NQ - Supply/Demand Trade Idea for Longs

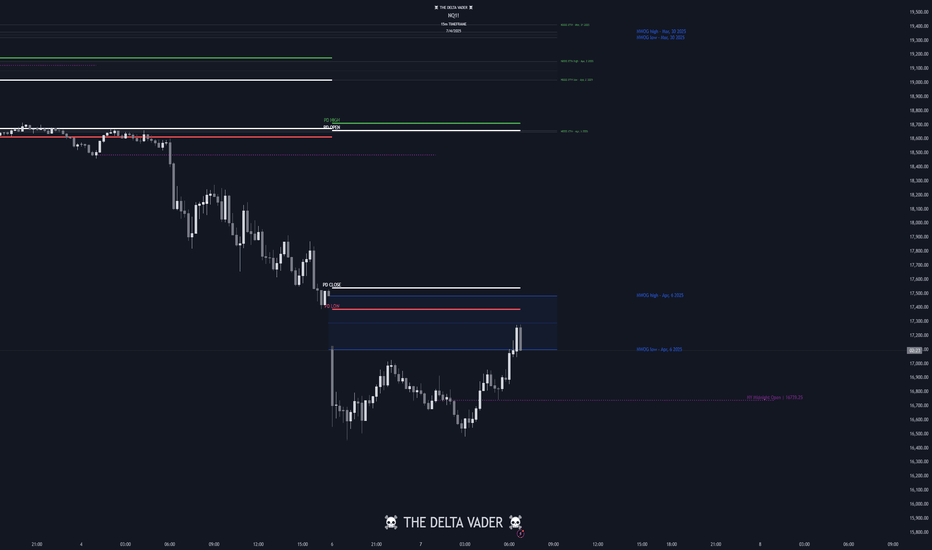

NQ is on its retracement from previous week deep dive. I am currently looking for price to retrace and test previous resistance as support. Once it gives this retest i will scale down to the 5 Minute for Long entries. There has to be a Break of structure paired with a Demand push/ FVG and orderblock for me to enter for Longs. 1:3 RR Stops will be at the swing low. (Watch My 5 minute video for entry breakdown)

UNF1! trade ideas

NQ - APRIL 8th Supply/Demand AnalysisNQ is on its retracement from previous week deep dive. I am currently looking for price to retrace and test previous resistance as support. Once it gives this retest i will scale down to the 5 Minute for Long entries. There has to be a Break of structure paired with a Demand push/ FVG and orderblock for me to enter for Longs. 1:3 RR Stops will be at the swing low.

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed lower after experiencing extreme volatility the previous day. Following a gap-down open, the market attempted a bottoming process. However, the spread of fake news related to tariffs triggered a 10% intraday swing, making the Nasdaq trade more like an individual stock than a major index. Massive trading volume occurred due to margin calls from CFDs and hedge funds, and the market showed some signs of recognition around a potential short-term bottom.

On the weekly chart, the index rebounded but was resisted at the 3-week moving average. On the daily chart, a doji bullish candlestick with strong volume formed, suggesting the market may attempt another rebound. However, since volatility from the bottom remains significant, if you’re planning to enter long positions, it's best to buy as close to the bottom as possible. If the market continues to form a base, a rebound toward the 5-day or 10-day moving average on the daily chart is possible.

On the 240-minute chart, the market is still in a death cross and remains oversold. Still, it's showing signs of forming a base around the 16,500 level, so it's better to avoid chasing short positions during any pullbacks that could form a double bottom. In this oversold environment, a buy-on-dip approach near the lows is favorable for a technical rebound. But since volatility remains high, make sure to set clear stop-loss levels for both long and short trades.

Crude Oil

Crude oil experienced a gap-down on the daily chart and closed lower after hitting resistance at the 3-day moving average. On both the daily and weekly charts, the $57–$59 zone appears to be a short-term support level. If the price dips into this zone, it may offer a buying opportunity. Yesterday’s candle was resisted at the 3-day line, so if a bottoming pattern forms today, a rebound toward the 5-day moving average could be anticipated. However, since the MACD has just issued a sell signal near the zero line, it's better to treat any long positions as short-term trades.

On the 240-minute chart, the sell signal is still valid, and the market remains in oversold territory. Watching for a potential double bottom formation before entering long positions is recommended. That said, if market sentiment continues to accept economic recession as a given, oil prices could keep falling. There's also the risk of a one-way downward move, so if you're going long, ensure tight stop-loss levels are in place.

Gold

Gold saw sharp volatility and closed lower after being rejected at the 5-day moving average. Due to the weaker dollar from U.S. tariff announcements, the attractiveness of gold has diminished in the short term. On the weekly chart, gold is still forming a range-bound movement near the 10-week moving average, with support appearing near the $2,975 level. On the daily chart, the lower Bollinger Band and the 60-day moving average are rising and beginning to converge.

These overlapping indicators could form a strong support zone, so if the price drops into this area, it may present a good opportunity to buy the dip. On the 240-minute chart, the MACD and signal lines have both dropped below the zero line, and the RSI has entered oversold territory.

While this could lead to further accelerated selling, it is also a zone where a rebound from oversold conditions could easily occur. It’s best to avoid chasing the downside and instead focus on buying during pullbacks near strong support zones.

Market volatility is increasing, but this is also a zone where technical rebounds are likely due to excessive declines. While confirmation of a bottoming pattern is needed, in this kind of market, it's safer to focus on one direction rather than trying to trade both ways.

Long positions currently offer a better risk-reward ratio, so it’s advisable to enter at the lower end of the range. Reduce leverage as much as possible and always set stop-loss levels to ensure safe trading in these turbulent conditions.

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

NQ Power Range Report with FIB Ext - 4/8/2025 SessionCME_MINI:NQM2025

- PR High: 17753.75

- PR Low: 17644.50

- NZ Spread: 244.0

No key scheduled economic events

Volatility remains high with Trump tariff excitement

- Advertising rotation off previous session low

- Holding above the close below the high, inside Friday's range

- AMP margins temp increase remains

Session Open Stats (As of 12:45 AM 4/8)

- Session Open ATR: 627.37

- Volume: 48K

- Open Int: 272K

- Trend Grade: Bear

- From BA ATH: -21.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Watching For Consolidation, Correction or ContinuationWeekly:

Price took out old swing low after a lower low was printed — confirming bearish intent.

However, price is now inside a new HTF support zone.

MACD remains bearish, signaling potential continuation lower, but watch for possible slowdown or divergence signs in this zone.

Daily:

Structure is firmly bearish — lower low confirmed.

MACD bearish and showing momentum strength — favors continuation lower unless lower timeframes suggest a deeper correction.

4H:

Bearish convergence confirmed — price action aligns with HTF bearish bias.

However, current price action is corrective/bullish — likely a pullback within a bearish trend.

MACD still bearish but weakening — signals caution for late shorts, or potential for deeper retracement.

1H:

Monday's failure to make a new low overnight hinted early market structure shift — bullish correction in play.

MACD turned bullish into Friday's POC, and price rallied into 4H bearish imbalance above it.

Currently:

1H hidden bearish convergence developing — early sign correction may exhaust.

MACD weakening — signals reduced bullish momentum.

Key overnight scenarios:

Consolidation near current highs (distribution?)

Continuation of bullish correction into deeper supply

Bearish continuation if sellers step in aggressively from imbalance zone

NQ Range (04-07-25)NAZ is likely to retest 2024 Open Level (blue line). Red Zone is previous Failed Auction zone and usually we see a bounce on these. May see drop under or gap open Sunday at blue line with slight bounce back up to FA Zone. Diablo's are all over the place and may keep the pressure with lower moves in the range/zone. Archie Bunker is feeling the Heat, back to TV shows as the Pro's take over.

Careful Trusting "News" | Fake News TradingOn Monday, April 7th, 2025 amidst incredible market volatility, you'd expect your most trusted news outlet to report on-the-minute news. But most importantly, accurate news .

With the markets down nearly 20% in ~4 trading days, every piece of information matters. But with the age of fast (social) media, news outlets will do anything possible to be the first to report. Even .... posting fake news. The way this works is they get news that's "probably true", they post it, then it's verified to be true. This may work often for them and when it doesn't, nobody really cares. But when you're talking about times of volatility unseen since COVID, all this nonsense gets exposed.

So - at roughly 10:10 AM EST, CNBC reported that there will be a "90-day pause on tariffs". A ground-breaking report that likely caused John Doe to buy $10M in NASDAQ:NVDA calls dated end of July because that's a no-brainer right? It surely cannot be false since CNBC is his go-to trusted news-source and there is just NO WAY that they would ever post any news without being 100% true and verified. ESPECIALLY news about TARIFFS -- the talk of the town (psh, the world actually) at the moment. 90 day pause? That's not something you report lightly. You know the ripple effect that'll have on the markets.

Result of that news report? The markets (e.g. CME_MINI:NQ1! ) jumped 6.60% in under 10 minutes.

Jane Doe likely saw that jump, looked at that news, and rebought her shares that she sold at the bottom earlier this morning.

Surely that news cannot be fake. It's a 90-day tariff pause. That's huge. Surely the White House will see "Yeah baby! We take credit for that".

Nope, at roughly 10:18 AM EST, the same CNBC reported that, "the 90-day pause on tariffs was fake news according to the White House". Results? Market right back down -6.5% in 20 minutes.

Suppose you FOMO'd into AMEX:SPY NASDAQ:QQQ calls.. well, you lost almost everything depending on the strike and date. In this market, manage your RISK and always hedge. Don't forget to thank CNBC, your most trusted news-source for that capital gain loss.

Welcome to trading in 2025. The age of report-first, verify-later. Welcome home.

Be careful listening to the news and take everything they say with a grain of salt. And as always, don't chase the news. KD out.

NQ volatility likely to persist until retest of 13k buy zonechart shows it all...expect more volatility this month, likely a retest of 61.8 fib level at 15k & 78.6 fib levels (based on lows from 2023) near 13k before we finally run to the highs again into 2026!

tariffs have similar impact as rate hikes...overall will be digested by markets just fine & we'll head back to the highs as fed sees more freedom to cut given those effects...very incentivized to prevent a "hard landing" economically without also boosting inflation too much, so this is all actually a good thing if you can see it :)

Nasdaq Enters Correction Territory Do we go Deeper

Monthly analysis done on the NQ with the ambition to connect with current price activity and gauge a deeper technical understanding on if this is just the start of a bigger correction for the year ahead . Tools used in this video Standard Fib , TR Pocket , CVWAP/ PVWAP Incorporating PVWAP and CVWAP into trading strategies allows for a more nuanced understanding of market dynamics used to assess trading performance and market trends.

Date and price range and trend line .

Some research below regarding the previous correction that I reference the technicals to in the video .

In November 2021, the Nasdaq reached record highs

However, concerns over rising inflation, potential interest rate hikes by the Federal Reserve, and supply chain disruptions led to increased market volatility. These factors contributed to a correction in the Nasdaq, with the index experiencing notable declines as investors reassessed valuations, particularly in high-growth technology stocks.

VS Today

March 2025 Correction:

As of March 2025, the Nasdaq Composite has faced another significant correction. On March 10, 2025, the index plummeted by 4%, shedding 728 points, marking its third-worst point loss ever, with only earlier losses during the COVID-19 pandemic surpassing this.

This downturn has been attributed to several factors:

Economic Policies: President Trump's announcement of increased tariffs on Canada, Mexico, and China has unsettled markets, raising fears of a potential recession

Inflation Concerns: Investors are closely monitoring upcoming consumer-price index (CPI) reports to gauge inflation trends, as higher-than-expected inflation could hinder the Federal Reserve's ability to lower interest rates, exacerbating stock market declines

Sector-Specific Declines: Major technology companies, including Tesla, have experienced significant stock price declines, contributing to the overall downturn in the Nasdaq

Comparison of the Two Corrections:

Catalysts: The November 2021 correction was primarily driven by concerns over rising inflation and potential interest rate hikes. In contrast, the March 2025 correction has been influenced by geopolitical factors, including new tariff announcements, and ongoing inflation concerns.

Magnitude: While both corrections were significant, the March 2025 correction has been more severe in terms of single-day point losses. The 4% drop on March 10, 2025, resulted in a loss of 728 points, marking it as one of the most substantial declines in the index's history.

Investor Sentiment: Both periods saw increased market volatility and a shift towards risk aversion. However, the recent correction has been accompanied by heightened fears of a potential recession, partly due to inconsistent government messaging regarding economic prospects.

In summary, while both corrections were driven by concerns over inflation and economic policies, the March 2025 correction has been more pronounced, with additional factors such as new tariffs and recession fears playing a significant role.

NQ! Short Idea (MXMM, Quarterly Theory)Hello, after 2 successful weeks I'm planning to continue this streak. Current WR is 75%.

After taking a quick Short on NQ, I'll be waiting for the NY Session for my next setup. I'm expecting a BSL Sweep at around 9:30 UTC-4, after that I will wait for the Macros 9:50 to enter Short.

Praise be to God

-T-

NQ Power Range Report with FIB Ext - 4/7/2025 SessionCME_MINI:NQM2025

- PR High: 17100.00

- PR Low: 16550.00

- NZ Spread: 1231.0 ⚠

No key scheduled economic events

AMP margins remain increased due to tariff news

- Continue high volatility value decline, 2.45% weekend gap

- Weekend gap fills above 17417

- Overall sentiment: anxiously hesitant in hopes of a nearby bottom

Session Open Stats (As of 12:15 AM 4/7)

- Session Open ATR: 593.15

- Volume: 131K

- Open Int: 276K

- Trend Grade: Bear

- From BA ATH: -25.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

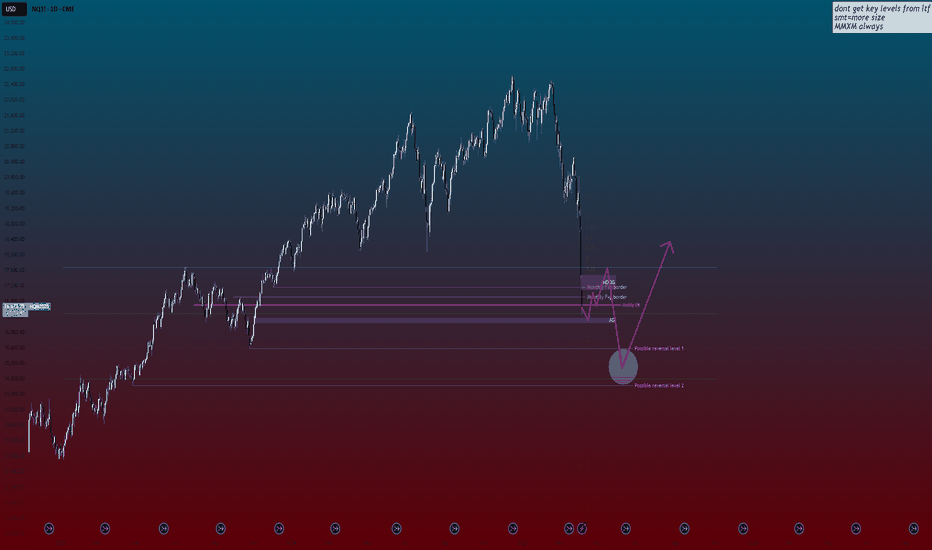

When will NASDAQ stop melting? You can't say I didn't warn you!I hate to say I told you but I warned about this crash at my analysis back at September 2024 for NQ1! (you can see it at related ideas below), anticipating market moves based on structure well before the narrative around election and tariffs even began circulating.

We often see markets engineer these kinds of dramatic dives below obvious lows. This projection towards the 4.0-5.0 zone looks characteristic of such a liquidity hunt, designed to clear out sell-side stops and shake out traders before a potential major move higher – a dynamic not unlike what we anticipated previously.

While the projected sharp drop on NQ1! below key levels like the Monthly Order Block near 3.0 and the AG (actual gap) level near 3.5 might look aggressively bearish, I'm viewing this as a potential setup for a significant buy opportunity.

My attention is focused on that "Possible reversal level 1" between 4.0 and 5.0. If price stabilizes and shows rejection signs within this zone, it could signal the start of a powerful rally, potentially targeting levels back up towards the 1.75 area or even revisiting prior highs.

Remember, these market structure plays can take time to fully develop, just as previous setups did. We could see NQ consolidate or even briefly dip lower within that 4.0-5.0 zone before the anticipated upward reversal truly gains traction.

Thanks for reading, boost and follow to stay liquid and not become liquidity.

Wish you safe and informed trading decisions.

___________

CME_MINI:NQ1! TVC:VIX

#202514 - priceactiontds - weekly update - nasdaq e-mini futures

Good Evening and I hope you are well.

comment: W3 has likely concluded and I expect the same price action as for W2. Market is respecting technicals precisely. Look at the chart and the obvious numbers and lines. We can always do an over- or undershoot but for now I don’t think looking for shorts after two days of crashing make any sense.

current market cycle: strong bear trend

key levels: 16000 - 19600

bull case: Bulls still running for the exits but we have fallen too much too fast and we are getting into value territory for bigger players to buy the dip. Almost nothing is ever as bad as these extreme market reactions want to trap you into. Not to the downside and certainly not to the upside but to the upside everyone is busy pounding their chest because they are such a genius for making money in a bull market. Bulls want a squeeze up to 19000, that’s about it. Bear trend line around 18800-19000 will most likely get hit over the next 2 weeks.

Invalidation is below 17000.

bear case: Same reasoning as for dax. Bears want the big bull trend line around 16500 but they won’t get there in a straight line. W4 is likely around the corner. If we stay below 18800, that would once again leave another gap open and be another show of big strength by the bears.

Invalidation is above 19100.

short term: W3 has likely concluded, shorting below 18000 is really really not a good trade unless it’s a momentum scalp. Looking to scalp some longs on the squeeze up.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. Clear W1 of this bear trend. Market now has to close below 19000 to confirm W3. Depending on how deep W3 goes, W5 will either reach only around 17500 or the bull trend line around 16000.

current swing trade: None

chart update: Made the bear trend clear and my expectation for W4 and W5. As always, it’s a guess.