L trade ideas

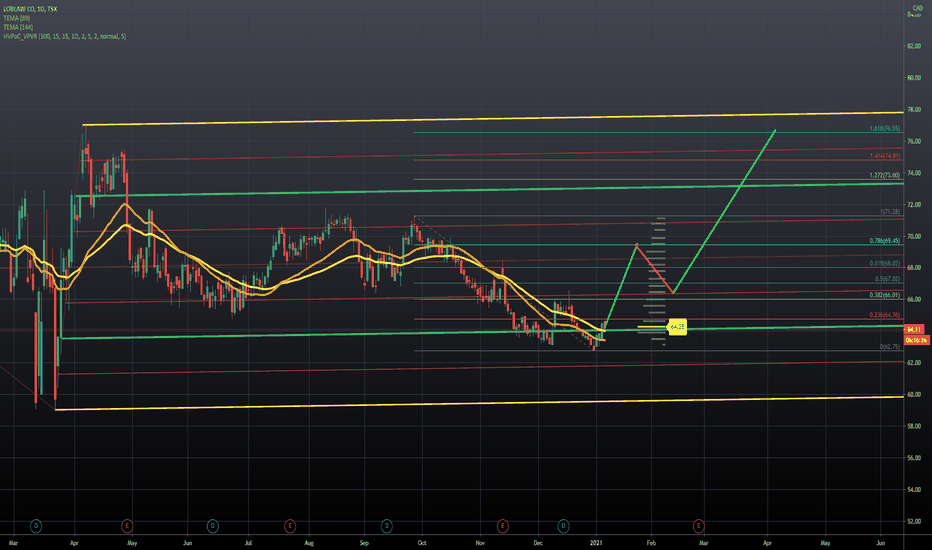

Loblaws - Bullish Pennant - Bottom of Channel / Strong Growth0. Notes to follow;

1. The channel data was missing from the last chart;

2.

Stay at home and bake and cook. These are trends that will endure. Simpler times, in a crazy world. The new normal if you will. As the lines in Canada get back to normal in most places and stores, the food lines continue to be long.

This shows continued demand to eat at home, coupled with the realization of the savings when eating out is minimized. This additional money is being funneled into "stay at home projects". Outdoor living, pools, cabanas, decks, and

internally - air conditioning, office renovations, new decks and office furniture, laptops, tablets, phone upgrades, electronic gadget and screen upgrades, basement refinishing, and many trends that will continue as they make sense on so many levels.

Many people working from home, and companies realizing the savings. The economy is evolving, and Loblaws is a big part of this. Great long term investment.

3. Final thoughts, your grandkids, whom you can give the stock to, will be shopping at Loblaws or associated stores as they continue to acquire everything. This Pandemic time, is a perfect opportunity for acquisition on the Loblaws side.

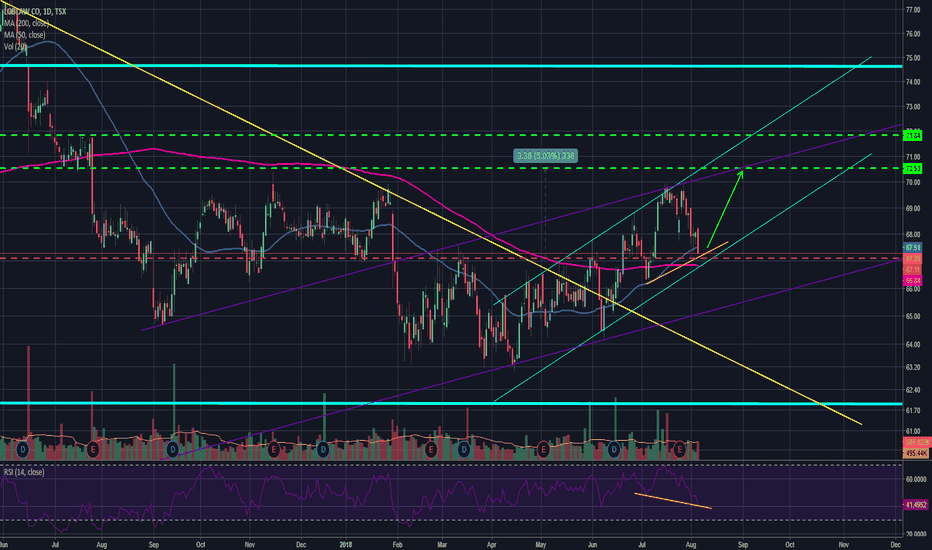

Chaos present buying opportunityIn my confession , I provided several sources where different countries reacted the same way when handling a chaotic situation like the Covid-19.

So, in chaos, there is always opportunities if you know where to look for it.

Already, groceries retailer are deemed as recession proof business. Regardless of how the economy performs, people will still need the basic necessities to survive. It is in a chaotic situation like Covid-19 that the buying frenzy gets out of hand. That drives insane sales to its outlets , stripping supplies out of the shelves faster than it can be replenished.

At $69, it was a great buying opportunity to get into Loblaw. It is now facing some resistance at 72.46 and I expect it to be broken up quickly to revisit its previous peak at 76.29. So, there you go, a $7 profit target opportunity.

Alternatively, if you prefer to zoom into a particular stock item, I have also provided my analysis here on another great company, Kimberly Clark.

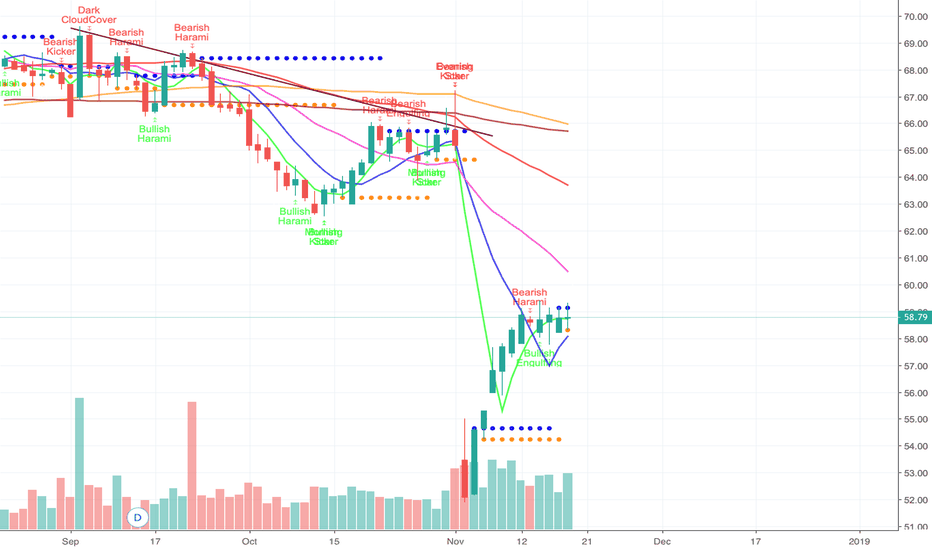

Reverse in trend L.TO

Market tried to break through a resistance twice, but was pushed back under it. I predict a bearish downtrend to the support level of 63.00. There is a small support 64.5, but I don't think it wil suffice a considerate pull back, but something to be aware of. Furthermore, trend line crosses price at 66.00, which becomes a second resistance confirmation. SMA 5 crosses SMA 10, and Full Stochastic is breaking down. However, +DI breaks above -DI on ADX(14), but this has happened before already and it has been quickly reversed.

Considering downtrend in S&P/TSX, I wouldn't be surprised if support at 63.00 is broken as well.

Let me know your thoughts.

Loblaws Shedding some odd lotsOk I need the cash, for the next crash!

Loblaws is a stock I know well, my first and second job was there , most of my family has worked for L at one time or another.

Food retail business is solid, but there will come a time when other players will come in and shake things up. (Amazon)

The fundamentals are very good, Loblaws will shift its focus on the online structure and will spend a lot to defend its turf.

I will stay on the side and wait for now.

Look for the PE to rise substantially and Div could be under pressure.

Once BV fall below 1.8 it will be time dive back in.

Loblaw Loblaw Co is likely to achieve targets in the price channel in February 2014. Breakdown-rollback diamond at the upper boundary of accelerated channel has already occurred. You can buy with target at 65.10, where the main channel converges with accelerated one. Some delay in movement is possible at the level of 61.22, the level at the top of the diamond, when this level is overcome, you can add to open position. The expected duration of trade is 2-3 weeks.

My forecast participates in the Market Forecaster contest. Follow the link s30061920484.whotrades.com

to vote for it and help me win the top prize. Thank you.