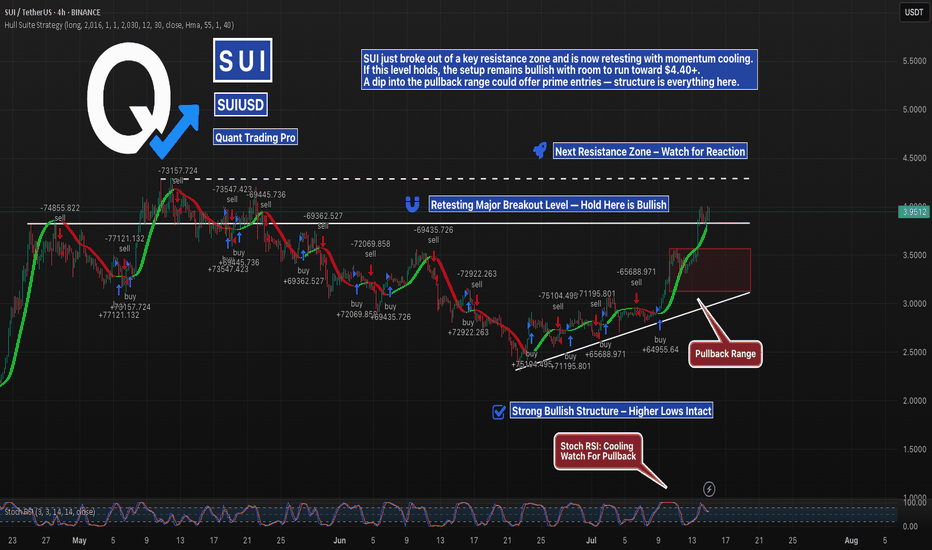

SUIUSD @ Retest Zone | Breakout Setup?SUI is consolidating in a potential bull flag above the previous resistance zone around $4.00.

Stoch RSI is low, trendline support is still intact, and a clean R:R setup presents itself with TP at $4.40 and SL at $3.80.

Watching for volume breakout confirmation before entry.

#SUIUSD #BullFlag #Crypto #SupportResistance #BreakoutSetup #TradingView #QuantTradingPro

SUI Analysis – July 15, 2025

SUI appears to have entered its bullish phase slightly earlier than most other altcoins.

This move seems to be fueled by a number of key partnerships and contracts signed over the past six months — a fundamentally positive signal.

📊 However, based on the current chart structure,

entering at this level may not be the most attractive opportunity.

✅ While a short-term 20% upside could be possible,

it’s more prudent to wait for price to test its previous high,

and observe how investors react to that resistance zone.

Their behavior will offer clearer insight into whether a continuation or correction is likely.

SUI is breaking out – Time to buy again.SUI is now breaking above the descending trendline. The price is approaching a key resistance zone around $4.10–$4.20. A successful breakout and retest could open the door to a strong bullish continuation.

💬 What do you think?

Drop your thoughts ⬇️

#SUI #CryptoTrading #Breakout #Altcoins #TechnicalAnalysis

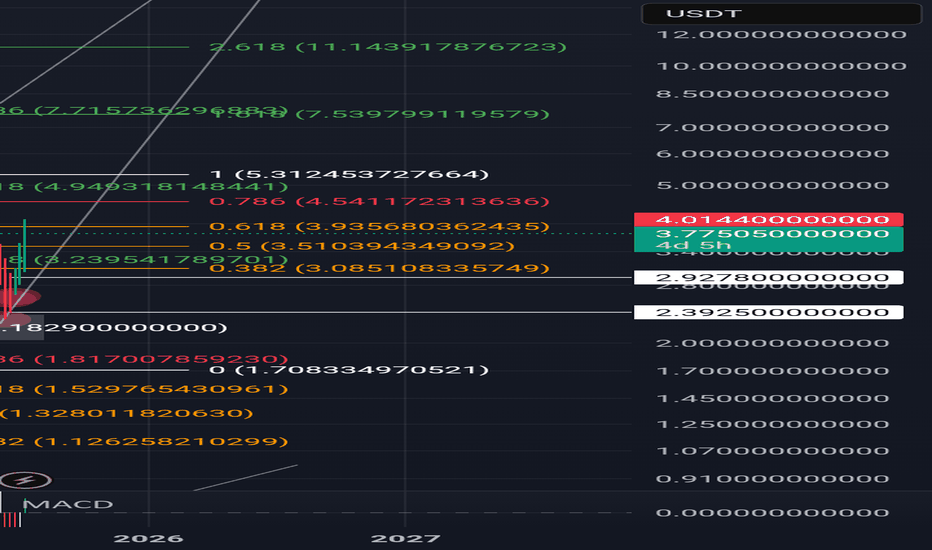

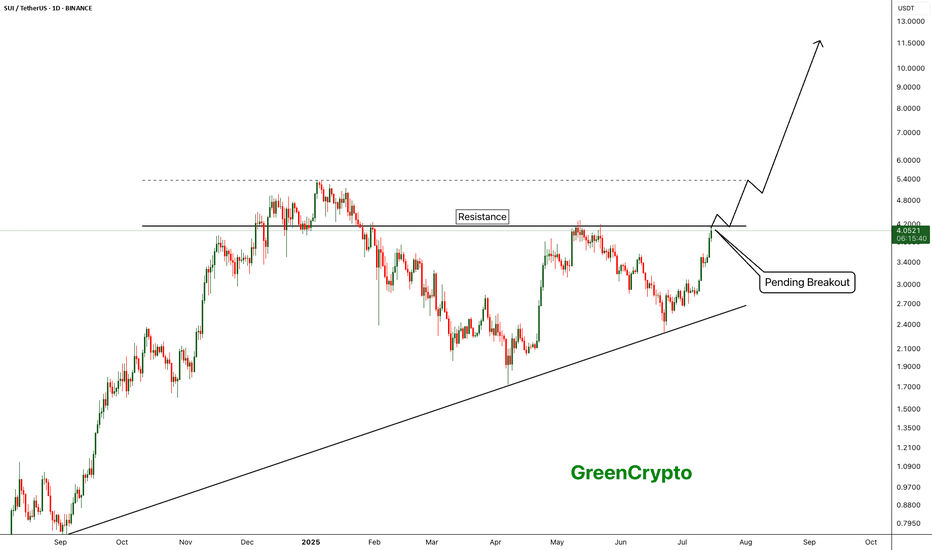

SUI - Breakout of the year- SUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

Cheers

GreenCrypto

Will key support be held or broken today?Hello friends

According to the complete analysis we conducted on this currency, we concluded that the price correction can continue with the failure of the specified support and go to lower supports, but if buyers support the price in the support area, it can have a good rise.

Note that with capital and risk management, you can buy in steps in the specified support areas and move with it to the specified targets.

*Trade safely with us*

SUI Breakout Retest in Progress — Bulls Have the BallSUI has finally broken above major horizontal resistance and is now retesting that level, backed by a rising trendline of higher lows. With Stoch RSI cooling and the price sitting just above a prior range, this is the key decision zone.

If bulls defend the breakout, continuation toward $4.40+ is likely. If not, the pullback zone between $3.50–$3.00 becomes critical. Structure still favors the bulls — but confirmation is everything.

#SUIUSDT #CryptoBreakout #QuantTradingPro #TradingView #BacktestYourEdge #AltcoinSetup

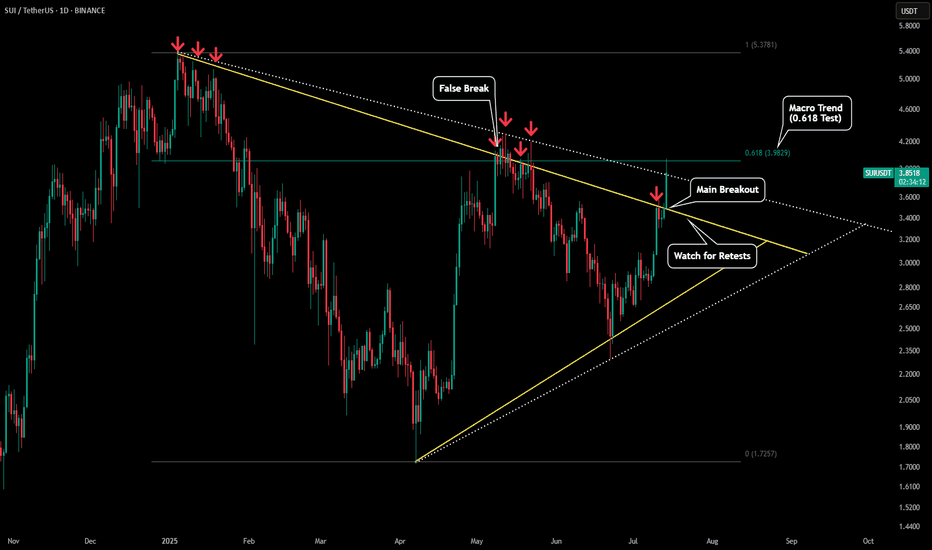

SUI - Daily Chart PerpectiveThis chart is in expansion to our previous post:

What we can see is SUI has clearly broken out of its symmetrical triangle (yellow trendlines). This is the first good sign for potential new highs for SUI.

However since the 4H chart could be spelling out a short term drop lets see where price could go.

Right now it is testing the 0.618 of the macro trend as resistance. It could also be battling with the top range of wick price action (dotted white lines).

If price does fall on the 4H chart it could coincide with a retest of our yellow trendline.

If we get a retest and hold of that yellow trendline that will be the confirmation we need for a full blown breakout for SUI.

If we do not fall on the 4h chart and break back above the $4 level then price will head to the 0.786 ($4.60) followed by a test of the previous high.

SUI 50% correction to $1.50 areaOn the above 3 day chart price action has moved up 700% since last August. A number of reasons now exist for a reversal, they include:

1) Broken market structure.

2) Price action and RSI support breakouts.

3) A reliable bearish crossover.

4) No support levels until 1.90. A strike of 1.50 is probable.

5) "Short" active from $4.05 area.

Is it possible price action continues printing higher highs? Sure.

Is it probable? No.

Ww

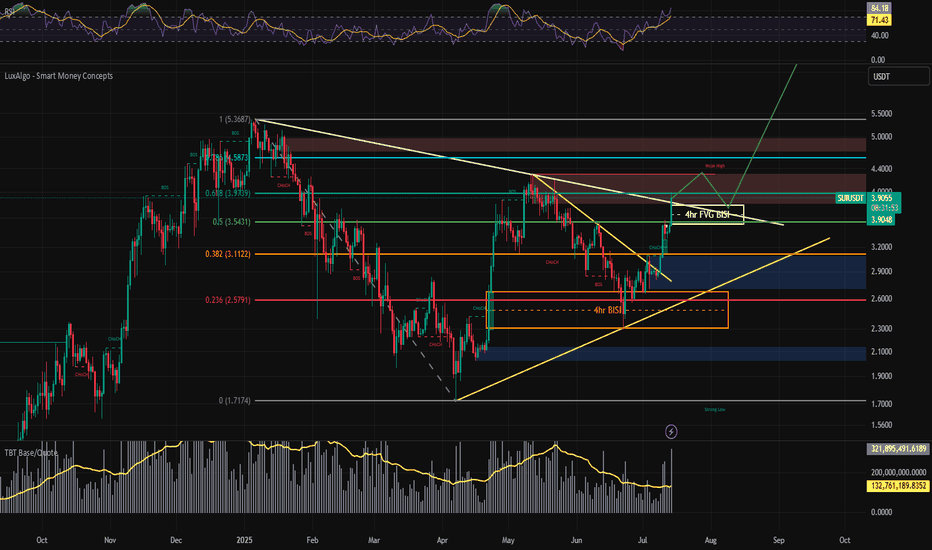

SUIUSDT Weekly Chart Analysis | Breakout Confirmed!SUIUSDT Weekly Chart Analysis | Breakout Confirmed, Massive Liquidity at $4–$4.20

🔍 Let’s dive into the SUI/USDT weekly chart after a decisive breakout from the symmetrical triangle, highlighting the critical liquidity zone and what it means for price action.

⏳ Weekly Overview

SUI has broken out of its multi-month triangle pattern following a textbook fakeout, with volume dynamics confirming renewed bullish momentum. The breakout is now awaiting daily candle confirmation for full validation.

🔺 Bullish Breakout & Key Liquidity Zone

A major liquidity cluster sits between $4.00 and $4.20, with more than $140 billion in liquidity concentrated in this range. This zone is crucial for several reasons:

- It represents a significant area where large buy and sell orders are stacked, likely leading to heightened volatility as price approaches or breaks through.

- Clearing this liquidity could unlock rapid moves toward the next upside targets at $7.03 and $9.50, as shown on the chart.

📊 Key Highlights

- Symmetrical triangle resolved with a bullish breakout, confirmed by increasing volume.

- The $4.00–$4.20 range holds over $140B in liquidity, making it a pivotal battleground for bulls and bears.

- Daily candle confirmation remains essential for trend validation.

- SUI ecosystem has reached a new all-time high in DeFi TVL, adding fundamental strength to the bullish case.

🚨 Conclusion

The breakout above the triangle, combined with surging volume and a record DeFi TVL, sets the stage for a potential rally. Watch the $4.00–$4.20 liquidity zone closely—how price interacts with this level could determine the speed and magnitude of the next move. Stay alert for daily confirmation and be prepared for volatility as SUI tests this high-stakes region.

#SUI #CryptoAnalysis #TradingView #Altcoins #ACA

SUI | Triangle BreakoutSUI/USDT has successfully broken out of a major triangle consolidation pattern. The breakout pattern suggests SUI could experience significant upside momentum, especially if it maintains above the triangle's upper boundary. This technical setup aligns well with a medium-term bullish outlook.

Key Technical Points:

Triangle pattern breakout confirmed with strong momentum

Price cleared the upper resistance trendline decisively

RSI showing recovery from oversold conditions

Multiple VWAP levels providing support structure

Price Targets:

First resistance: $4.20 (red shaded zone)

Extended target: $6.50+ following the projected path

Trade Setup:

Entry: Current levels (agressive) or on a pullback to the triangle (conservative)

Stop loss: Below $3.30 VWAP-90 Support

#SUI/USDT ready to surge 13% toward $3.72 target?#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 3.30.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3.20, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 3.44

First target: 3.53

Second target: 3.62

Third target: 3.72

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.