92% Win Rate Strategy Using Gann’s Planetary LongitudeHave you ever wondered how some traders seem to anticipate market reversals with uncanny precision, almost as if they can see into the future?

Well, what if I told you that the secret doesn’t lie in guesswork or traditional retail indicators, but in the heavens themselves?

Let me walk you through one of the most powerful forecasting tools in Gann's arsenal—the Planetary Longitude Method and how I used it to identify the exact price level from which the market reversed.

The Power of Planetary Time Cycles in Trading

This technique isn’t based on patterns, trendlines, or lagging indicators. It’s rooted in precise planetary time cycles, the same natural laws that govern the movement of celestial bodies.

Gann believed the markets were not chaotic but deeply connected to universal rhythm and planetary motion. According to his planetary longitude method, each planet holds a specific degree of longitude at any given time. These degrees can be directly mapped onto price charts, turning astronomical data into actionable trade setups.

When price meets planetary longitude, something extraordinary happens. These degrees act as invisible support and resistance levels—ones that retail traders never see. They are silent yet powerful markers of change, and because they are rooted in cosmic cycles, they give you a strategic edge in timing your trades.

Why These Degrees Matter

As a trader, what you’re truly looking for is reaction zones, areas where price is likely to pause, reverse, or accelerate. When planetary time and market price converge at a particular degree, it creates what Gann called a "vibrational point", a moment of energetic alignment. These are high-probability zones where you can anticipate market turning points with accuracy.

By tracking the longitudes of key planets, such as the Sun, Moon, Mars, Jupiter, or Saturn—you can identify these critical junctures. Each planet brings its own cycle, its own tempo. For deeper, longer-term reversals, I often rely on the slower-moving planets like Pluto, while for short-term setups, I look at the faster ones like the Moon or Mars.

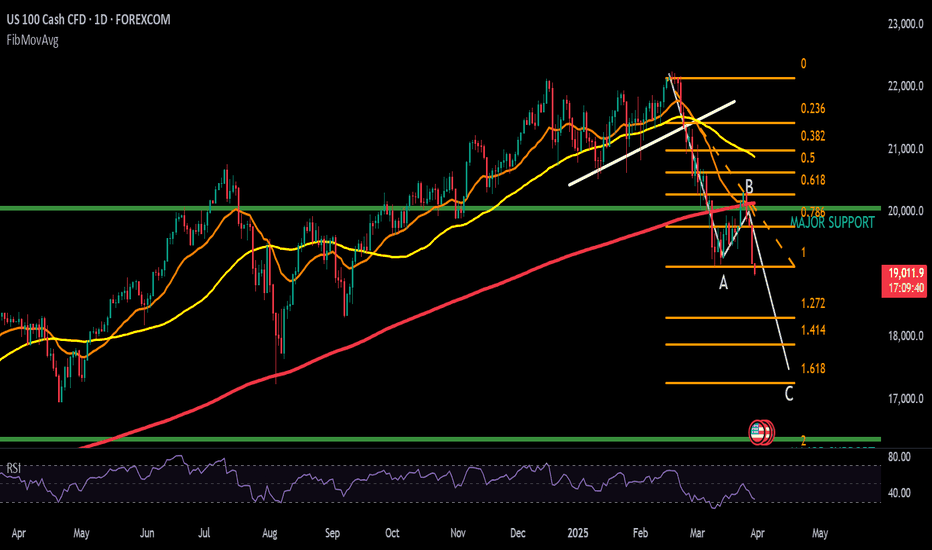

How I Forecasted the US100 Reversal from 19,384.6

Now, let’s get practical.

In this recent example, I was closely watching the US100 index, where I anticipated a potential reversal around the level of 19,384.6. Was this just another support/resistance zone? Absolutely not.

Here’s how I arrived at this precise level using Gann’s Planetary Longitude Technique:

First, I took the price level of 19,384.6 and converted it into degrees. To do this, I simply subtracted 360 repeatedly from the price until I arrived at a number less than 360. This process is based on the 360° circle of the zodiac—once the price cycles through the full circle multiple times, what's left is the vibrational degree associated with that price. In this case, the price level of 19,384.6 converted to approximately 304.6°.

Then, I checked the planetary position of Pluto which was 303.55° in longitude.

This created a near-perfect alignment between Pluto’s time cycle and the vibrational price degree. When planetary time meets price, it forms a cosmic convergence zone—a point of natural balance where the market is highly likely to react. So, I wasn’t just guessing—I was waiting for that moment of planetary resonance.

And as the chart clearly shows, the market reacted sharply the moment it touched 19,384.6, confirming the sensitivity of this degree. It wasn’t random. It was a harmonic response, echoing the laws of cosmic vibration that Gann so strongly emphasized.

This is a real-time example of how combining planetary time with price geometry can give you a decisive trading edge, especially in forecasting major turning points.

Why This Method Works

The market respects these planetary degrees not because of mysticism, but because it moves in cycles—natural cycles that repeat. The alignment of price with planetary longitude often marks pivot points in the market.

And this method doesn’t just help with identifying reversals. It also enhances your entry and exit timing, allowing you to trade with confidence, knowing you're aligned with the larger cosmic structure that influences all things—including financial markets.

Final Thoughts

This is just one example of how planetary geometry, when applied correctly, can lead to powerful trade setups. While Pluto offers long-term signals, don’t underestimate the value of the Moon, Mars, or Jupiter for shorter timeframes. The market dances to their rhythm too.

And once you learn to listen to that rhythm, you'll never look at price the same way again.

USTEC trade ideas

Nasdaq Pending Short: Completion of Wave 1 of CLike I mentioned in the video, we have completed a 5-wave structure for wave 1 of C. We are currently in wave 2 of C. And while this is a long-then-short idea, I feel that the risk to go long at this point of my posting is too risky, so it's better to wait for a short opportunity.

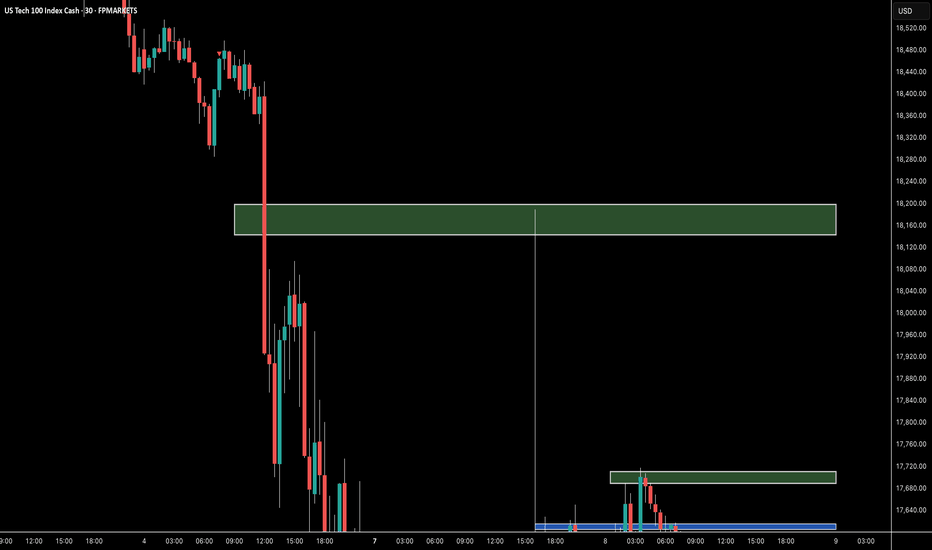

NQ: End of Day Analysis!1- We got a Red daily close but inside the previous 2 days. A continuation has the least resistance. If you're not in already, it's too late; unless quick in and out.

2- Tariffs enter in play from mid-night tonight (NY time). Asian and European sessions will be very active.

3- China retaliation via additional tariffs and/or selling US treasuries. This will make the whole market in a dangerous situation. I added a new key level from October 2023 that is reachable in this scenario where the FED continues being death.

4- FED intervention and just delaying the entry in play of tariffs for later (e.g., 90 days rumors), price might jump up to 18800 within minutes.

So, it's very risky environment. Quick in and out with Stop loss is the only way to trade it.

Take care and see you tomorrow!

Nas100 continuation lower?Good evening traders, I am busy with my market recap and I saw this beautiful idea on nas100/US100 or whatever name your broker uses.

Indices have been pretty bearish from our understanding as we saw price crush, well my thought process when analysing chart is question based, question like did price move above our weekly opening price to give us our manipulation phase in the power of 3, and in this case or in the case of this analysis the answer is yes it moved higher following this week’s open. Today in the 1 hour TF we have a structure shift lower and before we can do anything we need to see price come higher to Atleast the FVG that is marked on the chart, I know ICT teaches deeper about FVG but for me it’s fine for price to completely cover it. Or if maybe the OTE(optimal trade entry) is the method you use to enter trades it’s still fine or even order blocks if maybe you can see any than it’s also completely fine.

Currently price is showing momentum lower and maybe it’ll close prices lower but if we close the daily candle above the midpoint of the weekly gap we can expect price go than trigger the limit.

Hanzo | Nas100 15 min Breaks – Will Confirm the Next Move🆚 Nas100

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bearish Setup After Break Out – 17550 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 16880

Key Level / Equal lows Formation - 16350

Strong Rejection from 16350 – The Ultimate Pivot

Strong Rejection from 16890 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 16890 – Liquidity Engineered

Twin Wicks @ 17000 – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 18 jan 2024 – Bearish Retest 16900

💯 11 jan 2024 – Bearish Retest 16900

💯 18 jan 2024 – Bullish Run After Break That level

👌 The Market Has Spoken – Are You Ready to Strike?

NASDAQ: Cyclical correction most likely completed. ATH by June?Nasdaq remains oversold both on its 1D (RSI = 25.630) and 1W (RSI = 28.851, MACD = -442.980, ADX = 36.399) technical outlook as yesterday's rally is being corrected today on strong technical selling. Long term it looks like this was a cyclical correction, reached -25%, hit the 3W MA50/1W MA200 zone (which has been the best buy entry in the past 10 years) that has most likely been completed. In addition, the 1W RSI is on the same oversold levels as May 16th 2022, the lowest it has been since 2008. According to the Fibonacci Channel Up, the market can hit 22,300 as early as June.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Nasdaq Short: Adjustment in Primary Wave CountsI've made changes to my original wave count where wave A has ended on a short 5th wave. However, the strength of the rally today made me revisit the counts itself and I realised that it is actually more appropriate for the 5th wave to extend.

I studied if there is a relationship if I moved the original 5th wave down 1 degree to become a 1st of 5th and I was truly taken aback when the relationship was crystal clear and staring at me but I was too blind to see it (actually, I was too busy at work to study the charts again which is why I only publish this 2 days later).

Now that Wave A has completed, the strong rally these 2 days can be easily accepted. Are we going into a wave C crash? I believe so. So sit tight and enjoy the ride!

Remember to keep your risk tight. I can be wrong (as I often do).

Good luck!

US NAS100Preferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message..

Enjoy Trading... ;)

NASDAQ 100: Is a Reversal Coming?Learn why the NASDAQ 100 might face strong resistance near 19,000 and what key levels to watch for a potential rollover. We also explore how crypto weakness could signal downside risk for equities.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

NASDAQThe decision to buy or sell should be based on individual financial goals, risk tolerance, and investment timelines. Given the current market volatility and economic uncertainties, a cautious approach with a focus on diversification and defensive investments may be prudent. It's essential to conduct thorough research and consult with financial professionals before making any investment decisions.

NQ: Uncertainty after the bloodbath!Good day!

Yesterday close was irrelevant: Uncertainty, indecision and inside the previous huge candle. Until clear direction, we've today Trump's ultimatum to China with additional 50% tariffs if China does not step back with its retaliation of 34%. China has additional tools: sell US Treasuries which trigger a crise worldwide and particularly in USA.

Along this, we've some cracks within Trump billionaires, including E. Musk, who start showing frustration with tariffs.

Nasdaq 1 day - Imbalance 📝 Chart Structure Overview

The chart previously formed a rising wedge — a classic bearish reversal pattern — which broke down aggressively.

The breakdown has now led to a steep decline, bringing price back to the major support zone between 17,000 – 17,700, which held strong multiple times in the past (highlighted in purple).

📉 Current Price Action

Current price: 17,618.3

Price is hovering just above a key demand zone from 2023, with a small bounce visible today.

The large red candle breaking through multiple support levels suggests strong bearish momentum, but this area could act as temporary support or a bounce zone.

💹 Volume Analysis

There’s a visible spike in volume, indicating capitulation or panic selling — this can often lead to short-term relief rallies or bounces as buyers step in at support.

📊 RSI (Relative Strength Index)

RSI is 34.76, approaching oversold territory (<30), signaling potential exhaustion of the sellers.

Momentum is still bearish but could be ripe for a short-term bounce or consolidation phase.

⚠️ Key Levels

Support Zone (Demand): 17,000 – 17,700

Resistance Levels:

19,921 (previous support, now resistance)

20,532 (supply zone)

Breakdown Level: ~20,000 (former wedge support)

✅ Potential Trading Setups

1. Reversal/Bounce Play (Short-Term Bullish Idea):

Entry: Around 17,600–17,700 if price stabilizes

Target 1: 18,400

Target 2: 19,200–19,500

Stop Loss: Below 17,000

2. Bearish Continuation (If support fails):

Entry: On break below 17,000 with high volume

Target: 16,000 (next major support)

Stop Loss: Above 17,700

ABC Correction on nas100!Trading plan

SL:20,448.6

TP:17,000 / floating

Trading set up

(ABC) correction

A-Wave: Initial sharp decline with increasing volume, breaking short-term support.

B-Wave: Temporary recovery (typically 50-61.8% retracement) with lower volume.

C-Wave: Final decline, typically final capitulation, targeting major support and weekly moving averages or 1,618 fib level around 17,000 level as target price for correction

reasoning:

Trade war, trump tariff ,geopolitical issue and stocks has been overpriced for the last couple of months.

Nasdaq-100 H1 | Potential bullish bounceNasdaq-100 (NAS100) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 17,407.64 which is a swing-low support that aligns close to the 50.0% Fibonacci retracement.

Stop loss is at 17,000.00 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 18,238.84 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Possible move for nasdaqI had to redraw my channels from my last view. Sometimes we really have to zoom out to get the bigger picture.....I believe we may have entered a bear phase for the market. I have noted the important levels on the chart. I have outlined the possible path the market might take...There are plenty of untested levels below where massive buy orders are sitting. Of course it will not get there in a day or 2. But it is very clear where bears are sitting. Bear market bull rallies are also quite strong and might give an impression that we will go to ATH. But there is a reason why channels work most of the time at least from a long term perspective. This is merely a conjecture, but if you view the larger time frame as a 5 min chart, you know what moves might take place. I'm not advocating a full blown market crash, but we might get to see lower highs and lower lows over the next few months.....I could be completely wrong on this....For investors these are the best levels to enter big, for day traders...well...vix is still elevated and we trade the day whether it is bullish or bearish...So keep your position size smaller than usual as you will need a wider SL. Trade small, trade safe....Investors can start accumulating good stocks bit by bit and average out with every 10-15% dip, of course in smaller amounts....As we don't know when a bottom will happen...