EQX trade ideas

EQUINOX GOLD Stock Chart Fibonacci Analysis 121923 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 4.7/61.80%

Chart time frame : C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Just A Retest?Israel conflict/geopolitical uncertainty causes short term spike in price of gold. An overwhelming victory for Israel over Hamas and the other Iran proxies will, undoubtedly, relieve these trepidations and, thusly, the price of gold. I would suspect this is being reflected in EQX's price action and expect this to result in a retest and potential rejection of our triangle structure. Target on the chart. Nothing is for certain, however, so please practice sound risk management.

A nice setup this is playing out to bePlease provide a meaningful and detailed description of your analysis and prediction. Walk us through your thought process. Put yourself in the reader’s shoes and see if you would understand the context based on what you wrote. Clearly stated profit targets and stop loss areas help clarify any trade idea.

A cup and handle formation. Appears poised for the return trip up to the 12 dollar range. Take some profits (10-75%) and hang on for the ride to the moon. Hopefully get off before stop-lossing at 2019 low.

$EQX gold setup 👁🗨*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management

My team entered gold mining company Equinox Gold Corp $EQX today at $5.75 per share. Our take profit is $9.50. We also have a stop less set at $5.15

OUR ENTRY: $5.75

FIRST TAKE PROFIT: $9.50

STOP LOSS: $5.15

If you want to see more, please like and follow us @SimplyShowMeTheMoney

Equinox Gold (NYSE: $EQX) Preparing For Bull Run 2022! 👑Equinox Gold Corp. engages in the operation, acquisition, exploration, and development of mineral properties. The company primarily explores for gold and silver deposits. Its properties include the Aurizona gold mine located in Maranhão State; the RDM gold mine located in Minas Gerais State; and Fazenda gold mine and the Santa Luz gold mine located in Bahia State, Brazil. The company also hold interests in the Mesquite gold mine and the Castle Mountain property situated in California, the United States; and the Los Filos Gold Mine located in Guerrero State, Mexico. In addition, it holds a 60% interest in the Greenstone project located in Ontario, Canada. The company was formerly known as Trek Mining Inc. and changed its name to Equinox Gold Corp. in December 2017. Equinox Gold Corp. was incorporated in 2007 and is headquartered in Vancouver, Canada.

Equinox pointing north?With its down trend line broken, and the crossing above the 200 MA the stock looks ready to go up.

He still has to clear 8.70 on a closing. RSI shows signs of higher lows and not falling below 40% is encouraging to say the least. Targets are 9.55 and 11.30 respectively. A closing below 8.20 will invalidate the scenario.

Equinox Gold 30%+ Potential GainWith the inflation report coming out showing an annualized inflation rate of 6.2% now is a good time to purchase physical gold or gold stocks like Equinox or EQX.

Sector: Materials

Industry: Metals & Mining

Company Location: Vancouver, BC

Equinox Gold Corp. engages in the acquisition, exploration, and development of mineral deposits. The company primarily explores for gold and silver deposits. Its properties include the Aurizona gold mine located in Maranhao State; the Fazenda gold mine located in Bahia State; the RDM gold mine located in Minas Gerais State; and the Santa Luz gold mine located in Bahia State, Brazil. The company also hold interests in the Mesquite gold mine and the Castle Mountain property situated in California, the United States; and the Los Filos Gold Mine located in Guerrero State, Mexico. In addition, it holds a 60% interest in the Greenstone project located in Ontario, Canada. The company was formerly known as Trek Mining Inc. and changed its name to Equinox Gold Corp. in December 2017. Equinox Gold Corp. was incorporated in 2007 and is headquartered in Vancouver, Canada.

12-Month Price Targets

Mean: $10.60

High: $11.00

Low: $10.20

Expected Return: 30%+

NEW POSITION $EQX Target 9.57 for 27.94%$EQX Target 9.57 for 27.94%

Or double position at 5.39

Ok, another gold one... I think this is going to be it for gold for me in this cycle. But this one popped up on my screener so why not... let's give it a try.

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

I finally added my YouTube Training Video to my profile tagline since I’m not allowed to on here. It’s a quick 15 minute training video on how to set up your chart and how to spot opportunities. So check here first but If you have questions just message me.

WATCHING $EXQ for ENTRY TARGET @ 7.48WATCHING $EXQ for ENTRY TARGET @ 7.48

I’m practicing to nail my entries even better… if target hits I will take a position.

If there's any ticker symbol you'd like me to determine a good entry price just comment below and I'll do as many as time permits. Some days I have lots of time and other’s not so much but as I can I’ll do them (and If I have enough charts left)

[Watch] EQXI rotated out of Gold sometime in Q4 to focus on Tech and Energy.

Now, I've made decent profits. It has felt all too easy in the stock market for months now. It's time to look again at deeply undervalued plays that have been forgotten.

One of my favorites is EQX. I will look for a trip to $9 or below to accumulate and accumulate big.

Can Gold test $1750/oz? If so, that will be a huge gift to buy EQX. If not, I will likely be chasing gold stocks higher, looking for inside-day consolidations or bull flags, for example. But buying into a dip at $9 is my ideal scenario.

Gold miners arragement Some gold miners operate synchronously.

They have been falling since the peak of August.

They are quite sensitive to movements in gold prices, maintaining a positive correlation.

They are trading below their 200 day simple moving average (undervalued signal).

Its last 2 peaks have occurred in the first week of the month, 2 months apart.

What is the possibility that another peak occurs in early March?

Either everyone goes up or everyone goes down.

I get the impression that they are going to rebound at the same time.

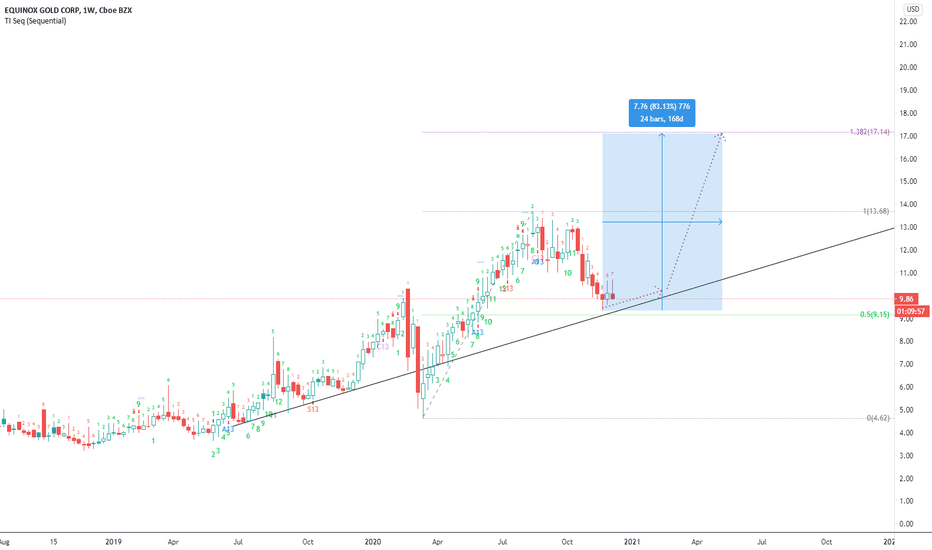

Equinox Gold setting base for an upward moveI believe Equinox Gold is valued much higher than current stock price, but I'm only following technical analysis here. This trend line has held for 18 months, and the swing gives indication for the volume of the coming upward momentum. I chose 1.382 of the previous swing to determine my target. I'm not confident about the target. I think time analysis will prove better method here. Also, the momentum for a launch upwards has not shown yet. I'm assuming it's going to be in a few weeks. So I'll be updating this as we go along.