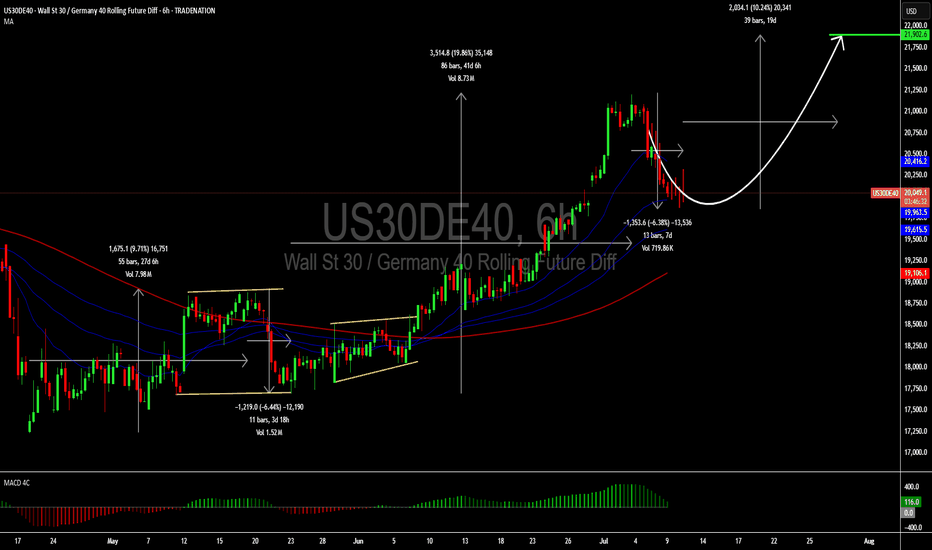

A small buy opportunity for US30DE40Hello,

The US30DE40 is on the rise since our last update. We see an opportunity for investors holding this asset to keep holding and those looking for short term opportunities to enter a small buy as we come closer to the moving average.

Those who were holding the asset from the bottom can look to manage their trades by at least moving the Stop loss to break even. The MACD Indicator is also getting close to zero reinforcing the upcoming bullish momentum.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US30DE40 trade ideas

US30DE40: Still at a great point to keep buyingHello,

From a technical standpoint, the US30DE40 asset is still at a pivotal juncture, hovering near multi-month lows, presenting an appealing entry point for traders anticipating a reversal and sustained upward momentum.

The broader market landscape bolsters this optimistic view, with strengthening macroeconomic indicators and growing investor confidence in risk assets. As a key gauge of market strength, the US30DE is primed to benefit from this potential upswing.

For investors with a medium- to long-term outlook, entering a position at current levels could deliver substantial returns. Those who weather short-term fluctuations and aim for higher resistance zones may optimize gains. Consider placing stop-loss orders below the support level to effectively manage risk.

Additionally, the MACD indicator is approaching a bullish zero-line crossover, further reinforcing the positive outlook.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US30DE40: A long term buyHello,

From a technical perspective, the asset (US30DE40) is currently positioned at a critical inflection point, trading near its multi-month lows. This creates an attractive entry zone for those seeking to capitalize on a potential reversal and sustained upside momentum.

The broader market environment supports this bullish outlook, with improving macroeconomic indicators and renewed investor confidence in risk assets. The US30DE, as a key barometer of market health, is well-positioned to capture this upside momentum.

For investors with a medium- to long-term horizon, initiating a position at current levels could yield significant returns. Buyers who hold through short-term volatility and target the upper resistance zones stand to maximize gains. Consider setting stop-loss orders below the support level to manage risk effectively.

The MACD indicator is also setting up for bullish 0 crossover further confirming the bullish bias.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.