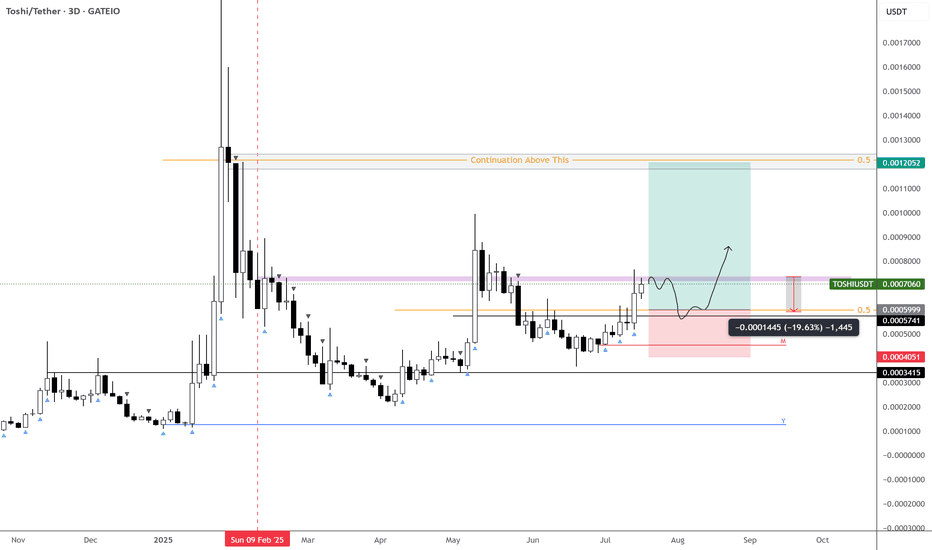

Awaiting entry, $TOSHIUSDT looks prime for a double top!Hard to gauge if we get a drop from here — but if we do, I’d love to see a ~20% flush into key support.

Not counting on it just yet, but the chart is coiled and primed for either direction. A potential 2x setup is on deck, so this one needs to be closely monitored given where it currently sits.

Two clear paths:

Flush into demand (my preferred entry)

Or a reclaim of the purple block to confirm continuation

⚠️ MEXC:TOSHIUSDT has strong technicals — keep it firmly on your watchlist.

TOSHIUSDT trade ideas

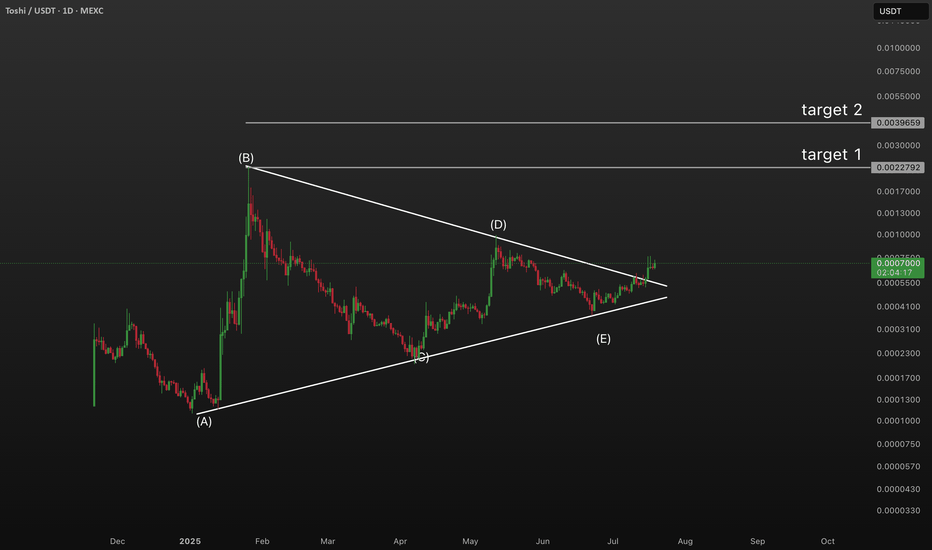

2025 Altcoin LeaderTOSHI, the primary meme on BASE, is tightening up at the end of a 1.5 year base. Looking back at prior leaders like DOGE (2021) and XRP (2017), they based for ~1.5 years before breaking out and going on their huge runs.

BASE likely to lead crypto this year given Coinbase's efforts and connections with Washington and TradiFi firms like BlackRock.

$TOSHI bounce incoming!I’m expecting a reaction near the previous breakout zone. At the moment, I’m not comfortable holding positions, especially in altcoins, until I see more confirmation. Only a few altcoins have strong structures, but the majority are just P&D setups.

Most meme coins are not worth buying right now, except for some of the newer ones within the $Binance ecosystem. CRYPTOCAP:SOL appears to be forming a new range, so it’s moving slowly there. The only coins I’m currently eyeing are $TOSHI, with potential for a nice bounce soon, and possibly $FARTCOIN and $AI16z for the longer term.

Targets & Strategy:

My target for COINEX:TOSHIUSDT is a bit ambitious, so I plan to take profits or adjust my position as necessary. It all depends on CRYPTOCAP:BTC , it’s crucial that it holds above 90k for bullish continuation.

Toshi Bull-Market Signal: 260% Daily Bullish BreakoutThis is a signal signaling the start of the 2025 bull-market. This trading pair, TOSHIUSDT, broke up yesterday and produced a candle that topped at 260%+, within the day.

If we take the 13-Jan. low as the start of the bullish move to the peak yesterday we get a total breakout amounting to 300%. This is seen only and can be seen only within a bull-market. Since it is early, we can take it as the start of the next major bullish move. Early is good.

Join early and you get lower risk and higher potential for rewards.

Early entries are better for sure because you get to enjoy the full bullish move.

This is a short post just to let you know that the bull-market is on, and it is going to go for a long while... Prepare for massive growth-massive growth; ultra-green in the days, weeks and months that are yet to come.

Thank you for your continued support. It is truly appreciated.

Namaste.

This Hidden Gem Could Skyrocket 70% – Ultimate Chart BreakdownTraders! Today, we’re looking at a chart that could have huge potential and bring big gains if you know how to play it right. This isn’t just any regular analysis – we’re breaking it down step by step so anyone can follow along. Whether you’re experienced or new to trading, this setup could be a big opportunity. Let’s see what makes this chart so exciting!

1. General Chart Structure

Trend: The chart shows a clear upward momentum following a long period of consolidation. The breakout suggests potential strength, but the recent pullback indicates a need for confirmation before further upside.

Patterns: The price appears to be forming a flag or pennant pattern, which is generally a continuation signal in an uptrend. The breakout from this structure will determine the next move.

2. Volume Analysis

Volume Spike: There’s a noticeable increase in volume during the initial breakout. This confirms strong interest from buyers. However, the volume during the pullback has decreased, suggesting that sellers are weaker.

Watch for Volume: A new breakout accompanied by rising volume will confirm strength. Lack of volume could lead to sideways action or a potential fake-out.

3. Candlestick Analysis

Recent Candlesticks: Long wicks on the upper side of recent candles indicate selling pressure near higher levels. This shows resistance at those levels.

Ideal Closure: A strong daily or 4-hour candle closing above the flag/pennant pattern would signal bullish continuation.

4. Key Levels

Support Levels:

Immediate support: $0.0002500 (recent low).

Major support: $0.0002000 (previous consolidation base).

Resistance Levels:

Immediate resistance: $0.0003500.

Next target: $0.0004500.

5. Risk-to-Reward Evaluation

*Entry Point: Enter near $0.0002600–$0.0002700 (current price level).

*Stop Loss: Place at $0.0002400, just below the recent pullback support. This limits the risk.

-Targets:

*Target 1: $0.0003500 (resistance zone, 30% upside).

*Target 2: $0.0004500 (higher resistance, 70% upside).

*Risk-to-reward: ~1:4 if aiming for the second target.

6. Scenarios

Bullish Scenario (High Probability):

Price breaks above $0.0003000 with strong volume.

First target: $0.0003500.

Second target: $0.0004500 (depending on overall market conditions).

Neutral/Sideways Scenario:

Price consolidates between $0.0002500–$0.0003000.

Wait for a breakout in either direction before entering.

*Bearish Scenario (Low Probability):

Price breaks below $0.0002400.

Target downside: $0.0002000.

*Stop Loss Strategy

*Use a trailing stop as the price moves upward. For example:

Move the stop loss to $0.0002800 once the price hits $0.0003500.

Secure profits as price approaches $0.0004500.

*Conclusion*

Potential: The chart has good upside potential, with a clear bullish structure. However, confirmation of the breakout is essential.

Risk: Moderate. Risk is limited if stop loss is respected.

Reward: High, with up to 70% upside if bullish momentum continues.

Recommendation: Wait for a daily close above $0.0003000 with volume for confirmation before entering.

TOSHI TRADE UPDATE. Bullish trade setup for next TOSHI PLAYToshi /usd Long trade setup on the 2 day chart is what im looking for. the last toshi vid i made for the 6hr trade setup play worked out nice , but we want those MULTIPLES ... those X's ... I KNOW I KNOW .. anyway... heres an update on how i see the safest, biggest return on a long play on TOSHI / USD . Patience is your biggest friend right now in my opinion. the reasons are in the vid explaining why the 2 day chart and what free indicators to use for setup rules i think will bring most returns . Happy trading !