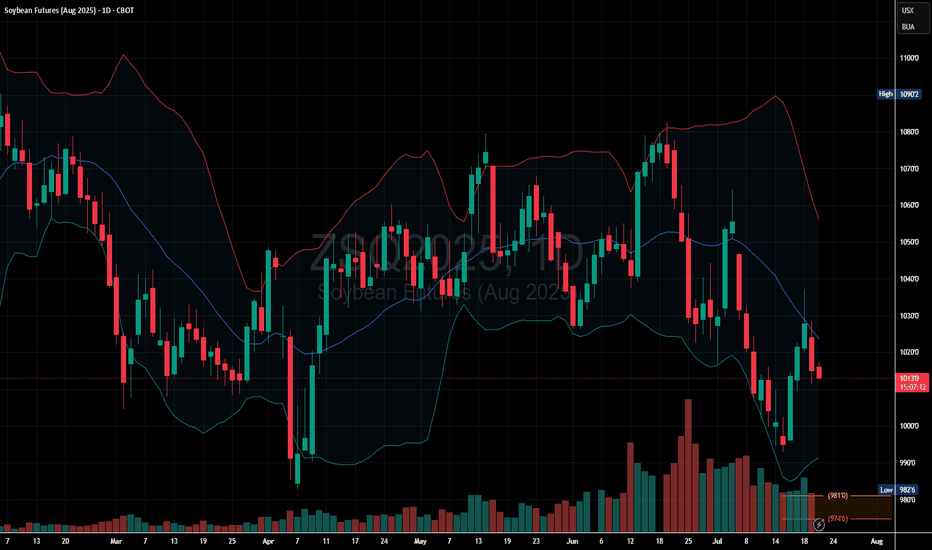

ZSQ2025 Slips Below Mid-Band: Downtrend in Motion

The price is trading below the midline of the Bollinger Bands, indicating weakness and bearish momentum.

Recent candles show lower highs and lower lows, a classic bearish structure.

Price has rejected the midline recently and is leaning back toward the lower band, a common setup in bearish conti

Related commodities

Soybeans and Rain: Moisture’s Market Impact on the Bean Trade1. Introduction: Moisture & Market Momentum

Soybeans, often referred to as “the oilseed king,” are a cornerstone of global agriculture. As a leading source of protein for both humans and animals, their price fluctuations affect industries ranging from food production to biofuels. One key variable

Soybeans Loading a Bounce? Demand Zone + COT1. Price Action & Technical Structure

Price has bounced off a strong daily demand zone (1011–969).

Today’s daily candle shows a clear rejection wick from the low, and RSI is signaling a potential reversal.

The market is trading inside a falling channel, currently near the lower boundary — setting up

Oversupply Meets Tepid Demand Weighing Down on Soybean MealSoybean meal futures rose in mid-June amid Israel-Iran tensions but retreated after a ceasefire. Even a 129% month-on-month surge in China’s May soybean imports failed to support prices.

Spike in import volumes is a consequence of normalisation in customs clearance and a rebound in crushing pl

Soybeans Crashing Into Demand — Reversal Coming or Trap?1. COT REPORT — Updated June 17, 2025

📌 Non-Commercials (Speculators)

Long: +5,661 → 195,984

Short: -9,226 → 110,761

✅ Net Long Increase: A clear bullish shift in speculative positioning (+14,887 net contracts). This is an early indication of a sentiment reversal.

📌 Commercials (Hedgers / Producer

Soybeans and Heat: Subtle Signals in a Volatile Market1. Introduction

Soybeans aren't just a staple in livestock feed and global cuisine—they’re also a major commodity in futures markets, commanding serious attention from hedgers and speculators alike. With growing demand from China, unpredictable yields in South America, and increasing climatic inst

Bullish Undercurrents Build in Soybean Oil MarketSoybean oil futures have rebounded nearly 14% in June, following a 5.7% drop in May, supported by tightening global supply, resilient demand, expanding biodiesel use, and steady U.S. production with some planting delays.

Severe drought in Brazil and Argentina, who together account for 45% of gl

Bearishness Persist in Soybeans Despite Rebound HopesSince mid-May, soybean prices have traded sideways, whipsawed by weather shifts, trade tensions, and fluctuating demand cues.

Soybean prices began rallying on May 19, driven by optimism over U.S. trade deals, crop damage in Argentina from heavy rains, and strong soybean oil prices.

However, t

Bean Oil Retreats From Rally. What’s Next?Soybean oil futures are easing after a stunning 24.5% rally from 24/Mar to 14/May. The surge was driven by rising biofuel mandates and renewable diesel output, which boosted domestic soybean crushing and tightened supplies.

Additionally, the May WASDE report highlighted soybean oil’s key role i

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Soybean Futures is 64,000 JPY — it hasn't changed in the past 24 hours. Watch Soybean Futures price in more detail on the chart.

Track more important stats on the Soybean Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Soybean Futures this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Soybean Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Soybean Futures. Today its technical rating is neutral, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Soybean Futures technicals for a more comprehensive analysis.