TIAUSDT trade ideas

TIAUSDT - Daily Chart - Complex Correction AnalysisHere's my Elliott Wave analysis for TIAUSDT, outlining a potential complex corrective structure.

Primary Scenario: Large ABC Correction

I've identified a primary three-wave correction (Big A - Big B - Big C).

Big A: A completed three-wave (a-b-c) correction with a deep Wave B (100% retracement) and an extended Wave C (1.414 extension).

Big B: A shallower three-wave (a-b-c) correction retracing 0.382 of Big A.

Big C: A deeper complex correction retracing 1.272 of Big A, unfolding as a W-X-Y structure. The sub-waves of W and X appear complete, with Wave Y currently unfolding.

Alternative Scenario: Triangle for Big B

An alternative interpretation suggests Big B could have formed a complex Expanding Triangle (a-b-c-d-e). If this is the case, the subsequent move (currently labeled as part of Big C in the primary scenario) would be the wave following the Triangle's completion.

Current Outlook and Bias:

The long-term structure suggests a significant correction is underway.

Primary Scenario: If Big C's W-X-Y structure is complete or nearing completion, we could anticipate a potential move in the opposite direction of the overall correction (bullish if the preceding trend was up).

Alternative Scenario: If Big B was a Triangle, the direction of the breakout from the Triangle will dictate the subsequent move.

TIAUSDT UPDATE

TIA Technical Setup

Pattern: Falling Wedge Breakout

Current Price: $2.96

Target Price: $6.33

Target % Gain: 125.33%

Technical Analysis: TIA has broken out of a falling wedge pattern on the 1D chart, showing bullish momentum. Volume is picking up, confirming the breakout and a strong move toward the target.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

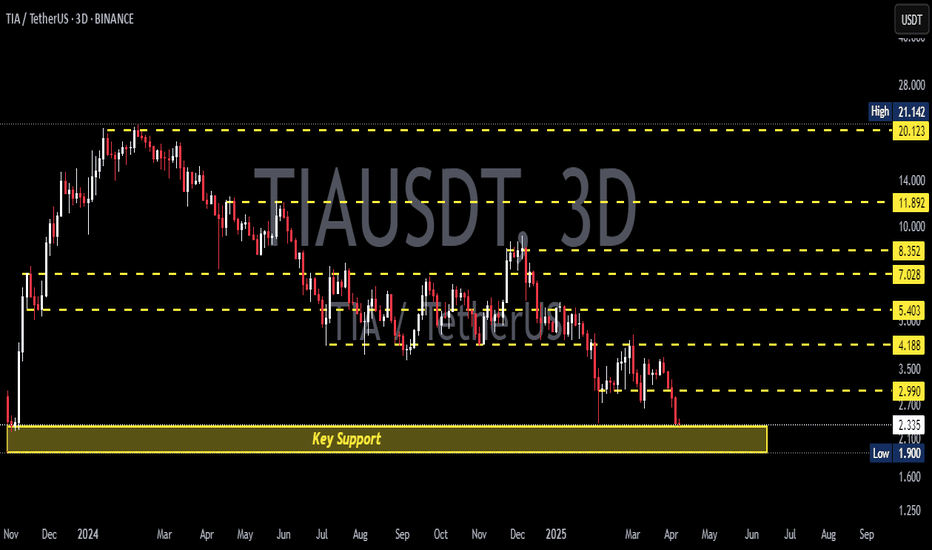

TIAUSDT — 2025 Technical RoadmapTIAUSDT — Daily Technical Roadmap

🕞 60-Second Read

Trend on the 1-D chart is still structurally bearish ; price (spot 2.865 USDT) just carved a higher-low off the 2.44 vector block and is knocking on the Yearly BC lid. Two large upside voids now beckon.

Hot-Zone #1 – 2.60 → 2.44 (1 D + 4 H vector demand): stacked fresh liquidity, 9-15 % under spot.

Hot-Zone #2 – 2.985 (Yearly BC): first breaker & range cap, only 4 % above; a daily close above here opens the air-pocket to 4.27.

Hot-Zone #3 – 4.932 → 6.947 (Yearly Pivot ↔ Yearly TC): macro supply shelf guarding a 72-142 % rally window.

💧 Liquidity & Imbalance

Daily vector 7.85 (77 % fill-rate inside 60 d).

Stacked 4 H vectors 9.86 / 9.83 = 2.5 % supply shelf.

Demand stack 2.69 – 2.44 only 18 d old.

⚡ Volatility & Momentum

GMMA Z-Score curling up from −2 σ; short ribbons still under long ribbons – suggests pause, not reversal.

🎲 Probability Dashboard

HTF Structure −3

Liquidity voids +1

Momentum −1

Vol-regime 0

Bear / Neutral / Bull ≈ 42 % / 33 % / 25 %

📈 Trade Playbook

Strategy 1

1. Layered Limit Grid – Aggressive Counter-Trend Long

Entry layers (size %):

2.60 – 40 % of your allocated TIAUSDT size

2.44 – 30 %

2.05 – 20 %

1.90 – 10 %

SL = 1.75 (≈ 1 ATR below extreme demand)

TP ladder:

2.985 – 25 % off-load

3.722 – 25 %

4.932 – 25 %

6.947 – 15 %

7.849 – 10 %

Weighted R:R ≈ 4.3

Strategy 2

2. Layered Limit Grid – Conservative Breakout Long

Trigger: daily close > 3.722 (Yearly Low reclaim), then place grid orders.

Entry layers (size %):

3.75 – 40 %

3.55 – 30 %

3.25 – 20 %

2.985 – 10 %

SL = 2.70

TP ladder:

4.932 – 30 %

6.947 – 30 %

7.849 – 20 %

9.860 – 15 %

12.432 – 5 %

Weighted R:R ≈ 3.8

⚠️ Risk Radar

Low-float token – slippage risk on size.

Macro event: FOMC 1 May → volatility spike possible.

BTC options IV rising – spill-over risk to alts.

Price must conquer 2.985 to open the upside magnet trail toward 4.27 → 4.93. Failure keeps 2.60 → 1.90 demand stack in play before any durable markup.

Not financial advice – do your own research & manage risk.

TIA buy/long setup (4H)TIA seems to be in the middle of a bullish pattern, especially as it has reclaimed key levels and there is an order block located below the current price.

Two entry points are marked on the chart, indicating where we’re looking for buy/long positions.

Targets are specified on the image.

A 4-hour candle closing below the invalidation level would invalidate this setup.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#TIA/USDT#TIA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.18.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 2.27

First target: 2.36

Second target: 2.42

Third target: 2.53

TIAUSDT Bottoming Out?TIAUSDT Technical analysis update

TIAUSDT has been trading within the longest descending channel. The price has once again touched the channel support and also retested the November 2023 support level or bottom. A strong bounce from this zone is likely, and we could potentially see a 100–150% move from the current level.

Long TIA from 2.30 to 5.5 dollars When price comes to the weekly chart lower band and bounces away as we have it now. The bears have been firmly defeated.

We have a weekly divergence and relative to selling there is more buying volume.

We could pop down to 2.05 as the final scare drop but am not counting on it but be prepared to load up more there.

Price should be going to the upper band around 5.50 to 6 dollars.

Is TIA About to Break Down Hard? Traders Beware Before It’s lateYello, Paradisers! Did you catch the recent bullish rally on #TIAUSDT? It’s been delivering solid gains over the past couple of days, giving traders reason to celebrate. But what if we told you that this rally might just be setting up a classic trap—one that smart money is already preparing to take advantage of? The technical structure forming right now suggests a high probability of a reversal, and if you’re not paying attention, you might end up on the wrong side of the move.

💎#TIAUSDT, at the core of setup is a developing a probable Bearish Gartley pattern. These harmonic structures are rare but extremely powerful when they align with multiple technical confirmations and that’s exactly what we’re seeing here. With the recent move upward, TIAUSDT appears to have completed its C leg, a critical part of the Gartley structure. This sets the stage for the D leg, which typically completes much lower. The price reacted strongly from the C leg area, which also happens to line up perfectly with a previous local high adding even more probability to the resistance at that zone.

💎This resistance isn't just horizontal there's a dynamic element at play as well. The 21-period EMA on multiple timeframes is currently acting as a ceiling for price action. When a key moving average starts rejecting price repeatedly, it often signals that the current trend is losing steam and this dynamic resistance only strengthens the case for a downside move from here.

💎Looking deeper, the bearish signs are confirmed by momentum indicators. The RSI on lower timeframes is not only overbought but also showing clear signs of bearish divergence. This divergence occurs when the price continues to make higher highs while RSI starts forming lower highs a classic sign that momentum is weakening. It’s one of the more reliable early warnings that a reversal may be near. In this case, RSI is flashing that warning now, suggesting that buyers may soon run out of fuel.

💎If this bearish probable scenario plays out as expected, the first key level to watch on the downside sits around the 3.278 zone. This minor support may offer a temporary bounce, but if the D leg of the Gartley is to be completed, we could see even deeper price action. This makes the current area extremely sensitive—any weakness from bulls could trigger a fast move downward.

💎However, no pattern is complete without an invalidation level, and for the Bearish Gartley, that comes in around the 3.805 resistance zone. A strong, sustained close above this level would invalidate the bearish setup and signal renewed bullish momentum. Until then, all technical signals are pointing toward caution, especially for those still riding long positions without a tight risk plan.

Stay alert, Paradisers. The market is about to decide. This is a textbook moment where emotions can take over, and late buyers get punished for chasing green candles. That’s why, we are playing it safe right now. If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest probability trading opportunities.

MyCryptoParadise

iFeel the success🌴

TIA | Next Altcoin to MOON ??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

In an earlier publication, I made an update about the ideal entry point for TIA:

A key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around. It is a bullish sign to see the gradual higher lows.

Moving Averages:

TIAUSDT - analysis of the downtrend phase and potentialProject :

Celestia is one of the key players in the new generation of modular blockchain architecture. Unlike traditional monolithic solutions, it separates the execution and consensus layers. This provides flexibility, scalability, and creates the infrastructure for rollup and L2 ecosystems.

📍 CoinMarketCap: #47

📍 Twitter (X): 397.7K

____________________________________________________________

🔎 Technical picture :

I marked the Seed / Series A / Series B zones on the chart — it's clear how early investors locked in massive profits: from listing, the price skyrocketed +634%, and their returns are many times higher!)

From the current levels, the price is down ~87% from its all-time high.

Formation: the price is moving inside a large descending channel. At the same time, a potential “cup” structure and a possibly emerging ascending channel are forming.

We are close to the lower boundary of these formations — it's an interesting zone.

A final sweep/fakeout toward the lower boundary of the descending channel is possible — keep this in mind when calculating risk.

Key level: the orange trendline marks the boundary of the secondary trend. A confident breakout and hold above it would be one of the reversal signals.

____________________________________________________________

💡 General conclusions :

Liquidity — solid.

The coin is traded on major exchanges.

Trend potential is marked on the chart.

As always — everything depends on your strategy and patience.

____________________________________________________________

📌 This review is not financial advice but my personal analysis and observations on the project.

TIA ( SPOT)BINANCE:TIAUSDT

TIA / USDT

(4H + 1D) time frames

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com