Nasdaq-100 Wave Analysis – 3 April 2025

- Nasdaq-100 index broke support level 18820.00

- Likely to fall to support level 18295.00

Nasdaq-100 index recently broke the key support level 18820.00 (the previous monthly low from the end of March).

The breakout of this support level 18820.00 accelerated the minor impulse wave 1 of the intermediate impulse wave (C) from February.

Nasdaq-100 index can be expected to fall to the next support level 18295.00 (former monthly low from September) – the breakout of which can lead to further losses to 18000.00.

USTEC trade ideas

Welcome to the real world Uncle Sam!The market can withstand a lot of pressure.

It can handle:

the dawn of "fake news" and outright "lying"

the pollution and "enshitification" of social media

imperialist ideas of a Gaza takeover

partnering with a Russian totalitarian state

overhyping of AI and Nvidia's overpricing

populist politics

unworldly valuations of tech stocks

What it cannot handle is:

Upsetting the world order

Undermining of NATO, Europe, and allies

Starting trade wars with your best friends

Establishing tariffs which will harm the US economy

I love the US stock market, and US animal spirits, it's the best in the world.

But when risk rises, then secure investments like bonds/treasuries become the smart money move. Stocks become "risk off"

Risk is rising, tariffs will pressure inflation, inflation kills economies and markets.

The European defense industry will benefit, the US consumer will pay higher prices.

Higher risk, could mean a lack of confidence, and confidence powers the stock market.

Batton Down the Hatches.

Trading Note: I sold all my US holdings on Tuesday, at the break of the double top neckline (see chart).

My target price is the 2021 high, before the one-year bear market. Its a big drop, I give it a 60-70% chance.

RSI & ROC Negative Medium-term divergences

Of course this could all change if Trump backtracks on trade wars, tariffs and imperialist rhetoric.

But until then, enjoy the ride.

My Opinion About Small Account 9-5These points come from my heart, I sometimes get overwhelmed by not having money and come with such stress to the markets and end up losing, not focusing on what is clear to see because I would be already overwhelmed. I hope we find some healing and pray for patience, things will be ok soon.

Trade war impact on Nasdaq 100Trade wars are escalating, and this time the United States is in conflict with nearly every major economy. In this video, I explain why this shift could have a massive impact on global markets and what it means for traders right now.

I walk through the historical parallels from 95 years ago, when similar tariffs deepened the Great Depression and led to an 80 percent drop in the Dow Jones. A decade later, World War II followed. While no one wants to see that repeated, economic tension is clearly building.

We take a closer look at the Nasdaq 100, which is now trading below its 200-day moving average. I explain why the technical setup suggests further downside and how traders might look to short into rallies rather than chase the current move.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

NQ: An ongoing storm after tariffs came into effect!Good day!

Finally tariffs are on! A response from worldwide is imminently expected.

NQ and all US equities, US dollar and Bonds and anything from US are in a free fall!

A definition of a self-inflicted destruction!

Anyhow...Today's plan: A shy bounce (23.6 Fib) during Asian session. Price created a bearish flag that is already broken. A retest around 38.2 fib (19115) is possible if Service data is inline.

Otherwise, price will continue the down move.

NASDAQ 100 (NAS100) Technical Outlook

NAS100 is currently in a corrective phase, trading at $18,900, with bearish momentum suggesting a potential move toward the $18,300 support level in the coming week. If this level holds, a rebound could push the index back up toward $20,300, creating a temporary recovery phase.

However, if the price struggles at $20,300 and fails to sustain bullish momentum, it would confirm the formation of a descending channel, reinforcing the broader downtrend. In this scenario, NAS100 could extend its decline toward $16,100, where the price may find support.

Key structural levels to watch:

Support Levels: $18,300 → $16,100 → $14,600 (Major support from 2021)

Resistance Levels: $20,300 → $16,000 (Resistance from 2023)

If the index reaches $16,100, this could serve as a critical level where a strong reaction may occur, as it aligns with historical price zones and previous sell-off extensions. The $14,600 support from 2021 remains a last defense level, potentially preventing deeper declines.

Traders should monitor volume and price action confirmations at key levels to assess whether the index is setting up for a reversal or further downside continuation.

NAS100 Testing Demand Zone – Major Reversal or More Drops? 📊 Market Overview:

The NASDAQ 100 (NAS100) just tested a strong demand zone (18,900 - 18,950) and is showing signs of a potential reversal. Can buyers push the price higher, or will bears take control?

🔹 Key Resistance Levels: 19,568 | 20,160

🔹 Current Price: 18,977

🔹 Key Support Levels: 18,896 (demand zone)

📉 Price Action Breakdown:

1️⃣ Sharp Drop into Demand Zone

Price recently fell from 19,568 after failing to break higher.

Buyers are now defending the 18,900 support zone, which has historically held strong.

2️⃣ Bullish Reversal Setup?

If the price holds above 18,900, we could see a bullish rally toward 19,568.

A breakout above 19,568 may open the way for 20,160+.

3️⃣ Bearish Breakdown Risk

If the price drops below 18,896, expect further downside towards 18,600 - 18,500.

Sellers would regain control, confirming a bearish continuation.

📊 Trading Plan:

📍 Bullish Case:

🔹 Look for bullish confirmation in the 18,900 - 18,950 zone.

🔹 A strong bounce could target 19,568, then 20,160.

📍 Bearish Case:

🔹 If price fails to hold 18,896, a short setup targeting 18,600 - 18,500 is possible.

🔹 Wait for a clean break & retest before shorting.

🔥 Will NAS100 bounce back from this demand zone, or will sellers dominate? Drop your thoughts in the comments! 👇

📊 Like & Follow for more trade insights! 🚀

#NASDAQ100 #TechStocks #Trading #StockMarket #SupplyAndDemand #Forex #PriceAction

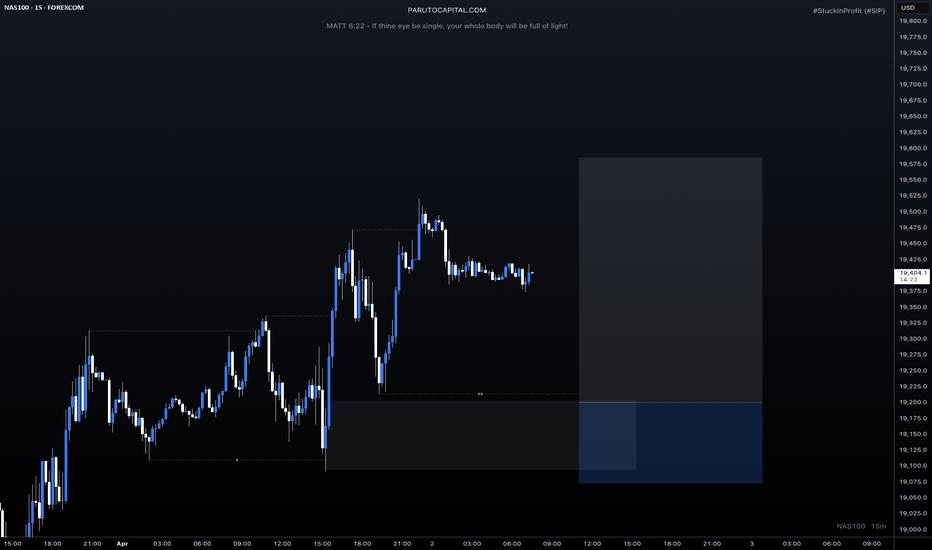

NASDAQ Trade Plan: From 4-Hour Trend to 15-Minute Execution!NAS100 Strategy: Using Fibonacci and Market Structure for Precision!

📊 In this NASDAQ (NAS100) trade idea, I focus on a top-down approach starting with the 4-hour chart. If the 4-hour trend is bullish, I look for higher highs and higher lows. If bearish, I focus on lower highs and lower lows. 🔄 My key strategy is identifying pullbacks into equilibrium—around the 50% Fibonacci retracement level—within any price swing. This is my point of interest.

Once price moves into this area, I shift to the 15-minute chart to refine my entry. 🔍 Here, I wait for a break of structure during the pullback, aligning with the overall trend direction. This approach allows for precise execution while staying in sync with the larger trend. 🚀

⚠️ This is not financial advice. Always trade responsibly and manage your risk.

NAS100 Analysis: Reversal Predictions Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analysis, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

I welcome your feedback on this analysis, as it will inform and enhance my future research.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

NAS100 Analysis: Reversal Predictions Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). To increase the probability of these analysis, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

I welcome your feedback on this analysis, as it will inform and enhance my future research.

Regards,

Shunya Trade

⚠️ Disclaimer:

This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

NAS100 BuyDonal Trump Announces BIG corporations to increase investment in the US Economy. whilst this suggests loss in profit for the shortrun, theres a potential for high yeilds in the long run. looking forward to seeing how this will translate on the ground. lets trade with caution as this is during a news event and anything drastic could happen.

LOOKING AT STRONG BUYif you look back a couple of weeks ago, the week of the 13 of March. US100 was sitting at a low price of 19143. This price was never swept the following week. US100 pushed further up until it reached its maximum price of 20322 for the last two weeks. Which was also support on 15 November 2024. Signaled a downward signaled a momentum, which eventually led to 1943 being swept by this downward movement (normally this would take 1 week any weekly high/low to be swiped). Now comes the case of the weekly high 20322(27/03/2025). Current price is pushing towards this price. However there is resistance level at 19800, which needs to be broken before we go for the weekly high(which is our TP).

Will Trump Dump The Markets Again?The NASDAQ was able to recover temporarily today. Whether this recovery is sustainable remains questionable.

After the close of trading, Trump will announce his decisions on tariffs - turbulence is guaranteed.

The normalized RSI shows inverse bearish divergences in the area of an important order block, from which one could profit with the setup shown.

NAS100 short setup alert!Hello traders,

I've identified a prime shorting opportunity on NAS100! As noted in my previous analysis, the index remains under bearish pressure, driven by Apple’s stock decline.

On March 28, 2025, NAS100 broke below 19,100 support zone, confirming strong downside momentum. It then retraced to 19,500, filling an imbalance before facing a rejection.

📉 Trade Setup:

🔻 Sell Zone: 19,200 – 19,350

🎯 Target 1: 18,800

🎯 Target 2: 18,297

🛑 Stop Loss: 19,564

Stay disciplined, trade smart, and secure those profits! 🚀📊