Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper ri

Key facts today

Apple Inc. (AAPL) shares fell 15.9% in 2025, contrasting with a 7.8% rise in the S&P 500, sparking talks about possible leadership changes amid AI adoption concerns.

Apple is suing YouTuber Jon Prosser and Michael Ramacciotti for allegedly stealing trade secrets about the iOS 26 update, seeking damages and an injunction to protect its information.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.94 EUR

84.19 B EUR

351.20 B EUR

14.92 B

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

FIGI

BBG000DH0LW5

Apple, Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, AppleCare, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in April 1976 and is headquartered in Cupertino, CA.

Related stocks

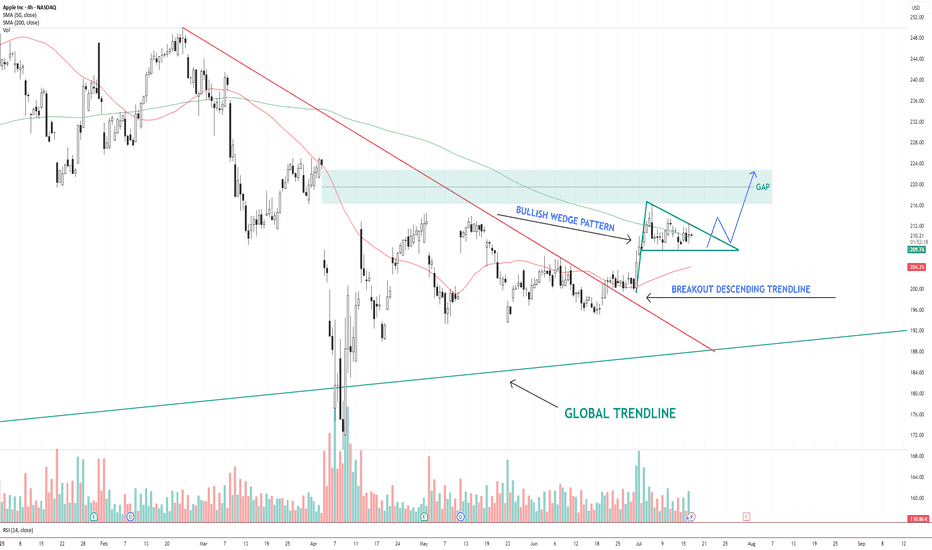

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting

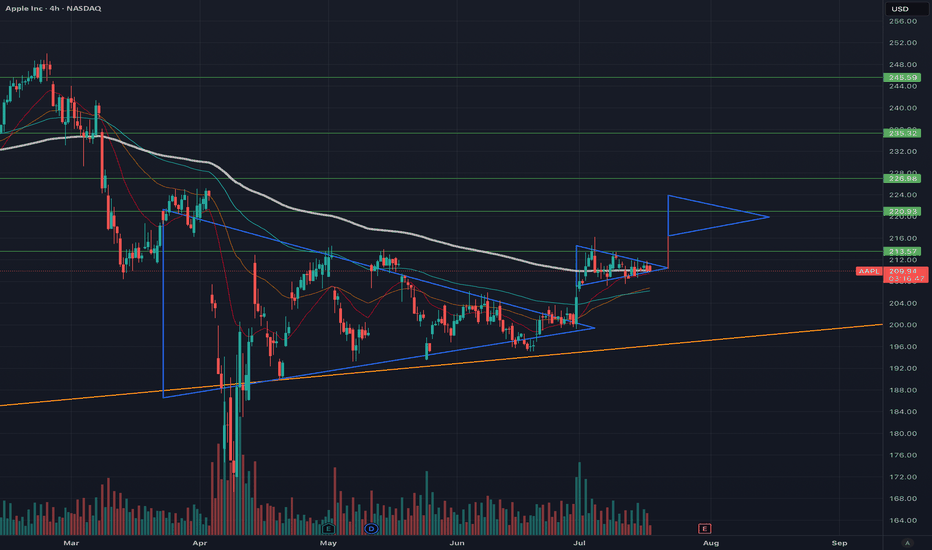

Time to buy? Too much negative press. Buy in Fear- Updated 13/7Apple has faced prolonged downward pressure from bearish investors. Despite its best efforts and some dips, the stock has steadily maintained a baseline price of 200 USD. The flag pattern required some adjustments along its path to break out, primarily due to geopolitical issues and economic variabl

Apple Stock Is Surging! Here’s What Most People MissWhen it comes to trading, we don’t care about the latest news headlines or whether some analyst has upgraded or downgraded Apple stock. We focus on one thing and one thing only: the undeniable forces of supply and demand imbalances on higher timeframes.

Right now, Apple’s monthly chart is a textboo

$AAPL | Smart Money Concepts Weekly DSS Update Apple ( NASDAQ:AAPL ) is approaching a critical decision zone on the weekly SMC structure, where liquidity, volume, and macro pressure converge.

🔎 Key Observations (WaverVanir DSS):

🔺 Premium Zone (240–260) acting as a weak high with multiple CHoCH & BOS confirmations

🔻 Major equilibrium level at

Time to buy? Too much negative press. Buy in Fear- Updated 18/7Apple has significantly underperformed compared to the other Magnificent 7 stocks, but I don’t believe it’s a company you should bet against in the current climate. With a slow rollout of AI and recent statements from Apple, they may not always be first to market, but they generally execute well. Th

AAAPL: Updated Outlook and Best Level to BUY/HOLD 70% gains________________________________________

Apple Outlook: July 2025–Q1 2026

After peaking near $200 in late May, Apple (AAPL) remains under correction territory despite pockets of resilience, closing July around $193. The current correction is projected to persist until Q1 2026, as global macro and

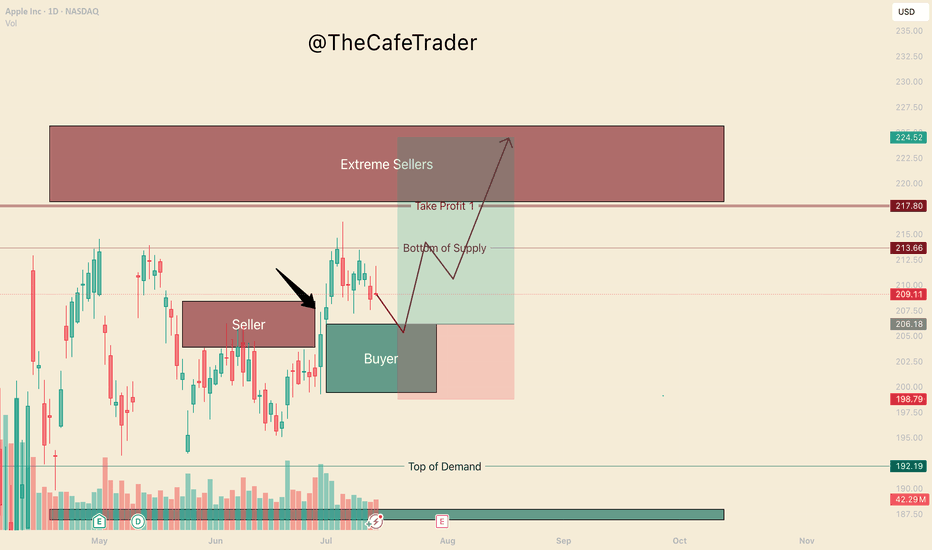

APPL. Bulls are in ControlHello, I’m TheCafeTrader.

This post is for technical traders looking to capitalize on short swings and options.

What you’re seeing here are supply and demand zones — areas where liquidity is concentrated. These levels are identified using a system built around footprint data, order flow, and marke

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US37833DZ0

APPLE 20/50Yield to maturity

7.08%

Maturity date

Aug 20, 2050

US37833EF3

APPLE 21/51Yield to maturity

6.94%

Maturity date

Feb 8, 2051

US37833EG1

APPLE 21/61Yield to maturity

6.91%

Maturity date

Feb 8, 2061

US37833EK2

APPLE 21/51Yield to maturity

6.91%

Maturity date

Aug 5, 2051

US37833EL0

APPLE 21/61Yield to maturity

6.90%

Maturity date

Aug 5, 2061

US37833DW7

APPLE 20/50Yield to maturity

6.89%

Maturity date

May 11, 2050

US37833EA4

APPLE 20/60Yield to maturity

6.79%

Maturity date

Aug 20, 2060

US37833DQ0

APPLE 19/49Yield to maturity

6.63%

Maturity date

Sep 11, 2049

US37833EE6

APPLE 21/41Yield to maturity

6.36%

Maturity date

Feb 8, 2041

US37833DD9

APPLE 17/47Yield to maturity

6.18%

Maturity date

Sep 12, 2047

US37833BA7

APPLE 15/45Yield to maturity

6.17%

Maturity date

Feb 9, 2045

See all APC bonds

Curated watchlists where APC is featured.

Frequently Asked Questions

The current price of APC is 181.54 EUR — it has decreased by −0.32% in the past 24 hours. Watch Apple Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Apple Inc. stocks are traded under the ticker APC.

APC stock has risen by 0.33% compared to the previous week, the month change is a 6.48% rise, over the last year Apple Inc. has showed a −13.47% decrease.

We've gathered analysts' opinions on Apple Inc. future price: according to them, APC price has a max estimate of 236.36 EUR and a min estimate of 119.47 EUR. Watch APC chart and read a more detailed Apple Inc. stock forecast: see what analysts think of Apple Inc. and suggest that you do with its stocks.

APC stock is 1.11% volatile and has beta coefficient of 1.03. Track Apple Inc. stock price on the chart and check out the list of the most volatile stocks — is Apple Inc. there?

Today Apple Inc. has the market capitalization of 2.71 T, it has increased by 0.24% over the last week.

Yes, you can track Apple Inc. financials in yearly and quarterly reports right on TradingView.

Apple Inc. is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

APC earnings for the last quarter are 1.53 EUR per share, whereas the estimation was 1.50 EUR resulting in a 1.39% surprise. The estimated earnings for the next quarter are 1.21 EUR per share. See more details about Apple Inc. earnings.

Apple Inc. revenue for the last quarter amounts to 88.14 B EUR, despite the estimated figure of 87.39 B EUR. In the next quarter, revenue is expected to reach 75.57 B EUR.

APC net income for the last quarter is 22.91 B EUR, while the quarter before that showed 35.09 B EUR of net income which accounts for −34.73% change. Track more Apple Inc. financial stats to get the full picture.

Yes, APC dividends are paid quarterly. The last dividend per share was 0.23 EUR. As of today, Dividend Yield (TTM)% is 0.48%. Tracking Apple Inc. dividends might help you take more informed decisions.

Apple Inc. dividend yield was 0.43% in 2024, and payout ratio reached 16.11%. The year before the numbers were 0.55% and 15.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 19, 2025, the company has 164 K employees. See our rating of the largest employees — is Apple Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Apple Inc. EBITDA is 128.36 B EUR, and current EBITDA margin is 34.44%. See more stats in Apple Inc. financial statements.

Like other stocks, APC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Apple Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Apple Inc. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Apple Inc. stock shows the neutral signal. See more of Apple Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.