USTEC trade ideas

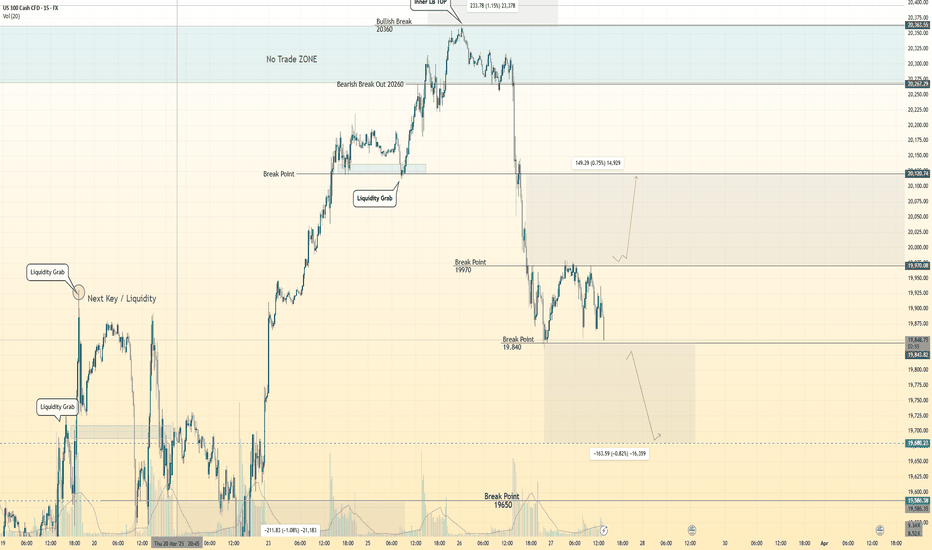

Hanzo | Nas100 15 min Breaks – Confirm the Next Move🆚 Nas100 – The Way of the Silent Blade

⭐️ We do not predict—we calculate.

We do not react—we execute.

Patience is our shield. Precision is our sword.

🩸 market is a battlefield where hesitation means death. The untrained fall into traps, chasing shadows, believing in illusions. But we are not the crowd. We follow no signal but the one left behind by Smart Money. Their footprints are our way forward.

🩸 Bullish Structure Shatters -

Key Break Confirms the Path – 19980

reasons

Liquidity Swwep

liquidity / choch

key level / multi retest before

weekly / monthly zone

🩸 Bearish Structure Shatters

Key Break Confirms the Path – 19840 Zone

our reversal always at key level

even a reversal area is well studded

reasons

Liquidity Swwep

liquidity / choch

key level / multi retest before

weekly / monthly zone

🔻 This is the threshold where the tides shift. If price pierces this level with authority, it is no accident—it is designed. The liquidity pool above has been set, and the institutions will claim their prize. Volume must confirm the strike. A clean break, a strong push, and the path is set.

Watch the volume. Watch the momentum. Strike without doubt

The Nasdaq 100’s short-term rally may be overThe Nasdaq 100 has had a rough start to 2025, plunging by nearly 15% over the year so far. Even with the recent rally, the technology-heavy index remains down almost 9%, and where it goes from here appears less certain. Many investors seem to believe that a V-shaped “snapback rally” is due, but the technical pattern — resembling a broadening megaphone — suggests that the next major move could be sharply lower.

The Nasdaq has completed three touches on an upper trendline and two touches on a lower trendline — a classic megaphone pattern — suggesting the formation is now complete, and the next significant move in the index could be towards the lower trendline at 19,600. Should the NASDAQ fall below 19,600, it could potentially undercut the 10 March low at 19,115.

The Nasdaq’s move higher off the 11 March low could be corrective, with overlapping wave structures. The index is also rebounding from oversold levels after it fell below the lower Bollinger Band and its relative strength index dropped below 30. However, that condition has passed, and the index is no longer oversold. Furthermore, the Nasdaq has stalled over the past two days just below the 200-day moving average (DMA) — a key resistance level.

If the Nasdaq can rise above the 200-DMA and surpass the upper trendline, the megaphone pattern would be invalidated, with the potential for the index to target the upper Bollinger Band at 20,900.

Written by Michael J Kramer, founder of Mott Capital Management

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

US100 NASDAQ100 Long Market turns!U.S. stocks ended higher on Tuesday on optimism that President Donald Trump’s reciprocal tariffs, which go into effect from April 2, will be less aggressive than previously expected

Therefor as traders we are very flexible and have to react fast,because a lot of people say a lot of things, and that makes the markest move faster and turning back more quickly.

Also its essential to take profits immediately as the markets move fast and turning, before giving that money gained back to the market.

Below the red line Bearish setups.

Rockets:Conservative(near of support) AND AGGRESSIVE ENTRIES.

Risk and money management is essential.Think about your stops!

US100 - Bullish Continuation Inside Ascending ChannelThis TradingView post showcases a technical analysis of the US100 (Nasdaq 100 Index) on the 4-hour timeframe. The chart highlights a well-defined ascending channel, reflecting the current bullish structure. Price action is seen retracing after touching the upper boundary of the channel, moving towards a key region of interest labeled as "IFVG" (Imbalance Fair Value Gap), where potential demand is expected.

The analysis predicts a retracement to the 0.618–0.65 Fibonacci retracement zone, aligning with a confluence of support levels within the channel. A potential bullish reversal is anticipated at this level, aiming for a continuation towards new highs near the upper boundary of the channel. The green projection line illustrates the anticipated path of price action.

This setup combines channel dynamics, Fibonacci levels, and market structure concepts to identify a favorable trade opportunity.

Potential Reversal on the NAS100. key level around 20700.0?The Nas100 has been in a downtrend since mid-February, primarily due to President Trump's tariffs, among other factors. The bearish trend began at a high of 22225.5 and has aggressively declined to 19171.0 without any significant corrections on the 1-day chart. However, currently, the price is forming a correction phase, and I am focusing on the 0.5 Fibonacci level, which is around 20700.0. This level coincides with a previous weekly higher high and higher low area.

Now on the 1D Chart

We can observe that the price bounced from 19171.0. After being choppy for a few days, the price has now broken the lower high structure. It appears that the price is aiming to return to the key level around the 20700.0 area, where we also have the aforementioned weekly levels.

The price seems to be making a gradual approach to the mentioned level, which I find favourable. As this develops on the daily chart, I will continue to monitor this setup in preparation for a bearish sell opportunity, when the price breaks the 1-day correction.

Thank you for reading! 🙋🏼♂️

Moustafa! NASDAQ 16.03 Warren Buffett would wink to me right now- If you want to know the moves of the market whales, you have to think as you are one of them! then you need to think big! and analyse on the large time frames!

- Open the weekly frame then you will notice the biggest rising channel in the history of Nasdaq which started to form on March 2020! then you will find that the index touched already twice its upper and lower line! which validated that channel! inside it you would find other smaller channels! but have a look on when the whales including the great Warren Buffett sold a big portion of his stocks! before it reaches the upper line! for a clear reason!

- I believe that chart is showing everything and the people in charge in this world is setting simply reasons to make it happen! any reasons you could imagine! just to make it work out! for example Trump winning or his created agenda of tariffs and the response back from the attacked countries to set other tariffs in return! a trade war! which no one knows when and how it would end! and how will exactly the consequences be in the medium and long term! but why we would not think that the stocks markets were not planned to crash from the early beginning?! nothing is not planned and they know exactly what they are doing! and what they will and how!

- You remember me creating an idea since two months and predicted that a huge bearish wave would hit this index and us 30 too and could be the biggest one in that index history! no one believed me! but now only all know that I was right! and Here I am, coming again with an idea for a medium and long term time frames predicting the next move and will tell you why!

- I said before that you would find series of red weekly candles and look now, we reached our 4th bearish weekly candles and moreover in a row! and this wave is the 7th fastest bearish waves in Nasdaq history! the 4th candle closed under the moving average 50! imagine that the last week candle closed under the average of the last 50 WEEKS candles! just imagine that!

- Just observe with me, that between September 2022 and January 2023, the price formed a double bottom pattern after a very strong bearish trend, was enough to turn the index completely bullish for a complete 2 years till February 2025! but now between December 2024 and February 2025, the index formed exactly the opposite! a double top pattern also on the weekly chart!

- In trading, there is a simple rule but not many traders know about it! that every long wick MUST and WILL be filled sooner or later! then have a look on the weekly candle lower long massive wick from the week of carry trade of 05.08.2024! remember that week as we will return back to its low! (the TP2) as the massive pull back happened after its settle on the MA50 exactly, then went up non-stop literally in a huge bullish rally leaving behind a wick could fill the space between the sky and the ground! This wick will be filled in this wave!

- Consider please the area I highlighted in yellow in a square! that is an area without any volume and each time recently the price go in that area, would try to return back so fast with a power! that would explain Friday 15.03.2025 massive push up for more than 2% to the upside! as if it would fell down, so no interest from traders in any price that! which means in case it would return back and fall in that area, the index would travel to its end non stop!

- The target of the massive double top pattern is 18330 but my TP1 is before that level! as the index did not reach back to test the high of the weekly candle of 20.05.2024 so there a retrace to the upside would happen! but temporarily! but on the weekly! so it could be looking like a big retrace on lower time frames!

- Let us say that market could open bullish on Monday then any good news would take place or whatever which would lead to a bullish wave! I would say no chance to go further up more than 20845! and the weekly candle would close under that price, as that the neck line of the massive double top pattern on the weekly chart!

- My TP 3 is so critical and the most important support and resistance level, when the index broke that resistance in the week of 15.01.2024 and never tested it back on the weekly chart! so I believe it is the time, that will happen!

- My TP4 is the deepest price we could reach to which is at the MA 200 and another top of the week 31.07.2024 which the index did not test too and it was also a strong resistance level! and by reaching there, would mean reaching to the lower line of the rising channel! or I expect it would reach there when the index reaches in same time the lower rising channel line! but I can guarantee the price but can not expect how long time it would take to reach there!

-

NAS100, US100, NQ, NASDAQ Long for 2 Weeks - Easy MoneyNAS100, US100, NQ, NASDAQ Long for 2 Weeks, it could drop a little forsure but with my back testing of this strategy, its good long now, manage your position accordingly.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

US100 Bullish AnalysisNASDAQ 100 (US100) - Bullish Setup for Liquidity Grab

📈 Overview:

The market recently broke structure (BOS), signaling a shift in momentum. Price is currently retracing towards an Order Block (OB), presenting a potential long opportunity.

🔍 Key Levels:

OB Zone: Potential demand area for a buy setup.

Resting Liquidity (Resting Liq): The market is likely to target this level for liquidity grab.

Target: 20,677 - 20,937 zone, where liquidity resides.

📊 Plan:

Wait for confirmation within the OB zone before entering a long position.

Target the resting liquidity above for a strong move.

Maintain risk management in case the setup invalidates.

💡 Bias: Bullish as long as OB holds.

🚀 Let’s see how this plays out!

#US100 #NASDAQ #SmartMoney #Liquidity #OrderBlock

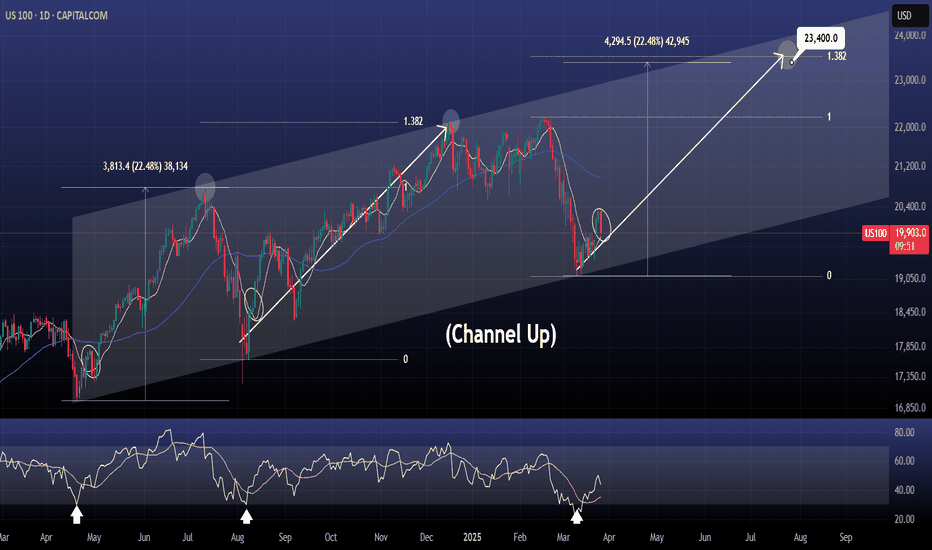

NASDAQ on the first minor pullback of the new bullish wave.Nasdaq / US100 has just started the new bullish wave of the long term Channel Up.

The bottom was made 2 weeks ago and every time the bullish wave crossed over its 4hour MA50, it is expected to make a pullback retest at some point.

This pullback is taking place today.

Whether it replicates the first bullish wave of the Channel Up or the second, the index aims for either a 22.48% total rise or the 1.382 Fibonacci extension.

Both happen to be around the same level.

Buy and target a little under them at 23400.

Previous chart:

Follow us, like the idea and leave a comment below!!

My NQ Long Idea 26/03/2025There is a big technical area that has taken the spotlight in NQ and it is around the 50% fib level with a gap opening.

US economy has seen some strengthening recently with the FED looking neutral-dovish. A price correction may not even occur here it can keep going up continuously the moment we have a conclusive risk-on environment.

Inflation has cooled down from 3.0 to 2.8 and interest rate was held at 4.50 from 4.50.

We are expecting a rate cut of 0.25 bps by Q2 so the market is looking forward to price that in.

I see a potential "buy the rumor" then "sell the news" scenario here. So during the next fomc meeting we may get a small sell off for a price correction then NQ will continue its up momentum.

Technical setup looks good I expect a turbulent price action which will fill the opening gap at the 50% a consolidation here can be healthy for price action before we get a Wyckoff spring.

We have recently exited a bearish channel and entered a new bullish channel which is still in progress but must pay attention to it as we could start trending in that direction.

I may take a short position (for the short term) since I anticipate a correction to the gap at the 50%.

[NDX] A textbook chart for being bearishSummary

- See the previous idea for context:

- Another realization: horizontal channels for S/R work better than diagonal ones. This doesn't mean that the latter need to be discarded altogether.

- Looking back, NDX did really have desperate jumps towards the end of the bull rally.

- High volume on days with large inverted hammers was a sure sign of an impending stampede.

- Today's rejection is why being long without confirmation is a bear trap. Being on the short side is much less stressful.

Nasdaq in Correction: Technical Targets and Weekly OutlookWe can observe that Nasdaq has started a new corrective leg since its last recovery in early Q3 2024. Currently, the index is experiencing its first rebound and test of the 20-period moving average (MA20, in green) since this average turned downward. Typically, this scenario triggers a selling reaction, with the first target at the previous low of 19,200. If selling pressure intensifies, the next projections are at 18,300 and 17,900.

However, from a weekly perspective, there is still room for a deeper correction, potentially reaching the 200-period moving average (MA200), which is currently at 15,690. When applying a Fibonacci retracement to the last major bullish leg (Oct 10, 2022 – Feb 17, 2025), we see that the 50% retracement level aligns closely with the weekly MA200 at 16,300.

We know that price movements do not follow a straight line but rather unfold in waves. Given this context, the bias remains bearish, and I see further corrections ahead in the U.S. market.

NAS100 Price ActionHey traders!

Looking at the current market structure, we can see that the price failed to make a new higher high , which is often the first sign of a potential trend reversal. This was followed by a break of two key structure levels, confirming a shift in momentum from bullish to bearish.

Interestingly, a supply zone was formed during this shift, but price didn’t even retest it — instead, it dropped right after its creation, showing strong bearish pressure. There's also an internal candle (IFC) marking the transition point.

With this kind of price action, it’s likely that the market is heading toward the next demand zone below. This could present a solid short opportunity, but always remember to manage your risk wisely and wait for clean confirmations.

Hanzo | Nas100 15 min Breaks Structure – Confirm the Next Move🆚 Nas100 – The Way of the Silent Blade

🩸 market is a battlefield where hesitation means death. The untrained fall into traps, chasing shadows, believing in illusions. But we are not the crowd. We follow no signal but the one left behind by Smart Money. Their footprints are our way forward.

☄️ Trading Insights:

💯 Liquidity moves the market.

✈️ Volume confirms breakouts.

👍 Precision wins—no hesitation.

Bullish Structure Shatters

🔥 Bullish Break Our Path – 20360

👌 Entry: Break + volume → Retest → Long position → Secure profits.

Bearish Structure Shatters

🔥 Bearish Break Our Path – 20260

👌 Entry: Break + momentum → Retest → Short position → Target lower liquidity.

Why we enter ?

🩸Liquidity Sweep – Institutions grab liquidity before pushing .

🩸CHoCH – Trend shift confirmation.

🩸Key Level Retest – Strong breakout zone.

🩸Weekly/Monthly Zone – Institutional accumulation.