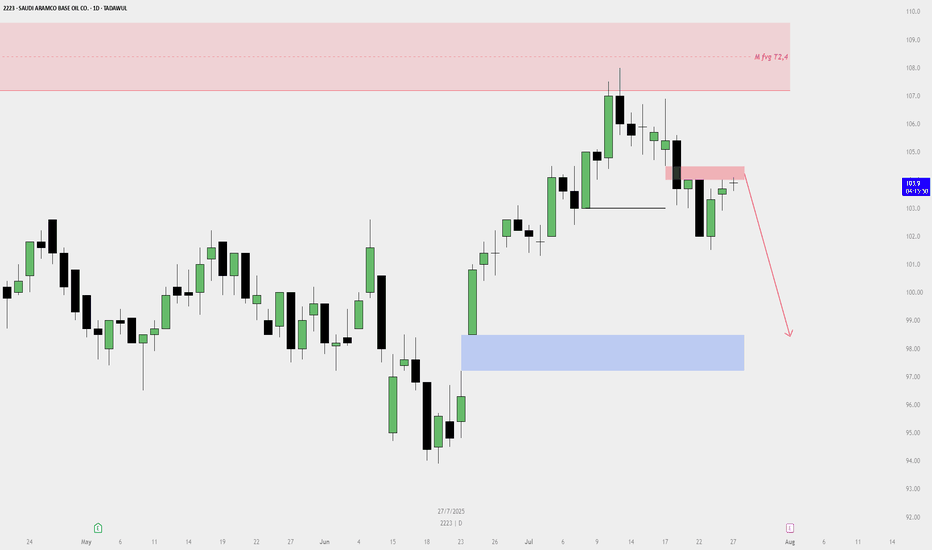

Saudi Aramco Base Oil Co. (Luberef - 2223) on the Daily timefram🔻 Sell Plan Summary

🔴 Key Supply Zones:

Monthly Fair Value Gap (FVG) / Premium Supply Zone — (Red Box around 108–110 SAR)

Labeled as “M fvg T2,4” on your chart.

Price previously reversed from this zone, indicating strong selling pressure.

Daily Bearish FVG / Rejection Zone — (Red Zone around 104.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.7 SAR

972.03 M SAR

10.04 B SAR

49.98 M

About SAUDI ARAMCO BASE OIL CO.

Sector

Industry

CEO

Samer A. Al-Hokail

Website

Headquarters

Jeddah

Founded

1976

ISIN

SA15M1HH2NH5

FIGI

BBG01BQGDC45

Saudi Aramco Base Oil Co. engages in the construction and operation of refineries lubricating oils. The firm also purchases, sells, transports, markets, imports, and exports lubricating oils, additives, lubricating oil blending stocks, by-products, and other related petroleum products. The company was founded on June 19, 1976 and is headquartered in Jeddah, Saudi Arabia.

Related stocks

ARAMCO is BullishPrice is in a strong downtrend printing lower lows and lower highs continuously. However, the eight month long trendline seems to be breaking. Moreover, accumulation at current levels is also an indication that bulls are trying to assume control of the price action. If previous lower high is broken

SAUDI ARAMCO BASE OIL - Daily Chart (TADAWUL)SAUDI ARAMCO BASE OIL - Daily Chart (TADAWUL)

"After a long bearish phase, the market finally pauses to breathe. If the next bullish leg confirms, it will unlock the roadmap to higher targets. With strong conviction, I believe the 2025 low is already in place. Eyes on 107.4 first, then 111.8. Let p

SAUDI ARAMCO is BullishPrice was in a strong downtrend, however it seems that bears are exhausted and price is ready for a take-off from here. Bullish RSI divergence has emerged on both daily and weekly time frame, hinting the control of bulls. If previous lower high is broken successfully, then we can expect a bullish re

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 2223 is 104.4 SAR — it has increased by 1.56% in the past 24 hours. Watch SAUDI ARAMCO BASE OIL CO. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TADAWUL exchange SAUDI ARAMCO BASE OIL CO. stocks are traded under the ticker 2223.

2223 stock has risen by 0.87% compared to the previous week, the month change is a 2.15% rise, over the last year SAUDI ARAMCO BASE OIL CO. has showed a −19.94% decrease.

We've gathered analysts' opinions on SAUDI ARAMCO BASE OIL CO. future price: according to them, 2223 price has a max estimate of 131.50 SAR and a min estimate of 113.00 SAR. Watch 2223 chart and read a more detailed SAUDI ARAMCO BASE OIL CO. stock forecast: see what analysts think of SAUDI ARAMCO BASE OIL CO. and suggest that you do with its stocks.

2223 reached its all-time high on Mar 13, 2024 with the price of 179.0 SAR, and its all-time low was 92.1 SAR and was reached on Apr 7, 2025. View more price dynamics on 2223 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

2223 stock is 2.65% volatile and has beta coefficient of 0.90. Track SAUDI ARAMCO BASE OIL CO. stock price on the chart and check out the list of the most volatile stocks — is SAUDI ARAMCO BASE OIL CO. there?

Today SAUDI ARAMCO BASE OIL CO. has the market capitalization of 17.57 B, it has decreased by −1.21% over the last week.

Yes, you can track SAUDI ARAMCO BASE OIL CO. financials in yearly and quarterly reports right on TradingView.

SAUDI ARAMCO BASE OIL CO. is going to release the next earnings report on Aug 3, 2025. Keep track of upcoming events with our Earnings Calendar.

2223 earnings for the last quarter are 1.32 SAR per share, whereas the estimation was 1.26 SAR resulting in a 4.72% surprise. The estimated earnings for the next quarter are 1.72 SAR per share. See more details about SAUDI ARAMCO BASE OIL CO. earnings.

SAUDI ARAMCO BASE OIL CO. revenue for the last quarter amounts to 2.13 B SAR, despite the estimated figure of 2.21 B SAR. In the next quarter, revenue is expected to reach 2.43 B SAR.

2223 net income for the last quarter is 221.51 M SAR, while the quarter before that showed 208.21 M SAR of net income which accounts for 6.39% change. Track more SAUDI ARAMCO BASE OIL CO. financial stats to get the full picture.

SAUDI ARAMCO BASE OIL CO. dividend yield was 5.97% in 2024, and payout ratio reached 115.63%. The year before the numbers were 7.06% and 111.40% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SAUDI ARAMCO BASE OIL CO. EBITDA is 1.22 B SAR, and current EBITDA margin is 12.55%. See more stats in SAUDI ARAMCO BASE OIL CO. financial statements.

Like other stocks, 2223 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SAUDI ARAMCO BASE OIL CO. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SAUDI ARAMCO BASE OIL CO. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SAUDI ARAMCO BASE OIL CO. stock shows the sell signal. See more of SAUDI ARAMCO BASE OIL CO. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.