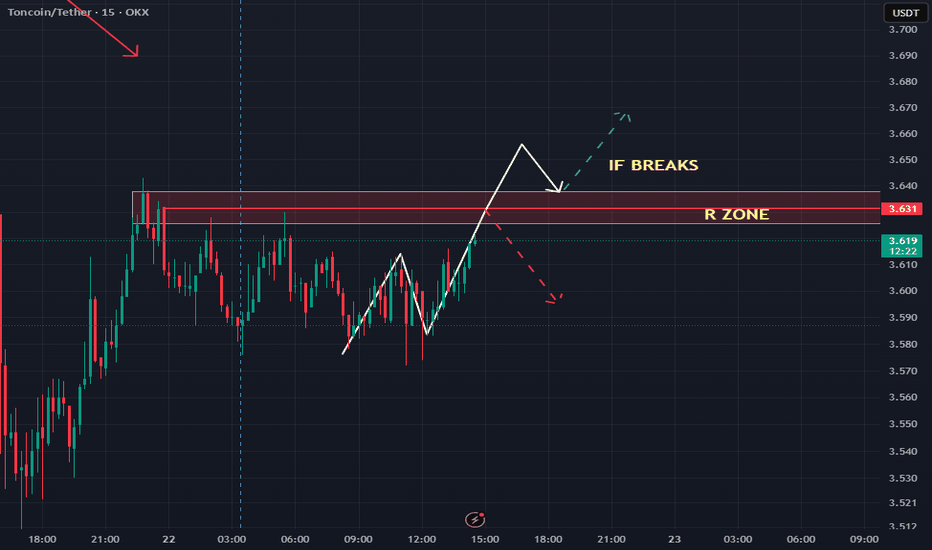

TONUSDT NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

TONUSDT trade ideas

TONUSD NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

TON – Breakout or Breakdown?TON Coin – Breakout or Breakdown?

🔹 Currently moving in a downward channel.

📉 Lower highs & lower lows – a textbook bearish trend.

🚧 Right at a resistance zone.

Where could it go from here? Let's break it down!

TON’s Current Price Action

The chart clearly shows the downward channel—lower highs, lower lows, signaling trend weakness.

🎯 Right now, price is at resistance. From here, we either see a breakout or a rejection. (Spoiler: I’m leaning towards the latter.)

Why a Rejection Seems Likely

Price is at the top of the channel—if it doesn’t break out, it’s likely to return to the range.

The next key support sits around $2.80, making it a crucial level to watch.

Bearish RSI Divergence

On the 4H chart, RSI isn’t confirming the price action. Price is moving up, but RSI is trending down = classic bearish divergence.

This often signals trend weakness and a potential reversal.

Conclusion

⚠️ If price rejects at resistance, $0.90 is a key target. I expect it to reach this level—not today, not tomorrow, but somewhere around here will be the bottom.

The trend is still down—until we see a strong breakout, short setups remain favorable. If a breakout happens, time to reassess.

Are you bullish or bearish on TON? Drop your thoughts in the comments! 🔽

TON/USDT: Potential Pullback After Sharp RallyThe TON/USDT market experienced a 20% surge following unexpected news that Telegram founder Pavel Durov had regained his passport, enabling unrestricted travel. This bullish momentum led the price to rebound from support and approach the 4.00 resistance zone.

However, as the price neared this key resistance, momentum began to slow, and signs of a bearish divergence emerged. On the daily timeframe, candles with upper wicks suggest rejection at higher levels. Given these developments, the market may be poised for a short-term corrective move toward lower support. The next potential target is the support zone around 3.330

Lingrid | TONUSDT price Deceleration at RESISTANCE ZoneOKX:TONUSDT market surged by 20% following the surprising news that Telegram founder Pavel Durov had regained his passport, allowing him to travel freely. Consequently, the market bounced off the support level and nearly reached the 4.00 resistance zone. However, as it approached this resistance zone, signs indicated a potential pullback; the price has been decelerating and a bearish divergence is evident. Additionally, on the daily timeframe, we observe candles with wicks indicating rejection. Therefore, I expect the market may form a short corrective move toward the support level. My goal is support zone around 3.330

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy

TONUSDT.P Scaliping Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Be successful and profitable.

TON will likely lose up to 20% of it´s value

In my opinion the pwProfile (previous week profile) is not bullish. This looks a lot like shorts covering. Long term-holders are taking profits off their shorts. The recent uptrend left a big zone of singleprints behind which could get filled at some point. The context of the singleprints within a possible bearish profile rotation matches very well.

Up here we are witnessing bracketing (consolidation) on decreasing volume in comparion to the uptrend caused by shorts covering. So far that´s not what bulls wanna see. Currently the 6th - 4 hr candle is rejecting the pwVAH. (previous weeky value area high). That isn´t acceptance, it is rejection. People do not see the pwVAH and prices above as fair. This was my original basis for a short trade from here.

On Monday price has put a first potential swing high as "excess" above the pwVAH. This happened on decreasing volume, that´s why I am defining this as excess. A place where short-term buyers do not get accompanied by long-term buyers. That high got tested yesterday, but also on decreasing buying volume and price fell back below the pwVAH.

After checking the local daily profiles with the help of TPO, we can see that during this bracketing time, daily profiles are overlapping, marking a potential end of the local uptrend.

The whole TPO bracketing looks like "fading bracket extremes". Price is literally "hanging" at one extreme on decreasing volume, the pwVAH, defined by multiple days of overlapping values.

If bulls want to claim this and pump higher, they need to close several 4 hr candles above the pwVAH, build volume with an increase of buyers. As long as this doesn´t happen, I am going for the short trade which is offering potential high reward and low risk.

TON/USDT – Ascending Triangle Formation & Key Resistance LevelsTON/USDT is forming an ascending triangle on the 15-minute timeframe, signaling potential continuation. The price is testing a key resistance zone around $3.60 - $3.70, with strong support near $3.30. A breakout above resistance could push the price higher, while a breakdown may lead to a retest of lower support levels. RSI indicates mid-range momentum, suggesting possible volatility ahead. 📈

What are your thoughts? 🚀🔥 #TON #Crypto #Trading #TechnicalAnalysis

Toncoin TON price will surprise everyone💎If you look closely at the OKX:TONUSDT chart, you can see/think that the last six months have seen a global trend reversal pattern - Head and Shoulders.

But! This pattern will be confirmed after the price of CRYPTOCAP:TON is firmly fixed below $4.50. Then the target is $2.30-2.50.

However, this is all very obvious, trite, and not interesting)

We want this idea to become prophetic and Legendary, so we hope for the beginning of a hypercycle of #Toncoin price growth with an ultimate goal of $93

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TON road map !!!If the price can break through this important resistance, it can easily reach the desired targets.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

$TON is still a great bet!Even though the market dipped today the CRYPTOCAP:TON Founder Pavel Durov is still free!

CRYPTOCAP:TON and its beta coins retraced because CRYPTOCAP:BTC did, but the ecosystem will could have a few catalysts once Pavel gets back to work!

This is a good place to be researching as CRYPTOCAP:BTC holds the market down!

There is a pump on $TON!The real secret to benefiting from the CRYPTOCAP:TON pump, because Durov is now free, is by looking for high beta CRYPTOCAP:TON coins.

A high beta CRYPTOCAP:TON coin is a coin that moves in lockstep with CRYPTOCAP:TON but with amplified volatility both up and down.

So, whilst CRYPTOCAP:TON is pumping, the CRYPTOCAP:TON ecosystem is doing even better.

However, you won't truly profit from this unless you are shown how to.

And you should really find out how before it is too late!

TON Main trend 16 03 2025Logo of rhymes. Gann fan for understanding the logic of trend development and dynamic levels of support and resistance.

Time frame 1 week, for full orientation in the trend and potential targets. Key price reversal zones on which the trend development depends are shown with arrows. Conservative and adequate targets in the medium and long term. Everything above, as for me, should not worry you much, but this is purely my opinion, nothing more.

🟡 Pay attention how clearly the percentages of large triangles and time reversal zones are worked out according to the algorithm. Someone who is far from trading says that TA does not work on cryptocurrency.

TA is a banal logic, an exchange algorithm (you need to be tied to something), real supply/demand (market participants) and manipulative supply/demand, that is, large market participants (exchanges, funds, creators).

In the development of the trend, there is a fractal behavior of the price in the trend at the moment. Perhaps this logic will continue. The secondary, downward trend formed a wedge-shaped formation, as before.

1 day time frame

🟣 Currently locally an aggressive buyback is taking place (probably, as an excuse for the price movement, some positive news was released) from the dynamic support of the fan (on the 5-minute time frame, after the impulse-buyback, a bullish triangle was formed in consolidation, and now its goals are being realized). If after a rollback on the senior time frame (1 day, 1 week) this zone is preserved - a reversal of the secondary trend. At the moment, the price is moving within the wedge canvas, locally there is a complete absorption of the bearish candle on the weekly time frame.

🔴 Also, if there is a test of this reversal zone (less likely) , then the price can consolidate according to the logic of the descending wedge. Price consolidation, especially not overcoming the dynamic former fan support on a repeated retest — a decline to begin with to the median (red dotted line) of the range. On the chart you will see an "illogical" head and shoulders. This is an extremely unlikely scenario, but I will describe it just in case, so that you take this into account in your money management (not risk management).

TON Go to $4.5?Durov was finally released, he returned to Dubai, and #TON perked up by +16% in a day.

That's it, now people will love the CRYPTOCAP:TON Ecosystem again, a bunch of new tapals will come out.

The key resistance level will be at $4.5

We can also go to $2.7

The break of the global triangle upwards may be in Seb-Oct

Correction time The TON Ecosystem was used wisely, they identified weak points, protected their market from Competitors with protectionism, mini apps in Telegram should only use TON, now Liquidity will accumulate more inside Telegram, and not go to Solana.

The game starts again)) and we are ready for it.

TON UPWith our Fbuy prints printing beautifully so what's the news/rumour? ccording to media reports, Pavel Durov has left France and going back to Dubai with court approval.ccording to media reports, Pavel Durov has left France and going back to Dubai with court approval.

That's how 7-star works.

For indicator access, you can drop a message.

DYOR

Lingrid | TONUSDT sell Potential at the CONFLUENT ZoneOKX:TONUSDT market fell alongside the broader crypto market. However, we can observe that the price is approaching the channel border. Analyzing the price action, it becomes clear that the market lacks momentum, indicating that bullish movements are significantly weaker than bearish ones. Prior to the recent sell-off, the price was in an accumulation phase, forming a triangular pattern. I think the price may head back to retest this zone. I expect that it will test the midpoint of the triangle's downward trendline and a key psychological level before continuing donward move, as the overall trend remains bearish. My goal is support zone around 2.55

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Lingrid | TONUSDT short-Term BULLISH Momentum on the HorizonOKX:TONUSDT market reached the 3.00 support level, as I predicted in my previous forecast . Currently, the price is fluctuating around this psychological level, squeezed between the support level and a downward trendline. This situation is likely to result in a breakout, and I think the market may push higher, given that the price continues to bounce off the support level. Notably, it reached the March high of 2024. Thus the price may oscillate around the 3.00 level, moving up and down. However, I expect an upward movement if the unexpected news does not have a negative impact on the cryptocurrency market. My goal is resistance zone around 3.250

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

TON/USDTToncoin (TON) is the native cryptocurrency of The Open Network (TON), a decentralized layer-1 blockchain initially developed by Telegram's team. Designed to support scalable and secure decentralized applications, TON utilizes a proof-of-stake consensus mechanism. Toncoin serves various purposes within the network, including transaction fee payments, network security through staking, and governance participation.

Technical Analysis: Toncoin is exhibiting a bearish trend, with prices moving downward. Currently, the price is consolidating within a small wedge pattern. A breakdown from this wedge could signal further declines. Additionally, there's an untested Volume Weighted Average Price (VWAP) in the highlighted green area, which may serve as a potential support level.