Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.58 CAD

6.11 B CAD

35.66 B CAD

2.05 B

About CANADIAN NATURAL RESOURCES LTD

Sector

Industry

Website

Headquarters

Calgary

Founded

1973

FIGI

BBG0014HPGP5

Canadian Natural Resources Ltd. is an oil and natural gas production company, which engages in the exploration, development, marketing, and production of crude oil and natural gas. It operates through the following segments: Oil Sands Mining & Upgrading, Midstream & Refining, and Exploration & Production. The Oil Sands Mining & Upgrading segment produces synthetic crude oil through bitumen mining and upgrading operations. The Midstream & Refining segment focuses on maintaining pipeline operations and investment. The Exploration & Production segment consists of operations in North America, largely in Western Canada, the United Kingdom portion of the North Sea, and Côte d’Ivoire and South Africa in Africa. The company was founded on November 7, 1973 and is headquartered in Calgary, Canada.

Related stocks

CNQ | Long | Oil & Gas Diversification Play | (July 9, 2025)CNQ | Long | Oil & Gas Diversification Play | (July 9, 2025)

1️⃣ Short Insight Summary:

Canadian Natural Resources (CNRL) is moving strong thanks to its diversified oil & gas operations, LNG expansion, and solid ESG positioning. We’re already up nicely on this move, and the setup still looks promis

Canadian Natural resources is undervaluedUsing my simple method of technical analysis and fundamental calculation of the intrinsic value of a stock for which the range of intrinsic value of CNQ is between $35-$55. Assuming oil can make a reversal at this pivotal time in history for the world the stock looks very cheap. It also pays good di

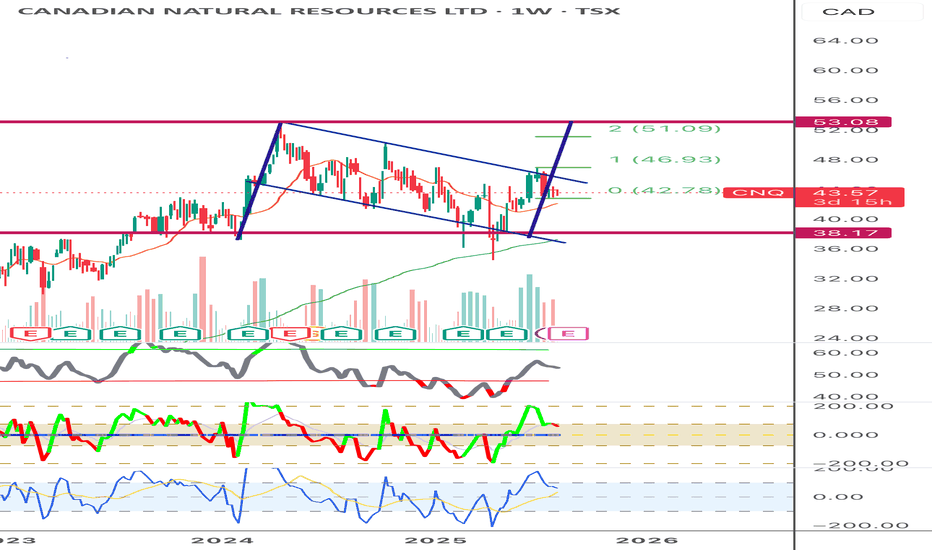

Canadian Natural Resources Stock Chart Fibonacci Analysis 050925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 40/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

CNQ | Long Setup | Energy Value Play | (May 2025)CNQ | Long Setup | High Dividend + Energy Value Play | (May 2025)

1️⃣ Short Insight Summary:

Canadian Natural Resources (CNQ) offers strong energy exposure with solid dividends, but it's currently trading in a downward channel. I'm watching for signs of a reversal and a potential long setup forming

Black Hole SunshineA surreal dreamscape, when spilled on water, can ignite under the right conditions, creating dramatic (but harmful) floating flames—an event that brings people back to reality.

The oil patch is on the verge. With an oil to gold ratio near all time high, the watershed moment is close. Accumulate thr

Road map for CNQIts a clear roadmap for NYSE:CNQ

I had done this analysis about 9 days ago for one of my friends and I forgot to publish it, and now that I am back, I see that it has progressed exactly step by step according to the analysis.

I need to see which price action pattern I specified on the chart wil

$CNQ is hitting All-Time Highs (ATH) NYSE:CNQ is hitting All-Time Highs (ATH) 🚀 & still buying back stocks - a whopping 2,825,000 shares for approx. $285M! 📈 After a two-year base breakout, we're eyeing targets of $85-$90.

💡 KK Tip: Though tempting, it might be hard to chase right now. Keep it on your radar!

CNQ - time to take profits Chart setting up with what looks to be head and shoulder pattern. Taking some profits now before next earnings release. Lower commodity pricing might come into play. Watching closely the next few weeks and setting targets....if it drops a bit, would be a great buying opportunity long term.

CNQ - Time for some profit taking?CNQ - Canadian Natural Resources looks to be forming a classic Wyckoff Distribution pattern after this massive run up. I think it is time for some profit taking. A mild winter could produce a weak earnings report in February as demand for oil/gas is down. Natural gas prices remain down and I believe

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CNQ4500092

Canadian Natural Resources Limited 4.95% 01-JUN-2047Yield to maturity

6.42%

Maturity date

Jun 1, 2047

CNQ3672460

Canadian Natural Resources Limited 6.75% 01-FEB-2039Yield to maturity

5.73%

Maturity date

Feb 1, 2039

CNQ3670206

Canadian Natural Resources Limited 6.25% 15-MAR-2038Yield to maturity

5.67%

Maturity date

Mar 15, 2038

CNQ3668707

Canadian Natural Resources Limited 6.5% 15-FEB-2037Yield to maturity

5.66%

Maturity date

Feb 15, 2037

CNQ3706921

Canadian Natural Resources Limited 5.85% 01-FEB-2035Yield to maturity

5.58%

Maturity date

Feb 1, 2035

CNQ5954231

Canadian Natural Resources Limited 5.4% 15-DEC-2034Yield to maturity

5.54%

Maturity date

Dec 15, 2034

US136385AC5

CDN. NTL. RESOURCES 02/32Yield to maturity

5.21%

Maturity date

Jan 15, 2032

CNQ3702347

Canadian Natural Resources Limited 6.45% 30-JUN-2033Yield to maturity

5.21%

Maturity date

Jun 30, 2033

CNQ5005077

Canadian Natural Resources Limited 2.95% 15-JUL-2030Yield to maturity

4.80%

Maturity date

Jul 15, 2030

CNQ5954229

Canadian Natural Resources Limited 5.0% 15-DEC-2029Yield to maturity

4.72%

Maturity date

Dec 15, 2029

CNQ4499997

Canadian Natural Resources Limited 3.85% 01-JUN-2027Yield to maturity

4.35%

Maturity date

Jun 1, 2027

See all CNQ bonds

Curated watchlists where CNQ is featured.

Upstream oil: Liquid gold extractors

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of CNQ is 42.72 CAD — it has decreased by −2.60% in the past 24 hours. Watch CANADIAN NATURAL RESOURCES LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TSX exchange CANADIAN NATURAL RESOURCES LTD stocks are traded under the ticker CNQ.

CNQ stock has fallen by −1.20% compared to the previous week, the month change is a −2.06% fall, over the last year CANADIAN NATURAL RESOURCES LTD has showed a −12.94% decrease.

We've gathered analysts' opinions on CANADIAN NATURAL RESOURCES LTD future price: according to them, CNQ price has a max estimate of 64.00 CAD and a min estimate of 45.00 CAD. Watch CNQ chart and read a more detailed CANADIAN NATURAL RESOURCES LTD stock forecast: see what analysts think of CANADIAN NATURAL RESOURCES LTD and suggest that you do with its stocks.

CNQ stock is 3.01% volatile and has beta coefficient of 1.00. Track CANADIAN NATURAL RESOURCES LTD stock price on the chart and check out the list of the most volatile stocks — is CANADIAN NATURAL RESOURCES LTD there?

Today CANADIAN NATURAL RESOURCES LTD has the market capitalization of 89.42 B, it has decreased by −2.60% over the last week.

Yes, you can track CANADIAN NATURAL RESOURCES LTD financials in yearly and quarterly reports right on TradingView.

CANADIAN NATURAL RESOURCES LTD is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

CNQ earnings for the last quarter are 1.16 CAD per share, whereas the estimation was 1.03 CAD resulting in a 12.19% surprise. The estimated earnings for the next quarter are 0.63 CAD per share. See more details about CANADIAN NATURAL RESOURCES LTD earnings.

CANADIAN NATURAL RESOURCES LTD revenue for the last quarter amounts to 10.95 B CAD, despite the estimated figure of 10.18 B CAD. In the next quarter, revenue is expected to reach 8.73 B CAD.

CNQ net income for the last quarter is 2.46 B CAD, while the quarter before that showed 1.14 B CAD of net income which accounts for 115.99% change. Track more CANADIAN NATURAL RESOURCES LTD financial stats to get the full picture.

Yes, CNQ dividends are paid quarterly. The last dividend per share was 0.59 CAD. As of today, Dividend Yield (TTM)% is 5.30%. Tracking CANADIAN NATURAL RESOURCES LTD dividends might help you take more informed decisions.

CANADIAN NATURAL RESOURCES LTD dividend yield was 4.82% in 2024, and payout ratio reached 74.42%. The year before the numbers were 4.26% and 49.04% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 10.64 K employees. See our rating of the largest employees — is CANADIAN NATURAL RESOURCES LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CANADIAN NATURAL RESOURCES LTD EBITDA is 18.66 B CAD, and current EBITDA margin is 47.11%. See more stats in CANADIAN NATURAL RESOURCES LTD financial statements.

Like other stocks, CNQ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CANADIAN NATURAL RESOURCES LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CANADIAN NATURAL RESOURCES LTD technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CANADIAN NATURAL RESOURCES LTD stock shows the neutral signal. See more of CANADIAN NATURAL RESOURCES LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.