NDQ100 Weekly projection as of 13 April 2025Based on the chart pattern I have seen for NDQ100, I believe that NDQ100 will make a big correction before it can fly higher compare to the previous HH.

Let's us see together and trade together.

Hi, I am new and would appreciate if everyone can share your insights too. Thanks

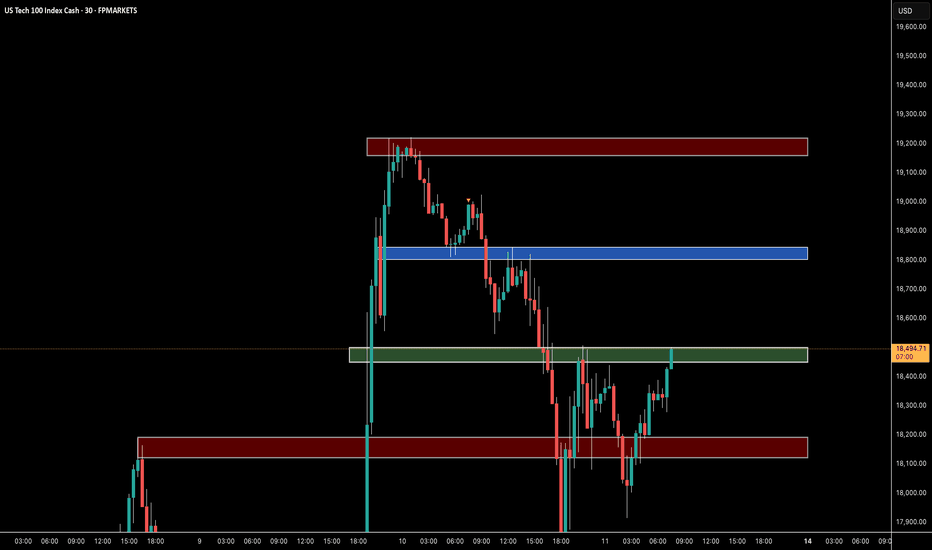

USTEC trade ideas

Likely Bullish Gap at Open Followed by a Sharp Drop📈 US100 – Likely Bullish Gap at Open Followed by a Sharp Drop 📉

On the 15-minute chart of the US100, we can see a corrective structure forming within an ascending channel, likely representing wave (B) of a larger correction. The price is currently near the top boundary of the channel, around 18,872.1.

🔍 Key Technical Highlights:

Clear prior bearish impulse.

Ongoing corrective move within a rising channel.

ABC correction forming inside the channel.

Potential rising wedge, suggesting bullish exhaustion.

📌 Main Hypothesis: I expect the market to open with a bullish gap, potentially reaching or briefly exceeding the 18,872.1 level, before starting a stronger downward move toward 17,411.8, which aligns with a key support zone and broader trendline confluence.

📊 Key Levels:

Resistance: 18,872.1 (ideal reversal area)

Target Support: 17,411.8

⚠️ Alternative Scenario: A strong breakout and consolidation above the channel could invalidate the bearish setup and suggest a continuation to the upside.

💡 Conclusion: This move would fit well within a broader corrective pattern, offering a technical pullback before any potential continuation. I’ll be watching the open closely for confirmation.

💼 Trade Idea:

🔹 Strategy: Short from resistance

🔹 Suggested Entry: 18,850 – 18,880 (potential gap zone and upper channel resistance)

🔹 Stop Loss: Above 18,920 (outside channel and above recent highs)

🔹 Take Profit: 17,500 – 17,450 (key support zone / technical target)

🔹 Risk/Reward Approximation: 1:4

🧠 Wait for price action confirmation (rejection, bearish engulfing candle, or intraday structure break before entering).

Symmetrical Triangle: Bullish or Bearish Breakout?Description:

The NASDAQ 100 (NAS100) has formed a symmetrical triangle on the 15-minute timeframe, indicating a consolidation phase after a 5.4% drop. The price is near the triangle's apex, suggesting that a significant directional move is imminent. Here are the key levels and possible scenarios:

Bullish Scenario:

Entry: Breakout above 18,500 on volume.

Target: 19,710.8 (138% Fibonacci).

Stop Loss: 17,800.

R/R: 1:2.

Bearish Scenario:

Entry: Breakout below 17,800 on volume.

Target: 17,341.3 (138% Fibonacci).

Stop Loss: 18,300.

R/R: 1:1.5.

Key Levels:

Resistance: 19,710.8.

Support: 17,341.3.

Intermediate Zones: 18,500 (resistance) and 17,500 (support).

Considerations:

Monitor volume during the breakout to confirm the breakout.

Review macroeconomic events (interest rates, inflation data) and tech company earnings, as the NASDAQ is sensitive to these factors.

Technology market sentiment will be key in determining the direction.

Warning: Trade at your own risk and ensure you have an appropriate risk management plan. Share your opinion in the comments!

Tags: #NASDAQ #NAS100 #SymmetricTriangle #Breakout #TechnicalAnalysis

Nasdaq High Impact Analysis (Stock Market Crash)we are looking at a stock market crash.

high valuations of tech companys (nvidia, apple, microsoft, tesla etc)

a synthetic covid scenario, same news, same playouts, same situations playing out.

1995 - 2001 dot.com bubble playing out

we projecting a bottoming of 10 000

we projecting a high of 30 000

the whole scenario is re balancing the tech sector

alot more downward pressure before we see a bottom / buy the dip kind of playout.

To new ATHs?After a sharp drop, the price has been rejected at 16300. In my opinion, the fall has nothing to do with the presidency of the United State, rather a perfect opportunity for the investors to buy the dip. The last two HLs on monthly time frame were printed in March 2020 ( Worldwide Pandemic) and Oct 2022. Since then, Nasdaq has been going up steadily and making HHs and HLs on daily and weekly. Now, in April 2025 another HL has been printed on monthly and I think that market might be on it's way to make new ATHs in coming weeks and months and even years.

NASDAQ100Perfect — now we’re on the 4H timeframe, which is great for refining entries. Let’s break this down again with the three frameworks:

⸻

1. Smart Money Concept (SMC)

Key Elements:

• CHoCH (Change of Character) — clearly marked after price broke above a short-term structure, shifting market sentiment bullish on 4H.

• EQH (Equal Highs) — potential liquidity resting above; smart money may target these.

• BOS (Break of Structure) — further confirms internal bullish structure.

• Order Block (OB) or Demand Zone in the green box (~17,700–18,200)** — price respected this zone strongly after BOS, indicating smart money accumulation.

SMC Bias (4H):

• Currently bullish, moving from demand to premium pricing.

• Price is forming higher highs and higher lows post-CHoCH.

• Liquidity pool above EQH near 19,000 is likely next target.

• Potential long re-entry if price returns to demand zone (18,000–18,200).

⸻

2. Elliott Wave View (Micro Count on 4H)

• If this is part of Wave 4 retracement on the Daily, this current 4H rally could be subwave A or B of the corrective structure (flat, zigzag, triangle).

• Alt. view: This may be Wave 1 of a new impulsive move upward if macro bearish bias gets invalidated.

• Current price action looks impulsive — strong vertical move (potential Wave 1 or 3).

If impulsive structure:

• Wave 1: 17,000 → 18,900

• Wave 2: pullback to ~18,100 (near OB)

• Wave 3 underway — targetting >19,000

⸻

3. Dow Theory (on 4H)

• Short-term trend is now up: Higher high confirmed post-BOS, and higher low formed.

• To maintain bullish structure, price must not break below 17,900 (demand zone).

• Confirmation of strength if we break above 19,000 — forming a higher high again.

⸻

Trade Idea (4H Setup) — Bullish SMC Entry

Entry (Buy Limit): 18,150 (mid-demand zone)

SL: 17,750 (below OB)

TP1: 19,000 (liquidity above EQH)

TP2: 19,800 – 20,200 (Daily supply zone)

RR Ratio: ~1:3+

⸻

Would you like a tighter setup on 1H for sniper entry, or are you trading swing/position from here

How I Traded A FULL Multi-Timeframe Wave - AND got PAIDThis week, I tracked NASDAQ from a technical + psychological level most traders avoided… but I saw the opportunity 🔎

While others sat on the sidelines calling it “too choppy,” I:

✅ Identified Wave 5 structure on the 4H + 1H timeframes

✅ Mapped out entries using price action + liquidity zones

✅ Held through 6+ rejections at resistance

✅ Executed with discipline, not emotion

✅ Took partial profits, protected capital

✅ Watched price explode — and I got my 💸

✅ Then wrapped the week with a real withdrawal

📚 KEY LESSONS I’M DROPPING FOR YOU:

📊 Technical Analysis = The "What"

→ Chart patterns, structure, liquidity zones, entries/exits.

🌍 Fundamental Analysis = The "Why"

→ News, interest rates, sentiment.

I stayed focused on the “what” — not the fear headlines.

💡 Liquidity Isn’t Noise. It’s a Signal.

Every rejection I held through was just price loading up.

I didn’t flinch. I let smart money do the work.

💥 Wave 5s test your strategy AND your patience.

I saw smaller TF Wave 5 complete before 4H — so I waited.

I didn’t FOMO back in — I planned for the pullback and possible short flip.

🧠 MINDSET WINS > CHART WINS

🧘🏽♀️ My biggest move this week?

I walked away with clarity — not just profit.

That’s trader growth.

💬 Final thoughts:

You don’t need 100 trades. You need 1 well-managed setup and a calm mind.

📲 Follow me to keep learning how to trade structure, not stress.

Mastering Volatile Markets: Why Reducing Position Size is Key █ Mastering Volatile Markets Part 1: Why Reducing Position Size is Key

Trading is always challenging, but how do you navigate today's markets? That's a whole different level. Today, we'll move away from the usual "Trump's tariffs are horrendous" discussions. We'll instead focus on how experienced traders profit in the current volatile market.

Right now, we're seeing extreme volatility across many assets. It's not uncommon for markets to move 3% to 10% in a single day , and for indices like NAS100 (Nasdaq), intraday swings of 300 to 500 points can happen in just 5 to 30 minutes.

This can seem like bad news, but as Warren Buffet said in 2008, "In short, bad news is an investor's best friend."

Volatile markets can shake even experienced traders — but they don’t have to. With 16 years of trading experience , we’ll show you exactly how to approach conditions like these with confidence and clarity.

█ Reducing position size is the key to surviving volatility:

The most critical adjustment in a volatile market is reducing position size.

Why? Because when the market moves faster and with bigger swings, your potential risk per trade automatically increases. The key is to keep your d ollar risk the same — even when volatility is exploding.

⚪ Let's take a look at how position size changes when markets change:

2 Weeks Ago — Stable Market:

NAS100 average move per trade = 50 to 100 points

Risk per trade = 100 points = $500 risk (for example)

Position Size = 5 contracts

Today — Volatile Market:

NAS100 average move per trade = 300 to 500 points

To maintain the same $500 risk per trade → Position Size = 1 contract

⚪ The Benefit:

With a smaller position, you can still earn the same profit because the price is moving much more. At the same time, your risk stays controlled , even in these wild markets.

This is exactly how professional traders survive and thrive in volatile conditions — by adjusting to what the market is giving them.

⚪ What Happens If You Don't Reduce Size?

Let's say you keep the same position size as in stable markets, but now the market moves 300-500 points against you instead of 50-100. Here's how it plays out (example):

In Stable Markets (NAS100 average move: 50-100 points):

Position Size: 5 contracts

Risk per contract: $10 per point

Risk per trade: 100 points x $10 x 5 contracts = $5,000 risk per trade

In Volatile Markets (NAS100 average move: 300-500 points):

Position Size: 5 contracts (unchanged)

Risk per contract: $10 per point

Risk per trade: 500 points x $10 x 5 contracts = $25,000 risk per trade

Without reducing position size, your risk increases dramatically as the market moves wildly. As a result, your losses will skyrocket when the market moves against you.

█ Summary:

Huge volatility = Smaller position size

Same risk = Same profit potential

Trade smarter, not bigger

This is rule number one when navigating wild markets like the ones we have today.

█ What's Coming Next in the Series:

Part 2: Liquidity Is the Silent Killer

Part 3: Patience Over FOMO

Part 4: Trend Is Your Best Friend

Stay tuned for the next part — and remember, adapting to volatility isn't just about managing risk, it's about mastering the market!

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

NAS100 Triangle Apex – Breakout or Breakdown ImminentBullish View:

• Price is forming higher lows and holding above the lower ascending trendline.

• A breakout above the upper descending trendline near 18,500 would confirm bullish

momentum.

• If the breakout is sustained, potential upside targets include 18,650 and 18,800.

Bearish View:

• Price has tested the lower support trendline and shown weakness near the apex of the

triangle.

• A breakdown below 18,100 would indicate bearish momentum and invalidate the ascending

structure.

• If the breakdown is sustained, potential downside targets include 17,950 and 17,700.

Short Day TradeTook a Short position at the daily EMA9

Entry: 18440

SL: 18690

TP 17950

Went short because today China reacted with a tariff increase on Trump action and Tesla does not take orders in China anymore. Was thinking about shorting Tesla but I decided to stick to the index.

Entry Level was choosen because I expected the price to touch the daily ema9 again (when I woke up it was way below it). The TP is just the intraday low which I expect to be hit again. The SL is a little high, thought about taking the premarket high but considered that this might be the SL for many shorts and it might hit at market open to erase some shorts from the market.

So the Risk Reward Ratio is bad for this trade. If I weren't so bearish for the market I probably would not have taken the trade

In my opinion the upstick of the market was just market manupulation by Trump (who should be impeached over this) and the uncertainty will bring the market much lower

I trade on the 4h chart, the 1h is just to see the progress.

I will close the trade before the market closes, no matter where it is.

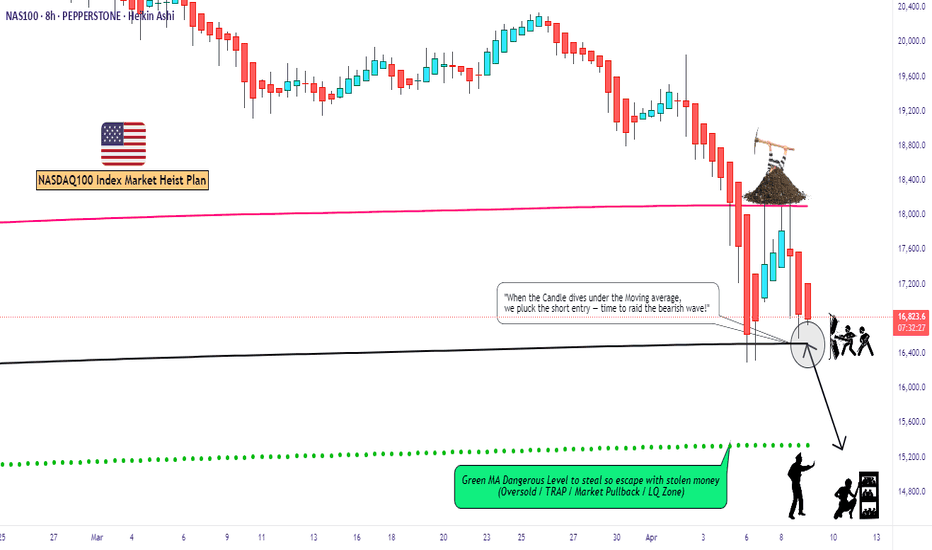

"NAS100/US100" Index Market Money Heist Plan (Day / Scalping)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "NAS100/US100" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (16400) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (17300) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 15300 (or) Escape Before the Target

"NAS100/US100" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Explanation 📝

Fundamentals: Growth stalls 📉, valuations adjust—bearish shift 🐻.

Macro: Cooling economy 🌍, sticky inflation 🔥—downward pressure.

COT: Speculators flee 📉, hedgers dig in—bearish signal 🐻.

Index: Correction deepens 📉, support tests near—technical bear 🐻.

Intermarket: Yields/USD crush risk assets 💪—bearish tide.

Geopolitical: Trade wars ⚔️, regulation 🔍—negative catalysts pile up.

Sentiment: Fear takes hold 😟—bearish consensus builds.

Trends: Near/medium-term declines 📉, long-term hinges on recovery ⚖️.

Outlook: Moderately bearish 🌩️—tough sledding ahead.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NSDQ100 China to Hike Tariffs on All US Goods – Market MixedChina to Hike Tariffs on All US Goods – Market Reaction Mixed

China announced it will raise tariffs on all US imports from 84% to 125%, effective April 12. The move follows Washington’s decision to increase levies on Chinese goods to 145% earlier this year.

However, Beijing signaled it will no longer respond to future US tariff increases, calling the back-and-forth “a joke,” suggesting a shift in tone from retaliation to dismissal.

Market Reaction:

USD: The dollar weakened further following the announcement, reflecting rising trade tensions and risk-off sentiment.

Equities: US futures turned lower as traders priced in the potential economic drag from escalating tariffs.

Gold: Continued to rise, reinforcing its role as a preferred safe-haven amid geopolitical uncertainty.

US Treasuries: Traditionally seen as a safe-haven, Treasuries underperformed, suggesting investor confidence in them may be weakening under mounting fiscal and trade concerns.

Analysis:

Markets are increasingly pricing in the fallout from an intensifying US-China trade standoff. The rise in gold and the dip in Treasuries suggest a shift in investor preference toward alternative safe-haven assets. If trade tensions continue to escalate, further downside in risk assets and USD strength reversal are possible.

Key Support and Resistance Levels

Resistance Level 1: 19000

Resistance Level 2: 19552

Resistance Level 3: 19873

Support Level 1: 17254

Support Level 2: 16773

Support Level 3: 16400

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

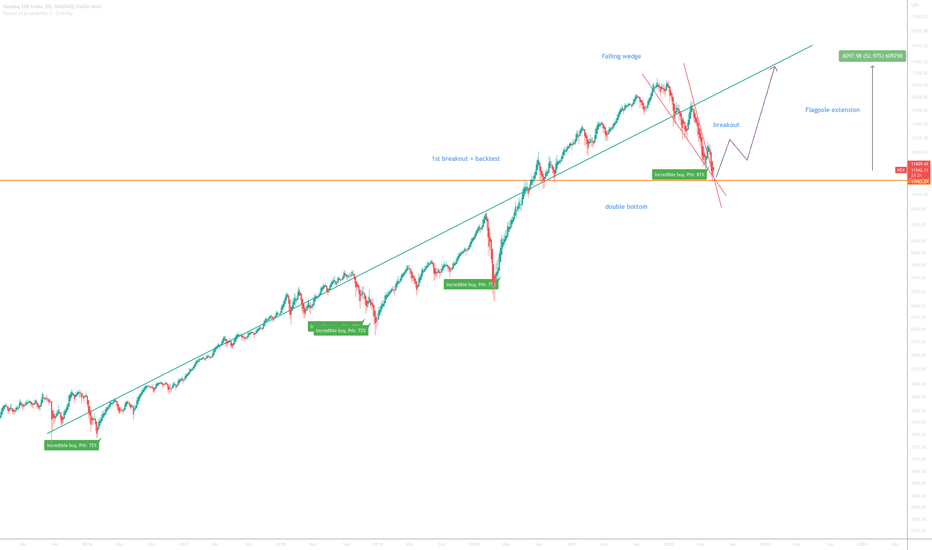

Nasdaq 100 to 17000On the above 3-day chart price action has corrected 33% since late December. A number of reasons now exist to be bullish, including:

1) The ‘incredible buy’ signal has printed. Look left.

2) The buy signal is coming in at 81% probability. The previous were 75%, 72@, & 72% percent, respectively. Look at the strength of if a 75% recovery, what do you think a 81% will be like? This can only be the result of a massive short squeeze, in my opinion.

3) Price action has just printed a ‘double bottom’ (orange line) on past support / resistance - look left!

4) Most recently price action has broken out of a bullish falling wedge formation with back test confirmation, see below.

Is it possible price action falls further? For sure.

Is it probable? No.

Good luck!

Ww

A little closer

NASDAQ 100 – Mega Wedge Ending? Black Swans Circling!📉 NASDAQ 100 🦢💥

By: Bullmaster 🐂

This isn’t just a chart – it’s a macro time bomb ticking louder each month.

Zoomed out to the monthly timeframe, the US Tech 100 is sitting at the edge of a massive rising wedge, formed over two decades.

We’ve completed what looks like a classic Elliott Wave 5-structure ✅

Every historic peak is marked:

🧱 Dot Com Bubble Peak

🏦 2008 Peak

🧪 Covid Peak

🏛️ Trump-Era Peak

Now comes the real danger…

🔻 If the wedge breaks down, major levels below are exposed:

• 16,659 – First line of defense

• 10,669 – Covid crash retest

• 4,816 – 2008 crisis level

• 2,239 – Dot Com peak

🦢 Black Swans are stacking up: • 💵 Unsustainable debt levels

• 📉 Artificial liquidity driving irrational prices

• 💼 AI bubble inflating fast

• 🌍 Geopolitical tensions (Taiwan, Middle East, etc.)

• 🏦 Fragile banking systems in the shadows

• 🧨 Overexposure to a handful of megacaps

“Markets rise in euphoria, and fall in terror. Be ready for both.” – Bullmaster

📊 This isn't FUD. It's macro risk preparation.

Stay sharp, manage risk, and remember: crisis = opportunity for those who survive the drop. 💀➡️👑

#NASDAQ #MacroView #CrashComing? #BlackSwanAlert #Bullmaster #ElliottWave #RiskManagement #TechBubble

NAS100 Is Bullish! Buy!

Please, check our technical outlook for NAS100.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 18,440.0.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 21,081.9 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NASDAQ BuyPossible reverse to the upside, markets are very volatile and great opportunities to buy at a discount are there. Given the current political climate we could see unexpected large moves in short spaces of time. please exercise proper risk management and dont overtrade, and stick to your plan.

NQ/US100/NAS100 Short - Day TradesNAS100, US100, NQ, NASDAQ short for day trade, it got bullish pressure but not yet to take rocket flight, came back to pick more orders, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

You may enter only 1 trade

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Maybe fast we VA V-shaped recovery in stocks refers to a very sharp and rapid decline in the market (or a particular stock or index), followed by an equally fast and strong rebound. If you look at a price chart, the movement resembles the letter “V”.

🔍 Key Characteristics:

📉 Rapid drop: Often caused by panic, crisis, or a major economic shock.

📈 Quick rebound: Recovery begins quickly after the bottom and moves upward with strong momentum.

⏱️ Short duration: The total period of decline and recovery is relatively brief.

💼 Investor sentiment: Confidence returns quickly, and buying pressure increases.

Im in 17.860 out 18,364 - SL in profit - 18.051