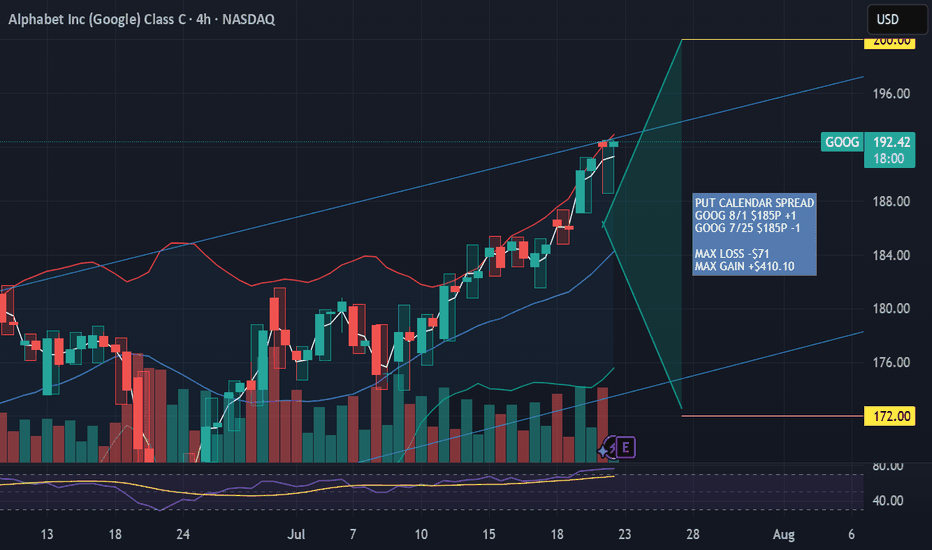

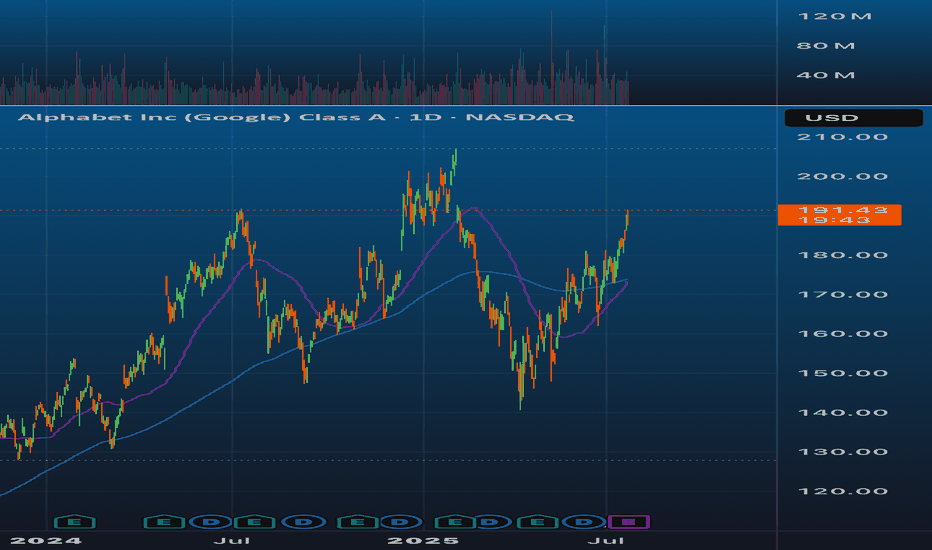

GOOG Put Calendar Spread July 22, 2025GOOG has earnings upcoming and is in the top Bollinger band, daily RSI is 74. With a price target of $185 this trade is profitable between $200 and $172 providing a large target window in a short timeframe. Trade will be a

PUT CALENDAR SPREAD

GOOG 8/1 $185P +1

GOOG 7/25 $185P -1

MAX LOSS -$71

MAX

13.24 CAD

137.16 B CAD

479.22 B CAD

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

FIGI

BBG012313987

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

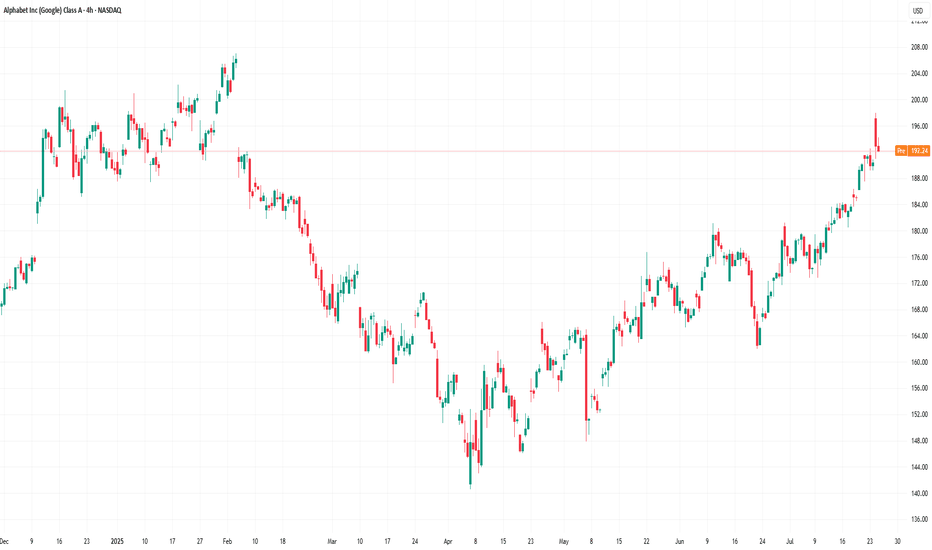

Alphabet (GOOGL) Stock Chart Analysis Following Earnings ReleaseAlphabet (GOOGL) Stock Chart Analysis Following Earnings Release

Earlier this week, we highlighted the prevailing bullish sentiment in the market ahead of Alphabet’s (GOOGL) earnings report, noting that:

→ an ascending channel had formed;

→ the psychological resistance level at $200 was of particu

Alphabet (GOOGL) Stock Approaches $200 Ahead of Earnings ReleaseAlphabet (GOOGL) Stock Approaches $200 Ahead of Earnings Release

According to the Alphabet (GOOGL) stock chart, the share price rose by more than 2.5% yesterday. Notably:

→ the price reached its highest level since early February 2025;

→ the stock ranked among the top 10 performers in the S&P 500

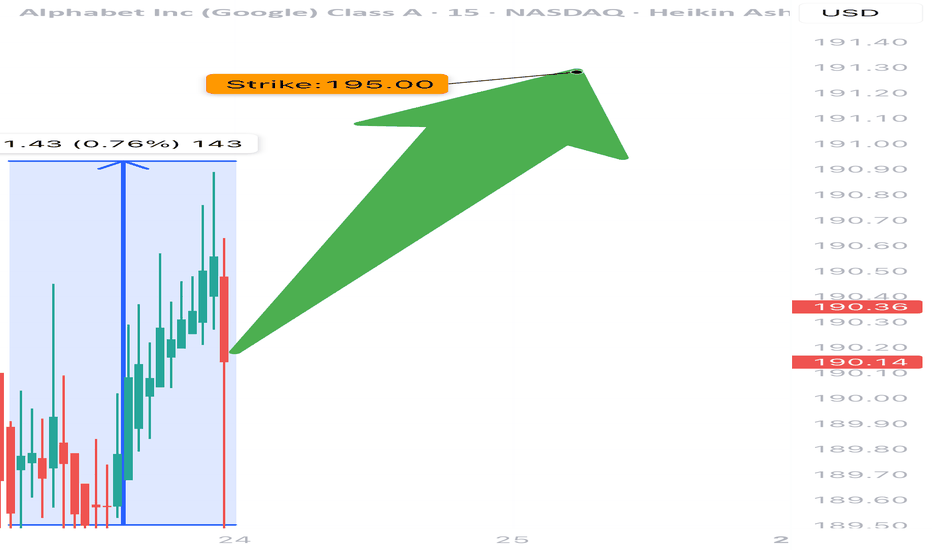

GOOG Earnings Setup (2025-07-23)

📈 GOOG Earnings Setup (2025-07-23) 🚀

🔥 STRONG BULLISH BIAS – 85% Confidence

Alphabet (GOOG) is set to report after market close. Here’s why this setup is 🔥:

⸻

📊 Fundamental Highlights:

• 💸 TTM Revenue Growth: +12.0%

• 🧾 Profit Margin: 30.9%

• 💯 Earnings Beat Rate: 8/8 last quarters

• 📈 EPS E

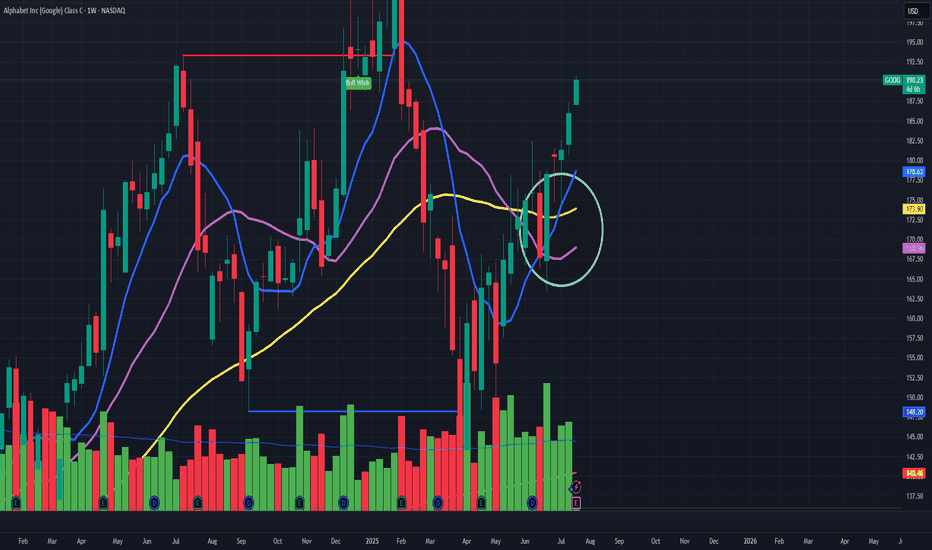

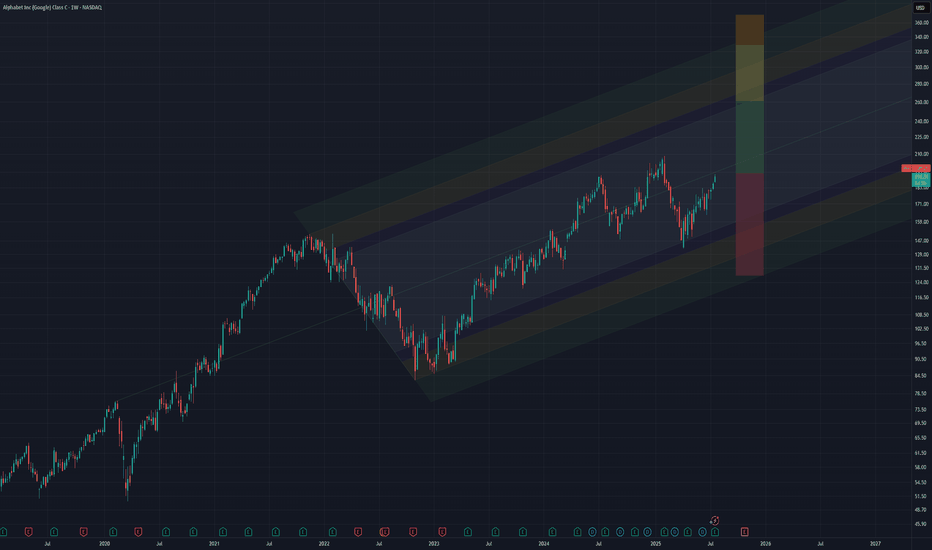

Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, the

With price near $190 and strong volume, $200+ looks imminent.🔥 NASDAQ:GOOGL Weekly Chart Signals a Golden Cross

Alphabet’s (GOOG)9-week MA is crossing the 20 and 50-week MA—classic bullish setup. With price near $190 and strong volume, $200+ looks imminent.

💡 Why It’s Climbing:

- AI breakthroughs (Gemini, DeepMind)

- Google Cloud gaining traction

- Big tec

Momentum Watch: GOOG Entry ZoneNASDAQ:GOOG – Trend Continuation Setup

The price has been trending within a clean ascending channel since April 2025.

After a pullback toward the midline and Bollinger basis, price is showing potential support.

Setup:

• Entry: $175 (conceptual)

• Stop: $165.5 (below channel)

• Target: $208 (u

GOOG - Possible Break OutHello Everyone,

Happy Sunday to All.

I would like to make a quick Analyse on GOOG. When i was scanning the stocks,i reliazed that this could be a possible breakout and could be a opportunity to buy.

This looks like a breakout and i am expecting to Re-test trend line which price level 175 $.

Then

Google About to 10x Off Agentic AIAlright, no dashes, just straight talk:

If you believe agentic AI is going to take off and actually become a core part of everyone’s daily life, Google is the best setup out there. They already have the user base, the data, and the infrastructure. Think search, Android, Gmail, YouTube, Maps, Chrome

EOY based on yesterday's earnings and the flywheel effect# Alphabet's Accelerating Flywheel: Q2 2025 Earnings Validate the Strategy

technicals grounded in an anchored pitchfork hinged on the pre-covid levels (covid bottom just makes the path too aggressive for EOY) and fib retracements of the 2022 bear market decline. General and simple targets since m

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US2079KAF4

ALPHABET 20/50Yield to maturity

7.07%

Maturity date

Aug 15, 2050

US2079KAG2

ALPHABET 20/60Yield to maturity

6.94%

Maturity date

Aug 15, 2060

US2079KAE7

ALPHABET 20/40Yield to maturity

6.30%

Maturity date

Aug 15, 2040

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.55%

Maturity date

May 15, 2065

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.46%

Maturity date

May 15, 2055

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

4.78%

Maturity date

May 15, 2035

GOOG5025299

Alphabet Inc. 0.45% 15-AUG-2025Yield to maturity

4.53%

Maturity date

Aug 15, 2025

US2079KAD9

ALPHABET 20/30Yield to maturity

4.48%

Maturity date

Aug 15, 2030

US2079KAC1

ALPHABET 16/26Yield to maturity

4.31%

Maturity date

Aug 15, 2026

XS306443038

ALPHABET 25/54Yield to maturity

4.19%

Maturity date

May 6, 2054

US2079KAJ6

ALPHABET 20/27Yield to maturity

4.07%

Maturity date

Aug 15, 2027

See all GOOG bonds

Curated watchlists where GOOG is featured.