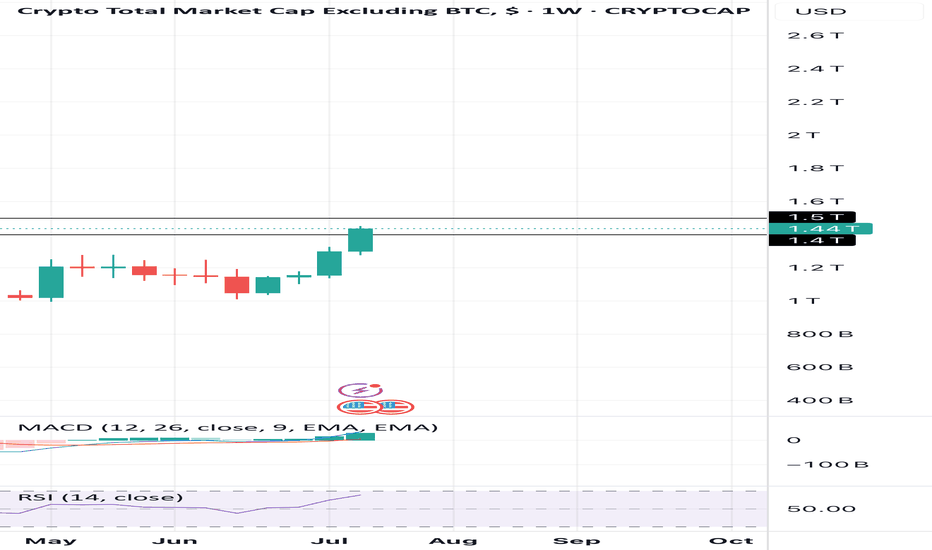

The Correction Is Over! Bull FlagThe bull flag is a popular pattern. Everybody who has seen a chart is familiar with this pattern. It is a continuation pattern.

When I say that the correction is over I am not talking about the short short-term, I am talking about the bigger picture.

Yes, bullish action is expected to start and intensify within weeks, no!, days. But still, with thousands of projects, it takes lots of time before energy (money) reaches all sectors of the market. Allow for strong variations but the correction is over which means growth.

The correction is over means that the low is already in for most pairs and will be in, in the coming days for all remaining pairs.

The correction is over means that everything will grow, just as it did after the 7-April bottom low. The difference is that this new wave will be many times bigger and stronger than before.

TOTAL2 produced an advance from early April until late May. The retrace produced a bull flag continuation pattern. The pattern has run its course, it will resolve with a new phase of growth. It won't take long. It will be obvious in a matter of days. No need to pray, Crypto is going up.

Namaste.

TOTAL2 trade ideas

TOTAL2 Moving Averages · This Bull Market Will Change Your LifeMarch 2024 signaled the end of a bullish cycle. After this month, the Cryptocurrency market went bearish. TOTAL2 index went bearish. As it was bullish, it traded above all the moving averages plotted on this chart. As it went bearish, all the moving averages broke as support but one, MA200. The back line on the chart.

MA200 works as support and denotes the broader and bigger cycle. As long as the action happens above this indicator, the market is growing thus bullish long-term. If the action moves below, the bears are in and winning.

Another strong moving average is EMA89, blue on this chart.

When TOTAL2 was bearish it managed to close only briefly below this level. One week and the next week back green. August 2024 and September 2024 TOTAL2 found support at MA200 and EMA89. As soon as these indicators were confirmed as support, we saw the development of a new bullish wave.

The altcoins market grew in November leading to a peak in December 2024. Here the same pattern repeats. TOTAL2 went from bullish to bearish. While it was bullish, it traded above all of the moving averages: EMA8, EMA13, EMA21, EMA55, EMA89 & MA200. As it turned bearish, all these moving averages were tested as support, all of them broke but one, MA200.

In April 2025 MA200 was tested as support and holds. As long as TOTAL2 trades above this level, we know the bigger broader market bias remains bullish. Bullish confirmed. As soon as this level was tested we had a small recovery above all moving averages, until May. Then a retrace led to a test of EMA89 as support and this level holds.

When TOTAL2 trades above all the moving averages, bullish confirmed.

TOTAL2 is now trading above EMA8, EMA13, EMA21, EMA55, EMA89 and MA200 on the weekly timeframe. Ultra-bullish and ready to grow.

Just as the December 2024 high was a higher high compared to March 2024, the late 2025 high will be a higher high vs December 2024. We are in a rising trend and this is confirmed because MA200 always holds as support.

Now that this level has been confirmed, we can expect additional growth. Instead of a single month of bullish action as it happened in late 2024, we can expect a minimum of 3 months of continued growth. In total, we will have at least 6 months, and then some more.

Because it is unexpected, this bull market will change your life, forever. You will receive more benefits and more blessings than anything you can ever imagine. All your hard work will pay-off. You will be rewarded for your patience, persistence and continued support.

Namaste.

Total2 wants to inv h&s its way into completing its cup’s handleShould break above the neckline of this lemon lime colored inverse head and shoulder pattern in the upcoming 1-3 weekly candles here, and we are likely less than a week a way from the daily chart golden cross (not shown here). The breakout target from this inverse head and shoulder pattern will take price above the rimline of the larger cup and handle pattern and upon triggering the breakout from that we head to the light blue erasure move target which fro where price action currently is is about a 100% gain for the alt racket which should confirm alt season. *not financial advice*

The daily chart for total2 to look at the impending golden crossWanted to also post a daily chart tie frame of my previous idea. I first posted it in weekly to fit the entire cup and handle breakout target in the frame, but wanted to also post the daily time frame to provide both a close up of the inverse head and shoulders pattern as well as the impending golden cross on the daily time frame. Loos very likely that alt season may finally be approaching here. Gonna pay close attention to both this chart and the bitcoin dominance chart btc.d to know for sure. *not financial advice*

Crypto 2021-22 Rerun?Crypto ex-BTC looks like an identical setup with high, divergent higher high, dead cat bounce, with the same level of resistance in play (both double top and 'right shoulders')

Shitcoins and crypto are much less popular among retail this time around, which has me thinking a FOMO surge to new highs is off the table this time.

I think there's a short setup here, but posting before a break confirmation has occurred anyway (so technically still neutral today). I dont trade crypto, but follow the trends and this just stood out to me enough to share.

Total2 Market Cap breakout above a descending

### 🇺🇸 **Technical Analysis (Crypto Total2 Market Cap – Excluding Bitcoin):**

✍️ By **@rooz999**

This chart illustrates a significant breakout in the altcoin market (Total2):

* A breakout above a descending channel.

* Key resistance levels at:

🔸 **1.66T**

🔸 **1.83T**

🔸 **2.32T**

💡 The major bullish momentum began in early August, followed by a clear consolidation zone.

📆 Watch price action closely toward late August, as we may see either a breakout continuation or a pullback to the 1.66T zone.

📌 This is a personal analysis and not financial advice.

\#Altcoins #Crypto #Total2 #ETH #SOL #XRP #ADA #MATIC #TechnicalAnalysis #CryptoTrading

🔁 **@rooz999**

### 🇸🇦 **التحليل الفني (الإجمالي السوقي للعملات الرقمية Total2 – بدون بيتكوين):**

✍️ بواسطة **@rooz999**

رؤية فنية لحركة إجمالي السوق البديل (Altcoins) تُظهر:

* صعودًا قويًا اخترق قناة هابطة سابقة.

* مقاومات مهمة عند:

🔸 **1.66T**

🔸 **1.83T**

🔸 **2.32T**

💡 **نقطة التحول** كانت مع بداية أغسطس، حيث تسارعت وتيرة الارتفاع ثم ظهرت منطقة تذبذب واضح.

📆 من المهم مراقبة حركة السعر حتى نهاية أغسطس، حيث قد تتشكل قمم جديدة أو يعاد اختبار دعم 1.66T.

📌 هذا التحليل مجرد رأي شخصي وليس توصية استثمارية.

\#Altcoins #CryptoMarket #Total2 #تحليل\_فني #عملات\_رقمية #Ethereum #SOL #XRP #ADA #MATIC #تحليل\_سوقي

🔁 **@rooz999**

Banana zone starts when PMI is above 53.Check your charts to verify this fact.

Total 2 with the US Purchasing Managers Index overlain.

The PMI is one of the most reliable leading indicators for assessing the state of the U.S. economy.

Previous Banana zones have coincided with the PMI above 53.

so not just when the economy is growing, but when the economy has entered humming along approaching full acceleration.

This is when most people will feel confidence and WANT to take on more risk as they are most optimistic about the future when the economy is in this state of being.

July Altcoin Watchlist Reversal Signals Are Heating UpHi Everyone,

The crypto market is heating up as we step into July, and the tone is shifting. After months of uncertainty, several altcoins are beginning to show early signs of structural reversal, positioning July to potentially emerge as one of the strongest bullish setups we've seen this cycle.

With fresh liquidity flows, breakout attempts across key pairs, and major alts retesting critical zones, it’s time to scan the charts and identify the most promising opportunities across the altcoin landscape.

Will July finally ignite a full-blown altseason, or are we still caught in a cycle of deceptive rallies and distribution traps? Let’s break it down with sharp technical insights and prepare for what's next.

🔹 Which altcoins should I analyze?

🔹 Are we witnessing real strength or just another shakeout?

🔹 Key support/resistance levels, structural pivots, and liquidity zones

Drop your favorite altcoin requests in the comments, and I’ll provide detailed technical breakdowns including critical levels, trade setups, and directional bias based on current market structure.

📅 Submission Deadline: JULY 7th, 2025

🔹 Request Guidelines:

✅ Each member may submit one altcoin for analysis

✅ Use the format: ETHBTC, ETHUSDT, or ETHUSD

✅ Please include either the coin’s ticker or full name

Despite recent volatility and persistent fakeouts, our objective remains unchanged: to deliver at least 30 high-quality altcoin analyses, helping the community stay informed, tactical, and one step ahead of the market.

⚠ Important Reminder:

All shared analyses are for educational purposes only and should not be considered financial advice. Always conduct your own due diligence before entering any position.

💡 The market may still feel uncertain, but this is often where the most asymmetric opportunities emerge. Stay sharp, stay strategic, and let’s navigate this phase together. 🚀

TOTAL2 – Battling MA Resistance

TOTAL2 on the daily found support at the 0.382 Fib level on June 22. Since then, it has been moving upward.

Now it’s fighting the 50MA and 200MA resistance zone.

If this resistance is cleared, the 0.236 Fib level could be the next target.

Always take profits and manage risk.

Interaction is welcome.

What is Needed for BTC-Altcoins Bull Market —Crypto is Going Up!Some people are under the impression that Bitcoin needs to go down for the altcoins to go up. No, no, no, no, no... This is a big mistake. Bitcoin needs to continue growing for the altcoins to explode. Let me explain.

Bitcoin has been trading very high forever now and the altcoins grow when Bitcoin is very strong. The current situation with Bitcoin is good for the altcoins but the altcoins need a major force, a strong impulse and maximum support for a bull run and this only happens when Bitcoin goes up.

If Bitcoin retraces from resistance this is bad for the altcoins. Whatever gains tend to be removed right away. If Bitcoin moves forward and hits a new all-time high, this is incredibly beneficial for the altcoins and the altcoins continue growing for the long haul.

Instead of Bitcoin going down or falling behind for the altcoins to grow, Bitcoin needs to continue strong. A stronger Bitcoin is good for the altcoins. The more Bitcoin grows, the more pressure the altcoins market feels to follow.

As long as Bitcoin trades above $100,000, the altcoins can do great. If Bitcoin falters, the altcoins suffer but this is only short-term.

Regardless of what happens in the short-term, Cryptocurrency is set to grow. We will experience the best yet since 2021. This bull market will extend beyond 2025 and it will go into 2026 and who knows, maybe even beyond.

100% certainty, you can bet your house on it; Crypto is going up.

Namaste.

TOTAL2, TOTAL MARKET CUP without BTCTOTAL2, TOTAL MARKET CUP without BTC

Reasonable targets are within the yellow zone — these are high-probability levels based on current price action, volume, and market structure. They offer the best risk/reward and are ideal for primary take-profit planning.

Targets outside the yellow zone are still possible but come with higher risk. They typically require extended time, increased volatility, or external catalysts. These should be treated as secondary or speculative targets, best approached with reduced size or active trade management.

Summary:

Yellow zone = high probability, balanced risk/reward.

Beyond yellow = lower probability, higher risk, use with caution.

Final Shakeout Complete, Bullish On Everything —The Wait Is OverToday the Cryptocurrency market completes its final shakeout. From now on, we are bullish —everything grows (altcoins).

This is an early signal but confirmation comes from the fact that many altcoins, specifically stable long-term projects, are moving ahead with force, some growing even three digits in a single day, while Bitcoin is producing a shakeout. There is more.

Bitcoin wicked below 100K but is set to close above this level. Even if it closes below a recovery is very likely to follow immediately. At this point, ignore Bitcoin and focus on the altcoins.

👉 We are ultra-hyper bullish on the altcoins market.

This is a friendly reminder my friend.

The wait is over.

Namaste.

TOTAL 2 Analysis (6H)The TOTAL2 chart — representing the altcoin market cap excluding Bitcoin — currently shows signs of weakness. A double top formation has emerged and is actively playing out. In addition, a micro trend change of character has clearly appeared, further validating short-term bearish pressure.

Technical Observations:

Price recently retested a broken support level and failed to reclaim it — a typical bearish confirmation.

In such scenarios, it’s common for the price to decline at least the depth of the double top formation.

However, it’s important to note that macro trend indicators still remain bullish, so entering aggressive short positions is not advised. Instead, consider setting alerts at the key reversal zones marked on the chart — these levels are likely to trigger a strong rebound.

If TOTAL2 breaks above the $1.23T resistance, this double top analysis becomes invalid.

— Thanks for reading.

$TOTAL2 and $USM2: Correlation never broken. What now? Today we dive into the world of crypto. We are looking into the recent rally in the Altcoins including CRYPTOCAP:ETH and §Sol and try to understand the reasons behind it and what is means for the future. CRYPTOCAP:TOTAL2 depicts the total market capitalization of all the Altcoins except CRYPTOCAP:BTC but including stable coins. When in doubt, zoom out. Today we are looking at the monthly candle stick charts for the CRYPTOCAP:TOTAL2 vs the $USM2. ECONOMICS:USM2 is the total M2 money supply from all the sources not only the banks but also other forms of cash within the economy. M2 money supply generally goes up and the economy grows and the Govt and Fed Balance sheets grow.

ECONOMICS:USM2 is primarily responsible for the increase in stock and asset prices. Crypto is no exception to it. Whenever the M2 Money supply goes up the Altcoins usually goes up. During the last Crypto cycle, the Altcoins peaked @ 1.7T $ in Nov 2021 and the ECONOMICS:USM2 peaked a few months after that in March 2022 @ 21.71T $. When the ECONOMICS:USM2 fell to 20.66T $ the Altcoins market suffered a bear market and lost 75% of the value. So, the question comes what happens to the CRYPTOCAP:TOTAL2 chart when the M2 money supply is expanding. We have clearly saw a recent surge in the Altcoin market but still below the ATH. Currently CRYPTOCAP:TOTAL2 at 1.16T $ is still below the 0.618 Fib retracement level plotted on the last cycle from top to bottom. Still CRYPTOCAP:TOTAL2 must cover a lot of ground and grow by 50% to reach its previous cycle top. In those cases, the ECONOMICS:USM2 must go up also by 1-2T $ to support such a jump in the $TOTAL2. But what will CRYPTOCAP:BTC do in that case?

Verdict : CRYPTOCAP:TOTAL2 can only go above $1.7T $ if ECONOMICS:USM2 expands by 1-2T $. Watch out for CRYPTOCAP:BTC in that case.

TOTAL2 Breakout Incoming ?Hello Traders 🐺

In this idea, I want to talk about TOTAL2, which represents the Altcoins Market Cap (including ETH) — but why is it so important?

In every bull run or crash, TOTAL2 helps you visualize the bigger picture. It lets you estimate potential tops or bottoms for the altcoin market and gives you perspective on when an Altseason might begin. Because let's face it—when the market is euphoric, people tend to exaggerate price targets... but having a chart-based framework keeps you grounded and helps you make better decisions.

🕵️♂️ Let’s start with the Daily Timeframe:

📊

We’ve been in a 200-day bear trend—but in my opinion, that’s about to change.

The price is currently trying to break above the red resistance box, and if it can hold above this level, that would be one of the clearest signs of a trend reversal.

This structure also shows signs of a bullish continuation, and I believe a solid ETH pump could be the catalyst to push TOTAL2 past this critical resistance.

📌 Price target?

Roughly 1.65T, near last year's high — which would be a +40% move from here 🚀

🔍 Now let’s zoom out to the Weekly Chart:

📈

On the weekly timeframe, price is moving within a strong ascending channel, consistently respecting support and resistance.

But the real magic happens when you zoom out:

There’s a gigantic triangle formation, and a breakout from the upper resistance could signal the official start of Altseason 🔥

I hope you found this idea helpful!

Keep your eyes on the chart, stay smart, and most importantly—stick to the golden rule:

🐺 Discipline is rarely enjoyable, but almost always profitable. 🐺

🐺 KIU_COIN 🐺

TOTAL2 – Altcoin Market Cap (Weekly TF) 2025

**Summary:**

The TOTAL2 chart (crypto market cap excluding BTC) is showing a structurally bullish formation after a deep retracement and a higher low confirmation. This setup suggests a potential multi-phase rally toward 2.98T and beyond, with defined support zones and Fibonacci targets aligned with liquidity cycles. This analysis visualizes the expected roadmap based on trend-based Fibonacci extensions, retracement levels, and psychological market phases. Notably, the outlook includes the possibility of an initial correction to retest strong support zones before the market begins its ascent.

**Chart Context:**

TOTAL2 represents the aggregated market capitalization of all crypto assets excluding Bitcoin. Historically, it reflects capital rotation into altcoins, especially following BTC dominance peaks. The current chart shows strong reaccumulation above the 1T support zone, with Fibonacci confluences hinting at a sustained recovery pattern. Dotted arrows illustrate a wave-like projection of accumulation, rally, retracement, and expansion. The possibility of a near-term correction to lower support zones is also embedded in the path structure.

**Key Technical Observations: and Levels**

TP1 = 1.78T

TP2 = 2.05T

TP3 = 2.4T

TP4 = 2.85T

* **Secondary Fib Retracement :** 0% = 1.23T, 100% = 425.89B

* Key zones: 23.6% = 1.04T, 38.2% = \~840.42B, 61.8% = \~569.41B

Possible Support Levels: 1.04T, 930B, 840B, 766B, 735B,

* **Trend-Based Fib (A-B-C):** A = \~420B, B = \~1.23T, C = \~735B

* This projection aligns with TP1 at 1.78T

* **Support Area:** Around 1T psychological zone (930B)

* **Strong Support Zone:** 735 Bto775B

* **First Target Zone:** Between 1.73T and 1.89T (early resistance + Fib cluster)

**Indicators:**

* Weekly structure forming higher lows

* Long-term Fib retracements respected

* Trend-Based Extension projecting 1.618 move

* No divergence, confirming strength

**Fundamental Context:**

* Liquidity conditions are improving globally with rate cuts expected into late 2025.

* ETH and ecosystem tokens are likely to lead altcoin recovery.

* Regulatory clarity and ETF flows add legitimacy to broader crypto allocations.

* Historical alt-seasons emerge from BTC profit rotation—TOTAL2 leads that shift.

* However, several macro risks may trigger a correction before rallying:

* The Crypto Fear & Greed Index is currently high, suggesting overbought conditions.

* Macroeconomic uncertainties (e.g., inflation, rate hike fears) can suppress short-term risk appetite.

* Regulatory tightening across major jurisdictions introduces hesitation in capital deployment.

* Technical signs of a five-wave drop in BTC hint at a larger ABC correction scenario.

* DAT (Digital Asset Treasury) exposure among public firms may lead to forced liquidations during downturns.

**Philosophical or Narrative View:**

This is not just a market cycle—it's a reflection of decentralized innovation reclaiming narrative dominance. After fear-induced lows, TOTAL2's rise echoes the resilience of builders, protocols, and investor conviction. Each Fibonacci level acts like a checkpoint in the unfolding story of crypto's evolution beyond Bitcoin.

**Related Reference Charts:**

*

**Bias & Strategy Implication:**

* **Bias:** Bullish with short-term corrective risk

* **Accumulation Zone:** 1.0T–1.23T

* **Initial Risk:** Price may revisit the **Support Area (1T)** or even the **Strong Support Zone (775B–725B)** before a sustained move higher.

* **Partial TP:** 1.78T–2.05T

* **Extended TP:** 2.4T–2.98T

* Caution near TP4–Bonus zones as distribution risk increases

* Invalidated if closes below 725B (structure break)

**Notes & Disclaimers:**

This is a structural macro outlook and not financial advice. Markets are dynamic and subject to rapid shifts in sentiment, liquidity, and regulation. Always use risk management.