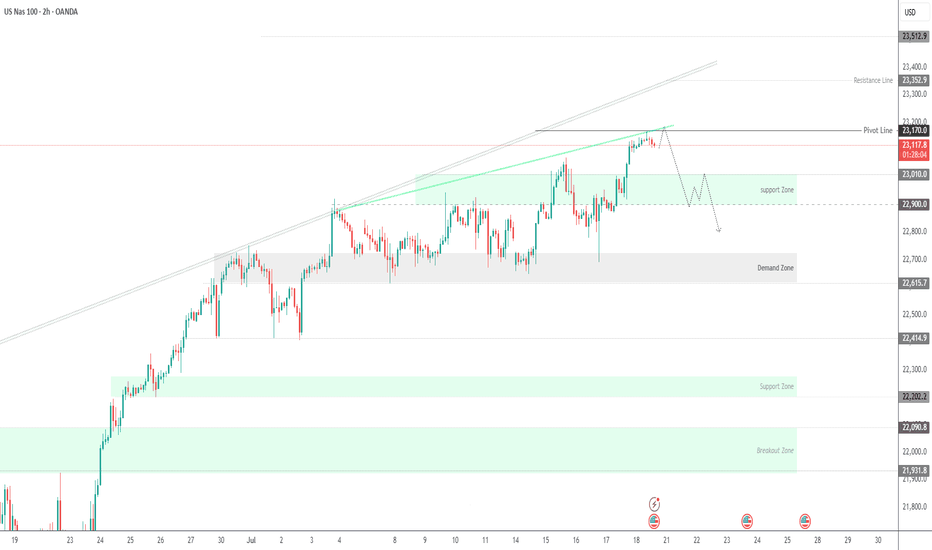

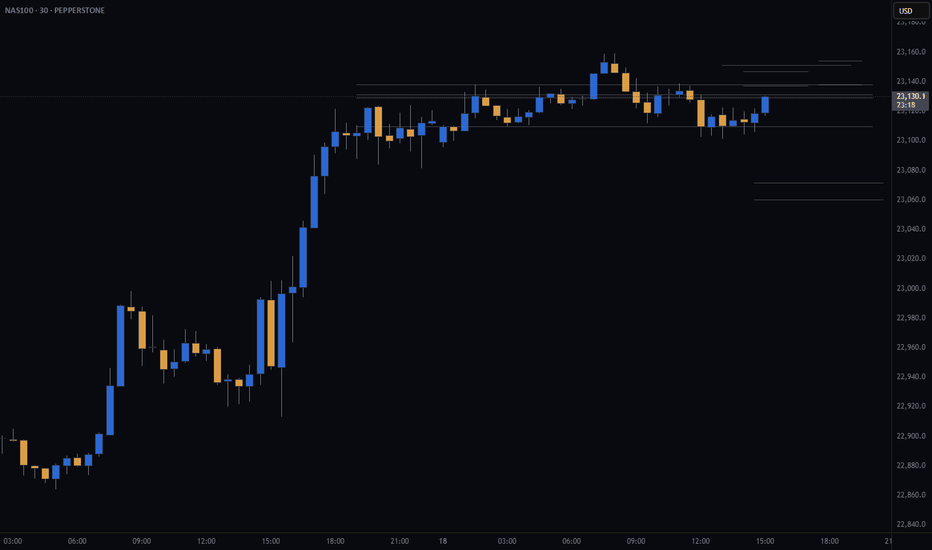

NASDAQ100 Hits Target at 23170 – Watch for Breakout or PullbackNASDAQ100 Tests ATH – Key Decision Zone at 23170

New ATH Achieved:

NASDAQ100 recorded a new All-Time High (ATH), hitting our target at 23170 precisely as projected.

Currently, price is consolidating below 23170. Sustained rejection at this level could trigger a short-term bearish pullback toward 23010. A deeper correction may extend to 22900 or even 22815.

However, a clean breakout above 23170 would confirm bullish continuation, with the next target at 23350.

Key Levels

• Pivot: 23170

• Resistance: 23250 / 23350

• Support: 23010 / 22900 / 22815

Outlook:

• Bullish above 23170

• Bearish below 23170 (short-term pullback zone)

USTEC trade ideas

#NDQ - Monthly Targets: 23721.73 or 21387.86?Date: 03-07-2025

#NDQ - Current Price: 22641.89

Pivot Point: 22554.80 Support: 22276.15 Resistance: 22835.11

Upside Targets:

Target 1: 23028.36

Target 2: 23221.62

Target 3: 23471.67

Target 4: 23721.73

Downside Targets:

Target 1: 22082.06

Target 2: 21887.98

Target 3: 21637.92

Target 4: 21387.86

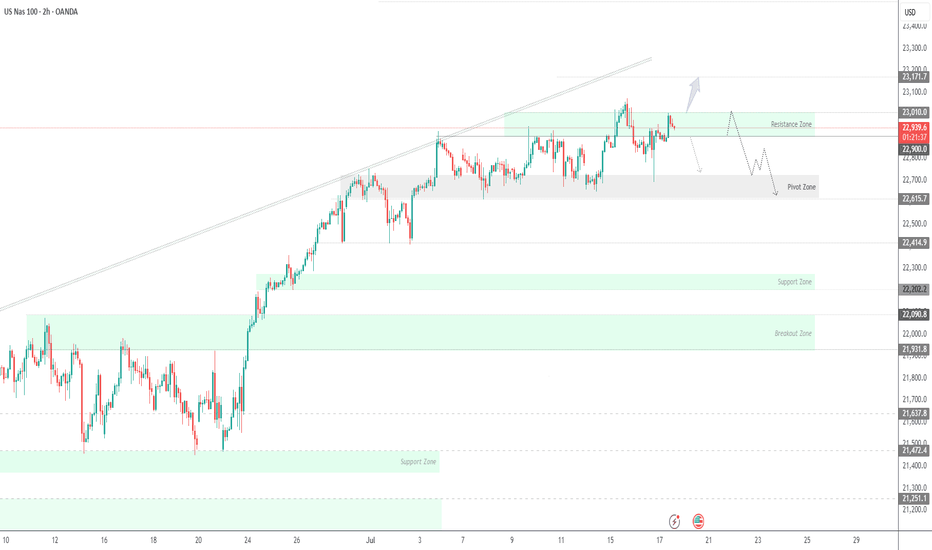

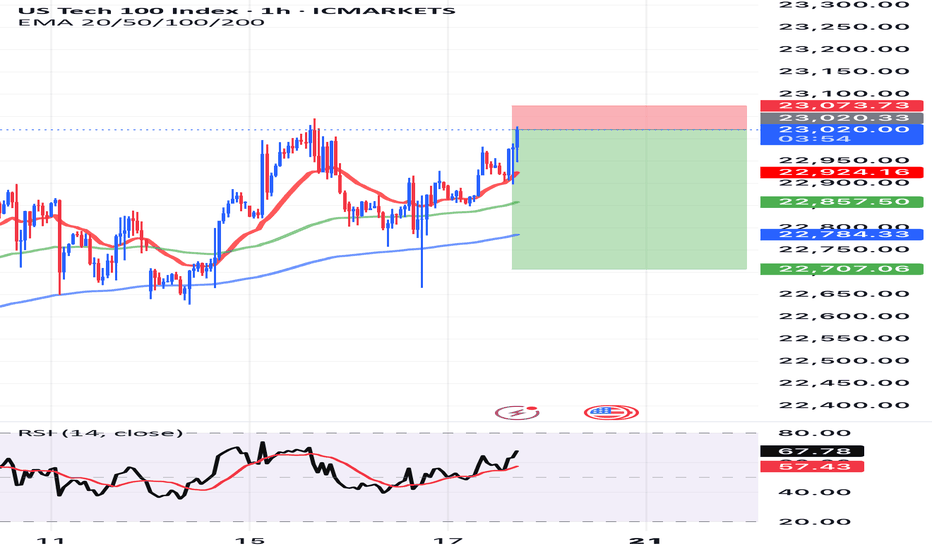

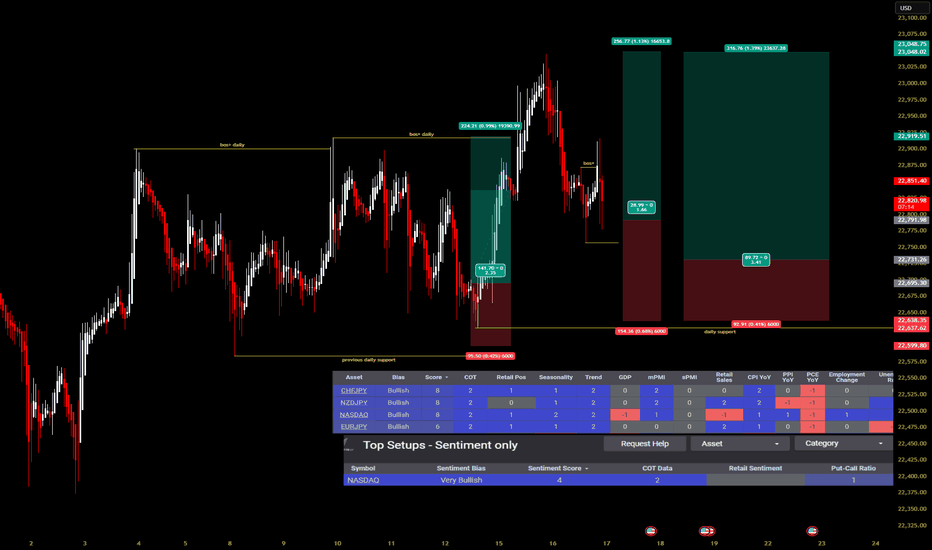

USNAS100 | Consolidation 23010 - 22900, Bearish or Not Yet...USNAS100: Cautious Consolidation as Powell Uncertainty Lingers

Following political noise around Fed Chair Powell — with Trump admitting he floated the idea of replacing him — tech markets have entered a cautious consolidation. While no immediate action was taken, the underlying uncertainty continues to weigh on sentiment, especially in rate-sensitive sectors like tech.

Technically: Consolidation Before the Break

The price is currently consolidating between 22900 and 23010.

A confirmed 1H close below 22900 would signal the start of a bearish trend, targeting 22700 and 22615.

Conversely, a close above 23010 would open the path toward a new all-time high (ATH) at 23170.

Key Levels:

Support: 22700, 22615

Resistance: 23010, 23170

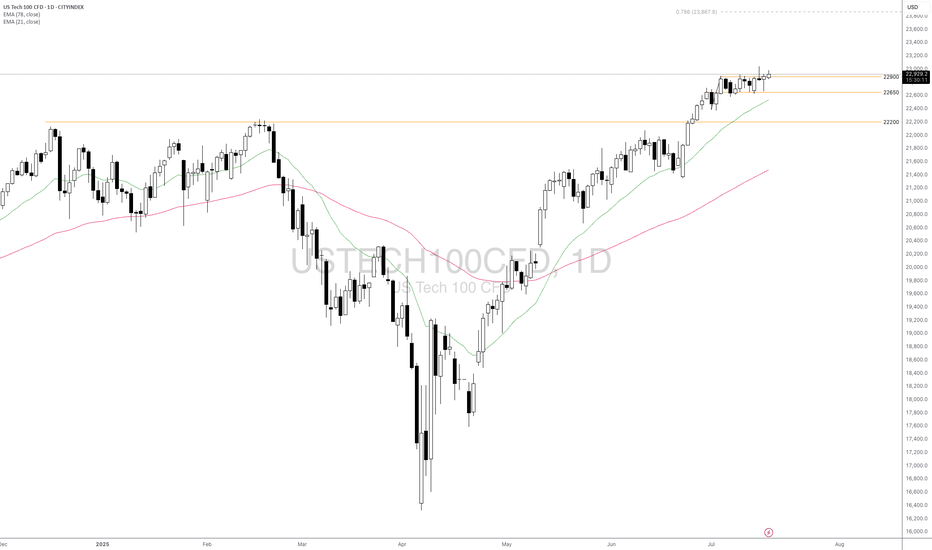

Will USTEC Continue to Climb Amid Key Catalysts Ahead?Fundamental approach:

- USTEC climbed to fresh record highs this week, supported by positive investor sentiment amid consolidation ahead of key catalysts.

- Sentiment was buoyed by expectations of continued AI and semiconductor strength, with Nvidia (NVDA) and Amazon (AMZN) registering gains, while Tesla (TSLA) rebounded on optimism despite recent volatility. However, persistent tariff threats and uncertainty around US trade policy generated caution, with markets jittery as investors eyed incoming earnings reports and inflation data releases for further direction. The term structure in tech remains constructive, with buyers stepping in on minor pullbacks, showing little sign of trend exhaustion.

- USTEC may face heightened volatility as the next round of corporate results and updates on US tariffs could shift sentiment. Upcoming earnings from major tech firms and macroeconomic releases, including key inflation and consumer confidence data, could set the tone for the index's next move.

Technical approach:

- USTEC closed above the range of 22650-22900, and also above both EMAs, indicating a strong upward momentum.

- If USTEC maintains above 22900, it may continue to rise to 78.6% Fibonacci Extension at around 23870.

- On the contrary, closing below 22900 may push the price to retest the previous support at 22650.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

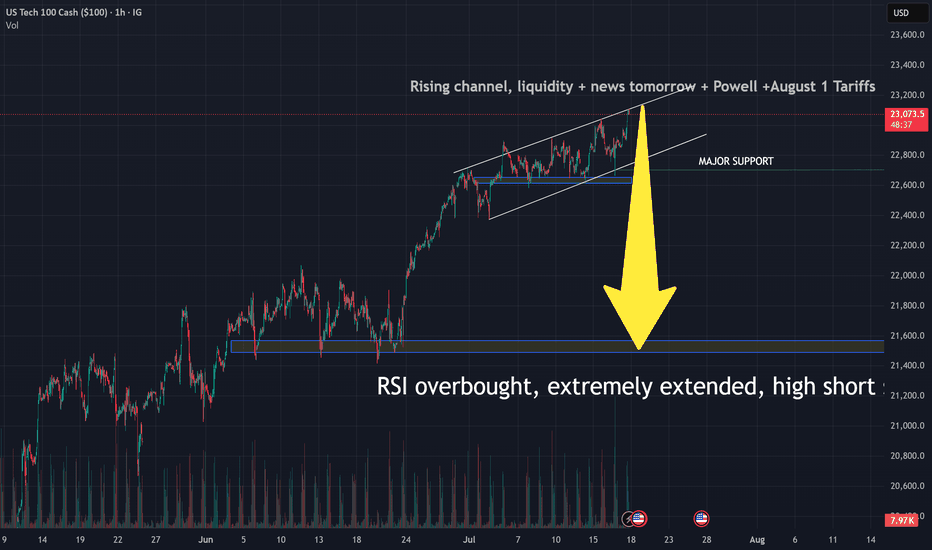

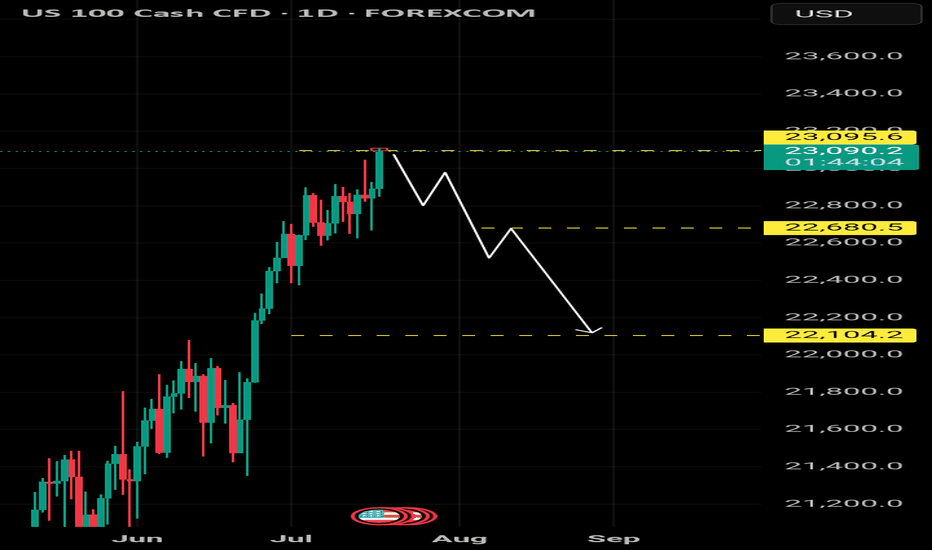

NASDAQ will fall to 21500 until August 1Nearly all Indicators, Geopolitics, uncertainties, Trade Tariffs, Powell vs Trump- tell us to sell, marking a bearish perception on Stock Market. Although your right analysis to sell is still bougt by super fast algorithms, there are facts that neither investors nor programms can ignore, and they are about to come. If housing market stambles tomorrow, which, probably, will be the fact, it will be the first step towards this deep dive. Wish us all profitable trading. Remember, it is not about being right or wrong, it is about making money, so even if you are wrong-dont compete with your own money against you, stay focused falks. See ya.

NAS100Short-Term Outlook for NAS100 (as of mid-July 2025):

Recent Trend:

• The NAS100 has been in a strong bullish trend throughout much of 2025, driven by:

• Big tech earnings growth (e.g., Apple, Nvidia, Microsoft, Meta).

• AI and chip sector boom.

• Fed’s pause (or even rate cuts) in interest rates.

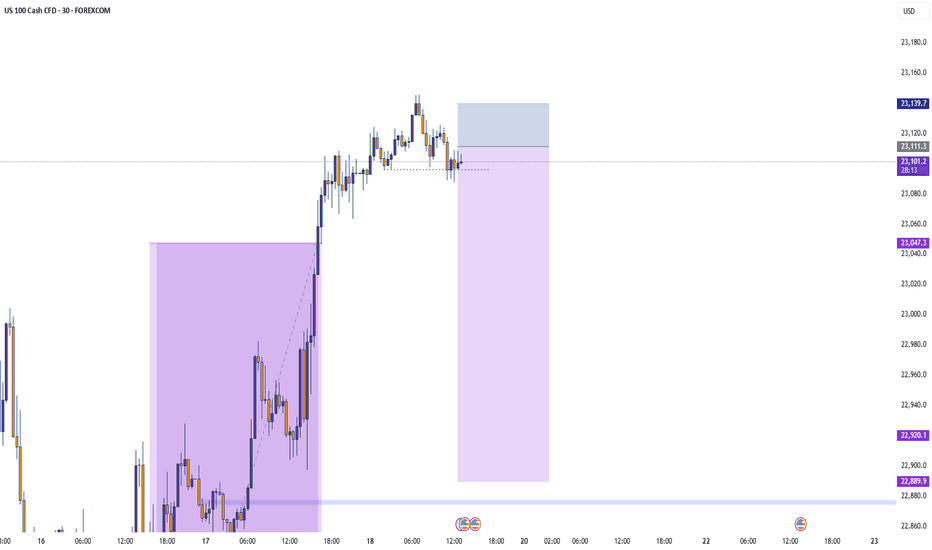

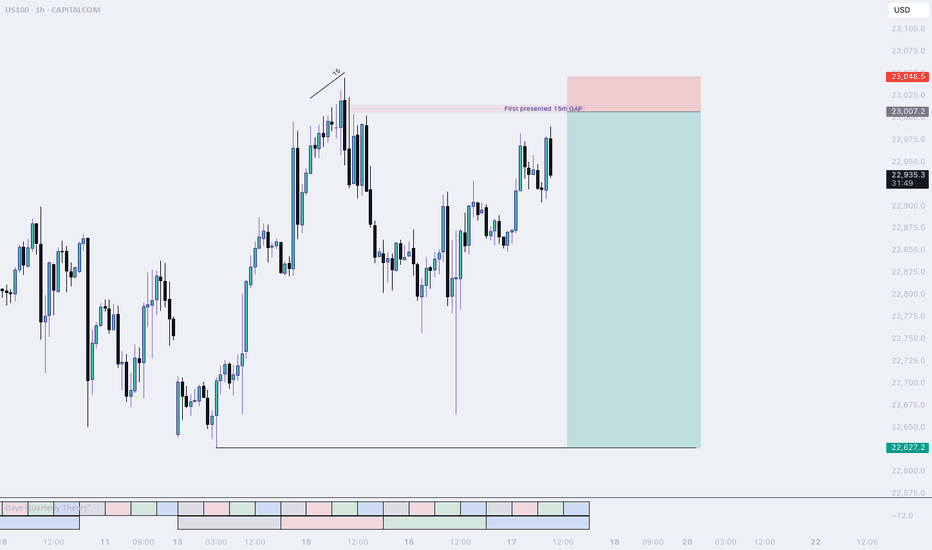

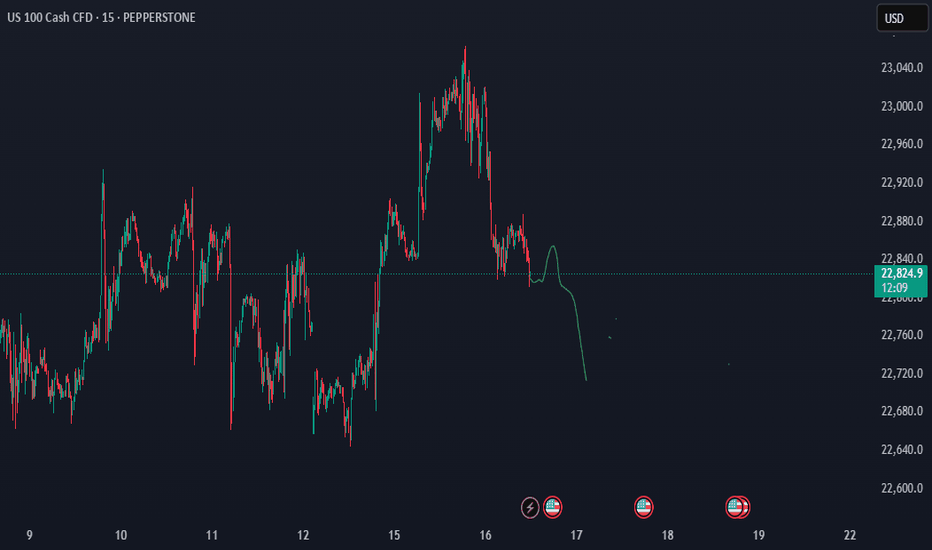

NQ, Short setupJust before market Open price dropped lower, I expect price to travel back up into the 15 m Gap and then sell off. This is the only setup I am interested in today.

The 15m level will be a resistance level for price. This level is derived from the last reversal. Since NQ was lagging, i expect price to use his level to squeeze the shorts out and start a new down trend.

If this does not happen and the highs get taken out, I will be flat today

Goodluck, Good trading.

F

USNAS100 – Bearish Below 22900 as Earnings & Tariffs Hit MarketUSNAS100 – Bearish Bias Ahead of Earnings, PPI & Tariff Tensions

S&P 500 and Nasdaq futures are slightly lower as traders weigh rate outlook, tariff developments, and major earnings reports.

📊 Earnings in Focus:

Goldman Sachs NYSE:GS , Morgan Stanley NYSE:MS , and Bank of America NYSE:BAC are set to report today.

JPMorgan Chase NYSE:JPM and Citigroup NYSE:C posted strong results yesterday, but expressed caution over U.S. tariff policies.

🌍 Tariff Watch:

Trump announced a 19% tariff on Indonesian goods, with more deals anticipated ahead of the August 1 tariff deadline. The EU is reportedly preparing retaliatory measures if negotiations stall.

🔧 Technical Outlook:

The Nasdaq100 shows bearish momentum as long as it trades below 22900 and 23010, with potential downside targets:

Support: 22720 → 22615 → 22420

Resistance: 23010 → 23170

To shift back to a bullish trend, price must stabilize above 22900 and break 23010.

Key Events Today:

• Corporate Earnings

• Tariff Developments

• U.S. PPI Report

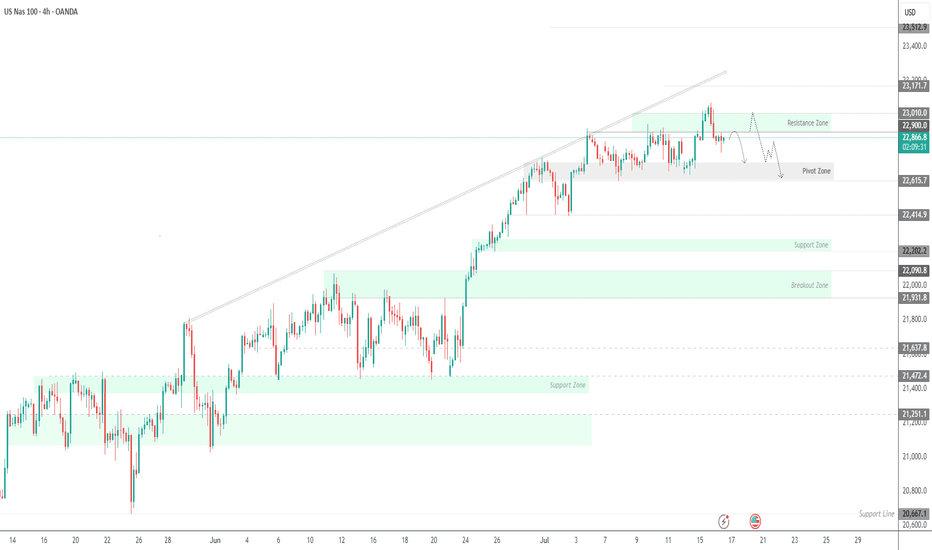

US100: The only risk remains Trump with his tariffs.US100: The only risk remains Trump with his tariffs.

US100 is in a strong uptrend and the chances of it rising are still high.

The price has already found a strong support near 22600 and I think it is preparing to start an uptrend soon.

The only risk for the Indices is related to Trump and his tariffs. This is the only threat I see at the moment.

Key targets: 22875 ; 22997; 23075

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

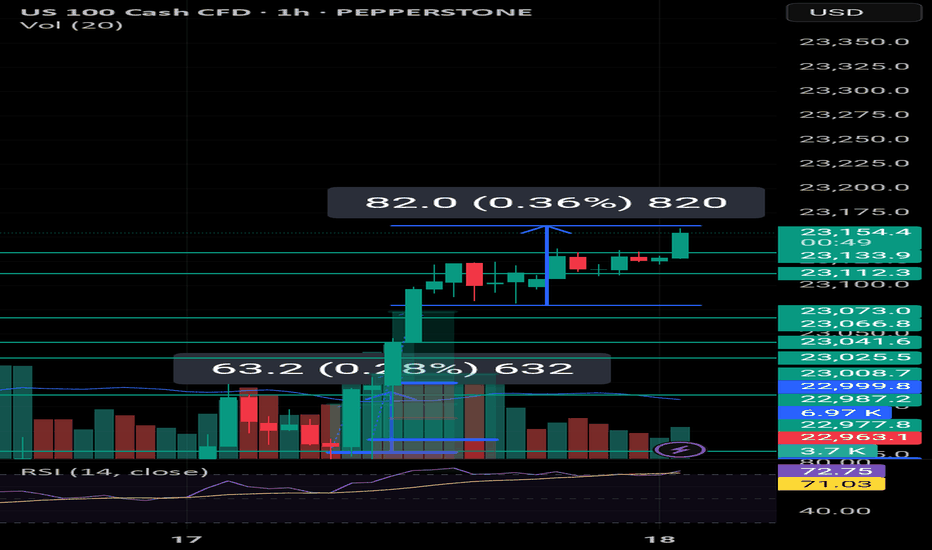

USNAS100 Outlook – CPI Data to Confirm Breakout or PullbackUSNAS100 – Bullish Momentum Holds Ahead of CPI

USNAS100 continues to show strong bullish momentum, trading above 22,905 and recently printing a new all-time high (ATH).

As long as price remains above this level, the next upside target is 23,170, followed by 23,300.

Market Focus – CPI Data Today:

• Expected: 2.6%

• Below 2.6% → bullish reaction likely

• Above 2.6% → bearish pressure expected

• Exactly 2.6% → could trigger a short-term bearish pullback

Key Risk Level:

A confirmed break below 22,905 would signal weakness and open the door for a correction toward 22,615.

Weekly Close High to HOLD?As expected Nas100 will end in a weekly high after hitting a nice fresh record due to TSMI stock among other things like Trump walking back on firing Jermone Powell.

Technicals tell me that this is extremely overbought and I wonder if this will continue I cannot believe this rally. AS LONG as it holds the 23100 to 23150 range then it could break out again and set another high but I would be cautiously optimistic. Somebody's got to take the profit!

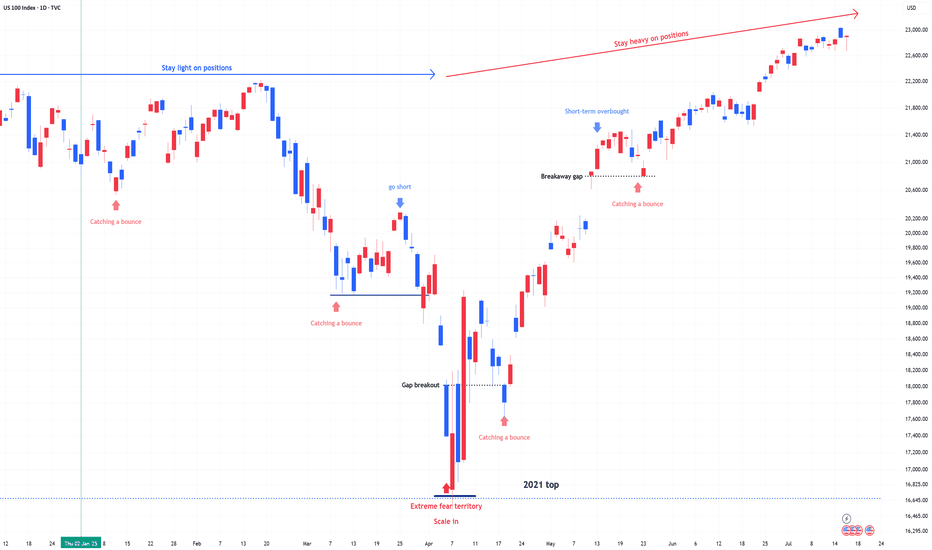

US 100 (NDQ) : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

2) Current Market State: No More Fear, but Watching

Since then, the market has stabilized.

The fear has disappeared, but we are still in a wait-and-see mode as traders assess the next move.

Momentum is holding, but participation remains cautious.

3) Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

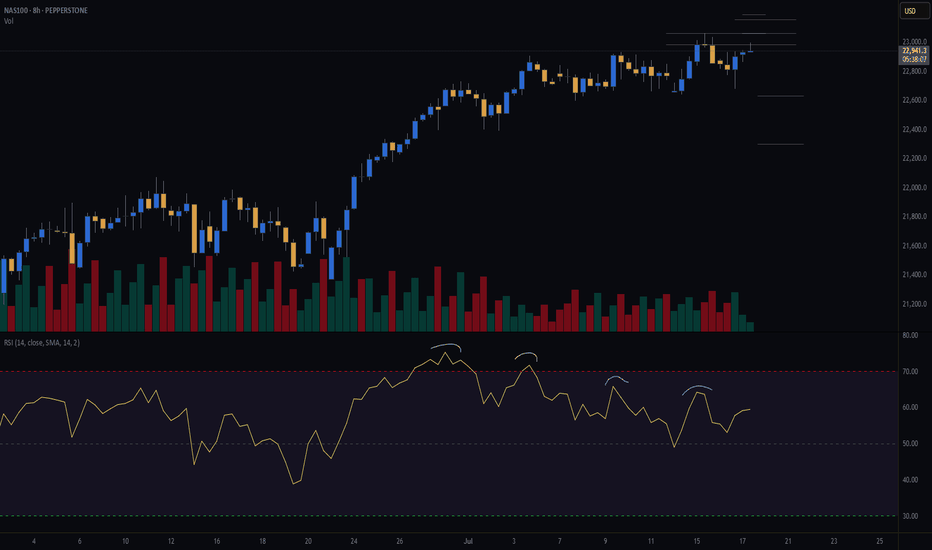

NAS100 (CASH100) SHORT - Double Top H8Risk/reward = 4.6

Entry price = 23 063

Stop loss price = 23 190

Take profit level 1 (50%) = 22 635

Take profit level 2 (50%) = 22 303

Still waiting for confirmation on some variables.

For example, need H8 candle to close in range and volume to validate, amongst other variables.

NASDAQ Is looking for a massive break-out to 24000!Nasdaq (NDX) is most likely taking advantage of the 4H MA50 (blue trend-line) as a Support and after hitting it, it appears that the price will look for a way above the Parabola.

This might be similar to what took place after the May 07 test of the 4H MA50. The price broke above that parabolic pattern and peaked on the 2.0 Fibonacci extension. As a result, we are looking for 24000 as a potential Target in the next 2 weeks.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇