USTECFU trade ideas

Fibonacci Retrace Strategy NAS100 Trade Idea📈 NASDAQ 100 (NAS100) is holding a strong bullish trend 🚀. After a weekend gap-up 🕳️➡️📈, price retraced back into the gap zone—exactly what you'd expect in a healthy trending market.

🔍 I'm applying my Fibonacci Expansion + Retrace Strategy 🔢, watching closely for a pullback into equilibrium ⚖️ within the previous price swing. That’s where I’ll be waiting for a bullish market structure break 🔓📊 to confirm my long bias.

🧠 Patience is key here—let the setup come to you.

📌 As always, this is not financial advice!

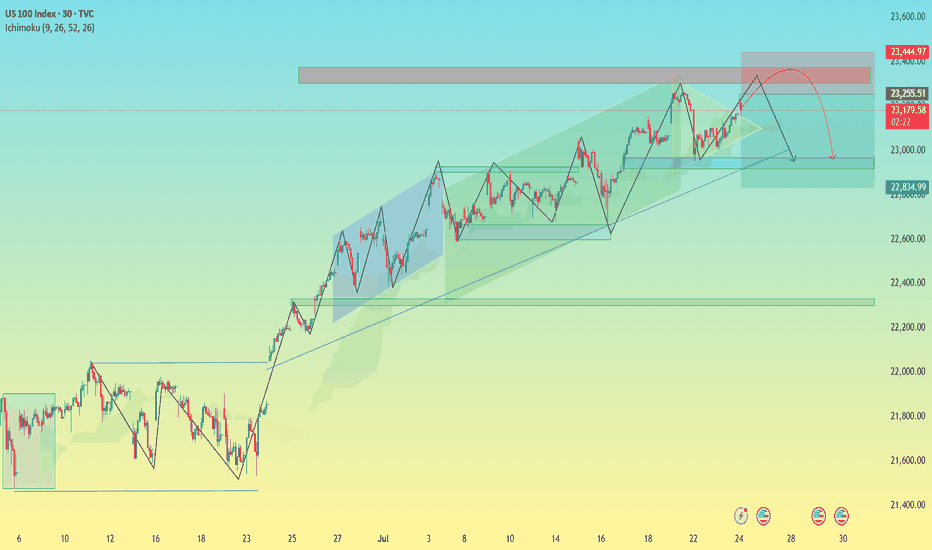

US100 Index – Potential Bearish Reversal in Key Resistance Zone🧠 US100 Index – Potential Bearish Reversal in Key Resistance Zone

Timeframe: 30-Minute | Chart Published: July 24, 2025

---

🔍 Overview

The US100 (NASDAQ) has been trading in a well-structured ascending channel, forming higher highs and higher lows. However, recent price action suggests that the index is testing a critical supply zone near 23,400, with signs of weakening bullish momentum. This may signal a potential corrective phase or bearish reversal.

---

📈 Technical Analysis Breakdown

🔵 Trend Structure:

Price is respecting a clear ascending trendline (blue), connecting multiple higher lows.

Multiple bullish flag/channel formations have been completed within the uptrend, showing healthy momentum until the current point.

🟥 Resistance Zone:

Strong supply zone marked between 23,250 – 23,450.

Price action shows stalling candles and rejection wicks within this zone, indicating buyer exhaustion.

⚠ Bearish Patterns:

The red path projection suggests a head and shoulders-like structure forming at the top of the channel.

This, along with divergence in wave strength and shrinking momentum, supports a potential reversal.

🔵 Key Support:

First support lies around 23,000 — aligning with the ascending trendline and previous consolidation.

If broken, next demand zone is around 22,835 – 22,900, where historical consolidation took place.

---

🔁 Projected Scenario (as per visual path)

1. Price may attempt one last push into the 23,400–23,450 zone (possible false breakout).

2. Rejection from this level could trigger a fall toward the ascending trendline support.

3. A confirmed break of the trendline can lead to a larger correction toward the 22,800 zone.

---

🧠 Unique Insight

This chart combines multi-timeframe structure recognition with a real-time reversal formation inside a long-standing bullish trend. The analysis doesn’t just rely on textbook patterns—it recognizes real-time price behavior shifts, which makes it valuable for proactive traders.

---

📌 Conclusion

While the trend remains bullish overall, caution is warranted as the US100 approaches a historically significant resistance zone. The setup offers a compelling risk-reward short opportunity for aggressive traders, especially if the price confirms a break below trendline support.

---

🔧 Next Steps for Viewers

> “Watch for a clean rejection candle or lower high at resistance before entering short. If trendline breaks cleanly, 22,835 could be the next target zone.”

NAS - TIME FOR JUICYTeam, hope you all making a killing on SHORT tonight.

as we expected. Thank you for asking and be patience

TIME TO MAKE NAS100 GREAT AGAIN.

Sorry my entry was 23240, but now the market is 23332

you should entry small volume at the current price 23332 - if a little pull back below 23300 add more

STOP LOSS at 23230-50

TARGET 1 at 23385-23400

TARGET 2 at 23475-23515

LETS go - time to make ACTIVE TRADER ROOM GREAT AGAIN.!

NASDAQ-Lets catch 250 Points togetherHello Fellow Traders,

Nasdaq has been wild since a time now. Today, I have spotted a rade to share with my fellow traders.

Yesterday closed with a good bullish candle. As the NY seesion has begun now, I am anticipating price to retrace to the highlighted breaker block that accurately aligns with an IFVG as well.

I am waiting for the price to fall into my area where I will monitor price's reaction, if we see signs of ejection from the highlighted areas, I wuld love to take a Buy Trade.

Entry= If rice enters the Breaker and IFVG and shows a good rejection.

SL= 23340

TP= Today's highs or 23700.

Manage your risk according toyour capital and only enter the trade if we happen to see a good rejection from the area. Be patient and don't hurry.

NAS - LET'S MAKE MILLIONS Team, last night NAS I was expect the FALL BACK as I predicted rate un-change will get NASTY on both DOW AND NAS.

So I have a set up entry LONG, i didnt expect the NAS flying to the moon.

both target hit so fast in 15 minutes

However, today is another opportunity to SHORT NAS on the current market at 23613-23625

STOP LOSS AT 23720

Once the NAS pull back toward 23580-65 - BRING STOP LOSS TO BE

TARGET 1: at 23540-20

TARGET 2: at 23480-65

LETS GO

USNAS100 New ATH, looks a Correction...Wall Street Indices Hit Record Highs as AI Momentum Builds

Indices tied to the S&P 500 and Nasdaq reached fresh all-time highs on Thursday, driven by strong earnings reports from Meta and Microsoft. The results reinforced investor optimism that AI investments are delivering tangible returns and fueling future growth.

Meanwhile, Fed Chair Jerome Powell noted it's still too early to predict a rate cut in September, emphasizing that current monetary policy is not constraining economic activity. His comments followed a stronger-than-expected Q2 GDP reading, further supporting the Fed’s cautious stance.

Technical Outlook – USNAS100

After reaching recent highs, the index appears to be entering a corrective phase. A pullback toward 23470 is likely, with bullish momentum expected to resume if the price stabilizes above 23440. A sustained move above that level would target a new ATH near 23870.

However, a break below 23440 could trigger a deeper correction toward 23295.

Support: 23540 • 23440 • 23295

Resistance: 23870 • 24040

NASDAQ Index Analysis (US100 / NASDAQ)The index is moving within an upward channel in the broader trend and is currently trading near the 23,900 zone.

🔻 Bearish Scenario:

If the price breaks below 23,850, a corrective wave may begin, testing the 23,700 area. A break below this level could open the door for further downside corrections.

🔺 Bullish Scenario:

If the price manages to break and hold above 23,900, this could support a continuation of the uptrend toward a new high at 24,000.

NSDQ100 rally on rate cuts expectation US equities rallied, with the S&P 500 hitting a new high (+1.13%) after July CPI matched expectations, keeping hopes alive for a September Fed rate cut. Headline CPI was +0.2% MoM / +2.7% YoY, helped by falling gasoline prices, while core CPI rose +0.32% MoM, lifting the YoY rate to 3.1% — the highest core reading in six months. Markets shrugged off the stickier services inflation, focusing instead on the relief that inflation wasn’t hotter. Treasury Secretary Bessent backed the idea of a 50bp cut, further boosting rate-cut bets. Geopolitical headlines — including Putin–Trump summit plans and ongoing Ukraine tensions — were largely ignored by risk assets.

Conclusion for Nasdaq 100 trading

The inflation data reinforced expectations for Fed easing, keeping risk appetite strong and likely supporting further upside in the Nasdaq 100 in the near term. However, the hotter core services figure is a reminder that any sharp rally could face headwinds if upcoming data challenge the rate-cut narrative.

Key Support and Resistance Levels

Resistance Level 1: 23965

Resistance Level 2: 24120

Resistance Level 3: 24290

Support Level 1: 23665

Support Level 2: 23533

Support Level 3: 23422

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USNAS100 | Holding Above ATH – Key Pivot at 23870USNAS100 at Record Highs on Fed Rate Cut Hopes

Nasdaq indexes held at record highs on Wednesday, supported by growing confidence that the Federal Reserve could restart its monetary policy easing cycle next month.

Technical Outlook:

The price has stabilized in a bullish trend after breaking its all-time high, with a 4H candle closing above it on strong volume.

As long as it trades above 23870, the bullish trend remains intact toward 24090.

To turn bearish, the price would need to close at least 1H below 23870, targeting 23690.

Resistance: 24090, 24190

Support: 23690, 23430

NAS100 Building Up On Bearish PressureHi there,

NAS100 has been very surprising for us recently, with increased bullishness that appears to be giving a bearish bias.

🦉 We'll use RSI and DEMA to coordinate price movements.

🎙️The price is bearish from the 23,600 area and has broken a minor dashed trendline. As long as the price remains below the purple 36 DEMA, below the RSI 50 level, and below the yellow RSI EMA, we remain bearish toward the solid trendline. This outlook points to two target support areas: 23,325 and 23,207.

🧩 Note: the bearish momentum is driven by the 3-hour chart. If it changes there, the setup will be invalidated.

Happy Trading,

K.

Rate-cut optimism fueled risk-on mood, lifting US equities

July CPI showed little inflationary impact from tariffs, amplifying expectations for a September Fed cut. Optimism also returned for small-cap firms, previously seen as most vulnerable to tariff pressures. Headline CPI rose 2.7% YoY in July, 0.1% lower than a year earlier, with a 1.1% MoM drop in energy prices contributing to the overall decline.

BlackRock CIO Rick Rieder noted that shelter costs, the largest CPI component, slowed to their lowest since 2021, significantly boosting the odds of a September cut. He added that the Fed could take a more aggressive approach, with a 50bp cut at the September FOMC.

USTEC extended its sharp uptrend after breaching above the 23700 high. The widening gap between both EMAs indicates the potential continuation of bullish momentum. If USTEC holds above 23700, the index may gain upward momentum toward the psychological resistance at 24000. Conversely, if USTEC breaks below 23700, the index could retreat toward 23300.

Nasdaq Short Again (nth time): Fibo Extension Level and 5-wavesOver here, I attempt to short Nasdaq again after another failure yesterday. This time, the 5-waves structure is supported by Fibonacci Extension level at 2.618x sub-wave 1 against entire wave 5 structure.

However, take note the circled area where I pointed out 2 imperfections in the wave structure:

1. Wave 4 overlaps Wave 1

2. Sub-wave 4 overlaps Sub-wave 1 (a comparison with S&P500 increases the odds that it may still be a valid count)

Given the imperfections of the wave counts, we still need to set our stop above the all-time-high to protect ourselves.

Good luck!

NAS100 Sell Trade PlanThe market is showing a lower high formation on the 1H chart, indicating potential bearish continuation. Entry is planned at 23,481.2, with a stop loss at 23,584.6 to protect against upside breakouts. The first target (TP1) is set at 23,363.8 to secure partial profits, and the second target (TP2) is at 23,275.0 for extended downside potential. RSI is currently below the 50 level (44.70), supporting bearish momentum. Risk-to-reward ratio favors the setup, aligning with the recent downtrend structure.

NAS100 at mjaor resistance area Fib 0.5Price has reached the 0.5–0.382 Fibonacci retracement zone of the recent swing. If the bears are strong, we may see a rejection toward the trendline support. However, if this resistance is broken, a bullish continuation is also possible. Let's see how it plays out.

Nasdaq Index Analysis (US100 / NASDAQ)The index is currently trading near $23,670, a pivotal zone between two possible scenarios:

🔻 Bearish Scenario:

If the support at $23,570 is broken and the price holds below it, we may see a decline first toward $23,400, followed by an extended move toward $23,290 as a test area. A break below this level could open the door for further downside corrections.

🔺 Bullish Scenario:

If the price successfully breaks and holds above $23,680, this could support a continuation of the uptrend toward $23,800, and with sustained momentum, a new high could be targeted.

⚠️ Disclaimer:

This analysis is not financial advice. Please monitor market behavior and analyze data carefully before making any investment decisions.

US100 Bullish Momentum Targets AheadThe US100 shows strong bullish structure after completing an ABCD correction, with price eyeing a potential move towards the 1st target at 23,791 and possibly the 2nd target at 24,053. A brief pullback may precede the continuation towards these key resistance levels.

1. Current Structure

The chart follows an ABCD pattern after a strong bullish impulse from the early August lows.

Points A–B–C–D suggest a completed correction phase, with momentum now shifting upward.

Price is currently around 23,629, approaching the first resistance zone.

2. Key Levels

Immediate Support: ~23,500 (recent swing low, short-term demand zone)

1st Target: 23,791 (minor resistance, potential profit-taking zone)

2nd Target: 24,053 (major resistance, psychological round area)

Major Support: 23,200 (break below here could invalidate bullish momentum)

3. Price Action Expectation

Short term:

A small pullback toward 23,500–23,550 is possible before continuing upward (healthy retracement to build buying pressure).