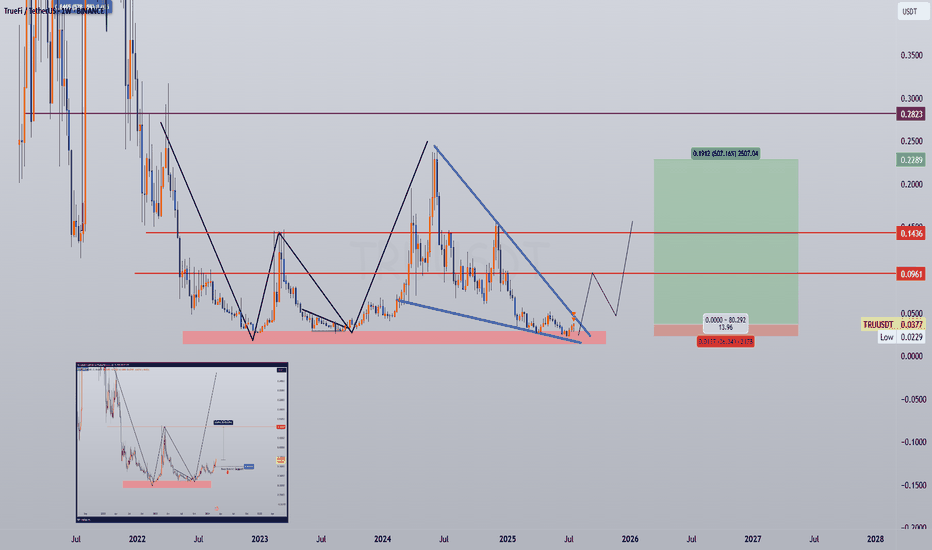

TRU/USDT Weekly – On the Verge of a Reversal or Breakdown?📌 Overview:

TRU/USDT is currently trading within a key long-term demand zone between $0.0229–$0.0307 — an area that has consistently acted as a strong bounce level since early 2023. Now that this zone is being tested again, the outcome could define the next major move for TrueFi.

---

🔍 Market Structure & Pattern:

The pair has been moving sideways in a year-long accumulation range, hinting at a potential accumulation phase by smart money.

There's a possibility of a triple bottom formation, a classic reversal signal, should price break above resistance with momentum.

Although the overall trend remains bearish, selling pressure is weakening, suggesting a possible trend transition phase.

---

📈 Bullish Scenario (Reversal Potential):

If price holds the support zone and confirms a bullish weekly candle:

Upside Targets:

🔹 $0.0387 (First breakout level)

🔹 $0.0512 – $0.0610 (Previous distribution range)

🔹 $0.1209 – $0.1545 (Mid-term trend shift target)

Potential catalysts: strong breakout volume, improving market sentiment, and weakening BTC dominance.

---

📉 Bearish Scenario (Breakdown Risk):

If price fails to hold above $0.0229 and closes below on the weekly chart:

Price could fall further toward the psychological level around $0.0200 or even lower.

This would confirm a new lower low, continuing the broader bearish trend and possibly entering a capitulation phase.

---

🎯 Key Levels to Watch:

Level Significance

$0.0229 – $0.0307 Major demand zone (historical support)

$0.0387 Initial resistance / bullish trigger

$0.0512 & $0.0610 Previous supply zones

$0.1209 & $0.1545 Mid-term reversal targets

$0.2437 Long-term target if uptrend confirms

---

🔄 Conclusion:

TRU/USDT is at a make-or-break point. Bulls and bears are clashing at this critical support. Will this be the start of a long-awaited reversal, or will we see a deeper breakdown?

The coming weekly candles will be crucial. Smart traders will wait for clear confirmation — not just reaction.

---

🧲 Trading Strategy Ideas:

Conservative Bulls: Wait for a weekly breakout above $0.0387 with volume confirmation.

Aggressive Traders: Consider entry at support with tight stop-loss below $0.0225, aiming for $0.0512 short-term.

Bearish Bias: Short after confirmed weekly close below support.

#TRUUSDT #TrueFi #CryptoReversal #AltcoinAnalysis #SupportZone #TripleBottom #BreakoutSetup #WeeklyChart

TRUUSDT trade ideas

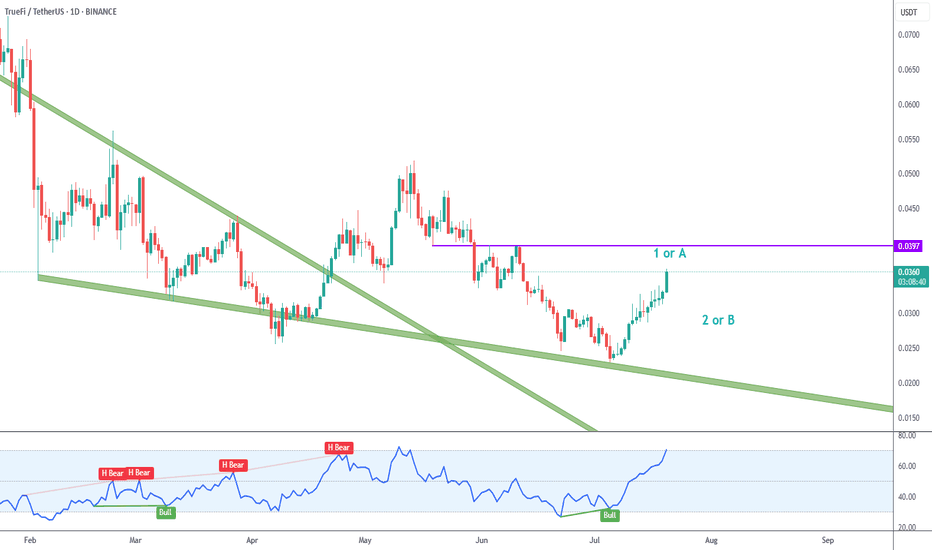

TRUUSDT Forming Falling WedgeTRUUSDT is currently exhibiting a Falling Wedge Pattern, a well-known bullish formation that often signals the end of a downtrend and the beginning of a strong upward move. This pattern is characterized by descending trendlines that converge, showing reduced selling pressure and a potential shift in momentum. As TRU approaches the apex of this wedge with gradually narrowing price action, traders are closely watching for a breakout to the upside—typically a powerful signal that price could rally sharply from current levels.

Volume remains healthy, which is a crucial factor when validating any breakout from a wedge formation. An uptick in volume upon breakout would serve as strong confirmation of bullish intent and increase the probability of TRUUSDT reaching its projected target. Historical breakouts from similar patterns have shown explosive gains, and in this case, the setup suggests a potential gain of 90% to 100% or more, especially if supported by broader market strength.

Investor interest is steadily increasing in the TRU ecosystem, reflecting growing confidence in the project’s utility and future developments. As the token gains traction and technical indicators align in its favor, momentum traders and swing traders are identifying this as a high-potential opportunity. The structure of this wedge presents a low-risk, high-reward setup with clearly defined support and resistance levels.

In summary, TRUUSDT’s falling wedge breakout scenario could be one of the more promising bullish setups currently unfolding. With strong volume dynamics, positive sentiment, and a clear pattern in play, it’s an excellent chart to keep on your radar in the coming days.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#TRU/USDT Low Risk vs High Rewards#TRU

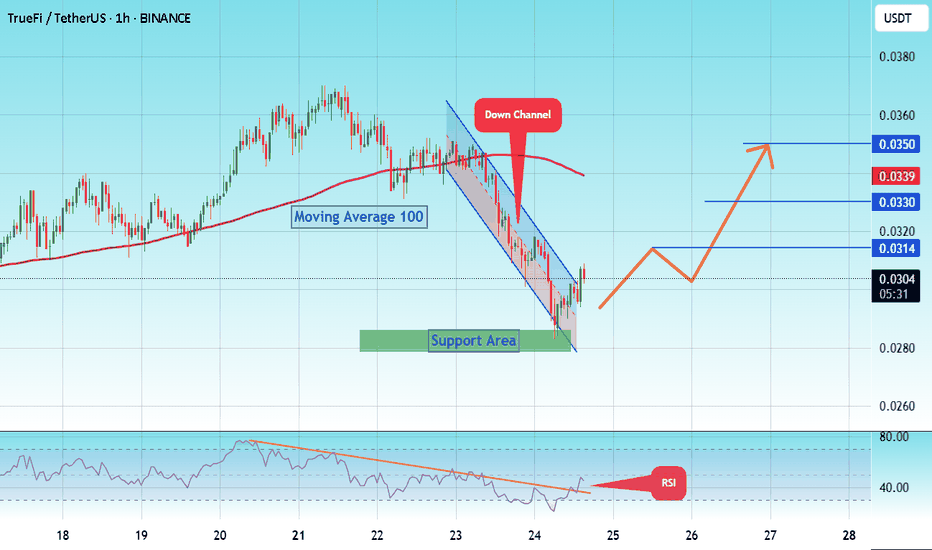

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.0285, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0280.

Entry price: 0.0300

First target: 0.0314

Second target: 0.0328

Third target: 0.0350

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

TRUUSDT Setup – Real World Asset DeFi Play | Buy Zones + Target📌 Coin: TRU (TrueFi)

💰 Buy Levels:

✅ First Entry: $0.0378

✅ Second Entry: $0.0325

✅ Third Entry: $0.0270

🛑 Panic / SL Level: Weekly close below $0.0240

🧠 Fundamental Analysis (FA) – In Short

*️⃣ Sector: DeFi / Real World Assets (RWA) Lending

*️⃣ Use Case: TrueFi is a decentralized credit protocol focused on unsecured and real-world asset lending, serving institutions with on-chain transparency.

*️⃣ Tech: Combines DeFi-native liquidity pools with off-chain credit assessment for borrowers. Offers tokenized credit portfolios, automated debt servicing, and risk scoring.

*️⃣ Narrative Fit: Perfectly aligned with the RWA + on-chain credit markets narrative, TrueFi offers one of the few active RWA lending infrastructures in DeFi.

*️⃣ Adoption: Partnered with large institutions including Archblock (formerly TrustToken), active in real-world treasury and asset-backed lending markets.

*️⃣ Unique Angle: TrueFi pioneered on-chain uncollateralized lending — a rare use case bridging traditional finance (TradFi) with DeFi.

📊 Tokenomics & Market Data

(As of July 2025)

🪙 Current Price: ~$0.034

🧾 Market Cap: ~$38M

🔢 Rank: ~Top 450

🧮 Circulating Supply: ~1.1B TRU

🔒 Max Supply: 1.45B TRU

⚙️ Token Use: Governance, staking, incentive alignment for underwriters and lenders

💡 Inflation: Fixed max supply, most emissions already circulated

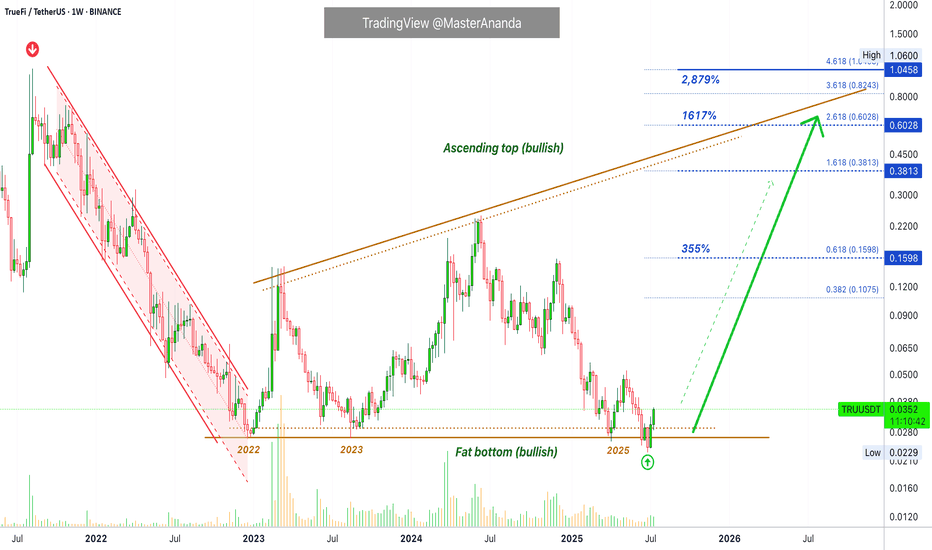

🎯 Bull Market Target (Realistic)

Target Range: $0.09 – $0.12

*️⃣ Based on revaluation of DeFi protocols aligned with RWA lending and increased institutional adoption.

🚀 Mega Bullish Target (Speculative Top)

Target Range: $0.18 – $0.28+

*️⃣ If on-chain credit and RWA tokenization become core crypto narratives, TRU could be a top re-rated microcap in that sector.

*️⃣ As one of the first RWA lending protocols with real integrations, it has potential to lead a sector-wide DeFi resurgence.

✅ Final Take

🧠 TRU stands out as one of the earliest movers in institutional RWA lending on-chain.

Your $0.027–$0.0378 entries are deep within macro support, and the $0.024 SL offers clear protection against breakdown.

Low market cap + strong narrative = explosive upside if RWA gains traction.

we ask Allah reconcile and repay

TRU Upside Reversal

Truefi´s recent upside after touching the green descending trendline looks convincing, with a motive wave and bullish RSI divergence.

I´m labeling this as wave 1/A.

Right now price is overbought, so I´ll wait for wave 2/B pullback to look for long trades.

Next key resistance zone is just below 0.04.

TrueFi · Bitcoin vs the Altcoins · Low Risk vs High RewardsTrueFi is trading at bottom prices. Notice the big difference between this pair and the ones that are trading high, near resistance or at a new all-time high. This is the difference I want to point out to new buyers.

If you are entering the market just now, you should be considering pairs like this one rather than the ones that are already pretty advanced. This is because the ones trading low/near support have more room available for growth, higher profits potential and very little risk. When prices are trading near the bottom, there isn't much room to go lower. When prices are trading high, even with marketwide bullish action, a correction can develop anytime.

We look for pairs like this one to buy and hold.

The second consideration is related to growth potential. While Bitcoin is awesome; Bitcoin is crypto; Bitcoin is great and is here to stay, it is already worth trillions of dollars. If everything goes amazing for Bitcoin, we might enjoy an additional 100% growth before the cycle ends. On an altcoin, in comparison, we can enjoy 1,000%, 2,000%, 3,000%, 5,000% or more. So you need to choose wisely.

A whale can easily choose Bitcoin because of liquidity issues, accessibility, security, stability, accounting, long-term performance, etc. A tiny fish is better off with the altcoins market, they have more room for growth.

Technical analysis

The red channel reveals a downtrend, the previous bear-market. The flat bottom in the following years reveals a consolidation period, long-term. Not a downtrend but creating a base. From the bottom we grow.

TRUUSDT is no longer bearish, moving down, instead it accumulated for years and now that this accumulation phase is over we are ready for massive growth.

We witnessed first a downtrend, then sideways (consolidation) and now comes an uptrend. These are the only three ways in which the market can move. Down—neutral—up.

The logical next step after a downtrend is always a sort of transition period, after this transition the uptrend starts.

We will have an uptrend now, this is what we call a "bull market." Higher highs and higher lows."

If you enjoy the content, you can always follow for more. It is easy and free and you get to receive updates every time I publish a new article.

Thanks a lot for your continued support.

Namaste.

TrueFi (TRU)#TRU

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.0270, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0260.

Entry price: 0.0275

First target: 0.0281

Second target: 0.0290

Third target: 0.0301

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#TRU/USDT#TRU

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0300.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are in a trend of consolidation above the 100 Moving Average.

Entry price: 0.0315

First target: 0.0327

Second target: 0.0337

Third target: 0.0350

$TRU 4H chartNYSE:TRU 4H chart has broken out of a descending trendline, showing bullish momentum.

Price is now approaching the key resistance zone around $0.041.

A successful breakout here could push the price toward the $0.0474 target +25%.

Watch for a possible retest of the breakout zone before continuation.

DYRO, NFA

#TRU/USDT#TRU

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel.

This support is at 0.0375.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.0378

First target: 0.0387

Second target: 0.0395

Third target: 0.0403

TRUUSDT CHART ANALYSİS - EDUCATİONAL POSTHow NFT Technology Developed

NFT technology was created in 2017 based on Ethereum smart contracts. Since then, we have witnessed many successful NFT projects and deals. Stories like these perfectly describe the current and future possibilities of the technology.

The development of blockchain technology and the emergence of NFT services coincided with other processes in society and the economy. Many new players appeared in the stock markets, including non-professional traders and amateur investors.

The democratization of financial markets coincided with the pandemic: being in self-isolation, alone with their devices, many people began to pay attention to new financial instruments.

The information that arose around them also played a specific role in the “revival” of NFTs. The big names in the news headlines supporting NFTs couldn’t help but draw attention to them. That is one of the reasons why the success of the technology was inevitable.

TRU/USDTKey Level Zone: 0.04400 - 0.04430

HMT v6 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis