UNF1! trade ideas

NQ Power Range Report with FIB Ext - 4/11/2025 SessionCME_MINI:NQM2025

- PR High: 18597.75

- PR Low: 18464.50

- NZ Spread: 297.25

Key scheduled economic events:

08:30 | PPI

Retraced 50% of Wednesday's range

- Rotating off 18400 zone pivot, above previous session close

- High volatility sentiment continues

Session Open Stats (As of 12:55 AM 4/11)

- Session Open ATR: 865.12

- Volume: 54K

- Open Int: 236K

- Trend Grade: Bear

- From BA ATH: -17.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed lower following news of additional tariffs on China. On the daily chart, the index failed to break above the 20-day moving average and pulled back to the 5-day MA, continuing its box-range movement. Since the 5-day MA is still acting as support, the current trend can still be seen as a sideways consolidation, with 18,500 acting as a central pivot level.

The MACD on the daily chart has not yet clearly broken above the Signal line, so it remains uncertain whether it will make a golden cross with additional upward momentum, or turn downward again. Thus, it’s best to adopt a neutral range-bound trading strategy, keeping strict stop-losses on both sides.

On the 240-minute chart, both the MACD and Signal line have moved above the zero line, entering a key area to observe whether the third wave of MACD upside begins after this box-range consolidation. Since the current price is correcting after a rebound from a double bottom, and is maintaining the center of the prior bullish candle, buying remains more favorable. Unless the previous day’s low is broken, it’s better to stay buy-biased.

Please note that today's PPI data release is scheduled, which may lead to increased volatility around the announcement time.

Crude Oil

Crude oil closed lower with a large bearish candle. On the daily chart, it failed to hold the 5-day and 10-day moving averages, breaking below the 5-day MA. The MACD continues its downward slope, and unless oil clearly reclaims the 10-day MA, the market will remain bear-biased.

There is resistance now at the 3-day and 5-day MAs, so it’s important to see whether further downside unfolds. As previously noted, the $59 level is a key support zone — watch closely for any breakdowns.

On the 240-minute chart, the MACD is trending up and pulling the Signal line along, but both remain below the zero line. If oil continues in a box range but the MACD turns downward again and forms a dead cross, there could be another leg lower. For now, continue to focus on buying near the $59 level, and maintain a range-trading approach until further confirmation.

Gold

Gold closed higher with another strong rally. On the daily chart, the MACD has now crossed above the Signal line, generating a buy signal. However, this signal will only be valid if today’s candle closes as a bullish bar, so watching the daily close is critical.

Gold hit new all-time highs during the pre-market session, with the long-awaited 3,216 level, which has been the target since March, now within reach. Beyond this level, we enter the overshooting zone, where it’s difficult to define a precise top. Therefore, it's best to stick to dip-buying strategies, as safe-haven demand continues to surge.

Even though the MACD has crossed bullishly, divergence may form if the current MACD fails to exceed the previous peak. Avoid chasing long positions at the top; instead, look for entries during pullbacks.

On the 240-minute chart, the MACD has climbed above the zero line, showing a strong one-way bullish trend. RSI across intraday charts is now in overbought territory, so it’s best to avoid short positions entirely for today.

Market Sentiment & VIX

Looking at the VIX index, the daily candle has once again broken above the 5-day MA, indicating that volatility could expand further at any time. With Trump’s remarks shaking markets, it’s impossible to predict what new developments might emerge over the weekend.

Avoid holding overnight positions due to heightened headline risk, and make sure to wrap up this trading week with solid risk management.

Wishing you a profitable trading day!

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

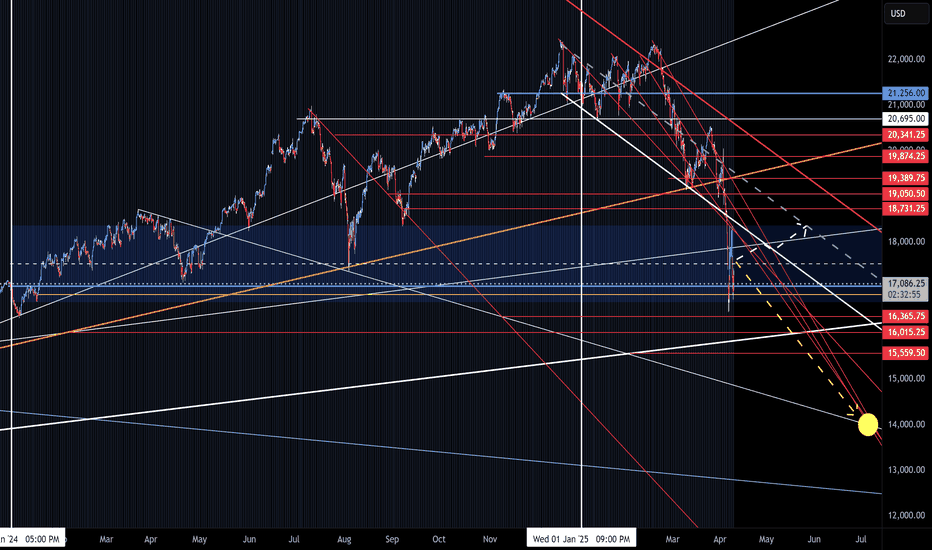

Does History Repeat Itself? How Far Can the Nasdaq Fall?Let's examine the current 2025 correction on a logarithmic chart: the price movements show significant similarities to the February 2020 decline. At that time, the global crisis—then driven by COVID-19 panic—fundamentally influenced market movements, while now, trade uncertainties are generated by President Trump's aggressive tariff announcements.

The chart reveals that the Nasdaq is declining steeply, and technical levels play a decisive role: yesterday, the price bounced back from the 61.8% Fibonacci retracement level. However, it is clear that supporting technical indicators—such as the break of the RSI convergence trend on the days triggering the decline—confirm the downward movement.

In the earlier 2020 decline, massive volume accompanied the initial weeks' movements, while this year's movement is characterized by steadily increasing volume. Nevertheless, the current volume peak falls short of the peak measured in the 2020 week (4.45 million vs. 6.8 million), indicating that the trend may continue with further declines.

Overall, technical analysis—the examination of logarithmic charts, the break of the RSI trend, and volume movements—suggests that the current correction may deepen further, and the Nasdaq's target price can be estimated between 14,500 and 15,000 points.

Observing a similar scenario in history, when global events triggered high volatility, it appears that market reactions now do not differ from past patterns. If the current negative trend continues, a further deepening of the correction is plausible, as the lag in market volume (4.45M vs. 6.8M) indicates that investors have not yet been able to offset the negative sentiment prevailing in the sector.

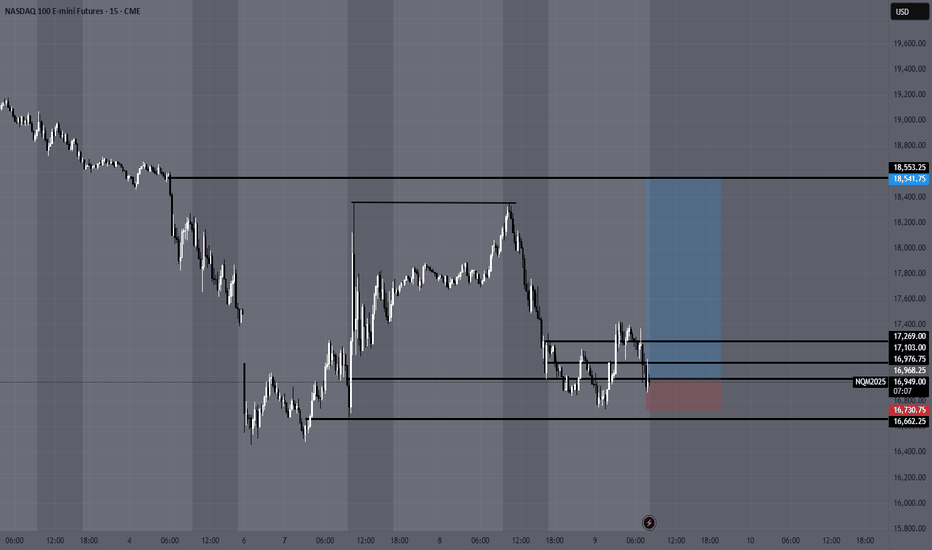

2025-04-10 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: Big bear trend line is holding up and market printed a lower high. I expect lower highs and higher lows for much more time. By now you should know that I don’t make up stuff about trading ranges and a triangle is a form of a trading range. You buy low, sell high and scalp. Mark the 30% of the upper and lower bound of the range, trend lines and trade if market turns. It’s not rocket science. It’s about you against you and not letting emotions mess up your trading success.

current market cycle: bear trend valid until bear trend line broken but trading range a bit more likely right now. At least on lower time frames.

key levels: 16000 - 20000

bull case: Bulls want to keep this higher low much higher than 17200 and are trying above the breakout price 18360. Tomorrow we will see if they can get a second leg up and retest 19000. I have no opinion on that and will wait what the market will give me. Shorting below 18800 is bad, no matter what. Is 18450 a good buy for the bulls? Far from it. Where would you put your stop? 17900? Risk of that getting hit is very high.

Invalidation is below 16400.

bear case: Bears did good at keeping this a lower high and casually selling down for 1469 points. In the grand scheme of things it’s around a 50% retracement of yesterday, so currently a “normal” move if you just look at this week. Markets are broken and someone bigger will fail soon. They always do. Swing shorts are ok at 18400 if you can add higher again. Risk of a retest 19000 is too big for a trade with a tight stop. If I had to guess, I think we will retest 17500 tomorrow and close somewhere around 18000.

short term: Neutral around 17900-18700 and only interested in fading the extremes in given range.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. W3 overshot it by 1000 points. Now my bearish bias is gone and I will wait how this unfolds. Big uncertainty for this year but I think this selling is overdone and big bois are buying with both hands below 17000.

trade of the day: Shorting yesterday’s high was the obvious trade of the day since market only made lower highs since Globex open. Tough day in any case because the swings are so wild that the risk is gigantic on any given trade. Not the best environment for beginners or people with small accounts. Trade small and be humble.

NQ Range (04-10-25)Staying with the Range 19,400 - 18,200. Looking for 18,200 retest to hold or not. Was that insider trading yesterday? Seemed like it. Anyway, we can add that to the bag of tricks, curveballs, etc. Yesterday was a major Danger Zone, U Turn, Drop Offset, Info Leak, Algo Long Only move that happened during the Dead Zone. With O/N -400 points tonight, we may be setting up for a 18,200 retest. Big action and bigger reaction may be in store after the one sided perfectly timed manufactured move from yesterday.

MNQ!/NQ1! Day Trade Plan for 04/10/2025MNQ!/NQ1! Day Trade Plan for 04/10/2025

📈19130

📉18530

Thanks to all my followers! Truly appreciate the support!

Please like and share for more NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

NQ Power Range Report with FIB Ext - 4/10/2025 SessionCME_MINI:NQM2025

- PR High: 19359.00

- PR Low: 19242.25

- NZ Spread: 261.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

- CPI (Core|YoY|MoM)

13:00 | 30-Year Bond Auction

FOMC gave 1900 point lift back to April 2 range

- Mechanical rotation off daily Keltner average crowd

- No change in volatility expectations

Session Open Stats (As of 12:25 AM 4/10)

- Session Open ATR: 815.83

- Volume: 58K

- Open Int: 243K

- Trend Grade: Bear

- From BA ATH: -16.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed with a sharp surge following news of a possible delay in Trump’s tariff implementation. A 12% single-day rally on the daily chart is unprecedented — it was an extraordinary rise. On the daily chart, the 20-day moving average is acting as resistance, and to fully fill the April 3rd gap-down, the index would need to rise to around 19,750. If the Nasdaq continues to climb and fills that gap, a potential pullback should be anticipated.

Although the MACD has turned sharply upward in a V-shape, it hasn't fully broken above the Signal line yet. Given the rapidly changing global conditions, the possibility of a reversal still exists. However, since the 90-day tariff delay has been confirmed, the market may be entering a phase of relative stability. On the weekly chart, we see a sharp rebound that has brought the index up to the 5-week moving average. Both the Nasdaq and the VIX suggest that today could be a range-bound (sideways) session, so it's better to set wider trading ranges and adopt a box-range trading strategy.

On the 240-minute chart, a double bottom pattern has formed, with the MACD bouncing off the Signal line and rising again. The MACD is trending upward, but the Signal line remains below the zero line, which means a short-term pullback could still occur. Overall, it is advisable to use a buy-low, sell-high approach, with more upside potential still open. Also, today’s CPI report is scheduled, so please be mindful of increased volatility around the data release.

Crude Oil

Crude oil rebounded sharply from the $55 level, showing an impressive 12% range between high and low. However, the sell signal remains active. The price has broken above the 5-day moving average and entered a box range between the 5- and 10-day MAs, suggesting that a moving average-based box strategy would be effective.

On the weekly chart, oil has not yet reached the 5-week MA, so there’s still room up to the $65 level, which has historically served as strong resistance. Around that area, it might be more effective to consider short positions. On the 240-minute chart, the MACD showed signs of a third wave down, but failed to make a new low — signaling bullish divergence. A head-and-shoulders inverse pattern may be forming, with the right shoulder potentially developing around the $59–$60 zone. Overall, the strategy should remain range-based, with some more room to the upside.

Gold

Gold also closed sharply higher, benefiting from the tariff delay news. On the daily chart, the price closed higher, giving the illusion of a support bounce off the lower Bollinger Band, as that band is rising. The MACD remains above the zero line, so there’s still room for a retest of the Signal line, but given the current gap between MACD and Signal, the price needs to either rise further or move sideways to bring the MACD closer and potentially break above the Signal line.

If it fails to rise from here, the MACD may turn down again, so avoid chasing the price upward. Like Nasdaq and oil, gold is heavily influenced by global developments, so stay updated on the geopolitical landscape. On the 240-minute chart, gold formed a triple bottom around the 2,980 level and then rebounded strongly. The MACD is trending upward and pulling the Signal line along with it, but resistance around the 3,130 level remains significant. Gold may see increased volatility from today’s CPI report and tomorrow’s PPI release, so stay alert.

Market Summary

The market has been showing signs of irrational behavior. Investor sentiment is extremely volatile and driven more by emotion than logic. In times like this, it’s more important than ever to stick to the basics, shorten trade duration, cut back on risk, and trade with discipline. The more you chase after gains, the more likely your trades will be swept away by market turbulence.

Warren Buffett is considered a legend in the financial markets precisely because he has always stuck to fundamental principles. Likewise, it is crucial to establish and stick to your own trading principles to survive in the markets. If you haven’t yet experienced the kind of volatility we saw during the Trump era or the pandemic, this is a time to be especially cautious and defensive in your approach.

Wishing you another day of successful trading

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

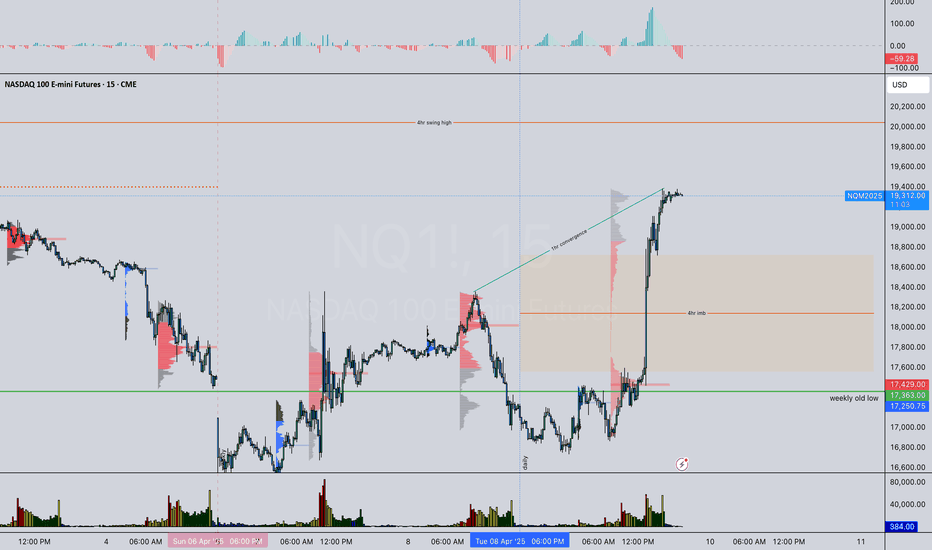

Are getting strong 4 long lol??✅ Summary of Top-Down Analysis:

🟢 Daily (Macro Bias):

Bias: Neutral → Leaning Bullish

Context:

MACD and price both made lower lows (convergence = no divergence, but momentum weakening).

Price hit strong support at 16,457.

Bullish close post-FOMC + macro catalyst (Trump’s tariff changes) = positive sentiment.

Key note: China-specific tariff at 125% could inject volatility, possibly sector-specific.

🟠 4HR:

Bias: Bullish

Confluence:

Higher high in price and MACD = bullish momentum confirmed.

Price reclaimed structure after failed low.

Approaching last week's POC → possible liquidity grab + continuation.

4HR bullish imbalance could be a key reaction zone (support).

🔴 1HR:

Bias: Bullish

Context:

Clear bullish structure + MACD higher high.

Aligned with 4HR bullish flow = continuation potential.

🔵 15min:

Bias: Bullish

Micro Context:

Structure and MACD aligned → price above previous NY POC = showing strength into next session.

May look to use NY POC or VWAP pullbacks for entry.

🎯 Gameplan Suggestions:

Scenario 1 – Continuation Entry:

Look for pullbacks into 4HR imbalance zone or 15m demand + VWAP area.

Use MACD + price action confirmation for entry (e.g., engulfing, break of lower highs).

Targets: swing high above 4HR structure + liquidity zones.

Scenario 2 – Reversal Risk:

If price shows exhaustion near last week’s POC, especially with MACD divergence on lower timeframes → consider a quick short scalp or stay flat until new structure forms.

👀 Key Levels to Watch:

🔹 16,457 = macro support

🔹 Last week’s POC = near-term resistance/liquidity

🔹 Bullish 4HR imbalance zone (mark this for entries)

🔹 Previous NY POC / VWAP area = short-term entry pullback zone

NQ Range (04-09-25)NAZ Range, again. The range to watch is 16,700 - 18,300. This chart may be viewed as 2024 being a Long Trap set up, KL 17,500 is Long above and Short below for now. Look for the NAZ to retest the KL and rotate around inside the range. Lower yellow circle, lower range break out over the Danger Zone Edge (16,500-300). Looking move sideways than lower PA today and for next few days, should push/pull PA show up, look SHORT.

MNQ!/NQ1! Day Trade Plan for 04/08/2025MNQ!/NQ1! Day Trade Plan for 04/08/2025

📈18365

📉17755

Thanks to all my followers! Truly appreciate the support!

Please like and share for more NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed lower after forming an upper wick at the 5-day moving average on the daily chart. If it had closed with a bullish candle, a technical rebound from the oversold condition could have opened the way to the 10-day moving average, but instead, it ended with a bearish candle.

The daily chart still shows a sell signal, but the best-case scenario would be for the market to form a double bottom pattern after confirming a short-term low and attempt another rise toward the 10-day moving average.

On the intraday charts, there's a high probability that the market will show a double bottom during the pre-market session, especially since there's no clear sell reversal on lower timeframes yet. The 240-minute chart shows a golden cross on the MACD, and although a death cross hasn't yet occurred, the large gap between the MACD and the zero line suggests a continued corrective trend.

As long as the death cross doesn't materialize, buying on dips near the bottom remains favorable. The 16,500 level is a strong support zone on the monthly, weekly, and daily charts, so shorting is not recommended — better to lean toward long setups. With the FOMC minutes due out early tomorrow and the CPI report on the horizon, volatility is expected to rise as the market attempts to form a bottom. Stick to buying on dips, manage risk carefully, and reduce leverage in this volatile environment.

Crude Oil

Crude oil closed lower, continuing its recent downtrend on the daily chart. Concerns over a global economic slowdown and increased production from OPEC nations are dampening the upside. Although the sell signal on the daily MACD remains, there's still potential for a short-term rebound toward the 5-day moving average. If trading short, make sure to set a stop-loss, especially near the strong $57 support zone, where shorting is riskier.

On the 240-minute chart, the MACD has re-crossed into a death cross, showing signs of a third wave of selling pressure. However, there's still a chance of bullish divergence, so avoid chasing short positions. The $57–$59 support range remains strong, and unless this level breaks, buying on dips offers a more favorable risk-reward ratio. Note that today's U.S. crude inventory report could introduce more volatility, so trade carefully.

Gold

Gold closed lower with an upper wick on the daily chart. While the price is still above the 0 line on the MACD, if it pulls back to the previous high resistance area, which coincides with the lower Bollinger Band and the 60-day moving average, it may present a good buying opportunity for swing trades. On the weekly chart, gold is still moving within a sideways range, trapped between key moving averages. With the FOMC minutes today and the CPI tomorrow, it's important to monitor whether the price breaks out of this range.

The 240-minute chart shows that the MACD has not yet formed a golden cross, and there's still a large gap from the 0 line. If MACD rebounds and then corrects again, it's crucial to check whether a double bottom around the 2,980 area is forming. Overall, gold remains a buy-the-dip candidate, and if the price falls to around the 60-day moving average, it could present a great swing entry.

Investor sentiment is reaching extreme levels, and we're witnessing unusually fast and wide price swings. It's hard to rely on daily or weekly charts alone, so it's important to focus on short-term price action and use appropriate leverage for your strategy.

The market will always be open. Survival and consistent profitability are what matter most in the long run. Stay disciplined, manage risk carefully, and take a long-term view as a trader.

Wishing you another day of successful trading!

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

NQ Power Range Report with FIB Ext - 4/9/2025 SessionCME_MINI:NQM2025

- PR High: 17240.00

- PR Low: 16971.00

- NZ Spread: 601.5 ⚠

Key scheduled economic events:

10:30 | Crude Inventories

13:00 | 10-Year Note Auction

14:00 | FOMC Meeting Minutes

Mechanical pivot off Monday's high

- Rotating back into 16700s inventory

- AMP margins and volatile session open indicates we're still in the volatility storm

Session Open Stats (As of 12:45 AM 4/9)

- Session Open ATR: 692.29

- Volume: 84K

- Open Int: 256K

- Trend Grade: Bear

- From BA ATH: -24.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone