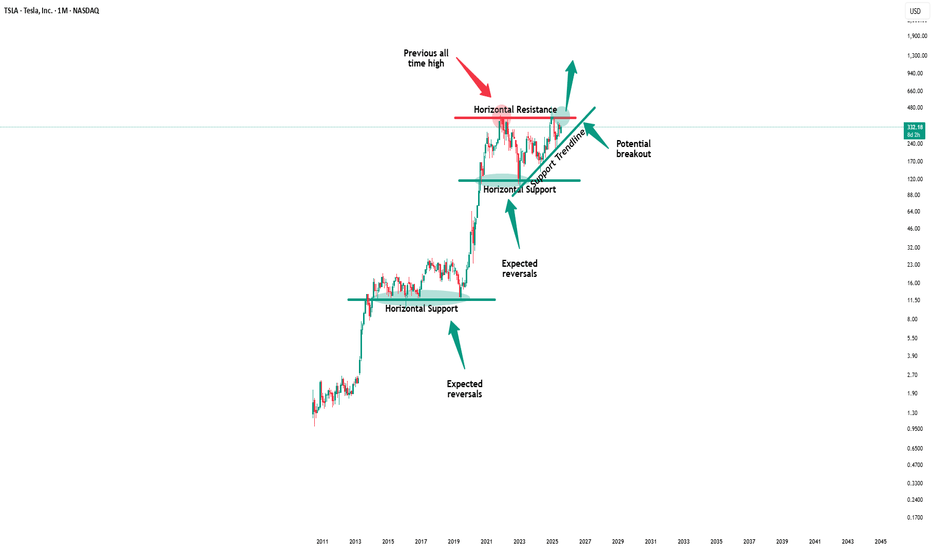

TSLA Long-Term Bold Projection (2025-2035)This is a long-term analysis of Tesla (TSLA) stock on the weekly timeframe, combining Elliott Wave Theory, Fibonacci extensions, and price structure (base formations) within a broad logarithmic trend channel.

Key Highlights:

🔹 Base Formations:

Base 1 (2010–2013): First consolidation before TSLA’s

Key facts today

A recent court ruling has sparked concerns over Tesla's autonomous vehicle safety, possibly impacting its robotaxi expansion plans and leading to more regulatory scrutiny on its self-driving tech.

In July, Tesla's sales in Germany dropped 55.1% year-over-year to 1,110 units, contributing to a 57.8% decline for the year. The U.K. saw a 60% decrease, while France dropped 27%.

Tesla (TSLA) rose 0.6% to $310.97 in premarket trading, following a 2.2% gain on Monday, driven by CEO Elon Musk's $23.7 billion pay package aimed at boosting shareholder value.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.89 USD

7.13 B USD

97.69 B USD

2.81 B

About Tesla

Sector

Industry

CEO

Elon Reeve Musk

Website

Headquarters

Austin

Founded

2003

FIGI

BBG000N9MNX3

Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. The company operates through Automotive and Energy Generation and Storage. The Automotive segment includes the design, development, manufacture, sale, and lease of electric vehicles as well as sales of automotive regulatory credits. The Energy Generation and Storage segment is involved in the design, manufacture, installation, sale, and lease of stationary energy storage products and solar energy systems, and sale of solar energy systems incentives. The company was founded by Jeffrey B. Straubel, Elon Reeve Musk, Martin Eberhard, and Marc Tarpenning on July 1, 2003 and is headquartered in Austin, TX.

Related stocks

Tesla Builds Momentum - Can It Reach $490?Tesla Builds Momentum - Can It Reach $490?

From a technical perspective, Tesla is showing signs of volume accumulation and appears to be forming a contracted triangle pattern.

The price seems to have found solid support around 287, suggesting this corrective phase might be nearing its end.

If

TESLA Sellers In Panic! BUY!

My dear friends,

TESLA looks like it will make a good move, and here are the details:

The market is trading on 302.63 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the mar

Tesla (TSLA) Crash Ahead? $101.81 Retest in SightThe Tesla price chart appears to show a large flat correction labeled W-X-Y.

Wave W consists of three downward waves from 2021 to 2023. (white)

Wave X shows a three-wave upward retracement from 2023 to 2024, which even overshot the start of wave W. (blue)

Now, we seem to be in the final leg of th

Tesla - The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) will break out soon:

🔎Analysis summary:

For the past five years Tesla has overall been consolidating between support and resistance. But following the recent bullish break and retest, bulls are slowly taking over control. It is actually quite likely that Tesla will soon

Make or Break point for TSLAlots of bulls and bears for TSLA. Wedging for a bit now. Filled the 296 gap and gap above, now its time to see if TSLA wants up or down. RSI MACD stabilized, volume thinned out, so whatever direction it chooses I think will be explosive. Plenty of Call and Put flow on both sides.

TSLA Breakout Watch: Symmetrical Triangle Squeeze!Trade Summary

Setup: Symmetrical triangle pattern tightening since March; volatility compression signals an imminent breakout.

Entry: On daily close above the triangle resistance (~$324)

Stop‑loss: Below triangle support (~$305)

Targets:

• Target 1: $375

• Long-term: $500+

$TSLA: Branching Effect🏛️ Research Notes

Reaching branching effect through cross-cycle interconnection. Alongside I'll test some elements mentioned below.

Local Progressions

Rhyme and levels derived from apparent cycle compression.

Added channels with darkening gradient that cover bullrun from mid 2019, drive

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSLA4317805

Tesla Energy Operations, Inc. 5.45% 17-DEC-2030Yield to maturity

11.26%

Maturity date

Dec 17, 2030

TSLA4296328

Tesla Energy Operations, Inc. 5.45% 16-OCT-2030Yield to maturity

10.51%

Maturity date

Oct 16, 2030

TSLA4290558

Tesla Energy Operations, Inc. 5.45% 01-OCT-2030Yield to maturity

9.82%

Maturity date

Oct 1, 2030

TSLA4247202

Tesla Energy Operations, Inc. 5.45% 21-MAY-2030Yield to maturity

9.30%

Maturity date

May 21, 2030

TSLA4286421

Tesla Energy Operations, Inc. 5.45% 17-SEP-2030Yield to maturity

8.52%

Maturity date

Sep 17, 2030

TSLA4324758

Tesla Energy Operations, Inc. 4.7% 14-JAN-2026Yield to maturity

8.01%

Maturity date

Jan 14, 2026

TSLA4231716

Tesla Energy Operations, Inc. 5.45% 23-APR-2030Yield to maturity

7.89%

Maturity date

Apr 23, 2030

TSLA4250220

Tesla Energy Operations, Inc. 5.45% 29-MAY-2030Yield to maturity

7.67%

Maturity date

May 29, 2030

TSLA4313161

Tesla Energy Operations, Inc. 5.45% 03-DEC-2030Yield to maturity

7.43%

Maturity date

Dec 3, 2030

TSLA4222068

Tesla Energy Operations, Inc. 5.45% 19-MAR-2030Yield to maturity

7.39%

Maturity date

Mar 19, 2030

TSLA4265473

Tesla Energy Operations, Inc. 5.45% 16-JUL-2030Yield to maturity

7.00%

Maturity date

Jul 16, 2030

See all TSLA bonds

Curated watchlists where TSLA is featured.

Frequently Asked Questions

The current price of TSLA is 308.72 USD — it has decreased by −0.69% in the past 24 hours. Watch Tesla stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Tesla stocks are traded under the ticker TSLA.

TSLA stock has fallen by −5.66% compared to the previous week, the month change is a −3.41% fall, over the last year Tesla has showed a 66.68% increase.

We've gathered analysts' opinions on Tesla future price: according to them, TSLA price has a max estimate of 500.00 USD and a min estimate of 115.00 USD. Watch TSLA chart and read a more detailed Tesla stock forecast: see what analysts think of Tesla and suggest that you do with its stocks.

TSLA reached its all-time high on Dec 18, 2024 with the price of 488.54 USD, and its all-time low was 1.00 USD and was reached on Jul 7, 2010. View more price dynamics on TSLA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TSLA stock is 2.27% volatile and has beta coefficient of 1.69. Track Tesla stock price on the chart and check out the list of the most volatile stocks — is Tesla there?

Today Tesla has the market capitalization of 997.50 B, it has increased by 3.66% over the last week.

Yes, you can track Tesla financials in yearly and quarterly reports right on TradingView.

Tesla is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

TSLA earnings for the last quarter are 0.40 USD per share, whereas the estimation was 0.40 USD resulting in a 0.70% surprise. The estimated earnings for the next quarter are 0.49 USD per share. See more details about Tesla earnings.

Tesla revenue for the last quarter amounts to 22.50 B USD, despite the estimated figure of 22.28 B USD. In the next quarter, revenue is expected to reach 24.56 B USD.

TSLA net income for the last quarter is 1.17 B USD, while the quarter before that showed 409.00 M USD of net income which accounts for 186.55% change. Track more Tesla financial stats to get the full picture.

No, TSLA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 6, 2025, the company has 125.67 K employees. See our rating of the largest employees — is Tesla on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tesla EBITDA is 11.50 B USD, and current EBITDA margin is 13.44%. See more stats in Tesla financial statements.

Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tesla stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tesla technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tesla stock shows the buy signal. See more of Tesla technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.