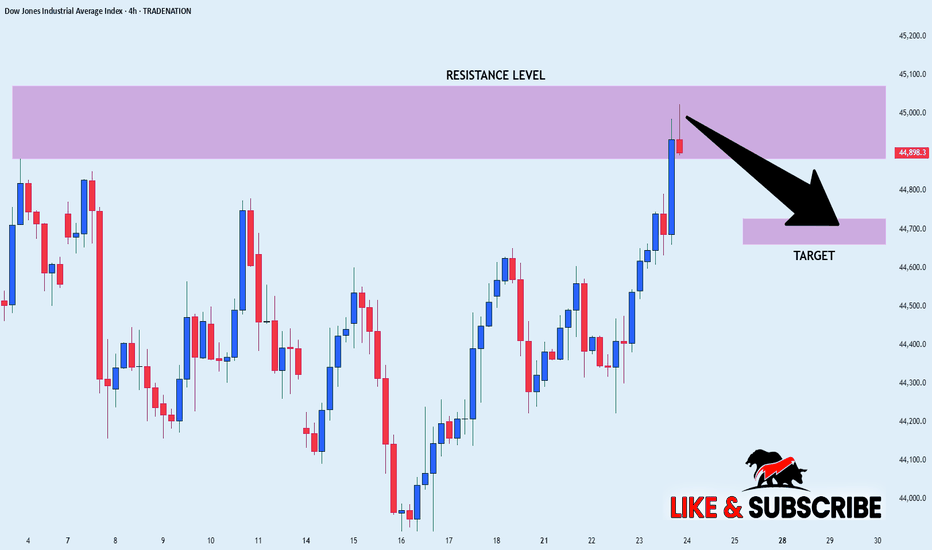

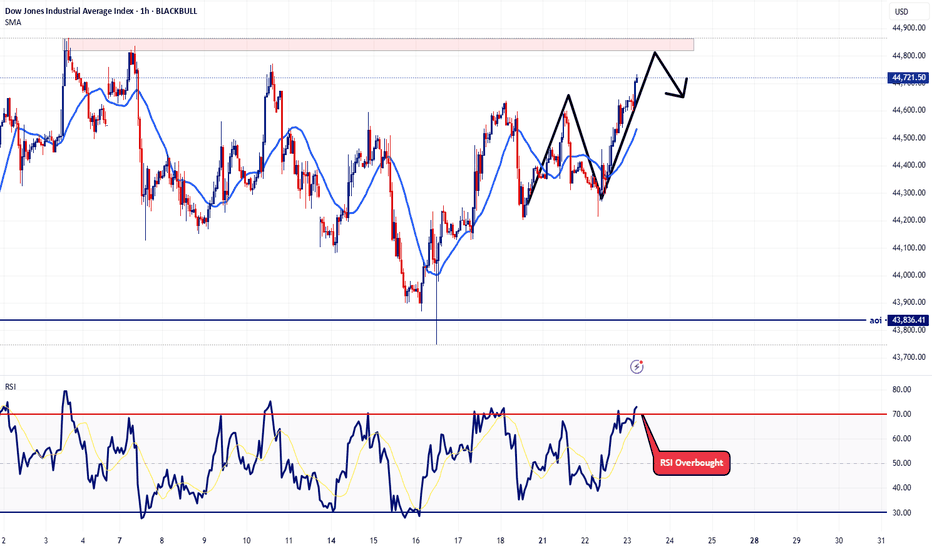

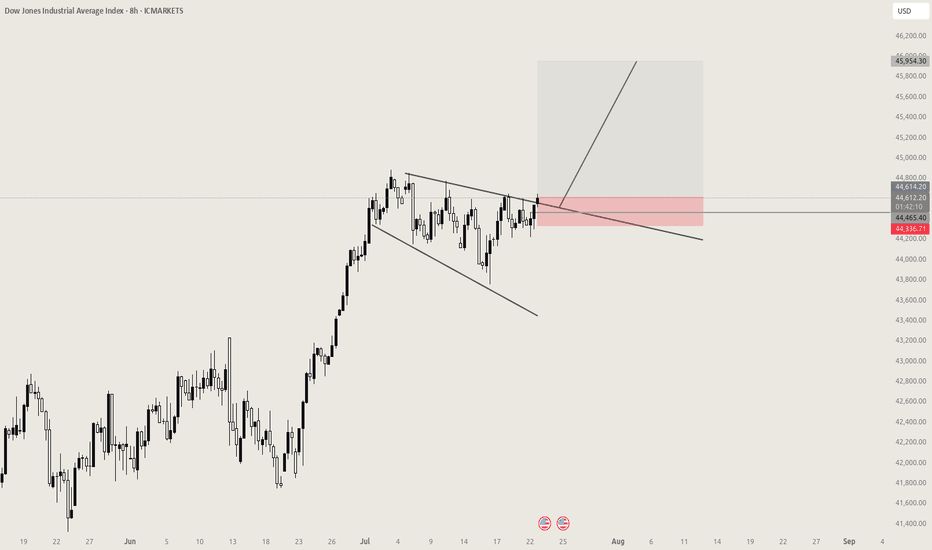

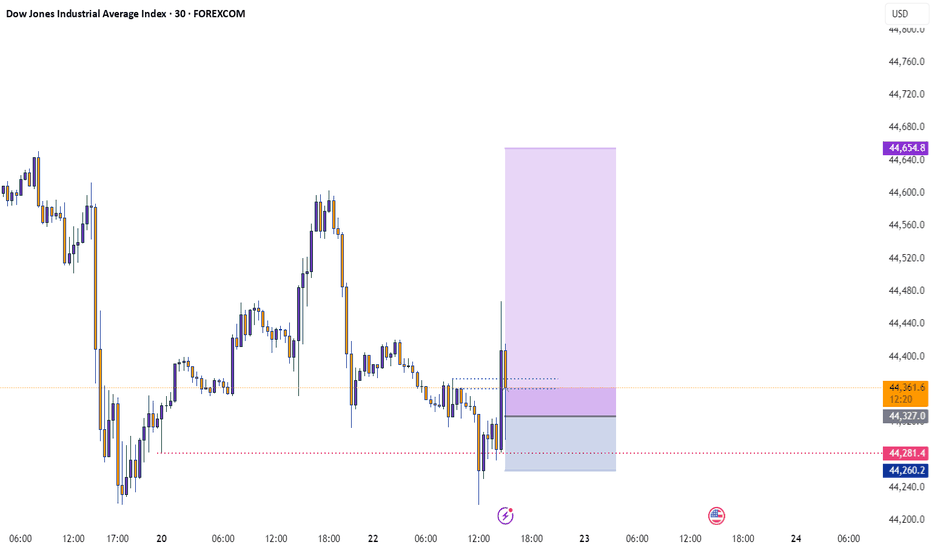

US30 SHORT FORM RESISTANCE|

✅DOW JONES index keeps

Growing in a strong uptrend

And we are bullish biased long-term

However the price has hit an all-time-high

Resistance level of 45,072(which can be seen

Further left you zoom out on higher TF)

So as we are already seeing a local

Bearish reaction we will be

Expecting a local bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US30 trade ideas

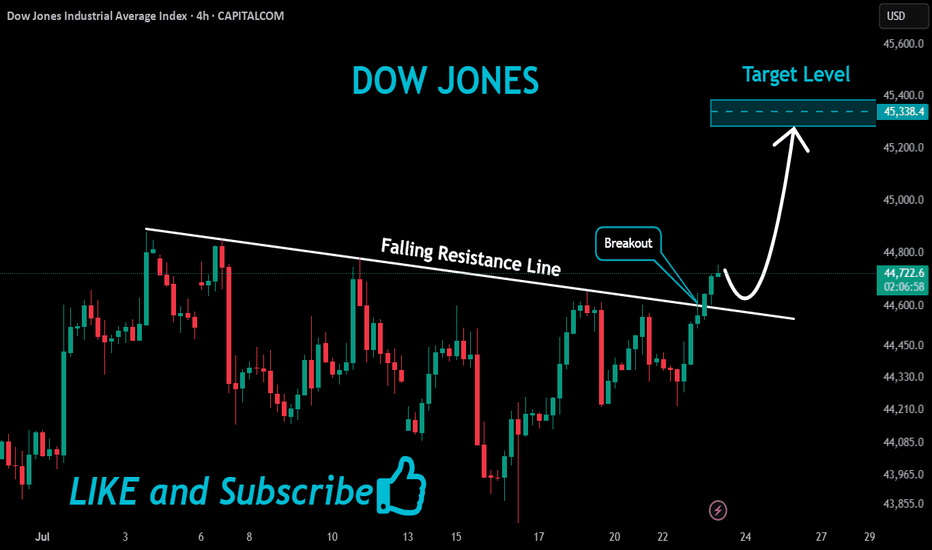

US30 Massive Bullish Breakout!

HI,Traders !

#US30 is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

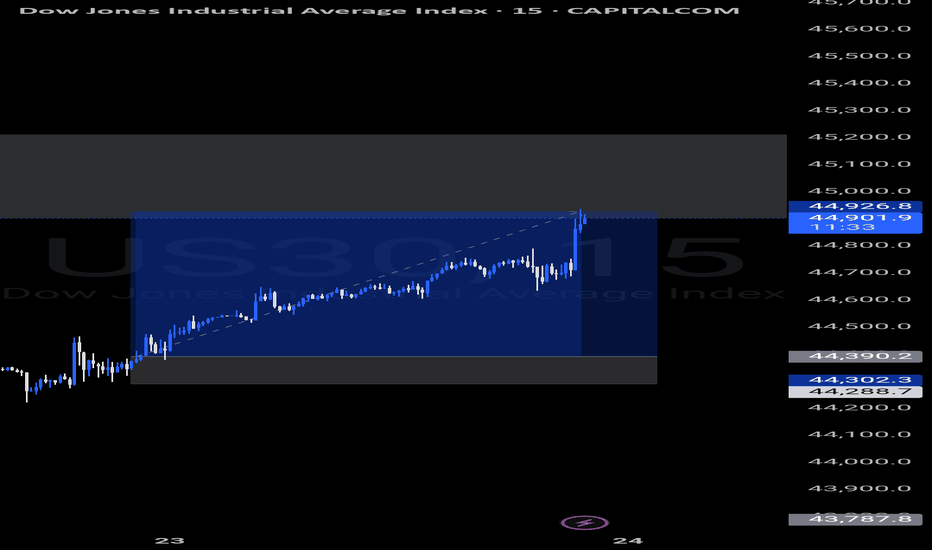

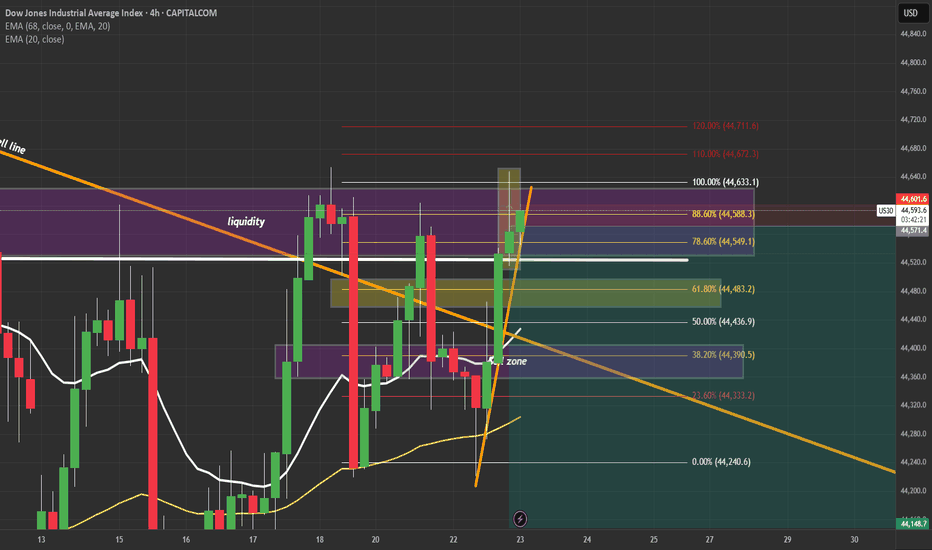

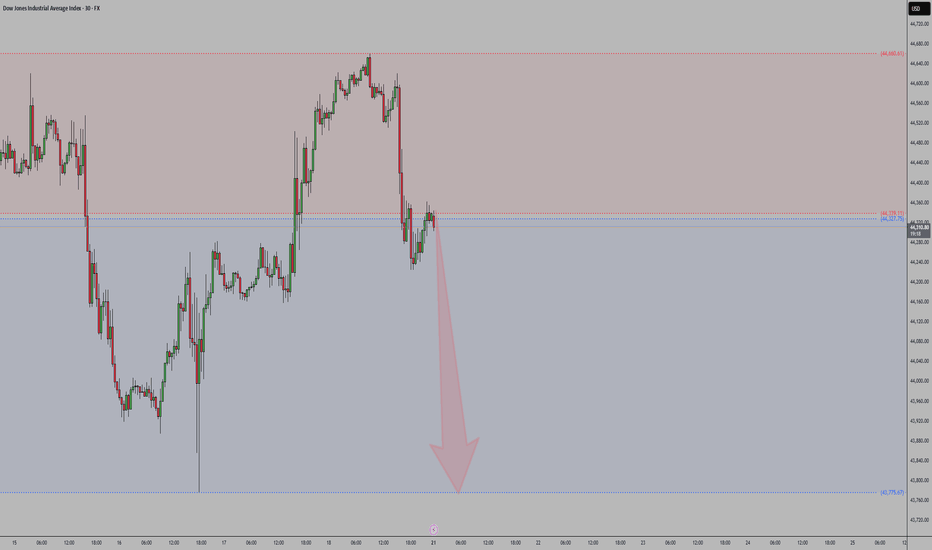

KOG - US30US30

Looking at this we have a clean reversal in play suggesting we’re going to get lower order regions before a potential RIP. The red boxes have been added and may give us opportunities to capture the tap and bounces on the smaller TFs.

If we can support lower, we could very well see this push up into the ideal target level we have illustrated.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

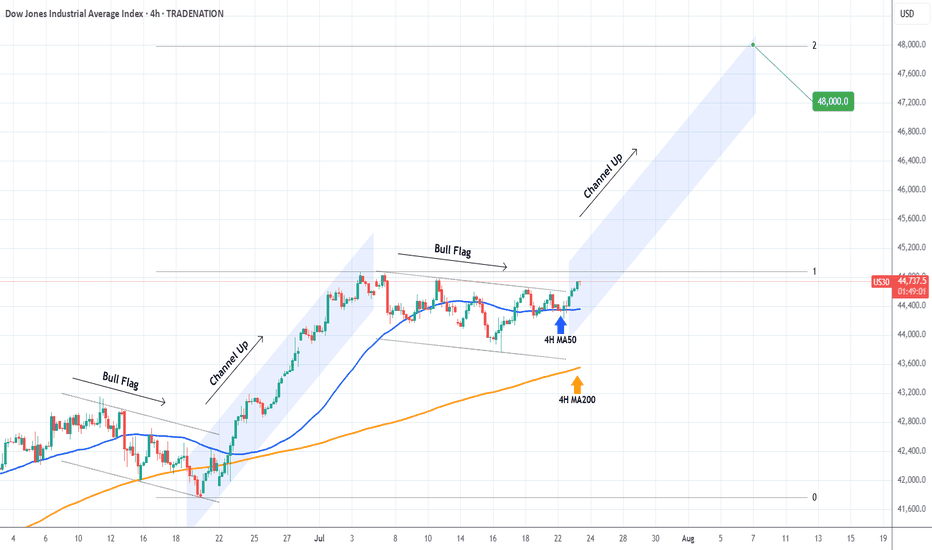

DOW JONES Strong rebound on its 4H MA50.Dow Jones (DJI) is having a strong rebound exactly on its 4H MA50 (blue trend-line). This is taking place just after the price broke above the Bull Flag that served as the accumulation pattern following the previous Channel Up.

This is a repetitive pattern and most likely we will now see the new Channel Up starting. The technical Target on such formations is the 2.0 Fibonacci extension at 48000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

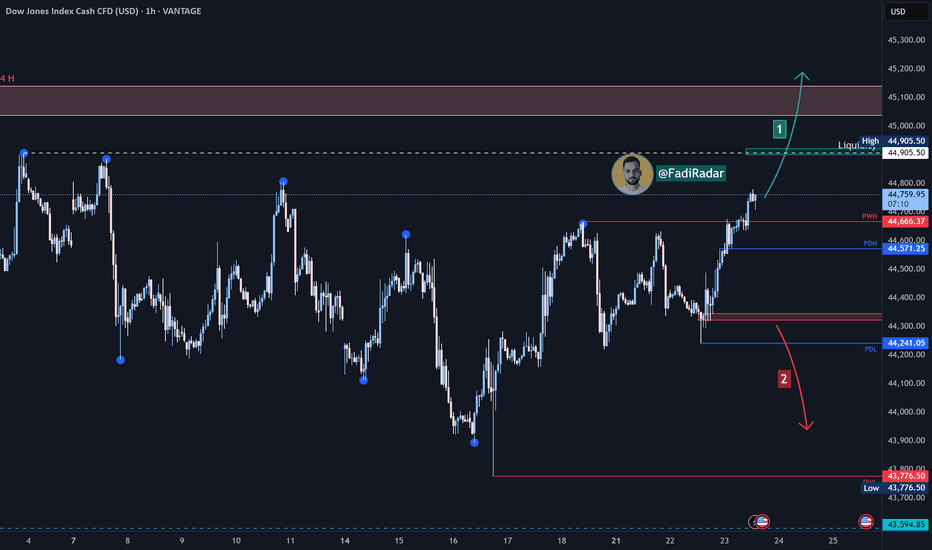

Dow Jones Index US30 Analysis:🔹 The index is approaching a key liquidity zone near 44,905 USD.

1️⃣ If price breaks and closes above 44,905, this could trigger a bullish continuation toward 45,100 USD.

2️⃣ However, if the price fails to break above and bearish momentum appears, a pullback is expected to test 44,570 and 44,320.

🔻 A confirmed break and close below 44,320 could resume the bearish trend and open the way toward 43,900 USD.

⚠️ Disclaimer:

This analysis is not financial advice. Please monitor the markets carefully before making any investment decisions.

Dow Set for Volatile Move as Earnings, Tariff Risks CollideUS30 OVERVIEW

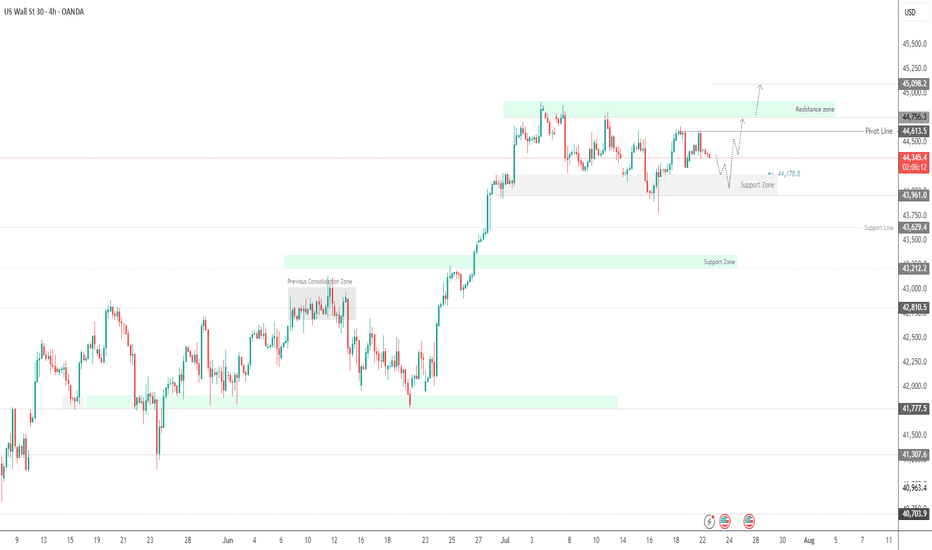

The price is currently consolidating between 44,180 and 44,620, awaiting a catalyst. Today’s earnings reports are expected to heavily influence Dow Jones price action.

If earnings come in strong, the index is likely to push toward 44,620 and 44,760. A confirmed stability above 44,620 would strengthen the bullish case, potentially opening the path toward a new all-time high near 45,100.

However, a break below 44,180 would signal bearish momentum, with potential downside toward 43,960. Additional pressure could come from escalating tariff tensions, further weakening sentiment.

Resistance: 44,620 · 44,760 · 45,100

Support: 44,180 · 43,960 · 43,630

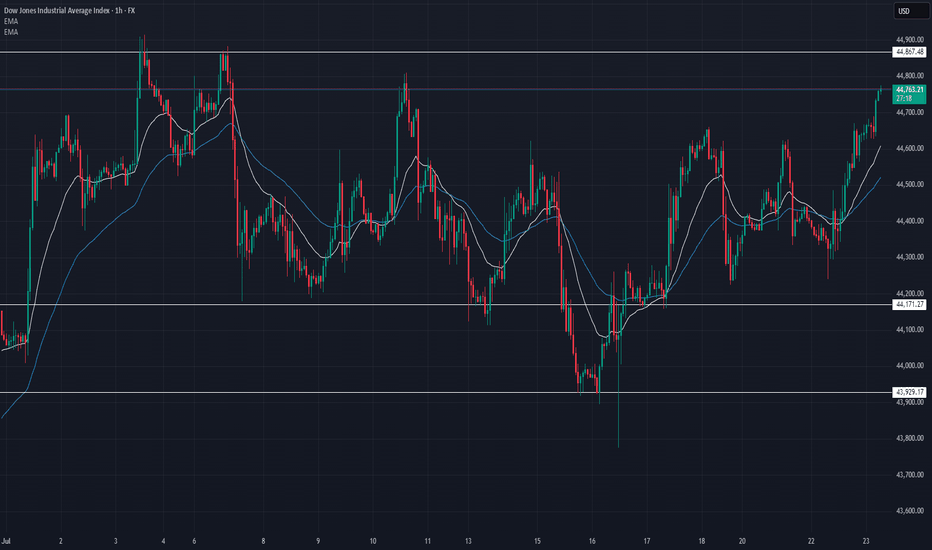

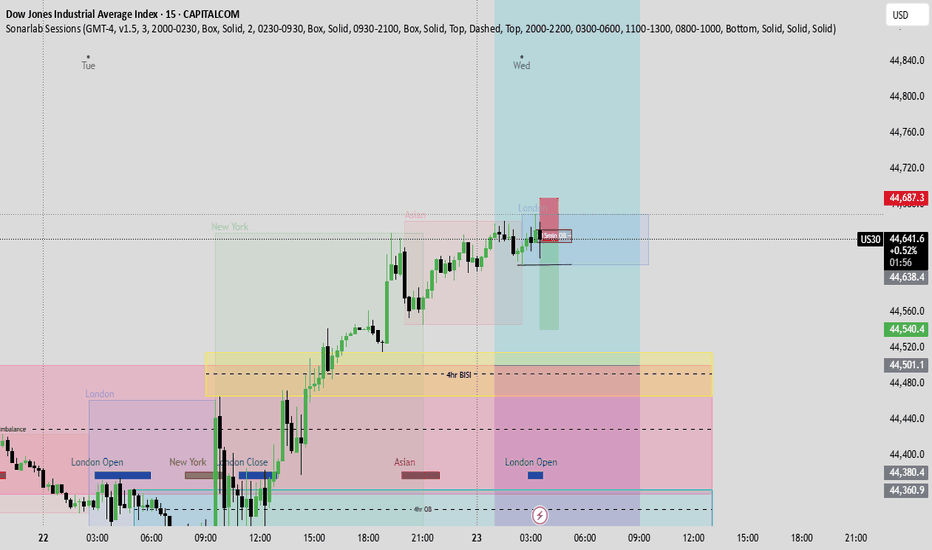

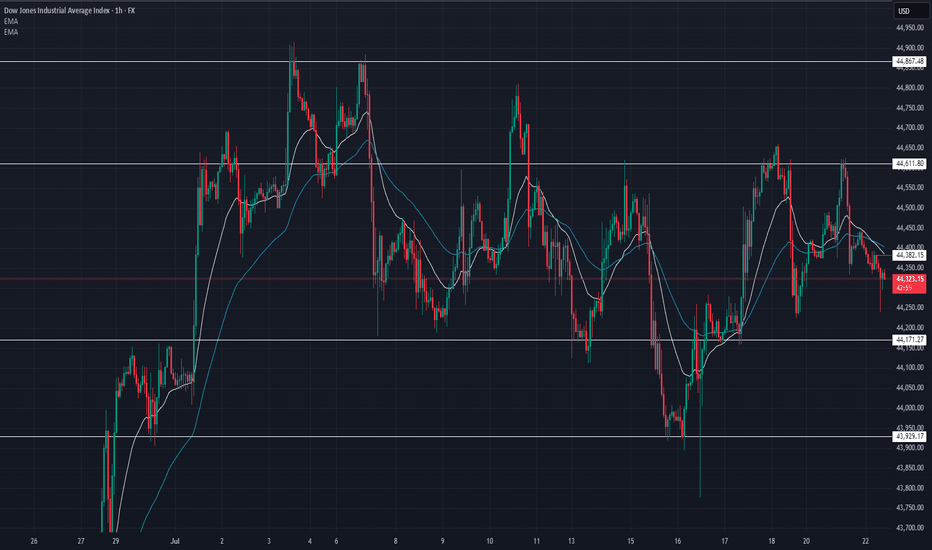

US30 Update – 07/23/2025📍 US30 Update – 07/23/2025

The bulls are back in control 🚀

After consolidating below 44,450, we finally saw a strong breakout above the mid-range and EMAs. Price surged straight into the 44,760–44,867 resistance zone with strength, riding the 9/21 EMA crossover 🟢

We're now testing a major supply zone, so momentum traders should watch for a reaction here.

📊 Market Structure:

✅ Clean higher lows

✅ Breakout above 44,600 resistance

✅ EMAs aligned bullish on 1H

✅ Bullish engulfing + follow-through

🔑 Key Levels:

🔼 Resistance: 44,764 → 44,867

🔽 Support: 44,450 → 44,171

🧠 Market Bias:

Short-term bullish ✅

➡️ Holding above 44,600 = bullish continuation

➡️ Rejection at 44,867 = possible pullback/retest

💡 Trade Scenarios:

📈 Breakout Continuation (Aggressive Long):

Entry: Above 44,780

TP1: 44,867

TP2: 44,950

SL: Below 44,700

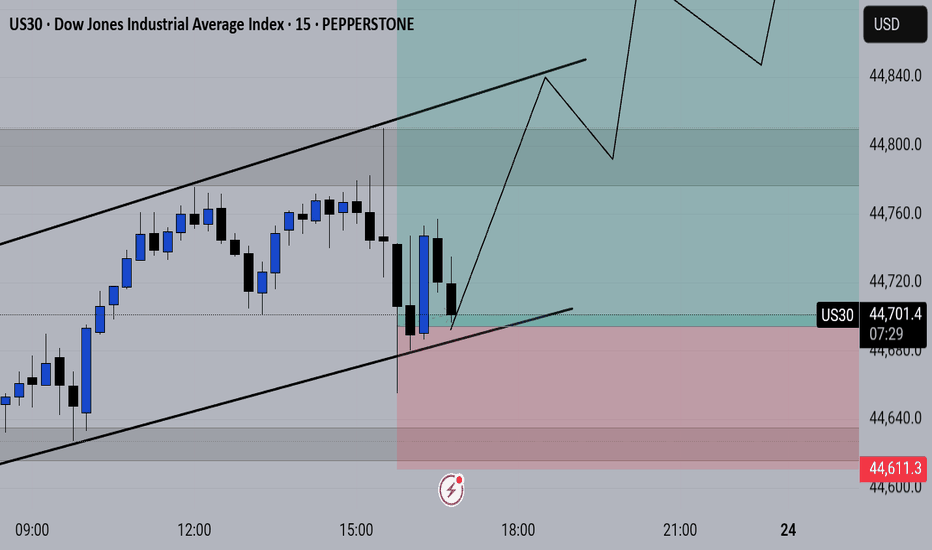

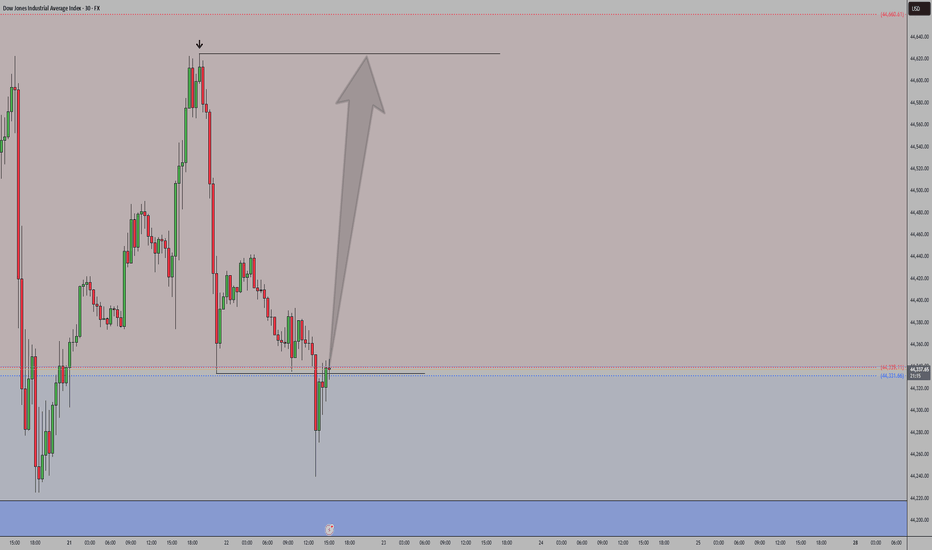

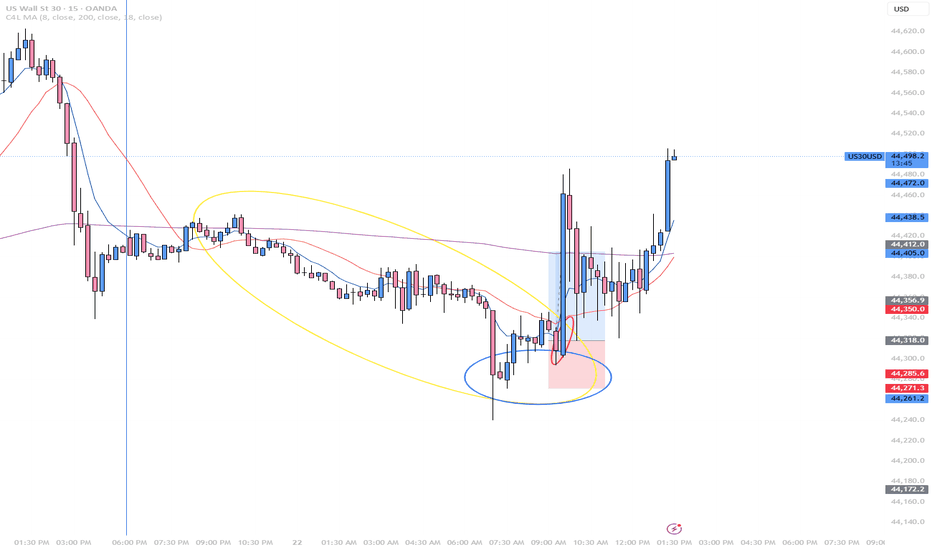

US30 - What I believe will happen todayConsidering today is now Wednesday and Wednesday's have a consistency of being one of those off days. Primarily because usually there are Fed speeches on this day that manipulate the market. With that said, I'm expecting price action to play out how I plotted the arrows on the chart. I believe there is still some further upside for today but then I believe we might get that intraday correction around 11:am - noon EST.

Let's see how today plays out. Trade safe

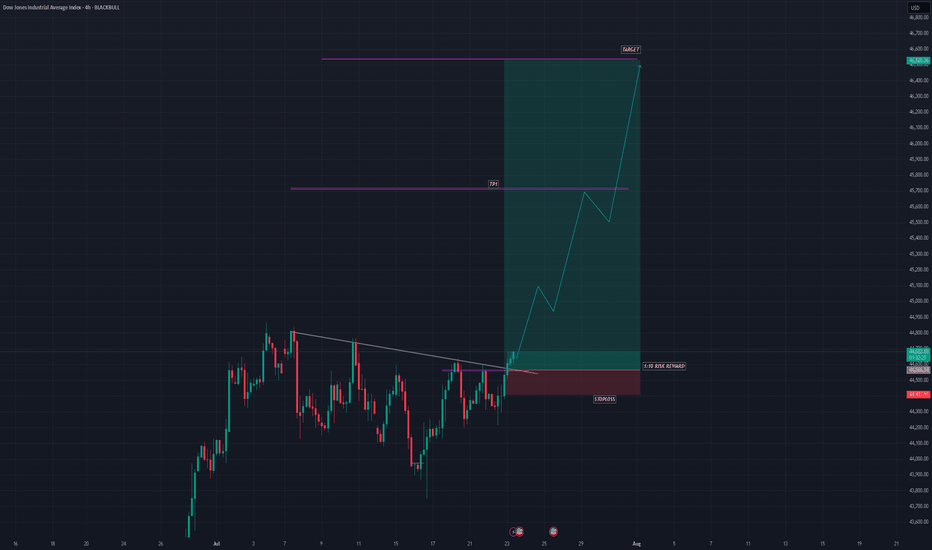

US30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARDUS30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follows good risk reward

please dont use more than one percentage of your capital follow risk reward and tradeing rules

that will help you to to become a better trader

thank you

US30 | Inverted Hammer at Key Supply Zone – Reversal or BreakoutUS30 just printed an inverted hammer on the 4H at a major supply zone (44,550–44,600). This is a critical decision point:

✅ Bearish Case:

If price rejects and closes back below 44,530, sellers could take control with targets at 44,380 → 44,180 → 44,020.

✅ Bullish Fakeout:

If price breaks and holds above 44,620, expect a push toward 44,700 and 44,900.

📌 What I’m Watching:

Rejection candle + bearish close → short entries.

Strong breakout candle with retest → long continuation.

Key Levels:

🔴 Resistance: 44,550–44,600

🟢 Support: 44,380 → 44,020

⚠️ Manage risk carefully. Volatility is high and liquidity hunts are common in this zone.

💬 Do you think we reject here or break out higher? Drop your thoughts below!

#US30 #DowJones #PriceAction #SmartMoney #TradingView #TechnicalAnalysis #IndicesTrading

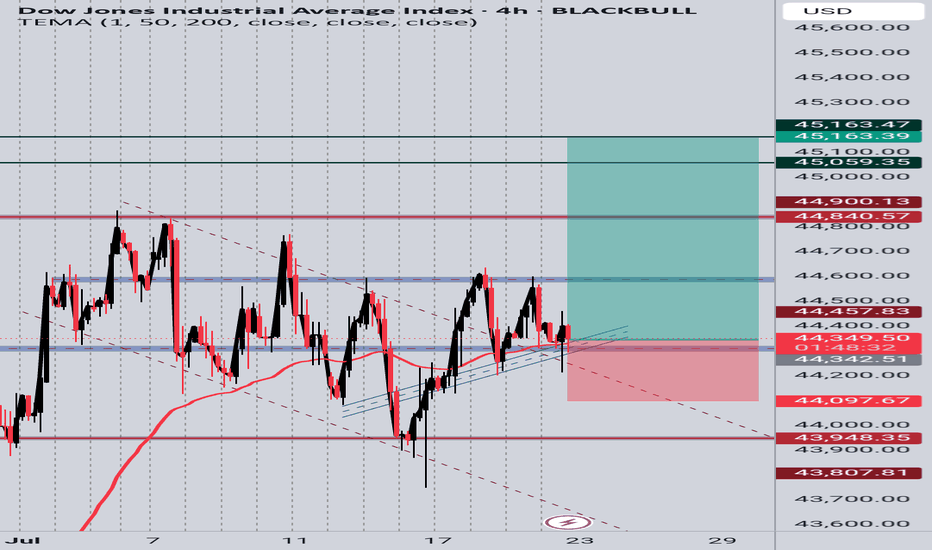

US30 4H Long SetupPrice is respecting a rising trendline and holding above a key support zone. After multiple rejections at the trendline and EMA bounce, current candle shows bullish intent. Targeting previous resistance zones around 45,059 and 45,163. SL placed below the trendline and recent structure low at 44,097. Setup based on structure support, EMA reaction, and potential bullish continuation.

US30 Update – 07/22/2025📍 US30 Update – 07/22/2025

Still trapped in the range chop ⚠️

Price rejected off 44,611 again and is now pulling back toward mid-range. Structure continues to respect key zones, and we now see lower highs forming — early signs of bearish pressure building 🐻

EMA crossover is flipping bearish on the 1H — sellers gaining control short term.

📊 Market Structure:

📉 Lower highs forming below 44,611

📈 Still above demand at 44,171

📉 EMA 9/21 crossover down — bearish tilt

📉 Momentum weak under 44,385

🔑 Key Levels:

🔼 Resistance: 44,611 → 44,867

🔽 Support: 44,171 → 43,929

🧠 Market Bias:

Short-term bearish 🧨

➡️ Clean breakdown of 44,171 = bearish momentum

➡️ Buyers must reclaim 44,385 to shift bias

💡 Trade Scenarios:

📉 Bearish Rejection Play:

Entry: 44,380–44,400

TP1: 44,200

TP2: 44,000

SL: Above 44,430

📈 Demand Bounce (Low-Risk Buy):

Entry: 44,180–44,150

TP1: 44,385

TP2: 44,600

SL: Below 44,100

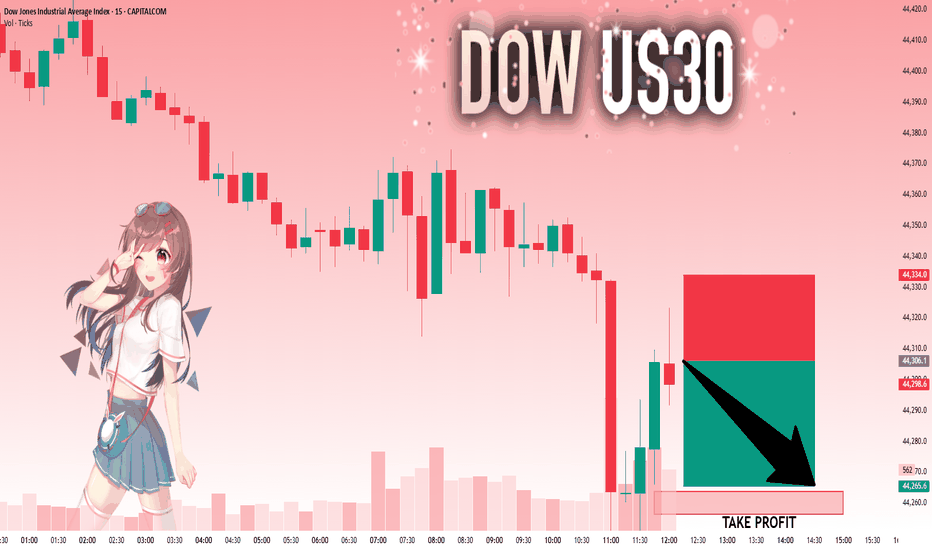

US30: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 44,306.1 will confirm the new direction downwards with the target being the next key level of 44,263.8..and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️