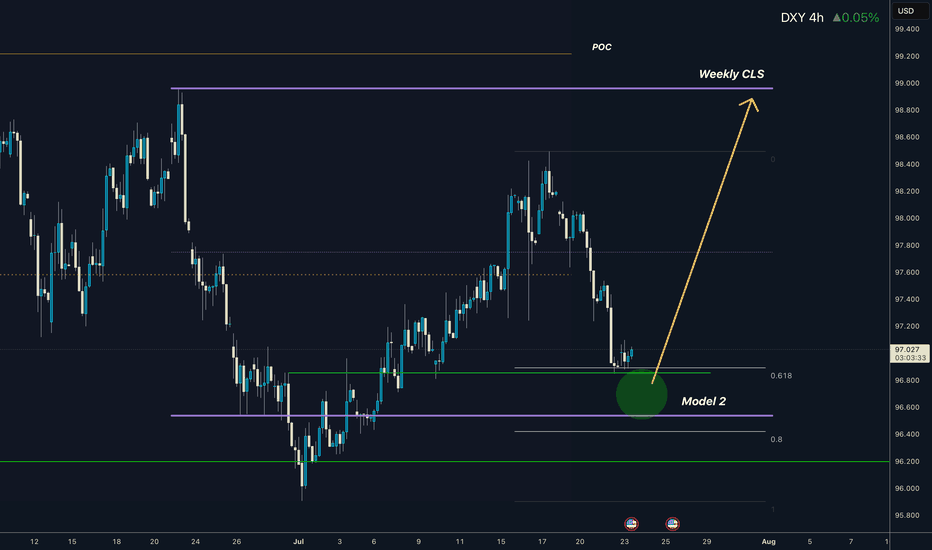

Dollar I Weekly CLS I Model 2 I Ready for pullbackYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/d

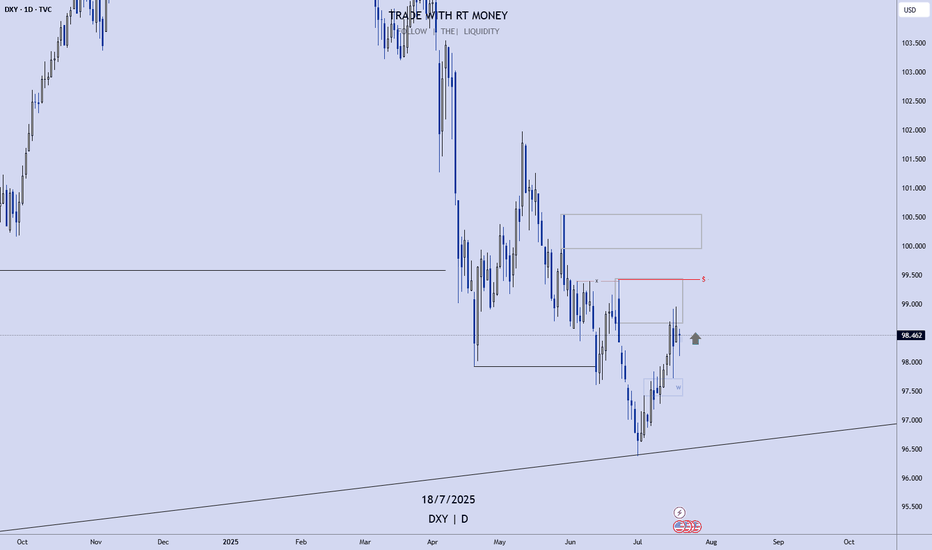

USD Is Still Bullish! Wait For Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

USD

The DXY has run bullish last week, up into an area of Supply, where the momentum hesitates now. Next week may pull back a bit... before continuing higher to the buy

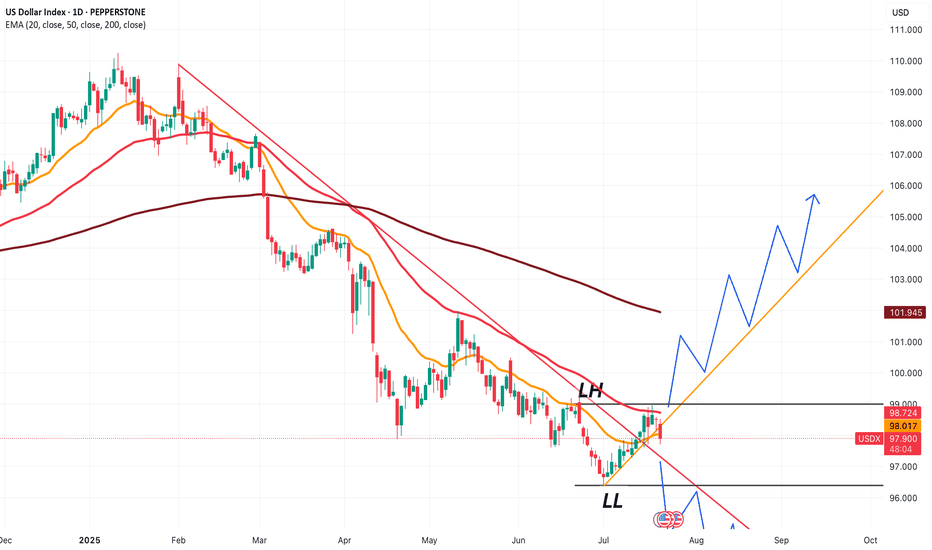

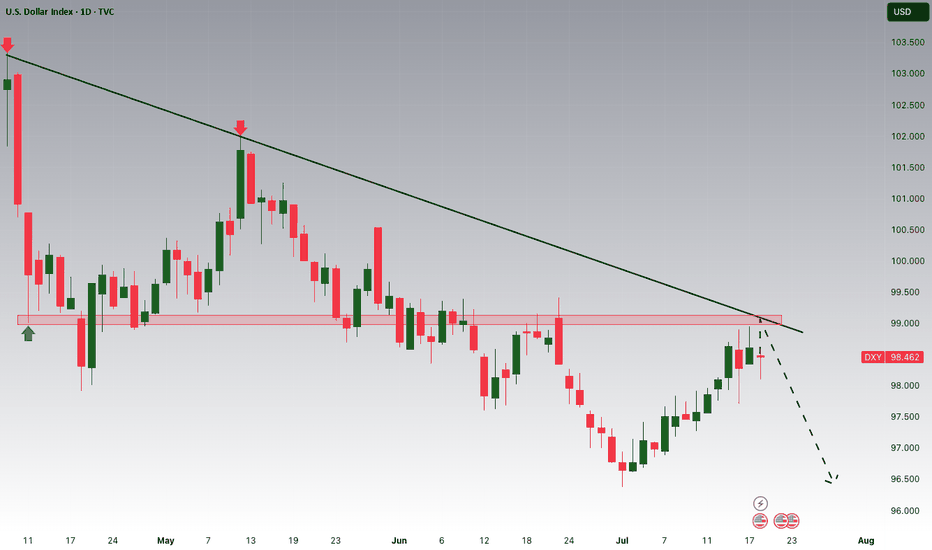

USDX at a crucial price point, which will decide trendThe next few candles for USDX price will be extremely important to understand where the dollar index is headed.

Based on that, we'll be able to choose 'which' Forex pairs we can trade, and more importantly 'how' we can trade them.

If price starts to follow the green line, and takes out 99.000, we'

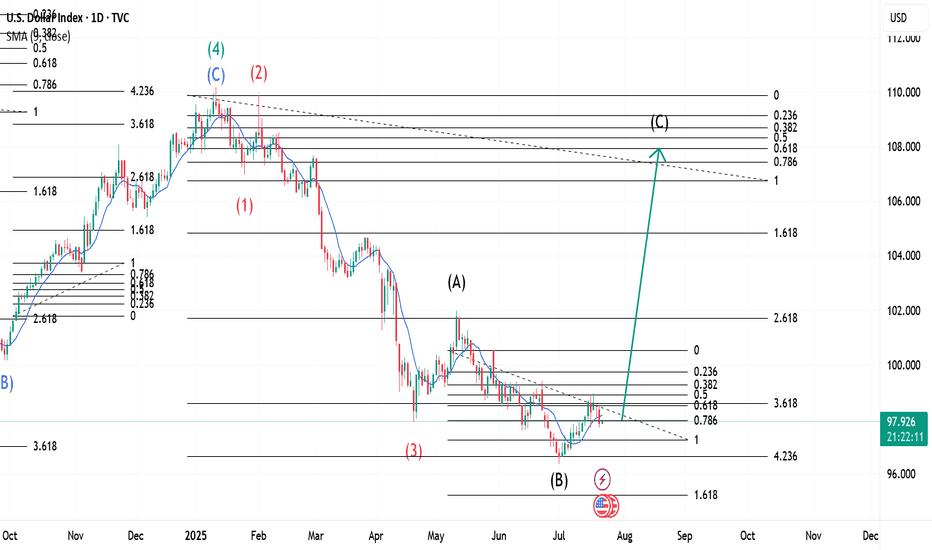

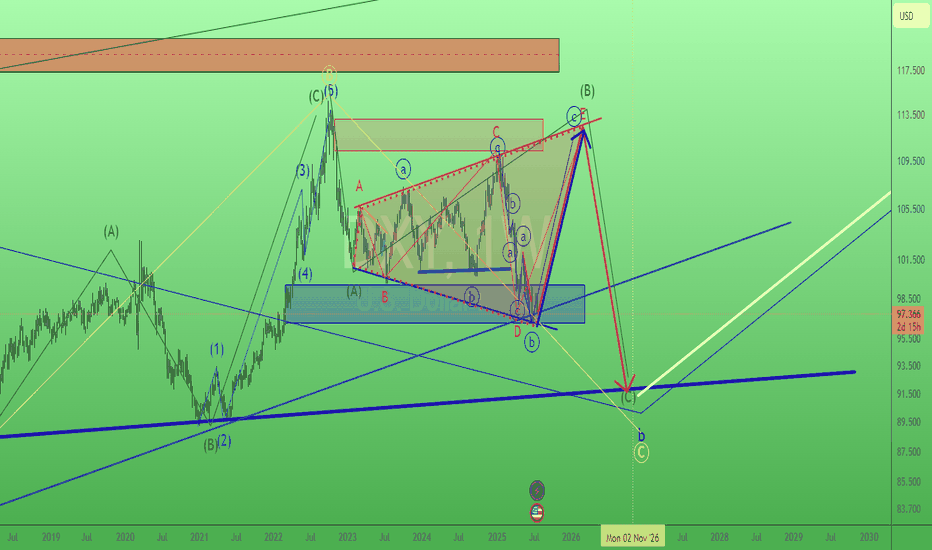

The $ Index ~ Elliott Wave Theory in real time.This is an update of a previously uploaded Dollar index Chart. Analysis remains the same and a confirmation at its current location would trigger continuation of the upward move as analysed on the first chart I had posted. Theoretically, the pullback on Monday, 21st July 2025 could be our Wave 2 wit

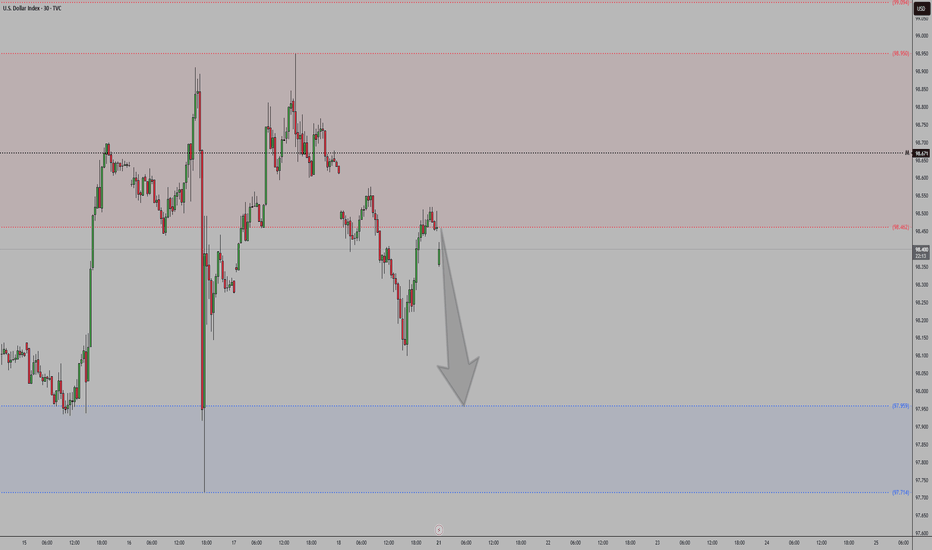

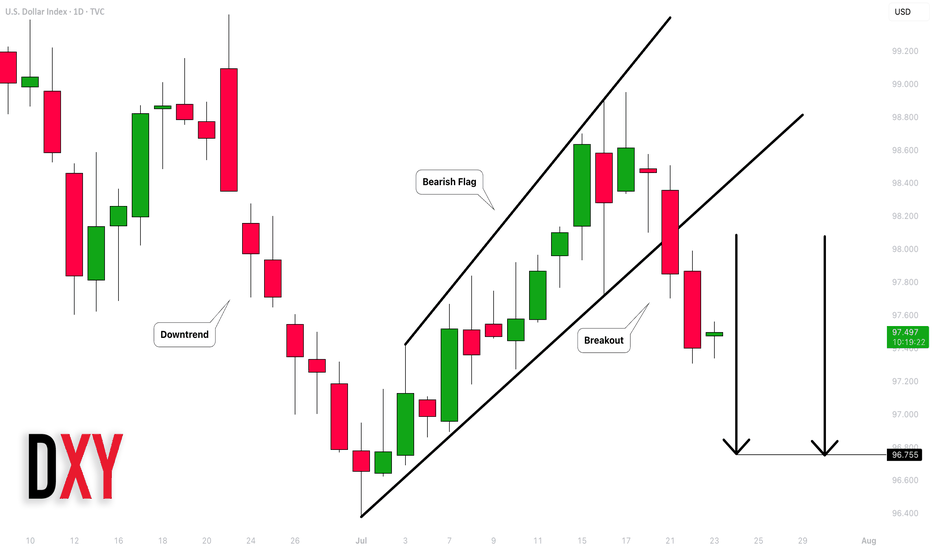

Dollar Index (DXY): Strong Bearish Price Action

Dollar Index broke and closed below a support line

of a bullish flag pattern on a daily.

Because the market is trading in a bearish trend,

this violation provides a strong bearish signal.

I expect a bearish movement to 96.75

❤️Please, support my work with like, thank you!❤️

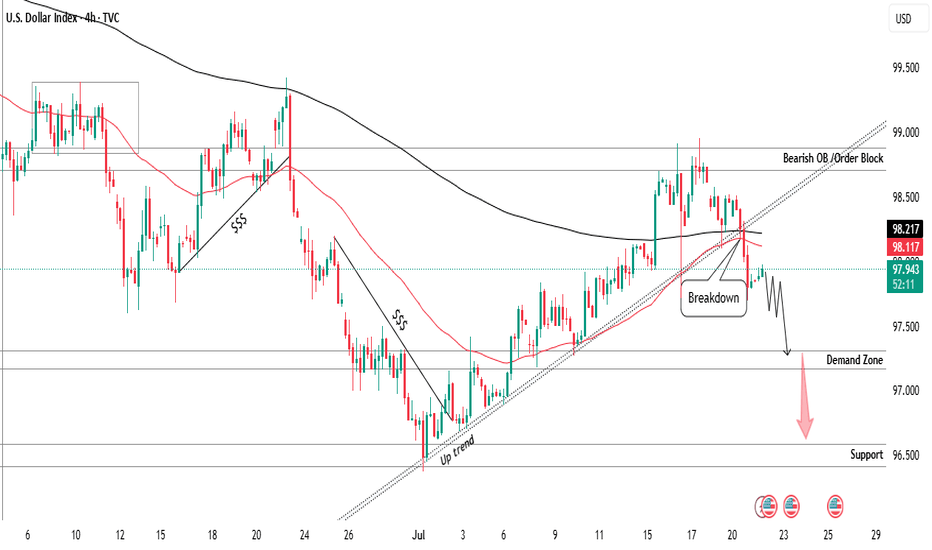

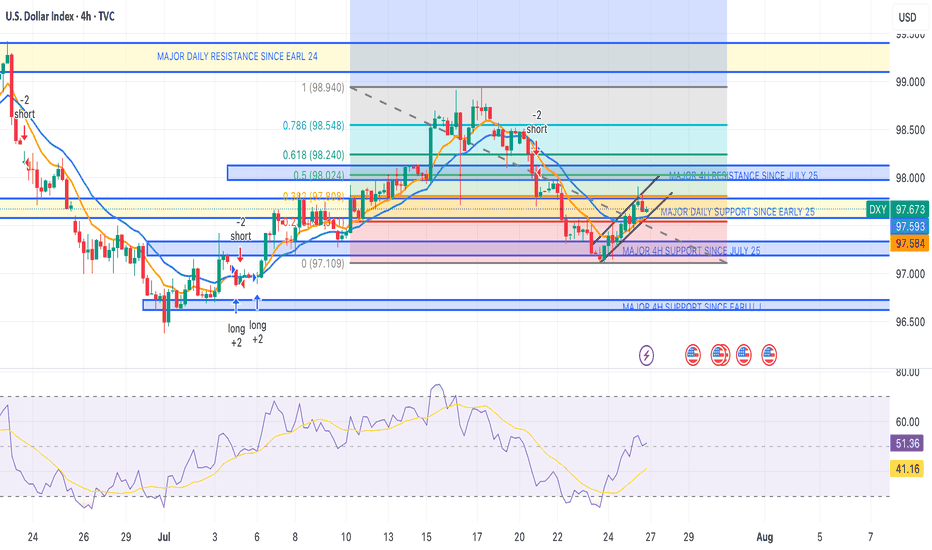

DXY Sell breakdown from bullish trend selling pressure 📊DXY – US Dollar Index Analysis – 4H Timeframe

The US Dollar Index has broken its bullish trend with a strong bearish candle, signaling a possible shift in momentum to the downside

📍 Sell Position Active:

Entry taken at 98.000 following the trendline break and bearish confirmation candle

🎯 Tech

DXY HEADING INTO LAST WEEK OF JULY DXY ZONES

WEEKLY TF, TO DAILY, TO 4HR ANALYSIS.

The successful devaluation of the dollar by the administration since the election continues.

DXY dumped below key daily support at 97.600.

It was reclaimed but failed at key daily resistance dating back to 2024 — the same zone as the 0.382 Fibonacci

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Dollar Index reached its highest quote on Sep 28, 2022 — 114.715 USD. See more data on the Dollar Index chart.

The lowest ever quote of Dollar Index is 78.910 USD. It was reached on May 8, 2014. See more data on the Dollar Index chart.

Dollar Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Dollar Index futures or funds or invest in its components.